Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GREENWOOD HALL, INC. | s104912_8k.htm |

Exhibit 99.1

Helping Higher Education Prosper Investor Presentation December 2016 Ticker: ELRN - OTCQB greenwoodhall.com

The information in this presentation may include “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 . These include statements regarding Greenwood Hall’s business strategy as well as other statements that are not historical facts . Forward - looking statements also include but are not limited to those preceded or followed by the words "anticipates," "believes," "could," "estimates," "expects," "intends," "may," "plans," "projects," "should," “strategy,” "targets ," “path,” “on track,” “trends or trending,” and/or similar expressions . By their nature, forward - looking statements are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected . Readers are cautioned not to place undue reliance on these forward - looking statements . Except for any ongoing obligation to disclose material information as required by the United States federal securities laws, Greenwood Hall does not have any intention or obligation to publicly update or revise any forward - looking statements after Greenwood Hall distributes this document, whether to reflect any future events or circumstances or otherwise . For a discussion of potential risks and uncertainties, please refer to the risk factors listed in Greenwood Hall’s SEC filings . 2 Forward - Looking Statements

3 Greenwood Hall Snapshot ▪ Proprietary solutions platform with 10 year track - record of success ▪ 86% core business revenue growth and 95% improvement in Adjusted EBITDA in Q4 - 16 ▪ 100%+ projected core business revenue growth in Q1 - 17 ▪ 5.2 year client stickiness; 100% renewal rate on all state bids since 2011 ▪ Recurring contractual subscription revenue model largely focused on critical college functions of recruiting and retention ▪ Unique systems, analytics and strategy that help schools create enduring relationships with students ELRN provides specialized co - sourcing solutions for higher education serving over 600,000 students. Our product suite provides high returns on investment for our education partners and has created a rapidly growing strategic business.

4 Investment Opportunity ▪ EdTech market estimated to grow to $94 billion by 2020, up from $43 billion in 2015 (Market & Markets, 2015) ▪ Compelling and undiscovered corporate turnaround story – de - emphasizing lower margin legacy business vs. higher margin EdTech growth platform ▪ 18 new contracts signed in FY - 16 compared to 8 in FY - 15 ▪ Transformative financing completed in October 2016 eliminating negative working capital, providing cash infusion, decreasing liabilities by >$3mm ▪ Operational turnaround advancing rapidly with dramatic profitability improvements accomplished and projected positive EBITDA in FY - 17 ▪ Solid 10 year track record in higher e ducation with brand name clients and compelling long - term customer stickiness ▪ Very few public companies in a sector with substantial investor interest

5 Higher Ed is Facing a Series of Headwinds … Requiring Colleges to: ▪ Enter new recruiting markets ▪ Improve relationships / retention ▪ Become more business - like ▪ Understand and leverage eLearning ▪ Provide high - touch student experience Multiple Forces Working Against Traditional School Processes ▪ High cost of recruitment (~$10k per) ▪ Fierce competition for students ▪ Worsening demographics (population) ▪ 50% graduation rates ▪ Student loan availability and cost ▪ Declining federal and state funds ▪ eLearning platforms now necessary ▪ General change in mindset on importance ▪ Students expecting on - demand support Traditional reliance on population growth and cheap financing is over

6 …Creating a Huge Opportunity for ELRN Through our technology and analytics platforms, we enable colleges and universities to: ▪ Generate new sources of revenue (expand recruiting base) ▪ Retain students and protect existing sources of revenue ▪ Maximize graduation rates and help at - risk students ▪ Reduce costs by streamlining student support functions including enrollment support, advising, and financial aid counseling ▪ Quantify substantial ROI for co - sourcing expenditures ▪ Most contracts are fixed fee projected to provide many schools with at least 2 - 3x+ ROI.

7 Schools Endorse eLearning as a Growth Center Online Programs have Compelling E conomics ▪ Expanded market – students out of region and working adults • High school students projected to decrease by 3% between 2007 - 08 and 2020 - 21, including 13% decreases in Northeast and 6% in Midwest • 25+ year old students now represent 40% of all enrollments. • 21% increase in students 25 - 34 and 16% increase with students 35+ ▪ Uses adjuncts rather than tenured professors as instructors ▪ Largely “full - pay” student base ▪ Helps build brand name of school through greater exposure ELRN helps clients develop attractive online offerings leveraging our expertise and recruiting and retention tools. As such, we represent the cutting - edge of the future of higher education.

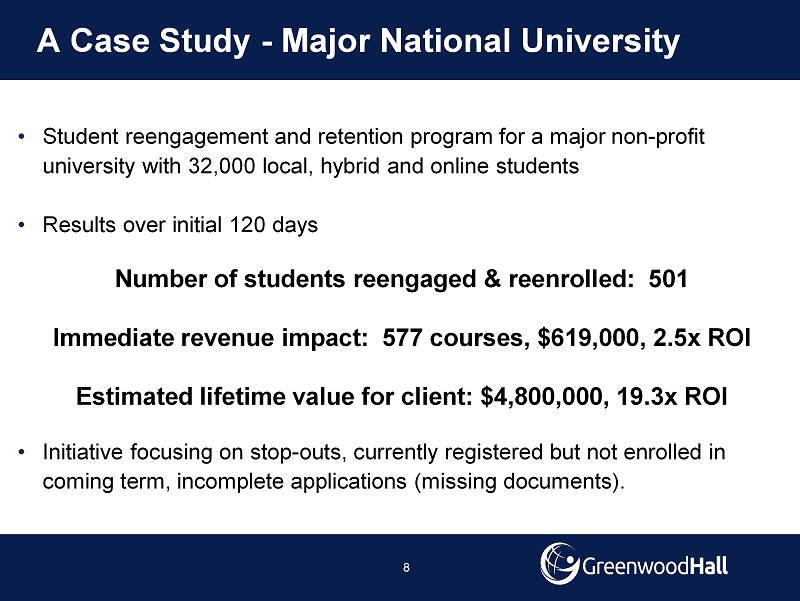

A Case Study - Major National University • Student r eengagement and retention p rogram f or a m ajor non - profit u niversity w ith 32,000 local, hybrid and o nline s tudents • Results o ver i nitial 120 days Number of students r eengaged & reenrolled: 501 Immediate revenue i mpact: 577 courses, $619,000, 2.5x ROI Estimated lifetime value for client: $4,800,000, 19.3x ROI • Initiative focusing on stop - outs, currently registered but not enrolled in coming term, incomplete applications (missing documents). 8

A Case Study – Small Faith - Based University • Declining student population of 350 in 2011 • Challenging geographic location • Bold move was necessary to survive and grow • Launched solution in 2011 to grow and expand online programs 314% Growth In Starting Student Body Over 18 Months Drove Online Enrollment Growth to Over 1,200 Students 90% Term - to - Term Retention, Increased Overall Retention by 18% Record Fall 2016 Enrollment of 1,089+ Students 3x ROI 9

10 Helping Schools Invest In Their Success Financing for Enrollment & Retention Solutions ▪ Available in early 2017 ▪ Most schools need/want solutions. Budgets can be an issue. ▪ Q ualified schools can defer first year costs of up to $ 750K - $ 2MM. ▪ Should enable clients to generate cash flow prior to making payments. ▪ Requires 3 - 5 year commitments while allowing schools to pay deferred costs over time in manageable monthly payments. ▪ Unique approach maximizes flexibility for education partners. ▪ External financing capability limits risk to ELRN . ▪ Allows ELRN to help more schools and students, while increasing business opportunities.

11 Rapidly Growing Market / Gaining Share In 2010, only a handful of schools relied on external partners • Higher education has been slow to embrace other business models • Academics - driven mindset focused on maintaining control of all key functions • Only when pressed by economics have schools moved • Market today has expanded from approximately 60 colleges in 2010 to over 400 today out of a US addressable market of 4,700 ▪ ELRN is tightly integrated with clients’ needs making integration and student interaction seamless ▪ D eep - benched sales team has developed a robust sales pipeline

Growing Client List of Prestigious Institutions 12

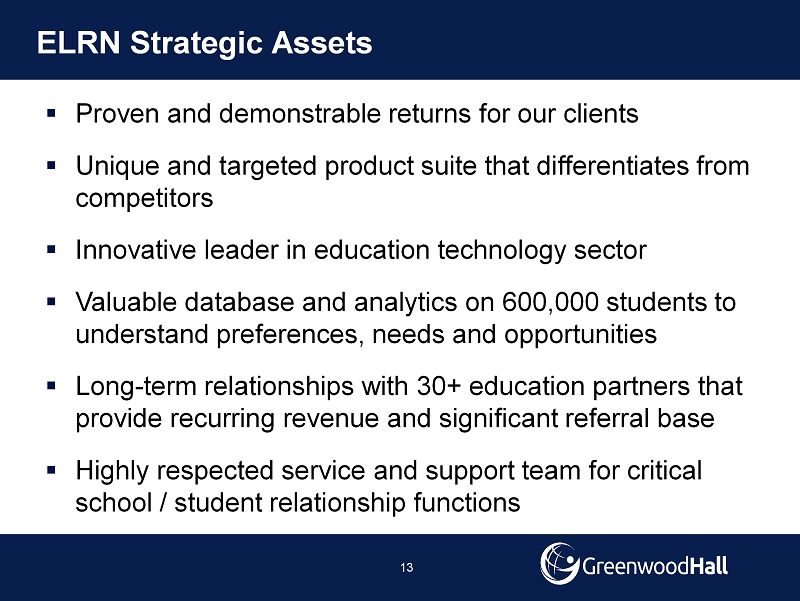

13 ELRN Strategic Assets ▪ Proven and demonstrable returns for our clients ▪ Unique and targeted product suite that differentiates from competitors ▪ Innovative leader in education technology sector ▪ Valuable database and analytics on 600,000 students to understand preferences, needs and opportunities ▪ Long - term relationships with 30+ education partners that provide recurring revenue and significant referral base ▪ Highly respected service and support team for critical school / student relationship functions

ELRN Model Advantages • Subscription Model expands addressable market beyond limits of competition that must limit their focus to only certain schools • Full Lifecycle expertise enhances value and credibility • Ability to s upport eLearning, Hybrid, or Ground • More flexibility for school to unbundle or bundle solution elements • Visibility and transparency

15 Recent Transformative Developments ▪ Completed $4 million recapitalization in October 2016 improving balance sheet; creating a better path to growth ▪ Enhancing BOD with strong new members ▪ Signed new client contracts with estimated value of $14.8 million ▪ New contracts with premier names including University of Arizona, Nevada State , College of Southern Nevada , Concordia University, Troy University and City University of New York ▪ Continued improvement in Adjusted EBITDA – ($44K) in Q4 - 16, ($174K) in Q3 - 16 and ($1.152 MM) in Q2 - 16 ▪ Resolved key legacy litigation matters

16 Q4 - 16 Financial Highlights Q4 - 2016 Q4 - 2015 Legacy Business Revenue $ 127,448 $ 440,539 EdTech Business Revenue $2,603,737 $1,400,486 EdTech Sales Growth 86% N/A Total Revenue $2,731,185 $1,841,025 Adjusted EBITDA ($44,183 ) ($ 875,125 ) Adjusted EBITDA Growth 95% N/A *Adjusted EBITDA is a Non - GAAP measure.

17 FY - 16 Financial Highlights 2016 2015 Legacy Business Revenue $ 1,413,207 $ 3,853,088 EdTech Business Revenue $6,141,229 $4,211,177 EdTech Sales Growth 46% N/A Total Revenue $7,554,436 $8,064,265 Adjusted EBITDA ($2,412,957 ) ($ 3,319,597 ) Adjusted EBITDA Growth 27% N/A *Adjusted EBITDA is a Non - GAAP measure.

18 Financial Outlook For FY - 2017 ▪ N ew contracts from FY - 16 have just begun to impact revenues with 95% increase in Q4 - 16 EdTech sales and similar growth expected in Q1 - 17 ▪ Outlook largely based on existing and newly signed contracts expected to be serviced in the upcoming fiscal year vs high probability pipeline opportunities ▪ $11.5 – 12.2 million in EdTech sales expected for FY - 17, compared to $6.1 million in EdTech revenue in FY - 16 ▪ P ositive Adjusted EBITDA expected for upcoming full fiscal year R ecent contracts expected to help generate 90% increase in core revenue in FY - 17

19 ▪ Only two PUBCO comps. trading at 8.1x and 5.5x revenues respectively ▪ Active EdTech market with 66 M&A transactions through October, up from 41; validates market for EdTech products and lifecycle management services* ▪ 52% of M&A deal activity was originated by strategic buyer* Notable Education Technology & Lifecycle Transactions of Companies Comparable to Greenwood Hall Strategic Investments Date Implied Purchase Price HotChalk , Inc. » January 2016 » $690 M (9.0x revenue) LoudCloud Systems, Inc. » March 2016 » $17.9 M (6.0x revenue) M&A Transactions Date Implied Purchase Price LoudCloud Systems, Inc. » March 2016 » $17.9 M (6.0x revenue) Advisory Board Acquires Royall & Company » January 2015 » $850M (8.9x revenue) Public Comps 2U, Inc. (NASDAQ: TWOU) » December 2016 » $1.56B (8.1x revenue) Instructure, Inc. (NYSE: INST) » December 2016 » $554 M (5.5x revenue) Significant Investor Interest Validates Strategy *Capstone IQ, 2016

20 Experienced Leadership Team John R. Hall, Ed.D. CEO and Co - Founder, Chairman of the Board » >23 years of experience in the education management, direct response and customer relationship management industries » Founded enCircle Media (built revenue to $20 million before successful sale) » Trusted advisor to university presidents across the U.S. on various higher education issues; Member, Roosevelt University Board of Trustees, USC Pullias Center For Higher Education, Governor Appointed Member, State of California Interagency Coordinating Council » MBA, Pepperdine University; Doctorate of Education, University of Southern California William Bradfield EVP, Business Development » >40 years of executive and sales leadership in software, professional services, telecommunications, and education management. Founded Perceptis , Inc., a leading provider of support services to higher education, which he sold to Blackboard, Inc. Shane Cobb EVP, Talent Management » 25 years human resources leadership experience in best - in - class companies; additional roles leading IT, business development, restructuring, facility start - ups and relocations, mergers and acquisitions David Ruderman EVP, Strategic Relationships » >25 years of direct marketing experience with a focus on education marketing, 10 years as CMO of Chapman University Josh Cage EVP, Operations » >12 years of experience, in senior operational management positions with Education Management Corporation and University of Phoenix

21 Distinguished Board of Directors Jerry Rubinstein Independent Director and Audit Committee Chair » Attorney and CPA » Former CEO and Chairman of ABC Records, United Artists Records » Former Director, Recording Industry of America » Founded and sold Bel Air Savings & Loan, DMX Inc., and XTRA Music » Non - Executive Chairman of US Global Investors (NASDAQ:GROW) » Director and Audit Committee Chair, CKE Restaurants » Managed financial affairs of The Eagles, Crosby Stills, Nash & Young and David Geffen Cary Sucoff Independent Director and Compensation Committee Chair » Member, New York State Bar » Principal, Equity Source Partners » Director, ContraFect Corporation (NASDAQ: CFRX), Root9B Technologies (OTCMKTS: RTNB), Legacy Education Alliance (OTCMKTS: LEAI) » President & Trustee, New England Law School/Boston Michael Poutre II Director » 25 years experience managing, financing, building, and operating private and public companies » Former President and Chief Compliance Officer, The Blue & White Fund » Co - Founder & Principal, Redwood Fund, LP. » CEO, Utilligent , Inc. Lyle Green Independent Director » 20 years of executive management positions within the telecommunications and direct marketing industry » Partner at MarkeTouch Media since 2002; Vice President of Sales/Marketing Jonathan Newcomb Independent Director » 40 years in financial, education and publishing industries » Managing Director, Rockdale Partners » Former Chairman & CEO, Simon & Schuster » Former President, Standard & Poors ; Former CEO, Cambium Learning » Director, XanEdu , Inc.

22 Key Investment Takeaways ▪ Strong underlying demand for ELRN’s product suite ▪ Gaining market share in a rapidly growing sector ▪ 90 %+ core revenue growth projected for FY - 17 ▪ Customer stickiness ▪ Projected positive EBITDA in FY - 17 ▪ Leading reputation in higher education marketplace ▪ Compelling value proposition trading at <1x sales vs comps. ▪ Multiple paths to trading liquidity, uplisting and strategic deals

23 Company: John Hall, Ed.D . Chief Executive Officer Greenwood Hall, Inc. jhall@greenwoodhall.com Contact Information