Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 2016 ESV AND Q3 2016 INVESTOR PRESENTATION - Lightstone Value Plus REIT V, Inc. | opii8-k2016esv.htm |

©

2

0

1

6

B

e

h

rin

g

e

r

3843-1

December 6, 2016

Behringer Harvard Opportunity REIT II, Inc.

2016 Third Quarter Update

Arbors Harbor Town, Memphis, TN

Exhibit 99.1

© 2016 Behringer

Dial-In and Replay Information

To listen to today’s call:

Dial: 888-490-2762

Conference ID: 4206711

For a replay of today’s call:

Dial: 888-203-1112

Conference ID: 4206711

© 2016 Behringer

Forward-Looking Statements

This presentation contains forward-looking statements, including discussion and analysis of the financial

condition of us and our subsidiaries and other matters. These forward-looking statements are not

historical facts but are the intent, belief or current expectations of our management based on their

knowledge and understanding of our business and industry. Words such as “may,” “anticipates,”

“expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should” and variations of

these words and similar expressions are intended to identify forward-looking statements. We intend that

such forward-looking statements be subject to the safe harbor provisions created by Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not

guarantees of future performance and are subject to risks, uncertainties and other factors, some of which

are beyond our control, are difficult to predict and could cause actual results to differ materially from those

expressed or forecasted in the forward-looking statements.

Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false.

We caution you not to place undue reliance on forward-looking statements, which reflect our

management's view only as of the date of this presentation. We undertake no obligation to update or

revise forward-looking statements to reflect changed assumptions the occurrence of unanticipated events

or changes to future operating results.

© 2016 Behringer

Forward-Looking Statements

Factors that could cause actual results to differ materially from any forward-looking statements made in the

presentation include but are not limited to:

• market and economic challenges experienced by the

U.S. and global economies or real estate industry as

a whole and the local economic conditions in the

markets in which our investments are located;

• the availability of cash flow from operating activities

for special distributions, if any;

• conflicts of interest arising out of our relationships

with our advisor and its affiliates;

• our ability to retain our executive officers and other

key personnel of our advisor, our property manager

and their affiliates;

• our level of debt and the terms and limitations

imposed on us by our debt agreements;

• the availability of credit generally, and any failure to

obtain debt financing at favorable terms or a failure to

satisfy the conditions and requirements of that debt;

• our ability to make accretive investments in a

diversified portfolio of assets;

• future changes in market factors that could affect the

ultimate performance of our development or

redevelopment projects, including but not limited to

construction costs, plan or design changes, schedule

delays, availability of construction financing,

performance of developers, contractors and

consultants, and growth in rental rates and operating

costs;

• our ability to secure leases at favorable rental rates;

• our ability to sell our assets at a price and on a

timeline consistent with our investment objectives;

• impairment charges

• unfavorable changes in laws or regulations impacting

our business, our assets or our key relationships; and

• factors that could affect our ability to qualify as a real

estate investment trust.

The forward-looking statements should be read in light of these and other risk factors identified in the

“Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2015, as

filed with the Securities and Exchange Commission.

© 2016 Behringer

Agenda

• Notable Events

• Estimated Share Value

• Financial Review

• Portfolio Updates

• Strategy Review

• Questions

Arbors Harbor Town, Memphis, TN

© 2016 Behringer

Notable Events

• Board of Directors continuing to

consider orderly disposition of assets

and special distributions

• Sold Lakewood Flats for contract

price of $68.8 million

• Acquired in 2014 for contract price of

$60.5 million

• Sale netted approximately $32 million

of cash to the fund

• Simple annual average return of 23%

(property level)

• Established new estimated per-share

value (ESV) of $7.80

Courtyard by Marriott at Coconut Beach, Kauai, HI

© 2016 Behringer

Estimated Share Valuation (ESV)

• New ESV of $7.80

• Increase of $0.11 per share

• Compares with previous adjusted ESV of $7.69

• Total value creation:

1 Regular distributions paid since inception per weighted average shares outstanding at October 31, 2016. The actual

regular distributions a shareholder has received will vary based on the date they invested.

Original offering price = $10.00 per share

October 31, 2016

Estimated hare Value $7.80

Cumulative Regular Distributions1 1.19

Special Cash Distributions:

May 2012 0.50

September 2014 0.50

March 2015 1.00

January 2016 1.50

Total Value $12.49

© 2016 Behringer

ESV Allocation

• Allocation of ESV

• For more information about the ESV, including methodologies used, please refer

to the Company’s Form 8-K that was filed with the SEC on December 5, 2016.

(1) Accounted for as an investment in unconsolidated joint venture on our consolidated balance sheet.

(2) Net of mark-to-market adjustment.

(per share data) Oct. 31, 2016

ESV

Oct. 31, 2015

ESV Change

Real estate:

Operating 10.60$ 13.06$ (2.46)$

Mezzanine loan investment(1) 1.00 0.82 0.18

Cash and cash equivalents 2.75 3.07 (0.32)

Restricted cash 0.25 0.16 0.09

Notes payable(2) (5.80) (7.03) 1.23

Other assets and liabilities (0.28) (0.30) 0.02

No controlling interests (0.72) (0.59) (0.13)

Estimated net asset value per share 7.80$ 9.19$ (1.39)$

Estimated enterprise value premium - - -

Total estimated value per share 7.80$ 9.19$ (1.39)$

Less Special Distribution - (1.50) 1.50

Total estimated value per share, as adjusted 7.80$ 7.69$ 0.11$

© 2016 Behringer

Financial Review

Selected Financial Data

Cash Position

(Dollars in Thousands)

September 30, December 31,

2016 2015 Change

$69,687 $76,815 ($7,128)

2016 2015 Change % Change

Rental Revenue 6,740$ 8,349$ (1,609)$ (19.3%)

Property Operating Expenses 2,635$ 3,172$ (537)$ (16.9%)

Same Store Rental Revenue 5,905$ 5,607$ 298$ 5.3%

Same Store Property Operating Expenses 2,308$ 2,304$ 4$ 0.2%

Hotel Revenue 4,653$ 4,190$ 463$ 11.1%

Hotel Operating Expenses 3,509$ 3,166$ 343$ 10.8%

2016 2015 Change % Change

Rental Revenue 21,590$ 25,300$ (3,710)$ (14.7%)

Property Operating Expenses 7,128$ 8,836$ (1,708)$ (19.3%)

Same Store Rental Revenue 17,458$ 16,453$ 1,005$ 6.1%

Same Store Property Operating Expenses 6,120$ 6,258$ (138)$ (2.2%)

Hotel Revenue 13,946$ 13,332$ 614$ 4.6%

Hotel Operating Expenses 10,219$ 9,440$ 779$ 8.3%

Three Months Ended September 30,

Nine Months Ended September 30,

© 2016 Behringer

Financial Review (cont.)

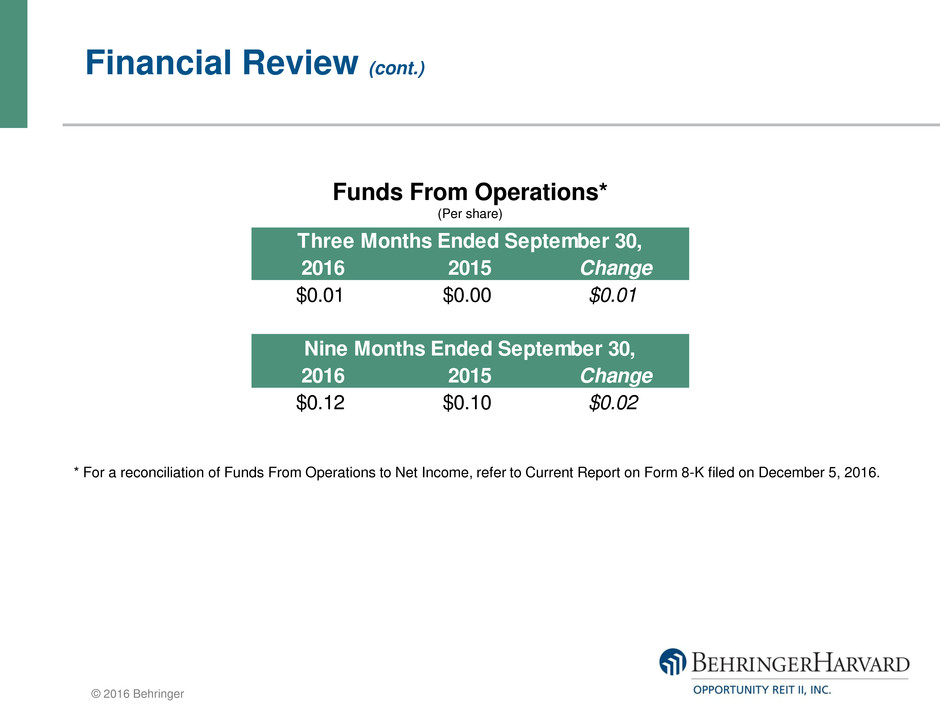

Funds From Operations*

(Per share)

* For a reconciliation of Funds From Operations to Net Income, refer to Current Report on Form 8-K filed on December 5, 2016.

2016 2015 Change

$0.01 $0.00 $0.01

2016 2015 Change

$0.12 $0.10 $0.02

Three Months Ended September 30,

Nine Months Ended September 30,

© 2016 Behringer

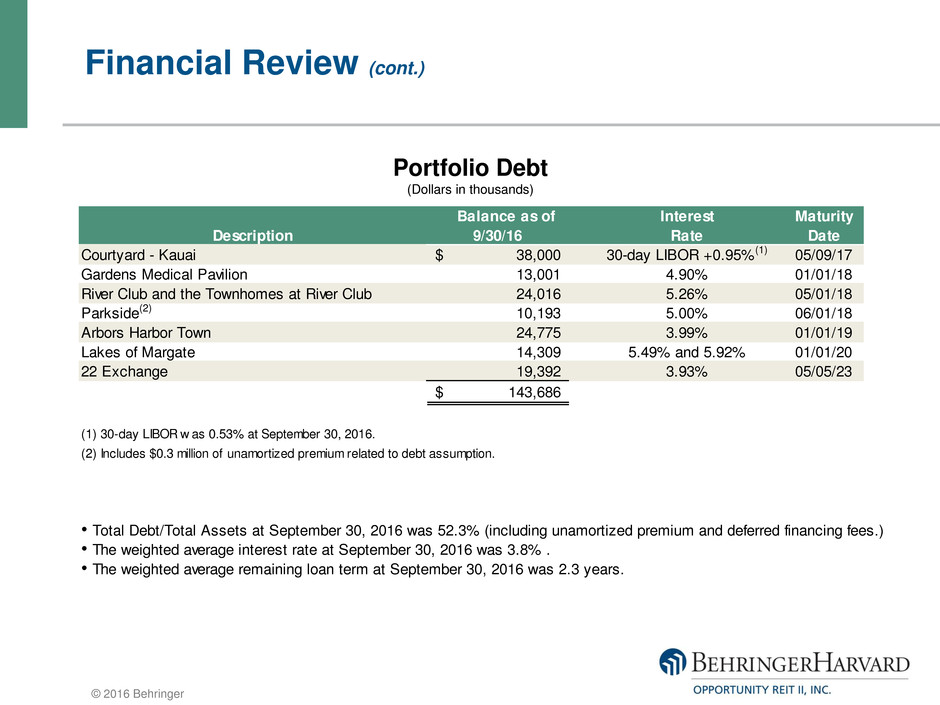

Financial Review (cont.)

Portfolio Debt

(Dollars in thousands)

Interest Maturity

Description 9/30/16 Rate Date

Courtyard - Kauai 38,000$ 30-day LIBOR +0.95%(1) 05/09/17

Gardens Medical Pavilion 13,001 4.90% 01/01/18

River Club and the Townhomes at River Club 24,016 5.26% 05/01/18

Parkside(2) 10,193 5.00% 06/01/18

Arbors Harbor Town 24,775 3.99% 01/01/19

Lakes of Margate 14,309 5.49% and 5.92% 01/01/20

22 Exchange 19,392 3.93% 05/05/23

143,686$

(1) 30-day LIBOR w as 0.53% at September 30, 2016.

(2) Includes $0.3 million of unamortized premium related to debt assumption.

• Total Debt/Total Assets at September 30, 2016 was 52.3% (including unamortized premium and deferred financing fees.)

• The weighted average interest rate at September 30, 2016 was 3.8% .

• The weighted average remaining loan term at September 30, 2016 was 2.3 years.

Balance as of

© 2016 Behringer

Behringer Harvard Opportunity REIT II Portfolio

River Club 22 Exchange Courtyard by Marriott - Kauai

Gardens Medical Pavilion Prospect Park Development

Mezzanine Financing

Arbors Harbor Town Parkside Apartments Lakes of Margate

© 2016 Behringer

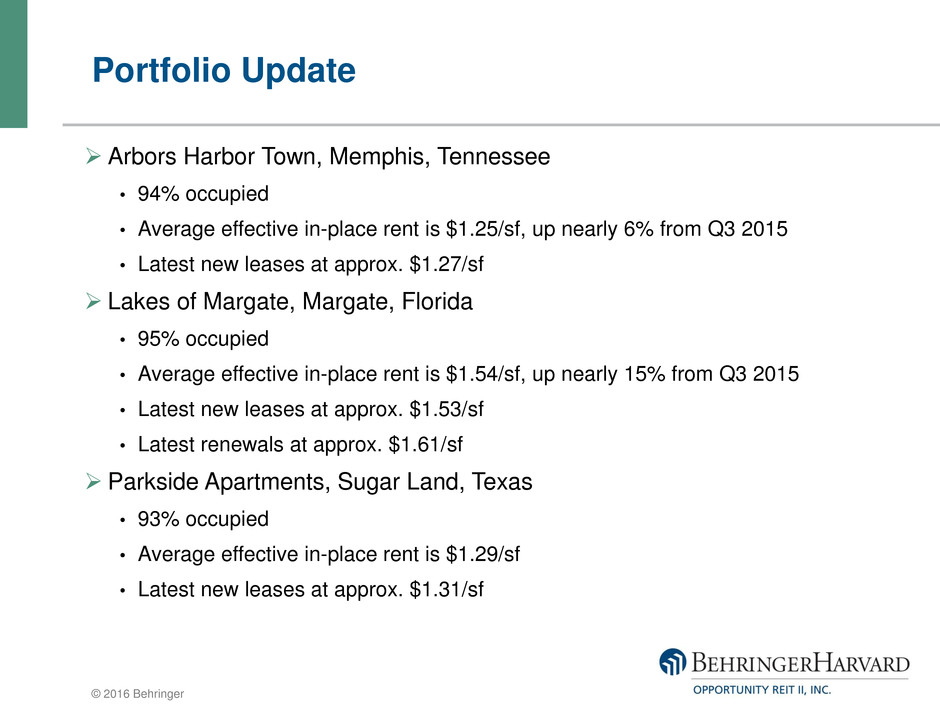

Arbors Harbor Town, Memphis, Tennessee

• 94% occupied

• Average effective in-place rent is $1.25/sf, up nearly 6% from Q3 2015

• Latest new leases at approx. $1.27/sf

Lakes of Margate, Margate, Florida

• 95% occupied

• Average effective in-place rent is $1.54/sf, up nearly 15% from Q3 2015

• Latest new leases at approx. $1.53/sf

• Latest renewals at approx. $1.61/sf

Parkside Apartments, Sugar Land, Texas

• 93% occupied

• Average effective in-place rent is $1.29/sf

• Latest new leases at approx. $1.31/sf

Portfolio Update

© 2016 Behringer

Portfolio Update (cont.)

Courtyard Kauai, Hawaii (year to date)

• Revenues: +4.6% YOY

• ADR: Unchanged YOY

• Occupancy: Increased 1 pct. pt., to 84.4%

• RevPAR: +1.4% YOY

• NOI: -4.0% YOY

River Club Apartments and Townhomes, University of Georgia

• 100% occupied for 2016-17 school year

• 7% preleased for 2017-18 school year, among leaders in local market

22 Exchange, University of Akron

• 90% occupied for 2016-17 school year

• 7% preleased for 2017-18, compared with 1.4% same time last year

• Strong competition in local market

• Signed a new lease with a national drugstore chain; continuing to seek new

tenants for the retail space

© 2016 Behringer

Portfolio Update (cont.)

Gardens Medical Pavilion, Palm Beach Gardens, Florida

• 66% occupied, as of end of Q3; has since increased to 72% occupied

• Negotiating with several prospective tenants

© 2016 Behringer

Operating Strategy

1875 Lawrence, Denver, CO

• Manage assets to create liquidity for shareholders

• Continue to focus on identifying the appropriate time to sell remaining assets

• Maintain a strong balance sheet, which provides flexibility to execute

• Continue to consider additional special cash distributions from asset sales

© 2016 Behringer

Playback Information

• Presentation and playback will be available at

behringerinvestments.com under “Prior Programs Resources”

• A dial-in playback will be available at 888-203-1112; use

conference ID 4206711

• Playbacks will be available until January 3, 2017.