Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Zayo Group Holdings, Inc. | zgh_ex991.htm |

| 8-K - 8-K - Zayo Group Holdings, Inc. | zgh_currentfolio8k.htm |

Exhibit 99.2

|

|

Zayo Acquisition of Electric Lightwave 30 November 2016 |

|

|

ZAYO GROUP SAFE HARBOR Information contained in this presentation that is not historical by nature constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “believes,” “expects,” “plans,” “intends,” “estimates,” “projects,” “could,” “may,” “will,” “should,” or “anticipates” or the negatives thereof, other variations thereon or comparable terminology, or by discussions of strategy. No assurance can be given that future results expressed or implied by the forward-looking statements will be achieved and actual results may differ materially from those contemplated by the forward-looking statements. Such statements are based on management’s current expectations and beliefs and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, those relating to Zayo Group Holdings, Inc.’s (“the Company” or “ZGH”) financial and operating prospects, current economic trends, future opportunities, ability to retain existing customers and attract new ones, outlook of customers, and strength of competition and pricing. In addition, there is risk and uncertainty in the Company’s acquisition strategy including our ability to integrate acquired companies and assets. Specifically there is a risk associated with our recent acquisitions, and the benefits thereof, including financial and operating results and synergy benefits that may be realized from these acquisitions and the timeframe for realizing these benefits. Other factors and risks that may affect our business and future financial results are detailed in the “Risk Factors” section of our Annual Report or Form 10-K filed with the Securities and Exchange Commission (“SEC”). We caution you not to place undue reliance on these forward-looking statements, which speak only as of their respective dates. We undertake no obligation to publicly update or revise forward-looking statements to reflect events or circumstances after releasing this supplemental information or to reflect the occurrence of unanticipated events, except as required by law. 2 |

|

|

The Transaction 3 Purchase of Electric Lightwave (“ELI”) (formerly Integra), a facilities-based provider of communications services $538 million LQA Revenue $180 million LQA EBITDA $1.42 billion purchase price Subject to standard closing and post-closing adjustments (ex: working capital) ~7.9x Adjusted EBITDA (~6.5x with planned run-rate synergies) Expected CY1Q17 close Based on standard closing conditions, including regulatory approval >$400M in NOLs acquired ~2-year extension from prior estimate until Zayo becomes a material cash tax payer (now FY 2023/2024) Anticipate funding with combination of cash on hand and debt |

|

|

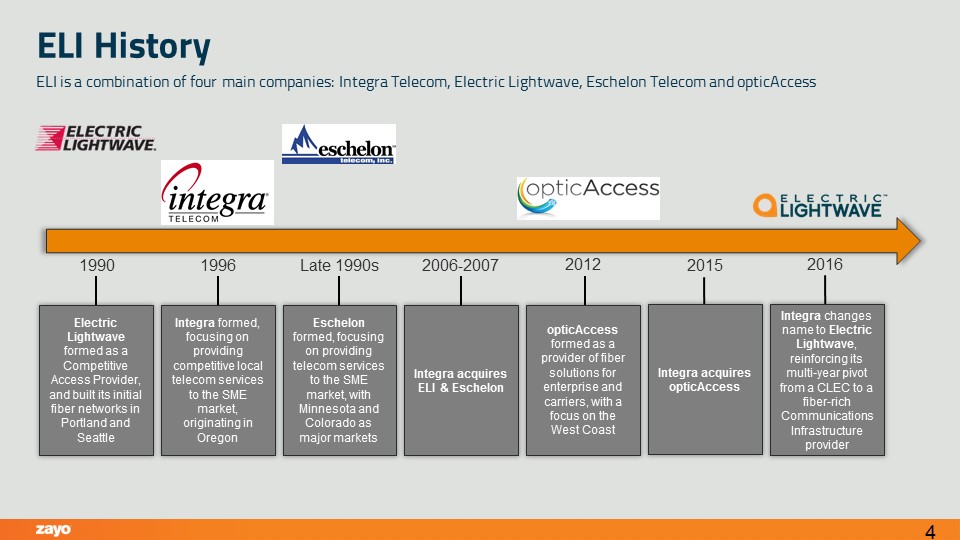

2012 2015 2016 Integra changes name to Electric Lightwave, reinforcing its multi-year pivot from a CLEC to a fiber-rich Communications Infrastructure provider ELI History ELI is a combination of four main companies: Integra Telecom, Electric Lightwave, Eschelon Telecom and opticAccess Integra acquires opticAccess opticAccess formed as a provider of fiber solutions for enterprise and carriers, with a focus on the West Coast Integra acquires ELI & Eschelon 2006-2007 Eschelon formed, focusing on providing telecom services to the SME market, with Minnesota and Colorado as major markets Late 1990s Integra formed, focusing on providing competitive local telecom services to the SME market, originating in Oregon 1996 Electric Lightwave formed as a Competitive Access Provider, and built its initial fiber networks in Portland and Seattle 1990 4 |

|

|

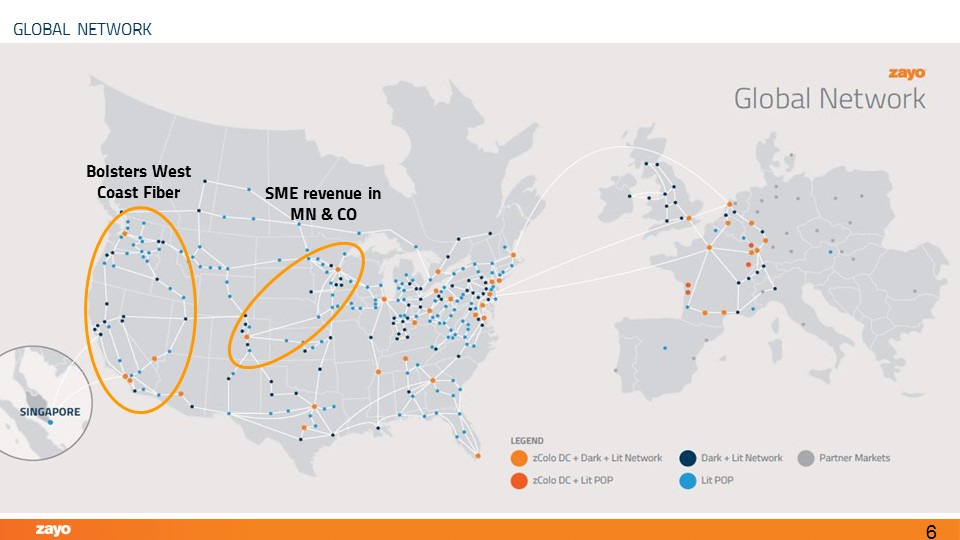

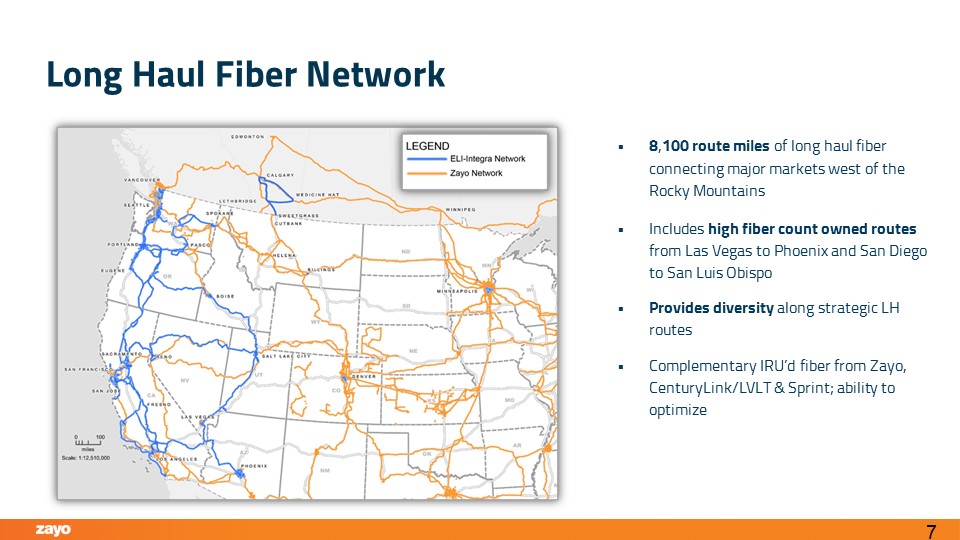

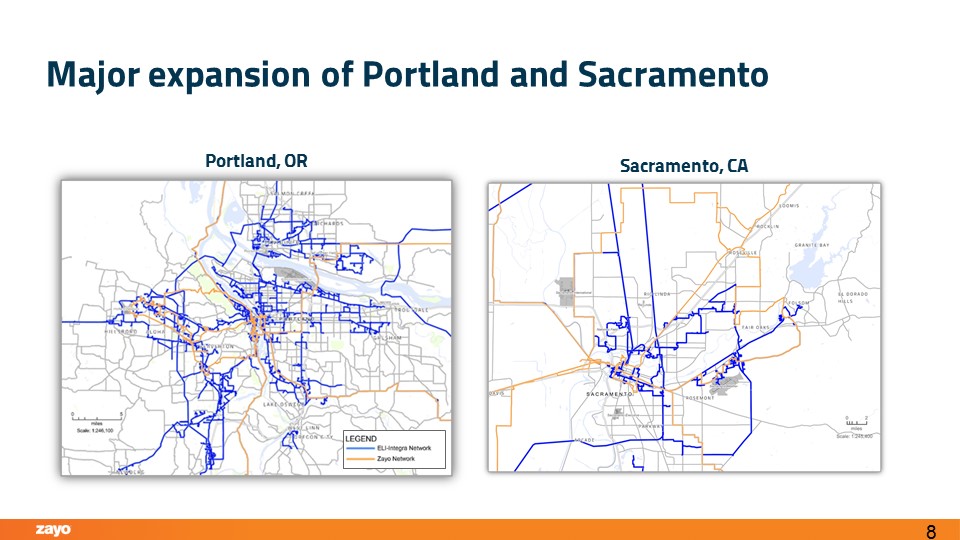

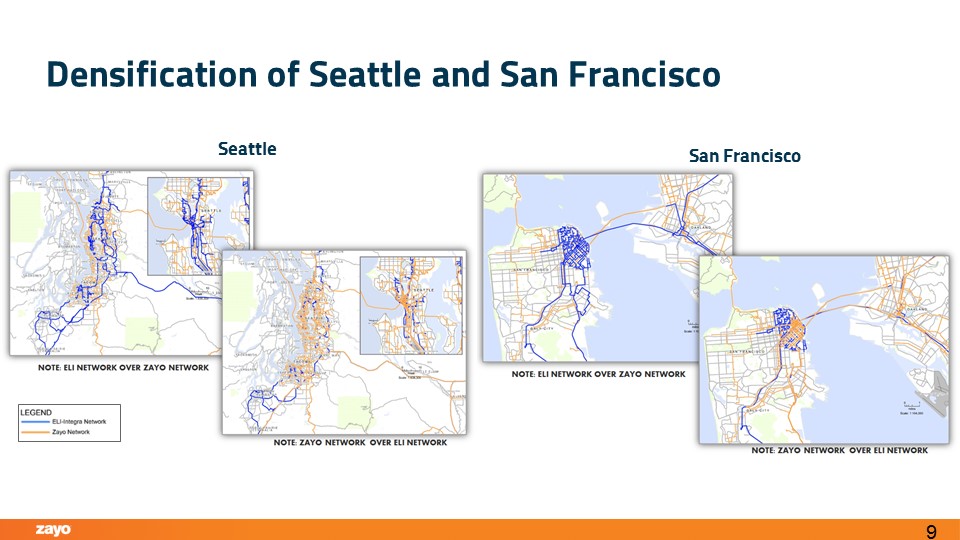

ELI strengthens Zayo’s fiber position along the West Coast ELI’s broad and deep fiber asset is highly complementary to Zayo’s existing network 8,100 route miles of long haul fiber connecting major markets west of the Rocky Mountains 4,000 route miles of metro fiber in 35 markets including: San Francisco, Portland, Seattle, Sacramento, Salt Lake City, Spokane, Boise, and Phoenix ~110 average fiber count in metro markets 3,100 on-net enterprise buildings Zayo’s Communications Infrastructure business benefits from the combination of network assets Network is additive to Zayo’s mobile infrastructure builds Cost synergies realized from densification of networks Revenue synergies expected from the increase in scale 5 |

|

|

6 GLOBAL NETWORK Bolsters West Coast Fiber SME revenue in MN & CO |

|

|

Long Haul Fiber Network 7 8,100 route miles of long haul fiber connecting major markets west of the Rocky Mountains Includes high fiber count owned routes from Las Vegas to Phoenix and San Diego to San Luis Obispo Provides diversity along strategic LH routes Complementary IRU’d fiber from Zayo, CenturyLink/LVLT & Sprint; ability to optimize |

|

|

8 Major expansion of Portland and Sacramento Portland, OR Sacramento, CA |

|

|

9 Densification of Seattle and San Francisco Seattle San Francisco |

|

|

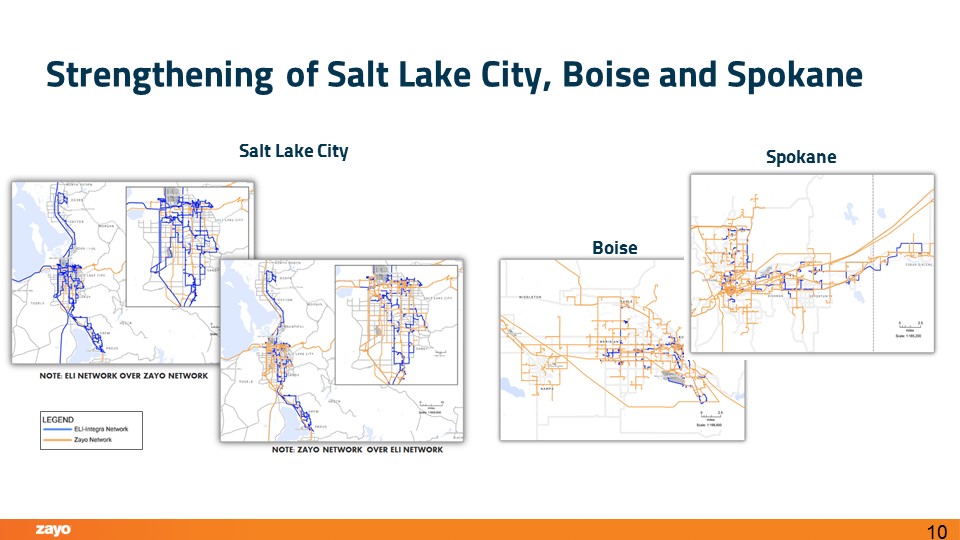

10 Strengthening of Salt Lake City, Boise and Spokane Salt Lake City Spokane Boise |

|

|

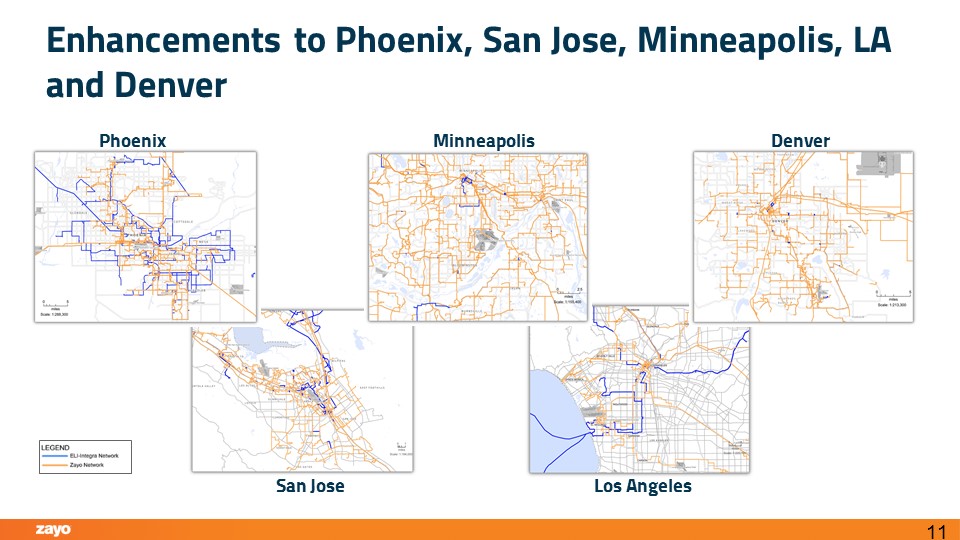

11 Enhancements to Phoenix, San Jose, Minneapolis, LA and Denver Phoenix Minneapolis Denver Los Angeles San Jose |

|

|

Now is an opportune time for Zayo to acquire Historically, “Integra” focused on CLEC business model From 2011 to 2016, “Integra” began transition to fiber-focused business model In August 2016, changed name to ELI and began separation into two businesses: Communications Infrastructure (Electric Lightwave) and legacy business (Integra) Reinforced ELI’s commitment to Communications Infrastructure As separation is not yet operationally complete, Zayo is uniquely positioned acquiror and has meaningful opportunity to create value by completing separation Strong track record of de-integrating businesses with ability to maximize value of both segments Excellent understanding of complementary west coast assets 12 |

|

|

High Level Integration Plan Focus on leveraging fiber assets as Communications Infrastructure 35-45% of ELI revenue Heavy and rapid integration into core Zayo organization, processes and systems Target >50% EBITDA contribution Leverage Allstream workstream to optimize value of SME and Voice businesses Complete de-integration from Communications Infrastructure business Believe viable and valuable cash-flow generating businesses, though with low to negative growth Target >20% EBITDA contribution Over ~4 quarters, migrate customers and revenue, where appropriate, from Integra MN & CO base to core Zayo; potentially 5-10% of aggregate ELI revenue Anticipate overall synergies to be >$40M in annual run rate, achieve within 5 quarters of close 13 |

|

|

Summary Fiber rich and complementary assets in important west coast markets Low pre-synergy and post-synergy purchase price multiple Zayo’s balance sheet enables funding at a low incremental cost of capital Zayo uniquely positioned acquiror, given complementary assets, integration expertise and timing of ELI’s pivot to Communications Infrastructure Strengthens Zayo’s position as only independent national infrastructure focused provider 14 |

|

|

Q & A |

|

|

Thank You |