Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORTHWEST NATURAL GAS CO | a8-kirmaterialsdec2016.htm |

LEAD.

INNOVATE.

GROW.

Investor Presentation

December 2016

INVESTOR INFORMATION

This and other presentations made by NW Natural from time to time, may contain forward-looking statements

within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements

can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects”

and similar references to future periods. Examples of forward-looking statements include, but are not limited

to, statements regarding the following: including regional third-party projects, storage, pipeline and other

infrastructure investments, commodity costs, competitive advantage, customer service, customer and

business growth, conversion potential, multifamily development, business risk, efficiency of business

operations, regulatory recovery, business development and new business initiatives, environmental

remediation recoveries, gas storage markets and business opportunities, gas storage development, costs,

timing or returns related thereto, financial positions and performance, economic and housing market trends

and performance shareholder return and value, capital expenditures, liquidity, strategic goals, carbon savings,

gas reserves and investments and regulatory recoveries related thereto, hedge efficacy, cash flows and

adequacy thereof, return on equity, capital structure, return on invested capital, revenues and earnings and

timing thereof, margins, operations and maintenance expense, dividends, credit ratings and profile, the

regulatory environment, effects of regulatory disallowance, timing or effects of future regulatory proceedings or

future regulatory approvals, regulatory prudence reviews, effects of regulatory mechanisms, including, but not

limited to, SRRM and the Company’s infrastructure investments, effects of legislation, including but not limited

to bonus depreciation and PHMSA regulations, and other statements that are other than statements of

historical facts.

Forward-looking statements are based on our current expectations and assumptions regarding our business,

the economy and other future conditions. Because forward-looking statements relate to the future, they are

subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual

results may differ materially from those contemplated by the forward-looking statements, so we caution you

against relying on any of these forward-looking statements. They are neither statements of historical fact nor

guarantees or assurances of future performance. Important factors that could cause actual results to differ

materially from those in the forward-looking statements are discussed by reference to the factors described in

Part I, Item 1A “Risk Factors,” and Part II, Item 7 and Item 7A “Management’s Discussion and Analysis of

Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosure about Market

Risk” in the Company’s most recent Annual Report on Form 10-K, and in Part I, Items 2 and 3 “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and “Quantitative and Qualitative

Disclosures About Market Risk”, and Part II, Item 1A, “Risk Factors”, in the Company’s quarterly reports filed

thereafter.

All forward-looking statements made in this presentation and all subsequent forward-looking statements,

whether written or oral and whether made by or on behalf of the Company, are expressly qualified by these

cautionary statements. Any forward-looking statement speaks only as of the date on which such statement is

made, and we undertake no obligation to publicly update any forward-looking statement, whether as a result

of new information, future developments or otherwise, except as may be required by law.

FORWARD LOOKING STATEMENTSCOMPANY INFORMATION

NW Natural

220 NW Second Ave.

Portland, OR 97209

nwnatural.com

Nikki Sparley

Director, Investor Relations

(503) 721 – 2530

nikki.sparley@nwnatural.com

2

TABLE OF CONTENTS

I. Introduction

II. Utility

III. Gas Storage

IV. Growth Opportunities

V. Financial Performance

VI. Conclusion

Appendix

4

NW NATURAL LEADERSHIP

Mr. Anderson is currently NW Natural’s President and CEO effective August 1, 2016. Since

he joined the Company in 2004, Mr. Anderson has served in various executive positions

over Operations, Regulation, as COO and CFO. Previously, Mr. Anderson held executive

positions within TXU Corporate including Senior Vice President and Chief Accounting

Officer. Mr. Anderson holds a BBA in Accounting from Texas Tech University and held a

CPA (retired) and CGMA.

Brody J. Wilson

Interim CFO & Interim Treasurer and Chief Accounting Officer & Controller

Mr. Wilson is currently serving as NW Natural’s Interim CFO and Interim Treasurer effective

September 2, 2016. Mr. Wilson was appointed Chief Accounting Officer and Assistant

Treasurer in 2016 and has been serving as NW Natural’s Controller since 2013. Prior to

joining the Company in 2012, he was a Senior Manager at PricewaterhouseCoopers LLP

where he worked in PwC’s Energy & Utility Group in Portland, Oregon and London, England.

Mr. Wilson holds a Bachelor of Science in Accounting from George Fox University and is a

CPA in Oregon.

David H. Anderson

President and CEO

6

INVESTMENT HIGHLIGHTS

• Low-risk business profile with 90%+ of revenues from pure-play LDC

• Over 718,000 utility customers with nearly 14,000 miles of distribution and

transmission mains

• Supportive regulatory environments in Oregon and Washington with progressive

recovery mechanisms

• Modern distribution system – no identified cast iron or bare steel

Stable, Regulated

Earnings Profile

Proven Financial

Performance

Tangible Growth

Opportunities

• Stable dividends with 61-year record of increasing dividends paid annually

• Investment grade credit ratings of AA- and A1 at S&P and Moody’s, respectively (1)

• Experienced management team with broad energy knowledge

• Projected five-year capital expenditures plan of $850-950 million

• Service territory experiencing above average customer growth (1.6% for the year

ending September 30, 2016)

• Continuous replacement of existing infrastructure to ensure reliability and safety

• $128 million regulated expansion of Mist facility to support renewables in the region

(1) The above credit ratings are dependent upon a number of factors, both qualitative and quantitative, and are subject to change at

any time. The disclosure of these credit ratings is not a recommendation to buy, sell or hold NW Natural securities. 7

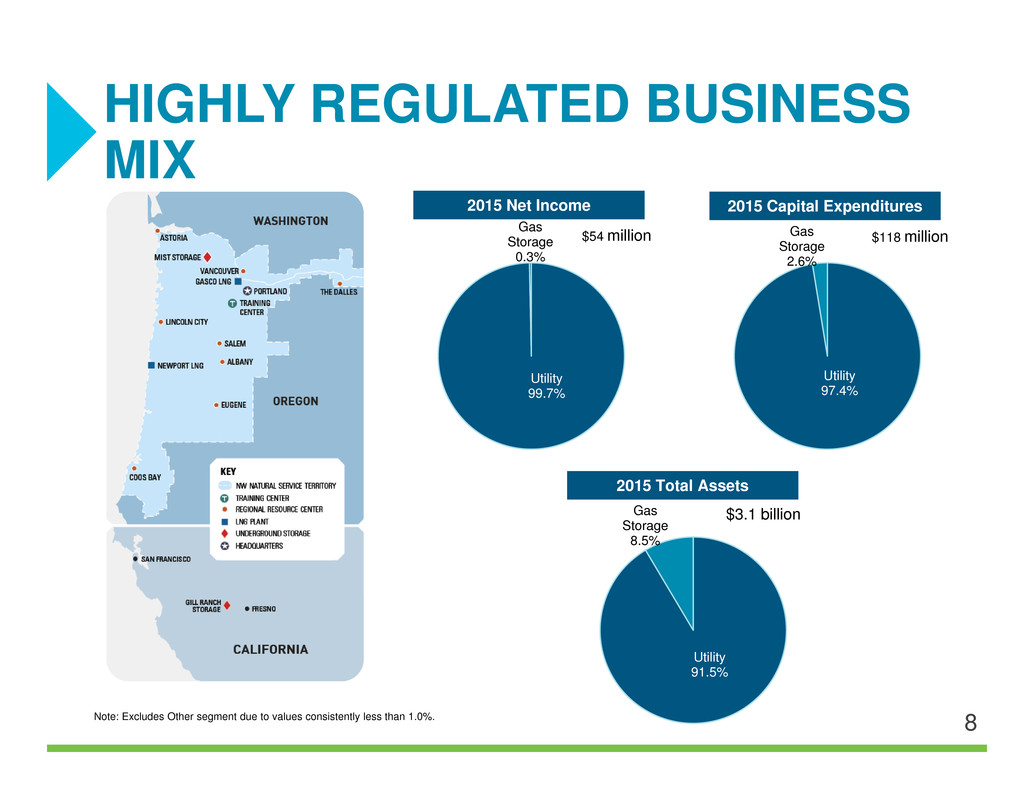

HIGHLY REGULATED BUSINESS

MIX

Note: Excludes Other segment due to values consistently less than 1.0%.

Utility

99.7%

Gas

Storage

0.3%

Utility

97.4%

Gas

Storage

2.6%

Utility

91.5%

Gas

Storage

8.5%

2015 Capital Expenditures2015 Net Income

2015 Total Assets

$118 million$54 million

$3.1 billion

8

CORPORATE STRATEGY

A CONSERVATIVE BUSINESS PROFILE

Stable utility margins through progressive regulation

• Weather & decoupling mechanisms in Oregon

• Environmental cost recovery mechanism in Oregon

• Constructive relationships with regulators and customer groups

Excellent operations and efficient cost structure

• Commitment to safety, reliability, and quality service

• Continued focus on efficient business operations

Long-term growth opportunities that fit NWN’s profile

• Utility: attractive and growing service territory driving above-average customer growth and investments

• Mist facility: high-value long-term contracts, asset optimization, planned expansion

• Gill Ranch facility: potential long-term storage value from California's RPS requirement and carbon

reduction targets

9

Low-Carbon

Pathway

Enable Growth Superior Customer

Experience

OUR STRATEGIC UTILITY GOALS

Constructive

Regulation

Workforce of the

Future

Effectively position our

Company for a low-

carbon future.

• Target: 30% carbon

emissions savings

associated with

current and new

customers by 2035,

from a 2015 baseline.

• Build public policy

coalitions to support

this goal.

Further a successful

regulatory agenda

that serves the

interests of

customers, benefits

the company, meets

the duties of

regulators and

furthers

stakeholders’

missions.

Channel our

organizational

energies around

revenue growth so we

can succeed in

an increasingly

competitive and

complex marketplace.

• Simplify processes

and leverage

technology.

• Examine our tariffs

to meet new market

demands and a low-

carbon business

model.

Improve processes,

deploy new

technology and use

metrics to continually

improve and meet

evolving customer

expectations.

Continue to drive

operational priorities

that ensure we are

delivering safe,

reliable and superior

service.

Foster a culture of

accountability, creativity

and collaboration that is

inclusive and supports

opportunities for cross-

functional effectiveness.

10

CORE UTILITY SEGMENTS

Safe, Reliable Service

• Strong safety record

• Modern distribution and transmission system — No known cast

iron and bare steel since 2015

• State of the art training facility used for hands-on scenario-based

safety training

• Outstanding customer satisfaction — #1 in West, JD Power and

Associates (2016)

• Resource diversity — 11 Bcf regulated gas storage and 2 Bcf

LNG storage

Attractive Service Territory

• Approximately 89% of customer base in Oregon and 11% in

Washington

• Territory covers over 75% of Oregon’s population

• Includes Vancouver (Clark County) — the fastest growing county

in Washington

• Supportive and progressive regulation

Growth Potential

• Organic opportunities — gas in approximately 60% of single-

family homes

• Strong customer growth

• Positive economic trends and housing fundamentals in region

90%+ of net income and assets from pure-play LDC Cast Iron & Bare Steel Removed

Cap-Ex Focus on System Integrity,

Maintenance and Growth

($ in millions)

12Chart above is based on accrual capital expenditure figures.

RATE STRUCTURES &

MECHANISMS

Oregon Washington

Rate Structures:

Rate Case Year 2012 2009

ROE 9.5% 10.1%

ROR 7.8% 8.4%

Equity Ratio 50% 51%

2015 Rate Base $1.2B $0.1B

Key Mechanisms:

Decoupling/WARM X

Purchased Gas Adjustment X X

Environmental Cost Recovery Deferral(1)

Pension Balancing X

Incentive Sharing(2) X X

(1) Washington allows deferral of environmental costs, but a cost recovery mechanism or methodology has not yet been established by the Washington Commission. A carrying

charge related to deferred amounts will be determined in a future proceeding.

(2) In Oregon, NW Natural shares PGA gains and losses. In both Oregon and Washington, NW Natural shares with customers revenues it achieves through interstate storage

and optimization activities. 13

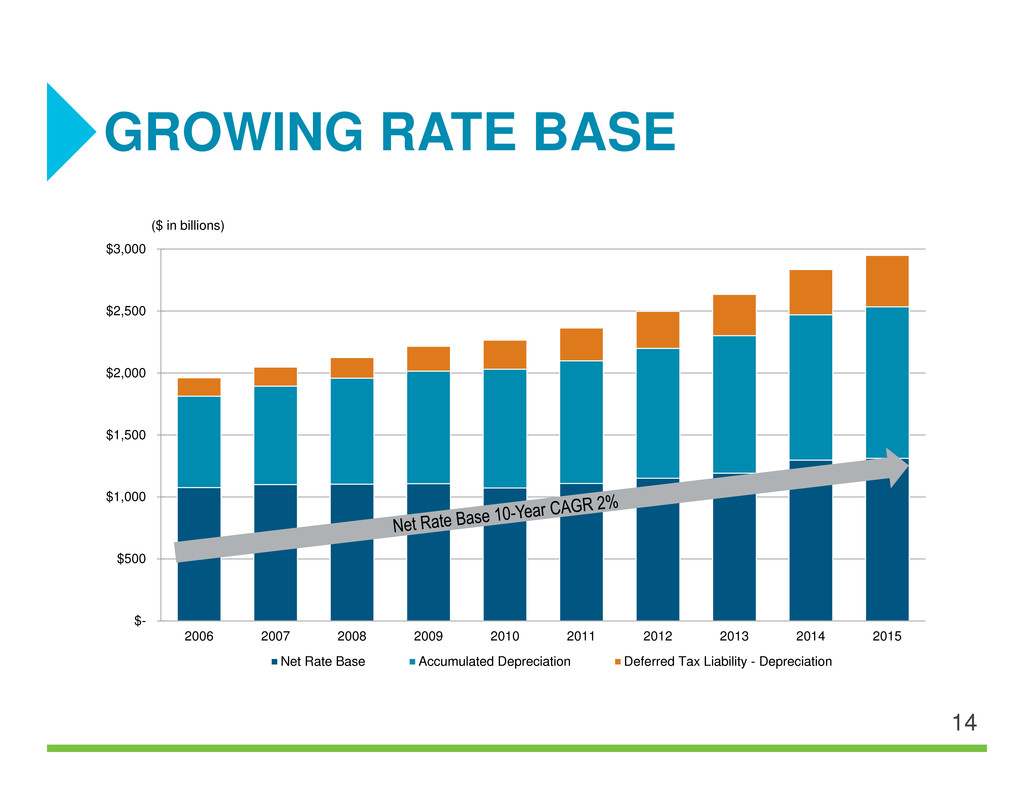

GROWING RATE BASE

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Net Rate Base Accumulated Depreciation Deferred Tax Liability - Depreciation

($ in billions)

14

SUPPORTIVE REGULATORY

MECHANISMS

• Allows for deferral of environmental costs and in OR the accrual of carrying costs

• Recovers environmental costs allocated to OR through a site remediation mechanism (SRRM), subject to an

annual prudence review and earnings test(1)

• Defer costs in WA, recovery & carrying charge to be determined in future proceeding

• Breaks link between earnings and consumption by removing incentive to increase usage

• Employs use-per-customer decoupling calculation, which adjusts margin revenues to account for the difference

between actual and expected customer volumes

• Adjusts annual rates to reflect changes in expected cost of gas commodity purchases

• Includes spot purchases, contract supplies, derivatives, storage inventories, gas reserves

• Includes temporary rate adjustments amortizing deferred regulatory account balances

• Stabilizes collection of fixed costs for residential and commercial customers

• Adjusts billings based on temperature variances compared to average weather

• Applied from December through May of each heating season

• Defers annual pension expenses above the amount set in rates

• Expect deferral account to come to zero after nearer-term years of higher pension costs are balanced with

future years of lower pension costs

O

r

e

g

o

n

a

n

d

W

a

s

h

i

n

g

t

o

n

O

r

e

g

o

n

a

n

d

W

a

s

h

i

n

g

t

o

n

O

r

e

g

o

n

O

r

e

g

o

n

O

r

e

g

o

n

Decoupling

Weather

Normalization

(WARM)

Purchased Gas

Adjustment (PGA)

Environmental

Cost Deferral

Pension Balancing

15(1) To the extent the utility earns more than its authorized ROE in a year, the utility is required to cover environmental expenses and interest on expenses greater than

$10 million (plus interest from insurance proceeds) with those earnings that exceed its authorized ROE.

RECENT REGULATORY

PROCEEDINGS

• January 2016 order resolved open matters regarding the implementation of the environmental recovery

mechanism

• OPUC confirmed recovery of prudently incurred environmental costs allocated to Oregon ratepayers (96.68% of

site costs allocated to Oregon)

• Disallowed interest earned on original charge resulting in $3.3 million pre-tax charge in January 2016

• OPUC opened all-party docket to discuss appropriate gas portfolio hedging in the state

— NWN request for guidelines on long-term hedging included in docket

— Expect to work through the docket during 2016 and the first half of 2017

• WUTC engaged in review of Local Distribution Company (LDC) hedging practices during 2016

• NWN submitted Combined Heat and Power Program under Senate Bill 844 to OPUC in June 2015

• OPUC declined program in April 2016 as filed & provided guidance on program structure & incentives for future

submission

• Contemplating next steps for this program and possible resubmission

• OPUC issued order in March 2015 requiring a third-party cost study to be performed

• Steering committee consisting of Company, OPUC staff, and customer groups to hire third-party to perform cost

study

• OPUC formed working group to study how utilities may expand natural gas service to areas that do not currently

have access to natural gas

• Report with high-level guidelines published in September 2016

Environmental

Cost Recovery

Carbon Solutions

Program

Interstate Storage

Sharing

Stranded

Communities

Commodity

Hedging

16

UTILITY STORAGE AT MIST

Overview

• In operation since 1989

• Storage capacity at Mist 16 Bcf

─ 11 Bcf Core Utility

─ 5 Bcf Non-Utility Interstate Storage Services

Unique Asset

• Limited storage options in Pacific Northwest

• Part of utility’s diverse, reliable gas supply strategy

• Utility can recall Interstate portion for Core Utility

demand

• Optimize Interstate portion and share with customers

0.00

0.10

0.20

0.30

0.40

0.50

0.60

BCF / Day

Utility Utility Recall Interstate

0

3

6

9

12

15

18

BCF

Utility Utility Recall Interstate

Mist Storage Capacity

Mist Storage Deliverability

17

18

STORAGE SEGMENT OVERVIEW

OR

WA

Portland

CA

San Francisco

Gill Ranch

Mist

NWN

Service

Territory

Mist (Interstate Portion) Gill Ranch

Designed Capacity (Bcf) 5 20

Max Deliverability (Dth/day) 215,000 490,000

In-Service Year 2001 2010

Mist

16 Bcf Total

Mist Storage

31 Bcf Total Gas Storage

Gill Ranch

15 Bcf

Mist (Utility)

11 Bcf

Mist

(Interstate)

5 Bcf

• NWN owns and operates two storage assets:

─ Mist – Gas Storage Segment (non-utility Interstate portion) currently has 5 Bcf of capacity at the 16 Bcf storage

facility in Mist, OR (remaining 11 Bcf dedicated to Utility Segment)

─ Gill Ranch – owns 75% of 20 Bcf Gill Ranch Storage Facility near Fresno, CA (PG&E owns remaining 25%)

• 2015 gas storage revenues were $21.4 million

19

GILL RANCH STORAGE FACILITY

20

• Fully contracted for 2016-17 gas storage year with slightly higher prices than 2015-16;

however, prices remain low relative to our original contracts for the facility

• Unlevered asset

• Pursuing higher value service contracts and new market opportunities

• Expect flexible energy resources to be needed in California to meet state’s RPS

• Additional regulations currently underdevelopment for gas storage facilities, which

could result in higher capital expenditures and on-going maintenance expenses

• Ability to expand, but will depend on California storage market conditions

• High-value asset in premium geographic location with limited competition from other

Pacific Northwest storage facilities

• Facility fully contracted with longer-term, multi-year contracts

• Strong and stable operating results

• Interstate capacity is fully recallable by the utility in the future

GAS STORAGE OUTLOOK

Mist Interstate Storage Trends

Gill Ranch Storage Trends

21

22

FOCUS ON REGULATED GROWTH Select one picture

INVESTING IN GROWTH

($ in millions)

Projecting Investment of $850 to $950 million in Core Utility over Five Years

• Strong utility customer growth: Clark County Washington upgrades to support fast growing county

• Customer acquisition growth: Current 60% penetration level provides room for organic growth

• Key utility reliability and asset management projects: Newport and Portland LNG

• Critical regional project: North Mist gas storage expansion in Oregon to support gas-fired electric generation

(1) Additional potential investments for bonus depreciation extension not considered in forecast.

(2) Total project spend is currently estimated at $128 million.

$0

$50

$100

$150

$200

2011 2012 2013 2014 2015 2016 Fcst Avg. 5-Yr Fcst

Utility Non-Utility North Mist Project Depreciation

Projected Capital Spend

(2)

23

HIGH-GROWTH SERVICE

TERRITORY

Solid Customer Growth Rate

• NW Natural growth 1.6%(1)

Strong Residential Growth

• Over 60% of utility margin

• Growth rate of 1.7%(1)

• Since 2012, steady growth in

single-family new construction

• Strong preference by new and

future homeowners for natural

gas; local survey shows willing to

pay $50k more for a home with all

natural gas appliances

Steady Commercial Growth

• Over 25% of utility margin

• Growth rate of 1.3%(1)

• Higher margins on commercial

customers

Industrial

• Less than 10% of utility margin

• Spread across diverse

manufacturing and industrial

sectors

(1) Customer growth measured over 12-month period ended September 30, 2016

Consolidated Customer Growth

3.1%

2.4%

1.6%

0.8% 0.9%

0.8%

0.9%

1.3% 1.4% 1.4%

1.6%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

0

5,000

10,000

15,000

20,000

25,000

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

(1)

N

e

t

C

u

s

t

o

m

e

r

G

r

o

w

t

h

R

a

t

e

G

r

o

s

s

C

u

s

t

o

m

e

r

A

d

d

i

t

i

o

n

s

Conversions Construction Net Growth Rate

24

Competitive Advantage

• Preferred energy source with recent survey showing 9 out

of 10 new or future homeowners primarily in the

Portland/Vancouver area would pick a home with all natural

gas appliances versus electric

• Low-cost, reliable, clean energy choice

• Natural gas in approximately 60% of single-family homes

Customer Connections Portal

• Cutting edge web-based tool for targeted conversions,

validates customer interest

• Enhanced web services for trade allies

Leveraging the Portal

• Ability to identify potential main extensions

• Beginning to identify targets and analyze cost profiles

Gas Not Currently AvailableGas Available

Gas Likely Available

INNOVATIVE CUSTOMER

ACQUISITION

25

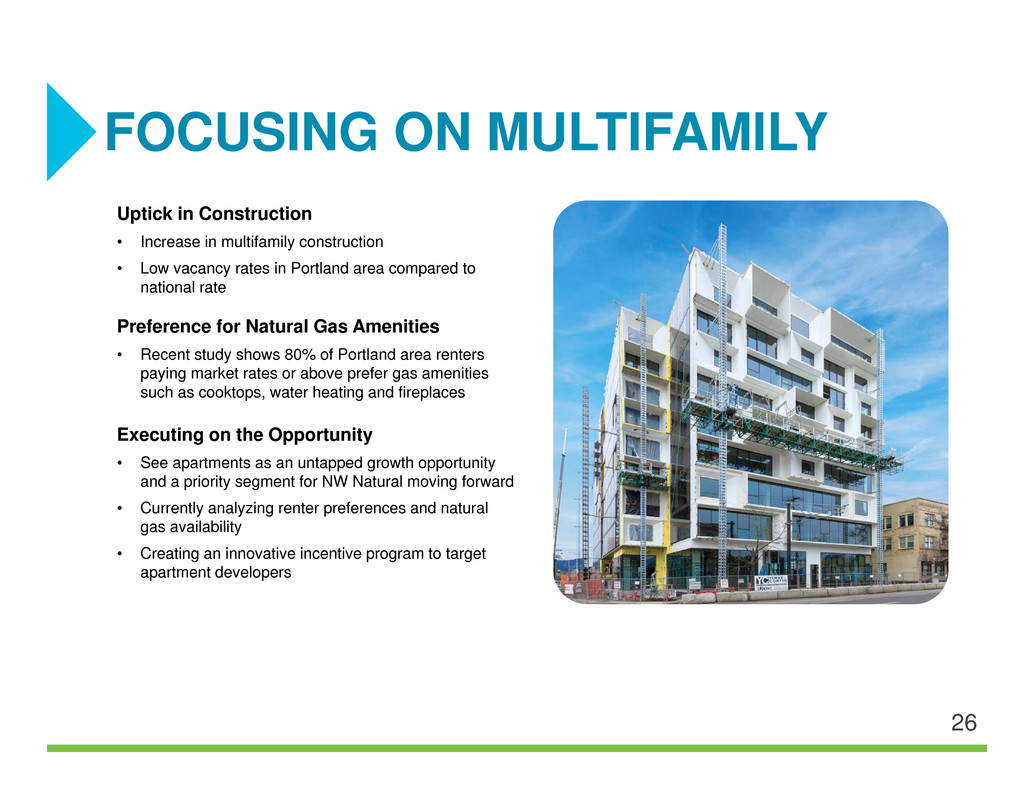

FOCUSING ON MULTIFAMILY

Uptick in Construction

• Increase in multifamily construction

• Low vacancy rates in Portland area compared to

national rate

Preference for Natural Gas Amenities

• Recent study shows 80% of Portland area renters

paying market rates or above prefer gas amenities

such as cooktops, water heating and fireplaces

Executing on the Opportunity

• See apartments as an untapped growth opportunity

and a priority segment for NW Natural moving forward

• Currently analyzing renter preferences and natural

gas availability

• Creating an innovative incentive program to target

apartment developers

26

LNG Facilities

Newport LNG

• Upgrades underway totaling approx. $25 million with construction

from 2015 – 2018

Portland LNG

• Upgrades planned over the next several years

Vancouver, Washington Infrastructure

• Fastest growing region in service territory

• Upgrades underway totaling approx. $25 million with construction

from 2015 - 2020

System Integrity, Replacement, and Betterments

• General system replacements and betterments at Mist, operating

facilities, and information technology enhancements

• Proposed PHMSA gas safety regulations in April 2016; comment

phase in 2016; expect final rules in late 2017

Integrated Resource Plan Update

• Filed IRP in August 2016; expect acknowledgement in March 2017

Gas Reserve Investments

• Future investments contingent upon additional direction from open

OPUC hedging docket, market conditions, and tax appetite

INVESTING FOR RELIABILITY &

GROWTH

27

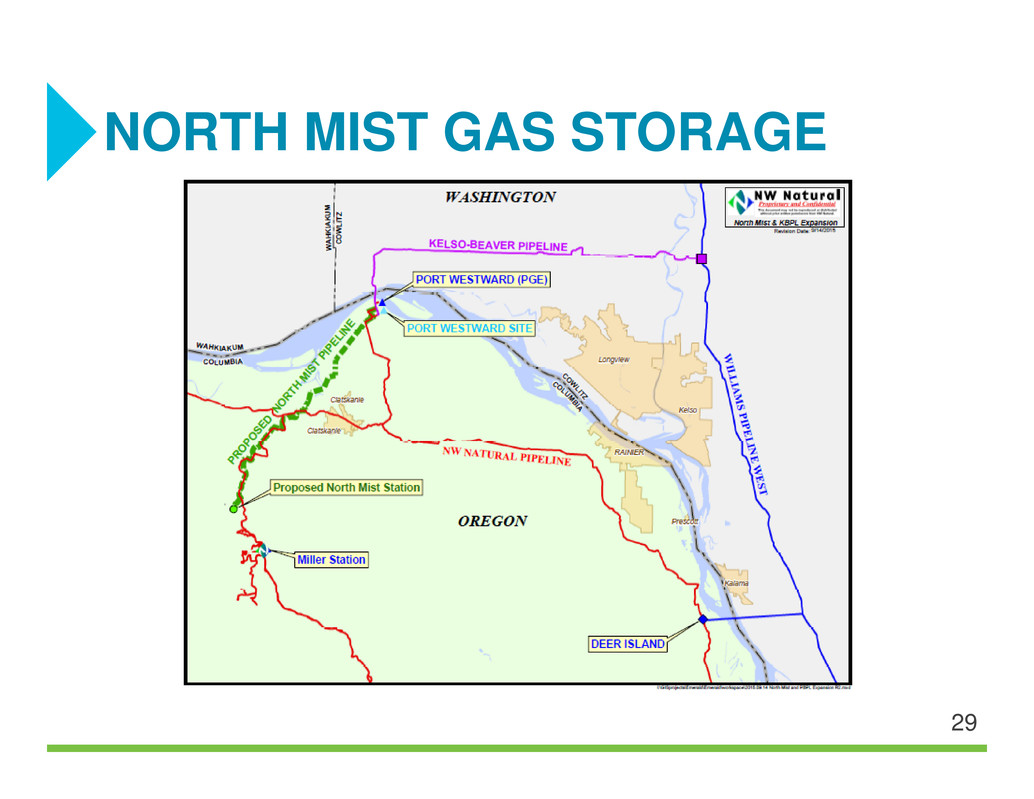

Planned Expansion Profile

Storage Capacity 2.5 Bcf

Deliverability 120,000 Dth/day

Estimated Project Spend $128 million(1)

Target In-Service Date Winter 2018/2019

Planned Expansion Project Update

• Innovative no-notice 24/7 storage service integrates

renewables into the power system for RPS

• Agreement with PGE to serve their Port Westward Plant

• Received critical permit from Oregon Energy Facilities Siting

Council in April 2016

• Received Notice to Proceed on September 30, 2016 allowing

NW Natural to move forward with construction

• Expansion for single long-term customer; no rate case

required for cost recovery; revenues earned under

established tariff schedule

(1) Total project spend based on 2016 notice to proceed estimate.

EXPANDING MIST UTILITY

STORAGE

28

NORTH MIST GAS STORAGE

29

30

(1) Stock and financial metrics are as of September 30, 2016 unless otherwise noted.

(2) Source: SNL Financial

(3) As of October 6, 2016

DELIVERING SHAREHOLDER

VALUE

• Solid balance sheet and investment grade credit ratings

• Sustainable dividend

• 61 consecutive years of increased dividends paid

Key Statistics(1)

Listed NYSE / “NWN”

52 Week Trading $45.39 to $65.60

Market Cap $1.7 Billion

Enterprise Value $2.4 Billion

Book Value Per Share $28.27

Shares Outstanding 27,558,000

Forward Dividend Yield 3.3%

2017 Indicated Dividend(3) $1.88

Returns(2)

Period Ended

September 30, 2016

Beginning

Stock Price

Total

Shareholder

Return

One year $45.84 35.8%

Five year $44.10 65.5%

Ten year $39.28 121.4%

31

SOLID EARNINGS

Delivered on 2015 Guidance

• GAAP EPS of $1.96 within 2015 guidance range of $1.77 to $1.97 per share

• Non-GAAP EPS of $2.29, which excludes environmental disallowance, and in non-GAAP guidance range of $2.10 to

$2.30 per share(1)

• Increased utility margin and steady customer growth

• Streamlined Gill Ranch expense structure

• Navigated challenges: regulatory environmental write-off and record warm winter; responded with temporary cost savings

initiatives ~$5 million savings

Steady Earnings YTD September 30, 2016 Compared to 2015

• GAAP EPS of $1.11 YTD 2016, compared to $0.88 YTD 2015

• Non-GAAP EPS of $1.18 YTD 2016, compared to $1.21 YTD 2015, excluding environmental disallowances (1)(2)

• Higher utility margin from customer growth and gains from gas cost sharing mechanism despite extremely warm year

• Higher revenues from both gas storage facilities; reaped benefits of lower Gill Ranch cost structure and redeeming long-

term note in December 2015

• Increased utility O&M as the Company resumes sustainable operating expense levels to support operations and growth

Expectations for 2016

• Full year 2016 guidance: GAAP EPS of $1.98 to $2.18 or non-GAAP guidance of $2.05 to $2.25 excluding environmental

disallowance (2)(3)

(1) 2015 non-GAAP adjusted EPS excludes the $15 million pre-tax regulatory disallowance related to the OPUC's Feb. 2015 environmental order. Amounts per share are calculated using

the combined federal and state statutory tax rate of 39.5% and divided by 27.4 million diluted shares.

(2) 2016 non-GAAP adjusted EPS excludes the $3.3 million pre-tax regulatory disallowance related to the OPUC's Jan. 2016 environmental order. Amounts per share are calculated using

the combined federal and state statutory tax rate of 39.5% and divided by 27.6 million diluted shares.

(3) The Company’s 2016 earnings guidance assumes customer growth from the utility segment, average weather conditions, sustainable operations and maintenance expense levels and

normal inflationary increases, slow recovery of the gas storage market, the impact of the five-year extension of bonus depreciation resulting from the enactment of the Federal PATH

Act of 2015, and no significant changes in prevailing legislative and regulatory policies, mechanisms, or outcomes.

32

Cash Flows

• Operating cash flows support capital needs

• Higher CFFO from environmental insurance recoveries in 2011

and 2014

• Ongoing cash flow strengthening through new environmental

mechanism

• Expect cash tax savings from bonus depreciation

Equity and Debt Offerings in November 2016

• Successful equity offering generated net proceeds of over $50

million

• Strong $150 million medium-term note issuance under shelf:

• $40 million 30-year debt at 4.136% (115 bps over treasury);

• $35 million 10-year debt at 3.211% (90 bps over treasury);

and

• $75 million 2-year debt at 1.545% (45 bps over treasury)

• Proceeds will be used for general corporate purposes, to fund

utility capital expenditures, including the North Mist gas storage

expansion, and to reduce short-term debt balances

Liquidity

• $300 million credit facility through 2019

• Access to capital markets

• Solid credit ratings(1)

STRONG CASH FLOWS AND

LIQUIDITY

Credit Ratings(1)

Dividend

$50 M

CFFO

S&P Moody’s

Secured Debt AA- A1

Commercial Paper A-1 P-2

Outlook Stable Stable

(1) The above credit ratings are dependent upon a number of factors,

both qualitative and quantitative, and are subject to change at any

time. The disclosure of these credit ratings is not a recommendation to

buy, sell or hold NW Natural securities.

($ in millions)

Cash Flow from Operations

$0

$50

$100

$150

$200

$250

2011 2012 2013 2014 2015

$216

$185

$176$169

$233

33

$1.00

$1.10

$1.20

$1.30

$1.40

$1.50

$1.60

$1.70

$1.80

$1.90

$2.00

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Indicated

• 2016 marked the 61th consecutive year of increased dividends paid to shareholders

• Supported by strong and stable cash flows

LEGACY OF INCREASING

DIVIDENDS

34

Stable utility margins

• Company results continue to show steady growth from utility

• Utility-focused business with stable core customer revenues

• Organic growth potential with strong economics driving single and

multifamily construction

Excellent operations and efficient cost structure

• Consistently high customer satisfaction ratings and system reliability

• Strong balance sheet and cash flows

• 61-year history of increasing dividends paid to shareholders

Long-term growth opportunities

• Innovative ideas and new programs

• Storage development opportunities to support flexible energy resource

needs

• Regional pipeline expansion opportunity

CONSISTENT CORPORATE

STRATEGY

36

INVESTMENT HIGHLIGHTS

• Low-risk business profile with 90%+ of revenues from pure-play LDC

• Over 718,000 utility customers with nearly 14,000 miles of distribution and

transmission mains

• Supportive regulatory environments in Oregon and Washington with progressive

recovery mechanisms

• Modern distribution system – no identified cast iron or bare steel

Stable, Regulated

Earnings Profile

Proven Financial

Performance

Tangible Growth

Opportunities

• Stable dividends with 61-year record of increasing dividends paid annually

• Investment grade credit ratings of AA- and A1 at S&P and Moody’s, respectively (1)

• Experienced management team with broad energy knowledge

• Projected five-year capital expenditures plan of $850-950 million

• Service territory experiencing above average customer growth (1.6% for the year

ending September 30, 2016)

• Continuous replacement of existing infrastructure to ensure reliability and safety

• $128 million regulated expansion of Mist facility to support renewables in the region

(1) The above credit ratings are dependent upon a number of factors, both qualitative and quantitative, and are subject to change at

any time. The disclosure of these credit ratings is not a recommendation to buy, sell or hold NW Natural securities. 37

38

STATE EMISSIONS BY SECTOR

39

*** Washington is currently under development.

GOAL: 30% SAVINGS BY 2035

40

Based on carbon emissions savings associated with current and new

customers by 2035, from a 2015 baseline.

Oregon Commission (OPUC)

Lisa Hardie, Chair

• Appointed May 2016

• Term began June 1, 2016

• Current term ends May 2020

Stephen Bloom, Commissioner

• Originally appointed December 2011

• Reappointed May 2016

• Current term ends November 2019

John Savage, Commissioner

• Originally appointed September 2003

• Reappointed three consecutive times

• Current term ends March 2017

Washington Commission (WUTC)

David Danner, Chair

• Appointed chair February 2013

• Current term ends January 2019

Ann Rendahl, Commissioner

• Appointed December 2014

• Current term ends November

2020

Philip Jones, Commissioner

• Originally appointed March 2005

• Reappointed March 2011

• Current term ends February

2017

CURRENT COMMISSIONERS

41

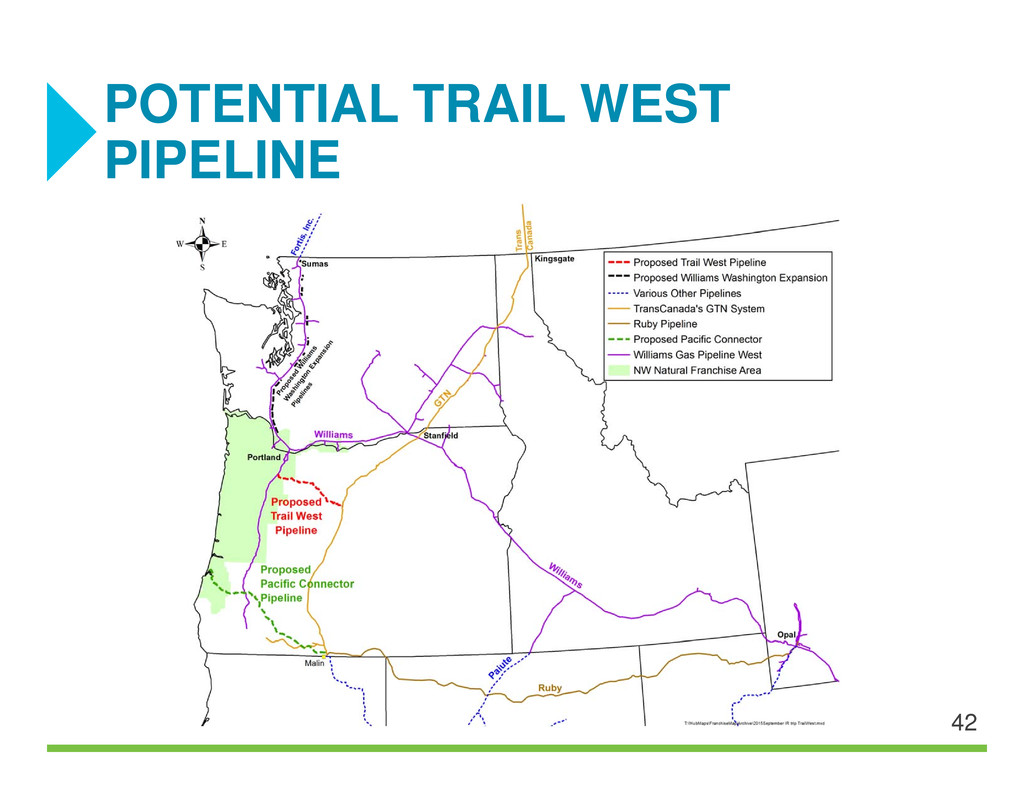

POTENTIAL TRAIL WEST

PIPELINE

42

LEAD. INNOVATE. GROW.