Attached files

| file | filename |

|---|---|

| EX-99.4 - TENTH AMENDED AND RESTATED SHARE REDEMPTION PROGRAM - Pacific Oak Strategic Opportunity REIT, Inc. | kbssor8kexhibit994.htm |

| EX-99.2 - CONSENT OF LANDAUER SERVICES, LLC - Pacific Oak Strategic Opportunity REIT, Inc. | kbssor8kexhibit992.htm |

| EX-99.1 - CONSENT OF DUFF & PHELPS, LLC - Pacific Oak Strategic Opportunity REIT, Inc. | kbssor8kexhibit991.htm |

| 8-K - FORM 8-K - Pacific Oak Strategic Opportunity REIT, Inc. | kbssor8k.htm |

KBS Strategic Opportunity REIT

Valuation and Portfolio Update

December 15, 2016

Forward-Looking Statements

The information contained herein should be read in conjunction with, and is qualified by, the information in the KBS Strategic

Opportunity REIT, Inc. (“KBS Strategic Opportunity REIT”) Annual Report on Form 10-K for the year ended December 31, 2015, filed

with the Securities and Commission Exchange (the “SEC”) on March 28, 2016 (the “Annual Report”), and in KBS Strategic Opportunity

REIT’s Quarterly Report on Form 10-Q for the period ended September 30, 2016, filed with the SEC on November 14, 2016, including

the “Risk Factors” contained therein. For a full description of the limitations, methodologies and assumptions used to value KBS

Strategic Opportunity REIT’s assets and liabilities in connection with the calculation of KBS Strategic Opportunity REIT’s estimated

value per share, see KBS Strategic Opportunity REIT’s Current Report on Form 8-K, filed with the SEC on December 15, 2016.

Forward-Looking Statements

Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private

Securities Litigation Reform Act of 1995. KBS Strategic Opportunity REIT intends that such forward-looking statements be subject to

the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. These statements include statements regarding the intent, belief or current expectations of KBS Strategic

Opportunity REIT and members of its management team, as well as the assumptions on which such statements are based, and

generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,”

“intends,” “should” or similar expressions. Further, forward-looking statements speak only as of the date they are made, and KBS

Strategic Opportunity REIT undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions,

the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Actual results may

differ materially from those contemplated by such forward-looking statements.

The valuation methodology for KBS Strategic Opportunity REIT’s real estate investments assumes that its properties realize the

projected cash flows and exit cap rates and that investors would be willing to invest in such properties at cap rates equal to the cap

rates used in the valuation. Though the appraisals and valuation estimates used in calculating the estimated value per share are Duff &

Phelps and Landauer Services’ best estimates as of September 30, 2016, and/or KBS Strategic Opportunity REIT’s and KBS Capital

Advisors LLC’s (“the Advisor”) best estimates as of December 8, 2016, KBS Strategic Opportunity REIT can give no assurance that these

estimated values will be realized by KBS Strategic Opportunity REIT. These statements also depend on factors such as future economic,

competitive and market conditions, KBS Strategic Opportunity REIT’s ability to maintain occupancy levels and rental rates at its

properties, and other risks identified in Part I, Item IA of KBS Strategic Opportunity REIT’s Annual Report on form 10-K for the year

ended December 31, 2015, and its subsequent quarterly reports. Actual events may cause the value and returns on KBS Strategic

Opportunity REIT’s investments to be less than that used for purposes of KBS Strategic Opportunity REIT’s estimated value per share.

2

Total Acquisitions1: $1,397,658,000

Current Portfolio Cost Basis2: $1,466,957,000

20 Equity Assets

December 2016 Estimated Value of Portfolio3: $1,776,963,000

SOR Equity Raised4: $561,749,000

Portfolio Leverage5: 57%

Percent Leased as of 9/30/166: 89%

Occupancy at Acquisition6: 71%

1 Represents acquisition price (excluding closing costs) of real estate and loans acquired since inception (including investments which have been disposed), adjusted

for KBS Strategic Opportunity REIT’s share of consolidated and unconsolidated joint ventures. This total is $1,513,045,000 including our partners’ shares of

consolidated and unconsolidated joint ventures. Subsequent to acquisition, KBS Strategic Opportunity REIT foreclosed on or otherwise received title to the properties

securing five of its original debt investments, all of which were non-performing loans at the time of acquisition.

2 Represents cost basis, which is acquisition price (net of closing credits and excluding closing costs) plus capital expenditures and acquisitions of minority interests

in joint ventures, for real estate in the portfolio as of September 30, 2016, adjusted for KBS Strategic Opportunity REIT’s share of consolidated and unconsolidated

joint ventures. This total is $1,588,787,000 including our partners’ shares of consolidated and unconsolidated joint ventures .

3 Value as of September 30, 2016, and is the net total of real estate, investments in unconsolidated JVs and minority interest as shown on page 6.

4 Represents gross offering proceeds from the sale of common stock in the primary portion of KBS Strategic Opportunity REIT’s initial public offering.

5 As of September 30, 2016, KBS Strategic Opportunity REIT’s consolidated borrowings were approximately 57% of the appraised va lue of consolidated properties.

6 For consolidated properties in the portfolio as of September 30, 2016.

Portfolio Overview

3

Estimated value per share2 calculated using information as of September 30, 2016

• Net asset value; no enterprise (portfolio) premium or discount applied

• Considered potential participation fee that would be due to the advisor in a hypothetical

liquidation if the required shareholder return thresholds are met.

KBS Strategic Opportunity REIT followed the IPA Valuation Guidelines, which included

independent third-party appraisals for all of its consolidated properties and one of its two

unconsolidated joint venture investments in real estate properties. Duff & Phelps and Landauer

Services, LLC were engaged to provide appraisals of the estimated market values of real estate

assets. Duff & Phelps provided appraisals of all investments in consolidated real estate

properties (excluding undeveloped land) and 110 William Street, and Landauer provided

appraisals of all investments in undeveloped land. The appraisals were performed in accordance

with the Code of Professional Ethics and Standards of Profession Practice set forth by the

Appraisal Institute and the Uniform Standards of Professional Appraisal Practice (USPAP).

• The valuation of the Company’s real estate properties were based on (i) on appraisals of

such investments performed by third-party valuation firms and (ii) in the case of one office

property, the appraised value of the property reduced by valuation information provided by

the Advisor related to the marketing of the property subsequent to the appraisal date.

Non-controlling interest liability due to our joint venture partners calculated by assuming a

hypothetical liquidation of the underlying real estate properties at their current appraised values

and the payoff of any related debt at its fair value, based on the profit participation thresholds

contained in the joint venture agreements.

1For more information, see KBS Strategic Opportunity REIT’s Current Report on Form 8-K filed with the SEC on December 15, 2016.

2The estimated value of the REIT’s assets less the estimated value of the REIT’s liabilities, divided by the number of shares outstanding, all as of September 30, 2016.

Valuation1

4

1Based on data as of September 30, 2016

2Based on data as of September 30, 2015

3Includes cash and cash equivalents, restricted cash, rents and other receivables, deposits and prepaid expenses as applicable.

4Includes accounts payable, accrued liabilities, security deposits, contingent liabilities and prepaid rent.

Valuation1

Estimated Value of Portfolio

5

As of December 20161 As of December 20152

Assets: $1.874 Billion $1.500 Billion

Real Estate (i) $1.646 Billion (88%) $1.295 Billion (86%)

Investments in Unconsolidated JVs (i) $157.3 Million (8%) $140.4 Million (9%)

Real Estate Loan Receivable (i) $27.9 Million (2%)

Other Assets3 $71.1 Million (4%) $37.0 Million (3%)

Liabilities: $1.003 Billion $601.2 Million

Mortgage and Other Debt $941.6 Million $554.2 Million

Advisor Incentive Fee Potential Liability $28.6 Million $19.5 Million

Other Liabilities4 $32.8 Million $27.5 Million

Minority Interest in Consolidated JVs (i) $26.2 Million $107.1 Million

Net Equity at Estimated Value $845.1 Million $792.0 Million

Estimated Value of Portfolio (before debt) sum of (i) $1.777 Billion $1.356 Billion

Valuation1

On December 8, 2016, KBS Strategic Opportunity REIT’s Board approved an estimated value per share of $14.81.1

The following is a summary of the estimated value per share changes within each asset and liability group.

6

1 Based on the estimated value of KBS Strategic Opportunity REIT’s assets less the estimated value of its liabilities, divided by the number of shares outstanding,

all as of September 30, 2016.

2 Operating cash flow reflects adjusted modified funds from operations (“adjusted MFFO”), as disclosed in Forms 10-K and 10-Q filed with the SEC, plus the

amortization of deferred financing costs.

Change in Estimated

Value Per Share

December 2015 estimated value per share $13.44

Real Estate

Real Estate 1.24

Investments in Unconsolidated JVs 0.25

Capital expenditures on Real Estate (0.63)

Subtotal – Real Estate 0.86

Operating Cash Flows in Excess of Quarterly Distributions Declared2

Acquisition and Financing Costs

Acquisition of Minority Interest in Consolidated JV’s

Advisor Participation Fee Potential Liability

Other Changes

0.16

(0.30)

0.73

(0.16)

0.08

Total Change 1.37

December 2016 estimated value per share $14.81

Valuation History

1 This represents the maximum per share offering price at which shares of KBS Strategic Opportunity REIT’s common stock were sold in the

primary portion of its initial public offering. The per share offering price was determined arbitrarily and does not represent a valuation of KBS

Strategic Opportunity REIT’s assets and/or liabilities during the offering.

2 The estimated value per share is based on the estimated value of the REIT’s assets less the estimated value of the REIT’s liabilities, or net asset

value, divided by the number of shares outstanding as of September 30, 2016. For more information, please refer to KBS Strategic Opportunity

REIT’s 8-K filed on December 15, 2016.

Initial Offering Price: $10.001

Valuation History:

– March 25, 2014 $11.27

– December 9, 2014 $12.24

– December 8, 2015 $13.44

– December 8, 20162 $14.81

7

Real Estate Updates

8

Westmoor Center

The appraised value increased $13.1 million from prior year appraised value due to the following:

The asset performed well in 2016. The physical occupancy was approximately 83% as of September 30, 2016

compared to 79% as of September 30, 2015.

The REIT signed a long-term lease (128 months) with a tenant for over 100,000 rentable square feet commencing

in July 2016. The starting rental rate for this lease is $17.00 psf compared to a projection of $15.50 psf in prior year

appraisal.

Vacancy rates in the northwest Denver submarket has improved year-over-year from a vacancy rate of 12.3% in

prior year to 10.4% in the current year. Rent growth in the submarket has remained steady at approximately 5%

from prior year to current year.

Plaza Buildings

The appraised value increased $10.6 million from prior year appraised value due to the following:

The property has experienced consistent year-over-year gains as a result of continued improvements throughout

the overall market, as well as directly at the property as occupancy has increased from 76% as of September 30,

2015 to 85% as of September 30, 2016.

Both cap and discount rates throughout the overall region have declined.

As a result of market conditions, starting rental rates have increased and general vacancy has decreased.

Bellevue Tech Center

The appraised value increased $8.1 million from prior year appraised value due to the following:

• The property has experienced consistent year-over-year gains as a result of continued improvements throughout

the overall market, as well as directly at the property as occupancy has increased from 93% as of September 30,

2015 to 98% as of September 30, 2016.

• Both cap and discount rates throughout the overall region have declined.

• Strong rent growth resulting from market tightening. Starting rent at the asset is projected to be between $19-24 psf

compared $16.50-21.50 psf in the prior year.

2016 Milestones

1. Successfully Issued $250 million AA- Rated Israeli Bond

2. Purchased/committed $357 million for new growth assets with

bond proceeds

• Westpark Portfolio, Redmond, WA

• 353 Sacramento Street, San Francisco

• Battery Point Mortgage Portfolio

• Park Highlands, Las Vegas, NV (acquisition of non-controlling

interests)

3. Growing the portfolio to $1.777 billion

4. Executed agreement for first land sale in Park Highlands (estimated

closing February 2017)

5. Achieved NAV growth

6. Filed preliminary S-11 for daily NAV conversion

9

Israeli Bond Offering

Description

Bond offering backed by KBS Strategic Opportunity REIT’s assets with the goal

of increasing the size of the portfolio through additional acquisitions

March 2016 : 2023 Bonds

Amount: NIS 970 million

(Approx. $250 million)

Ratings: AA- / AA-

Duration: 7 years

(4.4 years weighted average)

Coupon: 4.25%

Financial Covenants

Minimum Equity: $475 million

Debt/EBITDA Ratio: <17

Net Debt/CAP: <70%

Minimum EBITDA: $50 million

Interest Payment Deposit: 0.5 years

10

Recent Acquisition

Westpark Portfolio

Location Redmond, WA

Westpark Business Park

No. of Buildings 14 two-story office

buildings

Size 580,104 SF

Year Built 1989-1992

% Leased at acquisition 77%

Redmond Center Court

No. of Buildings 2 industrial buildings

Size 77,492 SF

Year Built 1987

% Leased at acquisition 100%

Pacific Business & Technology Center

No. of Buildings 5 flex buildings

Size 120,876 SF

Year Built 1986-1988

% Leased at acquisition 98%

Purchase Price $125.8 Million

• 21 Suburban Office/Flex/Industrial buildings,

• 778,472 square feet over 41 acres

• 82% leased at acquisition

• Diverse tenant roster with more than 100 tenants;

no one tenant occupies more than 5% of the

rentable square feet of the Westpark portfolio

• Close proximity to the Microsoft headquarters

WESTPARK

REDMOND CBD

Going In Cap rate: 6.1%

Going In Occupancy: 82% 11

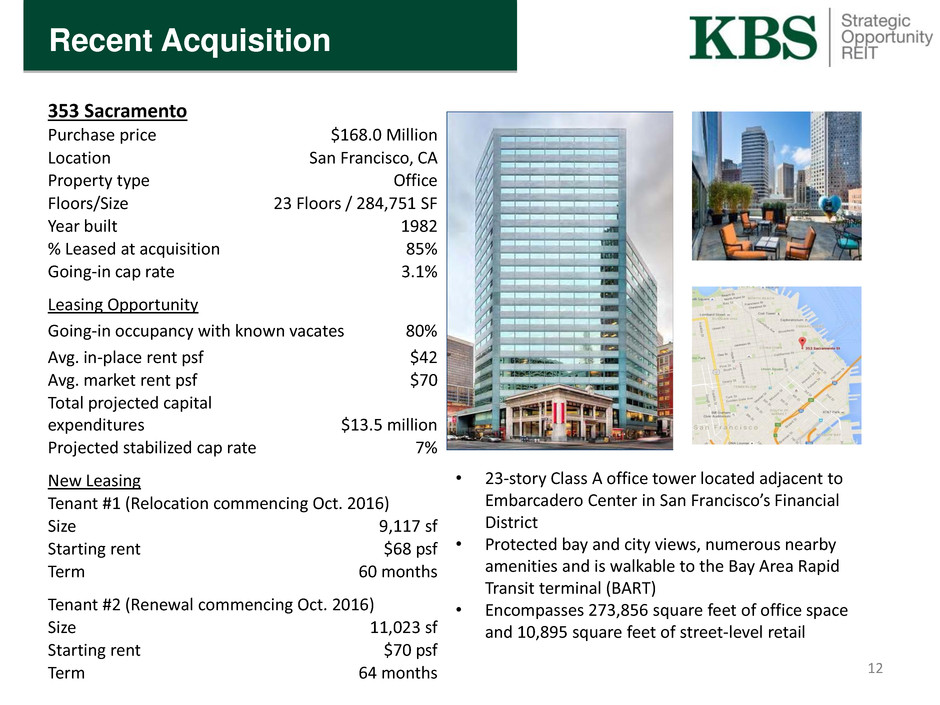

• 23-story Class A office tower located adjacent to

Embarcadero Center in San Francisco’s Financial

District

• Protected bay and city views, numerous nearby

amenities and is walkable to the Bay Area Rapid

Transit terminal (BART)

• Encompasses 273,856 square feet of office space

and 10,895 square feet of street-level retail

353 Sacramento

Purchase price $168.0 Million

Location San Francisco, CA

Property type Office

Floors/Size 23 Floors / 284,751 SF

Year built 1982

% Leased at acquisition 85%

Going-in cap rate 3.1%

Leasing Opportunity

Going-in occupancy with known vacates 80%

Avg. in-place rent psf $42

Avg. market rent psf $70

Total projected capital

expenditures

$13.5 million

Projected stabilized cap rate 7%

New Leasing

Tenant #1 (Relocation commencing Oct. 2016)

Size 9,117 sf

Starting rent $68 psf

Term 60 months

Tenant #2 (Renewal commencing Oct. 2016)

Size 11,023 sf

Starting rent $70 psf

Term 64 months

Recent Acquisition

12

13

Park Highlands Acquisition of Non-Controlling Interests

On March 18, 2016, the REIT increased its

membership interest in the Park Highlands joint

venture from 50.1% to 51.58% by acquiring an

additional 1.48% membership interest from one

of the joint venture partners, who was also the

managing member.

On March 18, 2016, the Company increased its

membership interest in the Park Highlands II joint

venture from 99.5% to 100% by acquiring the

remaining 0.5% membership interest from its

joint venture partner, who was also the managing

member.

On June 6, 2016, the Company increased its

membership interest in the Park Highlands joint

venture from 51.58% to 97.62% by acquiring an

additional 46.04% membership interest from one

of the joint venture partners.

On June 25, 2016, the Company increased its

membership interest in the Park Highlands joint

venture from 97.62% to 100% by acquiring the

remaining 2.38% membership interest from one

of the joint venture partners.

JV Member

Price Paid to

Acquire JV

Partner

Interest

JV Partner

Interest Liability

at Time of

Acquisition

Discount

(Addt'l

Owner's

Equity)

Crescent Bay 741,000$ 12,820,000$ 12,079,000$

Benchmark 34,500,000 63,939,000 29,439,000

Other 2,745,000 2,858,000 113,000

Total 37,986,000$ 79,617,000$ 41,631,000$

Recent Acquisition

14

University House First Mortgage Loan

The University House First Mortgage Loan, with an outstanding principal balance of $27.9 million, matured

on June 30, 2015 without repayment. On April 21, 2016, the Company assigned the loan to an unrelated

third party for total proceeds of $31.6 million, which reflects the outstanding principal balance of $27.9

million, interest and default interest due of $3.6 million and other costs incurred of $0.1 million.

Loan Payoff

Estimated Value Changes

Since Inception

15

16

Portfolio Occupancy

1 Reflects weighted-average lease percentage as of the acquisition date taking into account all real estate owned as of each respective date.

2 Includes future leases that had been executed, but not yet commenced as of September 30, 2016.

40.00%

45.00%

50.00%

55.00%

60.00%

65.00%

70.00%

75.00%

80.00%

85.00%

90.00%

95.00%

100.00%

3/

1

/20

1

1

5/

1

/20

1

1

7/

1

/20

1

1

9/

1

/20

1

1

1

1

/1/2

0

1

1

1/

1

/20

1

2

3/

1

/20

1

2

5/

1

/20

1

2

7/

1

/20

1

2

9/

1

/20

1

2

1

1

/1/2

0

1

2

1/

1

/20

1

3

3/

1

/20

1

3

5/

1

/20

1

3

7/

1

/20

1

3

9/

1

/20

1

3

1

1

/1/2

0

1

3

1/

1

/20

1

4

3/

1

/20

1

4

5/

1

/20

1

4

7/

1

/20

1

4

9/

1

/20

1

4

1

1

/1/2

0

1

4

1/

1

/20

1

5

3/

1

/20

1

5

5/

1

/20

1

5

7/

1

/20

1

5

9/

1

/20

1

5

1

1

/1/2

0

1

5

1/

1

/20

1

6

3/

1

/20

1

6

5/

1

/20

1

6

7/

1

/20

1

6

9/

1

/20

1

6

Occupancy at Acquisition1 vs Actual Leased %2

Delta Actual Leased % Leased % at Acquisition

17

Portfolio Occupancy1

Consolidated Properties in Portfolio

at Sept. 30, 2016 and Sept. 30 , 2015

Occupancy at

Acquisition

Leased%

as of Sept 2015

Leased %

as of Sept 2016

% Change

Since Sept

2015

% Change

Since

Acquisition

Northridge Center (Atlanta, GA) 40% 81.7% 93.9% 12.2% 53.9%

Iron Point Business Park (Folsom, CA) 38% 93.7% 97.0% 3.3% 59.0%

Richardson Portfolio (Richardson, TX) 49% 87.0% 88.3% 1.3% 39.3%

Bellevue Technology Center (Bellevue, WA) 62% 96.9% 98.2% 1.4% 36.2%

Powers Ferry Landing (Atlanta, GA) 32% 94.9% 94.9% 0.0% 62.9%

1800 West Loop South (Houston, TX) 76% 88.1% 87.8% -0.3% 11.8%

West Loop I & II (Houston, TX) 77% 78.5% 89.0% 10.5% 12.0%

Burbank Collection (Burbank, CA) 57% 75.0% 88.5% 13.5% 31.5%

Austin Suburban Portfolio (Austin, TX) 75% 83.1% 85.5% 2.4% 10.5%

Westmoor Center (Westminster, CO) 81% 81.6% 82.7% 1.2% 1.7%

Central Building (Seattle, WA) 82% 93.8% 94.2% 0.4% 12.2%

50 Congress (Boston, MA) 88% 92.7% 96.8% 4.1% 8.8%

1180 Raymond (Newark, NJ) 72% 94.0% 89.0% -5.0% 17.0%

Maitland Promenade II (Orlando, FL) 77% 95.5% 93.8% -1.7% 16.8%

Plaza Buildings (Bellevue, WA) 81% 81.0% 85.1% 4.0% 4.1%

424 Bedford (Brooklyn, NY) 97% 100.0% 97.0% -3.0% 0.0%

Weighted-Average/Total 69% 87.1% 89.4% 2.3% 20.5%

Acquisitions from Oct. 1, 2015 to Sept. 30, 2016

Westpark Portfolio (Redmond, WA) 82% N/A 83.4% N/A 1.4%

353 Sacramento (San Francisco, CA) 85% N/A 89.2% N/A 4.2%

Weighted-Average/Total 83% N/A 84.9% N/A 2.1%

Consolidated Portfolio Weighted-Average/Total 71% 87.1% 88.6% 1.5% 17.1%

1 For consolidated properties, and includes future leases that had been executed, but not yet commenced, as of September 30, 2015, and September 30, 2016,

as applicable.

Distribution History1

Record Date Payment Date Amount/Share Reason

12/23/2011 12/28/2011 $0.30 Estimated increase in portfolio value, as supported by completed broker opinions

of value (BOVs)

2/14/2012 2/17/2012 $0.02309337 Gain on the sale of 1 Roseville building

4/16/2012 4/30/2012 $0.025 Gain from paying off loan at a discount, disposition of Roseville land and

estimated increased value in the portfolio

7/20/2012 7/31/2012 $0.35190663 Estimated increase in portfolio value, as supported by a second round of

completed BOVs

3/22/2013 4/4/2013 $0.06153498 Gain from the unsolicited sale of one building in the Richardson Portfolio

11/13/2013 12/5/2013 $0.38 100% of forecasted taxable income for 2013, including gains from the sales of 2

Powers Ferry buildings, the remaining 4 Roseville buildings, and the payoff of

Ponte Palmero mortgage loan

3/31/2014 4/15/2014 $0.04931507 Based on Board’s determination of available cash flow; 2.0% Annualized

6/16/2014 6/23/2014 $0.056096 Based on Board’s determination of available cash flow; 2.25% Annualized

9/15/2014 9/24/2014 $0.069315 Based on Board’s determination of available cash flow; 2.75% Annualized

12/15/2014 12/29/2014 $0.088219 Based on Board’s determination of available cash flow; 3.5% Annualized

3/20/2015 3/26/2015 $0.09246575 Based on Board’s determination of available cash flow; 3.75% Annualized

6/18/2015 6/25/2015 $0.09349315 Based on Board’s determination of available cash flow; 3.75% Annualized

9/21/2015 9/28/2015 $0.09452055 Based on Board’s determination of available cash flow; 3.75% Annualized

12/15/2015 12/22/2015 $0.09452055 Based on Board’s determination of available cash flow; 3.75% Annualized

3/22/2016 3/29/2016 $0.09323770 Based on Board’s determination of available cash flow; 3.75% Annualized

6/17/2016 6/22/2016 $0.09323770 Based on Board’s determination of available cash flow; 3.75% Annualized

9/16/2016 9/22/2016 $0.09426230 Based on Board’s determination of available cash flow; 3.75% Annualized

12/8/2016 12/15/2016 $0.09426230 Based on Board’s determination of available cash flow; 3.75% Annualized

Total $2.15448005

1 Based on all distributions declared, but not necessarily paid as of December 8, 2016.

18

Stockholder Performance

KBS Strategic Opportunity REIT is providing this estimated value per share to assist broker dealers that

participated in its initial public offering in meeting their customer account statement reporting

obligations. As with any valuation methodology, the methodologies used are based upon a number of

estimates and assumptions that may not be accurate or complete. Different parties with different

assumptions and estimates could derive a different estimated value per share. KBS Strategic

Opportunity REIT can give no assurance that:

a stockholder would be able to resell his or her shares at this estimated value per share;

a stockholder would ultimately realize distributions per share equal to KBS Strategic Opportunity

REIT's estimated value per share upon liquidation or sale of KBS Strategic Opportunity REIT;

KBS Strategic Opportunity REIT's shares of common stock would trade at the estimated value per

share on a national securities exchange;

an independent third-party appraiser or other third-party valuation firm would agree with KBS

Strategic Opportunity REIT's estimated value per share; or

the methodology used to estimate KBS Strategic Opportunity REIT's value per share would be

acceptable to FINRA or for compliance with ERISA reporting requirements.

Further, the estimated value per share as of December 8, 2016 is based on the estimated value of KBS

Strategic Opportunity REIT's assets less the estimated value of KBS Strategic Opportunity REIT's

liabilities, or net asset value, divided by the number of shares outstanding as of September 30, 2016.

All of KBS Strategic Opportunity REIT's assets and liabilities were valued as of September 30, 2016.

19

Stockholder Performance

Hypothetical Performance of First and Last Investors

Assumes all distributions have been taken in cash and stockholder has held shares since the dates below1

(1) Does not reflect the hypothetical performance of investment by stockholders that participated in the dividend reinvestment plan.

(2) KBS Strategic Opportunity REIT is providing this estimated value per share to assist broker dealers that participated in its initial public offering in meeting their customer account

statement reporting obligations. As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate

or complete. Different parties with different assumptions and estimates could derive a different estimated value per share. KBS Strategic Opportunity REIT can give no

assurance that:

a stockholder would be able to resell his or her shares at this estimated value per share;

a stockholder would ultimately realize distributions per share equal to KBS Strategic Opportunity REIT's estimated value per share upon liquidation or sale of KBS Strategic

Opportunity REIT;

KBS Strategic Opportunity REIT's shares of common stock would trade at the estimated value per share on a national securities exchange;

an independent third-party appraiser or other third-party valuation firm would agree with KBS Strategic Opportunity REIT's estimated value per share; or

the methodology used to estimate KBS Strategic Opportunity REIT's value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements.

Further, the estimated value per share as of December 8, 2016 is based on the estimated value of KBS Strategic Opportunity REIT's assets less the estimated value of KBS Strategic

Opportunity REIT's liabilities, or net asset value, divided by the number of shares outstanding as of September 30, 2016. All of KBS Strategic Opportunity REIT's assets and liabilities

were valued as of September 30, 2016.

Estimated Value

Per Share as of

December 8, 2016 (2)

Cumulative Cash

Distributions Per Share

Received as of

December 8, 2016

Sum of Estimated Value Per Share and

Cumulative Cash Distributions Per Share

Received, as of December 8, 2016

First Investor (Invested at Escrow Break on April 19, 2010):

$14.81 $2.06 $16.87

Last Investor (Invested at Close of Public Offering on Nov. 14, 2012):

$14.81 $1.36 $16.17

20

$0.44

$0.62 $0.98 $1.36

$11.27

$12.24

$13.44

$14.81

$10.00

$11.71

$12.86

$14.42

$16.17

Offering price Mar-2014 Dec-14 Dec-15

Breakdown of Late Cash Investor Value

Cumulative Distributions

Estimated Value Per Share

$1.14 $1.32 $1.68

$2.06

$11.27

$12.24

$13.44

$14.81

$10.00

$12.41

$13.56

$15.12

$16.87

Offering Price Mar-14 Dec-14 Dec-15

Breakdown of Early Cash Investor Value

Cumulative Distributions

Estimated Value Per Share

Stockholder Performance

Hypothetical Performance of Early and Late Investors

$10.00 Share Price, All Distributions Received in Cash

“Valuation Information” for an early cash investor assumes all distributions received in cash and no share redemptions and reflect the cash payment amounts

(all distributions paid since inception) per share for a hypothetical investor who invested on or before escrow break and consequently has received all

distributions paid by the REIT. “Cumulative distributions” for an early cash investor and a late cash investor assumes all distributions received in cash and no

share redemptions, and reflect the cash payment amounts (all distributions paid since investment) per share for a hypothetical investor who invested on

April 19, 2010, and November 14, 2012, respectively. The “offering price” of $10.00 reflects the maximum per share purchase price in the primary initial

public offering.

21

Offering Closed

Nov. 14, 2012

Offering Closed

Nov. 14, 2012

Dec-16 Dec-16

Share Redemption Program

On December 8, 2016, the REIT adopted an amended and restated share

redemption program:

• Shares will be redeemed at 95% of the REIT’s most recent estimated value per

share as of the applicable redemption date, except for redemptions made upon

a stockholder’s death, “qualifying disability” or “determination of

incompetence.”

• Upon the death, “qualifying disability” or “determination of incompetence” of

a stockholder, the redemption price will continue to be equal to the REIT’s

most recent estimated value per share.

• The amended share redemption program will be effective for the December

2016 redemption date, which is December 30, 2016. Please see the Valuation

8-K for full details.

22

2017 Goals & Objectives

1) Continue to implement a value-add strategy for remaining and new assets,

primarily through lease-up and repositioning

2) Explore value-add opportunities for existing assets, primarily in land holdings,

both direct development and added entitlements

3) Refinance upcoming maturities to capitalize on an ever competitive lending

environment

4) Distribute available cash to stockholders through growing rents, leasing and

refinancing in 2017

5) Strategically sell assets and consider special distributions

6) Explore target liquidity options, including foreign exchanges and daily NAV

conversion, while managing continued value creation

23

Shareholder Communication

Statements will reflect new estimated value per share of $14.81 beginning with

December 2016 statements.

Shareholder letter will be included with December 2016 statements mailed in

early January 2017.

Estimated value per share visible through DST will be updated to show new

estimated value.

Expected next NAV date: December 2017

24

For more information, please contact your

financial advisor or KBS Capital Markets

Group at (866) 527-4264.

KBS Capital Markets Group

Member FINRA & SIPC

800 Newport Center Drive, Suite 700

Newport Beach, CA 92660

www.kbs-cmg.com

Thank you!

25