Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PRUDENTIAL FINANCIAL INC | d366328d8k.htm |

Prudential Financial, inc. 2017 Financial Outlook Conference Call Presentation December 15, 2016 Exhibit 99.1

Building Prudential’s Investor Value Proposition 2017 Financial Outlook Conference Call Includes capital deployed through subsidiaries. Achieve Key Financial Objectives Fortify Leadership Position Maintain differentiated ROE Free cash flow (1) ~60% of after-tax adjusted operating income (AOI) over time Focus on Protection, Retirement and Asset Management Challenges and Considerations Sustained low interest rate environment Talent, culture and collaboration drive superior execution Near-term impact of expenses associated with investments to support innovation Maintain strong capital position; manage to “AA” financial strength standards Continued investments to support innovation in products, distribution, data and digital, as well as systems and technology Evolving regulatory environment Solid earnings and book value growth; continue to manage volatility Active capital management supporting balanced deployment for business growth opportunities and returns to shareholders including dividends and share repurchases

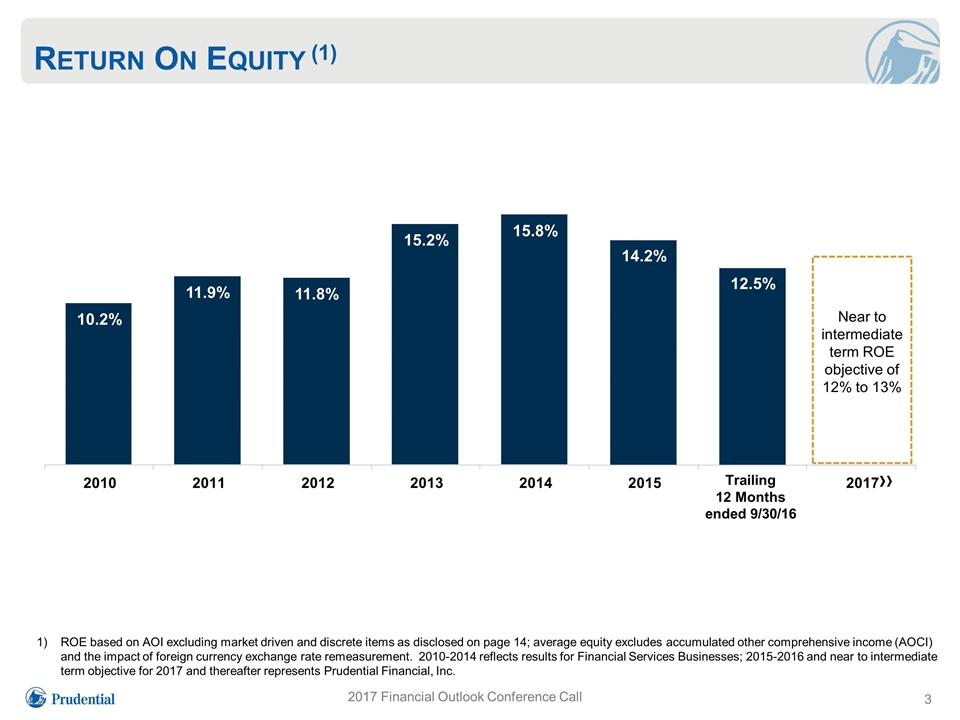

Return On Equity (1) 2017 Financial Outlook Conference Call Near to intermediate term ROE objective of 12% to 13% Trailing 12 Months ended 9/30/16 ROE based on AOI excluding market driven and discrete items as disclosed on page 14; average equity excludes accumulated other comprehensive income (AOCI) and the impact of foreign currency exchange rate remeasurement. 2010-2014 reflects results for Financial Services Businesses; 2015-2016 and near to intermediate term objective for 2017 and thereafter represents Prudential Financial, Inc. 10.2% 11.9% 11.8% 15.2% 15.8% 14.2% 12.5% 2010 2011 2012 2013 2014 2015 2017

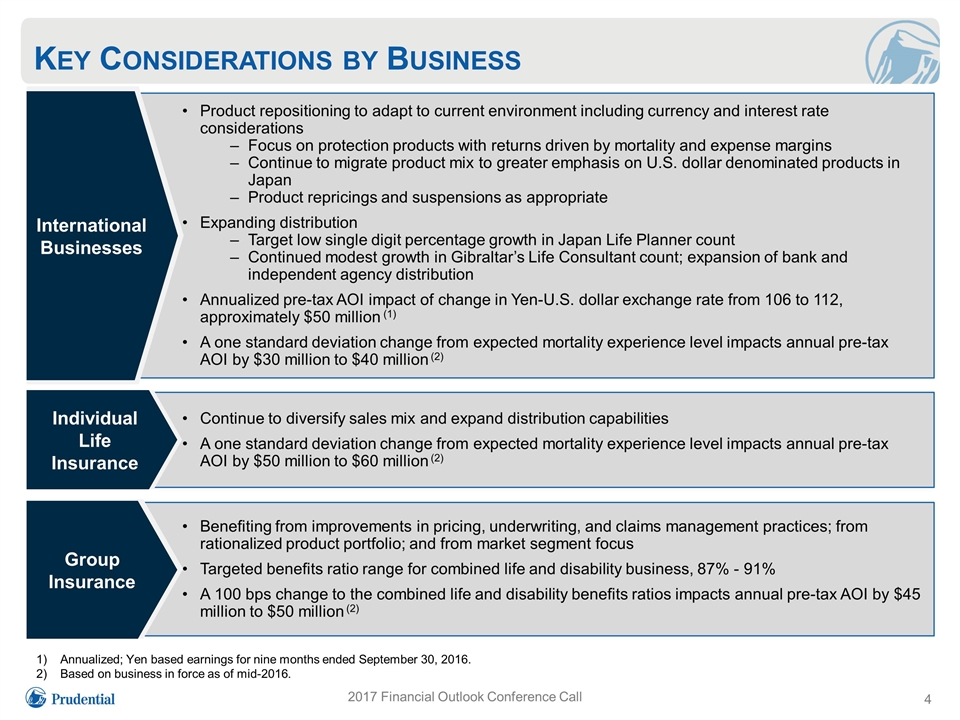

Key Considerations by Business 2017 Financial Outlook Conference Call International Businesses Product repositioning to adapt to current environment including currency and interest rate considerations Focus on protection products with returns driven by mortality and expense margins Continue to migrate product mix to greater emphasis on U.S. dollar denominated products in Japan Product repricings and suspensions as appropriate Expanding distribution Target low single digit percentage growth in Japan Life Planner count Continued modest growth in Gibraltar’s Life Consultant count; expansion of bank and independent agency distribution Annualized pre-tax AOI impact of change in Yen-U.S. dollar exchange rate from 106 to 112, approximately $50 million (1) A one standard deviation change from expected mortality experience level impacts annual pre-tax AOI by $30 million to $40 million (2) Individual Life Insurance Continue to diversify sales mix and expand distribution capabilities A one standard deviation change from expected mortality experience level impacts annual pre-tax AOI by $50 million to $60 million (2) Group Insurance Benefiting from improvements in pricing, underwriting, and claims management practices; from rationalized product portfolio; and from market segment focus Targeted benefits ratio range for combined life and disability business, 87% - 91% A 100 bps change to the combined life and disability benefits ratios impacts annual pre-tax AOI by $45 million to $50 million (2) Annualized; Yen based earnings for nine months ended September 30, 2016. Based on business in force as of mid-2016.

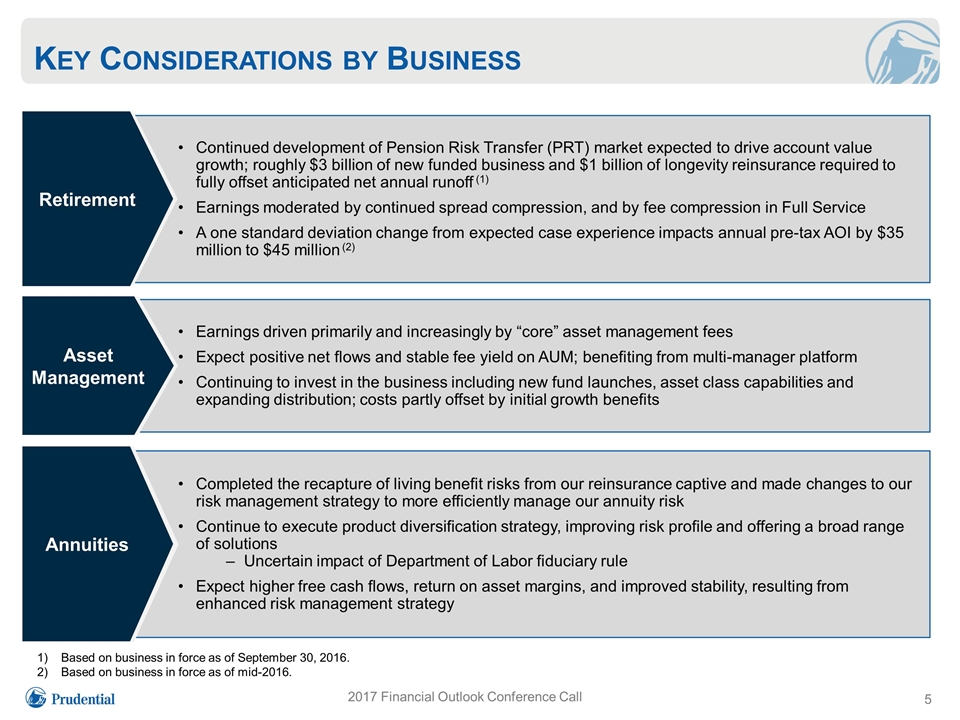

Key Considerations by Business 5 2017 Financial Outlook Conference Call Retirement Continued development of Pension Risk Transfer (PRT) market expected to drive account value growth; roughly $3 billion of new funded business and $1 billion of longevity reinsurance required to fully offset anticipated net annual runoff (1) Earnings moderated by continued spread compression, and by fee compression in Full Service A one standard deviation change from expected case experience impacts annual pre-tax AOI by $35 million to $45 million (2) Annuities Completed the recapture of living benefit risks from our reinsurance captive and made changes to our risk management strategy to more efficiently manage our annuity risk Continue to execute product diversification strategy, improving risk profile and offering a broad range of solutions Uncertain impact of Department of Labor fiduciary rule Expect higher free cash flows, return on asset margins, and improved stability, resulting from enhanced risk management strategy Asset Management Earnings driven primarily and increasingly by “core” asset management fees Expect positive net flows and stable fee yield on AUM; benefiting from multi-manager platform Continuing to invest in the business including new fund launches, asset class capabilities and expanding distribution; costs partly offset by initial growth benefits Based on business in force as of September 30, 2016. Based on business in force as of mid-2016.

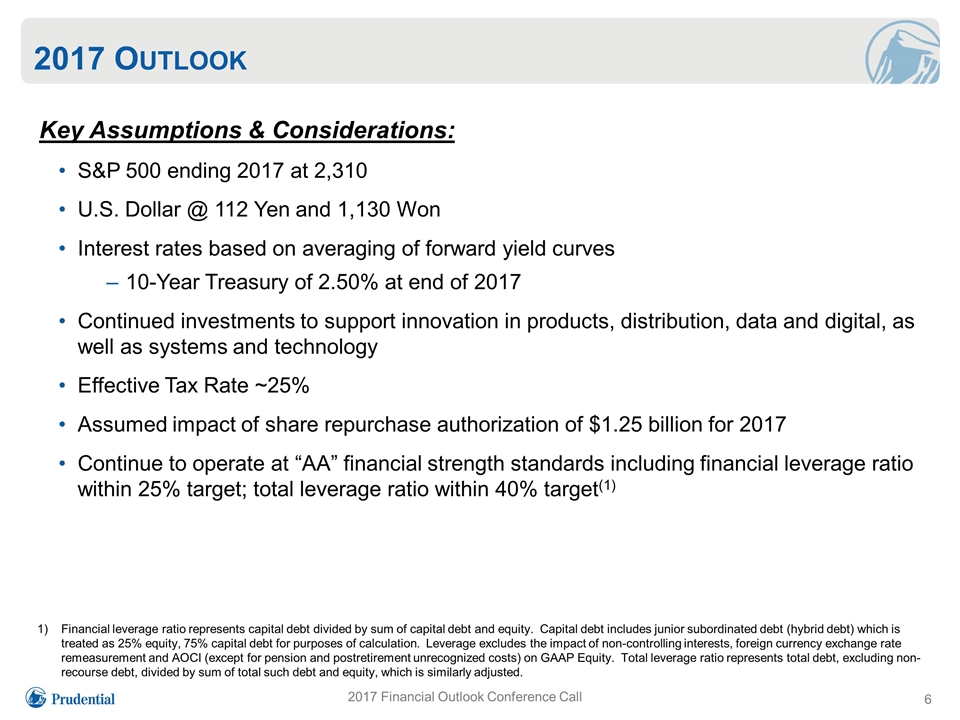

2017 Outlook 6 2017 Financial Outlook Conference Call Key Assumptions & Considerations: S&P 500 ending 2017 at 2,310 U.S. Dollar @ 112 Yen and 1,130 Won Interest rates based on averaging of forward yield curves 10-Year Treasury of 2.50% at end of 2017 Continued investments to support innovation in products, distribution, data and digital, as well as systems and technology Effective Tax Rate ~25% Assumed impact of share repurchase authorization of $1.25 billion for 2017 Continue to operate at “AA” financial strength standards including financial leverage ratio within 25% target; total leverage ratio within 40% target(1) Financial leverage ratio represents capital debt divided by sum of capital debt and equity. Capital debt includes junior subordinated debt (hybrid debt) which is treated as 25% equity, 75% capital debt for purposes of calculation. Leverage excludes the impact of non-controlling interests, foreign currency exchange rate remeasurement and AOCI (except for pension and postretirement unrecognized costs) on GAAP Equity. Total leverage ratio represents total debt, excluding non-recourse debt, divided by sum of total such debt and equity, which is similarly adjusted.

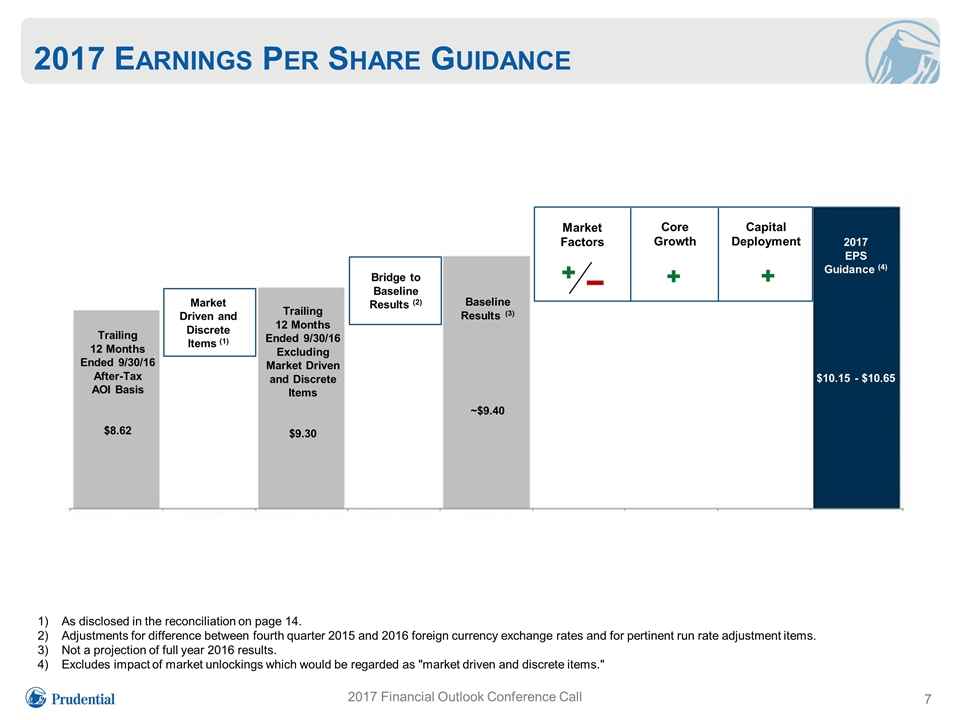

2017 Earnings Per Share Guidance 7 2017 Financial Outlook Conference Call As disclosed in the reconciliation on page 14. Adjustments for difference between fourth quarter 2015 and 2016 foreign currency exchange rates and for pertinent run rate adjustment items. Not a projection of full year 2016 results. Excludes impact of market unlockings which would be regarded as "market driven and discrete items." Trailing 12 Months Ended 9/30/16 After-Tax AOI Basis $8.62 Trailing 12 Months Ended 9/30/16 Excluding Market Driven and Discrete Items $9.30 Baseline Results (3) ~$9.40 2017 EPS Guidance (4) $10.15 - $10.65 Market Driven and Discrete Items (1) Bridge to Baseline Results (2) Capital Deployment Core Growth Market Factors

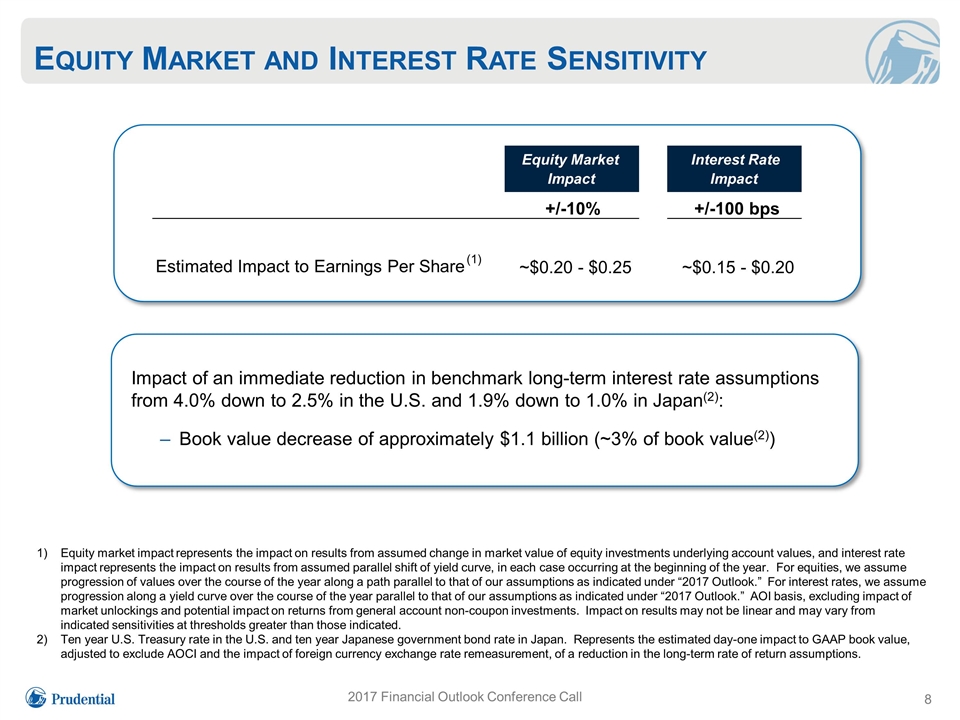

Equity Market and Interest Rate Sensitivity 2017 Financial Outlook Conference Call Equity market impact represents the impact on results from assumed change in market value of equity investments underlying account values, and interest rate impact represents the impact on results from assumed parallel shift of yield curve, in each case occurring at the beginning of the year. For equities, we assume progression of values over the course of the year along a path parallel to that of our assumptions as indicated under “2017 Outlook.” For interest rates, we assume progression along a yield curve over the course of the year parallel to that of our assumptions as indicated under “2017 Outlook.” AOI basis, excluding impact of market unlockings and potential impact on returns from general account non-coupon investments. Impact on results may not be linear and may vary from indicated sensitivities at thresholds greater than those indicated. Ten year U.S. Treasury rate in the U.S. and ten year Japanese government bond rate in Japan. Represents the estimated day-one impact to GAAP book value, adjusted to exclude AOCI and the impact of foreign currency exchange rate remeasurement, of a reduction in the long-term rate of return assumptions. Impact of an immediate reduction in benchmark long-term interest rate assumptions from 4.0% down to 2.5% in the U.S. and 1.9% down to 1.0% in Japan(2): Book value decrease of approximately $1.1 billion (~3% of book value(2)) Equity Market Impact Interest Rate Impact +/-10% +/-100 bps Estimated Impact to Earnings Per Share (1) ~$0.20 - $0.25 ~$0.15 - $0.20

Key Takeaways 9 2017 Financial Outlook Conference Call Business mix and solid fundamentals continue to produce an attractive financial profile; we are continuing to invest in longer term strategic initiatives Solid EPS growth despite headwinds from interest rates, currencies, etc. Maintain differentiated ROE with a range of 12% to 13% in current environment Maintain a balanced philosophy for shareholder distributions Share repurchase authorization of $1.25 billion for 2017 Common stock dividends continue to be aligned with earnings “AA” financial strength standards Greater financial flexibility resulting from: Business momentum driving solid capital generation Free cash flow ~60% of after-tax adjusted operating income over time Continued management of volatility in capital capacity, financial leverage and GAAP earnings

Prudential Financial, inc. 2017 Financial Outlook Conference Call Presentation Questions and Answers December 15, 2016

Forward-Looking Statements Certain of the statements included in this release constitute forward-looking statements within the meaning of the U. S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “anticipates,” “includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,” “should,” “will,” “shall,” or variations of such words are generally part of forward-looking statements. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its subsidiaries. There can be no assurance that future developments affecting Prudential Financial, Inc. and its subsidiaries will be those anticipated by management. These forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including, among others: (1) general economic, market and political conditions, including the performance and fluctuations of fixed income, equity, real estate and other financial markets; (2) the availability and cost of additional debt or equity capital or external financing for our operations; (3) interest rate fluctuations or prolonged periods of low interest rates; (4) the degree to which we choose not to hedge risks, or the potential ineffectiveness or insufficiency of hedging or risk management strategies we do implement; (5) any inability to access our credit facilities; (6) reestimates of our reserves for future policy benefits and claims; (7) differences between actual experience regarding mortality, morbidity, persistency, utilization, interest rates or market returns and the assumptions we use in pricing our products, establishing liabilities and reserves or for other purposes; (8) changes in our assumptions related to deferred policy acquisition costs, value of business acquired or goodwill; (9) changes in assumptions for our pension and other postretirement benefit plans; (10) changes in our financial strength or credit ratings; (11) statutory reserve requirements associated with term and universal life insurance policies under Regulation XXX and Guideline AXXX; (12) investment losses, defaults and counterparty non-performance; (13) competition in our product lines and for personnel; (14) difficulties in marketing and distributing products through current or future distribution channels; (15) changes in tax law; (16) economic, political, currency and other risks relating to our international operations; (17) fluctuations in foreign currency exchange rates and foreign securities markets; (18) regulatory or legislative changes, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the U.S. Department of Labor’s fiduciary rules; (19) inability to protect our intellectual property rights or claims of infringement of the intellectual property rights of others; (20) adverse determinations in litigation or regulatory matters, and our exposure to contingent liabilities, including related to the remediation of certain securities lending activities administered by the Company; (21) domestic or international military actions, natural or man-made disasters including terrorist activities or pandemic disease, or other events resulting in catastrophic loss of life; (22) ineffectiveness of risk management policies and procedures in identifying, monitoring and managing risks; (23) possible difficulties in executing, integrating and realizing projected results of acquisitions, divestitures and restructurings; (24) interruption in telecommunication, information technology or other operational systems or failure to maintain the security, confidentiality or privacy of sensitive data on such systems; (25) changes in statutory or U.S. GAAP accounting principles, practices or policies; and (26) Prudential Financial, Inc.’s primary reliance, as a holding company, on dividends or distributions from its subsidiaries to meet debt payment obligations and the ability of the subsidiaries to pay such dividends or distributions in light of our ratings objectives and/or applicable regulatory restrictions. Prudential Financial, Inc. does not intend, and is under no obligation, to update any particular forward-looking statement included in this document. See “Risk Factors” included in Prudential Financial, Inc.’s Annual Report on Form 10-K for discussion of certain risks relating to our business and investment in our securities. ______________________________________________________________________________ Prudential Financial, Inc. of the United States is not affiliated with Prudential PLC which is headquartered in the United Kingdom. 2017 Financial Outlook Conference Call

Non-GAAP Measure 2017 Financial Outlook Conference Call Adjusted operating income is a non-GAAP measure of performance. Adjusted operating income excludes “Realized investment gains (losses), net,” as adjusted, and related charges and adjustments. A significant element of realized investment gains and losses are impairments and credit-related and interest rate-related gains and losses. Impairments and losses from sales of credit-impaired securities, the timing of which depends largely on market credit cycles, can vary considerably across periods. The timing of other sales that would result in gains or losses, such as interest rate-related gains or losses, is largely subject to our discretion and influenced by market opportunities as well as our tax and capital profile. Realized investment gains (losses) within certain of our businesses for which such gains (losses) are a principal source of earnings, and those associated with terminating hedges of foreign currency earnings and current period yield adjustments are included in adjusted operating income. Adjusted operating income generally excludes realized investment gains and losses from products that contain embedded derivatives, and from associated derivative portfolios that are part of an asset-liability management program related to the risk of those products. However, the effectiveness of our hedging program will ultimately be reflected in adjusted operating income over time. Adjusted operating income also excludes gains and losses from changes in value of certain assets and liabilities relating to foreign currency exchange movements that have been economically hedged or considered part of our capital funding strategies for our international subsidiaries, as well as gains and losses on certain investments that are classified as other trading account assets. Adjusted operating income also excludes investment gains and losses on trading account assets supporting insurance liabilities and changes in experience-rated contractholder liabilities due to asset value changes, because these recorded changes in asset and liability values are expected to ultimately accrue to contractholders. In addition, adjusted operating income excludes the results of divested businesses, which are not relevant to our ongoing operations. Discontinued operations and earnings attributable to noncontrolling interests, each of which is presented as a separate component of net income under GAAP, are also excluded from adjusted operating income. We believe that the presentation of adjusted operating income as we measure it for management purposes enhances the understanding of the results of operations by highlighting the results from ongoing operations and the underlying profitability of our businesses. Trends in the underlying profitability of our businesses can be more clearly identified without the fluctuating effects of the items described above. However, adjusted operating income is not a substitute for income determined in accordance with GAAP, and the adjustments made to derive adjusted operating income are important to an understanding of our overall results of operations. Our expectation of Common Stock earnings per share is based on after-tax adjusted operating income. Due to the inherent difficulty in reliably quantifying future realized investment gains/losses and changes in asset and liability values given their unknown timing and potential significance, we cannot, without unreasonable effort, provide a measure of our Common Stock earnings per share expectation based on income from continuing operations, which is the GAAP measure most comparable to adjusted operating income. A reconciliation of adjusted operating income to income from continuing operations in accordance with GAAP is included as part of this presentation. Additional historic information relating to our financial performance is located on our Web site at www.investor.prudential.com.

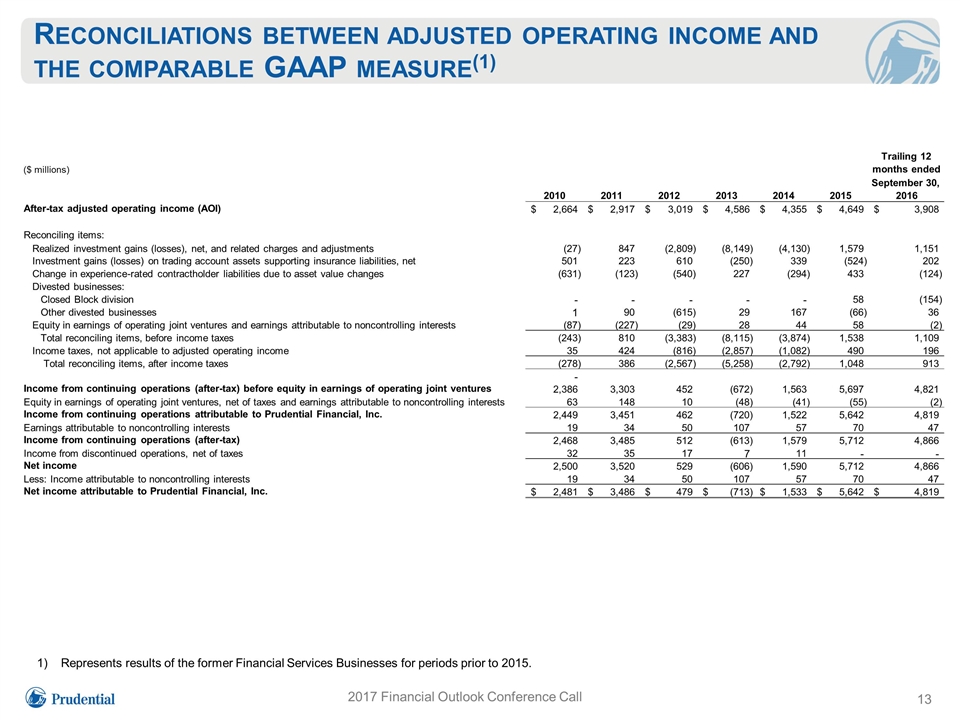

Reconciliations between adjusted operating income and the comparable GAAP measure(1) 2017 Financial Outlook Conference Call Represents results of the former Financial Services Businesses for periods prior to 2015. Trailing 12 ($ millions) months ended September 30, 2010 2011 2012 2013 2014 2015 2016 After-tax adjusted operating income (AOI) 2,664 $ 2,917 $ 3,019 $ 4,586 $ 4,355 $ 4,649 $ 3,908 $ Reconciling items: Realized investment gains (losses), net, and related charges and adjustments (27) 847 (2,809) (8,149) (4,130) 1,579 1,151 Investment gains (losses) on trading account assets supporting insurance liabilities, net 501 223 610 (250) 339 (524) 202 Change in experience-rated contractholder liabilities due to asset value changes (631) (123) (540) 227 (294) 433 (124) Divested businesses: Closed Block division - - - - - 58 (154) Other divested businesses 1 90 (615) 29 167 (66) 36 Equity in earnings of operating joint ventures and earnings attributable to noncontrolling interests (87) (227) (29) 28 44 58 (2) Total reconciling items, before income taxes (243) 810 (3,383) (8,115) (3,874) 1,538 1,109 Income taxes, not applicable to adjusted operating income 35 424 (816) (2,857) (1,082) 490 196 Total reconciling items, after income taxes (278) 386 (2,567) (5,258) (2,792) 1,048 913 - Income from continuing operations (after-tax) before equity in earnings of operating joint ventures 2,386 3,303 452 (672) 1,563 5,697 4,821 Equity in earnings of operating joint ventures, net of taxes and earnings attributable to noncontrolling interests 63 148 10 (48) (41) (55) (2) Income from continuing operations attributable to Prudential Financial, Inc. 2,449 3,451 462 (720) 1,522 5,642 4,819 Earnings attributable to noncontrolling interests 19 34 50 107 57 70 47 Income from continuing operations (after-tax) 2,468 3,485 512 (613) 1,579 5,712 4,866 Income from discontinued operations, net of taxes 32 35 17 7 11 - - Net income 2,500 3,520 529 (606) 1,590 5,712 4,866 Less: Income attributable to noncontrolling interests 19 34 50 107 57 70 47 Net income attributable to Prudential Financial, Inc. 2,481 $ 3,486 $ 479 $ (713) $ 1,533 $ 5,642 $ 4,819 $

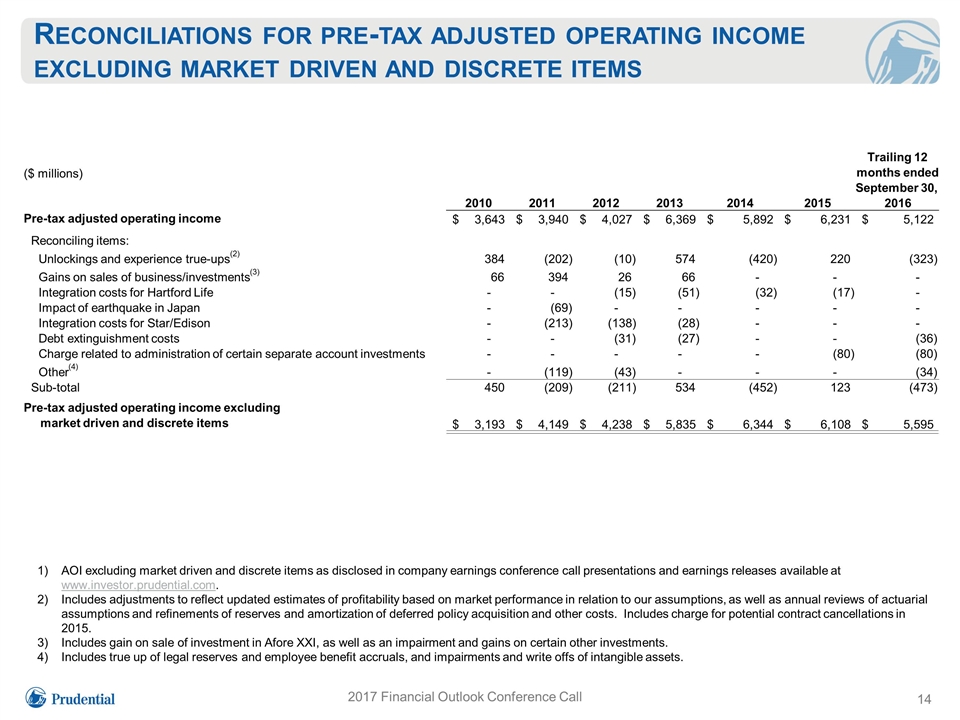

Reconciliations for pre-tax adjusted operating income excluding market driven and discrete items 2017 Financial Outlook Conference Call AOI excluding market driven and discrete items as disclosed in company earnings conference call presentations and earnings releases available at www.investor.prudential.com. Includes adjustments to reflect updated estimates of profitability based on market performance in relation to our assumptions, as well as annual reviews of actuarial assumptions and refinements of reserves and amortization of deferred policy acquisition and other costs. Includes charge for potential contract cancellations in 2015. Includes gain on sale of investment in Afore XXI, as well as an impairment and gains on certain other investments. Includes true up of legal reserves and employee benefit accruals, and impairments and write offs of intangible assets. Trailing 12 ($ millions) months ended September 30, 2010 2011 2012 2013 2014 2015 2016 Pre-tax adjusted operating income 3,643 $ 3,940 $ 4,027 $ 6,369 $ 5,892 $ 6,231 $ 5,122 $ Reconciling items: Unlockings and experience true-ups (2) 384 (202) (10) 574 (420) 220 (323) Gains on sales of business/investments (3) 66 394 26 66 - - - Integration costs for Hartford Life - - (15) (51) (32) (17) - Impact of earthquake in Japan - (69) - - - - - Integration costs for Star/Edison - (213) (138) (28) - - - Debt extinguishment costs - - (31) (27) - - (36) Charge related to administration of certain separate account investments - - - - - (80) (80) Other (4) - (119) (43) - - - (34) Sub-total 450 (209) (211) 534 (452) 123 (473) Pre-tax adjusted operating income excluding market driven and discrete items 3,193 $ 4,149 $ 4,238 $ 5,835 $ 6,344 $ 6,108 $ 5,595 $

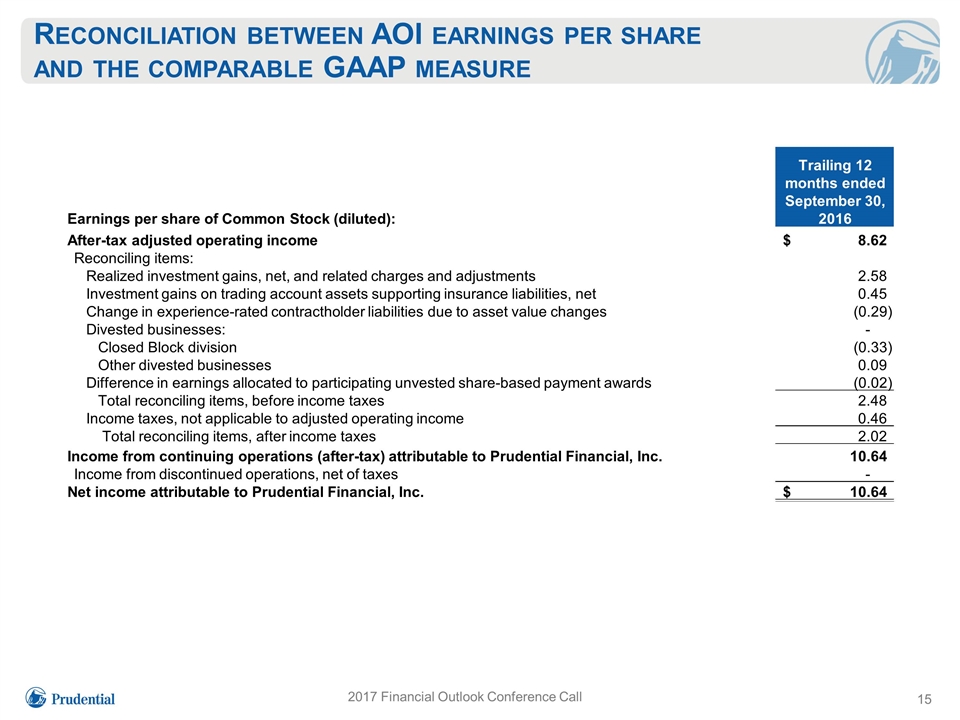

Reconciliation between AOI earnings per share and the comparable GAAP measure 2017 Financial Outlook Conference Call Earnings per share of Common Stock (diluted): After-tax adjusted operating income 8.62 $ Reconciling items: Realized investment gains, net, and related charges and adjustments 2.58 Investment gains on trading account assets supporting insurance liabilities, net 0.45 Change in experience-rated contractholder liabilities due to asset value changes (0.29) Divested businesses: - Closed Block division (0.33) Other divested businesses 0.09 Difference in earnings allocated to participating unvested share-based payment awards (0.02) Total reconciling items, before income taxes 2.48 Income taxes, not applicable to adjusted operating income 0.46 Total reconciling items, after income taxes 2.02 Income from continuing operations (after-tax) attributable to Prudential Financial, Inc. 10.64 Income from discontinued operations, net of taxes - Net income attributable to Prudential Financial, Inc. 10.64 $ Trailing 12 months ended September 30, 2016

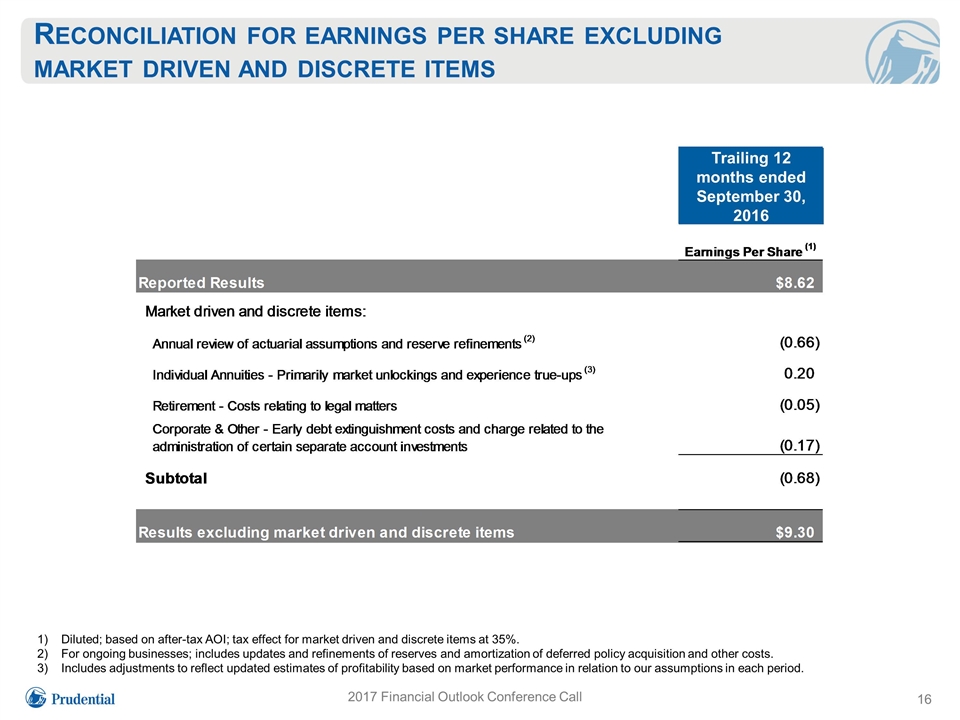

Reconciliation for earnings per share excluding market driven and discrete items Diluted; based on after-tax AOI; tax effect for market driven and discrete items at 35%. For ongoing businesses; includes updates and refinements of reserves and amortization of deferred policy acquisition and other costs. Includes adjustments to reflect updated estimates of profitability based on market performance in relation to our assumptions in each period. 2017 Financial Outlook Conference Call Trailing 12 months ended September 30, 2016