Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Gogo Inc. | d300111d8k.htm |

November 30, 2016 Bank of America Leveraged Finance Conference Exhibit 99.1

SAFE HARBOR STATEMENT This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are based on management’s beliefs and assumptions and on information currently available to management. Most forward-looking statements contain words that identify them as forward-looking, such as “anticipates,” “believes,” “continues,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms that relate to future events. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Gogo’s actual results, performance or achievements to be materially different from any projected results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent the beliefs and assumptions of Gogo only as of the date of this presentation and Gogo undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. As such, Gogo’s future results may vary from any expectations or goals expressed in, or implied by, the forward-looking statements included in this presentation, possibly to a material degree. Gogo cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial or operational goals and targets will be realized. In particular, the availability and performance of certain technology solutions yet to be implemented by the Company set forth in this presentation represent aspirational long-term goals based on current expectations. For a discussion of some of the important factors that could cause Gogo’s results to differ materially from those expressed in, or implied by, the forward-looking statements included in this presentation, investors should refer to the disclosure contained under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Note to Certain Operating and Financial Data In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), Gogo also discloses in this presentation certain non-GAAP financial information, including Adjusted EBITDA. This financial measure is not a recognized measure under GAAP, and when analyzing our performance, investors should use Adjusted EBITDA in addition to, and not as an alternative to, net loss attributable to common stock as a measure of operating results. In addition, this presentation contains various customer metrics and operating data, including numbers of aircraft or units online, that are based on internal company data, as well as information relating to the commercial and business aviation market, and our position within those markets. While management believes such information and data are reliable, they have not been verified by an independent source and there are inherent challenges and limitations involved in compiling data across various geographies and from various sources.

Who We Are Our Competitive Advantage Strong Execution And Path To Profitability GOGOAIR.COM | Why Invest In Gogo

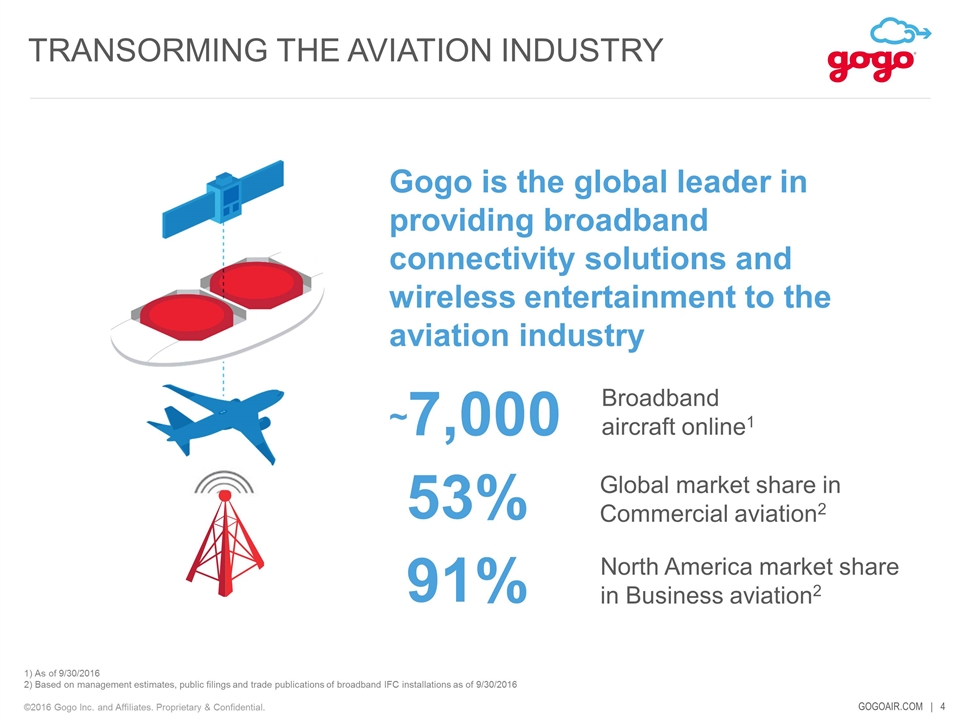

TRANSORMING THE AVIATION INDUSTRY 1) As of 9/30/2016 2) Based on management estimates, public filings and trade publications of broadband IFC installations as of 9/30/2016 Gogo is the global leader in providing broadband connectivity solutions and wireless entertainment to the aviation industry ~7,000 53% 91% North America market share in Business aviation2 Broadband aircraft online1 Global market share in Commercial aviation2

WHILE DELIVERING ENOURMOUS VALUE Passenger Experience Passenger Connectivity & Entertainment Aircraft Operational Efficiencies Rebooking Travel Baggage Tracker Digitized Attendants Turbulence Avoidance Lower Fuel Costs Maintenance Savings Turbulence Avoidance Internet Streaming Movies IPTV

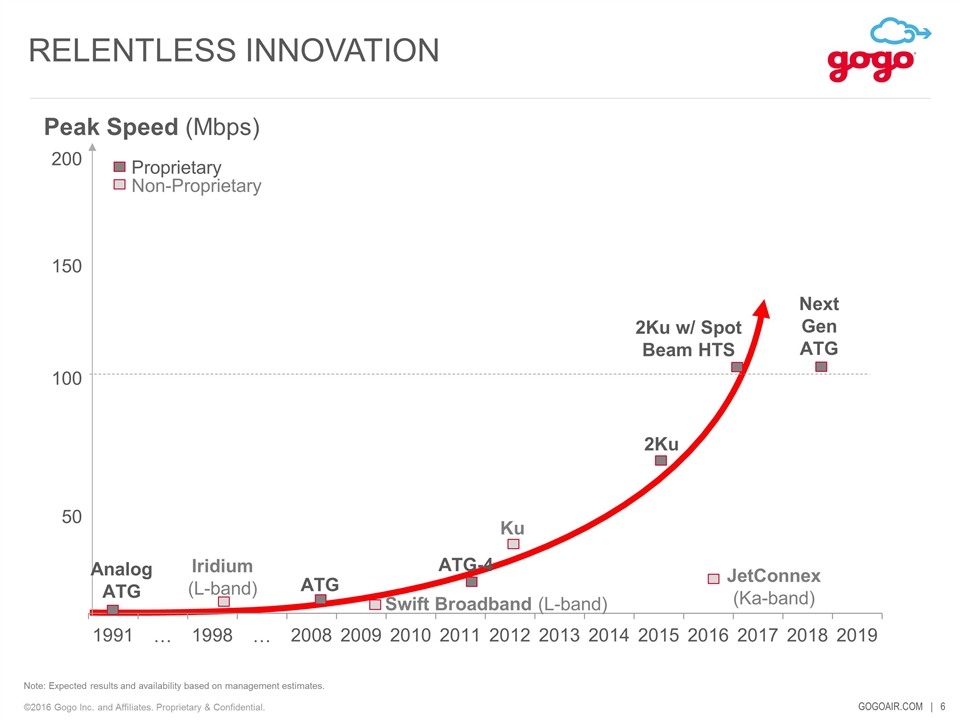

RELENTLESS INNOVATION Peak Speed (Mbps) ATG Ku 2Ku 50 100 Proprietary Non-Proprietary Next Gen ATG Analog ATG 2Ku w/ Spot Beam HTS ATG-4 Note: Expected results and availability based on management estimates. Iridium (L-band) JetConnex (Ka-band) Swift Broadband (L-band) 200 150

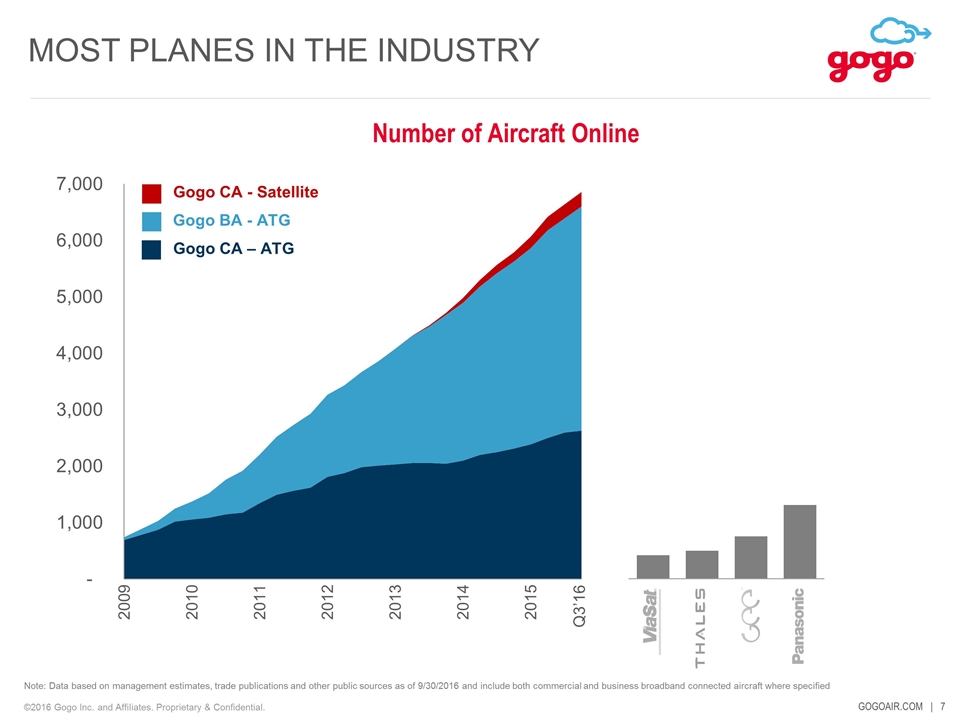

MOST PLANES IN THE INDUSTRY Gogo CA - Satellite Gogo BA - ATG Gogo CA – ATG Note: Data based on management estimates, trade publications and other public sources as of 9/30/2016 and include both commercial and business broadband connected aircraft where specified Q3’16 Number of Aircraft Online

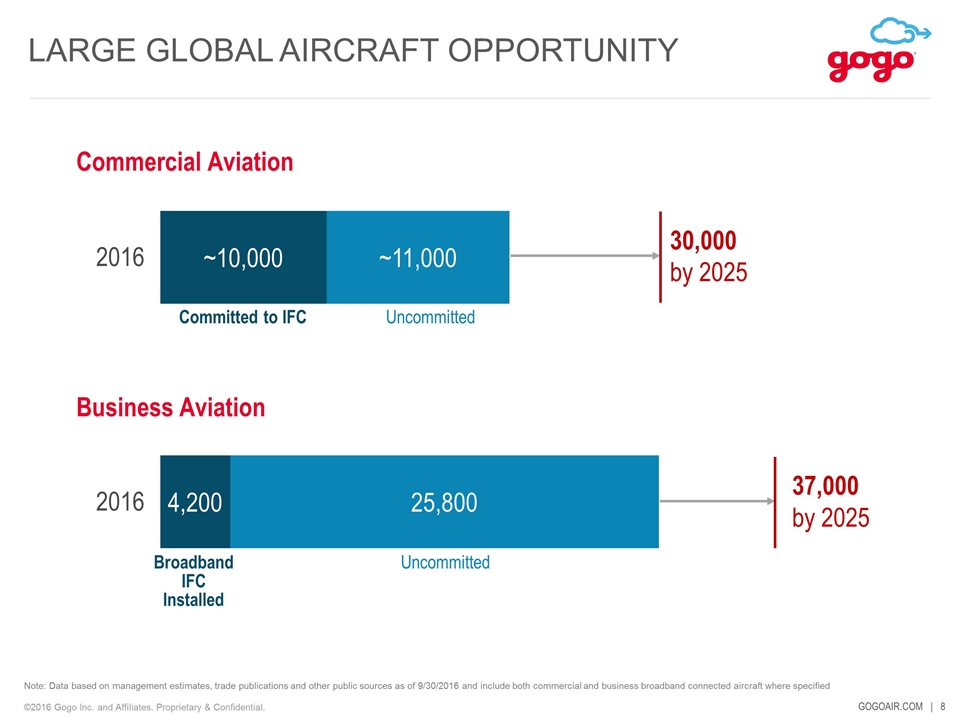

LARGE GLOBAL AIRCRAFT OPPORTUNITY Note: Data based on management estimates, trade publications and other public sources as of 9/30/2016 and include both commercial and business broadband connected aircraft where specified Commercial Aviation 30,000 by 2025 37,000 by 2025 Uncommitted Uncommitted Broadband IFC Installed Business Aviation Committed to IFC

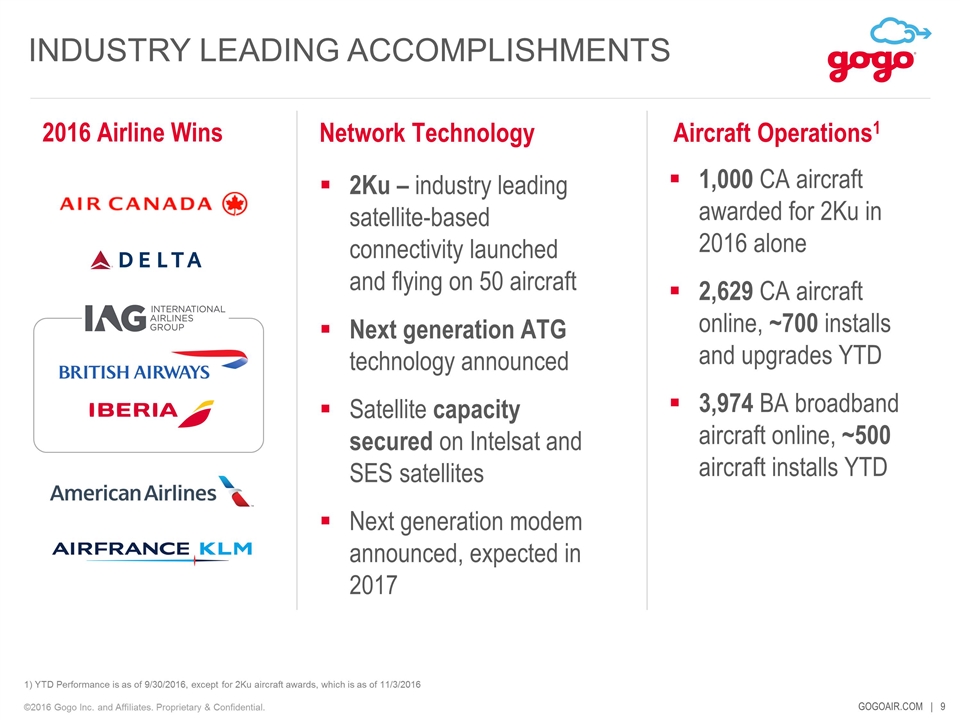

Network Technology Aircraft Operations1 INDUSTRY LEADING ACCOMPLISHMENTS 2016 Airline Wins 2Ku – industry leading satellite-based connectivity launched and flying on 50 aircraft Next generation ATG technology announced Satellite capacity secured on Intelsat and SES satellites Next generation modem announced, expected in 2017 1,000 CA aircraft awarded for 2Ku in 2016 alone 2,629 CA aircraft online, ~700 installs and upgrades YTD 3,974 BA broadband aircraft online, ~500 aircraft installs YTD 1) YTD Performance is as of 9/30/2016, except for 2Ku aircraft awards, which is as of 11/3/2016

Who We Are Competitive Advantage Strong Execution And Path To Profitability GOGOAIR.COM | Why Invest In Gogo

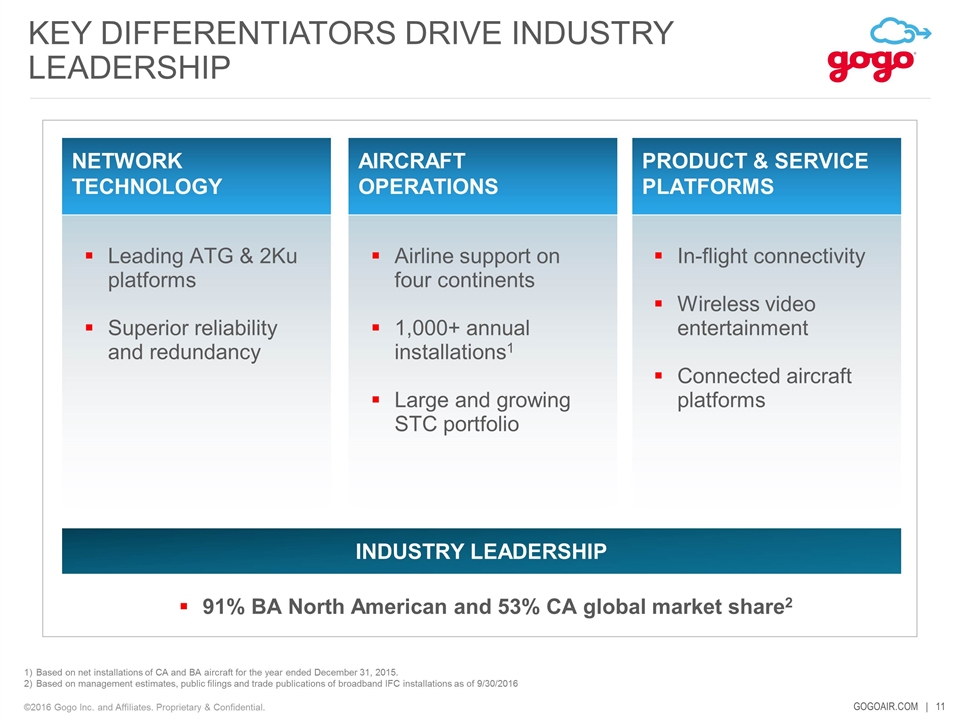

Airline support on four continents 1,000+ annual installations1 Large and growing STC portfolio KEY DIFFERENTIATORS DRIVE INDUSTRY LEADERSHIP 91% BA North American and 53% CA global market share2 INDUSTRY LEADERSHIP NETWORK TECHNOLOGY PRODUCT & SERVICE PLATFORMS AIRCRAFT OPERATIONS Based on net installations of CA and BA aircraft for the year ended December 31, 2015. Based on management estimates, public filings and trade publications of broadband IFC installations as of 9/30/2016 Leading ATG & 2Ku platforms Superior reliability and redundancy In-flight connectivity Wireless video entertainment Connected aircraft platforms

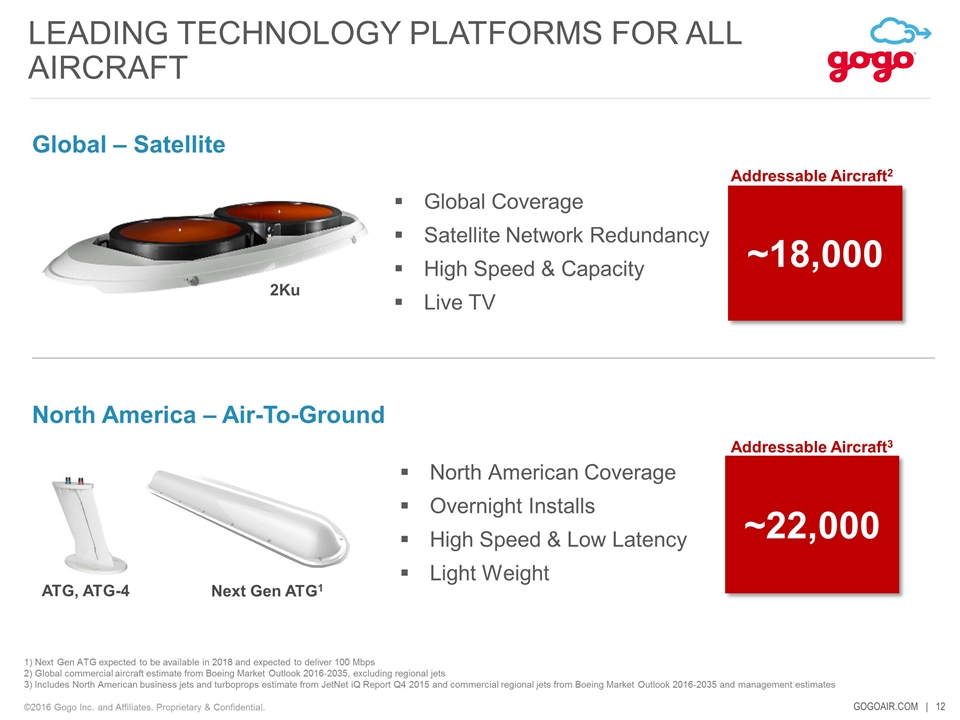

1) Next Gen ATG expected to be available in 2018 and expected to deliver 100 Mbps 2) Global commercial aircraft estimate from Boeing Market Outlook 2016-2035, excluding regional jets 3) Includes North American business jets and turboprops estimate from JetNet iQ Report Q4 2015 and commercial regional jets from Boeing Market Outlook 2016-2035 and management estimates 2Ku Global Coverage Satellite Network Redundancy High Speed & Capacity Live TV Global – Satellite LEADING TECHNOLOGY PLATFORMS FOR ALL AIRCRAFT ~18,000 Addressable Aircraft2 Next Gen ATG1 ATG, ATG-4 North American Coverage Overnight Installs High Speed & Low Latency Light Weight North America – Air-To-Ground ~22,000 Addressable Aircraft3

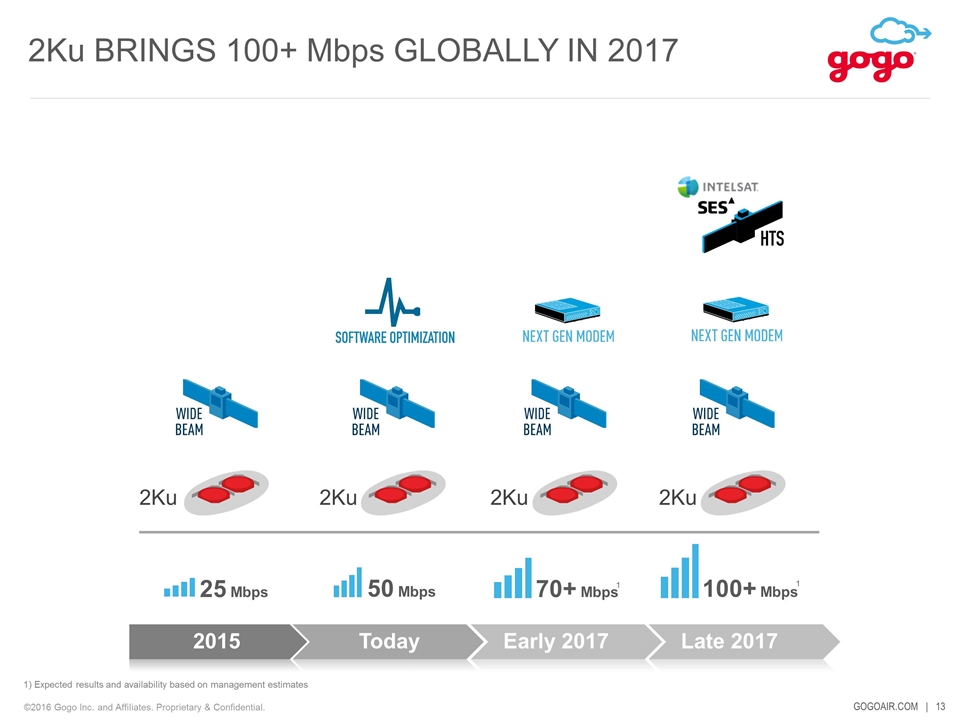

2Ku BRINGS 100+ Mbps GLOBALLY IN 2017 2015 Early 2017 Today Late 2017 2Ku 2Ku 2Ku 2Ku 1 1) Expected results and availability based on management estimates 25 Mbps 50 Mbps 70+ Mbps 100+ Mbps 1

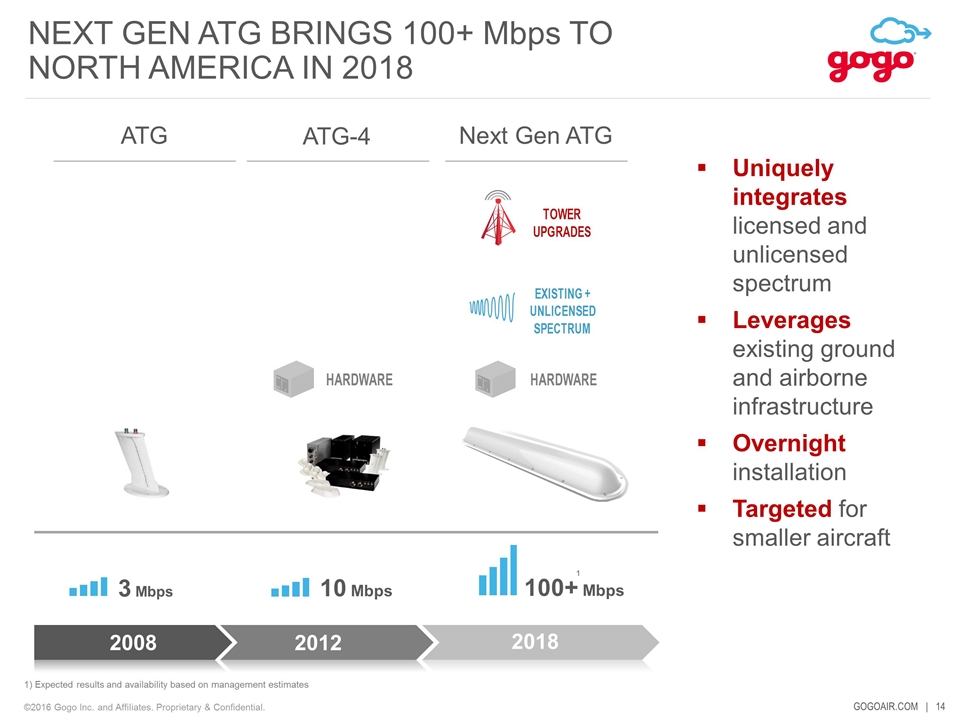

1) Expected results and availability based on management estimates 1 3 Mbps 10 Mbps 100+ Mbps Uniquely integrates licensed and unlicensed spectrum Leverages existing ground and airborne infrastructure Overnight installation Targeted for smaller aircraft NEXT GEN ATG BRINGS 100+ Mbps TO NORTH AMERICA IN 2018 2008 2018 2012 ATG ATG-4 Next Gen ATG

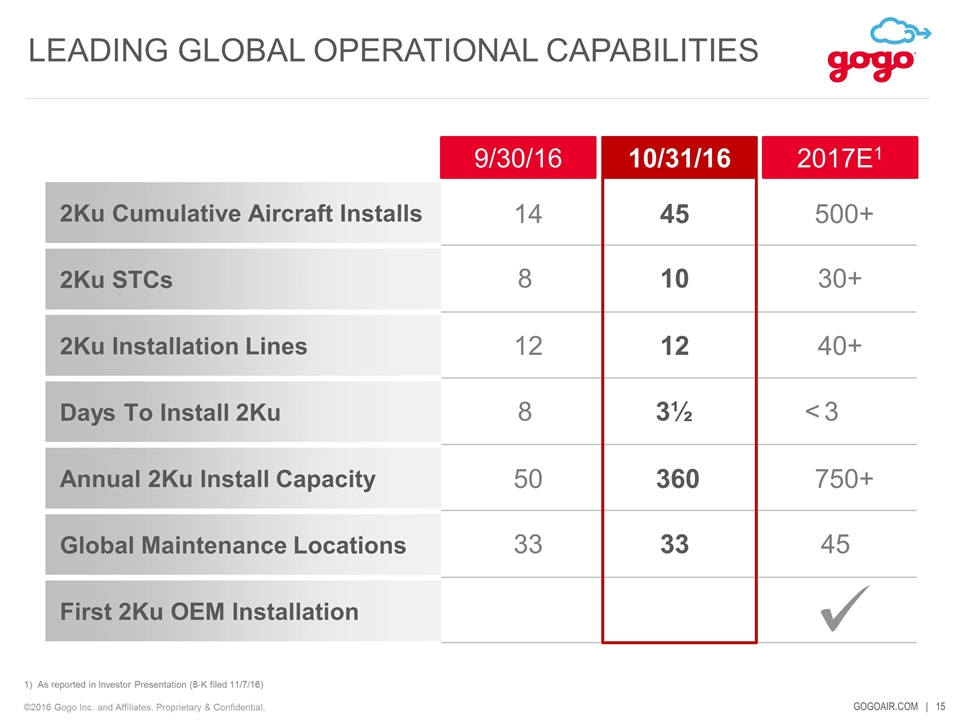

9/30/16 10/31/16 2017E1 2Ku Cumulative Aircraft Installs 2Ku Installation Lines Days To Install 2Ku Annual 2Ku Install Capacity 2Ku STCs Global Maintenance Locations 14 12 8 50 8 33 500+ 40+ < 3 750+ 30+ 45 45 12 3½ 360 10 33 First 2Ku OEM Installation LEADING GLOBAL OPERATIONAL CAPABILITIES 1) As reported in Investor Presentation (8-K filed 11/7/16)

Who We Are Competitive Advantage Strong Execution And Path To Profitability GOGOAIR.COM | Why Invest In Gogo

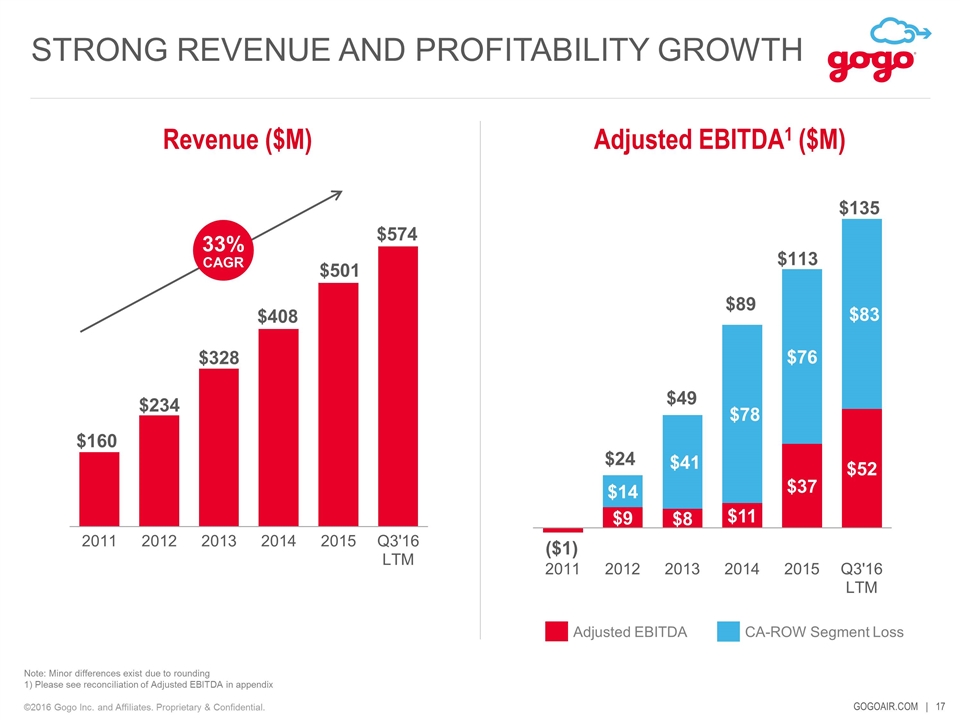

STRONG REVENUE AND PROFITABILITY GROWTH Note: Minor differences exist due to rounding 1) Please see reconciliation of Adjusted EBITDA in appendix $49 33% CAGR $89 CA-ROW Segment Loss Adjusted EBITDA $113 $24 $135 Revenue ($M) Adjusted EBITDA1 ($M)

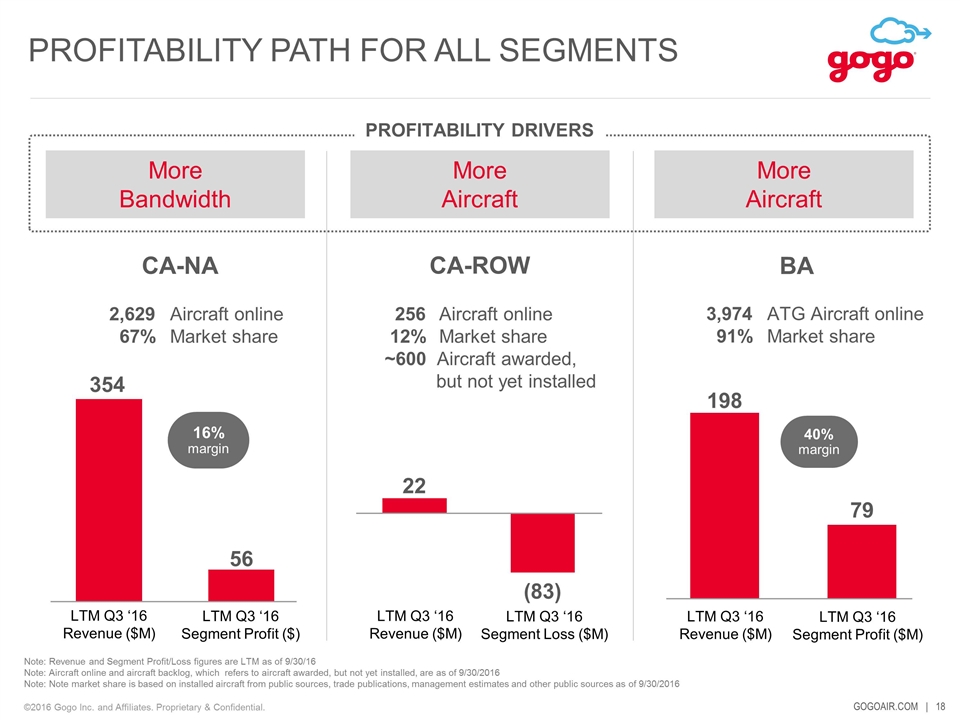

#1 More Bandwidth PROFITABILITY PATH FOR ALL SEGMENTS 16% margin 40% margin Note: Revenue and Segment Profit/Loss figures are LTM as of 9/30/16 Note: Aircraft online and aircraft backlog, which refers to aircraft awarded, but not yet installed, are as of 9/30/2016 Note: Note market share is based on installed aircraft from public sources, trade publications, management estimates and other public sources as of 9/30/2016 CA-NA CA-ROW BA 2,629 Aircraft online 67% Market share 256 Aircraft online 12% Market share ~600 Aircraft awarded, but not yet installed 3,974 ATG Aircraft online 91% Market share More Aircraft More Aircraft Profitability Drivers LTM Q3 ‘16 Revenue ($M) LTM Q3 ‘16 Segment Profit ($) LTM Q3 ‘16 Revenue ($M) LTM Q3 ‘16 Segment Loss ($M) LTM Q3 ‘16 Revenue ($M) LTM Q3 ‘16 Segment Profit ($M)

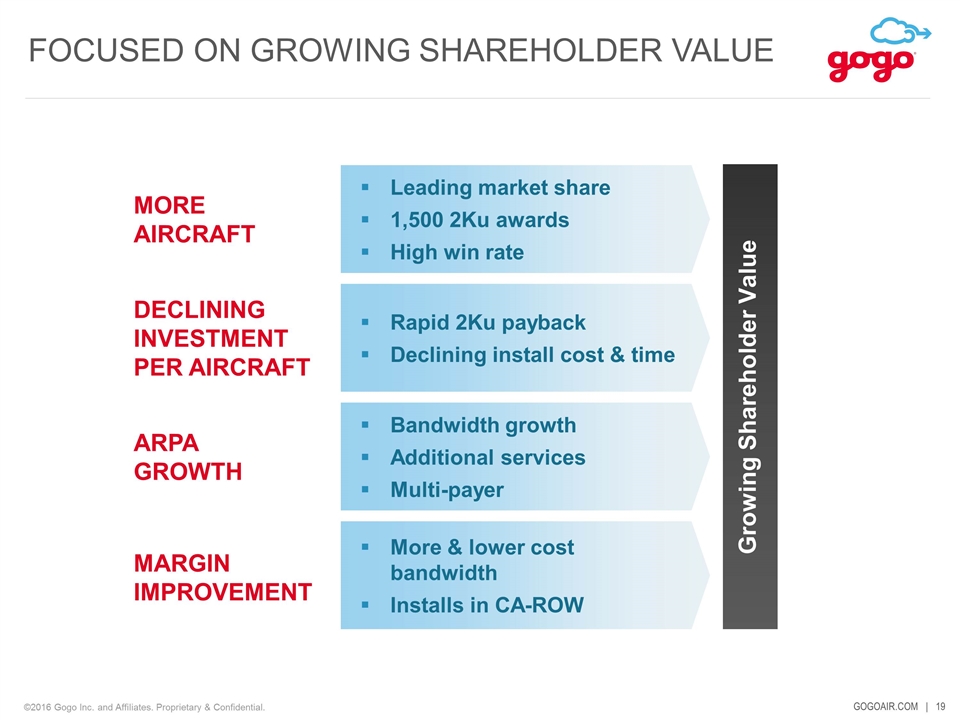

Growing Shareholder Value MORE AIRCRAFT Leading market share 1,500 2Ku awards High win rate DECLINING INVESTMENT PER AIRCRAFT ARPA GROWTH MARGIN IMPROVEMENT Rapid 2Ku payback Declining install cost & time Bandwidth growth Additional services Multi-payer More & lower cost bandwidth Installs in CA-ROW FOCUSED ON GROWING SHAREHOLDER VALUE

Scale CA-ROW segment to profitability Further reduce 2Ku installation costs Double ARPA by 2021 Achieve free cash flow in 2020 Scale Globally Expand Technology Leadership Grow Shareholder Value 1 2 3 STRATEGIC PRIORITIES (1) 1) Free cash flow is defined as cash flow from operating activities less consolidated capital expenditures. Extend global 2Ku roadmap Deploy next gen ATG solution Invest in our industry leading IFC & IFE platforms Install 1,500 2Ku aircraft awards Achieve 2Ku OEM offerability starting in 2017 Increase penetration of ATG systems in BA market

Who We Are Competitive Advantage Strong Execution And Path To Profitability GOGOAIR.COM | Why Invest In Gogo

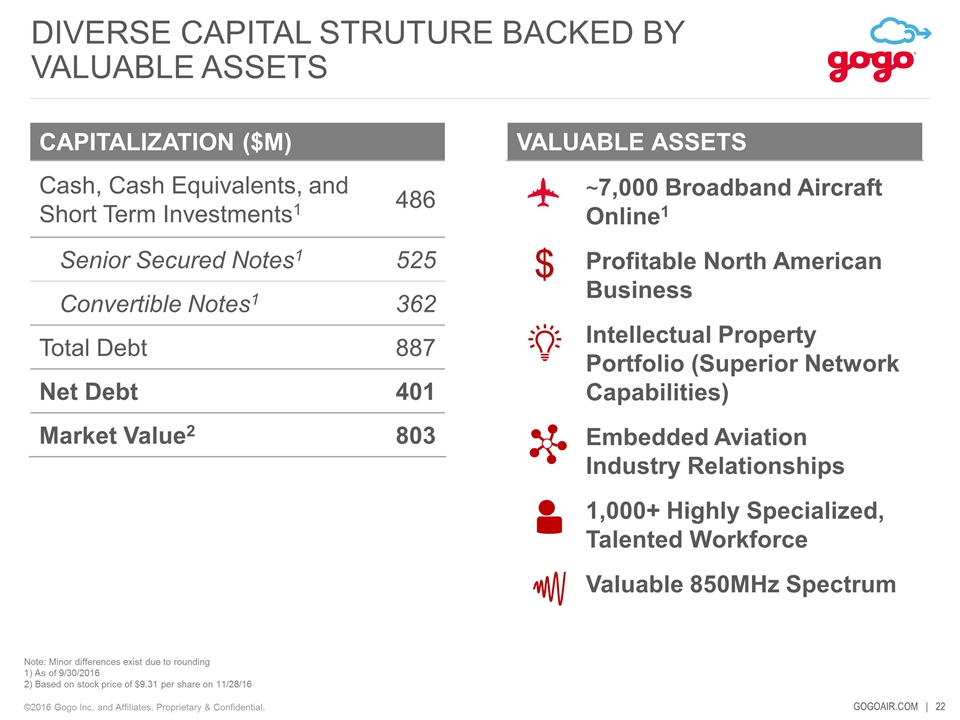

DIVERSE CAPITAL STRUTURE BACKED BY VALUABLE ASSETS Note: Minor differences exist due to rounding 1) As of 9/30/2016 2) Based on stock price of $9.31 per share on 11/28/16 CAPITALIZATION ($M) Cash, Cash Equivalents, and Short Term Investments1 486 Senior Secured Notes1 525 Convertible Notes1 362 Total Debt 887 Net Debt 401 Market Value2 803 ~7,000 Broadband Aircraft Online1 Profitable North American Business Intellectual Property Portfolio (Superior Network Capabilities) Embedded Aviation Industry Relationships 1,000+ Highly Specialized, Talented Workforce Valuable 850MHz Spectrum VALUABLE ASSETS $

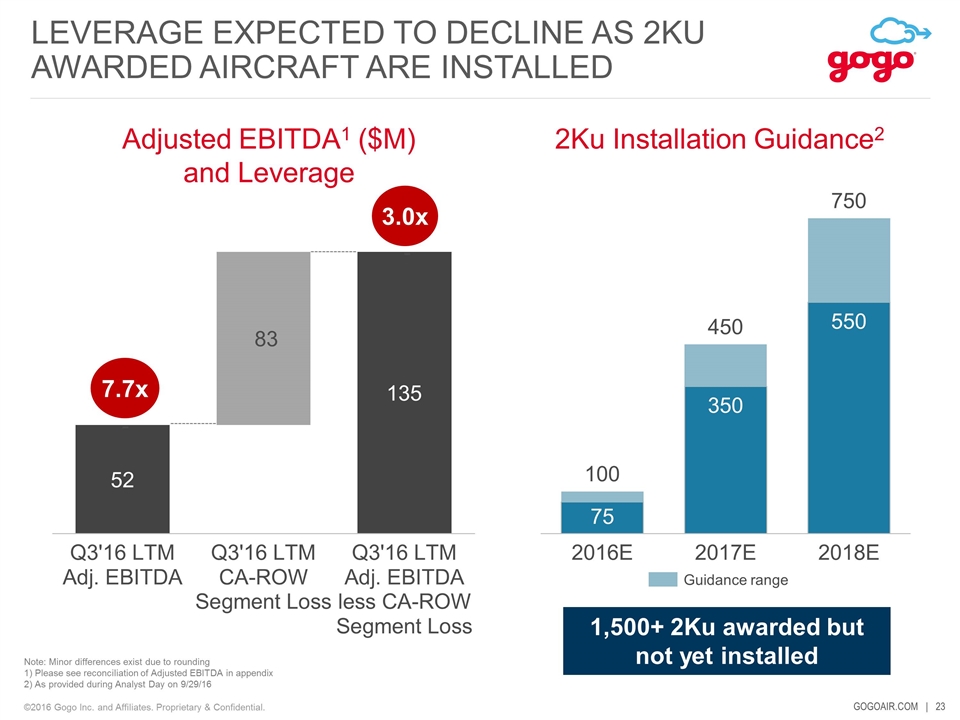

LEVERAGE EXPECTED TO DECLINE AS 2KU AWARDED AIRCRAFT ARE INSTALLED 7.7x 3.0x Guidance range Adjusted EBITDA1 ($M) and Leverage 2Ku Installation Guidance2 1,500+ 2Ku awarded but not yet installed Note: Minor differences exist due to rounding 1) Please see reconciliation of Adjusted EBITDA in appendix 2) As provided during Analyst Day on 9/29/16

WHY INVEST IN GOGO Leading Position, Experience & Scale Large Growth Opportunity Technology Leadership High Barriers to Entry Clear Path to Free Cash Flow

Appendix

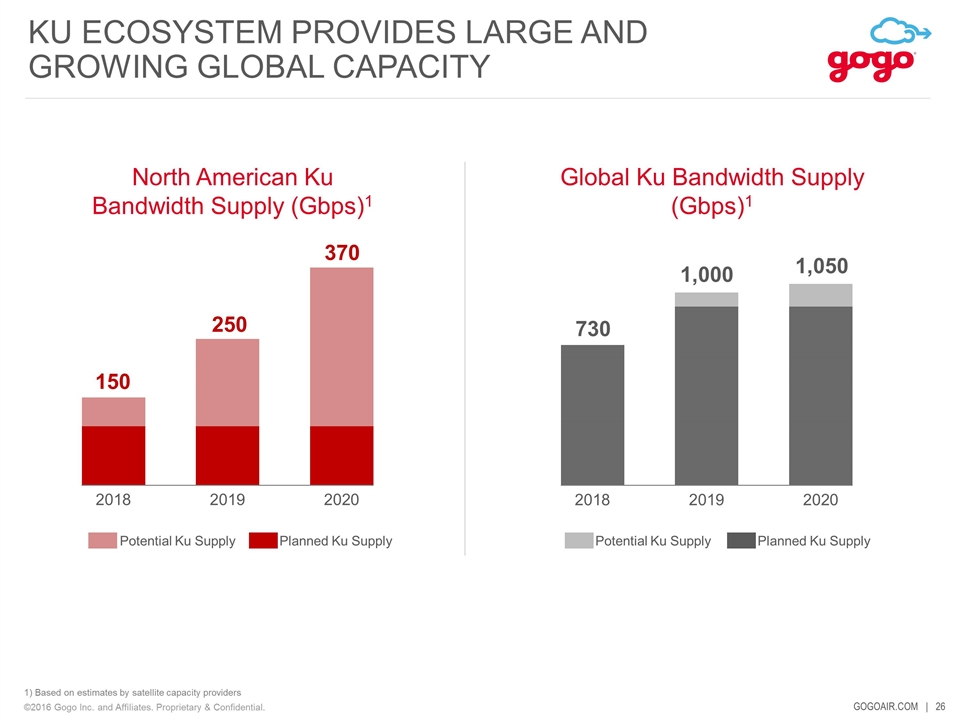

KU ECOSYSTEM PROVIDES LARGE AND GROWING GLOBAL CAPACITY 1) Based on estimates by satellite capacity providers Planned Ku Supply Potential Ku Supply Planned Ku Supply Potential Ku Supply 150 250 370 730 1,000 1,050 North American Ku Bandwidth Supply (Gbps)1 Global Ku Bandwidth Supply (Gbps)1

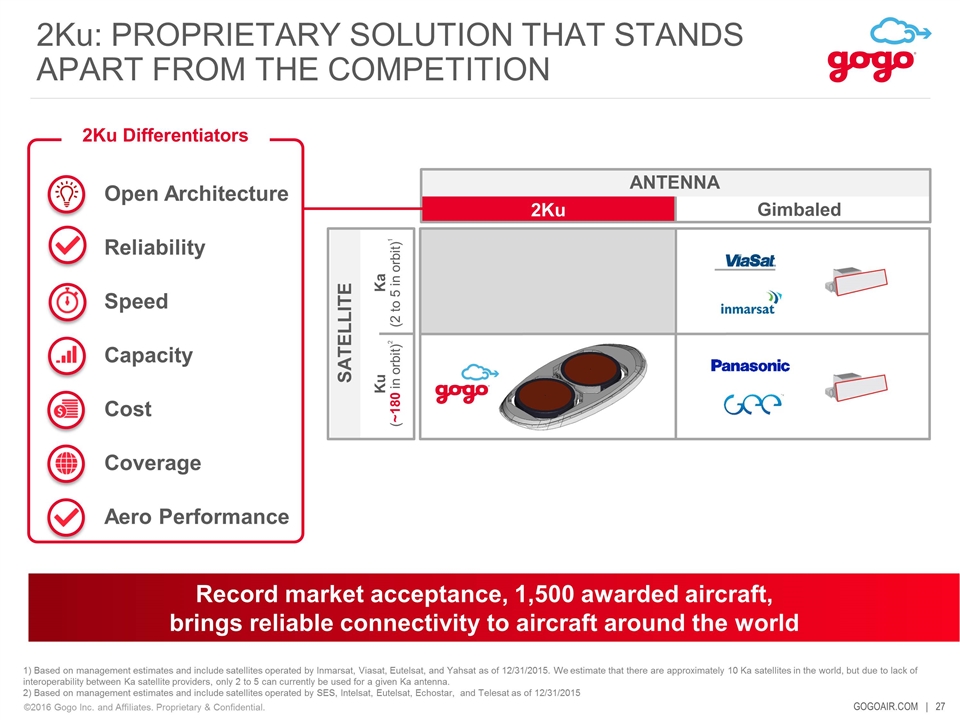

1) Based on management estimates and include satellites operated by Inmarsat, Viasat, Eutelsat, and Yahsat as of 12/31/2015. We estimate that there are approximately 10 Ka satellites in the world, but due to lack of interoperability between Ka satellite providers, only 2 to 5 can currently be used for a given Ka antenna. 2) Based on management estimates and include satellites operated by SES, Intelsat, Eutelsat, Echostar, and Telesat as of 12/31/2015 Ka (2 to 5 in orbit)1 2Ku Gimbaled Record market acceptance, 1,500 awarded aircraft, brings reliable connectivity to aircraft around the world Ku (~180 in orbit)2 SATELLITE ANTENNA 2Ku: PROPRIETARY SOLUTION THAT STANDS APART FROM THE COMPETITION Open Architecture Reliability Speed Capacity Cost Coverage Aero Performance 2Ku Differentiators

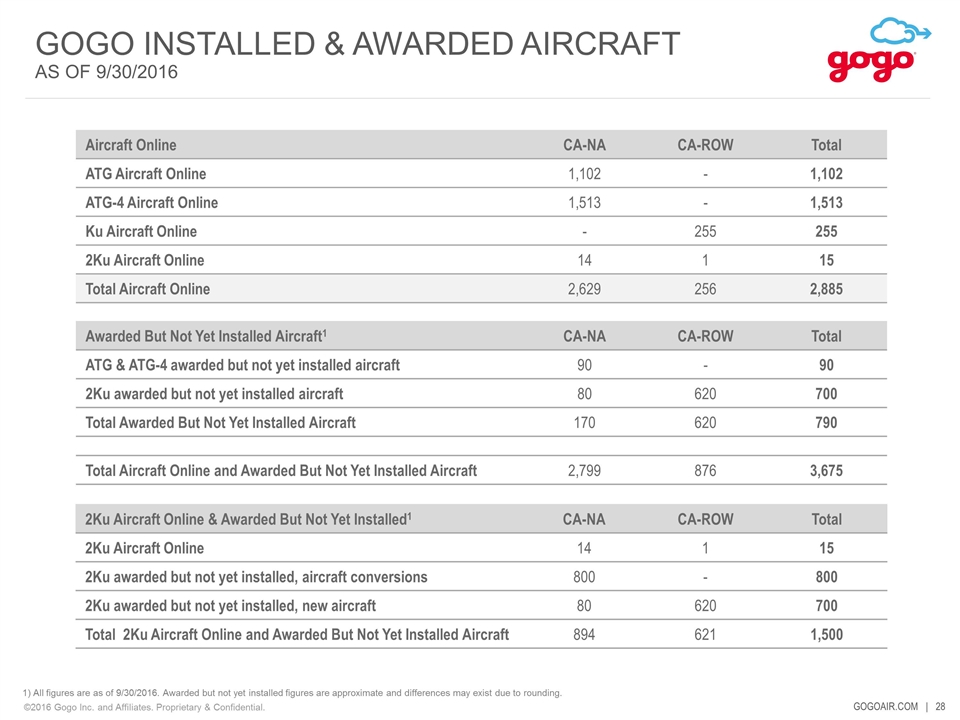

GOGO INSTALLED & AWARDED AIRCRAFT AS OF 9/30/2016 Aircraft Online CA-NA CA-ROW Total ATG Aircraft Online 1,102 - 1,102 ATG-4 Aircraft Online 1,513 - 1,513 Ku Aircraft Online - 255 255 2Ku Aircraft Online 14 1 15 Total Aircraft Online 2,629 256 2,885 Awarded But Not Yet Installed Aircraft1 CA-NA CA-ROW Total ATG & ATG-4 awarded but not yet installed aircraft 90 - 90 2Ku awarded but not yet installed aircraft 80 620 700 Total Awarded But Not Yet Installed Aircraft 170 620 790 Total Aircraft Online and Awarded But Not Yet Installed Aircraft 2,799 876 3,675 1) All figures are as of 9/30/2016. Awarded but not yet installed figures are approximate and differences may exist due to rounding. 2Ku Aircraft Online & Awarded But Not Yet Installed1 CA-NA CA-ROW Total 2Ku Aircraft Online 14 1 15 2Ku awarded but not yet installed, aircraft conversions 800 - 800 2Ku awarded but not yet installed, new aircraft 80 620 700 Total 2Ku Aircraft Online and Awarded But Not Yet Installed Aircraft 894 621 1,500

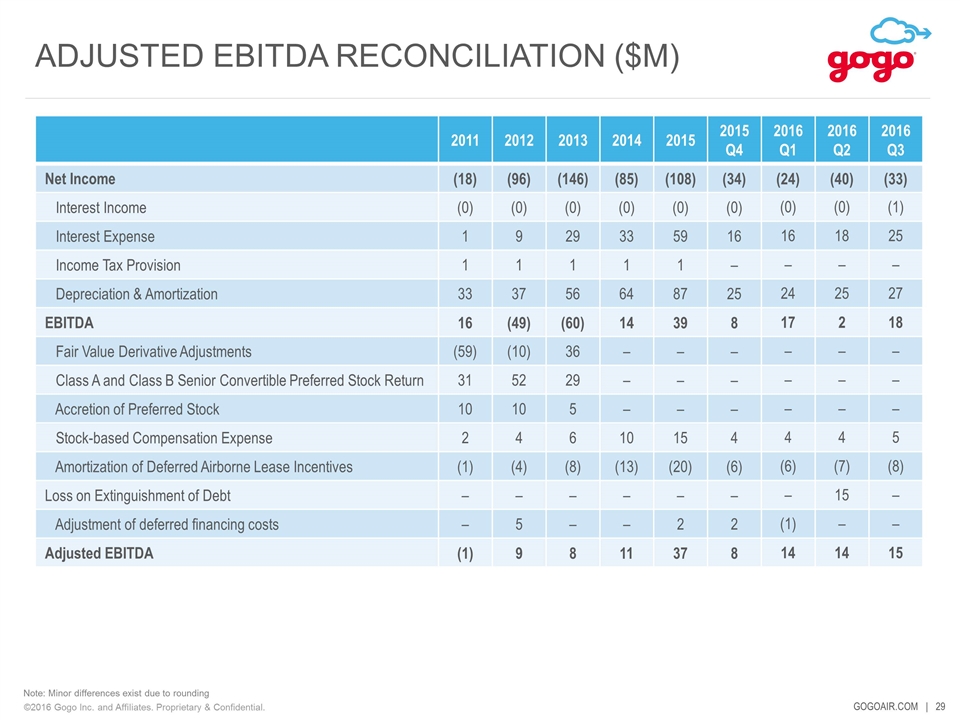

ADJUSTED EBITDA RECONCILIATION ($M) 2011 2012 2013 2014 2015 2015 Q4 2016 Q1 2016 Q2 2016 Q3 Net Income (18) (96) (146) (85) (108) (34) (24) (40) (33) Interest Income (0) (0) (0) (0) (0) (0) (0) (0) (1) Interest Expense 1 9 29 33 59 16 16 18 25 Income Tax Provision 1 1 1 1 1 – – – – Depreciation & Amortization 33 37 56 64 87 25 24 25 27 EBITDA 16 (49) (60) 14 39 8 17 2 18 Fair Value Derivative Adjustments (59) (10) 36 – – – – – – Class A and Class B Senior Convertible Preferred Stock Return 31 52 29 – – – – – – Accretion of Preferred Stock 10 10 5 – – – – – – Stock-based Compensation Expense 2 4 6 10 15 4 4 4 5 Amortization of Deferred Airborne Lease Incentives (1) (4) (8) (13) (20) (6) (6) (7) (8) Loss on Extinguishment of Debt – – – – – – – 15 – Adjustment of deferred financing costs – 5 – – 2 2 (1) – – Adjusted EBITDA (1) 9 8 11 37 8 14 14 15 Note: Minor differences exist due to rounding