Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE - ALASKA AIR GROUP, INC. | asrepondstodojcompletedrev.htm |

| 8-K - ALASKA AIR GROUP FORM 8-K - ALASKA AIR GROUP, INC. | form8-kdojapprovalannounce.htm |

Investor Update: DOJ Clearance

2

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about Alaska Airlines and

the proposed transaction with Virgin America. Forward-looking statements are statements that are not historical facts.

These statements can be identified by the use of forward-looking terminology such as "believe," "expect," "may,"

"likely," "should," "project," "could," "plan," "goal," "potential," "pro forma," "seek," "estimate," "intend" or "anticipate" or

the negative thereof, and may include discussions of strategy, financial projections, guidance and estimates (including

their underlying assumptions), statements regarding plans, objectives, expectations or consequences of announced

transactions and statements about the future performance, operations, products and services of Alaska Airlines and/or

Virgin America. Alaska Airlines cautions readers not to place undue reliance on these statements. These forward-

looking statements are subject to a variety of risks and uncertainties. Consequently, actual results and experience

may differ materially from those contained in any forward-looking statements.

3

Cautionary Statement Regarding Forward-Looking Statements

Such risks and uncertainties include: the possibility that the closing conditions to the proposed transaction may not be

satisfied or waived; delay in closing the transaction or the possibility of non-consummation of the transaction; the

occurrence of any event that could give rise to termination of the merger agreement; the risk that stockholder litigation

in connection with the contemplated transaction may affect the timing or occurrence of the contemplated transaction or

result in significant costs of defense, indemnification and liability; risks inherent in the achievement of anticipated

synergies and the timing thereof; risks related to the disruption of the transaction to Virgin America and its

management; the effect of announcement of the transaction on Virgin America's ability to retain and hire key

personnel and maintain relationships with suppliers and other third parties; labor costs and relations, general

economic conditions, increases in operating costs including fuel, inability to meet cost reduction goals, an aircraft

accident, and changes in laws and regulations. These risks and others are described in greater detail in Alaska Air

Group’s SEC filings, including its Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2015, as well as in

other documents filed by Alaska Air Group with the SEC after the date thereof. Alaska Air Group makes no

commitment to revise or update any forward-looking statements in order to reflect events or circumstances occurring

or existing after the date any forward-looking statement is made.

Highlights

4

Department of Justice clears Alaska Air Group to acquire Virgin America

There are 45 markets where Alaska loses existing codeshare revenue, and the net

financial impact is between $15-$20 million.

No impact on interline.

No asset divestitures required

DOJ clearance includes limited reduction of codeshare with American Airlines

We have agreed to seek DOJ approval before selling, leasing, or trading the slots and

gates at Dallas Love Field, New York LaGuardia or Washington Reagan that Virgin

American obtained from the American Airlines-US Airways settlement.

5

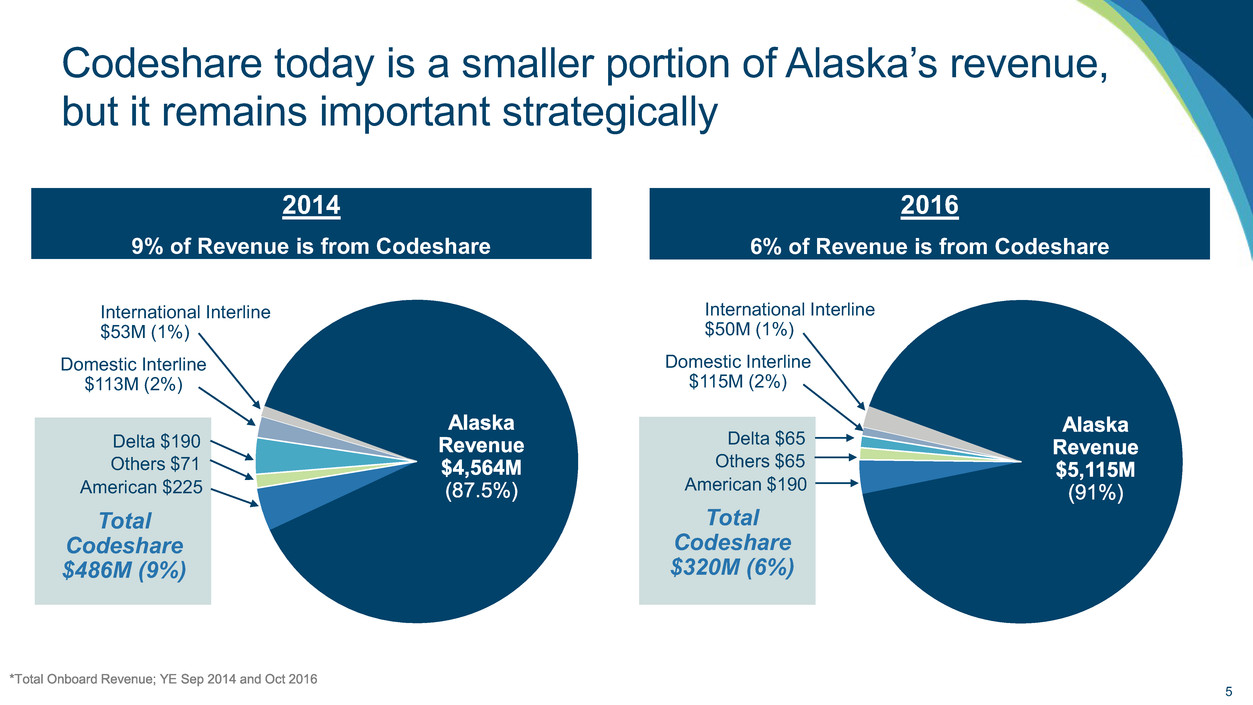

Total

Codeshare

$320M (6%)

International Interline

$50M (1%)

Domestic Interline

$115M (2%)

American $190

Delta $65

Others $65

Total

Codeshare

$486M (9%)

International Interline

$53M (1%)

Domestic Interline

$113M (2%)

American $225

Delta $190

Others $71

2014

9% of Revenue is from Codeshare

2016

6% of Revenue is from Codeshare

Codeshare today is a smaller portion of Alaska’s revenue,

but it remains important strategically

6

33 markets

Non-stop overlap routes flown by

both AA and AS/VX

AS and AA are not allowed to

market each other’s flights on

non-stop overlap markets

9 markets

Flights operated by AS/VX from

AA’s hubs, and vice versa

(non-overlap)

AA can’t sell AS flights from

AA hubs and vice versa

3 markets

Flights operated by AA between LAX

& AA’s other hubs (non-overlap)

AS can’t sell AA flights from LAX

to AA’s other hubs

Notwithstanding the above concessions, both carriers can

continue to sell itineraries “beyond” each others’ hubs

Only 45 markets under the American agreement

(representing ~$60M revenue) are financially impacted by

concessions

Examples of where codesharing is no longer permitted:

Example: An AA customer wants to

fly from Seattle to Los Angeles.

Before: The AA customer could book

an AA flight or an AS flight through

AA’s website, depending on their

preferred flight times. AS earned

codeshare revenue if the AA customer

booked the AS flight.

After: Since AS and AA both fly this

route, AS & AA can no longer market

each others’ flights. Only the AA flight

will appear to AA’s customers so AS

will not earn codeshare revenue, and

vice versa.

33 Markets

Non-stop overlap routes flown by

both AA and AS/VX

Example: An AA customer wants to

fly from Norfolk, VA to Seattle.

Before: An AA customer could fly AA

from ORF to DCA, and then connect

onto an AS flight from DCA-SEA. AS

earned codeshare revenue on the

DCA-SEA flight.

After: The customer will not be able

to buy this itinerary from AA, so AS

would potentially lose this codeshare

revenue.

However, the customer can still book

the same itinerary through AS, in

which case AS could still earn

passenger revenue on DCA-SEA

portion.

Example: An AS customer wants to

fly from Santa Rosa to Charlotte.

Before: The AS customer could fly an

AS flight from STS-LAX, and then

connect onto an AA flight from LAX-

CLT. AS earned passenger revenue

on the STS-LAX segment.

After: The customer will not be able

to buy this itinerary from AS, so AS

would potentially lose this revenue.

However, the customer can still book

the same itinerary through AA, in

which case AS could still earn

codeshare revenue on STS-LAX.

9 Markets

Flights operated by AS/VX from

AA’s hubs, and vice versa

(non-overlap )

3 Markets

Flights operated by AA between

LAX and AA’s other hubs

(non-overlap)

7

8

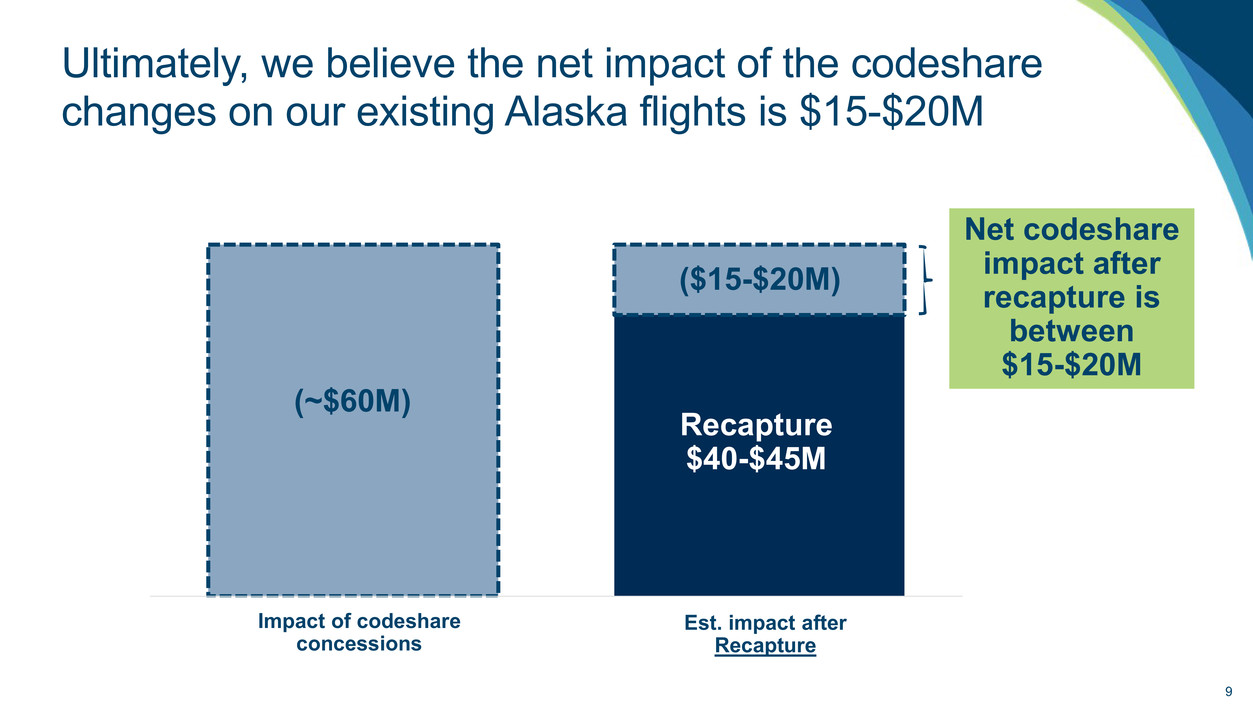

Customer demand in a market does not

disappear when codeshare ends

The amount of total customer demand (and

revenue) that we can recapture depends

on:

1. Whether we already serve the market

2. Current AS load factors

3. Current volume of customers on AS flights

provided by AA codeshare

4. Alternative connections or additional local traffic

within the existing Alaska network

5. Other feed from international partners

We believe we can recapture ~70% ($40-$45M) of lost

codeshare revenue by replacing it with our own passengers

C

ur

re

nt

A

S

Lo

ad

F

ac

to

r

Lo

w

H

ig

h

Current AA Contribution to

AS Load Factor

Low High

High recapture

Moderate recapture

5

Markets

1

Markets

Sample Recapture Analysis for Top 8

Markets (half of impacted revenue)

Limited recapture

Moderate recapture

2

Markets

0

Markets

Ultimately, we believe the net impact of the codeshare

changes on our existing Alaska flights is $15-$20M

9

Impact of codeshare

concessions

Est. impact after

Recapture

Net codeshare

impact after

recapture is

between

$15-$20M

(~$60M)

Recapture

$40-$45M

($15-$20M)

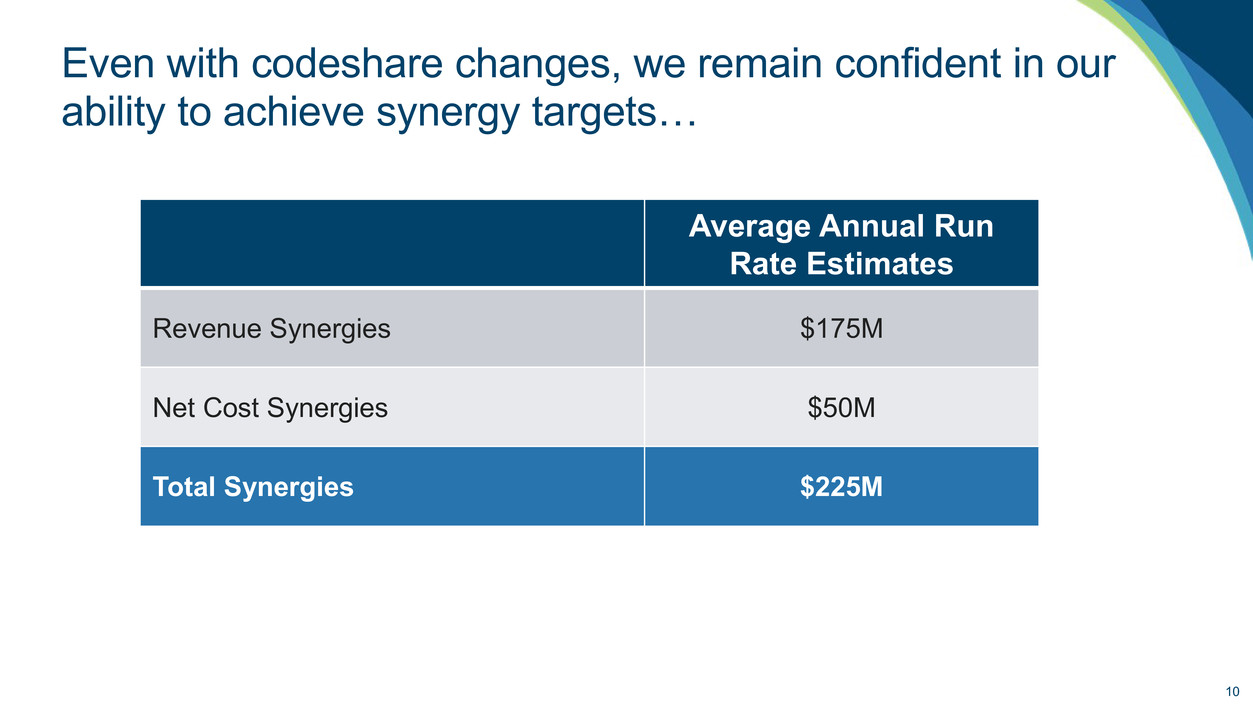

Even with codeshare changes, we remain confident in our

ability to achieve synergy targets…

10

Average Annual Run

Rate Estimates

Revenue Synergies $175M

Net Cost Synergies $50M

Total Synergies $225M

…and are focused on realizing deal benefits for investors,

employees, and consumers

11

Powerful West Coast Network

Access to Constrained Airports Opportunity to Grow & Improve Loyalty

Enhanced International Partnerships

California Customer Base

3x

PacNW

Population