Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE - DELTA AIR LINES, INC. | delta_8k-ex9902.htm |

| 8-K - FORM 8-K - DELTA AIR LINES, INC. | delta_8k.htm |

Exhibit 99.1

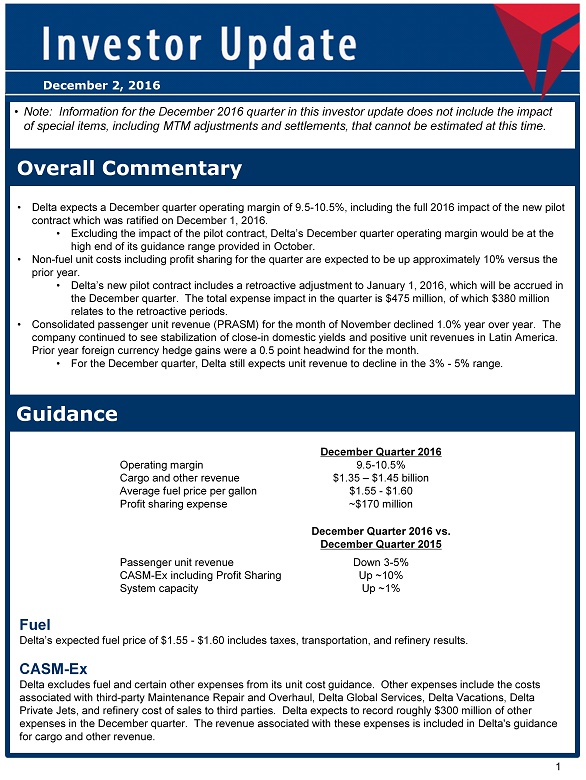

1 Overall Commentary Guidance • Delta expects a December quarter operating margin of 9.5 - 10.5%, including the full 2016 impact of the new pilot contract which was ratified on December 1, 2016. • Excluding the impact of the pilot contract, Delta’s December quarter operating margin would be at the high end of its guidance range provided in October. • Non - fuel unit costs including profit sharing for the quarter are expected to be up approximately 10% versus the prior year. • Delta’s new pilot contract includes a retroactive adjustment to January 1, 2016, which will be accrued in the December quarter. The total expense impact in the quarter is $475 million, of which $380 million relates to the retroactive periods. • Consolidated passenger unit revenue (PRASM) for the month of November declined 1.0% year over year. The company continued to see stabilization of close - in domestic yields and positive unit revenues in Latin America. Prior year foreign currency hedge gains were a 0.5 point headwind for the month. • For the December quarter, Delta still expects unit revenue to decline in the 3% - 5% range. December Quarter 2016 Operating margin 9.5 - 10.5% Cargo and other revenue $1.35 – $1.45 billion Average fuel price per gallon $1.55 - $1.60 Profit sharing expense ~$170 million December Quarter 2016 vs. December Quarter 2015 Passenger unit revenue Down 3 - 5% CASM - Ex including Profit Sharing Up ~10% System capacity Up ~1% December 2, 2016 • Note: Information for the December 2016 quarter in this investor update does not include the impact of special items, including MTM adjustments and settlements, that cannot be estimated at this time. Fuel Delta’s expected fuel price of $1.55 - $1.60 includes taxes, transportation, and refinery results. CASM - Ex Delta excludes fuel and certain other expenses from its unit cost guidance. Other expenses include the costs associated with third - party Maintenance Repair and Overhaul, Delta Global Services, Delta Vacations, Delta Private Jets, and refinery cost of sales to third parties. Delta expects to record roughly $300 million of other expenses in the December quarter. The revenue associated with these expenses is included in Delta's guidance for cargo and other revenue.

2 Forward Looking Statements Profit Sharing Delta’s employee profit sharing program for its ground and flight attendant employees currently pays 10% of the company’s adjusted annual pre - tax profit up to the prior year’s adjusted annual pre - tax profit and 20% above that amount (adjusted pretax profit for 2015 was $7.35 billion). Delta’s employee profit sharing program for its pilots currently pays 10% up to $2.5 billion in adjusted annual pre - tax profit and 20% above that amount. Profit sharing expense is accrued at a blended rate based on the company’s estimated profitability for the full year. Taxes Our December 2016 quarter results will reflect a 35% tax rate. There will be no material impact to cash as Delta’s net operating loss carryforwards will largely offset cash taxes. Statements in this investor update that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections or strategies for the future, may be "forward - looking statements" as defined in the Private Securities Litigation Reform Act of 1995. All forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectations, beliefs, intentions, projections and strategies reflected in or suggested by the forward - looking statements. These risks and uncertainties include, but are not limited to, the effects of terrorist attacks or geopolitical conflict; the cost of aircraft fuel; the impact of rebalancing our hedge portfol io, recording mark - to - market adjustments or posting collateral in connection with our fuel hedge contracts; the availability of aircraft fuel; the possible effects of accidents involving our aircraft; the restrictions that financial covenants in our fin anc ing agreements will have on our financial and business operations; labor issues; interruptions or disruptions in service at one o f our hub or gateway airports; disruptions or security breaches of our information technology infrastructure; our dependence on technology in our operations; the effects of weather, natural disasters and seasonality on our business; the effects of an extended disruption in services provided by third party regional carriers; failure or inability of insurance to cover a signi fic ant liability at Monroe’s Trainer refinery; the impact of environmental regulation on the Trainer refinery, including costs relat ed to renewable fuel standard regulations; our ability to retain management and key employees; competitive conditions in the airlin e industry; the effects of extensive government regulation on our business; the sensitivity of the airline industry to prolonge d periods of stagnant or weak economic conditions, including the effects of Brexit; and the effects of the rapid spread of contagious illnesses. Additional information concerning risks and uncertainties that could cause differences between actual results and forward - looking statements is contained in our Securities and Exchange Commission filings, including our Annual Report on Form 10 - K for the fiscal year ended Dec. 31, 2015 and our Quarterly Report on Form 10 - Q for the quarterly period ended June 30, 2016. Caution should be taken not to place undue reliance on our forward - looking statements, which represent our views only as of Dec. 2, 2016, and which we have no current intention to update. Delta sometimes uses information ("non - GAAP financial measures") that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non - GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Forward Looking Projections . The Company does not reconcile forward looking non - GAAP financial measures due to the impact of special items, including MTM adjustments and settlements, which will not be known until the end of the period. Non - GAAP Financial Measures