Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Realty Capital Healthcare Trust III, Inc. | v454279_8k.htm |

Exhibit 99.1

3rd Quarter 2016 Webinar Series

Third Quarter 2016 Investor Presentation Platform Advisor To Investment Programs

3 Important Information Risk Factors Investing in our common stock involves a high degree of risk . See the section entitled “Risk Factors” in our most recent Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q for a discussion of the risks which should be considered in connection with our Company . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the fund’s most recent Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q for a more complete list of risk factors, as well as a discussion of forward - looking statements.

Our primary investment objectives are: • Preserve and protect capital; • Provide attractive and stable cash distributions; and • Increase the value of assets in order to generate capital appreciation. We have announced that our board of directors has established a special committee (the “Special Committee”) comprised entirely of independent directors to evaluate various options in connection with a strategic review to identify, examine, and consider a range of strategic alternatives available to the Company with the objective of maximizing shareholder value. The Special Committee has engaged financial advisors and the board of directors has special legal counsel in connection with the Strategic Review. The board of directors has not made a decision to enter into any transaction at this time, and there are no assurances that the Strategic Review will result in any transaction. All investors are reminded the target holding period of this offering is three to six years from the close of the initial offering. The initial offering was suspended on November 15, 2015 and lapsed in accordance with its terms on August 20, 2016. 4 Investment Objectives

5 American Realty Capital Healthcare Trust III, Inc. (including, as required by context, American Realty Capital Healthcare III Operating Partnership, L.P. and its subsidiaries, the “Company” or “ARC HT III”) is a real estate investment trust focusing primarily on owning and operating healthcare - related assets including medical office buildings, seniors housing and other healthcare - related facilities. ARC Healthcare Trust III, Inc.

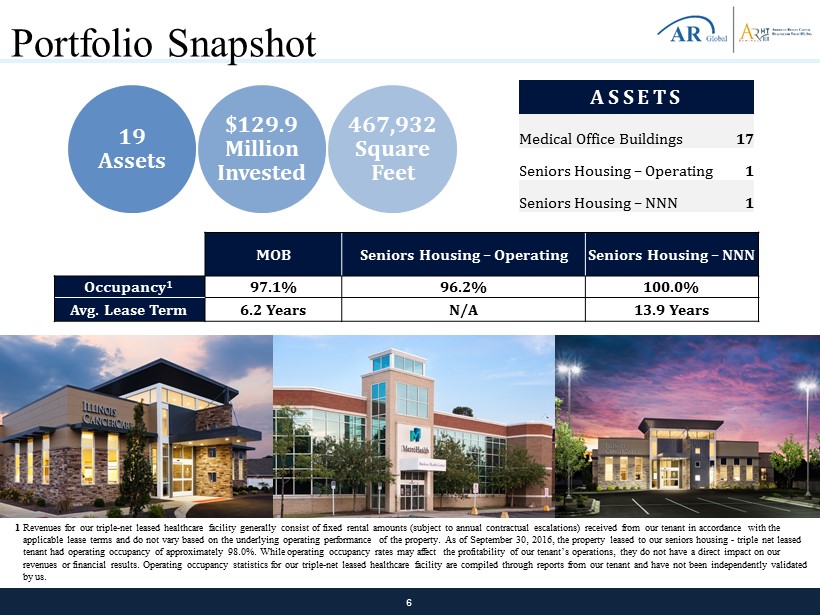

6 Portfolio Snapshot 1 Revenues for our triple - net leased healthcare facility generally consist of fixed rental amounts (subject to annual contractual escalations) received from our tenant in accordance with the applicable lease terms and do not vary based on the underlying operating performance of the property. As of September 30, 201 6, the property leased to our seniors housing - triple net leased tenant had operating occupancy of approximately 98.0%. While operating occupancy rates may affect the profitability of our te nant’s operations, they do not have a direct impact on our revenues or financial results. Operating occupancy statistics for our triple - net leased healthcare facility are compiled thro ugh reports from our tenant and have not been independently validated by us. ASSETS Medical Office Buildings 17 Seniors Housing – Operating 1 Seniors Housing – NNN 1 19 Assets $129.9 Million Invested 467,932 Square Feet MOB Senior s Housing – Operating Senior s Housing – NNN Occupancy 1 97.1% 96.2% 100.0% Avg. Lease Term 6.2 Years N/A 13.9 Years

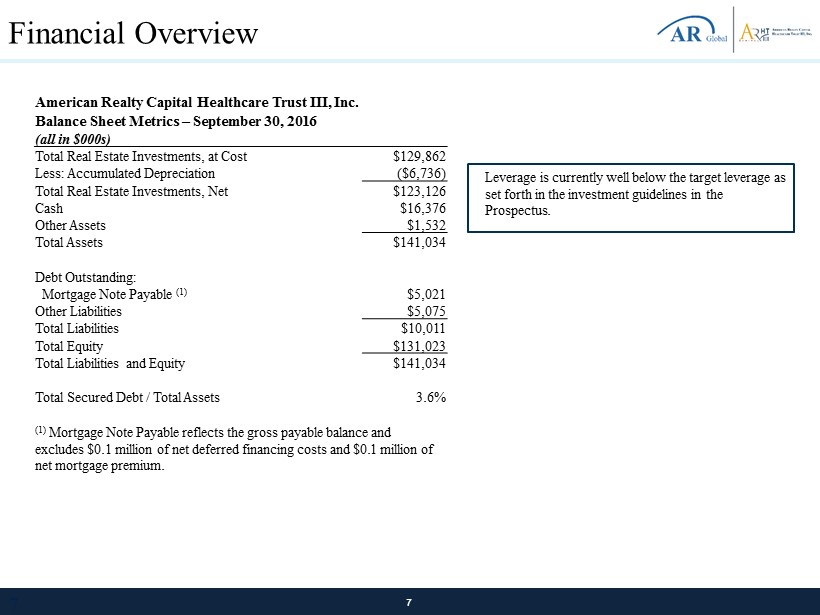

7 Financial Overview Leverage is currently well below the target leverage as set forth in the investment guidelines in the Prospectus. 7 American Realty Capital Healthcare Trust III, Inc. Balance Sheet Metrics – September 30, 2016 (all in $000s) Total Real Estate Investments, at Cost $129,862 Less: Accumulated Depreciation ($6,736) Total Real Estate Investments, Net $123,126 Cash $16,376 Other Assets $1,532 Total Assets $141,034 Debt Outstanding: Mortgage Note Payable (1) $5,021 Other Liabilities $5,075 Total Liabilities $10,011 Total Equity $131,023 Total Liabilities and Equity $141,034 Total Secured Debt / Total Assets 3.6% (1) Mortgage Note Payable reflects the gross payable balance and excludes $0.1 million of net deferred financing costs and $0.1 million of net mortgage premium.

8 Key Initiatives • Actively manage assets to optimize profitability : The portfolio continues to perform well and consistent with our underwriting of the properties and the 2016 budget . • Continue to evaluate liquidity options : On April 29 , 2016 , Healthcare Trust III announced that the Company’s Board of Directors, led by its independent directors, has initiated a strategic review process to identify, examine, and consider a range of strategic alternatives available to the Company with the objective of maximizing long term shareholder value .

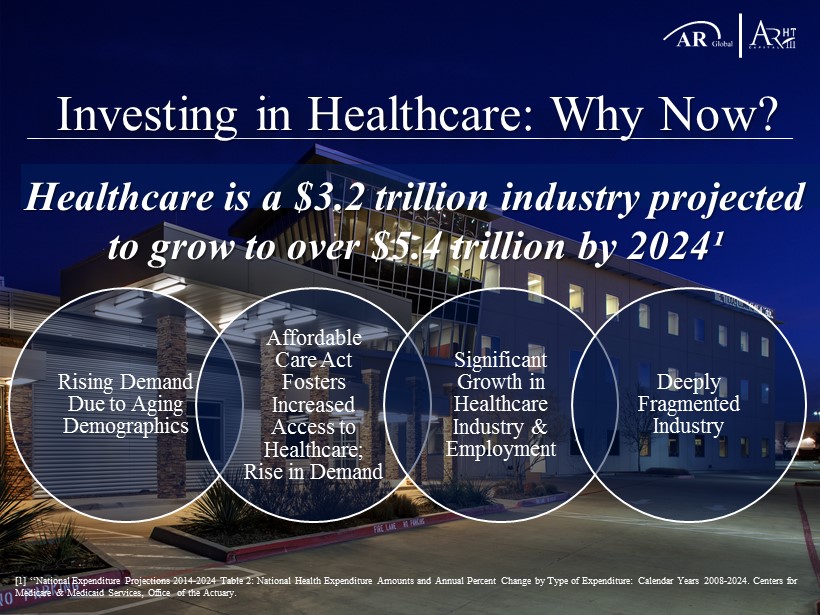

9 Investing in Healthcare: Why Now? Rising Demand Due to Aging Demographics Affordable Care Act Fosters Increased Access to Healthcare; Rise in Demand Significant Growth in Healthcare Industry & Employment Deeply Fragmented Industry [1] “National Expenditure Projections 2014 - 2024 Table 2: National Health Expenditure Amounts and Annual Percent Change by Type o f Expenditure: Calendar Years 2008 - 2024. Centers for Medicare & Medicaid Services, Office of the Actuary. Healthcare is a $3.2 trillion industry projected to grow to over $5.4 trillion by 2024¹

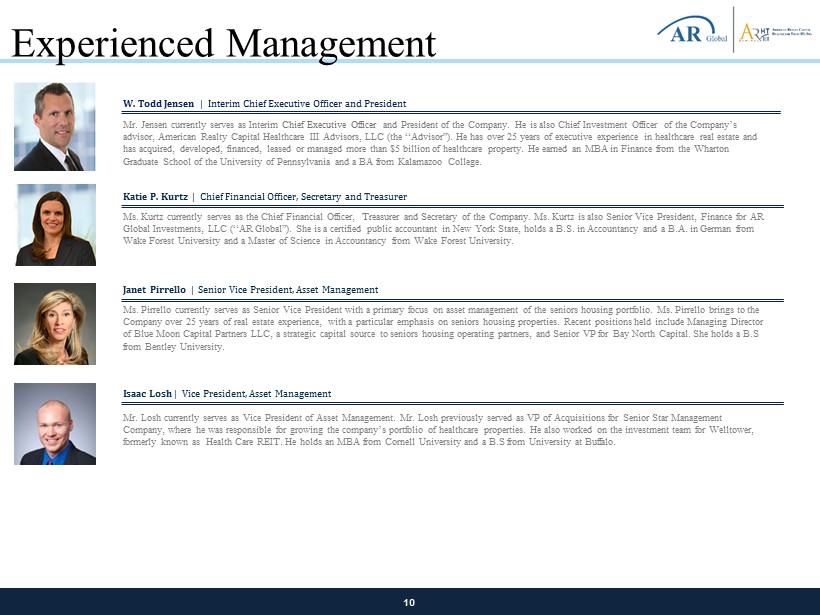

10 Experienced Management Mr. Jensen currently serves as Interim Chief Executive Officer and President of the Company. He is also Chief Investment Officer of the Company’s advisor, American Realty Capital Healthcare III Advisors, LLC (the “Advisor”). He has over 25 years of executive experience i n h ealthcare real estate and has acquired, developed, financed, leased or managed more than $5 billion of healthcare property. He earned an MBA in Finance fr om the Wharton Graduate School of the University of Pennsylvania and a BA from Kalamazoo College. W. Todd Jensen | Interim Chief Executive Officer and President Ms. Kurtz currently serves as the Chief Financial Officer, Treasurer and Secretary of the Company. Ms. Kurtz is also Senior V ice President, Finance for AR Global Investments, LLC (“AR Global”). She is a certified public accountant in New York State, holds a B.S. in Accountancy an d a B.A. in German from Wake Forest University and a Master of Science in Accountancy from Wake Forest University. Katie P. Kurtz | Chief Financial Officer, Secretary and Treasurer Ms. Pirrello currently serves as Senior Vice President with a primary focus on asset management of the seniors housing portfo lio . Ms. Pirrello brings to the Company over 25 years of real estate experience, with a particular emphasis on seniors housing properties. Recent positions h eld include Managing Director of Blue Moon Capital Partners LLC, a strategic capital source to seniors housing operating partners, and Senior VP for Bay No rth Capital. She holds a B.S from Bentley University. Janet Pirrello | Senior Vice President, Asset Management Mr. Losh currently serves as Vice President of Asset Management. Mr. Losh previously served as VP of Acquisitions for Senior Star Management Company, where he was responsible for growing the company’s portfolio of healthcare properties. He also worked on the investm ent team for Welltower , formerly known as Health Care REIT. He holds an MBA from Cornell University and a B.S from University at Buffalo. Isaac Losh | Vice President, Asset Management

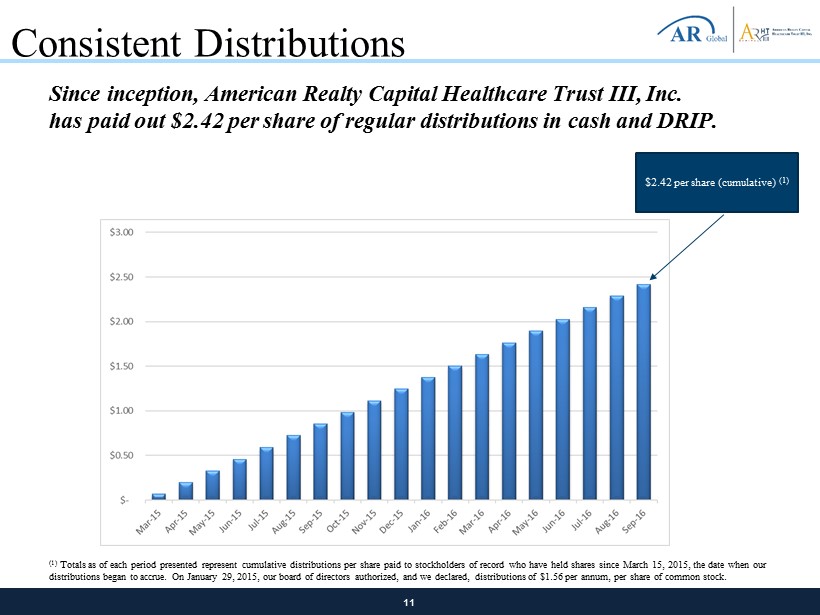

11 Consistent Distributions Since inception, American Realty Capital Healthcare Trust III , Inc. has paid out $2.42 per share of regular distributions in cash and DRIP. $2.42 per share (cumulative) (1) (1) Totals as of each period presented represent cumulative distributions per share paid to stockholders of record who have held sha res since March 15, 2015, the date when our distributions began to accrue. On January 29, 2015, our board of directors authorized, and we declared, distributions of $1.5 6 p er annum, per share of common stock.

12 Supplemental Information On September 22, 2016, ARC HT III filed on Form 8 - K an announcement that its board had determined to amend the Company’s existing share repurchase program (the “ SRP ” and the “ SRP Amendment”) to provide, solely for calendar year 2016, for one twelve - month repurchase period ending December 31, 2016. Prior to the SRP Amendment, the SRP provided, solely for calendar year 2016, for a nine - month repurchase period ending September 30, 2016 and a three - month repurchase period ending December 31, 2016, instead of two semi - annual periods ending June 30 and December 31. Following calendar year 2016, the repurchase periods will return to two semi - annual periods and applicable limitations set forth in the SRP . The annual limit on repurchases under the SRP remains unchanged and continues to be limited to a maximum of 5.0% of the weighted average number of shares of common stock of the Company outstanding during its prior fiscal year (the “2015 Outstanding Shares”) and is subject to the terms and limitations set forth in the SRP . F unding for the SRP will be limited to proceeds received during the same Fiscal Period through the issuance of Common Stock pursuant to any DRIP in effect. The SRP Amendment became effective on September 22, 2016 and applies only to repurchase periods in calendar year 2016.

13 Risk Factors Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Rep ort on Form 10 - K for the year ended December 31, 2015 and updated in our Quarterly Reports on Form 10 - Q from time to time. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements: • We have announced that our board of directors has established the Special Committee comprised of the board's independent directors to respond to the receipt of an unsolicited proposal (the “Proposal”) from an entity (the “Proposing Entity”) spons ore d by an affiliate of American Realty Capital VII, LLC, the Company’s sponsor (the “Sponsor”), relating to a potential strategic transaction with the Proposing Entity (the “Proposed Transaction”). The Company’s board of directors has not made a decision to enter into any transaction at this time, and there can be no assurance that the discussions and evaluation will result in a d efi nitive agreement or that any such transaction would be approved by the Company’s stockholders. • All of our executive officers and directors are also officers, managers or holders of a direct or indirect controlling intere st in the Advisor and other entities affiliated with AR Global (the successor business to AR Capital, LLC), the parent of our sponsor, American Realty Capital VII, LLC. As a result, our executive officers and directors, our Advisor and its affiliates face conf lic ts of interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment programs advised by affiliates of AR Global and conflicts in allocating time among these investment programs and us. These conflicts could result in unanticipated actions that adversely affect us. • Because investment opportunities that are suitable for us may also be suitable for other investment programs advised by affil iat es of AR Global, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other inve stm ents and such conflicts may not be resolved in our favor, meaning that we could invest in less attractive assets, which could redu ce the investment return to our stockholders. • No public market currently exists, or may ever exist, for shares of our common stock which are, and may continue to be, illiq uid . • We focus on acquiring a diversified portfolio of healthcare - related assets located in the United States and are subject to risks inherent in concentrating investments in the healthcare industry. We have only $16.4 million in cash on hand. While we may us e a portion of cash on hand to consummate additional acquisitions, we generally expect to use cash on hand to fund distributions or for working capital needs. • We suspended our IPO, which subsequently lapsed in accordance with its terms, which was our primary source of capital to implement our investment strategy, reduce our borrowings, complete acquisitions, make capital expenditures and pay distributions, and we may not be able to obtain additional capital from other sources. As a result, we will be unable to achi eve certain of our investment objectives, such as the anticipated size and diversification of our portfolio.

14 Risk Factors (Continued) • The healthcare industry is heavily regulated, and new laws or regulations, changes to existing laws or regulations, loss of l ice nsure or failure to obtain licensure could result in the inability of tenants to make lease payments to us. • We are depending on our Advisor to conduct our operations. Adverse changes in the financial condition of our Advisor or our r ela tionship with our Advisor could adversely affect us. • We may be unable to pay or maintain cash distributions or increase distributions over time. • We are permitted to pay distributions from unlimited amounts of any source. We have used, and may continue to use, net procee ds from our IPO, which has lapsed in accordance with its terms, and may use borrowings to fund distributions until we have sufficient cas h f lows from operations. There are no established limits on the amount of net proceeds and borrowings that we may use to fund distribution pa yments, except for those imposed by our organizational documents or Maryland law. • We may not generate cash flows in the future sufficient to pay our distributions to stockholders and, as such, to continue to pa y distributions, we may be required to fund distributions from our remaining proceeds from our IPO, which has been suspended, and from borrowi ngs , which may be at unfavorable rates and could restrict the amount we can borrow for investments and other purposes, or depend on our Adv isor to waive reimbursement of certain expenses and fees to fund our operations. • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates. • We depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of ou r t enants. • Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions to our sto ckholders. • We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit marke ts of the United States from time to time. • We may fail to continue to qualify to be treated as a real estate investment trust for U.S. federal income tax purposes, whic h w ould result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and the cas h a vailable for distributions. • We may be deemed to be an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Ac t") , and thus subject to regulation under the Investment Company Act. • Commencing on the net asset value ("NAV") pricing date, the offering price of shares sold pursuant to our DRIP and the repurc has e price for shares under our SRP will be based on NAV, which may not accurately reflect the value of our assets and may not represent what stockholders may receive on a liquidation of our assets. • We may be unable to maintain distributions over time. • We rely significantly on five major tenants (including, for this purpose, all affiliates of such tenants) and therefore are subj ect to tenant credit concentrations that make us more susceptible to adverse events with respect to those tenants. • Our property portfolio has a high concentration of properties located in five states. Our properties may be adversely affecte d b y economic cycles and risks inherent to those states.

15 ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com www.TheHealthcareREIT3.com