Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SYNTHESIS ENERGY SYSTEMS INC | f8k_120616.htm |

Exhibit 99.1

Synthesis Energy Systems, Inc. GROWTH WITH BLUE SKIES GLOBAL PROVIDER OF LOW - COST CLEAN ENERGY Corporate Overview December 2016

SES Forward - looking Statements This presentation includes "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements other than statements of historical fact are forward - looking statements . Forward - looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected . Among those risks, trends and uncertainties are the ability of our project with Yima to produce earnings and pay dividends ; our ability to develop and expand business of the TSEC joint venture in the joint venture territory ; our ability to successfully partner our technology business ; our ability to develop our power business unit and marketing arrangement with GE and our other business verticals, including DRI steel, through our marketing arrangement with Midrex Technologies, and renewables ; our ability to successfully develop the SES licensing business ; the ability of the ZZ Joint Venture to retire existing facilities and equipment and build another SGT facility ; the ability of Batchfire management to successfully grow and develop Callide operations ; the economic conditions of countries where we are operating ; events or circumstances which result in an impairment of our assets ; our ability to reduce operating costs ; our ability to make distributions and repatriate earnings from our Chinese operations ; our ability to successfully commercialize our technology at a larger scale and higher pressures ; commodity prices, including in particular natural gas, crude oil, methanol and power, the availability and terms of financing ; our ability to obtain the necessary approvals and permits for future projects, our ability to raise additional capital, if any, our ability to estimate the sufficiency of existing capital resources ; the sufficiency of internal controls and procedures ; and our results of operations in countries outside of the U . S . , where we are continuing to pursue and develop projects . Although SES believes that in making such forward - looking statements our expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected by us . SES cannot assure you that the assumptions upon which these statements are based will prove to have been correct . 2

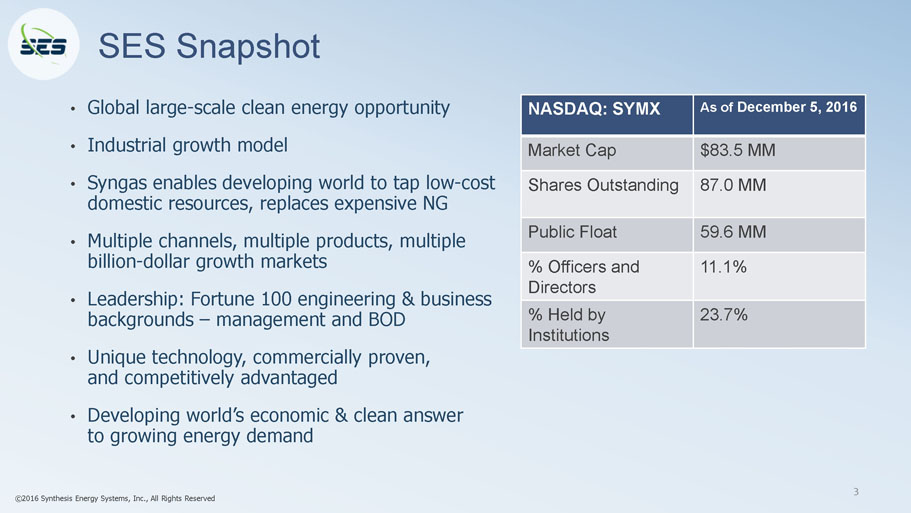

SES Snapshot • Global large - scale clean energy opportunity • Industrial growth model • Syngas enables developing world to tap low - cost domestic resources, replaces expensive NG • Multiple channels, multiple products, multiple billion - dollar growth markets • Leadership: Fortune 100 engineering & business backgrounds – management and BOD • Unique technology, commercially proven, and competitively advantaged • Developing world’s economic & clean answer to growing energy demand NASDAQ: SYMX As of December 5, 2016 Market Cap $ 83.5 MM Shares Outstanding 87.0 MM Public Float 59.6 MM % Officers and Directors 11.1% % Held by Institutions 23.7% ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 3

Meets Global Needs & Resources Confluence of Factors Propels Large - scale Demand • Global need for cleaner energy that is economical • New population growth, creation of new middle - class • Driven by world’s emerging economies, building GDP • Economic and geographic realities: • Abundant domestic, untapped, low - cost coal resources – Growing demand requires cleaner solution than old - gen coal - burning technologies – Desire for energy independence and security of supply • Natural gas is expensive or unavailable – Industrial & utility projects planned on 20 - 40 Year Outlooks, based on long - term international prices, not short - term strip prices – LNG requires import infrastructure at coastlines plus pipeline to interior, or infrastructure costs for imports by pipelines from foreign countries – not always allies, geopolitical risk Future Markets Historical Markets Asia continues to drive demand. New markets emerging in China, India, Africa, South America, Eastern Europe and Australia The Future of Gasification Sources: “2014 The Outlook for Energy: A View to 2040” by ExxonMobil, “ Towards the End of Poverty.” The Economist, “Progress on Sanitation and Drinking - Water.” WHO/UNICEF. 2012, “Annual Energy Outlook 2014.” U.S. Energy Information Administration (EIA) 201 4 ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 4

A New China Paradigm SES: Expanding in China and Globally via China’s One Belt, One Road Initiative x $40 billion New Silk Road Fund x $50 billion Asian Infrastructure Investment Bank x Financing, technology & manufacturing for large - scale international infrastructure projects x Impact: 4.4 billion people in 65 nations x Annual trade > $2.5 trillion Source: Foreign Affairs, April 19, 2015 SES is Well Aligned, Established & Positioned in China • 1 st SGT syngas production: 2007, Zao Zhuang New Gas Company, Shandong Province (2 systems) • 2 facility joint ventures ( Yima , ZZ); China regional JV: Tianwo - SES; Silk Road global alliance: China Coal Research Institute/CCTEG; Equity investment partner: China Environment State Investment Co. Chinese Government’s Major Initiatives • Increased focus on clean energy, drive for higher energy efficiency • Push for economically effective, integrated industrial base • Replace underperforming industrial operations • Response to rapid, heavy industrialization & over - reliance on old - gen coal - burning technologies that drove poor air quality • Evolving economy from low - cost export model > consumer & services based model SES Gasification Technology Installed Base: 12 SGT systems ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 5

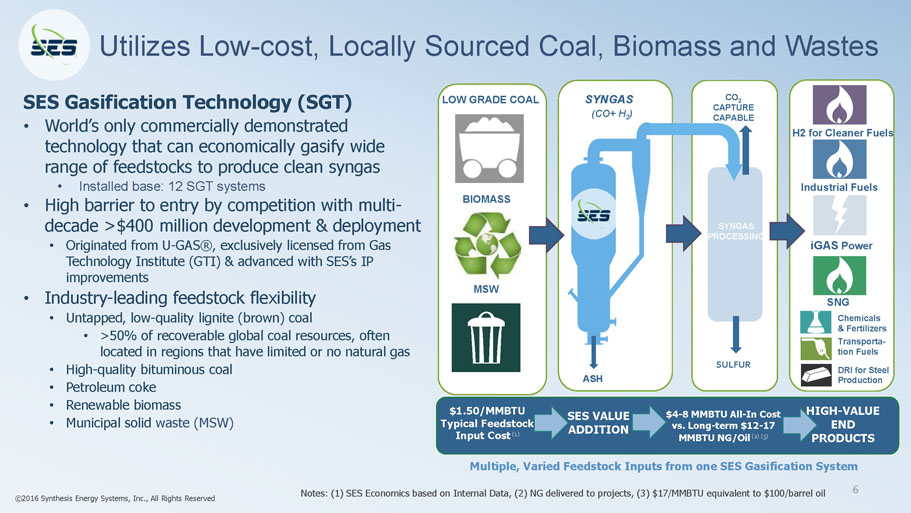

CO 2 CAPTURE CAPABLE LOW GRADE COAL BIOMASS SYNGAS PROCESSING SYNGAS (CO+ H 2 ) SULFUR ASH iGAS Power $1.50/MMBTU Typical Feedstock Input Cost (1) SES VALUE ADDITION $4 - 8 MMBTU All - In Cost vs. Long - term $12 - 17 MMBTU NG/Oil (2) (3) HIGH - VALUE END PRODUCTS MSW Notes: (1) SES Economics based on Internal Data, (2) NG delivered to projects, (3) $17/MMBTU equivalent to $100/barrel oil Industrial Fuels Chemicals & Fertilizers SNG Utilizes Low - cost, Locally Sourced Coal, Biomass and Wastes DRI for Steel Production Transporta - tion Fuels Multiple, Varied Feedstock Inputs from one SES Gasification System SES Gasification Technology (SGT) • World’s only commercially demonstrated technology that can economically gasify wide range of feedstocks to produce clean syngas • Installed base: 12 SGT systems • High barrier to entry by competition with multi - decade >$400 million development & deployment • Originated from U - GAS®, exclusively licensed from Gas Technology Institute (GTI) & advanced with SES’s IP improvements • Industry - leading feedstock flexibility • Untapped, low - quality lignite (brown) coal • >50% of recoverable global coal resources, often located in regions that have limited or no natural gas • High - quality bituminous coal • Petroleum coke • Renewable biomass • Municipal solid waste (MSW) ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 6 H2 for Cleaner Fuels

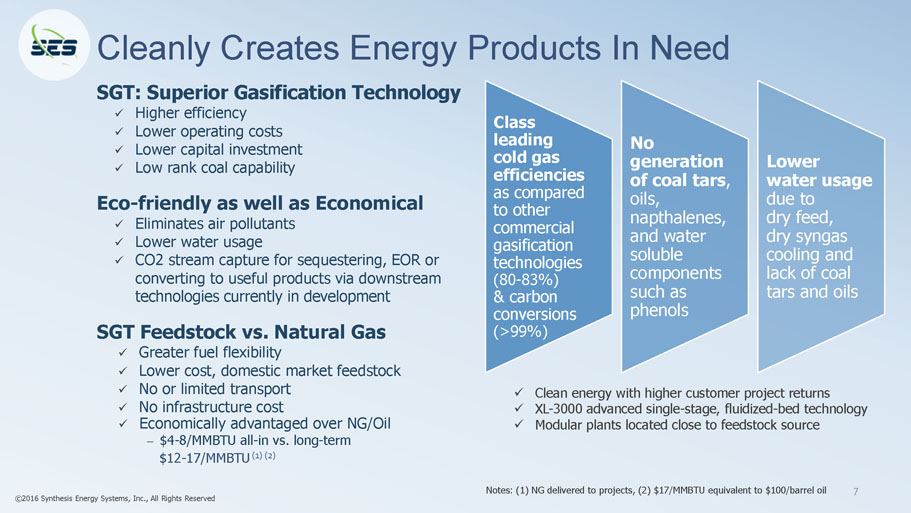

Cleanly Creates Energy Products In Need SGT: Superior Gasification Technology x Higher efficiency x Lower operating costs x Lower capital investment x Low rank coal capability Eco - friendly as well as Economical x Eliminates air pollutants x Lower water usage x CO2 stream capture for sequestering, EOR or converting to useful products via downstream technologies currently in development SGT Feedstock vs. Natural Gas x Greater fuel flexibility x Lower cost, domestic market feedstock x No or limited transport x No infrastructure cost x Economically advantaged over NG/Oil – $4 - 8/MMBTU all - in vs. long - term $ 12 - 17/MMBTU (1) (2) ) Class leading cold gas efficiencies as compared to other commercial gasification technologies (80 - 83%) & carbon conversions (>99%) No generation of coal tars , oils, napthalenes , and water soluble components such as phenols Lower water usage due to dry feed, dry syngas cooling and lack of coal tars and oils x Clean energy with higher customer project returns x XL - 3000 advanced single - stage, fluidized - bed technology x Modular plants located close to feedstock source ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 7 Notes: (1) NG delivered to projects, (2) $17/MMBTU equivalent to $100/barrel oil

30 Years R&D (GTI) ZZ Demonstration Plant Yima Large Scale Chemical Project 3 SGT Systems (2+1) Tianwo - SES Equipment Design and Manufacturing Aluminum Corporation of China 7 SGT Gasification Systems – Industrial Fuel Gas Building On Achievements, Positioned for Growth • Outstanding SGT Performance • Strong Base For Growth • Industrial Growth Model ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 8

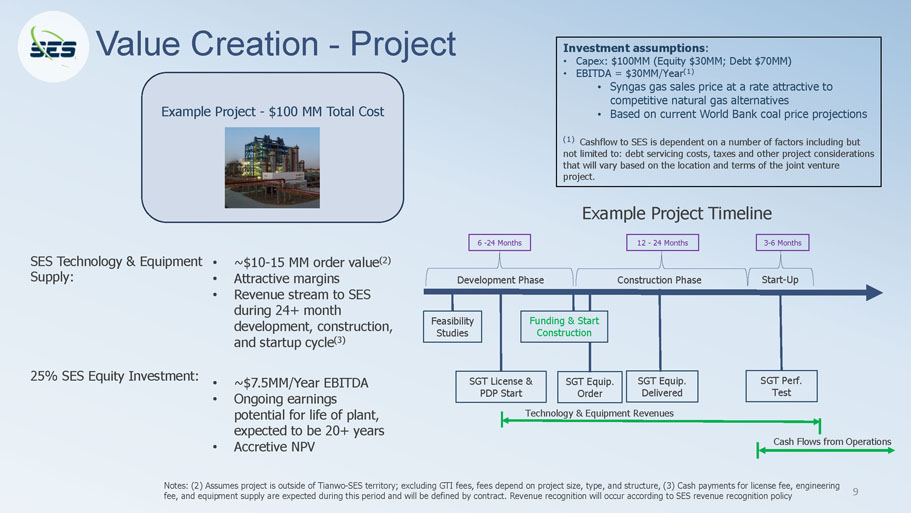

Value Creation - Project 9 Example Project - $100 MM Total Cost SES Technology & Equipment Supply: • ~$10 - 15 MM order value (2) • Attractive margins • Revenue stream to SES during 24 + month development, construction, and startup cycle (3) 25% SES Equity Investment: • ~$7.5MM/Year EBITDA • Ongoing earnings potential for life of plant, expected to be 20+ years • Accretive NPV Example Project Timeline Development Phase SGT License & PDP Start SGT Equip. Order SGT Equip. Delivered 6 - 24 Months 12 - 24 Months 3 - 6 Months Cash Flows from Operations Technology & Equipment Revenues Funding & Start Construction Feasibility Studies Construction Phase Start - Up SGT Perf. Test Notes: (2) Assumes project is outside of Tianwo - SES territory; excluding GTI fees, fees depend on project size, type, and structure, (3) Cash payments for license fee, engineering fee, and equipment supply are expected during this period and will be defined by contract. Revenue recognition will occur according to SES revenue recognition policy Investment assumptions : • Capex: $100MM (Equity $30MM; Debt $70MM) • EBITDA = $30MM/Year (1) • Syngas gas sales price at a rate attractive to competitive natural gas alternatives • Based on current World Bank coal price projections (1) Cashflow to SES is dependent on a number of factors including but not limited to: debt servicing costs, taxes and other project considerations that will vary based on the location and terms of the joint venture project.

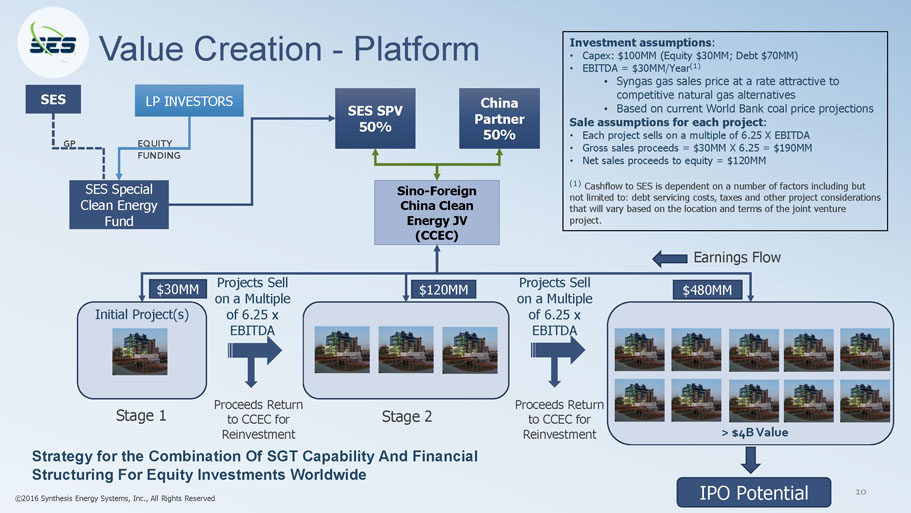

Initial Project(s) Value Creation - Platform 10 SES SPV 50% China Partner 50% Sino - Foreign China Clean Energy JV (CCEC) IPO Potential Projects Sell on a Multiple of 6.25 x EBITDA SES LP INVESTORS SES Special Clean Energy Fund GP EQUITY FUNDING Stage 1 Stage 2 Proceeds Return to CCEC for Reinvestment Proceeds Return to CCEC for Reinvestment $120MM $30MM $480MM > $4B Value Earnings Flow Strategy for the Combination Of SGT Capability And Financial Structuring For Equity Investments Worldwide Projects Sell on a Multiple of 6.25 x EBITDA ©2016 Synthesis Energy Systems, Inc., All Rights Reserved Investment assumptions : • Capex: $100MM (Equity $30MM; Debt $70MM) • EBITDA = $30MM/Year (1) • Syngas gas sales price at a rate attractive to competitive natural gas alternatives • Based on current World Bank coal price projections Sale assumptions for each project : • Each project sells on a multiple of 6.25 X EBITDA • Gross sales proceeds = $30MM X 6.25 = $190MM • Net sales proceeds to equity = $120MM (1) Cashflow to SES is dependent on a number of factors including but not limited to: debt servicing costs, taxes and other project considerations that will vary based on the location and terms of the joint venture project.

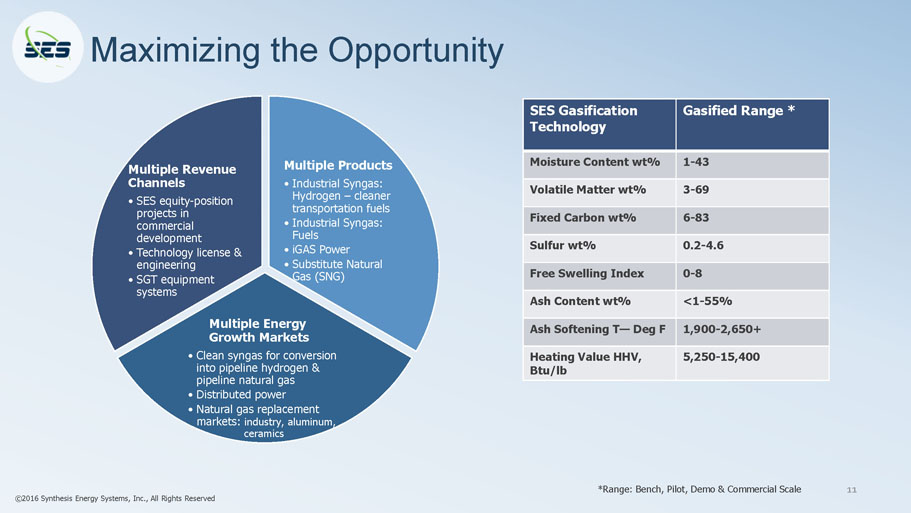

Maximizing the Opportunity ©2016 Synthesis Energy Systems, Inc., All Rights Reserved Multiple Products • Industrial Syngas: Hydrogen – cleaner transportation fuels • Industrial Syngas: Fuels • iGAS Power • Substitute Natural Gas (SNG) Multiple Energy Growth Markets • Clean syngas for conversion into pipeline hydrogen & pipeline natural gas • Distributed power • Natural gas replacement markets: industry, aluminum, ceramics Multiple Revenue Channels • SES equity - position projects in commercial development • Technology license & engineering • SGT equipment systems SES Gasification Technology Gasified Range * Moisture Content wt % 1 - 43 Volatile Matter wt % 3 - 69 Fixed Carbon w t % 6 - 83 Sulfur w t % 0.2 - 4.6 Free Swelling Index 0 - 8 Ash Content w t % <1 - 55% Ash Softening T — Deg F 1,900 - 2,650+ Heating Value HHV, Btu/ lb 5,250 - 15,400 *Range: Bench, Pilot, Demo & Commercial Scale 11

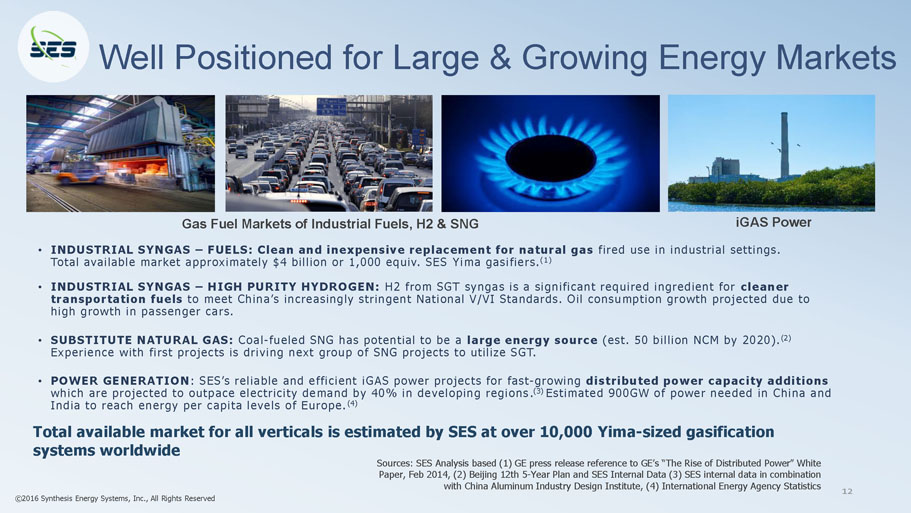

Well Positioned for Large & Growing Energy Markets Total available market for all verticals is estimated by SES at over 10,000 Yima - sized gasification systems worldwide Gas Fuel Markets of Industrial Fuels, H2 & SNG iGAS Power ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 12 • INDUSTRIAL SYNGAS – FUELS: Clean and inexpensive replacement for natural gas fired use in industrial settings. Total available market approximately $4 billion or 1,000 equiv. SES Yima gasifiers. (1) • INDUSTRIAL SYNGAS – HIGH PURITY HYDROGEN: H2 from SGT syngas is a significant required ingredient for cleaner transportation fuels to meet China’s increasingly stringent National V/VI Standards. Oil consumption growth projected due to high growth in passenger cars. • SUBSTITUTE NATURAL GAS: Coal - fueled SNG has potential to be a large energy source (est. 50 billion NCM by 2020). (2) Experience with first projects is driving next group of SNG projects to utilize SGT. • POWER GENERATION : SES’s reliable and efficient iGAS power projects for fast - growing distributed power capacity additions which are projected to outpace electricity demand by 40% in developing regions . (3) Estimated 900GW of power needed in China and India to reach energy per capita levels of Europe. (4) Sources: SES Analysis based (1) GE press release reference to GE’s “The Rise of Distributed Power” White Paper, Feb 2014, (2) Beijing 12th 5 - Year Plan and SES Internal Data (3) SES internal data in combination with China Aluminum Industry Design Institute, (4) International Energy Agency Statistics

Tianwo - SES Clean Energy Asian JV Partnership Global Business Partners Regional Partners Strategic Joint Venture Establishing SGT as the market leader in China & 5 Asian regions for clean coal gasification, include proprietary equipment and gasification island turnkey projects GE Packaged Power – iGAS Midrex Technologies – Direct Reduced Iron (DRI) for steel production China Coal Research Institute , subsidiary of China Coal Technology & Engineering Group Corp. China Equity Investment Partner: state - owned China Environment State Investment Co., Ltd, Beijing India Market Development Partner: Simon India, a subsidiary of Zuari Global Limited/ Adventz Group TIANWO - SES CLEAN ENERGY TECHNOLOGIES CO. Sino - Foreign Joint Venture between SES and Suzhou THVOW Technology Co., Ltd. - a l eading Chinese process equipment manufacturer SES 35%, THVOW 65% World - class Collaborators GE CESI ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 13

Growth Market 1: Industrial Syngas – Hydrogen HYDROGEN: • SGT to supply high - purity pipeline hydrogen (H2) – to local refineries for cleaner transportation fuels • Replaces costlier and more time - intensive H2 derived from methanol - cracking 14 Notes: (1) Due to available capacity, (2) “Opinion on Adjusting the Geographical Layout of Chemical Industry ( DongZhengFa (2017) No.7),” issued by the Dongying Municipal Government ©2016 Synthesis Energy Systems, Inc., All Rights Reserved • SES projects – Shandong Province: – Dongying City – equity position projects • Total 20 projects in 5 years varying in size & range between $75 million – > $400 million each in est. installed costs • Initial Dongying projects: – Lijin County Binhai New District – secured May 2016. Multi - project with est. total 2 billion yuan ($ 300 million) planned build - out. First project est. 700 million yuan ($ 105 million) – Shandong Dongying Hekou District Government – secured June 2016. Multi - project with est. total 2.5 billion yuan ($ 373 million) planned build - out. First project est. 550 million yuan ($ 82 million) • SES expects to secure equity funding from international and local investment groups who have expressed interest in project - level investment • SES intends to bring projects forward and manage them, and potentially operate the plants – ZaoZhuang City – ZZ JV new gasification project • SES, partner Shandong Weijiao Group Xuecheng Energy Co. ( Weijiao Group ), and the local government agreed to develop a new gasification project in October 2016 – Intended to have 3 SGT systems to produce hydrogen to be used in production of ultra - low sulfur diesel fuel – L ocated outside the city proper, in Zouwu Industrial Park, where Weijiao Group has existing operations • SES currently has about 9% ownership in ZZ JV • SES working with Weijiao Group to evaluate the project to determine if there will be further SES investment Dongying Port Economic Development Zone Dongying City Lijin Binhai New District Hekou Blue Economy Industrial Park Bohai Bay Shandong Province has the highest concentration of non - state - owned refineries (NSOs), dubbed “Teapots” due to their smaller size, which comprise 19% of China’s refinery capacity. The government has designated that future chemical plants must be located in the 3 industrial parks for current and future chemical plants. (2) The land at the Dongying Port Economic Development Zone is fairly limited; the relatively young Hekou Blue and Lijin Binhai will become the only two industrial parks that have the capacity to handle the relocation of those chemical plants as well as to build major new chemical plants.

Growth Market 1: Industrial Syngas – Fuels INDUSTRIAL FUELS: • SGT economically advantaged clean coal NG replacement projects – robust industrial fuels new business pipeline • Aluminum Corporation of China (CHALCO): China’s largest alumina and primary aluminum producer and the world’s second largest alumina producer • 3 industrial fuel supply plants • Secured by China JV Tianwo - SES partner, Suzhou THVOW Technology Co., Ltd. 15 Chalco Shandong 2 Systems Chalco Shanxi 1 System Commissioning 11/2015 Commissioning 4/2016 ©2016 Synthesis Energy Systems, Inc., All Rights Reserved Chalco Henan 4 Systems Commissioning 4/2016

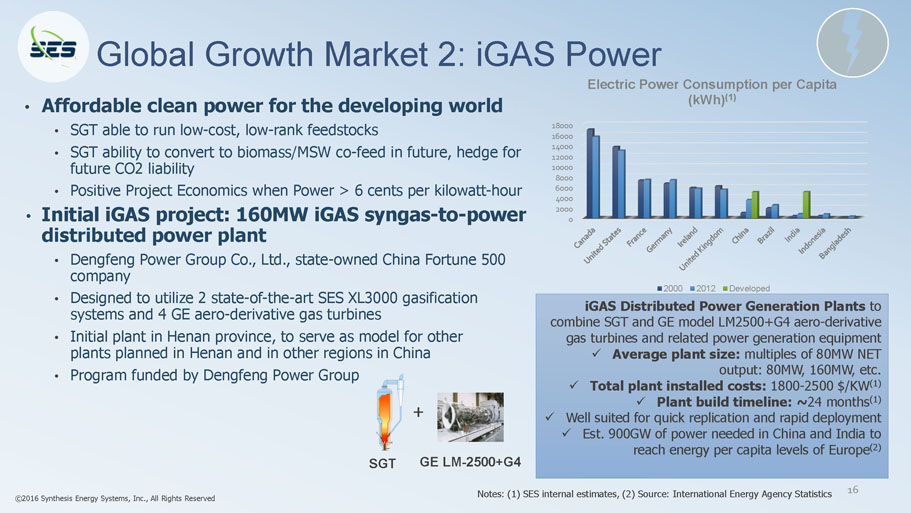

Global Growth Market 2: iGAS Power • Affordable clean power for the developing world • SGT able to run low - cost, low - rank feedstocks • SGT ability to convert to biomass/MSW co - feed in future, hedge for future CO2 liability • Positive Project Economics when Power > 6 cents per kilowatt - hour • Initial iGAS project: 160MW iGAS syngas - to - power distributed power plant • Dengfeng Power Group Co., Ltd., state - owned China Fortune 500 company • Designed to utilize 2 state - of - the - art SES XL3000 gasification systems and 4 GE aero - derivative gas turbines • Initial plant in Henan province, to serve as model for other plants planned in Henan and in other regions in China • Program funded by Dengfeng Power Group iGAS Distributed Power Generation Plants to combine SGT and GE model LM2500+G4 aero - derivative gas turbines and related power generation equipment x Average plant size: multiples of 80MW NET output: 80MW, 160MW, etc. x Total plant installed costs: 1800 - 2500 $/ KW (1 ) x Plant build timeline: ~ 24 months (1 ) x Well suited for quick replication and rapid deployment x Est. 900GW of power needed in China and India to reach energy per capita levels of Europe (2) + GE LM - 2500+G4 SGT 0 2000 4000 6000 8000 10000 12000 14000 16000 18000 Electric Power Consumption per Capita (kWh) (1) 2000 2012 Developed Notes: (1 ) SES internal estimates, ( 2) Source: International Energy Agency Statistics ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 16

Potential Growth Market 3: Substitute Natural Gas • SGT superior environmental performance and lower cost for substitute natural gas • Clean syngas for conversion into pipeline natural gas • Coal - based syngas is converted to low cost natural gas • SES syngas is high in methane, reduces cost of methane conversion technology • SES’s SNG pipeline • SES has identified and is strategically approaching multiple global SNG projects, including 15 potential SNG projects in China in early planning stages • In China, SES is approaching major state - sponsored owners and engineers to position SES for initial SNG demonstration and large - scale adoption in future projects 17 China Market Opportunity x In May 2014, China proposed SNG supply capacity to reach 32BNCM by 2017 x China’s Energy Development Action Plan (2014 - 2020) further supported SNG development x China has built its initial large - scale SNG Demonstration Projects, desires to further improve environmental and financial performance for subsequent projects x SNG Projects are the largest - scale gasification projects in the world, require large - scale investment, and bring desired energy independence ©2016 Synthesis Energy Systems, Inc., All Rights Reserved

SGT China JV Plants 18 Yima JV – 3 SGT Systems (2+1) ©2016 Synthesis Energy Systems, Inc., All Rights Reserved Yima JV Plant – Henan Province • 25% SES, 75% Yima Coal Industry Group – Joint Venture • Higher pressure, 10 bar operation • 377,000 metric tons per year (MPTY) nameplate methanol design capacity – at full production rates, 365 days per year • Mature plant expected to be capable of producing ~330,000 MPTY – includes planned and forced outages based on customary Chinese o perating practices for coal - to - chemical plants ZZ Demonstration Plant – Shandong Province • Commercial proof - of - concept SGT demonstration plant and feedstock test facility • 90K TPY design capacity • Syngas/coke oven gas to methanol operating plant • Proven successful operation on waste coals with ash content > 55% WT • Operation commenced in 2008; the plant ceased operations in October 2015 ZZ Demonstration Plant – 2 SGT Systems

SES In Australia ©2016 Synthesis Energy Systems, Inc., All Rights Reserved Callide Thermal Coal Mine – Central Queensland, Australia • Batchfire Resources Pty Ltd. acquired mine in October 2016 • SES holds an approximate 11% ownership position in Batchfire Resources, a privately owned Australian Company • Mature and significantly sized coal producer with substantial recoverable reserves (1 ) : • Approximately 230M tons of recoverable thermal coal reserves • Approximately 850M tons of resources • 650M tons of potential coal of high confidence • Over past 5 years, mine has produced and sold an average 7.5M tons per year of thermal coal into domestic and export markets • Callide B and C power stations are leading customers with long - term supply contracts, essential for major power generation facilities with a combined capacity of 1,510MW (1) (1) Information provided by Batchfire Resources 19

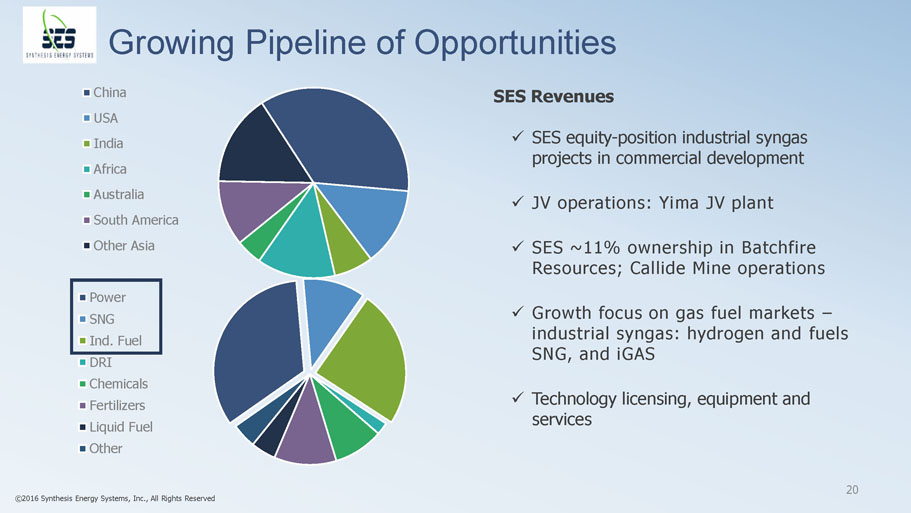

China USA India Africa Australia South America Other Asia Power SNG Ind. Fuel DRI Chemicals Fertilizers Liquid Fuel Other Growing Pipeline of Opportunities SES Revenues x SES equity - position industrial syngas projects in commercial development x JV operations : Yima JV plant x SES ~11% ownership in Batchfire Resources; Callide Mine operations x Growth focus on gas fuel markets – industrial syngas: hydrogen and fuels SNG, and iGAS x Technology licensing, equipment and services ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 20

SES 12 - Month Catalysts • Equity Investment – Advance initial Dongying projects – for Lijin County Binhai New District and Shandong Dongying Hekou District Government – for pipeline hydrogen cleaner transportation fuels, and bring additional clean energy projects into the platform – Work with Weijiao Group to develop the new gasification project at Zouwu Industrial Park – Arrange financing for SES equity - position industrial syngas projects – Continue to seek new partners to establish new investment platforms in Europe, China and other regions of the world – Complete final feasibility studies for initial iGAS project with Dengfeng Power Group, to move project toward government approval • Technology Licensing & Globalization – Continue to advance bid submittal towards securing a large - scale project in South America – Identify and actively pursue prospective new partners in India, for equity investment and technology licensing projects – Secure and launch projects from global new business pipeline, many of which have already indicated a strong preference to use SGT - Industrial Fuels - SNG - iGAS Power ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 21

SES 12 - Month Catalysts • JV Assets - Tianwo - SES: Work with China JV to help focus on profitability of new SGT projects, as well as on securing additional projects to further expand SGT commercialization - Yima JV Plant: Work with JV partner to continue to improve the facility’s business and financial operations, to achieve value for SES from this asset that is operating better than ever ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 22 - Industrial Fuels - SNG - iGAS Power

APPENDIX • Leadership • Management • Board of Directors • Partners & Collaborators • Includes Tianwo - SES current projects • Global Natural Gas: Long - term Asian Outlook • Global Coal Reserves 23

Management DeLome Fair, President and Chief Executive Officer • Appointed SES’s chief executive in February 2016. Joined the SES executive team as SVP, Gasification Technology in December 2014. 25 years’ gasification and IGCC technology expertise in energy and petrochemical industries, with GE and Chevron/Texaco. Ten years at GE Energy included General Manager of Engineering for GE’s Global Gasification Business • M.S. and B.S., Chemical Engineering, University of Kansas Francis Lau, Senior Vice President and Chief Technology Officer • 36 - year tenure at the Gas Technology Institute, with six years serving as GTI’s Executive Director of Gasification and Gas Processing Center; 2003 Pitt Award recipient for coal conversion R&D • M.S., Chemical Engineering, Northwestern University; B.S., Chemical Engineering, University of Wisconsin Scott Davis, Chief Accounting Officer and Corporate Secretary • 15 years’ accounting and finance experience. Served as a Senior Manager of External Reporting, Account Research and Policy with Noble Corporation, plc, before joining SES in May 2016 initially as its Corporate Controller. Career includes over six years at Noble and three years in public accounting with UHY LLP, in its audit and assurance group. He was appointed SES’s CAO and Corporate Secretary in November 2016 • B.B.A., Accounting and B.A., Political Science, Southern Methodist University; J.D., Houston College of Law; Texas CPA certification and Texas licensed attorney Wade A. Taber, Vice President of Engineering • 19 - year gasification engineering career, with most recent 9 - year tenure as GE’s Senior Engineering Manager – Components/Technology Innovation. Accomplishments included more than a dozen patented and trade secret innovations and GE’s Corporate Engineering Award for his development and commercialization of GE’s Advanced Chromia Refractory, which doubled refractory life for solid feedstock gasification • B.S., Ceramic Engineering/Materials Science, University of Illinois ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 24

John Winter, Ph.D., Chief Engineer • 30 - year petrochemical industry experience, including 15 years of gasification technology research, engineering design, tech services and gasification operations. Past senior positions include GE Energy, Texaco/ChevronTexaco, Allied Plastics and Dow Chemical • Ph.D., Chemical Engineering, University of Houston, M.S. and B.S., Chemical Engineering, University of Alabama Donald Huang, SES China Managing Director • Ten - year management tenure with SES in China, including overseeing the implementation of the ZZ plant. Experience with all aspects of project development, including government approvals and financing. Worked for eight years for the Enron Hainan 150 MW Power Plant • Masters of Education, Manchester University; Postgraduate Diploma of Business Administration, University of Wales, UK Khee Yoong Lee, Director of Commercial Development for China • Ten - year project development leadership related to the power, energy and chemicals industries, including various earlier leadership roles for SES in China beginning in 2005. Brings deep experience in China related to project development and financing, formation of Sino - Foreign joint venture businesses and their related commercial arrangements. 19 - year career includes positions at The Wing Group and Arthur Andersen • Degree in Economics and Commerce, University of Melbourne Management ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 25

Lorenzo Lamadrid , Chairman • Ten - year tenure as Chairman of SES. Since 2001, Managing Director of Globe Development Group, LLC, a firm that specializes in the development of large scale energy, power generation, transportation and infrastructure projects in China and provides business advisory services and investments with a particular focus on China. 40 - year career includes executive management positions with General Electric and GE’s International Sector, The Wing Group, and Arthur D. Little • M.B.A., Marketing and International Business, Harvard Business School; M.S., Chemical Engineering, Massachusetts Institute of Technology; B.S., Chemical Engineering and B.S., Administrative Sciences, Yale University Robert W. Rigdon , Vice Chairman • Served as President, CEO and Director of SES from 2009 until February 2016, with an 8 - year tenure with SES, steering commercialization, technology developments and global expansion • Leader in GE’s gasification business in multiple capacities including Manager of Gasification Engineering, Director of IGCC Commercialization and Director of Gasification Industrials and Chemicals Business, 2004 - 2008 • 23 - year previous tenure at Texaco, later ChevronTexaco, in Worldwide Power & Gasification group positions including Engineering Manager, Project Director and Vice President of Gasification Technology • B.S., Mechanical Engineering, Lamar University Charles M. Brown • Led 20 different operating businesses and more than two dozen factories around the world in a wide variety of industrial and consumer product categories. Most recently served as President, CEO and Board Member of Flow International Corp. • M.B.A., Northwestern University’s J. L. Kellogg Graduate School of Management; B.A., Economics and Government, Cornell University Board of Directors ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 26

Harry Rubin • Chairman of Henmead Enterprises, with a particular focus on advising companies regarding strategy, acquisitions and divestitures. Broad executive and financial management background spans computer software, entertainment and consumer brand industries, with companies including GT Interactive Software, Atari, RCA, GE, NBC and Boston Beer Company • M.B.A., Harvard Business School; B.A., Stanford University Denis Slavich • More than 35 years experience in large scale power generation development, including 20 years in executive positions with Bechtel Corporation. Currently serves as an international consultant to various U.S. and China - based companies engaged in cross border transactions, as well as an advisor and board member for a number of additional firms • Ph.D., Massachusetts Institute of Technology; M.B.A., University of Pittsburgh; B.S., Electrical Engineering, University of California at Berkeley Ziwang Xu • Since 2008, founded and manages CXC Capital, Inc. and CXC China Sustainable Growth Fund, with a particular interest in growth companies in the natural resources sector. Tenure with Goldman Sachs Group includes serving as an Advisory Director, 2005 - 2008, and Head of China, 1997 - 2005; previously Head of China for Morgan Stanley • Master of Arts, International Business Relations, Tufts University’s Fletcher School of Law and Diplomacy; M.S., Economics, Fudan University; B.A., East China Normal University Board of Directors 27 ©2016 Synthesis Energy Systems, Inc., All Rights Reserved

China • SES Joint Project Development & Investment Partner: China Environment State Investment Co., Ltd (CESI) • State - owned enterprise established in Beijing under the China Ministry of Environmental Protection • Charged with, and funded to, develop and invest in the energy conservation and environmental protection industry • March 2016 agreement – Total 20 projects in 5 years in SES industrial energy market segments; initial four identified target projects range from $75 million to over $400 million each in estimated installed costs – Equity in the projects for investment expected to be owned 51% CESI, and 49% SES through SES’s wholly owned Hong Kong subsidiary, SES Clean Energy Investment Holdings Limited • SES China JV Partner : Suzhou THVOW Technology Co., Ltd. • Leading coal - chemical equipment manufacturer. 11 billion yuan market cap, 3,000+ employees • SES - THVOW relationship begun at Yima JV Plant. SES China presence established > 10 years • SES - THVOW JV launched April 2014: Tianwo - SES Clean Energy Technologies Co., Ltd. – 35% SES, 65% THVOW – Delivering comprehensive equipment, engineering and gasification technology solutions for multibillion - dollar coal to energy and coal to chemicals industries in China and key Asian markets – Penetrating key regional market while protecting technology – Leading to modular, turnkey SES gasification plants throughout China and select Asian markets – Leveraging low - cost, high - quality equipment and engineering supply source for global business Partners & Collaborators ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 28

Tianwo - SES Current Projects: • Aluminum Corporation of China (CHALCO): China’s largest alumina and primary aluminum producer and the world’s second largest alumina producer • 3 industrial fuel supply plants with 7 total SES gasification systems – Secured by THVOW, total value order awarded 650 million yuan ($102 million) – Tianwo - SES JV projected project revenue from first order (CHALCO): approximately 140.3 million yuan (approximately $22 million) – THVOW’s 95% - owned subsidiary, Innovative Coal Chemical Design Institute (Shanghai) Co., Ltd. (ICCDI) is the general contractor providing all engineering and construction of the three projects Partners & Collaborators ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 29

India • SES Regional Marketing Partner : Simon India Limited • Engineering, procurement and contracting company, wholly owned subsidiary of Zuari Global Limited • Zuari and Simon India are member companies of the Adventz Group, a $3 billion Indian conglomerate comprising 23 companies in various industries, including high - quality complex fertilizers • Marketing SGT for coal and biomass gasification projects in India • Broader SGT engineering support globally GLOBAL • SES Global Alliance with China Coal Research Institute (CCRI) • CCRI is a subsidiary of China Coal Technology & Engineering Group Corporation (CCTEG) – considered the backbone of China’s coal industry • SES emerging economies business and market development • All projects will utilize SES’s advanced SGT to efficiently produce clean syngas from low - grade coals for use in producing multiple high value products • Clean energy technology projects will dovetail with the Chinese government’s One Belt, One Road “Going Out” strategy Partners & Collaborators ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 30

iGAS Power • SES iGAS Collaborator : GE Packaged Power • GE Packaged Power, Inc. is a Houston - based subsidiary of General Electric Company • iGAS power units combine SGT and GE aeroderivative power gen sets: fuel - flexible LM2500+G4 gas turbines • Dengfeng Power Group Co., Ltd .: State - owned industrial conglomerate specializing in thermal power generation. Products include aluminum, other non - ferrous metals and cement. Operates power generation plants and coal mines in Henan Province • Final feasibility studies underway for 160MW iGAS syngas - to - power IGGC distributed power plant – Designed to utilize 2 state - of - the - art SES XL3000 gasification systems and 4 GE gas turbines – Initial plant in Henan Province , to serve as model for other plants planned in Henan and in other regions • Exclusivity period extended through December 2017 and expanded initial project work scope DRI for Steel Production • SES Exclusive Global Partner: Midrex Technologies, Inc. • Midrex Technologies is a subsidiary of Kobe Steel, is world leader with about 60% market share • Expanded global strategic alliance in July 2015 - Midrex assumed lead position marketing fully integrated cleaner coal gasification - based next - gen Direct Reduced Iron (DRI) solution • State - of - the - art projects to combine industry - leading MIDREX ® Process using the MXCOL ® configuration with SGT to create clean syngas in order to convert iron ore into high - purity DRI • World DRI output exceeds 75MTPY (1) , DRI facilities replace coal - fired blast furnace for steelmaking Partners & Collaborators ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 31 Source: (1) Midrex Technologies, Inc.

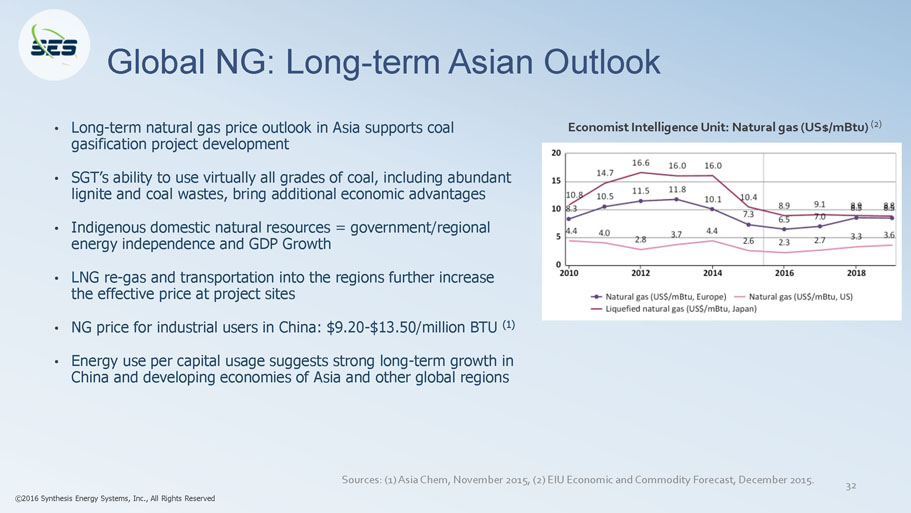

• Long - term natural gas price outlook in Asia supports coal gasification project development • SGT’s ability to use virtually all grades of coal, including abundant lignite and coal wastes, bring additional economic advantages • Indigenous domestic natural resources = government/regional energy independence and GDP Growth • LNG re - gas and transportation into the regions further increase the effective price at project sites • NG price for industrial users in China: $9.20 - $13.50/million BTU (1) • Energy use per capital usage suggests strong long - term growth in China and developing economies of Asia and other global regions Economist Intelligence Unit: Natural gas (US$/ mBtu ) (2) Global NG: Long - term Asian Outlook ©2016 Synthesis Energy Systems, Inc., All Rights Reserved 32 Sources: (1) Asia Chem , November 2015, (2) EIU Economic and Commodity Forecast, December 2015.

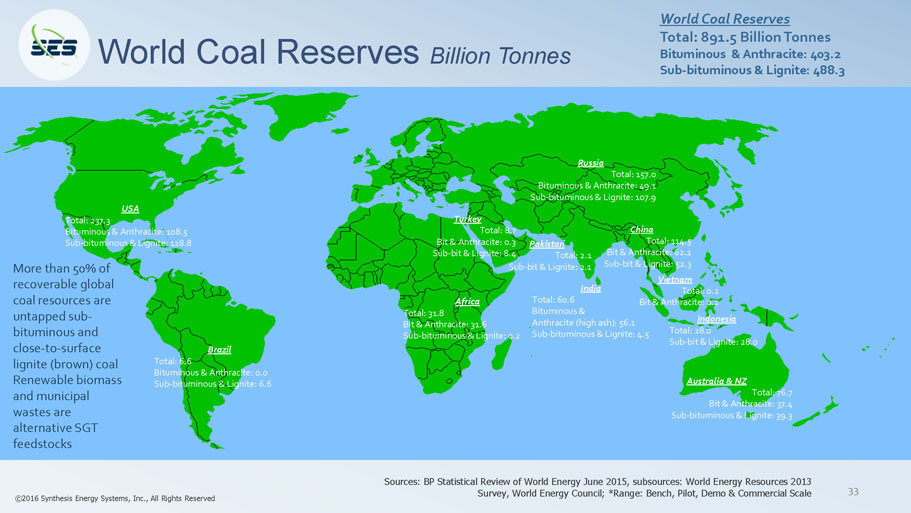

USA Total: 237.3 Bituminous & Anthracite: 108.5 Sub - bituminous & Lignite: 128.8 Africa Total: 31.8 Bit & Anthracite: 31.6 Sub - bituminous & Lignite: 0.2 India Total: 60.6 Bituminous & Anthracite (high ash): 56.1 Sub - bituminous & Lignite: 4.5 Australia & NZ Total: 76.7 Bit & Anthracite: 37.4 Sub - bituminous & Lignite: 39.3 Russia Total: 157.0 Bituminous & Anthracite: 49.1 Sub - bituminous & Lignite: 107.9 China Total: 114.5 Bit & Anthracite: 62.2 Sub - bit & Lignite: 52.3 Vietnam Total: 0.2 Bit & Anthracite: 0.2 Turkey Total: 8.7 Bit & Anthracite: 0.3 Sub - bit & Lignite: 8.4 Pakistan Total: 2.1 Sub - bit & Lignite: 2.1 Indonesia Total: 28.0 Sub - bit & Lignite: 28.0 Brazil Total: 6.6 Bituminous & Anthracite: 0.0 Sub - bituminous & Lignite: 6.6 World Coal Reserves Total: 891.5 Billion Tonnes Bituminous & Anthracite: 403.2 Sub - bituminous & Lignite: 488.3 World Coal Reserves Billion Tonnes ©2016 Synthesis Energy Systems, Inc., All Rights Reserved • More than 50% of recoverable global coal resources are untapped sub - bituminous and close - to - surface lignite (brown) coal • Renewable biomass and municipal wastes are alternative SGT feedstocks Sources: BP Statistical Review of World Energy June 2015, subsources : World Energy Resources 2013 Survey, World Energy Council; *Range: Bench, Pilot, Demo & Commercial Scale 33

Synthesis Energy Systems, Inc. Investor Relations: MDC GROUP Contact: David Castaneda (414) 351 - 9758 | IR@synthesisenergy.com Nasdaq: SYMX www.synthesisenergy.com GROWTH WITH BLUE SKIES