Attached files

| file | filename |

|---|---|

| 8-K - 8-K POTENTIAL FGIC TRANSACTION - ASSURED GUARANTY LTD | fgicpotentialtransaction8k.htm |

KL2 2975844.16

THE INSTITUTIONS LISTED ON EXHIBIT A

September 27, 2016

Assured Guaranty Corp.

1633 Broadway

New York, NY 10019

Attn: Mr. David A. Buzen

Dear David:

This letter will memorialize the indicative, non-binding terms regarding a potential commutation and

reinsurance transaction (the “Transaction”) involving Financial Guaranty Insurance Company (“FGIC”),

as agreed in principle by Assured Guaranty Corp. (together with its subsidiaries or affiliates, as

appropriate, “AGC” or “you”) and the undersigned firms, identified on Exhibit A hereto (“we” or “us”).

Each of us is a record or beneficial holder (or a provider of investment management or advisory services

on behalf of such holder(s)) of certain FGIC Interests. A “FGIC Interest” is an existing DPO (as defined

herein); an in-force insurance policy issued by FGIC under which claims have been made but capacity

still remains for future losses; an in-force insurance policy issued by FGIC under which no claims have

been made; and/or any interest in the foregoing. A holder of a FGIC Interest is referred to as a “FGIC

Interest Holder.” You and we agree that AGC (or any affiliate identified herein) may assign its rights and

obligations under any agreement identified herein to any affiliate, provided that the affiliate must have a

financial strength rating at least as high as the transferring AGC entity.

Under the transaction, generally,

FGIC Interest Holders within FGIC’s distressed insured exposure portfolio (specifically, FGIC

Interests in connection with RMBS Obligations, PR Obligations and Detroit Obligations, each as

defined below, provided, however, that based on AGC’s due diligence, additional liabilities, not

to exceed $25 million in initial required reserves, may need to be classified as part of FGIC’s

distressed insured exposure portfolio (“Additional Distressed Obligations”), and such liabilities

will be so added within 30 days of FGIC providing sufficient access to its book and records to

enable AGC to evaluate FGIC’s liabilities (the “Distressed Portfolio”)) will commute or cause to

be commuted their FGIC Interests in exchange for, in the aggregate, for all such FGIC Interest

Holders, (i) all Distributable Cash (defined below) plus (ii) newly issued surplus notes, deferred

payment obligations or similar instruments (“Surplus Notes”) representing the rights to 80% of

Future Recoveries (defined herein);

AGC will provide 100% quota-share reinsurance coverage on FGIC’s non-distressed insured

exposure portfolio;

AGC will provide excess-of-loss coverage, for losses in excess of FGIC’s negotiated reserve

requirements, for policy coverage remaining under non-commuting FGIC Interests in the

Distressed Portfolio (the “Remaining Distressed Portfolio”);

AGC will be entitled to consideration comprising a $281,500,000 reinsurance premium, net of a

ceding commission of $56,500,000 (i.e., $225,000,000, which is referred to herein as the “Net

Reinsurance Consideration”) and Surplus Notes representing the rights to 20% of Future

Recoveries;

Exhibit 99.1

Cleansing Materials

2

KL2 2975844.16

at the Effective Date (defined herein) immediately after giving effect to the transaction, FGIC

shall retain at least $100,000,000 in capital, including at least $33,000,000 expected to be retained

by FGIC UK Limited (“FGIC UK”), after FGIC pays such consideration and the Transaction

Expenses (as defined below); and

AGC will enter into a management agreement with FGIC to manage FGIC and FGIC UK.

“Future Recoveries” means all distributable income, earnings and other amounts collected by, and all

assets held by, FGIC from and after the Effective Date until the repayment in full of the Surplus Notes,

including without limitation litigation proceeds; Reserve Releases (defined herein); and the proceeds of

any sale of, or distributions from, FGIC UK.

“Distributable Cash” means all cash and other liquid assets remaining in FGIC on the Effective Date

following the payment of the Net Reinsurance Consideration to AGC and the required capital and

reserves contemplated herein. You and we intend to maximize the amount of Distributable Cash to the

extent practicable by having FGIC sell or otherwise monetize assets on or prior to the Effective Date. As

shown in Exhibit B, the illustrative commutation transaction is expected to result in at least $1.95 billion

of Distributable Cash for commuting FGIC Interest Holders, although the amount could be more if you

and we are successful in monetizing additional FGIC assets at the Effective Date.

You and we agree that the ideal transaction is one in which 100% of FGIC Interest Holders participate,

and, based on our current holdings and our discussions with other FGIC Interest Holders, that is our

present expectation. However, it is assumed herein, and it is a minimum requirement for pursuing a

transaction, that at least 90% of the insured exposure related to RMBS Obligations and PR Obligations in

the aggregate, 100% of outstanding DPOs (including DPO Accretion, as defined herein) arising under

FGIC’s coverage of Detroit municipal obligations (“Detroit Obligations”) and at least 90% of all other

outstanding DPOs (including DPO Accretion) in the Distressed Portfolio are commuted pursuant to the

transaction.

The transaction will be effectuated pursuant to an amendment (the “Plan Amendment”) to FGIC’s First

Amended Plan of Rehabilitation for FGIC dated June 4, 2013, together with all exhibits and the Plan

Supplement thereto (the “Plan”), to be sought by the New York State Superintendent of Financial

Services (the “Superintendent”), in her capacity as rehabilitator of FGIC, in a proceeding in New York

State Supreme Court. It is contemplated that you and we will, upon the execution of this letter, approach

FGIC and the New York State Department of Financial Services to solicit their support for the transaction

and to induce them to take all appropriate measures to seek such Plan Amendment in order to effectuate

the transaction.

Wherever this letter refers to commutation of a FGIC Interest, the property right being surrendered to

FGIC is insurance coverage provided by FGIC or a claim on FGIC for the DPO payment, as the case may

be, not the underlying obligation insured by FGIC. The commuting FGIC Interest Holder will continue to

hold such obligation post-commutation, but without the FGIC Interest. This may be accomplished

through a “synthetic commutation”, if necessary.

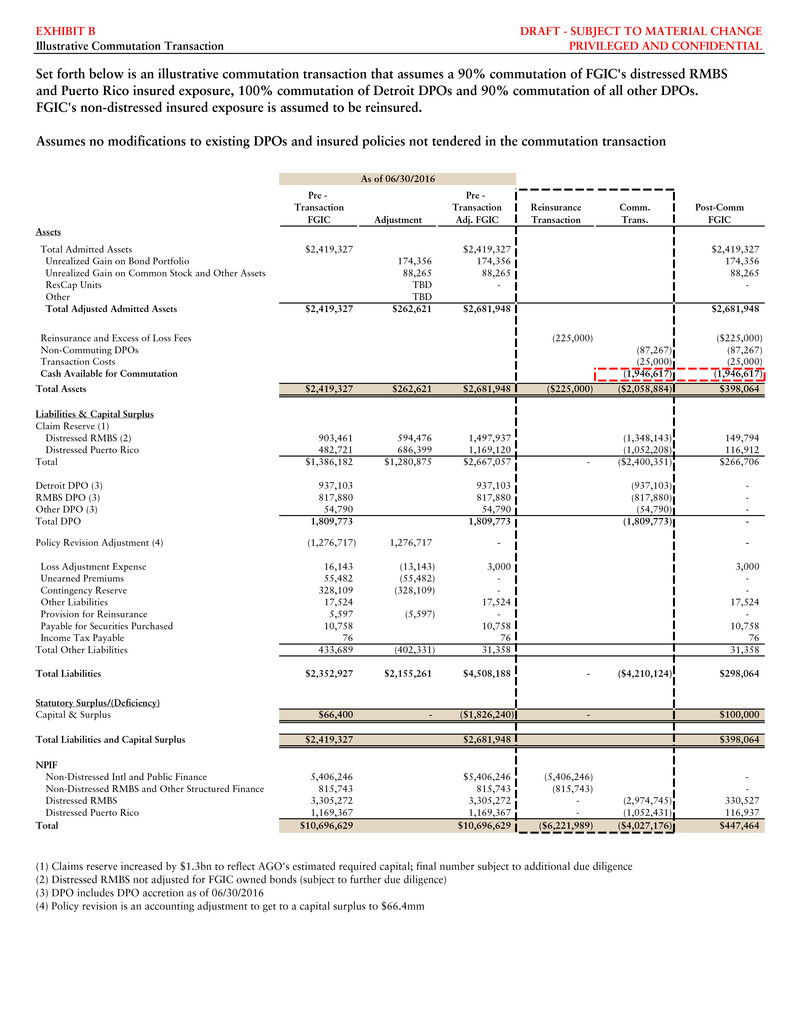

Exhibit B hereto sets forth FGIC’s balance sheet as of a June 30, 2016, adjustments in respect of an

illustrative commutation transaction and the resulting pro forma balance sheet giving effect to such

adjustments, showing the assets and liabilities remaining in FGIC and the aggregate distributions to

commuting FGIC Interest Holders.

3

KL2 2975844.16

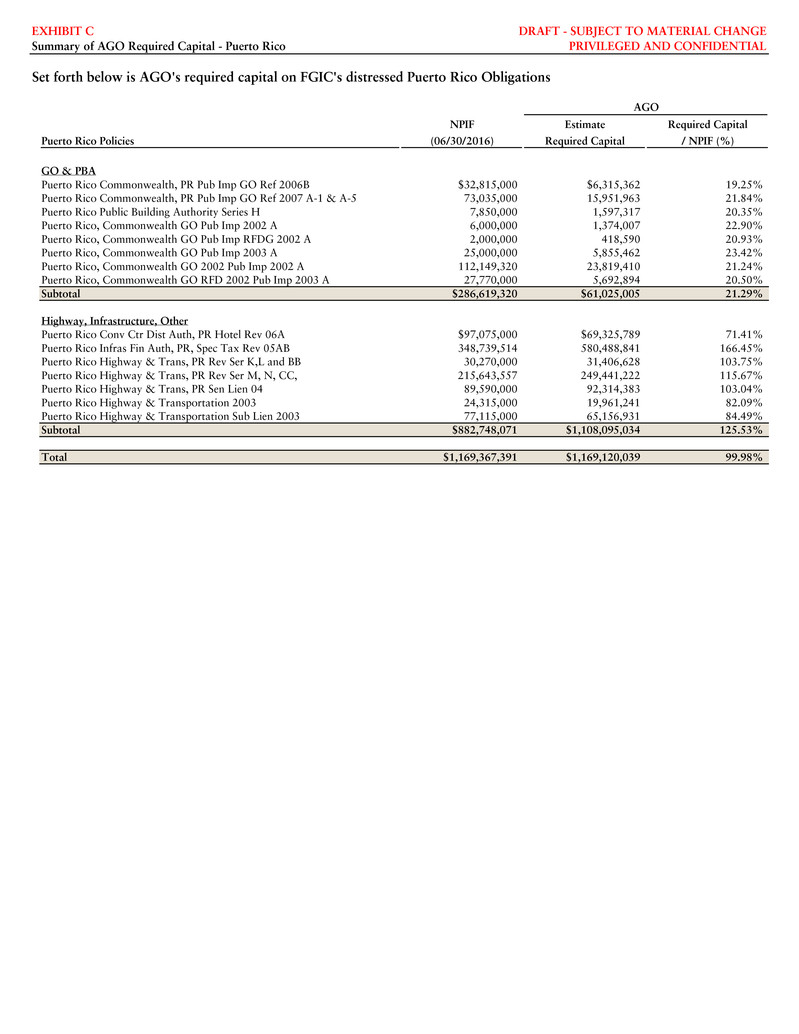

Exhibits C and D hereto set forth schedules showing, based on current information available to you and

us as of today’s date, FGIC’s initial required reserves on PR Obligations (defined herein) as contemplated

hereby and FGIC’s initial required reserves as contemplated hereby on its exposure to RMBS

Obligations, respectively, immediately prior to giving effect to the Commutation. These exhibits are

subject to change as you and we receive additional and updated information.

Exhibit E hereto shows all securities as to which FGIC insurance coverage in the Distressed Portfolio

attaches and therefore which could be included in the XOL Agreement (defined herein).

Exhibits B through E are subject to being updated by you and us as more current information becomes

available.

“DPO” has the meaning ascribed to it in the Plan.

“DPO Accretion” has the meaning ascribed to it in the Plan.

Under the transaction and pursuant to the Plan Amendment, subject to the satisfaction of all closing

conditions, the transaction will be effectuated as described below on a date agreed by the parties (the

“Effective Date”) pursuant to a master transaction agreement.

1. Commutation. FGIC Interest Holders within the Distressed Portfolio will commute or cause to

be commuted their coverage or DPOs (as the case may be) in exchange for all Distributable Cash

and Surplus Notes as set forth herein (the “Commutation”). Upon the Effective Date, FGIC will

not be entitled to any further reimbursements or subrogation rights arising from payments it has

made on insured obligations or payments made by FGIC in respect of commuting FGIC Interests,

with such exceptions, if any, as may be mutually agreed by you and us in order for FGIC to

preserve litigation rights to be able collect Future Recoveries. The Commutation may be

accomplished through a structured transaction that has the same economic effect as a

commutation by an individual FGIC Interest Holder (i.e., a “synthetic commutation”).

2. Reinsurance of Non-Distressed Portfolio. FGIC will cede to AGC a 100% quota share of

FGIC’s in-force policies other than those in the Distressed Portfolio. AGC will be permitted to

seek novation of all such policies following the Effective Date in its discretion and at its expense.

3. Excess of Loss Cover for Remaining Distressed Portfolio. FGIC will cede to AGC (x) all

losses, and (y) loss adjustment expense for (i) RMBS Obligations other than litigation costs and

(ii) PR Obligations and Additional Distressed Obligations (and excluding loss adjustment

expense for litigation costs related to RMBS Obligations) (“Ceded LAE”), on the Remaining

Distressed Portfolio exceeding an attachment point that will adjust from time to time as described

herein (the “XOL Agreement”), as will be illustrated on a mutually agreed Effective Date pro

forma balance sheet.

a. The initial attachment point will

i. be agreed by you and the FGIC Interest Holders participating in the

Commutation;

ii. represent an amount of reserves exceeding FGIC’s statutory-basis (“SAP”) claim

reserve in respect of the Remaining Distressed Portfolio as of the Effective Date

and the amount of Ceded LAE as of the Effective Date;

iii. in the case of exposures on obligations of the Commonwealth of Puerto Rico and

its territorial instrumentalities (“PR Obligations”), be set at the level as shown in

Exhibit C, after adjusting such level to give effect to the Commutation; and

4

KL2 2975844.16

iv. in the case of exposures on residential mortgage-backed securities (“RMBS

Obligations”), be set using a discount rate equal to the zero-coupon swap forward

curve plus 100 basis points (the “RMBS Discount Rate”).

b. You and we agree that this initial attachment point, or amount of reserves, is more

conservative than warranted under SAP and expect releases of these reserves over time.

The attachment point will be adjusted downward from time to time, as described in

Paragraph 7 below, as the Remaining Distressed Portfolio runs off. For the avoidance of

doubt, the attachment point will not be eroded by loss adjustment expenses other than

Ceded LAE.

4. Reinsurance Consideration Payable to AGC. AGC will be entitled to

a. The Net Reinsurance Consideration from FGIC payable on the Effective Date; and

b. Surplus Notes representing the 20% of all Future Recoveries.

5. Application of All Collections to Future Recoveries. AGC will bear the risk of any losses in

excess of the attachment point on the Remaining Distressed Portfolio even if FGIC’s other

current reserves held at a given time are less than the attachment point in effect at that time. For

the avoidance of doubt, FGIC’s reserves and capital levels will be determined assuming that

recoveries will be available to pay losses. Premium income, investment income and litigation

proceeds will not be used to pay losses and will instead be applied to Future Recoveries.

6. Reserve Calculations. AGC will perform Reserve Calculations in accordance with the time

periods set forth below, but in each case after FGIC’s statutory financial statement is filed but in

any case not later than June 30 of the applicable year, as follows. “Reserve Calculation” means a

calculation of FGIC’s SAP claim reserve associated with specified business, determined in

accordance with AGC’s then-current methodology for establishing SAP reserves for its own

portfolio (“AGC Reserve Methodology”), as modified by (i) in respect of RMBS Obligations, the

methodology described in Subparagraph 6.a below and (ii) in respect of PR Obligations, the

methodology described in Subparagraph 6.b below.

a. Annually in accordance with the AGC Reserve Methodology, AGC will perform a

Reserve Calculation on the RMBS Obligations and Additional Distressed Obligations.

Until the fifth anniversary of the Effective Date, such Reserve Calculation shall, as to

RMBS Obligations, be performed using the RMBS Discount Rate and shall include a

reserve in excess of SAP reserves equal to the excess reserve in effect prior to such

Reserve Calculation reduced proportionately by the same percentage that the SAP

reserves are reduced in such Reserve Calculation. Beginning as of the fifth anniversary

of the Effective Date, such Reserve Calculation shall be performed using the AGC

Reserve Methodology, but at no time will reserves exceed the amount of reserves prior to

such Reserve Calculation.

b. Beginning as of the fifth anniversary of the Effective Date (and annually thereafter in

accordance with the AGC Reserve Methodology), AGC will perform a Reserve

Calculation on the PR Obligations, provided that a Reserve Calculation on the PR

Obligations will also be performed as of any date, whether prior to or following the fifth

anniversary, on which (i) amounts are recovered on, and FGIC’s insured exposure

decreases in respect of, PR Obligations, triggering a release of reserves on such

obligations or (ii) a restructuring of PR Obligations is effectuated, reducing the insured

obligations, by a court order that has become a final order, but in each case only with

respect to the applicable PR Obligations.

7. Reserve Releases and Attachment Point Reset. Reserves will be released as follows.

5

KL2 2975844.16

a. To the extent that a Reserve Calculation results in a required reserve less than the (i)

required reserves for the relevant business on the Effective Date minus (ii) the cumulative

reserve releases for the relevant business as determined immediately prior to such

Reserve Calculation, redundant reserves will be released, provided that the reserve on any

PR Obligation that is repaid by the obligor at maturity will automatically be released,

provided, further, that the aggregate amount of redundant reserves released for the

relevant business shall not exceed the required reserves for the relevant business on the

Effective Date (a “Reserve Release”).

b. Upon a Reserve Release or other collection of a Future Recovery, subject to non-

disapproval by the Superintendent, following notice to the Superintendent, a distribution

on the Surplus Notes will become payable, provided that FGIC shall not be required to

give such notice any more frequently than annually, and any application will give effect

to any prior Reserve Releases that have accumulated but have not yet been distributed.

Upon a Reserve Release, the attachment point under the XOL Agreement will

automatically reset to reflect the new level of reserves.

c. To the extent that any Reserve Calculation results in a required reserve higher than the

amount reserved at that time, the attachment point will not reset and no approval for

payment under the Surplus Notes will be sought from the Superintendent.

8. Surplus Notes.

a. The Surplus Notes issued to the FGIC Interest Holders will entitle the holders to 80% of

all Future Recoveries. The FGIC Interest Holders’ Surplus Notes will not be subject to

transfer restrictions. It is contemplated that these Surplus Notes will be tradable and will

be exempt from registration requirements under the securities laws pursuant to Section

3(a)(10) of the Securities Act of 1933, as amended.

b. The Surplus Notes issued to AGC will entitle AGC to 20% of all Future Recoveries.

AGC’s Surplus Notes will not be transferable (other than to an affiliate) without the

written consent of the holders of 66-2/3% of the Surplus Notes held by the FGIC Interest

Holders who affirmatively participate in such determination, their successors or assigns

(as determined based on the then-outstanding face amount of the Surplus Notes).

c. The aggregate principal amount of all Surplus Notes on the Effective Date will be such

that 80% of the aggregate principal will equal (i) 100% of the net present value of

projected claims minus cash payments made in the Commutation in respect of

commuting policy coverage plus (ii) 100% of the face amount of commuted DPOs (plus

unpaid DPO Accretion accrued through the Effective Date) minus cash payments made in

the Commutation in respect of commuting DPOs.

d. The Surplus Notes held by AGC will be pari passu with those issued to the commuting

FGIC Interest Holders, and no distribution on the Surplus Notes will be made to AGC or

the commuting FGIC Interest Holders (or their transferees) without a ratably equivalent

distribution being made concurrently to the commuting FGIC Interest Holders (or their

transferees) or AGC, as the case may be.

e. There shall be no distributions on the Surplus Notes in the absence of non-disapproval

from the Superintendent following notice.

9. Management Agreement. On the Effective Date, AGC and FGIC will enter into a management

agreement pursuant to which AGC will provide all management and administrative services to

FGIC in consideration for an annual management fee of $7,500,000. AGC will bear all operating

expenses of FGIC. FGIC will bear all expenses other than those related to the management of the

assets and liabilities of FGIC, including but not limited to those expenses related to the

governance of FGIC and supervision by AGC, such as non-AGC director fees, directors and

officers insurance for non-AGC employees, audit expenses and associated legal fees, regulatory

6

KL2 2975844.16

filing fees and litigation costs and expenses. The initial term of the management agreement will

be five years, with automatic renewal thereafter unless terminated by a party. FGIC may

terminate the management agreement without cause only upon paying a termination fee equal to

one year’s management fees.

10. FGIC Board Matters. The FGIC board of directors will comprise seven directors, the minimum

number of directors required under New York insurance law. Of the seven, two will be

designated by the commuting FGIC Interest Holders; two will be designated by AGC; and three

will be designated by mutual agreement of the FGIC Interest Holders and AGC. A vacancy in one

of the two positions designated by the FGIC Interest Holders will be filled at the direction of the

remaining FGIC Interest Holders’ director. A vacancy in one of the two positions designated by

AGC will be filled at the direction of AGC. A vacancy in one of the three other positions will be

filled at the direction of a majority of the remaining directors, and in the event of a tie, a director

designated by AGC shall serve as the tiebreaking vote.

11. Breakage. “Breakage” means all costs incurred in connection with terminating FGIC contracts,

licenses and other arrangements not needed for the future administration of FGIC, including

severance, other than the four most expensive severance packages (“Top 4 Severance Costs”). In

satisfaction of these costs, (i) an amount equal to 50% of Breakage will be deducted from the Net

Reinsurance Consideration, and (ii) an amount equal to 50% of Breakage plus an amount equal to

Top 4 Severance Costs will be deducted from Distributable Cash being paid out to commuting

FGIC Interest Holders on the Effective Date.

12. Transaction Costs. FGIC shall bear all costs incurred by FGIC or the participating FGIC

Interest Holders in connection with the transaction, including but not limited to fees due to

advisors to such parties and regulatory filings made by such parties (“Transaction Expenses”).

13. Permitted Practices. The approval of the following permitted accounting practices for FGIC

from the Superintendent shall be a condition to closing the Transaction: (i) permission to

recognize the ceding commission as income immediately and (ii) permission to release

contingency reserves.

9

KL2 2975844.16

EXHIBIT A

SIGNATORY FIRMS

1. Monarch Alternative Capital LP, on behalf of certain of its advisory clients

2. Aurelius Capital Management, LP, solely as manager on behalf of its managed entities and not in its

individual capacity

3. King Street Capital Management, L.P., on behalf of certain entities it manages

4. Canyon Capital Advisors LLC (on behalf of its participating funds and/or clients)

5. Panning Capital Management, LP, on behalf of certain entities it manages

10

KL2 2975844.16

EXHIBIT B

PRO FORMA BALANCE SHEET

11

KL2 2975844.16

EXHIBIT C

PUERTO RICO RESERVES

12

KL2 2975844.16

EXHIBIT D

RMBS RESERVES

13

KL2 2975844.16

EXHIBIT E

SECURITIES ELIGIBLE FOR COVERAGE IN THE XOL AGREEMENT

EXHIBIT B DRAFT - SUBJECT TO MATERIAL CHANGE

Illustrative Commutation Transaction PRIVILEGED AND CONFIDENTIAL

Set forth below is an illustrative commutation transaction that assumes a 90% commutation of FGIC's distressed RMBS

and Puerto Rico insured exposure, 100% commutation of Detroit DPOs and 90% commutation of all other DPOs.

FGIC's non-distressed insured exposure is assumed to be reinsured.

Assumes no modifications to existing DPOs and insured policies not tendered in the commutation transaction

As of 06/30/2016

Pre - Pre -

Transaction Transaction Reinsurance Comm. Post-Comm

FGIC Adjustment Adj. FGIC Transaction Trans. FGIC

Assets

Total Admitted Assets $2,419,327 $2,419,327 $2,419,327

Unrealized Gain on Bond Portfolio 174,356 174,356 174,356

Unrealized Gain on Common Stock and Other Assets 88,265 88,265 88,265

ResCap Units TBD - -

Other TBD

Total Adjusted Admitted Assets $2,419,327 $262,621 $2,681,948 $2,681,948

Reinsurance and Excess of Loss Fees (225,000) ($225,000)

Non-Commuting DPOs (87,267) (87,267)

Transaction Costs (25,000) (25,000)

Cash Available for Commutation (1,946,617) (1,946,617)

Total Assets $2,419,327 $262,621 $2,681,948 ($225,000) ($2,058,884) $398,064

Liabilities & Capital Surplus

Claim Reserve (1)

Distressed RMBS (2) 903,461 594,476 1,497,937 (1,348,143) 149,794

Distressed Puerto Rico 482,721 686,399 1,169,120 (1,052,208) 116,912

Total $1,386,182 $1,280,875 $2,667,057 - ($2,400,351) $266,706

Detroit DPO (3) 937,103 937,103 (937,103) -

RMBS DPO (3) 817,880 817,880 (817,880) -

Other DPO (3) 54,790 54,790 (54,790) -

Total DPO 1,809,773 1,809,773 (1,809,773) -

Policy Revision Adjustment (4) (1,276,717) 1,276,717 - -

Loss Adjustment Expense 16,143 (13,143) 3,000 3,000

Unearned Premiums 55,482 (55,482) - -

Contingency Reserve 328,109 (328,109) - -

Other Liabilities 17,524 17,524 17,524

Provision for Reinsurance 5,597 (5,597) - -

Payable for Securities Purchased 10,758 10,758 10,758

Income Tax Payable 76 76 76

Total Other Liabilities 433,689 (402,331) 31,358 31,358

Total Liabilities $2,352,927 $2,155,261 $4,508,188 - ($4,210,124) $298,064

Statutory Surplus/(Deficiency)

Capital & Surplus $66,400 - ($1,826,240) - $100,000

Total Liabilities and Capital Surplus $2,419,327 $2,681,948 $398,064

NPIF

Non-Distressed Intl and Public Finance 5,406,246 $5,406,246 (5,406,246) -

Non-Distressed RMBS and Other Structured Finance 815,743 815,743 (815,743) -

Distressed RMBS 3,305,272 3,305,272 - (2,974,745) 330,527

Distressed Puerto Rico 1,169,367 1,169,367 - (1,052,431) 116,937

Total $10,696,629 $10,696,629 ($6,221,989) ($4,027,176) $447,464

(1) Claims reserve increased by $1.3bn to reflect AGO's estimated required capital; final number subject to additional due diligence

(2) Distressed RMBS not adjusted for FGIC owned bonds (subject to further due diligence)

(3) DPO includes DPO accretion as of 06/30/2016

(4) Policy revision is an accounting adjustment to get to a capital surplus to $66.4mm

EXHIBIT C DRAFT - SUBJECT TO MATERIAL CHANGE

Summary of AGO Required Capital - Puerto Rico PRIVILEGED AND CONFIDENTIAL

Set forth below is AGO's required capital on FGIC's distressed Puerto Rico Obligations

AGO

NPIF Estimate Required Capital

Puerto Rico Policies (06/30/2016) Required Capital / NPIF (%)

GO & PBA

Puerto Rico Commonwealth, PR Pub Imp GO Ref 2006B $32,815,000 $6,315,362 19.25%

Puerto Rico Commonwealth, PR Pub Imp GO Ref 2007 A-1 & A-5 73,035,000 15,951,963 21.84%

Puerto Rico Public Building Authority Series H 7,850,000 1,597,317 20.35%

Puerto Rico, Commonwealth GO Pub Imp 2002 A 6,000,000 1,374,007 22.90%

Puerto Rico, Commonwealth GO Pub Imp RFDG 2002 A 2,000,000 418,590 20.93%

Puerto Rico, Commonwealth GO Pub Imp 2003 A 25,000,000 5,855,462 23.42%

Puerto Rico, Commonwealth GO 2002 Pub Imp 2002 A 112,149,320 23,819,410 21.24%

Puerto Rico, Commonwealth GO RFD 2002 Pub Imp 2003 A 27,770,000 5,692,894 20.50%

Subtotal $286,619,320 $61,025,005 21.29%

Highway, Infrastructure, Other

Puerto Rico Conv Ctr Dist Auth, PR Hotel Rev 06A $97,075,000 $69,325,789 71.41%

Puerto Rico Infras Fin Auth, PR, Spec Tax Rev 05AB 348,739,514 580,488,841 166.45%

Puerto Rico Highway & Trans, PR Rev Ser K,L and BB 30,270,000 31,406,628 103.75%

Puerto Rico Highway & Trans, PR Rev Ser M, N, CC, 215,643,557 249,441,222 115.67%

Puerto Rico Highway & Trans, PR Sen Lien 04 89,590,000 92,314,383 103.04%

Puerto Rico Highway & Transportation 2003 24,315,000 19,961,241 82.09%

Puerto Rico Highway & Transportation Sub Lien 2003 77,115,000 65,156,931 84.49%

Subtotal $882,748,071 $1,108,095,034 125.53%

Total $1,169,367,391 $1,169,120,039 99.98%

EXHIBIT D DRAFT - SUBJECT TO MATERIAL CHANGE

Summary of AGO Required Capital - RMBS PRIVILEGED AND CONFIDENTIAL

Set forth below is AGO's required capital on FGIC's RMBS Obligations

NPIF AGO Estimate % of

RMBS Policies (06/30/2016) Req. Capital (1) NPIF

Ultimate Pay

MSAC 2007-NC4 $463,912,431 $214,016,241 46.1%

TMTS 2006-8SL 321,369,320 156,372,373 48.7%

TMTS 2005-13SL 139,014,300 153,339,981 110.3%

TMTS 2006-2HGS 138,773,743 62,674,543 45.2%

BARN 2007-1 N1 126,006,408 99,668,301 79.1%

MABS 2005-AB1 61,861,829 36,664,772 59.3%

MABS 2006-AB1 59,127,000 22,122,025 37.4%

CMLTI 2005-WF2 AF6B 52,540,000 14,838,017 28.2%

BSABS 2006-AC1 1A2 23,199,932 18,192,705 78.4%

CMLTI 2006-WF1W 17,099,556 12,379,362 72.4%

CMLTI 2006-WF1W 10,259,734 - -

Total Ultimate Pay $1,413,164,252 $790,268,322 55.9%

Current Pay

CWHEL 2006-H $261,225,868 $116,602,114 44.6%

CWHEL 2007-C A 138,947,346 41,568,111 29.9%

CWL 2006-S3 118,663,663 62,026,820 52.3%

CWL 2006-S5 118,135,628 62,632,176 53.0%

CWL 2006-S2 114,056,769 54,569,924 47.8%

BSABS 2007-SD3 A 103,447,592 10,174,306 9.8%

CWHEL 2005-B 83,052,004 29,972,752 36.1%

IMM 2004-11 54,847,281 2,650,478 4.8%

QUEST 2006-X1 52,493,724 11,012,169 21.0%

INDS 2006-2B A 39,081,720 12,212,652 31.2%

QUEST 2005-X2 A2 26,570,222 5,369,438 20.2%

HEMT 2006-2 2A1 18,664,131 11,403,888 61.1%

INDS 2006-1 18,101,010 58,309,087 322.1%

AHM 2005-2 6A 8,125,625 8,412,742 103.5%

AHM 2005-4 2A 7,938,105 3,698,162 46.6%

AHM 2005-1 9A 4,050,894 4,178,310 103.1%

BSABS 2005-AC9 A5 19,494,899 7,468,941 38.3%

INABS 2006-H1 A 30,962,532 9,226,368 29.8%

Total Current Pay $1,217,859,010 $511,488,437 42.0%

Other RMBS with AGO Required Capital 674,248,854 196,180,341 29.1%

Total Distressed RMBS Insured Exposure $3,305,272,117 $1,497,937,100 45.3%

Other RMBS (2) 557,888,593 - -

Other Structured Finance (3) 257,854,826 - -

Total Structured Finance $4,121,015,535 $1,497,937,100 36.3%

(1) Collateral and loss assumptions subject to further discussions between AGO and FGIC Interest Holders. Discount rate is the risk free swap + 100bps

(2) RMBS with no AGO required capital; assumed to be included in the reinsurance transaction

(3) Other structured finance with no AGO required capital; assumed to be included in the reinsurance transaction

EXHIBIT E DRAFT - SUBJECT TO MATERIAL CHANGE

XOL Agreement PRIVILEGED AND CONFIDENTIAL

Set forth below is a list of the Puerto Rico and RMBS Obligations to be covered under the XOL Agreement.

All other policies to be included in the reinsurance transaction

AGO

NPIF Estimate Required Capital

(06/30/2016) Required Capital / NPIF (%)

Puerto Rico Obligations

GO & PBA

Puerto Rico Commonwealth, PR Pub Imp GO Ref 2006B $32,815,000 $6,315,362 19.25%

Puerto Rico Commonwealth, PR Pub Imp GO Ref 2007 A-1 & A-5 73,035,000 15,951,963 21.84%

Puerto Rico Public Building Authority Series H 7,850,000 1,597,317 20.35%

Puerto Rico, Commonwealth GO Pub Imp 2002 A 6,000,000 1,374,007 22.90%

Puerto Rico, Commonwealth GO Pub Imp RFDG 2002 A 2,000,000 418,590 20.93%

Puerto Rico, Commonwealth GO Pub Imp 2003 A 25,000,000 5,855,462 23.42%

Puerto Rico, Commonwealth GO 2002 Pub Imp 2002 A 112,149,320 23,819,410 21.24%

Puerto Rico, Commonwealth GO RFD 2002 Pub Imp 2003 A 27,770,000 5,692,894 20.50%

Subtotal $286,619,320 $61,025,005 21.29%

Highway, Infrastructure, Other

Puerto Rico Conv Ctr Dist Auth, PR Hotel Rev 06A $97,075,000 $69,325,789 71.41%

Puerto Rico Infras Fin Auth, PR, Spec Tax Rev 05AB 348,739,514 580,488,841 166.45%

Puerto Rico Highway & Trans, PR Rev Ser K,L and BB 30,270,000 31,406,628 103.75%

Puerto Rico Highway & Trans, PR Rev Ser M, N, CC, 215,643,557 249,441,222 115.67%

Puerto Rico Highway & Trans, PR Sen Lien 04 89,590,000 92,314,383 103.04%

Puerto Rico Highway & Transportation 2003 24,315,000 19,961,241 82.09%

Puerto Rico Highway & Transportation Sub Lien 2003 77,115,000 65,156,931 84.49%

Subtotal $882,748,071 $1,108,095,034 125.53%

Total Puerto Rico $1,169,367,391 $1,169,120,039 99.98%

RMBS Obligations

Ultimate Pay

MSAC 2007-NC4 $463,912,431 $214,016,241 46.1%

TMTS 2006-8SL 321,369,320 156,372,373 48.7%

TMTS 2005-13SL 139,014,300 153,339,981 110.3%

TMTS 2006-2HGS 138,773,743 62,674,543 45.2%

BARN 2007-1 N1 126,006,408 99,668,301 79.1%

MABS 2005-AB1 61,861,829 36,664,772 59.3%

MABS 2006-AB1 59,127,000 22,122,025 37.4%

CMLTI 2005-WF2 AF6B 52,540,000 14,838,017 28.2%

BSABS 2006-AC1 1A2 23,199,932 18,192,705 78.4%

CMLTI 2006-WF1W 17,099,556 12,379,362 72.4%

CMLTI 2006-WF1W 10,259,734 - -

Total Ultimate Pay $1,413,164,252 $790,268,322 55.9%

EXHIBIT E DRAFT - SUBJECT TO MATERIAL CHANGE

XOL Agreement PRIVILEGED AND CONFIDENTIAL

Set forth below is a list of the Puerto Rico and RMBS Obligations to be covered under the XOL Agreement.

All other policies to be included in the reinsurance transaction

AGO

NPIF Estimate Required Capital

(06/30/2016) Required Capital / NPIF (%)

RMBS Obligations

Current Pay

CWHEL 2006-H $261,225,868 $116,602,114 44.6%

CWHEL 2007-C A 138,947,346 41,568,111 29.9%

CWL 2006-S3 118,663,663 62,026,820 52.3%

CWL 2006-S5 118,135,628 62,632,176 53.0%

CWL 2006-S2 114,056,769 54,569,924 47.8%

BSABS 2007-SD3 A 103,447,592 10,174,306 9.8%

CWHEL 2005-B 83,052,004 29,972,752 36.1%

IMM 2004-11 54,847,281 2,650,478 4.8%

QUEST 2006-X1 52,493,724 11,012,169 21.0%

INDS 2006-2B A 39,081,720 12,212,652 31.2%

QUEST 2005-X2 A2 26,570,222 5,369,438 20.2%

HEMT 2006-2 2A1 18,664,131 11,403,888 61.1%

INDS 2006-1 18,101,010 58,309,087 322.1%

AHM 2005-2 6A 8,125,625 8,412,742 103.5%

AHM 2005-4 2A 7,938,105 3,698,162 46.6%

AHM 2005-1 9A 4,050,894 4,178,310 103.1%

BSABS 2005-AC9 A5 19,494,899 7,468,941 38.3%

INABS 2006-H1 A 30,962,532 9,226,368 29.8%

Total Current Pay $1,217,859,010 $511,488,437 42.0%

Other RMBS

Alliance 1998-2 $3,219,105 $22,304 0.7%

Alliance 1999-2 15,826,368 1,038,623 6.6%

Alliance 1999-3 12,549,527 2,626,819 20.9%

Alliance 1999-4 17,257,023 1,359,156 7.9%

Alliance 2000-1 6,376,501 444,294 7.0%

BSABS 2005-AC5, Class 1-A3 15,796,667 4,004,592 25.4%

BSABS 2005-AC6, Class IA3 and IA4 25,805,772 2,665,405 10.3%

ContiMortgage 1995-1 900,601 655,987 72.8%

ContiMortgage 1995-2 822,216 482,633 58.7%

ContiMortgage 1995-4 1,925,468 478,817 24.9%

ContiMortgage 1996-1 2,440,439 3,037,065 124.4%

CWABS 2004-B (1st lien) 41,413,569 20,775,797 50.2%

CWABS 2004-C 21,283,946 5,772,307 27.1%

CWABS 2004-E 20,042,968 2,305,021 11.5%

CWABS 2004-F 28,755,264 5,309,948 18.5%

CWABS 2004-U 29,066,405 9,792,008 33.7%

CWHEQ 2005-G 99,192,604 32,952,957 33.2%

CWHEQ 2005-H 98,637,573 34,976,952 35.5%

DLJ 1993-4 166,899 20,184 12.1%

DMSI 2004-5, Class A-4A, A-5A, A-5B 12,499,001 661 0.0%

Impac CMB Trust 2004-10 117,330,318 4,282,256 3.6%

IndyMac 2005-L1 - 1,505,142 -

IndyMac 2005-L2 - 2,573,079 -

IndyMac 2005-L3 - 4,386,959 -

IndyMac 2006-L2 - 20,548,946 -

Irwin 2006-2 Class IA & VFN 9,436,047 22,999,242 243.7%

New Century HEL Trust 2004-A (FRMS) 84,244,493 687,537 0.8%

Sovereign 2000-1 HEL Trust 7,665,953 8,452,337 110.3%

Terwin Mortgage Trust 2004-23 1,594,128 2,023,312 126.9%

Total Other RMBS $674,248,854 $196,180,341 29.1%

Total RMBS $3,305,272,117 $1,497,937,100 45.3%

Total XOL Obligations $4,474,639,507 $2,667,057,140 59.6%