Attached files

| file | filename |

|---|---|

| 8-K - Mr. Amazing Loans Corp | form8-k.htm |

IEG Holdings Corporation (IEGH) Increases Loan Volumes to New Record High and Reiterates Upgraded First Quarter 2017 Earnings/Dividend Guidance

Las Vegas, Nevada – (December 14, 2016) – IEG Holdings Corporation (OTCQX: IEGH) today released the update below to summarize its current short-term plans and outlook.

Record High Loan Volumes

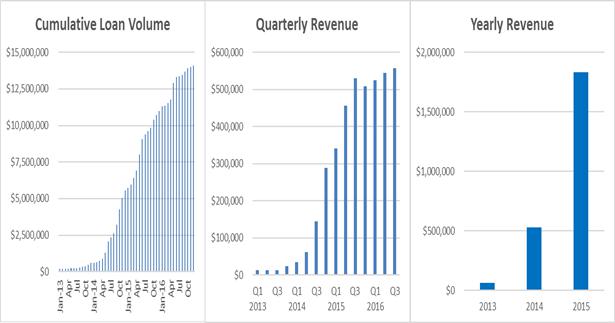

IEG Holdings Corporation has provided a further $60,000 in new consumer loans to date in December. Since January 2015, cumulative loan volume has increased by 154% from $5,549,023 to $14,079,023 as at December 13, 2016.

First Quarter 2017 Earnings Guidance

Effective January 1, 2017, management will fully implement the significant cuts to consulting fees, salaries/compensation and other operating expenses that were previously discussed in IEGH’s November 3, 2016 corporate strategy update.

As a result of these cuts, management now forecasts a small inaugural net profit and a positive operating cash flow position for the three months ending March 31, 2017. IEGH is in the strongest fundamental position in its history of operation in the US and management is very confident in its short, medium and long-term prospects.

Dividend Policy and Capital Management Policy Changes

In light of IEGH’s anticipated improvements in financial position, IEGH will change its dividend policy in 2017. IEGH intends to pay a small dividend to shareholders in April 2017 after its first quarter 2017 results are released and expects to pay ongoing regular quarterly dividends.

In addition to the change in dividend policy, IEGH plans to investigate capital management policy changes in the short-term, including potential stock repurchases.

12% Senior Unsecured Notes

IEG Holdings Corporation has launched its private offering of up to $10 million aggregate principal amount of its 12% senior unsecured notes due December 31, 2026 (the “Notes”), on a self-underwritten basis. There can be no assurance that the private offering of Notes will be completed. IEGH intends to use the net proceeds of the offering to increase the size of its loan book.

The Notes will be offered in a private offering exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). The Notes will not be or have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

This press release is being issued pursuant to Rule 135c under the Securities Act, and is neither an offer to sell nor a solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer to sell or a solicitation of an offer to buy, or a sale of, the Notes or any other securities in any jurisdiction in which such offer, solicitation or sale is unlawful.

Make sure you are first to receive timely information on IEG Holdings when it hits the newswire by signing up for IEG Holdings’ email news alert system at http://www.investmentevolution.com/alerts.

About IEG Holdings Corporation

IEG Holdings Corporation (IEGH) (“IEG Holdings”) provides online unsecured consumer loans under the brand name, “Mr. Amazing Loans,” via its website, www.mramazingloans.com, in 18 US states. IEG Holdings offers $5,000 and $10,000 loans over a term of five years at a 19.9% to 29.9% APR. IEG Holdings plans future expansion to 25 US states by mid-2017. For more information about IEG Holdings, visit www.investmentevolution.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts included in this press release are forward-looking statements. In some cases, forward-looking statements can be identified by words such as “believe,” “expect,” “anticipate,” “plan,” “potential,” “continue” or similar expressions. Such forward-looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors, risks and uncertainties are discussed in IEG Holdings’ filings with the Securities and Exchange Commission. Investors should not place any undue reliance on forward-looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond IEG Holdings’ control which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects IEG Holdings’ current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity. IEG Holdings assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

The contents of IEG Holdings’ website referenced herein are not incorporated into this press release.

Contact:

Company

Paul Mathieson

IEG Holdings Corporation

Chairman/CEO and Founder

info@investmentevolution.com

+1-702-227-5626