Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FAIRPOINT COMMUNICATIONS INC | frp-8kannouncementx12516.htm |

| EX-99.1 - EXHIBIT 99.1 - FAIRPOINT COMMUNICATIONS INC | prex991.htm |

NOVEMBER 2016

Acquisition of FairPoint

Communications

December 5, 2016

NASDAQ: CNSL

• Click to edit Master title style

Click to edit Master title style Call Participants

4

Bob Udell

President and CEO, Consolidated Communications

Steve Childers

Chief Financial Officer, Consolidated Communications

Paul Sunu

Chief Executive Officer, FairPoint

• Click to edit Master title style

Click to edit Master title style

Sustain and

Grow

Cash Flow

–

Increase

Shareholder Value

5

Diversify and Improve

Revenue Trends

Maintain Effective

Capital Deployment

Improve Operating

Efficiency

Pursue Selective

Acquisitions

Acquisition Consistent with Our Strategy

• Click to edit Master title style

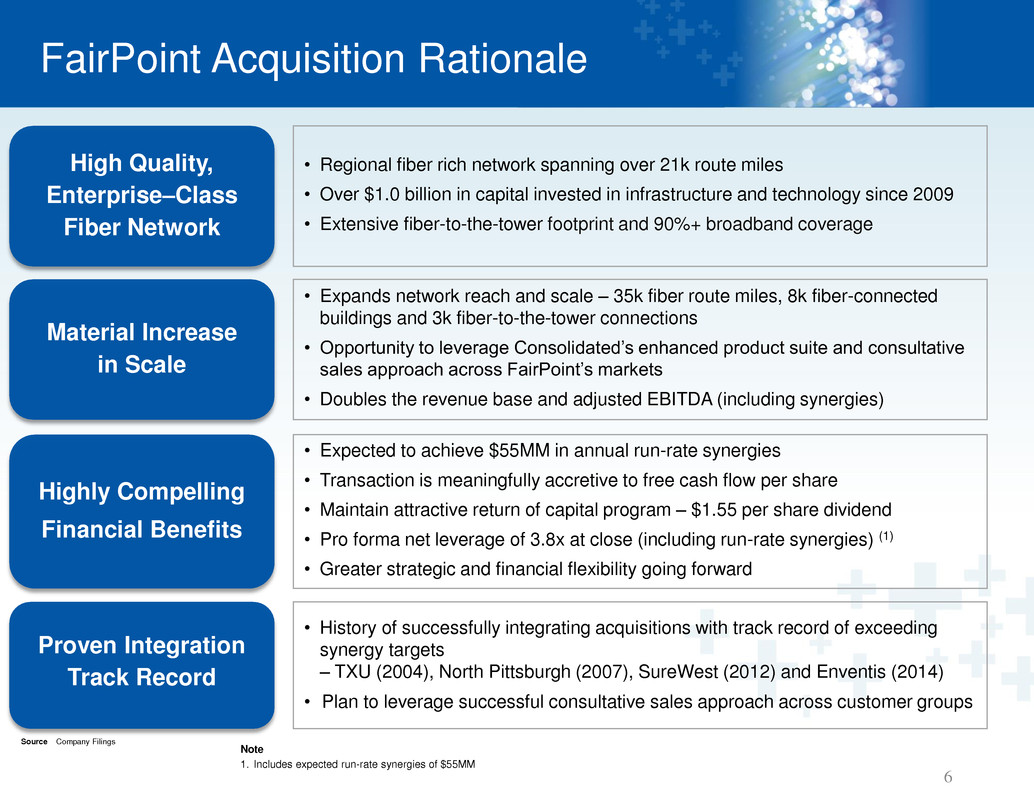

Click to edit Master title style FairPoint Acquisition Rationale

6

• Regional fiber rich network spanning over 21k route miles

• Over $1.0 billion in capital invested in infrastructure and technology since 2009

• Extensive fiber-to-the-tower footprint and 90%+ broadband coverage

High Quality,

Enterprise–Class

Fiber Network

• Expands network reach and scale – 35k fiber route miles, 8k fiber-connected

buildings and 3k fiber-to-the-tower connections

• Opportunity to leverage Consolidated’s enhanced product suite and consultative

sales approach across FairPoint’s markets

• Doubles the revenue base and adjusted EBITDA (including synergies)

Material Increase

in Scale

• History of successfully integrating acquisitions with track record of exceeding

synergy targets

– TXU (2004), North Pittsburgh (2007), SureWest (2012) and Enventis (2014)

• Plan to leverage successful consultative sales approach across customer groups

Proven Integration

Track Record

• Expected to achieve $55MM in annual run-rate synergies

• Transaction is meaningfully accretive to free cash flow per share

• Maintain attractive return of capital program – $1.55 per share dividend

• Pro forma net leverage of 3.8x at close (including run-rate synergies) (1)

• Greater strategic and financial flexibility going forward

Highly Compelling

Financial Benefits

Note

1. Includes expected run-rate synergies of $55MM

Source Company Filings

• Click to edit Master title style

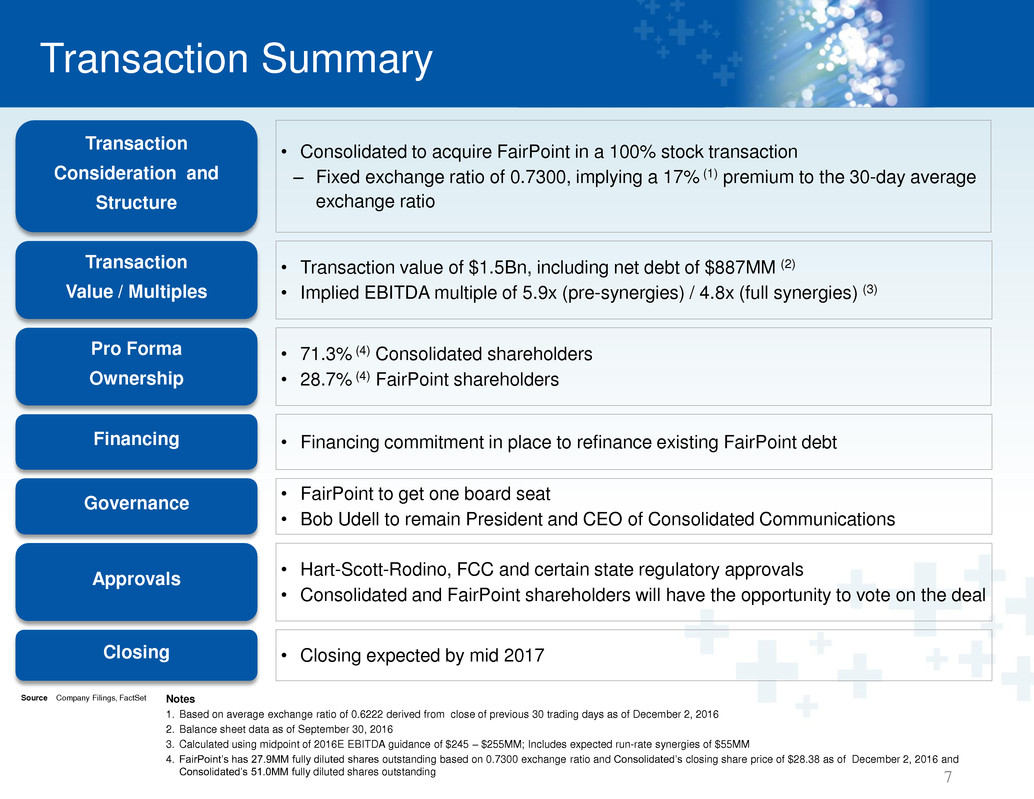

Click to edit Master title style Transaction Summary

7

Notes

1. Based on average exchange ratio of 0.6222 derived from close of previous 30 trading days as of December 2, 2016

2. Balance sheet data as of September 30, 2016

3. Calculated using midpoint of 2016E EBITDA guidance of $245 – $255MM; Includes expected run-rate synergies of $55MM

4. FairPoint’s has 27.9MM fully diluted shares outstanding based on 0.7300 exchange ratio and Consolidated’s closing share price of $28.38 as of December 2, 2016 and

Consolidated’s 51.0MM fully diluted shares outstanding

• Consolidated to acquire FairPoint in a 100% stock transaction

– Fixed exchange ratio of 0.7300, implying a 17% (1) premium to the 30-day average

exchange ratio

Transaction

Consideration and

Structure

• 71.3% (4) Consolidated shareholders

• 28.7% (4) FairPoint shareholders

Pro Forma

Ownership

• Financing commitment in place to refinance existing FairPoint debt Financing

• FairPoint to get one board seat

• Bob Udell to remain President and CEO of Consolidated Communications

Governance

• Closing expected by mid 2017 Closing

• Hart-Scott-Rodino, FCC and certain state regulatory approvals

• Consolidated and FairPoint shareholders will have the opportunity to vote on the deal

Approvals

• Transaction value of $1.5Bn, including net debt of $887MM (2)

• Implied EBITDA multiple of 5.9x (pre-synergies) / 4.8x (full synergies) (3)

Transaction

Value / Multiples

Source Company Filings, FactSet

• Click to edit Master title style

Click to edit Master title style

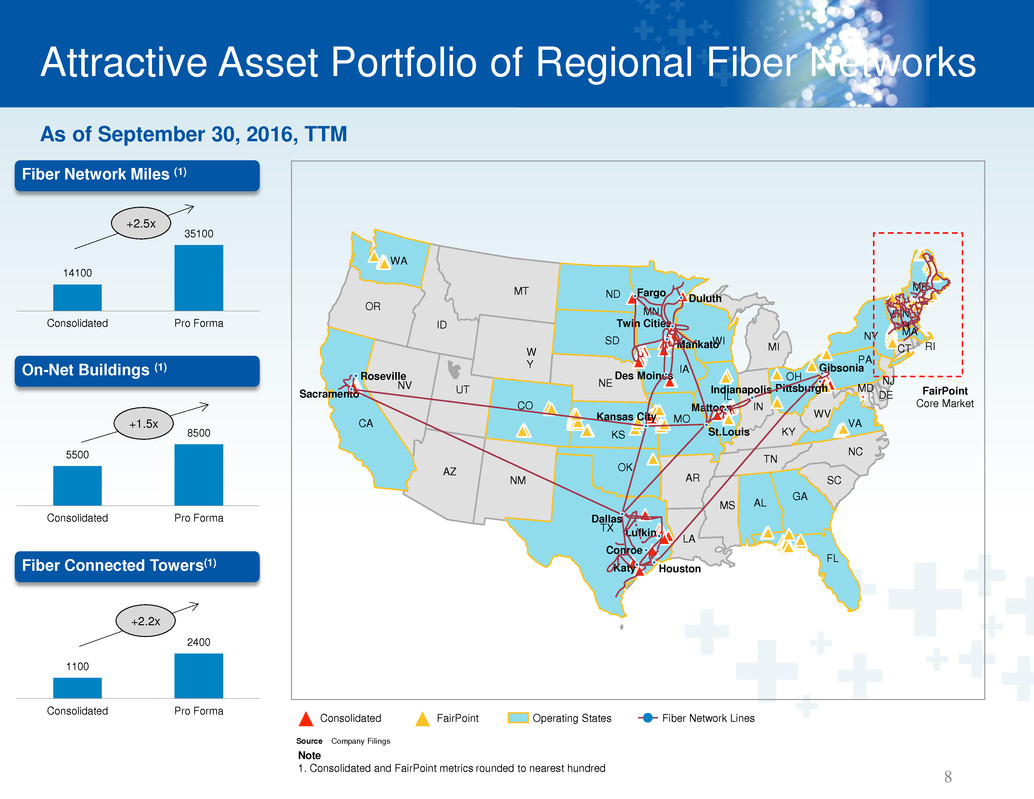

1100

2400

Consolidated Pro Forma

Attractive Asset Portfolio of Regional Fiber Networks

8

Source Company Filings

Consolidated FairPoint Operating States Fiber Network Lines

FL

NM

MD

TX

OK

KS

NE

SD

ND MT

W

Y

CO

UT

ID

AZ

NV

WA

CA

OR

KY

NY

PA

MI

N

H

MA

CT

VA

WV

OH

IN

IL

NC

TN

SC

AL

AR

LA

MO

IA

MN

WI

GA

MS

VT

NJ

DE

ME

RI

FairPoint

Core Market

Roseville

Sacramento

Fargo

Twin Cities

Duluth

Mankato

Des Moines

Kansas City

Dallas

Lufkin

Conroe

Katy Houston

St.Louis

Mattoon

Indianapolis Pittsburgh

Gibsonia

Note

1. Consolidated and FairPoint metrics rounded to nearest hundred

14100

35100

Consolidated Pro Forma

Fiber Network Miles (1)

+2.5x

5500

8500

Consolidated Pro Forma

On-Net Buildings (1)

+1.5x

Fiber Wireless Tower Sites (1)

+2.2x

As of September 30, 2016, TTM

-Net Buildings (1)

Fiber Network Miles (1)

Fiber Connected Tower (1)

• Click to edit Master title style

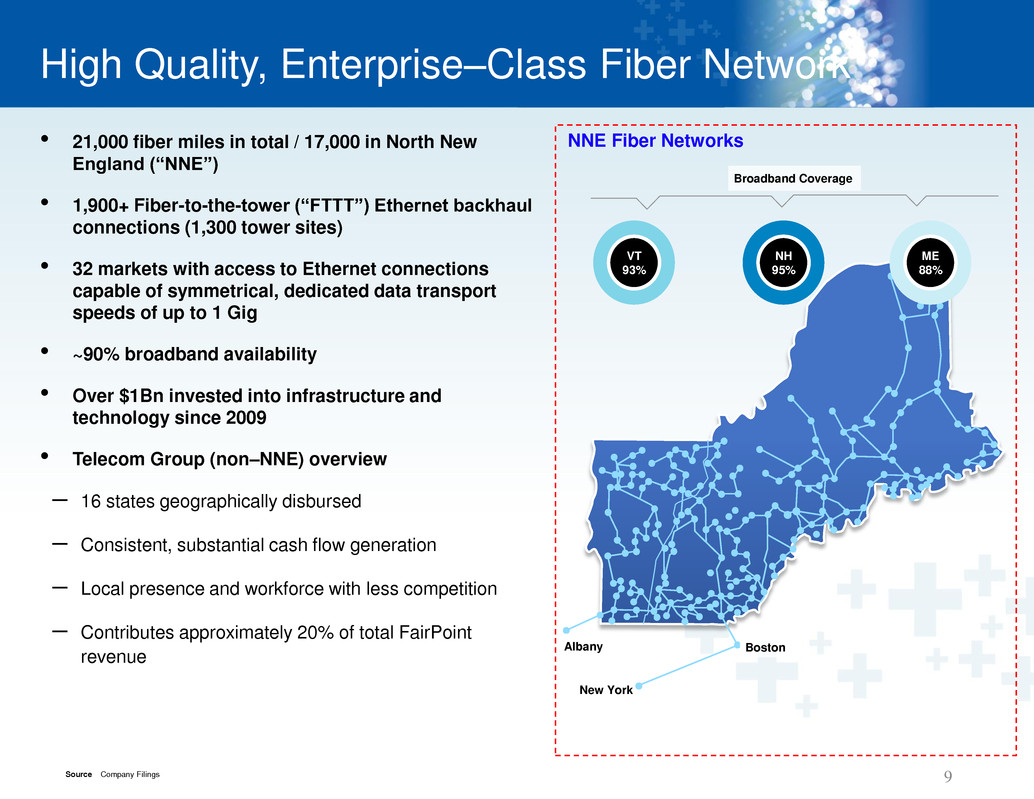

Click to edit Master title style High Quality, Enterprise–Class Fiber Network

9

• 21,000 fiber miles in total / 17,000 in North New

England (“NNE”)

• 1,900+ Fiber-to-the-tower (“FTTT”) Ethernet backhaul

connections (1,300 tower sites)

• 32 markets with access to Ethernet connections

capable of symmetrical, dedicated data transport

speeds of up to 1 Gig

• ~90% broadband availability

• Over $1Bn invested into infrastructure and

technology since 2009

• Telecom Group (non–NNE) overview

– 16 states geographically disbursed

– Consistent, substantial cash flow generation

– Local presence and workforce with less competition

– Contributes approximately 20% of total FairPoint

revenue

Source Company Filings

Broadband Coverage

NNE Fiber Networks

Bangor

Laconia

VT

93%

NH

95%

ME

88%

Boston

New York

Albany

• Click to edit Master title style

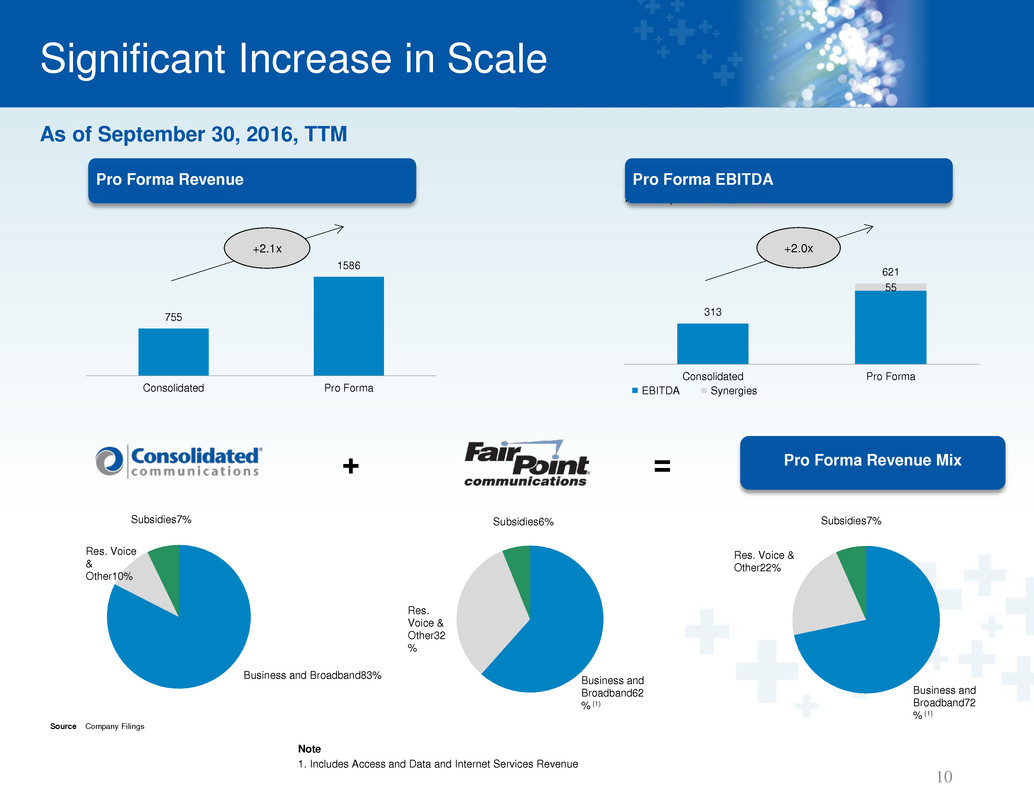

Click to edit Master title style Significant Increase in Scale

10

Note

1. Includes Access and Data and Internet Services Revenue

755

1586

Consolidated Pro Forma

Pro Forma Revenue

+2.1x

Source Company Filings

Pro Forma Revenue

As of September 30, 2016, TTM

Business and Broadband83%

Res. Voice

&

Other10%

Subsidies7%

Pro Forma Revenue Mix

55

313

621

Consolidated Pro Forma

EBITDA Synergies

+2.0x

Pro Forma EBITDA (2)

As of September 30, 2016

Pro Forma EBITDA

+ =

Business and

Broadband62

% (1)

Res.

Voice &

Other32

%

Subsidies6%

Business and

Broadband72

% (1)

Res. Voice &

Other22%

Subsidies7%

• Click to edit Master title style

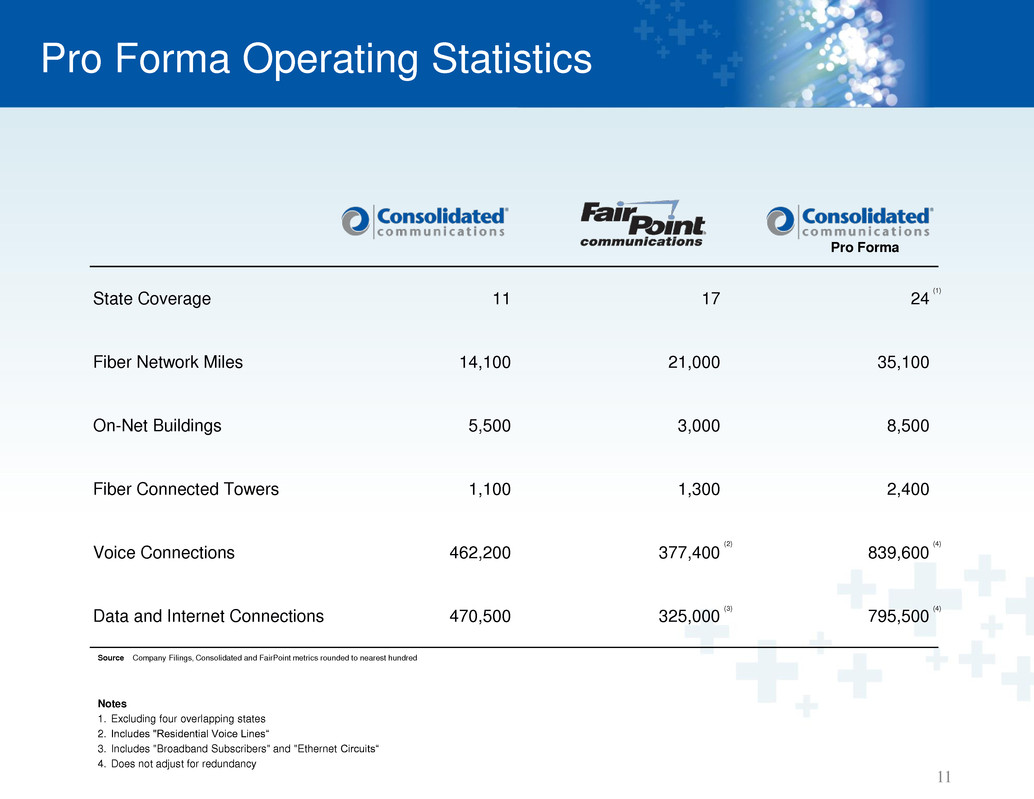

Click to edit Master title style

State Coverage 11 17 24

Fiber Network Miles 14,100 21,000 35,100

On-Net Buildings 5,500 3,000 8,500

Fiber Connected Towers 1,100 1,300 2,400

Voice Connections 462,200 377,400 839,600

Data and Internet Connections 470,500 325,000 795,500

Pro Forma Operating Statistics

11

Notes

1. Excluding four overlapping states

2. Includes "Residential Voice Lines“

3. Includes "Broadband Subscribers" and "Ethernet Circuits“

4. Does not adjust for redundancy

Source Company Filings, Consolidated and FairPoint metrics rounded to nearest hundred

(2)

(3)

(4)

(4)

(1)

Pro Forma

• Click to edit Master title style

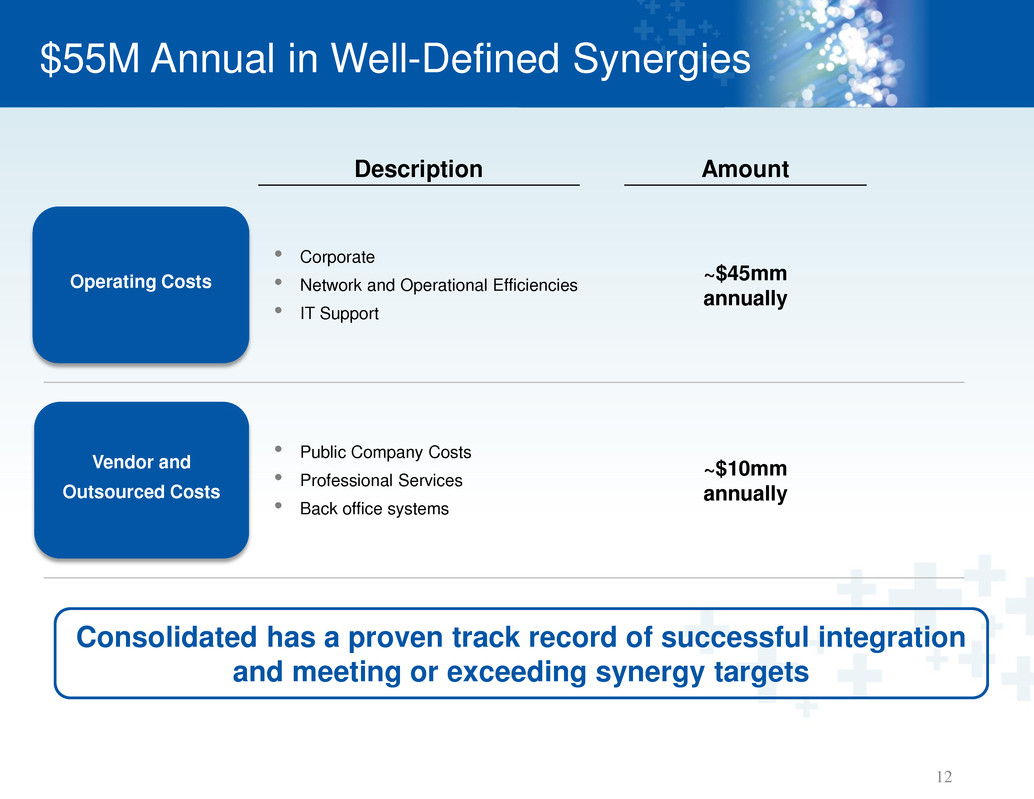

Click to edit Master title style $55M Annual in Well-Defined Synergies

12

Operating Costs

• Corporate

• Network and Operational Efficiencies

• IT Support

• Public Company Costs

• Professional Services

• Back office systems

~$45mm

annually

~$10mm

annually

Description Amount

Consolidated has a proven track record of successful integration

and meeting or exceeding synergy targets

Vendor and

Outsourced Costs

• Click to edit Master title style

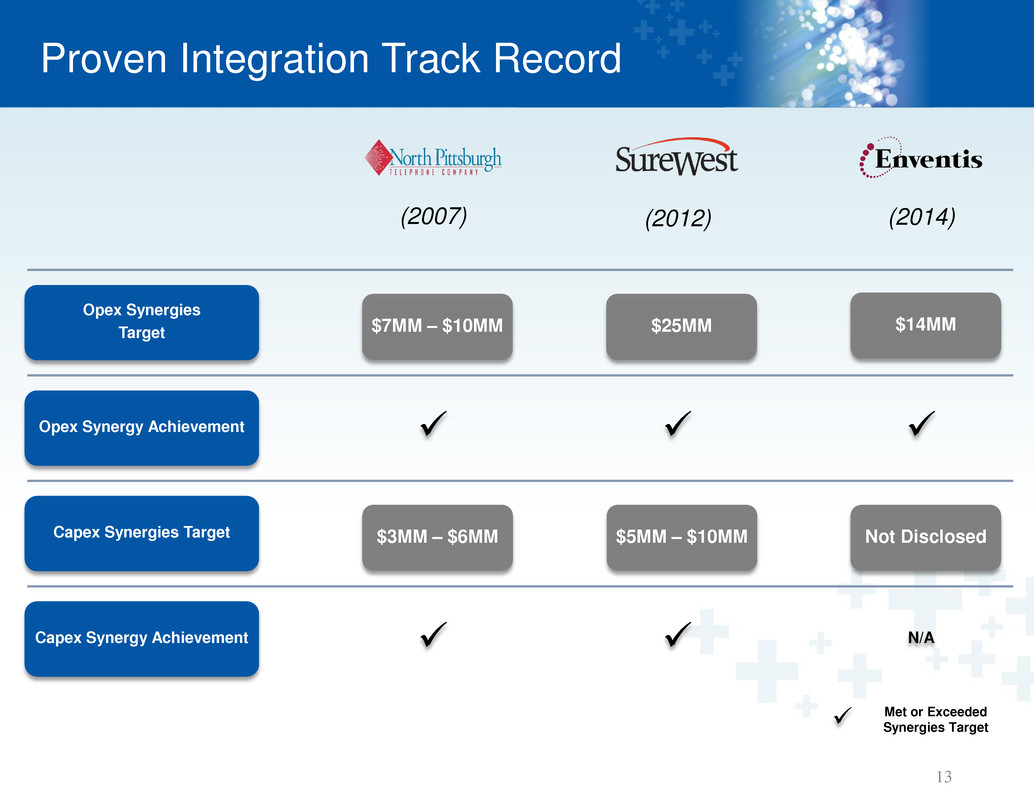

Click to edit Master title style

(2007) (2014)

13

(2012)

Proven Integration Track Record

Opex Synergies

Target $14MM $25MM $7MM – $10MM

Met or Exceeded Synergies Target

Opex Synergy Achievement

Capex Synergies Target

Capex Synergy Achievement

Not Disclosed $5MM – $10MM $3MM – $6MM

N/A

• Click to edit Master title style

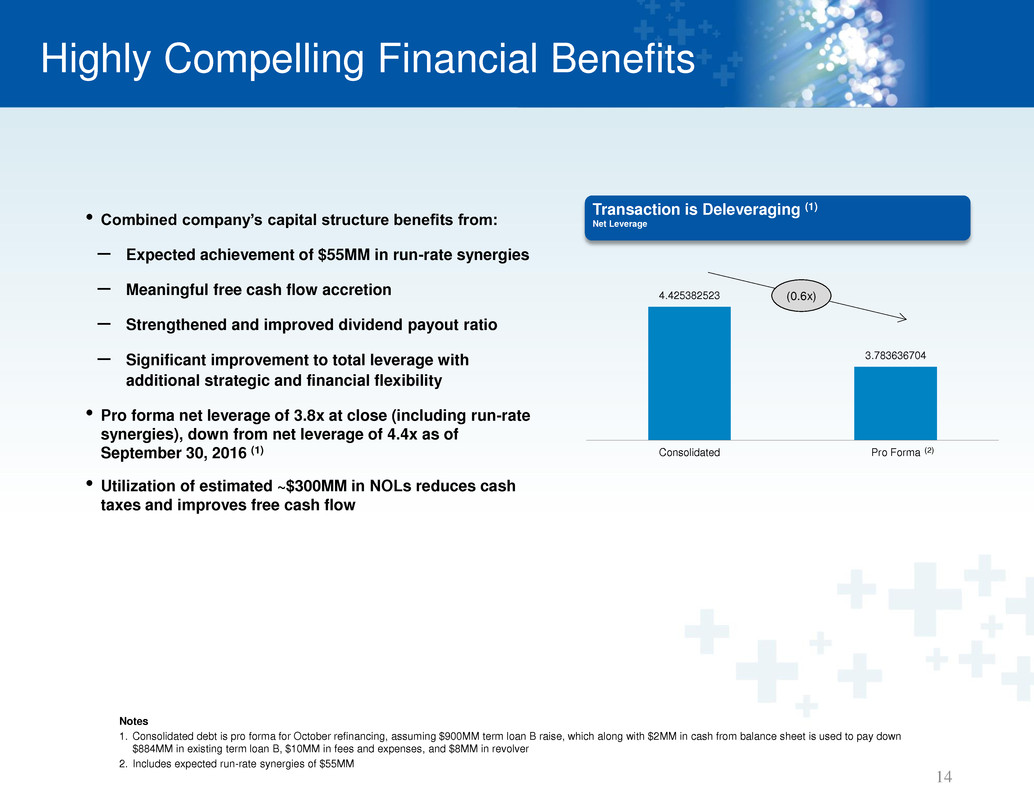

Click to edit Master title style Highly Compelling Financial Benefits

14

Notes

1. Consolidated debt is pro forma for October refinancing, assuming $900MM term loan B raise, which along with $2MM in cash from balance sheet is used to pay down

$884MM in existing term loan B, $10MM in fees and expenses, and $8MM in revolver

2. Includes expected run-rate synergies of $55MM

4.425382523

3.783636704

Consolidated Pro Forma

Pro Forma Deleveraging (2)

LTM

(0.6x)

(2)

• Combined company’s capital structure benefits from:

– Expected achievement of $55MM in run-rate synergies

– Meaningful free cash flow accretion

– Strengthened and improved dividend payout ratio

– Significant improvement to total leverage with

additional strategic and financial flexibility

• Pro forma net leverage of 3.8x at close (including run-rate

synergies), down from net leverage of 4.4x as of

September 30, 2016 (1)

• Utilization of estimated ~$300MM in NOLs reduces cash

taxes and improves free cash flow

Transaction is Deleveraging (1)

Net Leverage

• Click to edit Master title style

Click to edit Master title style

Q&A

15

• Click to edit Master title style

Click to edit Master title style Use of Non-GAAP Measures

This presentation includes disclosures regarding “EBITDA”, “adjusted EBITDA”, “cash available to pay dividends” and the related “dividend

payout ratio”, “total net debt to last twelve month adjusted EBITDA coverage ratio”, “adjusted diluted net income per share” and “adjusted net

income attributable to common stockholders”, all of which are non-GAAP financial measures and described in this section as not being in

compliance with Regulation S-X. Accordingly, they should not be construed as alternatives to net cash from operating or investing activities,

cash and cash equivalents, cash flows from operations, net income or net income per share as defined by GAAP and are not, on their own,

necessarily indicative of cash available to fund cash needs as determined in accordance with GAAP. In addition, not all companies use identical

calculations, and the non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. A

reconciliation of the differences between these non-GAAP financial measures and the most directly comparable financial measures presented in

accordance with GAAP is included in the tables that follow. Adjusted EBITDA is comprised of EBITDA, adjusted for certain items as permitted

or required by the lenders under our credit agreement in place at the end of each quarter in the periods presented. The tables that follow

include an explanation of how adjusted EBITDA is calculated for each of the periods presented with the reconciliation to net income. EBITDA is

defined as net earnings before interest expense, income taxes, depreciation and amortization on a historical basis. Cash available to pay

dividends represents adjusted EBITDA plus cash interest income less (1) cash interest expense, (2) capital expenditures and (3) cash income

taxes; this calculation differs in certain respects from the similar calculation used in our credit agreement. We present adjusted EBITDA, cash

available to pay dividends and the related dividend payout ratio for several reasons. Management believes adjusted EBITDA, cash available to

pay dividends and the dividend payout ratio are useful as a means to evaluate our ability to fund our estimated uses of cash (including interest

on our debt) and pay dividends. In addition, we have presented adjusted EBITDA, cash available to pay dividends and the dividend payout ratio

to investors in the past because they are frequently used by investors, securities analysts and other interested parties in the evaluation of

companies in our industry, and management believes presenting them here provides a measure of consistency in our financial reporting.

Adjusted EBITDA and cash available to pay dividends, referred to as Available Cash in our credit agreement, are also componen ts of the

restrictive covenants and financial ratios contained in our credit agreement that requires us to maintain compliance with these covenants and

limit certain activities, such as our ability to incur debt and to pay dividends. The definitions in these covenants and ratios are based on adjusted

EBITDA and cash available to pay dividends after giving effect to specified charges. In addition, adjusted EBITDA, cash available to pay

dividends and the dividend payout ratio provide our board of directors with meaningful information to determine, with other data, assumptions

and considerations, our dividend policy and our ability to pay dividends under the restrictive covenants in our credit agreement and to measure

our ability to service and repay debt. We present the related “total net debt to last twelve month adjusted EBITDA coverage ratio” principally to

put other non-GAAP measures in context and facilitate comparisons by investors, security analysts and others; this ratio differs in certain

respects from the similar ratio used in our credit agreement. These measures differ in certain respects from the ratios used in our senior notes

indenture. These non-GAAP financial measures have certain shortcomings. In particular, adjusted EBITDA does not represent the residual

cash flows available for discretionary expenditures, since items such as debt repayment and interest payments are not deducted from such

measure. Similarly, while we may generate cash available to pay dividends, we are not required to use any such cash to pay dividends, and the

payment of any dividends is subject to declaration by our board of directors, compliance with applicable law and the terms of our credit

agreement. Because adjusted EBITDA is a component of the dividend payout ratio and the ratio of total net debt to last twelve month adjusted

EBITDA, these measures are also subject to the material limitations discussed above. In addition, the ratio of total net deb t to last twelve month

adjusted EBITDA is subject to the risk that we may not be able to use the cash on the balance sheet to reduce our debt on a dollar-for-dollar

basis. Management believes these ratios are useful as a means to evaluate our ability to incur additional indebtedness in the future. We present

the non-GAAP measures adjusted diluted net income per share and adjusted diluted net income attributable to common stockholders because

our net income and net income per share are regularly affected by items that occur at irregular intervals or are non-cash items. We believe that

disclosing these measures assists investors, securities analysts and other interested parties in evaluating both our company over time and the

relative performance of the companies in our industry.

16