Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Function(x) Inc. | form8-ka11x28x2016earnings.htm |

Function(x) Inc. Reports First Quarter Financial Results

Significant increases in page views and monetization continues into second quarter fiscal 2017

NEW YORK – November 22, 2016 – Function(x) Inc. (NASDAQ: FNCX) (the “Company”) today reported financial results for the three months ended September 30, 2016.

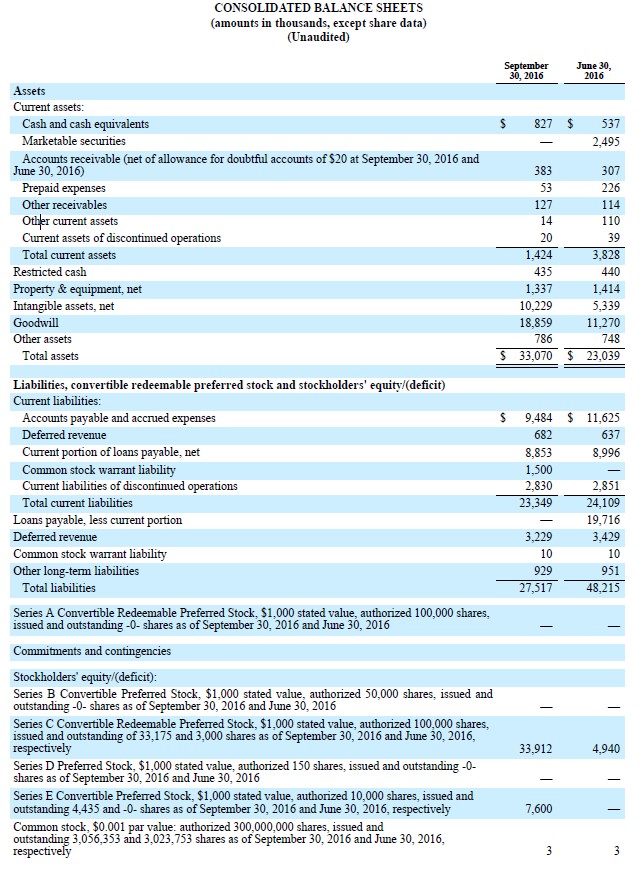

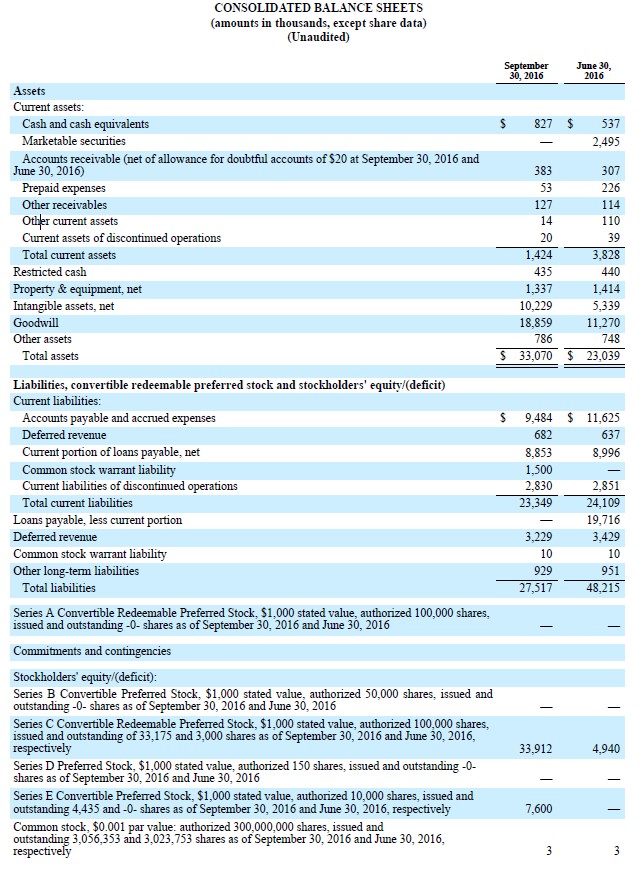

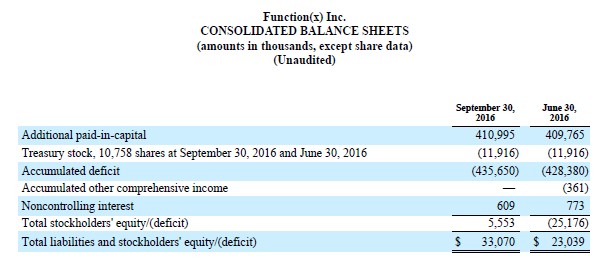

Revenue for the three months ended September 30, 2016 was $659,000 down from $922,000 for the three months ended September 30, 2015. For the same period the cash revenue for the Company’s Publishing Segment, which we consider our core operating business, was $371,000 down from $561,000 for the three months ended September 30, 2015.

Net loss and diluted loss per share for the three month period ended September 30, 2016 were $(7,553,000) and $(2.53), respectively.

EBITDA for the Company for the three months ended September 30, 2016 was a loss of $2,693,000, which is an improvement from a loss of $7,292,000 for the same period in 2015. EBITDA for the Publishing Segment was a loss of $1,633,000 for the three months ended September 30, 2016, which represents a material improvement from the loss of $6,756,000 for such segment in the prior year. Without expenses of $659,000, which management has determined are operational expenses that we do not anticipate to affect the financials going forward, the loss in EBITDA for the Publishing Segment would have been $973,000. These unusual operational expenses include stock compensation, costs associated with our ongoing S-1, costs associated with the acquisition of Rant, and one time marketing expense. Additionally, we have not included an incremental $173,000 of cost savings that were not fully realized in the quarter which we expect to impact our financials going forward; giving effect to these cost savings would further reduce the loss of $973,000 above to $800,000.

For full details on the above and other pertinent figures, please see exhibit A and B, attached herein.

"This past quarter confirms the opportunity we believed existed when we reshaped FNCX.” Said Robert FX Sillerman, Executive Chairman and Chief Executive Officer, “With an even stronger October behind us I am now convinced that the path we are on is the right one, and as such my willingness to convert my approximate $35MM of Preferred into common stock in the near future remains strong. The continued improvement of our operations in the quarter and my conversion of debt to preferred equity, resulting in a stronger balance sheet, provide the basis for us to exploit the robust opportunity in front of us. Although we have continuing defaults under our debentures, we are working to resolve the matter. As our cash drain continues to decrease, I continue to demonstrate my commitment to our efforts and fund the Company’s needs.”

“The excitement and potential that I saw in the company as a Board Member is coming to fruition, and the hard work and dedication of the team will continue to drive the success of the business and allow for us to achieve our long term goals”, said Birame Sock, President and COO.

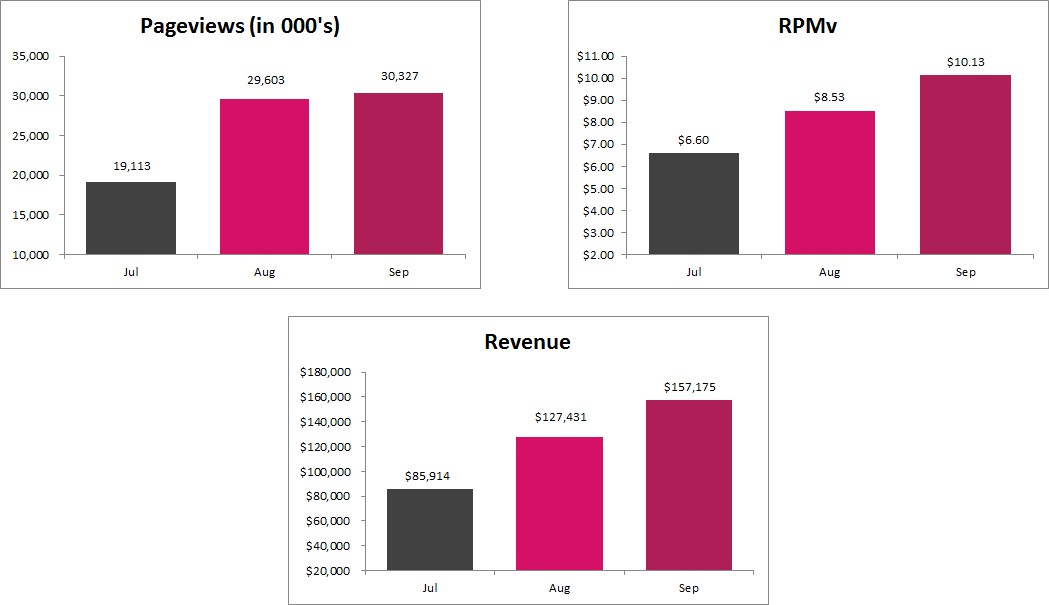

Function(X), Inc. – Key Performance Indicators

RPMv = Revenue Per 1,000 Visits

Our Q1 Fiscal 2017 accomplishments listed below are guided by our overall strategy and vision, in which Function (x) is building a highly scalable publishing platform that is designed to efficiently create, share and monetize content across a wide range of topics and audience. Our strategy is to invest in proprietary technology that gives us a competitive advantage versus traditional publishers and allows us to fully leverage the power of social media to better reach our target audiences. Our initial properties, Rant and WetPaint, have begun to take full advantage of our publishing infrastructure to deliver compelling content around sports, pop culture and entertainment. Future properties will also be built on top of our publishing technology.

Fiscal 2017 First Quarter Highlights and Recent Developments

• | New Management Team: Appointed a new and a highly experienced management team. Each member has had a prior professional relationship with the Company’s Chairman and CEO; |

• | Rant Acquisition: In Q1, the Company acquired Rant, Inc., a leading digital publisher that publishes original content in multiple different verticals, most notably sports, entertainment, and pets. This business has been integrated into the Company’s existing digital publishing platform; |

• | Deleveraging Initiatives: Affiliates of Function(x)’s Chairman and CEO, Mr. Sillerman, have committed to converting approximately $35,000,000 in preferred equity into shares of the Company’s common stock, further illustrating Mr. Sillerman’s commitment to the Company’s future; |

• | Established foundation for future growth: Developed a streamlined headcount plan to scale the business, implement disciplined financial controls and refine its operating expense model and revamp its technology platform and acquisition team intended to drive incremental growth; |

• | Optimized Revenue Model: Although not reflected in the Q1 financials, the Company has recalibrated its revenue model to achieve sustainable revenue growth and to better align its capital and focus in the most efficient manner possible; |

• | DraftDay Gaming Group: Recent positive regulatory developments in the daily fantasy space have increased confidence in the prospects of this business, and we are evaluating all strategic alternatives to maximize shareholder return; |

• | Key performance metrics: Implemented daily monitoring of operating results via automated reporting and analytics and continually refining its approach to implementing the long-term strategy. |

About Function(x) Inc.

Function(x) operates Wetpaint. com and Rant. Wetpaint is the leading online destination for entertainment news for millennial women, covering the latest in television, music, and pop culture. Rant is a leading digital publisher with original content in multiple different verticals, most notably in sports, entertainment, and pets,. Function(x) Inc. is also the largest shareholder of DraftDay Gaming Group, which is well-positioned to become a significant participant in the expanding fantasy sports market, offering a high-quality daily fantasy sports experience both directly to consumers and to businesses desiring turnkey solutions to new revenue streams. Function(x) Inc. also owns Choose Digital, a digital marketplace platform that allows companies to incorporate digital content into existing rewards and loyalty programs in support of marketing and sales initiatives. For more information, visit www. functionxinc.com.

How Function(x) Came To Be

Previously known as Viggle and DraftDay Fantasy Sports Inc., the genesis of Function(x) is largely due to the acquisition of Wetpaint in December of 2013 by the Company’s predecessor Viggle, Inc. as an audience driver for the rewards platform. Subsequently, the main assets of Viggle were sold in February of 2016, with exception of Wetpaint. Due to the sale of the Viggle name, the company briefly changed its name to DraftDay Fantasy Sports, Inc. while it evaluated the future direction of the business. Realizing that the Company had a tremendous opportunity not only DraftDay, but with Wetpaint (with over 13MM visits per month, its patented social distribution system and exclusive content produced with celebrities and social influencers). As Robert FX Sillerman has stated in the past, “Function X is often referred to in mathematics as the largest possible number. That is the goal of the company, to achieve the maximum results possible. The combination of Wetpaint and Rant along with the recent positive regulatory developments in fantasy sports positions us to achieve significant levels of success.” Like that, a brand was born, and the Company has been Function(x) ever since.

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements involve inherent risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. All information provided in this press release is as of the date of this release. Except as required by law, Function(x), Inc. undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Definitions

The following definitions apply to these terms as used throughout this press release and the exhibits:

Publishing Segments - represents Wetpaint and Rant and any corporate expenses allocated to this segment. 2015 Rant figures exclude revenue and corresponding expense associated with Traffic Acquisition, but includes revenue from organic traffic.

Traffic Acquisition – Money spent to drive traffic to a website.

EBITDA – represents net income (loss) before other income (loss), interest expense, income taxes, and depreciation and amortization.

Non-GAAP Financial Measures

We prepare our financial statements in accordance with generally accepted accounting principles (“GAAP”) in the United States of America. Within this press release, we make reference to EBITDA, which is a non-GAAP financial measure. We include these non-GAAP financial measures because management believes they are useful to investors in that they provide for greater transparency with respect to supplemental information used by management in its financial and operational decision making.

Management uses EBITDA to convey supplemental information to investors regarding our performance excluding the impact of certain non-cash charges, costs associated with our borrowings and other special items that can affect the comparability of results from quarter to quarter. In particular, EBITDA is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget, and to develop short- and long-term operational plans. Of note, the elimination of certain expenses in calculating EBITDA can provide a useful measure for period-to-period comparisons of our core business.

Accordingly, we believe the presentation of these non-GAAP financial measures, when used in conjunction with GAAP financial measures, is a useful financial analysis tool that can assist investors in assessing our operating performance and underlying prospects. This analysis should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. This analysis, as well as the other information in this press release, should be read in conjunction with our consolidated financial statements and footnotes contained in the Form 10-Q that we filed with the U.S. Securities and Exchange Commission. The non-GAAP financial measures used in this press release may be different from the methods used by other companies. For more information on the Non-GAAP financial measures, please see the Reconciliation of GAAP financial measures to Non-GAAP financial measures table in the press release

Contact:

For Function(x):

Investors:

Investors:

Michelle Lanken, 212-231-0092

Chief Financial Officer

mlanken@functionxinc. com

mlanken@functionxinc. com

or

Media Relations:

IRTH Communications

Robert Haag, 866-976-4784

IRTH Communications

Robert Haag, 866-976-4784

Managing Partner

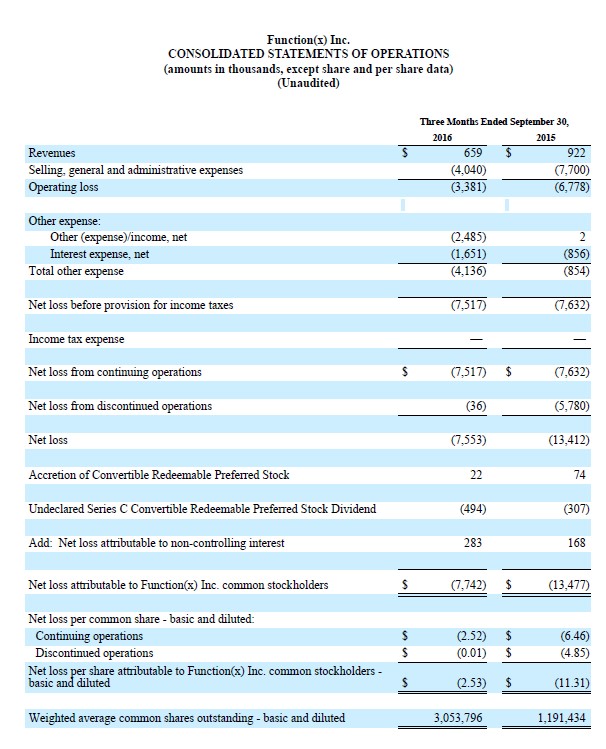

Exhibit A

2016 - All amounts shown in $ (000's) 2015 - All amounts shown in $ (000's)

Publishing Segment Cash Revenue Reconciliation Publishing Segment Cash Revenue Reconciliation

GAAP Revenue $659 GAAP Revenue $922

•Choose Revenue 58 - Choose Revenue 198

•DDGG Revenue 105 - DDGG Revenue 83

- Corporate Revenue 125 - Corporate Revenue 125

Pro-Forma Revenue $371 + Rant Revenue* 45

Pro-Forma Revenue $561

*Adjusted to remove Revenue associated with Traffic Acquisition

Company EBITDA Reconciliation Company EBITDA Reconciliation

GAAP Net Income ($7,517) GAAP Net Income ($7,632)

+ Interest Expenses 1,651 + Rant Net Income (1,364)

+ Depreciation and Amortization 687 + Interest Expenses 856

+ Other (income)/expense, net 2,485 + Depreciation and Amortization 850

EBITDA ($2,693) + Other (income)/expense, net (2)

EBITDA ($7,292)

Publishing Segment EBITDA Reconciliation Publishing Segment EBITDA Reconciliation

GAAP Net Income ($7,517) GAAP Net Income ($7,632)

•Choose Net Income (401) - Choose Net Income (485)

•DDGG Net Income (752) - DDGG Net Income 26

•Viggle Net Income (36) - MyGuy Net Income (336)

+ Interest Expenses 1,651 + Rant Net Income* (1,364)

+ Depreciation and Amortization 560 + Interest Expenses 856

+ Other (income)/expense, net 2,485 + Depreciation and Amortization 588

EBITDA ($1,633) EBITDA ($6,756)

*Adjusted to remove Revenue/Expenses associated with Traffic Acquisition

Publishing Segment EBITDA less Identified Operational Expenses Publishing Segment EBITDA less Identified Operational Expenses

EBITDA (as stated above) ($1,633) EBITDA (as stated above) ($6,756)

+ Equity Based Comp $7 + Equity Based Comp 4,388

- Expenses Associated with S-1 176 Adjusted EBITDA ($2,369)

- One-time Signing Bonus 50

- Severance 26

- Transaction Expense - Valuations 75

- Transaction Expense - Legal 225

- One Time Marketing Expense 100

- Cost Savings 173

Adjusted EBITDA ($800)

Exhibit B