Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Realty Capital Global Trust II, Inc. | v454350_8k.htm |

Exhibit 99.1

3 rd Quarter 2016 Webinar Series

A Public Non - Traded Real Estate Investment Trust* Third Quarter 2016 Investor Presentation Platform Advisor To Investment Programs

American Realty Capital Global Trust II, Inc. 3 IMPORTANT INFORMATION Risk Factors See the section entitled “Risk Factors” in the most recent Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with our company . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the fund’s most recent Annual Report on Form 10 - K or Quarterly Reports on Form 10 - Q from March 31, 2016, June 30, 2016 and September 30, 2016 for a more complete list of risk factors, as well as a discussion of forward - looking statements.

American Realty Capital Global Trust II, Inc. 4 STRATEGIC VIEW Quality Diversity Focus • High quality, mission - critical assets • Leased to predominantly investment - grade tenants • Real estate investments held in 6 countries spanning 12 industries • Single - tenant, net leased properties • Office, industrial & distribution assets

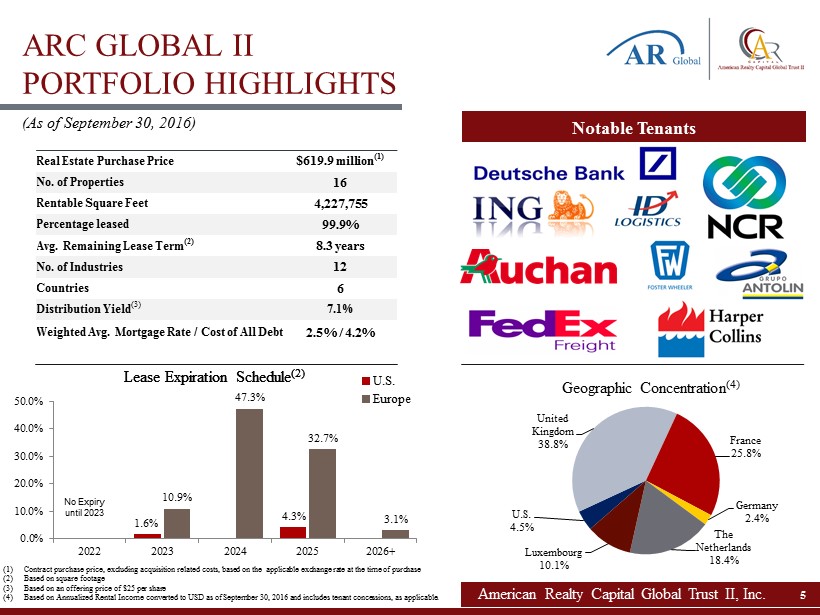

(1) Contract purchase price, excluding acquisition related costs, based on the applicable exchange rate at the time of purchase (2) Based on square footage (3) Based on an offering price of $25 per share (4) Based on Annualized Rental Income converted to USD as of September 30, 2016 and includes tenant concessions, as applicable. ARC GLOBAL II PORTFOLIO HIGHLIGHTS Notable Tenants (As of September 30, 2016) American Realty Capital Global Trust II, Inc. 5 Real Estate Purchase Price $619.9 million (1) No. of Properties 16 Rentable Square Feet 4,227,755 Percentage leased 99.9% Avg. Remaining Lease Term (2) 8.3 years No. of Industries 12 Countries 6 Distribution Yield (3) 7.1% Weighted Avg. Mortgage Rate / Cost of All Debt 2.5% / 4.2% Geographic Concentration (4) Lease Expiration Schedule (2) U.S. 4.5% United Kingdom 38.8% France 25.8% Germany 2.4% The Netherlands 18.4% Luxembourg 10.1% Lease Expiration Schedule (2) No Expiry until 2023 1.6% 4.3% 10.9% 47.3% 32.7% 3.1% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 2022 2023 2024 2025 2026+ U.S. Europe

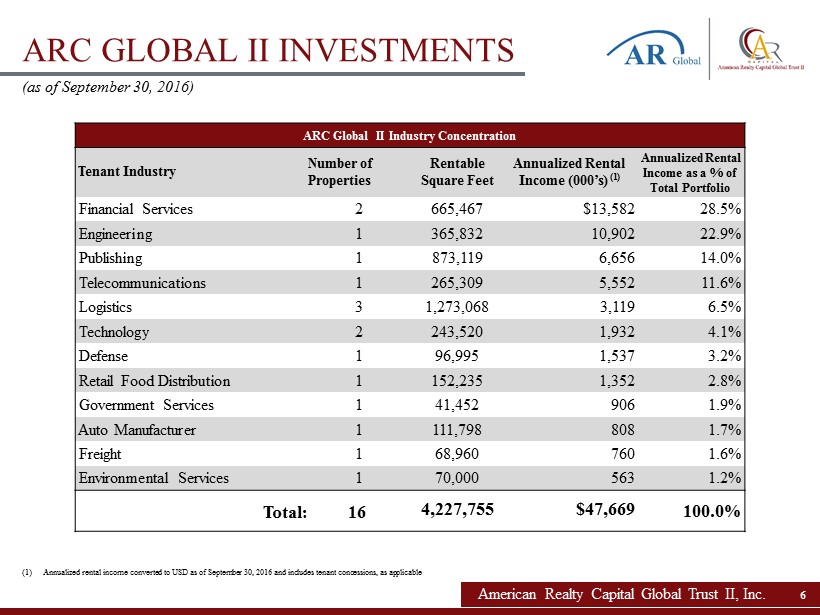

(1) Annualized rental income converted to USD as of September 30, 2016 and includes tenant concessions, as applicable ARC GLOBAL II INVESTMENTS (as of September 30, 2016) American Realty Capital Global Trust II, Inc. 6 ARC Global II Industry Concentration Tenant Industry Number of Properties Rentable Square Feet Annualized Rental Income (000’s) (1) Annualized Rental Income as a % of Total Portfolio Financial Services 2 665,467 $13,582 28.5% Engineering 1 365,832 10,902 22.9% Publishing 1 873,119 6,656 14.0% Telecommunications 1 265,309 5,552 11.6% Logistics 3 1,273,068 3,119 6.5% Technology 2 243,520 1,932 4.1% Defense 1 96,995 1,537 3.2% Retail Food Distribution 1 152,235 1,352 2.8% Government Services 1 41,452 906 1.9% Auto Manufacturer 1 111,798 808 1.7% Freight 1 68,960 760 1.6% Environmental Services 1 70,000 563 1.2% Total: 16 4,227,755 $47,669 100.0%

FINANCIAL OVERVIEW American Realty Capital Global Trust II, Inc. 7 American Realty Capital Global Trust II, Inc. Balance Sheet Metrics – 9/30/2016 (all in $000s) Total Real Estate Investments, at cost (1) $582,643 Less: Accumulated Depreciation and Amortization (25,587) Total Real Estate Investments, net 557,056 Cash and Cash Equivalents 20,806 Other Assets 36,322 Total Assets $614,184 Debt Outstanding: Mortgage Notes Payable, net (2) $287,093 Mezzanine Facility 118,154 Total Net Debt Outstanding 405,247 Other Liabilities 33,469 Total Liabilities 438,716 Total Equity 175,468 Total Liabilities and Equity $614,184 Total Net Debt / Total Assets 66.0% (1) Decrease of cost basis vs. purchase price of $619.9 million is primarily attributable to unfavorable foreign exchange rate movements (2) Gross Mortgage Notes Payable net of deferred financing costs of $5.2 million . • Total Revenue increased to $12.4 million, a year - over - year increase of 79.5% • Operating income increased to $2.4 million, a year - over - year increase of 42.1% • Paid down approximately $13.5 million on the Mezzanine facility, in both Euros and Pound Sterling during Q3 2016 Company Highlights (in millions) Offering Proceeds (gross inception to date) $297.1 Vested Restricted Shares 0.08 Distributions Reinvested 11.7 Total Proceeds $ 308.9 Financial Highlights – Q3 2016 All figures as of 9/30/2016

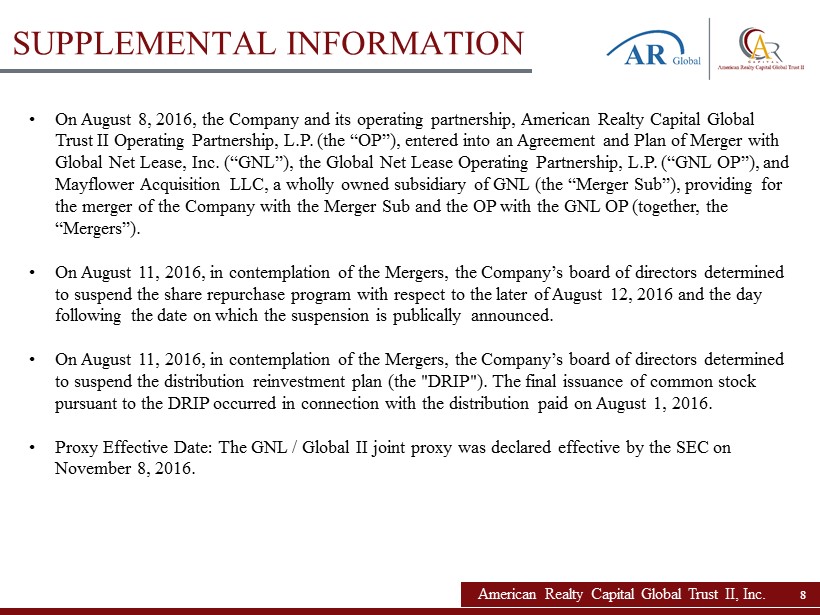

• On August 8, 2016, the Company and its operating partnership, American Realty Capital Global Trust II Operating Partnership, L.P. (the “OP”), entered into an Agreement and Plan of Merger with Global Net Lease, Inc. (“GNL”), the Global Net Lease Operating Partnership, L.P. (“GNL OP”), and Mayflower Acquisition LLC, a wholly owned subsidiary of GNL (the “Merger Sub”), providing for the merger of the Company with the Merger Sub and the OP with the GNL OP (together, the “Mergers”). • On August 11, 2016, in contemplation of the Mergers, the Company’s board of directors determined to suspend the share repurchase program with respect to the later of August 12, 2016 and the day following the date on which the suspension is publically announced. • On August 11, 2016, in contemplation of the Mergers, the Company’s board of directors determined to suspend the distribution reinvestment plan (the "DRIP"). The final issuance of common stock pursuant to the DRIP occurred in connection with the distribution paid on August 1, 2016. • Proxy Effective Date: The GNL / Global II joint proxy was declared effective by the SEC on November 8, 2016. American Realty Capital Global Trust II, Inc. 8 SUPPLEMENTAL INFORMATION

AR Global Moor Park ARC Global II Board of Directors Michael Weil Exec. Chairman Bob Burns Independent Director Lee Elman Independent Director and Audit Committee Chair Management Team / Investment Committee Scott Bowman CEO and President Timothy Salvemini CFO Shared Services Support Operations Investor Relations Accounting Legal Due Diligence IT Marketing Human Resources Financing Asset Management Moor Park Management Team / Investment Committee Jagdeep Kapoor CIO Shameel Kahn CEO Gary Wilder Executive Chairman Acquisitions Team Legal / Asset Management Finance / Operations United States Kyle Gray Analyst Jason Slear Executive Vice President Brian Mansouri Vice President Europe Michael Glaser United Kingdom Javier Paz Valibuena Germany Greg Smith Nordics Diego Voss Benelux Jamal Dutheil France Akomea Poku - Kankam Senior Vice President & Counsel Jacqui Shimmin Senior VP & European Counsel Ken Miles Transaction Counsel Karen Masey Assistant Property Manager Enessa Bruk Operations Controller Brandon Koch Chief Accounting Officer Shaun Riley Fund Controller Samir Mody Property Manager Leah Reifer Finance Manager Graydon Butler COO Sven Utermueller Investment Controller BOARD OF DIRECTORS AND MANAGEMENT TEAM American Realty Capital Global Trust II, Inc. American Realty Capital Global Trust II, Inc. 9 Ryan Reimers Transaction Counsel Razvan Ifrim Vice President of European Finance and Tax

STRONG CORPORATE GOVERNANCE American Realty Capital Global Trust II, Inc. 10 Board of Directors Corporate Governance Robert H. Burns Independent Director ▪ Founder of Regent International Hotels, a proprietor of luxury hotels ▪ Served as Chairman and Chief Executive Officer of Regent International Hotels ▪ 40 year industry veteran with extensive experience in overseas real estate investing and hospitality business. ▪ Served as a faculty member at the University of Hawaii from 1962 to 1994 Lee M. Elman Independent Director / Audit Committee Chair ▪ Founder & President of Elman Investors Inc., an international real - estate investment bank ▪ 40+ years of real estate investment experience in the US and abroad. ▪ Partner of Elman Ventures, an organization which is advisor to, and partner with various foreign investors in United States real estate ventures. ▪ Mr. Elman holds a J.D. from Yale Law School and a B.A. from Princeton University’s Woodrow Wilson School of Public and International Affairs. ▪ The board of directors of ARC Global II is comprised of a majority of independent directors, with additional oversight provid ed by an audit committee comprised solely of independent directors. ▪ PricewaterhouseCoopers currently serves as the external auditor and Deloitte serves as internal auditor for ARC Global Trust II. Both PricewaterhouseCoopers and Deloitte report directly to the audit committee ▪ Proskauer Rose currently serves as the external legal counsel. Michael Weil Executive Chairman ▪ Co - founder & CEO of AR Global ▪ Previously Senior VP of sales and leasing for AFRT and President of the Board of Directors of the Real Estate Investment Securities Administration (REISA).

Since Inception, American Realty Capital Global Trust II, Inc. has paid out $3.40 per share of regular distributions in cash and DRIP. $3.40 per share (1) American Realty Capital Global Trust II, Inc. 11 CONSISTENT DISTRIBUTIONS (1) Totals as of each period presented represent cumulative distributions per share paid to stockholders of record who have held sha res since November 1, 2014, the date when our distributions began to accrue. On October 22, 2014, our board of directors authorized, and we declared, a distr ibu tion rate of $1.775 per annum, per share of common stock. $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00

American Realty Capital Global Trust II, Inc. 12 There are risks associated with an investment in American Realty Capital Global Trust II, Inc. The following is a summary of som e of these risks. See the section entitled “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10 - K filed with the U.S. Securities and Exchange Commission on March 22, 2016 (the “10 - K”) and the quarterly reports for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016, filed on May 16, 2016, August 15, 2016 and November 14, 2016, respectively, for a discussion of the risks which should be considered in connection with your investment . • We have a limited operating history . This inexperience makes our future performance difficult to predict . • All of our executive officers are also officers, managers and/or holders of a direct or indirect controlling interest in American Realty Capital Global II Advisors, LLC (the “Advisor”), and other entities affiliated with AR Global Investments, LLC (the successor business to AR Capital LLC, "AR Global") . As a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment programs advised by AR Global affiliates and conflicts in allocating time among these investment programs and us . These conflicts could result in unanticipated actions . • Because investment opportunities that are suitable for us may also be suitable for other AR Global - advised investment programs, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other investments and such conflicts may not be resolved in our favor, meaning that we could invest in less attractive assets, which could reduce the investment return to our stockholders . • No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid . • If we and our Advisor are unable to find suitable investments, then we may not be able to achieve our investment objectives or pay distributions . • Our primary initial public offering ("IPO") raised substantially less proceeds than expected and has terminated in accordance with its terms . As a result, our portfolio will be less diversified than previously planned and we may suffer other materially adverse consequences . • The merger with GNL is subject to certain conditions, including approval by stockholders of Global II and GNL, and there is no assurance that the merger will be completed . • Failure to complete the merger could negatively impact the value of Global II common stock, and the future business and financial results of Global II . RISK FACTORS

American Realty Capital Global Trust II, Inc. 13 • We are obligated to pay fees that may be substantial to our Advisor and its affiliates . • We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic viability of our tenants . • Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions to our stockholders . • We may be unable to raise additional debt or equity financing on attractive terms or at all . • Adverse changes in exchange rates may reduce the value of our properties located outside of the United States . • We have paid distributions from proceeds from our primary offering, which is now terminated . As such, we do not expect to raise additional proceeds from our primary offering and, thus may be unable to pay future distributions at the same rate . • Our IPO lapsed in accordance with its terms on August 26 , 2016 after raising substantially less proceeds than expected , and we may not be able to obtain the additional capital we require from other sources . • We have not generated cash flows sufficient to pay our distributions to stockholders, as such, we may be forced to borrow at unfavorable rates or depend on our Advisor to waive reimbursement of certain expenses and fees to fund our distributions . There is no assurance that our Advisor will waive reimbursement of expenses or fees . • We are subject to risks associated with our international investments, including risks associated with compliance and changes in foreign laws, fluctuations in foreign currency exchange rates and inflation . • We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit markets of the United States of America and Europe from time to time . • We may fail to qualify to be treated as a real estate investment trust for U . S . federal income tax purposes ("REIT"), which would result in higher taxes, may adversely affect our operations and would reduce our NAV and cash available for distributions . • We may be deemed to be an investment company under the Investment Company Act of 1940 , as amended (the "Investment Company Act"), and thus subject to regulation under the Investment Company Act . • We may be exposed to risks due to a lack of tenant diversity, investment types and geographic diversity . • We may be exposed to changes in general economic, business and political conditions, including the possibility of intensified international hostilities, acts of terrorism and changes in conditions of US or international lending, capital and financing markets . • The revenue derived from, and the market value of, properties located in the United Kingdom and continental Europe may decline as a result of the non binding referendum on June 23 , 2016 in which a majority of voters voted to exit the European Union (the “Brexit” vote) . • Our ability to refinance or sell properties located in the United Kingdom and continental Europe may be impacted by the economic and political uncertainty following the Brexit vote . • We may be exposed to changes in general economic, business and political conditions, including the possibility of intensified international hostilities, acts of terrorism, and changes in conditions of U . S . or international lending, capital and financing markets, including as a result of the Brexit vote . RISK FACTORS

ARCGlobalTrust2.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com