Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HUNTINGTON BANCSHARES INC /MD/ | hban20161207_8-k.htm |

Welcome

©2016 Huntington Bancshares Incorporated. All rights reserved. (NASDAQ: HBAN)

Huntington Bancshares Incorporated

Goldman Sachs US Financial Services Conference

December 7, 2016

Exhibit 99.1

2

Disclaimer

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This communication contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals,

projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties.

Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking

statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target,

goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The

forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section

21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could

cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic,

political, or industry conditions; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve

Board; volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product

pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or

services implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations,

reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer

Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the

possibility that the anticipated benefits of the merger with FirstMerit Corporation are not realized when expected or at all, including as a

result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and

competitive factors in the areas where we do business; diversion of management’s attention from ongoing business operations and

opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the

completion of the merger with FirstMerit Corporation; our ability to complete the integration of FirstMerit Corporation successfully; and

other factors that may affect our future results. Additional factors that could cause results to differ materially from those described above

can be found in our Annual Report on Form 10-K for the year ended December 31, 2015 and our subsequent Quarterly Reports on Form

10-Q, including for the quarters ended March 31, 2016, June 30, 2016, and September 30, 2016, each of which is on file with the

Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of our website,

http://www.huntington.com, under the heading “Publications and Filings” and in other documents we file with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. We do not

assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-

looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As

forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on

such statements.

3

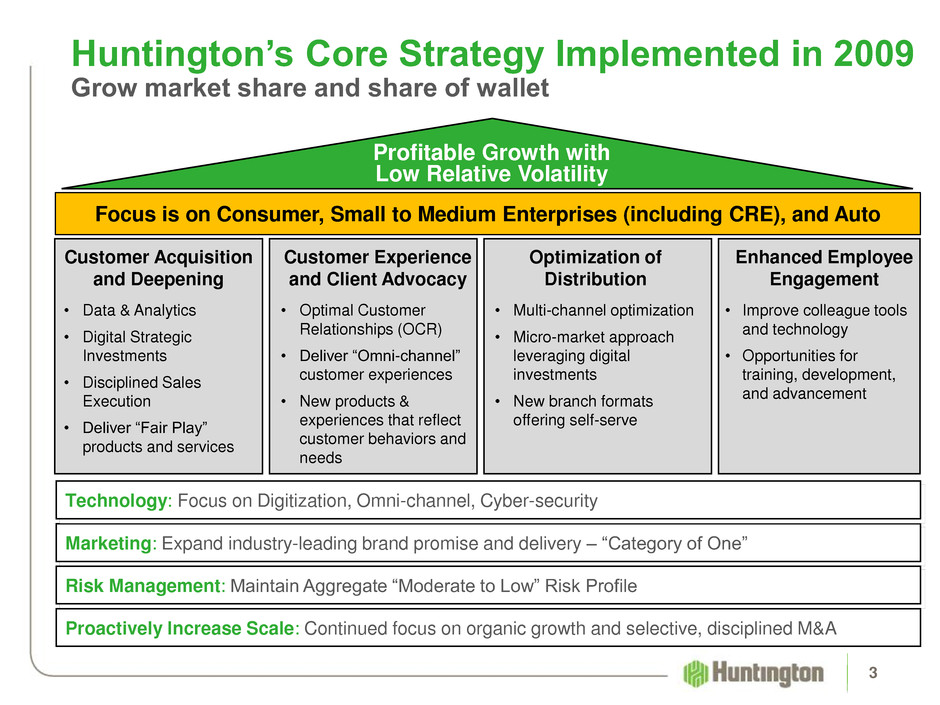

Huntington’s Core Strategy Implemented in 2009

Grow market share and share of wallet

Marketing: Expand industry-leading brand promise and delivery – “Category of One”

Technology: Focus on Digitization, Omni-channel, Cyber-security

Profitable Growth with

Low Relative Volatility

Customer Experience

and Client Advocacy

Optimization of

Distribution

Enhanced Employee

Engagement

Customer Acquisition

and Deepening

• Multi-channel optimization

• Micro-market approach

leveraging digital

investments

• New branch formats

offering self-serve

• Optimal Customer

Relationships (OCR)

• Deliver “Omni-channel”

customer experiences

• New products &

experiences that reflect

customer behaviors and

needs

Risk Management: Maintain Aggregate “Moderate to Low” Risk Profile

• Improve colleague tools

and technology

• Opportunities for

training, development,

and advancement

• Data & Analytics

• Digital Strategic

Investments

• Disciplined Sales

Execution

• Deliver “Fair Play”

products and services

Proactively Increase Scale: Continued focus on organic growth and selective, disciplined M&A

Focus is on Consumer, Small to Medium Enterprises (including CRE), and Auto

4

FirstMerit Acquisition Milestones

Effectively Managing Execution Risk is THE Immediate Focus

Back Office

Consolidations

(1Q17)

Acquisition

Closing

Integration Execution

Branch

Divestiture

Closing

(4Q16)

Network &

Equipment

Upgrades, and

Permanent

Signage Installed

(4Q16)

Standalone

Applications

and Systems

Conversions,

ATMs

deployed

(3Q16)

Subsidiary

Bank

Merger

Completed

FirstMerit has the potential to transform our efficiency and return profiles.

Ensuring a successful integration is our primary focus.

Mock

Branch

Conversions

(4Q16)

Colleague

Onboarding

and Training

(1Q17)

Final Systems &

Applications

Conversions

(2Q17)

Management &

Organizational

Changes

Implemented

(3Q16)

Branch

Conversions &

Consolidations

(1Q17)

Core Systems

Conversions

(1Q17)

Network &

Equipment

Upgrades, and

Permanent

Signage Installed

(3Q16)

Standalone

Applications

and Systems

Conversions,

ATMs

deployed

(4Q16)

Mock

Branch

Conversions

(1Q17)

Significant Branch Overlap Drives Consolidation

#1 Branch Share in Ohio and in Michigan provides immediate and

future consolidation opportunities

5

Michigan:

• # 1 (14%) branch

market share

• #6 (8%) deposit

market share

• 20% of total

HBAN deposits

Sources: FDIC, SNL Financial

Ohio:

• #1 (15%) branch

market share

• #2 (15%) deposit

market share

• 64% of total

HBAN deposits

Huntington Legacy Branches

FirstMerit Branches

Branch Consolidations / Closures / Divestitures

65% within 2.5 miles

39% within 1 mile

Implementation of Cost Savings on Pace

6

Significant progress toward achieving ~$255 million annualized cost savings target:

o Approximately 25% implemented during 3Q16

o Expect to have 50% implemented by year end

o The majority of remaining cost savings to be implemented in 1Q17 coincident with or immediately

following branch conversion/consolidation

Expect to implement all cost savings within one year of acquisition closing

Excludes incremental personnel expense associated with revenue enhancement opportunities and

changes to FDIC insurance premiums

$ in millions 4Q15 Actual 4Q17 Target

Pro Forma Pro Forma

HBAN FMER Combined Assumed HBAN FMER Combined

Reported Non-Interest Expense 499$ 156$ 654$ CAGR 529$ 165$ 694$

Less: Intangible Amortization 4 3 6 3.0% 4 3 7

Less: Significant Items 10 (0) 10 11 (0) 11

Adjusted Non-Interest Expense 484$ 153$ 638$ 514$ 163$ 677$

Quarterly cost savings 64$ Quarterly cost savings 68$

Adjusted Non-Interest Expense Target 609$

Annualized cost savings 255$ Annualized cost savings 271$

Cost Savings as % of: Cost Savings as % of:

Pro Forma Pro Forma

FMER Combined FMER Combined

42% 10% 42% 10%

7

L-T

Goal

3Q16

(GAAP)

3Q16

Adjusted (1)

(Non-GAAP)

2018

Target

Revenue (FTE) Growth 4%-6% +24% +24%

Expense Growth +Op Lev +35% +14%

Efficiency Ratio 56%-59% 75% 58%

NCO 35-55 bp 26 bp 26 bp

ROTCE 13%-15% 7% 14%

Acquisition Accelerates Achievement of our

Long-Term Financial Goals

59% Cost savings

56% Cost savings plus rates

Efficiency Ratio

(1) See reconciliation on slide 18

Expected Impact of Purchase Accounting

8

• Reflects purchase accounting impact exclusively related to the FirstMerit acquisition

• Projected purchase accounting accretion represents scheduled amortization, and does not include impact of any

accelerated payoffs.

9

Opportunity to Expand Fee Income at FirstMerit

Revenue Synergies Not Modeled into Deal Economics

Restoring the Noninterest Income contribution to 34% of Total Revenues

represents an approximately $100 million revenue opportunity.

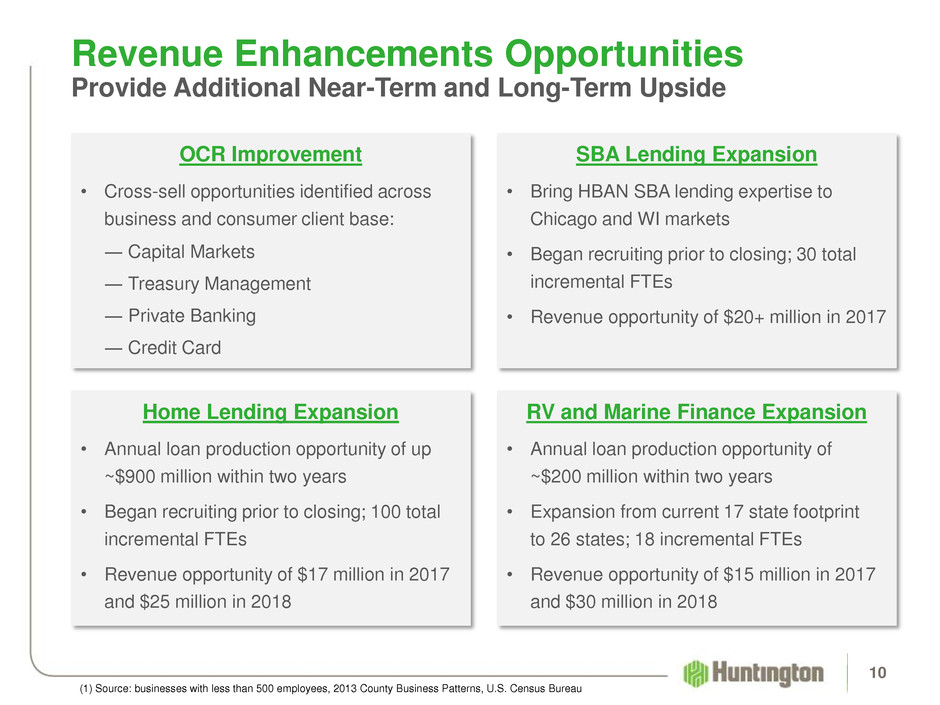

Revenue Enhancements Opportunities

Provide Additional Near-Term and Long-Term Upside

10

(1) Source: businesses with less than 500 employees, 2013 County Business Patterns, U.S. Census Bureau

Home Lending Expansion

• Annual loan production opportunity of up

~$900 million within two years

• Began recruiting prior to closing; 100 total

incremental FTEs

• Revenue opportunity of $17 million in 2017

and $25 million in 2018

OCR Improvement

• Cross-sell opportunities identified across

business and consumer client base:

― Capital Markets

― Treasury Management

― Private Banking

― Credit Card

SBA Lending Expansion

• Bring HBAN SBA lending expertise to

Chicago and WI markets

• Began recruiting prior to closing; 30 total

incremental FTEs

• Revenue opportunity of $20+ million in 2017

RV and Marine Finance Expansion

• Annual loan production opportunity of

~$200 million within two years

• Expansion from current 17 state footprint

to 26 states; 18 incremental FTEs

• Revenue opportunity of $15 million in 2017

and $30 million in 2018

Budgeting for unchanged interest rates for remainder of 2016 and 2017

Full year revenue growth of 20%+

Targeting positive operating leverage

o Implementation of all planned cost savings by 3Q17

Average balance sheet growth of 20%+

Net charge-offs below our long-term expectations of 35–55 bp

o Provision expense normalizing to reflect runoff in the acquired loan

portfolio and replacement loan growth

11

Initial 2017 Expectations

Focus on delivery of consistent, through-the-cycle shareholder returns

Consistent core strategy since 2009

o Focused on areas of expertise with sustainable competitive advantages:

Consumer Banking, Small Business and Middle Market Commercial,

and Auto Finance

o Track record of achieving results in difficult operating environment

o Disciplined risk management: Aggregate moderate-to-low risk appetite

Driving loan and core deposit growth through execution and a

differentiated customer experience

Significant progress in early stages of FirstMerit integration;

confidence in delivery of cost savings and revenue enhancements

High level of colleague and shareholder alignment

Important Messages

12

Appendix

13

Huntington Bancshares Overview

Midwest financial services holding company

Founded - 1866

Headquarters - Columbus, Ohio

Total assets - $101 Billion

Employees(1) - 14,511

Franchise:

14

(1) 3Q16 Average full-time equivalent (FTE) (2) Includes 26 Private Client Group Offices

Branches 1,129(2)

ATMs 1,979

% Deposits

#1 Share markets 44%

#1- #3 Share markets 63%

State Branches ATMs

Ohio 535 1,101

Michigan 353 446

Illinois 39 40

Wisconsin 37 40

Pennsylvania 53 108

Indiana 46 77

West Virginia 30 147

Kentucky 10 20

MSA Rank Branches Deposits Share

Columbus, OH 1 97 $20,453 32.1%

Cleveland, OH 2 153 8,976 14.0

Detroit, MI 6 121 6,542 5.4

Akron, OH 1 56 5,611 38.5

Indianapolis, IN 4 46 3,272 7.2

Cincinnati, OH 4 36 2,727 2.6

Pittsburgh, PA 8 38 2,689 2.3

Chicago, IL 16 39 2,581 0.7

Toledo, OH 1 33 2,474 23.7

Grand Rapids, MI 2 46 2,466 12.0

Deposits - Top 10 MSAs

Source: SNL Financial, company presentations and filings

FDIC deposit data as of June 30, 2016

Huntington’s Peer Group

15

$ in millions

Total

Assets

Total

Deposits

Total

Loans

Market

Capitalization

Price /

Dividend

Yield

Consensus

2017E

Tangible

Book

PNC Financial Services Group, Inc. $369,348 $259,895 $210,446 $54,780 14.9x 1.7x 2.0%

BB&T Corporation 222,622 159,915 142,423 37,196 15.0x 2.3x 2.6%

SunTrust Banks, Inc. 205,091 158,842 141,532 25,870 14.3x 1.6x 2.0%

Citizens Financial Group, Inc. 147,015 108,327 105,467 17,598 15.9x 1.4x 1.4%

Fifth Third Bancorp 143,279 101,271 93,151 19,978 15.1x 1.5x 2.0%

KeyCorp 135,805 104,185 85,528 19,302 14.0x 1.8x 1.9%

M&T Bank Corporation 126,841 98,137 88,942 22,806 17.2x 2.2x 1.9%

Regions Financial Corporation 125,177 99,289 80,883 17,037 14.7x 1.5x 1.9%

Comerica Incorporated 74,124 59,261 49,274 11,221 17.2x 1.6x 1.4%

CIT Group 65,966 32,854 29,918 8,353 12.4x 0.8x 1.5%

Zions Bancorporation 61,039 50,849 42,540 8,198 17.6x 1.4x 0.8%

Median 135,805 101,271 88,942 19,345 15.0x 1.5x 1.9%

Huntington Bancshares Incorporated 100,765 77,405 66,304 14,135 14.1x 2.1x 2.5%

Source: SNL; as of Dec. 1, 2016

16

Loan Portfolio Composition

3Q16 Average Balances

17

Deposit Composition

3Q16 Average Balances

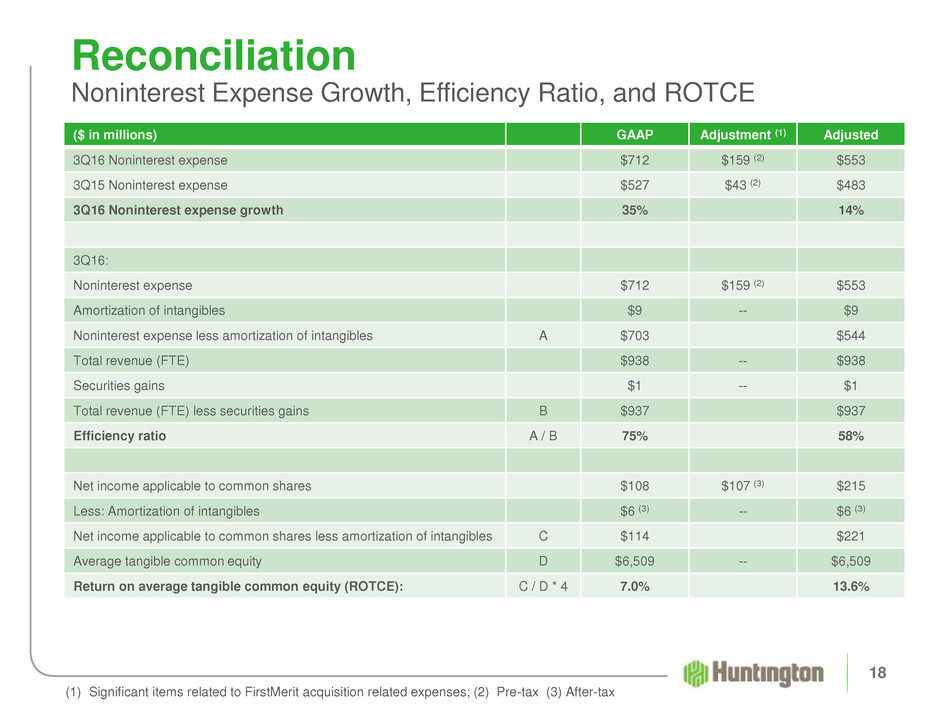

Reconciliation

Noninterest Expense Growth, Efficiency Ratio, and ROTCE

18

($ in millions) GAAP Adjustment (1) Adjusted

3Q16 Noninterest expense $712 $159 (2) $553

3Q15 Noninterest expense $527 $43 (2) $483

3Q16 Noninterest expense growth 35% 14%

3Q16:

Noninterest expense $712 $159 (2) $553

Amortization of intangibles $9 -- $9

Noninterest expense less amortization of intangibles A $703 $544

Total revenue (FTE) $938 -- $938

Securities gains $1 -- $1

Total revenue (FTE) less securities gains B $937 $937

Efficiency ratio A / B 75% 58%

Net income applicable to common shares $108 $107 (3) $215

Less: Amortization of intangibles $6 (3) -- $6 (3)

Net income applicable to common shares less amortization of intangibles C $114 $221

Average tangible common equity D $6,509 -- $6,509

Return on average tangible common equity (ROTCE): C / D * 4 7.0% 13.6%

(1) Significant items related to FirstMerit acquisition related expenses; (2) Pre-tax (3) After-tax

Welcome

©2016 Huntington Bancshares Incorporated. All rights reserved. (NASDAQ: HBAN)

Mark A. Muth

Director of Investor Relations

Office: 614.480.4720

E-mail: mark.muth@huntington.com