Exhibit 99.1

Please note that certain of the information in this presentation is covered under the Safe Harbor provisions of the Private Securities Litigation Reform Act. We caution viewers of this presentation that Bioptix’s (f/k/a Venaxis, Inc.) management will be making forward-looking statements. Actual results could differ materially from those stated or implied by these forward-looking statements due to risks and uncertainties associated with the the company's business. These forward-looking statements are qualified by the cautionary statements contained in our news releases and SEC filings, including our Annual Report on Form 10-K for the year ended December 31, 2015, which Venaxis filed on March 23, 2016 and our Quarterly Report on Form 10-Q for the period ended September 30,2016, which was filed on November 14, 2016. This presentation also contains time-sensitive information that is accurate only as of the date of this presentation. We undertake no obligation to revise or update any forward-looking statement to reflect events or circumstances after the date of this presentation.

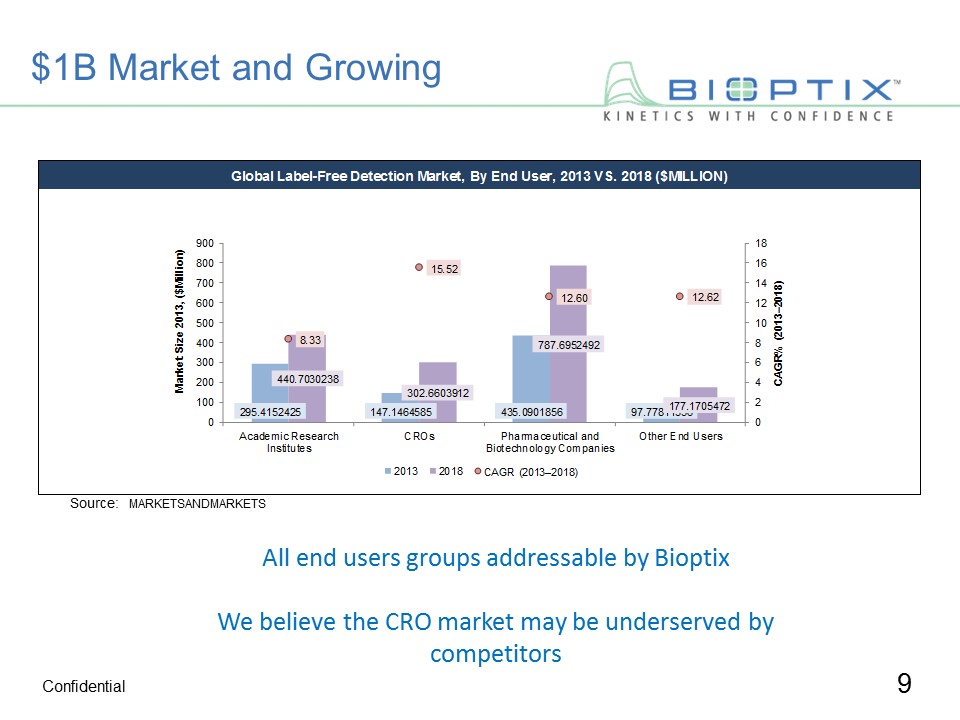

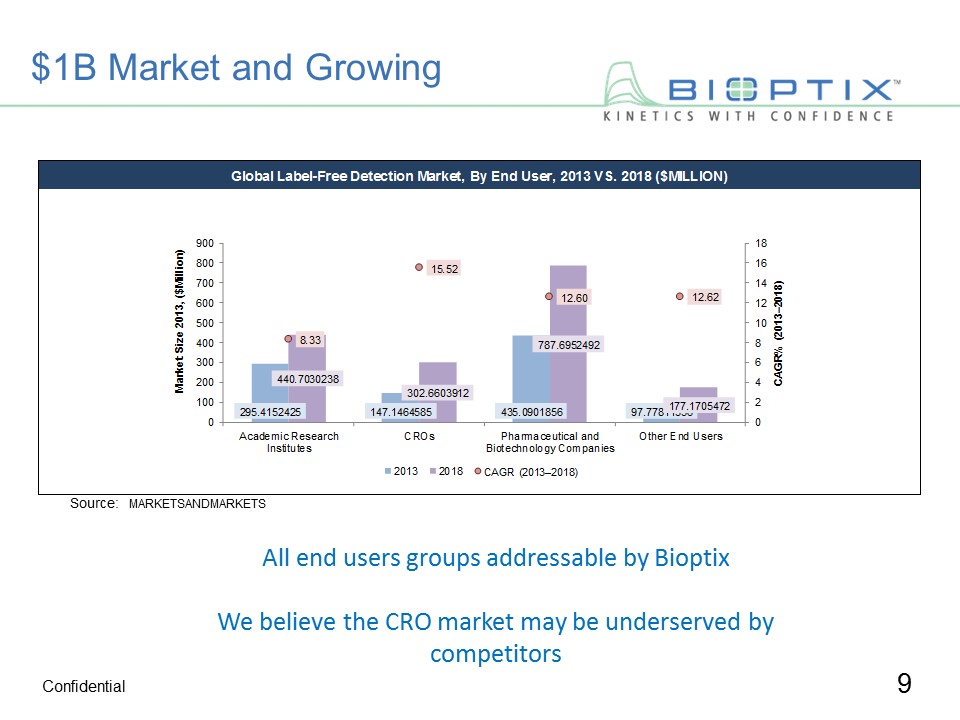

•Venaxis was seeking an attractive business combination in the life science or diagnostic space •On September 12, 2016 Venaxis announced the acquisition of BiOptix •Venaxis acquired BiOptix by issuing ~ 14% of its outstanding shares while incurring modest transactional costs •BiOptix, prior to Venaxis’ involvement had previously invested more than $20 mil developing its products and services, however it lacked funding to actively pursue commercialization of the 404pi and consumables •Venaxis’ capital spending is being focused to advance commercialization and nhancements to the BiOptix products and services •The market for BiOptix type products is large, growing and estimated in the range of $1B annually •The customer feedback received in our due diligence process on the BiOptix product and team was excellent •Life Science products in this field do not require FDA approval to commercialize

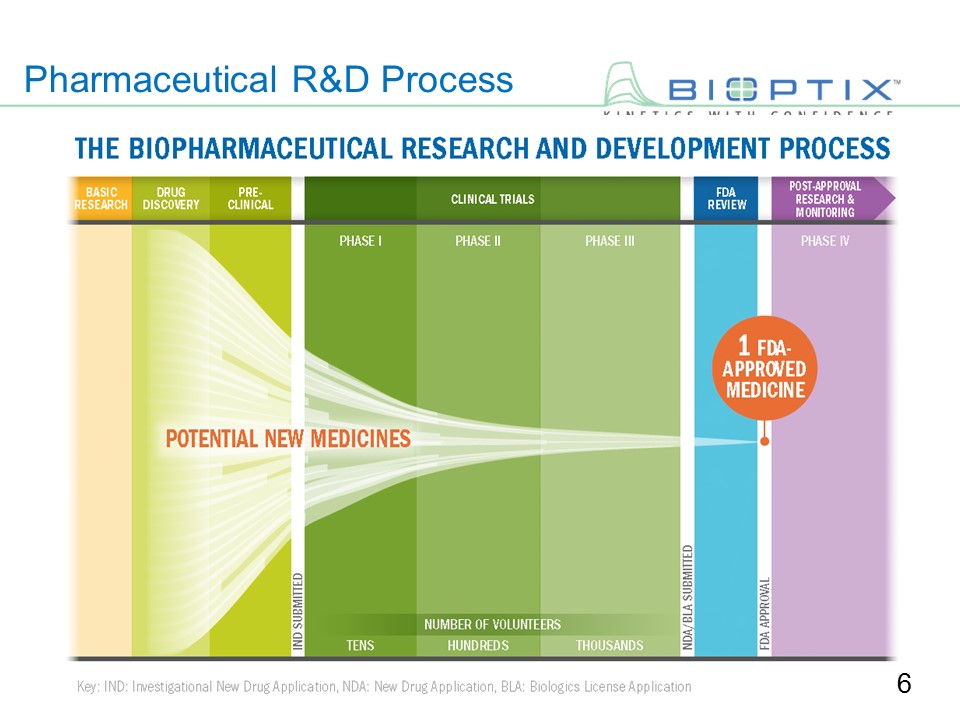

Big Pharma and Biotech companies have freezers full of old and new molecules that are potential drug candidates Biologics (e.g. Enbrel, Humira) have added to the realm of drug candidates which expands additional potential revenue and complexity Pharma and Biotech desire to ensure early on in development that their molecules have functionality against the disease target Bioptix products measure binding kinetics, affinities, and other key characteristics in a label-free manner-essential in drug development Bioptix’ instruments allow scientists to evaluate the biophysical properties of their drug candidates against specific disease states in the early stages of drug development

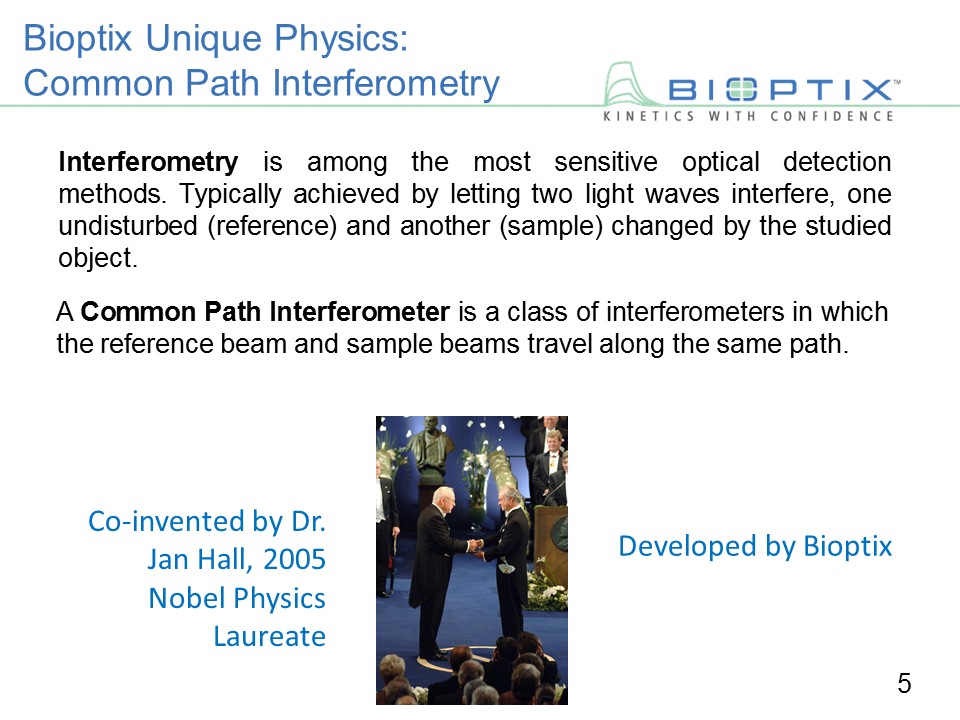

Interferometry is among the most sensitive optical detection methods. Typically achieved by letting two light waves interfere, one undisturbed (reference) and another (sample) changed by the studied object.

A Common Path Interferometer is a class of interferometers in which the reference beam and sample beams travel along the same path.

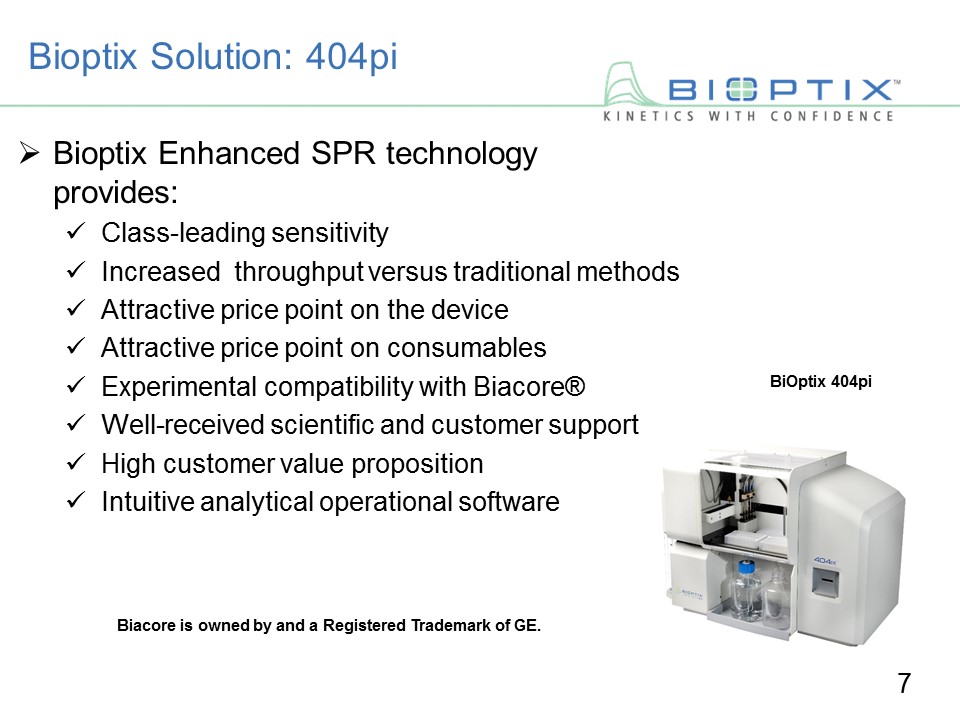

BioptixEnhanced SPR technology provides: Class-leading sensitivity Increased throughput versus traditional methods Attractive price point on the device Attractive price point on consumables Experimental compatibility with Biacore® Well-received scientific and customer support High customer value proposition Intuitive analytical operational software

UCSD:

“…the instrument is in use nearly 24/7…the unit has performed well…BiOptix offers a good compromise between throughput and sensitivity…customer service and support is world-class…BiOptix is an absolute pleasure to work with…we highly recommend the BiOptix 404pi…!”

Geoffrey Chang, Ph.D. University of California, San Diego (UCSD) Biogen: “…I just wanted to pass along another note of thanks—Bridget and Scott have been incredibly helpful in continuing to help me with assay development and data analysis questions. I truly appreciate your team’s dedication to customer support and am so happy to be working with your company! Xin Sun, Ph. D. Sr. Director of Bioassay Development

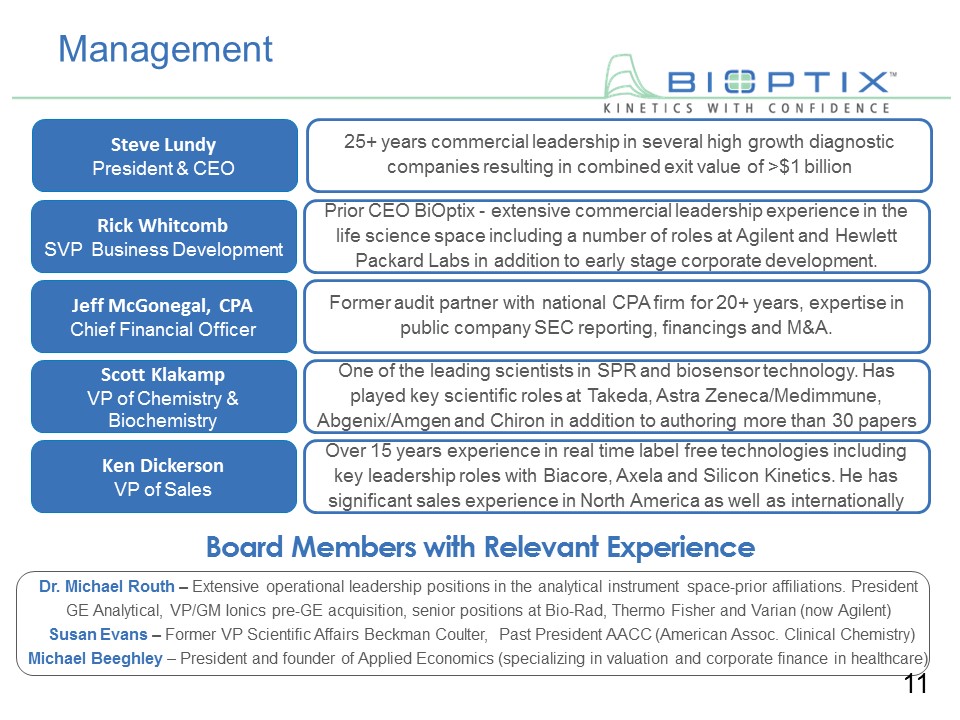

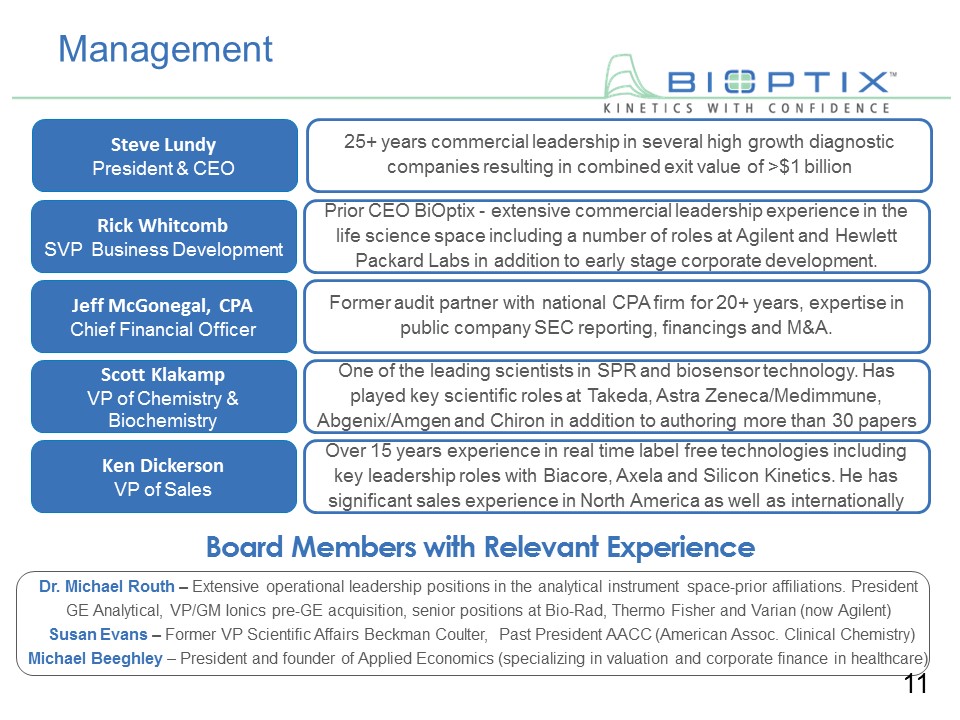

Steve Lundy President & CEO 25+ years commercial leadership in several high growth diagnostic companies resulting in combined exit value of >$1 billion Rick Whitcomb SVP Business Development Prior CEO BiOptix - extensive commercial leadership experience in the life science space ncluding a number of roles at Agilent and Hewlett Packard Labs in addition to early stage corporate development. Jeff McGonegal, CPA Chief Financial Officer Former audit partner with national CPA firm for 20+ years, expertise in public company SEC reporting, financings and M&A. Scott Klakamp VP of Chemistry & Biochemistry One of the leading scientists in SPR and biosensor technology. Has played key scientific roles at Takeda, Astra Zeneca/Medimmune, Abgenix/Amgen and Chiron in addition to authoring more than 30 papers Ken Dickerson VP of Sales Over 15 years experience in real time label free technologies including key leadership roles with Biacore, Axela and Silicon Kinetics. He has significant sales experience in North America as well as internationally Dr. Michael Routh– Extensive operational leadership positions in the analytical instrument space-prior affiliations. President GE Analytical, VP/GM Ionics pre-GE acquisition, senior positions at Bio-Rad, Thermo Fisher and Varian (now Agilent) Susan Evans – Former VP Scientific Affairs Beckman Coulter, Past President AACC (American Assoc. Clinical Chemistry) Michael Beeghley – President and founder of Applied Economics (specializing in valuation and corporate finance in healthcare)

Hire and train Regional Sales Managers, Inside Sales staff and Field Application Scientists Bioptix 404pi expanded production Demo units build-out Continue product advances Expand sales traction Create significant sales funnel Continue to achieve high level of customer satisfaction

|

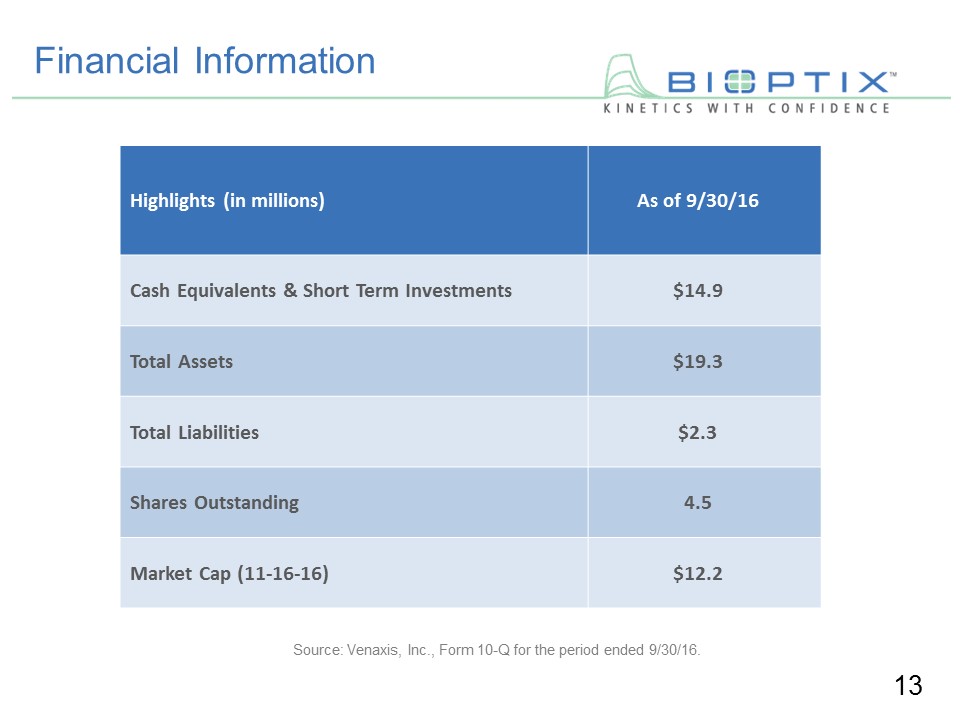

Highlights (in millions)

|

As of 9/30/16

|

|

Cash Equivalents & Short Term Investments

|

$14.9

|

|

Total Assets

|

$19.3

|

|

Total Liabilities

|

$2.3

|

|

Shares Outstanding

|

4.5

|

|

Market Cap (11-16-16)

|

$12.2

|