Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Finance Trust, Inc | v454187_8k.htm |

Exhibit 99.1

3 rd Quarter 2016 Webinar Series

A Public Non - Traded Real Estate Investment Trust* Third Quarter 2016 Investor Presentation Platform Advisor To Investment Programs

3 This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, RCA and the Company filed a joint preliminary proxy statement/prospectus with the SEC on October 20, 2016. Both RCA’s and the Company’s stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and other relevant documents filed with the SEC if and when they become available because they will contain important information about the proposed transaction. Investors may obtain free copies of the joint proxy statement/prospectus and other relevant documents filed by RCA and the Company with the SEC (if and when they become available) through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by the Company with the SEC are also available free of charge on the Company’s website at www.americanfinancetrust.com and copies of the documents filed by RCA with the SEC are available free of charge on RCA’s website at www.retailcentersofamerica.com. RCA and the Company and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from both companies’ stockholders in respect of the proposed transaction. Information regarding RCA’s directors and executive officers can be found in RCA’s definitive proxy statement filed with the SEC on April 29, 2016. Information regarding the Company's directors and executive officers can be found in the Company's definitive proxy statement filed with the SEC on April 29, 2016. Additional information regarding the interests of such potential participants will be included in the joint proxy statement and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available. These documents are available free of charge on the SEC’s website and from RCA and the Company, as applicable, using the sources indicated above. American Finance Trust, Inc. ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION AND WHERE TO FIND IT 3

4 Certain statements made in this letter are “forward - looking statements” (as defined in Section 21E of the Exchange Act), which reflect the expectations of RCA and the Company regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the Merger Agreement between RCA and the Company, among others, will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future dividends and market valuations, and other statements that are not historical facts. The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the ability to obtain regulatory approvals for the transaction and the approval by the Company’s and RCA’s stockholders of the transactions contemplated in the Merger Agreement; unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated; the inability to retain key personnel; continuation or deterioration of current market conditions; future regulatory or legislative actions that could adversely affect the companies; and the business plans of the tenants of the respective parties. Additional factors that may affect future results are contained in the Company’s and RCA’s filings with the SEC, which are available at the SEC’s website at www.sec.gov. The Company and RCA disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise. American Finance Trust, Inc. FORWARD - LOOKING STATEMENTS 4

American Finance Trust, Inc. PORTFOLIO UPDATE AS OF 9/30/2016 ▪ Strong Portfolio: 458 net lease assets with over 71% investment grade (1) tenants as of September 30, 2016 ▪ Leverage: 48.6% total debt to total assets with a weighted average effective interest rate of 4.76% ▪ Flexible Cash Position: Cash balance of $143.4 million provides operational flexibility ▪ Selective Acquisitions: Management will continue to evaluate the market for additional real estate investments ▪ Net Asset Value: On March 17, 2016, the Company’s independent directors unanimously reaffirmed an estimated per - share net asset value (“Estimated Per - Share NAV”) equal to $24.17 as of December 31, 2015 ▪ Distribution Rate: AFIN continues to pay an annualized distribution per share of $1.65, or 6.83% based on the most recent Estimated Per - Share NAV ▪ 3 rd Quarter Activity: ▪ Announced agreement to merge with American Realty Capital – Retail Centers of America, Inc. (2) (“RCA”) (1) Implied ratings are determined using a proprietary Moody’s analytical tool, which compares the risk metrics of the non - rated com pany to those of a company with an actual rating. A tenant with a parent that has an investment grade rating is included in implied investment g rad e. (2) Subject to approval of AFIN’s and RCA’s shareholders as well as satisfaction of customary closing conditions. 5

6 American Finance Trust, Inc. PORTFOLIO UPDATE

American Finance Trust, Inc. AFIN PORTFOLIO STRENGTH AS OF SEPTEMBER 30, 2016 Property Type (1) Tenant Credit Rating (1)(2) » Diverse, retail focused property mix » Over 71% Actual & Implied Investment Grade Tenant Ratings Tenant Industry (1) 1) Percentages are based on annualized SLR as of September 30, 2016. 2) Actual ratings reflect the tenant rating. Implied ratings are determined using a proprietary Moody’s analytical tool which co mpa res the risk metrics of the non - rated company to those of a company with an actual rating. A tenant with a parent that has an investment grade rating is incl ude d in implied investment grade. A tenant with an actual or implied rating that is not investment grade is included in Non Investment Grade. Ratings information is as of September 30, 2016. » AFIN’s tenants operate in 18 different industries 7 Distribution 25.4% Retail 45.3% Office 29.3% Retail Banking 19.0% Healthcare 15.2% Distribution 12.5% Financial Services 12.1% Refrigerated Warehousing 7.7% Grocery 6.7% Restaurant 6.6% Home Improvement 6.5% Pharmacy 3.8% Discount Retail 2.7% Other 7.2% Actual Investment Grade , 67.1% Implied Investment Grade , 4.1% Non Investment Grade , 25.5% Not Rated , 3.3%

American Finance Trust, Inc. Sources: JLL: Net Lease Investment Outlook Q3 2016, The Boulder Group: The Net Lease Market Report Q3 2016 8 • AFIN focuses on single tenant net lease assets, comprised of retail, office, and industrial properties • Investor demand for entire net lease group continues to remain strong, evidenced by single - asset sales volumes reaching the highest annual volume in 10 years • The overall net lease market remains active with both private and institutional buyers largely due to the fundamentals of the asset class with long term leases, triple net lease structure, and quality of tenancy • Supply/demand dynamics remain favorable with a lack of new construction properties on the market with long term leases • Foreign investment continues provide demand into the asset class, especially in the office sector with foreign investment in 2016 increasing 27% in the office segment NET LEASE MARKET CONDITIONS

American Finance Trust, Inc. 9 Source: Bloomberg • AFIN’s management team regularly monitors the net lease market, as well as the broader retail real estate market, and has remained patient in acquiring new assets with the expectation of cap rates reaching favorable levels in the near future • AFIN has bid on a number of assets throughout the 3 rd and 4 th quarter, however based on observable transactions, a large bid - ask spread remains between buyers and sellers, which we attribute to the historical lag between movement in interest rates, or cost of debt, and movements in cap rates within the real estate market • While the ten - year U . S . Treasury bond yield has risen steadily in the past three months from 1 . 56 % to 2 . 34 % , cap rates have remained relatively flat . However, we are confident that cap rates will eventually adjust and move higher as seller’s reset pricing expectations as properties currently for sale sit on the market for longer periods of time • AFIN’s management team has historically been able to take advantage of cap rate shifts as a result of short - term movements in interest rates . Several instances of these short term interest rate spikes occurred between 2011 and 2013 , where AFIN’s management team ( 1 ) simultaneously adjusted acquisition pricing and was able to achieve better than market yields on its investments . Today, AFIN is preparing to once again take advantage of the market shift and acquire high quality assets at favorable cap rates AFIN ACQUISITION PIPELINE 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 8/29/2016 9/29/2016 10/29/2016 11/29/2016 10 - Year Treasury (1) AFIN’s management team previously managed other net lease programs during this time period including American Realty Capital Tr ust Inc., American Realty Capital Trust III Inc., and American Realty Capital Trust IV Inc.

American Finance Trust, Inc. Sources: SNL 10 • As of 11/28/2016, the 10 - year U.S Treasury rate was 2.32%, which is still well below the historical average of 5.2% • At these spreads, net lease real estate is still an attractive investment • Even with potential rate hikes, AFIN is still able to find opportunities at cap rates in excess of our borrowing cost • We believe during Fed tightening periods, REITs can perform well as rising treasury yields typically indicate a recovering economy which drives occupancy, retail spending, rent growth, and overall demand for real estate INTEREST RATE IMPACT 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 12/1/10 6/1/11 12/1/11 6/1/12 12/1/12 6/1/13 12/1/13 6/1/14 12/1/14 6/1/15 12/1/15 6/1/16 Daily Treasury Yield 30 Year Historical Average

11 American Finance Trust, Inc. Nicholas Radesca Chief Financial Officer, Treasurer and Secretary ▪ Formerly CFO & Corporate Secretary for Solar Capital Ltd. and Solar Senior Capital Ltd. ▪ Previously served as Chief Accounting Officer at iStar Financial, Inc. Michael Weil Chief Executive Officer, President and Chairman of the Board of Directors ▪ Founding partner of AR Global ▪ Supervised the origination of investment opportunities for all AR Global - sponsored investment programs ▪ Previously served as Senior VP of sales and leasing for American Financial Realty Trust (AFRT) ▪ Served as president of the Board of Directors of the Real Estate Investment Securities Association (REISA) Jason Slear Senior Vice President of Real Estate Acquisitions and Dispositions ▪ Responsible for sourcing, negotiating, and closing AR Global's real estate acquisitions and dispositions ▪ Formerly east coast territory director for AFRT where he was responsible for the disposition and leasing activity for a porti on of AFRT's 37.3 million square foot portfolio EXPERIENCED MANAGEMENT 11

American Finance Trust, Inc. FINANCIAL OVERVIEW • As of 9/30/2016, AFIN had cash and cash equivalents of $143.4 million. • Future short - term operating liquidity requirements are met through a combination of cash on hand, cash from operations and proceeds from secured mortgage financings. • The Company’s leverage ratio as of 9/30/2016 is 48.6%. 12 American Finance Trust, Inc. Balance Sheet Metrics – 9/30/2016 (all in $000s) Total real estate investments, at cost $2,220,037 Less: accumulated depreciation and amortization (291,207) Total real estate investments, net 1,928,830 Cash and cash equivalents 143,386 Commercial mortgage loan, held for investment, net 17,163 Other assets 40,022 Total assets $2,129,401 Mortgage notes payable (1) $1,034,015 Other liabilities 47,647 Total liabilities 1,081,662 Total stockholders’ equity 1,047,739 Total liabilities and stockholders’ equity $2,129,401 Total debt / Total assets 48.6% (1) Mortgage notes payable reflects the gross payable balance, including mortgage premiums, net, less net deferred financing costs

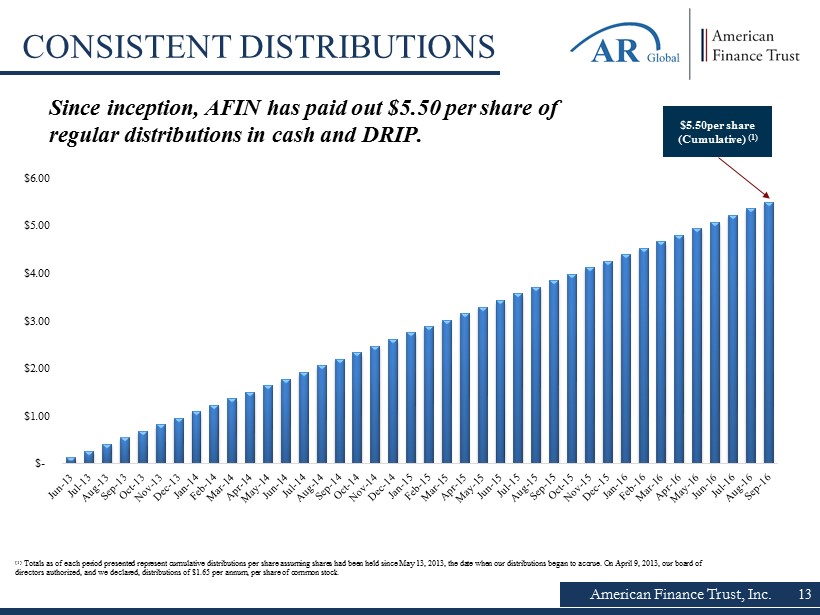

$- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 Since inception, AFIN has paid out $5.50 per share of regular distributions in cash and DRIP. CONSISTENT DISTRIBUTIONS American Finance Trust, Inc. 13 (1) Totals as of each period presented represent cumulative distributions per share assuming shares had been held since May 13, 2 01 3, the date when our distributions began to accrue. On April 9, 2013, our board of directors authorized, and we declared, distributions of $1.65 per annum, per share of common stock. $5.50per share (Cumulative) (1)

American Finance Trust, Inc. 14 Acquisition of American Realty Capital – Retail Centers of America, Inc. (“RCA”): On September 6, 2016, AFIN, its operating partnership, American Finance Operating Partnership, L.P. (the “AFIN OP”) and Genie Acquisition, LLC, a wholly owned subsidiary of AFIN (the “Merger Sub”), entered into an Agreement and Plan of Merger with RCA and its operating partnership, American Realty Capital Retail Operating Partnership, L.P. (the “RCA OP”), providing for t he merger of RCA with the Merger Sub and the RCA OP with the AFIN OP. Each RCA common share converts into the right to receive 0.385 AFIN common shares and $0.95 in cash. The completion of the merger is expected in Q1 2017 and is subject to the approval of RCA’s and AFIN’s stockholders as well as satisfaction of customary closing conditions. Share Repurchase Plan: On June 28, 2016, in consideration of the strategic review process, the board of directors of the Company determined to amend th e Company’s existing share repurchase program (the “SRP” and the “SRP Amendment”) to provide for one twelve - month repurchase period for calendar year 2016 (the “2016 Repurchase Period”) instead of two semi - annual periods ending June 30 and December 31. The annual limit on repurchases under the SRP remains unchanged and continues to be limited to a maximum of 5.0% of the weighted average number of shares of common stock of the Company outstanding during its prior fiscal year (the “2015 Outstanding Shares”) and is subject to the terms and limitations set forth in the SRP. Accordingly, the 2016 Repurchase Perio d w ill be limited to a maximum of 5.0% of the 2015 Outstanding Shares and continue to be subject to the terms and conditions set for th in the SRP, as amended. Following calendar year 2016, the repurchase periods will return to two semi - annual periods and applicable limitations set forth in the SRP. The SRP Amendment also provides, for calendar year 2016 only, that any amendment s, suspensions or terminations of the SRP will become effective on the day following the Company’s public announcement of such amendments, suspension or termination. The SRP Amendment will become effective on July 30, 2016 and will only apply to repurchase periods in calendar year 2016. Dividend Reinvestment Program: On August 30, 2016, in consideration of the merger, the board of directors of the Company determined to suspend the Company’s distribution reinvestment plan effective immediately upon mailing a notice of the suspension to each distribution reinvestmen t p lan participant. SUPPLEMENTAL INFORMATION

15 American Finance Trust, Inc. RISK FACTORS Our potential risks and uncertainties are presented in the section titled “Item 1 A . Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31 , 2015 and our Quarterly Reports on Form 10 - Q filed from time to time . The following are some of the risks and uncertainties relating to us and the proposed transaction, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements : ▪ All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in American Finance Advisors, LLC (our “Advisor”) or other entities under common control with AR Global . As a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor’s compensation arrangements with us and other investment programs advised by affiliates of our Sponsor and conflicts in allocating time among these entities and us, which could negatively impact our operating results . ▪ Although we previously announced our intention to list our shares of common stock on the New York Stock Exchange and the merger is conditioned on our shares of common stock being authorized for listing, the merger agreement does not require that our common stock be listed upon closing and there can be no assurance that our shares of common stock will be listed . No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid . ▪ We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic viability of our tenants . ▪ Our tenants may not achieve our rental rate incentives and our expenses could be greater, which may impact our results of operations . ▪ The merger and related transactions are subject to certain conditions, including approval by stockholders of AFIN and RCA . ▪ Failure to complete the merger could negatively impact the value of AFIN common stock, and the future business and financial results of AFIN . ▪ The pendency of the merger could adversely affect the business and operations of AFIN and RCA . ▪ If the merger is not consummated by April 21 , 2017 , either AFIN or RCA may terminate the merger agreement . ▪ RCA is engaged in the business of owning and operating retail properties, including power centers and lifestyle centers, and this business has different risks than our current business which primarily consists of owning net leased real estate, including shorter lease terms, greater exposure to downturns in the retail market, dependence on the success and economic viability of anchor tenants and competition from alternative retail channels such as internet shopping . 15

16 American Finance Trust, Inc. RISK FACTORS ▪ We have not generated, and in the future may not generate, operating cash flows sufficient to cover 100 % of our distributions, and, as such, we may be forced to source distributions from borrowings, which may be at unfavorable rates, or depend on our Advisor to waive reimbursement of certain expenses or fees . There is no assurance that our Advisor will waive reimbursement of expenses or fees . ▪ We may be unable to pay or maintain cash distributions at the current rate or increase distributions over time . ▪ We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates . ▪ We are subject to risks associated with any dislocation or liquidity disruptions that may exist or occur in the credit markets of the United States of America . ▪ We may fail to continue to qualify to be treated as a real estate investment trust for U . S . federal income tax purposes, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and our cash available for distributions . ▪ We may be deemed by regulators to be an investment company under the Investment Company Act of 1940 , as amended (the “Investment Company Act”), and thus subject to regulation under the Investment Company Act . 16

17 American Finance Trust, Inc. DISCLOSURE 17 Certain statements made in this presentation are “forward - looking statements” (as defined in Section 21E of the Exchange Act), which reflect the expectations of AFIN and RCA regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) between AFIN and RCA, among others, will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future dividends and market valuations, and other statements that are not historical facts. The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the ability to obtain regulatory approvals for the transaction and the approval by AFIN’s and RCA’s stockholders of the transactions contemplated in the Merger Agreement; market volatility; unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated; the inability to retain key personnel; continuation or deterioration of current market conditions; future regulatory or legislative actions that could adversely affect the companies; and the business plans of the tenants of the respective parties. Additional factors that may affect future results are contained in AFIN’s and RCA’s filings with the SEC, which are available at the SEC’s website at www.sec.gov. AFIN and RCA disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise.

AmericanFinanceTrust.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com