Attached files

| file | filename |

|---|---|

| EX-21.1 - DESCRIPTION OF SUBSIDIARIES OF THE REGISTRANT - Future FinTech Group Inc. | f10k2015ex21i_skypeople.htm |

| EX-32.2 - CERTIFICATION - Future FinTech Group Inc. | f10k2015ex32ii_skypeople.htm |

| EX-32.1 - CERTIFICATION - Future FinTech Group Inc. | f10k2015ex32i_skypeople.htm |

| EX-31.2 - CERTIFICATION - Future FinTech Group Inc. | f10k2015ex31ii_skypeople.htm |

| EX-31.1 - CERTIFICATION - Future FinTech Group Inc. | f10k2015ex31i_skypeople.htm |

| EX-23.2 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Future FinTech Group Inc. | f10k2015ex23ii_skypeople.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. - Future FinTech Group Inc. | f10k2015ex23i_skypeople.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ___ to ___

Commission File Number 001-34502

SKYPEOPLE FRUIT JUICE, INC.

(Exact name of registrant as specified in its charter)

| Florida | 98-0222013 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) | |

| 16F, National Development Bank Tower, | ||

| No. 2, Gaoxin 1st. Road, Xi’an, PRC | 710075 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's Telephone Number: 86-29-88377161

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.001 par value | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

| None | ||

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in rule 405 of the Securities Act. Yes ¨ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy statement or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☐ | Smaller reporting company | ☒ |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes ¨ No ☒

The aggregate market value of voting and nonvoting stock held by non-affiliates of the registrant, based upon the closing price of $2.19 per share for shares of the registrant’s Common Stock on June 30, 2016 the last business day of the registrant’s most recently completed second fiscal quarter as reported by the NASDAQ Global Market, was approximately $8.9 million. In calculating such aggregate market value, shares of Common Stock held by each officer, director and holder of 5% or more of the outstanding Common Stock (including outstanding shares with respect to which a holder has the right to acquire beneficial ownership within 60 days) were excluded because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of Common Stock outstanding as of November 22, 2016 was 4,061,090.

Annual Report on Form 10-K for Fiscal Year Ended December 31, 2015

| PART I | 2 |

| ITEM 1 – BUSINESS | 2 |

| ITEM 1A – RISK FACTORS | 15 |

| ITEM 1B – UNRESOLVED STAFF COMMENTS | 34 |

| ITEM 2 – PROPERTIES | 34 |

| ITEM 3 – LEGAL PROCEEDINGS | 36 |

| ITEM 4 – RESERVED | 36 |

| PART II | 37 |

| ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 37 |

| ITEM 6 – SELECTED FINANCIAL DATA | 38 |

| ITEM 7 – MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 39 |

| ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 56 |

| ITEM 8 – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 56 |

| ITEM 9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 56 |

| ITEM 9A – CONTROLS AND PROCEDURES | 57 |

| ITEM 9B – OTHER INFORMATION | 59 |

| PART III | 59 |

| ITEM 10 – DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 59 |

| ITEM 11 – EXECUTIVE COMPENSATION | 63 |

| ITEM 12 – SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 67 |

| ITEM 13 – CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 69 |

| ITEM 14 – PRINCIPAL ACCOUNTING FEES AND SERVICES | 69 |

| PART IV | 70 |

| ITEM 15 – EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 70 |

| Signature | 73 |

NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (“Annual Report”) of SkyPeople Fruit Juice, Inc. (together with our direct or indirect subsidiaries, “we,” “us,” “our” or “the Company”) includes forward-looking statements that involve risks and uncertainties within the meaning of the Private Securities Litigation Reform Act of 1995. Other than statements of historical fact, all statements made in this Annual Report are forward-looking, including, but not limited to (a) our projected sales, profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans and (e) our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements involve risks and uncertainties that are inherently difficult to predict, which could cause actual outcomes and results to differ materially from our expectations, forecasts and assumptions. The following important factors, among others, could affect our future results and could cause those results to differ materially from those expressed in such forward-looking statements:

| ● | fluctuations in the supply of raw material; |

| ● | general economic conditions and conditions which affect the market for our products; |

| ● | changes in U.S. and global financial and equity markets, including market disruptions and significant interest rate fluctuations, which may impede our access to, or increase the cost of, external financing for our operations and investments; |

| ● | our success in implementing our business strategy or introducing new products; |

| ● | our ability to attract and retain customers; |

| ● | changes in tastes and preferences for, or the consumption of, our products; |

| ● | impact of competitive activities on our business; |

| ● | risks associated with conducting business internationally and especially in the People’s Republic of China (“PRC”, or “China”), including currency fluctuations and devaluation, currency restrictions, local laws and restrictions and possible social, political and economic instability; and |

| ● | other economic, financial and regulatory factors beyond the Company’s control. |

Any or all of our forward-looking statements in this report may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including, without limitation, the risks outlined under “Item 1A. Risk Factors” in this Annual Report. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

We undertake no obligation to update forward-looking statements to reflect subsequent events, changed circumstances or the occurrence of unanticipated events.

| 1 |

PART I

ITEM 1 – BUSINESS

Overview

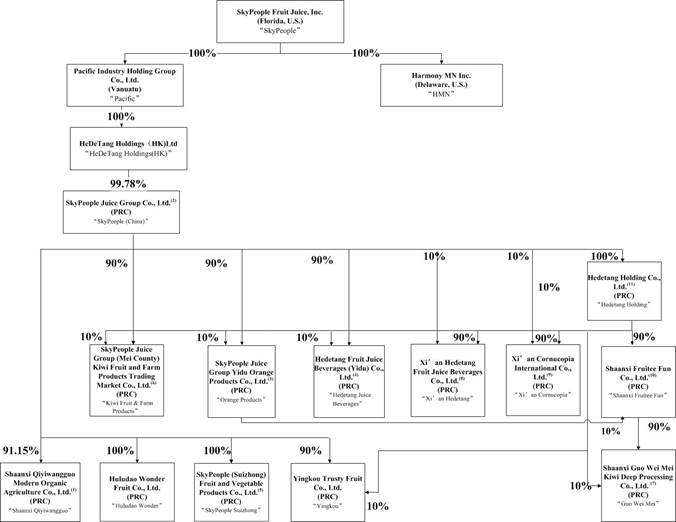

We are a holding company incorporated under the laws of the State of Florida. We have two direct wholly owned subsidiaries: Pacific Industry Holding Group Co., Ltd., (“Pacific”), a company incorporated under the laws of the Republic of Vanuatu, and Harmony MN Inc., (“Harmony”), a company organized under the laws of the State of Delaware. Pacific holds 100% equity interest of SkyPeople Juice International Holding (HK) Ltd. (“SkyPeople International”), a company organized under the laws of Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”). SkyPeople International holds 99.78% of the equity interest of SkyPeople Juice Group Co., Ltd., (“SkyPeople (China)”), a company incorporated under the laws of the PRC. SkyPeople (China) has twelve direct subsidiaries, all limited liability companies organized under the laws of the PRC: (i) Shaanxi Qiyiwangguo Modern Organic Agriculture Co., Ltd., (“Shaanxi Qiyiwangguo”), (ii) Huludao Wonder Fruit Co., Ltd., (“Huludao Wonder”), (iii) Yingkou Trusty Fruits Co., Ltd., (“Yingkou”), (iv) SkyPeople Juice Group Yidu Orange Products Co. Ltd., (“Orange Products”), (v) “Hedetang Fruit Juice Beverage (Yidu) Co., Ltd., (“Hedetang Juice Beverages”), (vi) SkyPeople (Suizhong) Fruit and Vegetable Products Co., Ltd., (“SkyPeople Suizhong”), (vii) SkyPeople Juice Group (Mei County) Kiwi Fruit and Farm Products Trading Market Co., Ltd. (“Kiwi Fruit & Farm Products”), (viii) Shaanxi Guo Wei Mei Kiwi Deep Processing Co., Ltd. (“Guo Wei Mei”), (ix) Hedetang Holding Co., Ltd., (x) Xi’an Hedetang Fruit Juice Beverages Co., Ltd., (xi) Xi’an Cornucopia International Co., Ltd. and (xii) Shaanxi Fruitee Fun Co., Ltd.

Products and Market

Through our indirect subsidiaries in the PRC, we are engaged in the production and sale of (1) fruit juice concentrates (including fruit purees, concentrated fruit purees and concentrated fruit juices); (2) fruit beverages (including fruit juice beverages and fruit cider beverages); and (3) other fruit-related products (including primarily organic and non-organic fresh fruits, dried fruit, preserved fruit, fructose) in and from the PRC.

We were recognized and certified as a Hi-Tech Enterprise jointly by the Shaanxi Department of Science and Technology, Department of Finance, Bureau of National Taxation and Bureau of Local Taxation in August 2009. This certificate was valid for three years, and was not renewed after it expired on October 22, 2015. The Company is also certified as the Leading Enterprise of the China Food Industry by the China National Food Industry Association from 2005 to 2008, the Leading Agricultural Commercialization Enterprise of Shaanxi Province by Shaanxi Agricultural Bureau in 2012, and the Enterprise with Essential Technology Innovation by the Department of Science and Technology of Shaanxi Province in 2010. Our Company was granted an AA level Certificate of the Standard and Good Conduct Enterprise by the Standardization Administration of China (“SAC”) in April 2015, and a Best Small and Middle Enterprises by Forbes China in 2011. Our concentrated pear juice and concentrated kiwi juice were awarded the Most Famous Products in Shaanxi Province by the People’s Government of Shaanxi in February 2012. The certificate was renewed in 2014; the period of validity of new certificate is from December 2015 to December 2017. Our fruit juice concentrates, which primarily include apple, pear and kiwi, are sold to domestic customers and exported directly or via distributors to customers in Asia, North America, Europe, Russia and the Middle East. Our Hedetang branded fruit juice concentrates were awarded the Famous Brand in Shaanxi Province by the Shaanxi Government in February 2015. This award will expire in December 2017. We sell our Hedetang branded bottled fruit beverages domestically, primarily to supermarkets in the PRC. Our brand name “Hedetang” was awarded the Most Famous Brand in Shaanxi Province by the Shaanxi Administration Bureau for Industry and Commerce, and this award will expire in December 2018. In March 2013, SkyPeople (China) was awarded the Creative Enterprise of the Year at the 88th China Food & Drinks Fair (CFDF).

In 2015, sales of our fruit concentrates, fruit beverages, fresh fruits and other fruit related products represented 49%, 51%, 0% and 0% of our revenue, respectively, compared to 44%, 48%, 4% and 4% respectively, in 2014.

Specialty fruit juices, or “small breed” fruit juices, are juices squeezed from fruits that are grown in relatively small quantities such as kiwi juice, mulberry juice, turnjujube juice and pomegranate juice. Currently, our specialty juice beverage offerings include pear juice, kiwi juice and mulberry juice. By the end of 2015, we possessed 22 patents and proprietary technologies in the processing technology of specialty fruit juice and gained a number of honors and qualifications in the fruit juice industry.

We intend to complete our current construction in progress, which will help to further diversify our business to reduce market risk, and also expand our distribution channel of fruit juice beverages to meet increasing customer demand.

| 2 |

Organizational Structure

Our current organizational structure is set forth in the diagram below:

| (1) | Xi’an Qinmei Food Co., Ltd., an entity not affiliated with the Company, owns the other 8.85% of the equity interest in Shaanxi Qiyiwangguo. |

| (2) | Formerly known as Shaanxi Tianren Organic Food Co. Ltd. |

| 3 |

| (3) | SkyPeople Juice Group Yidu Orange Products Co., Ltd. was established on March 13, 2012. Its scope of business includes deep processing and sales of oranges. |

| (4) | Hedetang Fruit Juice Beverages (Yidu) Co., Ltd. was established on March 13, 2012. Its scope of business includes production and sales of fruit juice beverages. |

| (5) | SkyPeople (Suizhong) Fruit and Vegetable Products Co., Ltd. was established on April 26, 2012. Its scope of business includes initial processing, quick-frozen and sales of agricultural products and related by-products. |

| (6) | SkyPeople Juice Group (Mei County) Kiwi Fruit and Farm Products Trading Market Co., Ltd. (“Kiwi Fruit & Farm Products”) was established on April 19, 2013. Its scope of business includes preliminary processing of agricultural and subsidiary products; establishment of trading market, etc. |

| (7) | Shaanxi Guo Wei Mei Kiwi Deep Processing Co., Ltd. was established on April 19, 2013. Its scope of business includes producing kiwi fruit juice, kiwi puree and cider beverages, and similar products. |

| (8) | Xi’an Hedetang Fruit Juice Beverages Co., Ltd. (“Xi’an Hedetang”) was established on March 31, 2014. Its scope of business includes production and sales of fruit juice beverages. |

| (9) | Xi’an Cornucopia International Co., Ltd. (“Cornucopia”) was established on July 2, 2014. Its scope of business includes retail and wholesale of pre-packaged food. |

| (10) | Shaanxi Fruitee Fun Co., Ltd. (“Fruitee Fun”) was established on July 3, 2014. Its scope of business includes retail and wholesale of pre-packaged food. |

| (11) | Hedetang Holding Co., Ltd. (“Hedetang Holding”) was established on July 21, 2014. Its scope of business includes corporate investment consulting, corporate management consulting, corporate imagine design and corporative marketing planning. |

| (12) | The Company acquired Huludao Wonder Co. Ltd. (“Huludao”) on June 10, 2008. Its scope of business mainly includes the manufacture and sale of concentrated fruit juice and fruit juice beverages. |

| (13) | The Company acquired Yingkou Trusty Fruits Co., Ltd. (“Yingkou”) on November 25, 2009. Its scope of business mainly includes the manufacture of concentrated fruit juice. |

Competitive Advantages

We believe our competitive advantages include the modern equipment and technology employed at our production factories in Shaanxi and Liaoning Provinces and the strategic locations of our manufacturing facilities. Our equipment and technology help us to ensure product quality, control costs and allow us to meet international fruit juice production standards such as ISO9001, HACCP, and Kosher certifications, and those imposed by the United States Food and Drug Administration. In addition, our manufacturing facilities are strategically located near regional fruit production centers. For example, Shaanxi Province, where two of our manufacturing facilities are located, is known in the PRC for pear and kiwi production. Our proximity to regional fruit production centers enables us to purchase fresh fruits directly from farmers, avoid the need of transporting fresh fruit over long distances to processing facilities, reduce our transportation expenses and damage to fresh fruit during transportation and helps us maintain high quality of finished products by preserving freshness.

We own and operate four manufacturing facilities in the PRC. To take advantage of economies of scale and to enhance our production efficiency, each of our manufacturing facilities focuses on juice products centering around one particular fruit based on the proximity of each facility to the supply center of that fruit. All concentrated juice products are manufactured using the same type of production line with slight variations in processing methods. We operate our pear juice products business out of our Jingyang Branch Office of SkyPeople (China). Our business involving apple juice products is operated out of Huludao Wonder and Yingkou, and our business involving kiwi products is operated out of Shaanxi Qiyiwangguo, in which we have held a 91.15% ownership interest since June 2006.

| 4 |

Corporate History

We were initially incorporated in 1998 in Florida as Cyber Public Relations, Inc. for the purpose of providing internet electronic commerce consulting services to small and medium sized businesses and did not have any material operations or revenue. On January 21, 2004, we purchased all of the outstanding share capital of Environmental Technologies, Inc., (“Environmental Technologies”), a Nevada corporation, in exchange for approximately 29,051 shares of the Company’s common stock (“Common Stock”). As a result, Environmental Technologies became our wholly-owned subsidiary and the Environmental Technologies shareholders acquired approximately 97% of our issued and outstanding Common Stock. We changed our name to Entech Environmental Technologies, Inc.

After our acquisition of Environmental Technologies, we operated through our wholly-owned subsidiary, H.B. Covey, Inc., (“H.B. Covey”), a business providing construction and maintenance services to petroleum service stations in the southwestern part of the United States and installation services for consumer home products in Southern California. In July 2007, we entered into and consummated a Stock Sale and Purchase Agreement pursuant to which we sold H.B. Covey.

We were a shell company with no significant business operations after we sold H.B. Covey. As a result of the consummation of a reverse merger transaction, on February 26, 2008 we ceased being a shell company and became an indirect holding company for SkyPeople (China) through Pacific.

On June 10, 2008, we acquired Huludao Wonder from Shaanxi Hede Investment Management Co., Ltd., (“Hede”), for a total purchase price of RMB 48,250,000, or approximately $6,308,591 based on the exchange rate on June 1, 2007. The payment was made through the offset of related party receivables. Prior to that, we operated our apple concentrate business out of the facilities of Huludao Wonder under a one-year lease agreement with Hede.

On June 17, 2009, we incorporated a new Delaware corporation called Harmony MN Inc., (“HMN”), to be a wholly owned subsidiary of the Company with offices initially in California to act as a sales company for the Company. The total number of shares of capital stock that HMN has authority to issue is 3,000 shares, all of which are Common Stock with a par value of $1.00 per share. On June 20, 2009, HMN was registered in the State of California to transact business in such state. HMN has not yet commenced operations and the Company plans to close down this dormant subsidiary.

On November 25, 2009, we acquired Yingkou for a purchase price of RMB 22,700,000 (or $3,325,569 based on the exchange rate of December 31, 2009), pursuant to the Stock Purchase Agreement that SkyPeople (China) entered into with Shaanxi Boai Pharmaceutical & Scientific Development Co., Ltd. (“Shaanxi Boai”, formerly known as “Xi’an Dehao Investment & Consultation Co., Ltd.”), on November 18, 2009. Yingkou commenced operating activities in the fourth quarter of 2010.

| 5 |

On March 13, 2012, we established SkyPeople Juice Group Yidu Orange Products Co., Ltd. (“Orange Products”) to engage in the business of deep processing and sales of oranges.

On March 13, 2012, we established Hedetang Fruit Juice Beverages (Yidu) Co., Ltd. (“Hedetang Juice Beverages”) to engage the business of production and sales of fruit juice beverages.

On April 26, 2012 we established SkyPeople (Suizhong) Fruit and Vegetable Products Co., Ltd. (“SkyPeople Suizhong”) to engage in the business of initial processing, quick-frozen and sales of agricultural products and related by-products.

On April 19, 2013, we established SkyPeople Juice Group (Mei County) Kiwi Fruit and Farm Products Trading Market Co., Ltd. (“Kiwi Fruit & Farm Products”) to engage in preliminary processing of agricultural and subsidiary products, the establishment of trading market and similar activities.

On April 19, 2013, we established Shaanxi Guo Wei Mei Kiwi Deep Processing Co., Ltd. (“Guo Wei Mei”) to engage in the business of producing kiwi fruit juice, kiwi puree and cider beverages, and similar products.

On March 31, 2014, we established Xi’an Hedetang Fruit Juice Beverages Co., Ltd. (“Xi’an Hedetang”) to engage in the business of production and sales of fruit juice beverages.

On July 2, 2014, we established Xi’an Cornucopia International Co., Ltd. (“Cornucopia”) to engage in the business of the retail and wholesale of pre-packaged food.

On July 3, 2014, we established Shaanxi Fruitee Fun Co., Ltd. (“Fruitee Fun”) to engage in the business of the retail and wholesale of pre-packaged food.

On July 21, 2014, we established Hedetang Holding Co., Ltd. (“Hedetang Holding”) to engage in the business of the retail and wholesale of pre-packaged food, research and development regarding pre-packaged food, bio-tech, machinery and packages, export of manufactured products and technology, business consulting and marketing planning.

On October 16, 2015, Skypeople Fruit Juice Inc. signed a Share Purchase Agreement with Skypeople International Holdings Group Limited to sell 5,321,600 shares of its common stock at $1.50 per share to Skypeople International Holdings Group Limited. The purchase price of $7,928,400 was paid by the cancellation of the loan from Skypeople International Holdings Group Limited to Skypeople International Holdings Group Limited under the loan agreement dated February 18, 2013, and renewed on February 18, 2014, in its principle amount. The remaining loan amount and interest owed was paid in cash.

On November 16, 2015, Hedetang Juice Beverages signed a construction agreement with China Yi Ye Group Co. Ltd. to engage China Yi Zhi Group Co. Ltd. to establish an orange comprehensive deep processing zone in Yidu. On November 23, 2015, construction began on the agricultural products trading market. The Company plans to finish the construction of the office building, R&D center, fruit juice production facility, cold storage and other areas in the second quarter of 2017, and construction on the distribution center is planned to be completed by the last quarter of 2017.

| 6 |

The Yidu project includes the establishment of:

| 1. | one modern orange distribution and sales center (the “distribution center”); |

| 2. | one orange comprehensive utilization deep processing zone (the “deep processing zone”), including: |

a) one 45 ton/hour concentrated orange juice and byproduct deep processing production line;

b) one bottled juice drink production line with a capacity to produce 6,000 glass bottles per hour;

c) one storage freezer facility with a capacity to store 20,000 tons of concentrated orange juice; and

d) general purpose facilities within the zone, office space, general research and development facilities, service area, living quarters and other ancillary support areas.

Principal Products

There are two general categories of fruit and vegetable juices available in the market. One is fresh juice that is canned directly upon filtering and sterilization after being squeezed out of fresh fruits or vegetables. The other general category is juice drinks made out of concentrated fruit and vegetable juices. Concentrated fruit and vegetable juices are produced through the pressing, filtering, sterilization and evaporation of fresh fruits or vegetables. Concentrated juices are not drinkable. Instead, they are used as a basic ingredient for manufacturing juice drinks and as an additive to fruit wine and fruit jam, cosmetics and medicines.

Our core products are (1) fruit juice concentrates, mainly including concentrated apple, pear, and kiwi juices; (2) fruit beverages, including pure fruit beverages and fruit cider beverages; and (3) other fruit-related products, including, for example, fresh fruits, vegetables and fructose.

Fruit Juice Concentrate

Our family of fruit juice concentrate products mainly includes concentrated apple, pear, and kiwi juices. Fruit juice concentrates can only be produced during the “squeezing season” of a year, when fresh fruits are available in the market. Generally, the squeezing season for apples is from August through January or February of the following year, the squeezing season for pears is from July or August through April of the following year, and the squeezing season for kiwifruits is from September through December or January of the following year.

Fruit juice concentrates are manufactured through a multi-stage process, which includes pressing, filtering, sterilizing and evaporating fresh fruits and fruit juices.

Fruit juice concentrates are used as the base ingredient in fruit juice beverages and are also used in other products such as ice cream, fruit wine and, to a lesser extent, cosmetics and medicine.

We currently sell apple, pear, and kiwifruit concentrates. Our fruit juice concentrate products include concentrated apple and pear juice. Our concentrated kiwifruits are made of three different categories: kiwifruit puree, concentrated kiwifruit puree and concentrated kiwifruit juice.

Kiwifruit puree is prepared from clean, sound kiwifruits that have been washed and sorted prior to processing. The kiwifruits are crushed and pressed and the pulp of the kiwifruit is kept. All of the water and some of the pulp are then removed from the kiwifruit puree and the sugar level is increased in order to produce concentrated kiwifruit puree. We use advanced technologies to maintain the natural flavors and nutrients of the kiwifruit puree. Kiwifruit puree and concentrated kiwifruit puree are ideal raw materials used in the production of concentrated kiwifruit juices, kiwifruit beverages, kiwifruit flavored ice creams, smoothies and health care products. Concentrated kiwifruit juice is made from concentrated kiwifruit puree by removing all of the remaining pulp.

| 7 |

Our production line at the Shaanxi Qiyiwangguo factory can only produce puree and concentrated puree. We use the production line that produces concentrated apple and pear juice in the facility of the Jingyang branch of SkyPeople (China) to produce concentrated clear kiwifruit juice.

Concentrated apple juice and concentrated pear juice are prepared from fresh fruits. Fruit juice concentrates can also be combined with other fruit juices for the production of blended fruit juices, canned foods, confectionaries, fruit cider beverages and other beverage products.

Fruit Juice Beverages

As compared to our fruit juice concentrate products, which experience seasonality, fruit juice beverages can be produced and sold year round. We plan to focus on developing new beverages with higher margins.

The manufacturing process for fruit juice beverages involves further processing of fruit juice concentrates. Our fruit juice beverages are divided into two categories: pure fruit juice and fruit cider beverages. The gross margins for our fruit beverages were 41% and 36% in fiscal years 2015 and 2014, respectively.

Currently we produce six flavors of fruit beverages in 280 ml glass bottles, 418 ml glass bottles and 500 ml glass bottles as well as BIB (“Bag in Box”) packages, including apple juice, pear juice, kiwifruit juice, mulberry juice, peach juice and pomegranate juice. We currently sell our fruit beverages to over 100 distributors and more than 20,000 retail stores in approximately 20 provinces. Our products are sold through distributors in stores such as Yonghui Supermarket in Beijing, RT-Mart in Shenyang, Carrefour in Chongqing and Shenyang and GMS Supermarket in Shanghai.

Other Fruit-Related Products

We also generally sell fresh fruits and vegetables, fructose and other products.

The fruit processing capacity of our fructose production line is 10 tons of fresh apples or pears per hour. Fructose is often used as an ingredient to make beverages and other food products. Although we currently plan to use the new fructose production line to produce pear fructose, this production may also be used to produce apple fructose from apple juice concentrates.

The gross margin for our other fruit-related products was 29% in the 2014 fiscal year. We did not have revenue from the sale of fruit-related products during the 2015 fiscal year.

| 8 |

Production Capacity

The following table sets forth our current production capacity.

| Subsidiary/branch | Location | Products | Production capacity | Notes | |||||

| Shaanxi Qiyiwangguo | Zhouzhi county, Shaanxi province | Kiwi puree, concentrated kiwi puree and fruit beverages | (1)

(2)

(3) |

Sorting fresh fruits: 10 tons fresh fruits per hour;

Puree/concentrated puree: processing 20 tons of fresh fruits per hour;

Fruit beverages: producing 6,000 bottles per hour |

Approximately 1.5 tons of fresh fruits are used to produce 1 ton of puree; 4 to 4.5 tons of fresh fruits are used to produce 1 ton of concentrated puree | ||||

| Jingyang branch of SkyPeople (China) | Jingyang County, Xianyang City, Shaanxi Province | Concentrated apple and pear juice, concentrated kiwifruit juice and fruit-related products | (1)

(2) |

Concentrated apple/kiwi/pear juice: processing 40 tons of fresh fruits per hour;

Fructose: processing 10 tons of fresh fruits per hour |

All concentrated juice products are manufactured using the same type of production line with slight variations in processing methods | ||||

| Huludao Wonder | Suizhong County, Huludao, Liaoning Province | Concentrated apple/pear juice Fruit juice beverages |

(1) |

Concentrated fruit juice: |

All concentrated juice products are manufactured using the same type of production line with slight variations in processing methods | ||||

| (2) | processing 30 tons of fresh fruits per hour Fruit juice beverages: producing 6,000 bottles/hour | On April 25, 2012, “China Food Production License” for production of Beverage (including fruit juice and vegetable juice) has been granted to Huludao Wonder by Liaoning Bureau of Quality and Technical Supervision. Huludao Wonder commenced operation of fruit juice beverages production line on April 28, 2012. | |||||||

| Yingkou | Gaotai Town, Gaizhou, Liaoning Province | Concentrated apple juice | (1) | Processing 20 tons of fresh fruits per hour | All concentrated juice products are manufactured using the same type of production line with slight variations in processing methods. | ||||

| 9 |

Research and Development

We believe that continuous investment in research and development is a key component to being a leader in fruit juice concentrate and fruit beverages. Our Research and Development Center of SkyPeople (China) was certified as the Provincial Industrial Research & Development Center jointly by six provincial institutions of Shaanxi Provincial People’s Government, including the Department of Communications, the Department of Science and Technology, the Department of Finance, the Bureau of National Taxation, the Bureau of Local Taxation and Xi’an Customs in December 2009. Our research and development effort emphasizes the design and development of our processing technology with the goal of decreasing processing costs, optimizing our production capabilities and maintaining product quality. During 2015 and 2014, the Company did not incur any research and development expenses. In 2015 and 2014, the Company suspended four research and development agreements with research institutions. No penalties were imposed on the suspension of agreements. We currently intend to concentrate on further building up our internal research and development team.

Industry and Principal Markets

Global Market

The fruit juice processing industry is an emerging industry. Consumption of fruit juice beverages has grown and sales have increased rapidly in recent years due to the increasing health consciousness of consumers and the natural and healthy qualities of fruit juice beverages. According to a new report from specialist food and drink consultancy Zenith International, global fruit juice and drink consumption exceeded 80 billion litres in 2015, representing 10% of overall soft drink volume, and the market is forecast to rise by an annual 5% over the next 5 years to 105 billion litres in 2020.

According to the Fruit Juice Section of the PRC Food and Agriculture Export Association, www.Chinajuice.org, the PRC exported approximately $1 billion in concentrated fruit juice to foreign countries every year in the past few years, which accounted for around 60% of the global output of concentrated fruit juice.

The PRC Market

The PRC has the world’s largest population, but the consumption of fruit juice beverages is relatively low. According to the report “China Fruit Juice Beverages Business and Market Analysis” published by the PRC Food and Agriculture Export Association, www.Chinajuice.org, the annual per capita consumption of fruit beverages in the PRC in 2009 was approximately 1 kilogram, which accounted for only 13% of the average world per capita consumption and 4% of the average per capita consumption in industrialized countries. In 2010, Chinese fruit juice production reached 17 million tons, an increase of 20.6% compared to 2009. In 2014, fruit juice consumption was RMB8.2 billion, an increase of 3% compared to the previous year. The growth rate of the revenue from fruit juice and fruit juice drink has ranked first compared with other food related industries. We believe that the increasing health consciousness of consumers and the quality of living powered by the PRC’s economic growth will continue to fuel the demand for our fruit juice products.

Marketing, Sales and Distribution

We market our products through three primary methods: direct contact with foreign businesses, attendance at international exhibitions and sales made through trade websites. Our marketing and sales teams work closely together to maintain a consistent message to our customers.

| 10 |

The sales team is divided into three subdivisions, focusing on the sales of fruit juice concentrates, fruit beverage products and derivative products, respectively.

We sell our fruit juice concentrates both domestically and internationally, while we have only sold our fruit beverages domestically. We sell our products either indirectly through distributors with good credit history or directly to end-users.

Our export business is primarily comprised of fruit juice concentrates. The export of our fruit juice concentrates is handled internally by our international trade department, which has 20 employees.

The North American and European markets represent a large portion of apple and pear concentrate consumption. The U.S. market is a highly mature market with stable growth for apple concentrate. Although we sell to distributors in the PRC, and therefore cannot be certain of where our exported fruit juice concentrate products are ultimately sold, we believe that the volume of exports to the United States of our fruit juice concentrate products has increased annually since 2004. The European market, which we believe has a generally stable consumer base, has been a target market since our inception. Apple concentrate is used to produce many beverages and wines consumed by Europeans. The Middle East is also a target market for our apple juice concentrate.

The Chinese market drives our fruit beverage sales most beverages are sold through provincial, city and county-level agents. We also sell directly to hotels, supermarkets and similar outlets in smaller quantities. The fruit beverage sales are carried out by a team of 45 employees. Historically, we have only sold our fruit beverages regionally in Shaanxi Province and some neighboring cities in the PRC. One of our strategies is to broaden the geographic presence of our brand-named fruit beverages and expand production and sales of higher margin fruit beverages in the PRC.

Our kiwifruit products are targeted at the European, Southeast Asian, South Korean, Japanese, Middle Eastern, Mainland Chinese and Taiwanese markets. The growth of our kiwifruit concentrate and kiwifruit beverages has exceeded the growth rate of any other product we offer.

Competition

The markets in which we operate are competitive, rapidly evolving and subject to shifting customer demands and expectations. We believe that a number of companies are producing products that compete directly with our product offerings and some of our competitors have significantly more financial resources than we possess.

Our apple juice concentrate competitors include Sdic Zhounglu Fruit Juice Co., Ltd., Yantai North Andre (Group) Juice Co., Ltd., Shaanxi Hengxing Fruit Juice and Shaanxi Haisheng Juice Holdings Co., Ltd. We also compete with fruit juice companies such as Wahaha, Huiyuan, Nongfu Guoyuan, Tongyi and Meizhiyuan.

We believe our competitive advantages include our modern equipment and our proprietary processes for the production of specialty fruit juices or small breed fruit juices. We currently possess thirteen patents technologies in fruit juice production. Among these thirteen proprietary technologies, we have obtained nine patents and are in the process of applying for another six patents for other technologies. Our current specialty fruit juice offering includes kiwifruit and mulberry related juice products. We also have technologies to produce concentrated persimmon, turnjujube, apricot, cherry, cherry tomato, sea-buckthorn, strawberry and wolfberry juices. Our technology allows us to develop and produce beverages, such as our new mulberry and kiwifruit cider beverages, which we introduced in the Chinese market in the first quarter of 2009. Our research indicates that these new beverages have higher gross margins than that of the industry average.

| 11 |

We believe the proximity of our manufacturing facilities to fruit farms is also one of our competitive advantages. It allows us to purchase fruit directly from fruit farmers, avoid the need for long distance transportation, minimize damages to the fruits and maximize the freshness of the fruits.

We produce fruit beverages from our fruit juice concentrates, which allows us to better control the quality of our beverages.

Raw Materials and Other Supplies

Fresh fruits, including apples, pears and kiwifruits are the primary raw materials for our products. The continuous supply of high quality fresh fruit is necessary for our current operations and our future business growth.

The PRC has the largest planting area of kiwifruit and apples in the world. Shaanxi Province, the location of two of our factories, has the largest planting area of kiwifruit and apples in the PRC. According to “Statistical Bulletin of Development of Fruit Industry in Shaanxi Province 2010,” in 2010, the kiwifruit planting area in Shaanxi Province was over 114,226 acres. In 2015, the kiwifruit planting area in Shaanxi Province was about 164,737 acres, with an output of 12.3 million tons, which is 20% of the world output and 33% of China’s total output. Pomegranate, strawberry, peach and cherry yields are also high in Shaanxi Province. Liaoning Province in the PRC, the location of our Huludao Wonder and Yingkou factories, abounds with high acidity apples. Other raw materials used in our business include pectic enzyme, amylase, auxiliary power fuels and other power sources such as coal, electricity and water.

We purchase raw materials from local markets and fruit growers that deliver directly to our plants. We have implemented a fruit purchasing program in areas surrounding our factories. In addition, we organize purchasing centers in rich fruit production areas, helping farmers deliver fruit to our purchasing agents easily and in a timely manner. We are then able to deliver the fruit directly to our factory for production. We have assisted local farmers in their development of kiwifruit fields to help ensure a high quality product throughout the production channel. Our raw material supply chain is highly fragmented and raw fruit prices are highly volatile.

Shaanxi Province is a large agricultural and fruit producing province with sufficient resources to satisfy our raw material needs. Shaanxi Province is also the main pear-producing province in the PRC and its pear supply can generally meet our production requirements. Liaoning Province, the PRC’s center for high acidity apples, can generally supply enough apples to meet our Liaoning Province factory’s production needs.

In addition to raw materials, we purchase various ingredients and packaging materials such as sweeteners, glass and plastic bottles, cans and packing barrels. We generally purchase our materials or supplies from multiple suppliers. We are not dependent on any one supplier or group of suppliers.

| 12 |

Seasonality

We can only produce fruit juice concentrates during the squeezing season generally from July or August through April of the following year, while our fruit juice beverages can be produced year round. Annual capacity of our production lines varies based on the availability of the fresh fruit and is ultimately contingent on weather and other climatic conditions leading up to and through the harvest seasons. As a result, our business is highly seasonal as sales of our products are generally higher during the squeezing season. Sales of our products during the months from March through July, or the non-squeezing season, generally tend to be lower due to a shortage of fresh fruit and a lower level of production activity. As a result, our results of operations for the first and fourth quarters are generally stronger than those for our second and third quarters. We can produce fruit juice beverages year round.

We plan to broaden our fruit product offerings to expand into fruits with harvesting seasons complementary to our current fruits. This will enable us to lengthen our squeezing season, thus increasing our annual production of fruit concentrate and fruit juice beverages. In the first quarter of 2009, we introduced mulberry and kiwifruit cider beverages in the Chinese market. We intend to diversify our product mix and increase our revenues.

Government Regulation

Our products are subject to central government regulation as well as provincial government regulation in Shaanxi and Liaoning Provinces. Business and product licenses must be obtained through application to the central, provincial and local governments. We have obtained our business licenses to operate domestically and export products under the laws and regulations of the PRC. We obtained business licenses to conduct businesses, including an operating license to sell packaged foods such as concentrated fruit and vegetable juices, fruit sugar, fruit pectin, frozen and freeze dried fruits and vegetables, dehydrated fruits and vegetables, fruit and vegetable juice drinks, fruit cider and organic food. Business, company and product registrations are certified on a regular basis and we must comply with the laws and regulations of the PRC, provincial and local governments and industry agencies.

In accordance with PRC laws and regulations, we are required to comply with applicable hygiene and food safety standards in relation to our production processes. Failure to pass these inspections, or the loss of or failure to renew our licenses and permits, could require us to temporarily or permanently suspend some or all of our production activities, which could disrupt our operations and adversely affect our business.

Currently Chinese environment laws and regulations do not negatively impact our business and our cost to comply with such laws and regulations is immaterial.

Intellectual Property

SkyPeople (China) currently possesses six proprietary technologies, including the technologies to:

| ● | Produce concentrated clear kiwifruit juice; | |

| ● | Produce a mulberry cider beverage; | |

| ● | Produce apricot juice concentrates; | |

| ● | Produce cherry tomato juice concentrates; | |

| ● | Produce sea-buckthorn juice concentrates; and | |

| ● | Produce wolfberry juice concentrates |

| 13 |

We hold twenty-two active patents granted by the State Intellectual Property Office of the PRC, (“SIPO”).

A crushing and peeling device (Patent No. ZL 2011204456246)

A peeling and dirt removal device (Patent No. ZL 2011204456212)

A kiwifruit cider beverage and its production method (Patent No. ZL 2009 1 0022739.1)

A production technology for strawberry juice concentrates (Patent No. ZL 2010 1 0209900.9)

A production technology for turnjujube juice concentrates (Patent No. ZL 2010 1 0108318.3)

A production technology for cherry juice concentrates (Patent No. ZL 2010 1 0209899.X)

A production technology for persimmon juice concentrates (Patent No. ZL 2010 1 0013613.0) (granted to SkyPeople (China) on January 16, 2013)

A production technology for medlar juice concentrates (Patent No. ZL 2010 1 0227315.1) (granted to SkyPeople (China) on April 24, 2013)

A production technology for sea-buckthorn juice concentrates (Patent No. ZL 2010 1 0227303.9) (granted to SkyPeople (China) on April 24, 2013)

A production technology for tomato cherry juice concentrates (Patent No. ZL 2010 1 0207254.2) (granted to SkyPeople (China) on March 6, 2013)

A production technology for apricot juice concentrates (Patent No. ZL 2010 1 0207253.8) (granted to SkyPeople (China) on April 9, 2014)

500 ml Hedetang-branded fruit juice beverages in glass bottle label (Patent No. ZL 2012302099757) (granted to SkyPeople (China) on May 30, 2012)

418 ml Hedetang-branded fruit juice beverages in glass bottle label (Patent No. ZL 2012302099935) (granted to SkyPeople (China) on May 30, 2012)

280 ml Hedetang-branded fruit juice beverages in glass bottle label (Patent No. ZL 2012 3 0557344.4) (granted to SkyPeople (China) on April 24, 2013)

418 ml Hedetang-branded fruit juice beverages in glass bottle label (Patent No. ZL 2012 3 0557424.X) (granted to SkyPeople (China) on April 3, 2013)

500 ml Hedetang-branded fruit juice beverages in glass bottle label (Patent No. ZL 2012 3 0557301.6) (granted to SkyPeople (China) on March 20, 2013)

236 ml Hedetang-branded fruit juice beverages in glass bottle label (Patent No. ZL 2014302060578) (granted to SkyPeople (China) on December 17, 2014)

888 ml fruit juice beverages in glass bottle label (Patent No. ZL 2014 3 0206022.4) (granted to SkyPeople (China) on February 18, 2015)

Kiwifruits box package (Patent No. ZL 2012 3 0561124.9) (granted to SkyPeople (China) on April 24, 2013)

418 ml fruits juice beverage packing box (Patent No. ZL 2012 3 0557226.3) (granted to SkyPeople (China) on April 3, 2013)

500 ml fruits juice beverage packing box (Patent No. ZL 2012 3 0557346.3) (granted to SkyPeople (China) on April 24, 2013)

500 ml fruits juice beverage packing box (Patent No. ZL 2012 3 0557346.3) (granted to SkyPeople (China) on April 24, 2013)

| 14 |

We believe that these technologies are leading technologies in our industry.

In addition, using our proprietary technologies, we have developed flow-through capacitor membrane, reverse osmosis concentration and composite biological enzymolysis technology to clarify and remove murkiness from fruit juice. We believe that such are leading technologies in our industry.

We believe that our continued success and competitive status depend largely on our proprietary technology and ability to innovate. We have taken the required measures to protect the confidentiality of our proprietary technologies and processes. We rely on a combination of know-how, patent and trade secret laws, as well as confidentiality agreements to protect our proprietary rights. We will take the necessary action to seek remuneration if we believe our intellectual property rights have been infringed upon. As of December 31, 2015, we held twenty-one active patents granted by SIPO related to breaking up and separating fruit peel; removing fruit peel and fruit hair; production of various concentrated fruit juice; and bottle tags, respectively. These patents have a duration of 10 years. In addition to these nine active patents, we are applying for another six scientific patents. However, we do not have patents on certain other items of intellectual property that we possess.

We also hold registered trademarks for our “Hedetang” brand with the Trademark Bureau of the State Administration for Industry and Commerce (“SAIC”) granted on September 14, 2008 in Category 29, Category 30, Category 31 and Category 32, and on April 21, 2009 in Category 5. The trademarks expire on September 13, 2018 and April 20, 2019, respectively, and can be extended upon expiration.

We hold registered trademarks for our “SkyPeople” brand with the Trademark Bureau of the SAIC in Category 30 and Category 32 with period of validity from May 14, 2011 to May 13, 2021, and in Category 31 with period of validity from September 7, 2011 to September 6, 2021. The registration of such trademarks can be extended upon expiration.

Employees

As of December 31, 2015, we had approximately 250 full-time employees and approximately 95 part-time employees, all of whom are located in the PRC. None of our employees are covered by a collective bargaining agreement.

ITEM 1A – RISK FACTORS

An investment in the Company’s common stock involves a high degree of risk. In addition to the following risk factors, you should carefully consider the risks, uncertainties and assumptions discussed herein, and in other documents that the Company subsequently files with the Securities and Exchange Commission, (the “Commission” or the “SEC”), that update, supplement or supersede such information for which documents are incorporated by reference into this Report. Additional risks not presently known to the Company, or which the Company considers immaterial based on information currently available, may also materially adversely affect the Company’s business. If any of the events anticipated by the risks described herein occur, the Company’s business, cash flow, results of operations and financial condition could be adversely affected, which could result in a decline in the market price of the Company’s common stock, causing you to lose all or part of your investment.

| 15 |

Risks Related to Our Business

We may not be able to effectively control and manage our growth, and a failure to do so could adversely affect our operations and financial condition.

Our revenue increased significantly from 2006 to 2010 with revenue of approximately $17.4 million in 2006, approximately $29.4 million in 2007, approximately $41.7 million in 2008, approximately $59.2 million in 2009, approximately $93.2 million in 2010. In 2011, our revenue decreased by 9.9% to $84.0 million as compared to the prior year. In 2012, our revenue increased by 22% to $102 million. In 2013, our revenue decreased 23% to $79.0 million. In 2014, our revenue increased to $99 million. In 2015, our revenue decreased to $86 million. If our business and markets continue to experience significant growth, we will need to expand our business to maintain our competitive position. We may face challenges in managing and financing expansion of our business, facilities and product offerings, including challenges relating to integration of acquired businesses and increased demands on our management team, employees and facilities. Failure to effectively deal with increased demands on us could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies. Other challenges involved with expansion, acquisitions and operation include:

| ● | unanticipated costs; | |

| ● | the diversion of management’s attention from other business concerns; | |

| ● | potential adverse effects on existing business relationships with suppliers and customers; | |

| ● | obtaining sufficient working capital to support expansion; | |

| ● | expanding our product offerings and maintaining the high quality of our products; | |

| ● | continuing to fill customers’ orders on time; | |

| ● | maintaining adequate control of our expenses and accounting systems; | |

| ● | successfully integrating any future acquisitions; and | |

| ● | anticipating and adapting to changing conditions in the fruit juice and beverage industry, whether from changes in government regulations, mergers and acquisitions involving our competitors, technological developments or other economic, competitive or market dynamics. |

Even if we obtain benefits of expansion in the form of increased sales, there may be delay between the time when the expenses associated with an expansion or acquisition are incurred and the time when we recognize such benefits, which could negatively affect our earnings.

| 16 |

Our revenue and profitability are heavily dependent on prevailing prices for our products and raw materials, and if we are unable to effectively offset cost increases by adjusting the pricing of our products, our margins and operating income may decrease.

As a producer of commodities, our revenue, gross margins and cash flows from operations are substantially dependent on the prevailing prices we receive for our products and the cost of our raw materials, neither of which we control. The factors influencing the sales price of concentrated fruit juice include the supply price of fresh fruit, supply and demand of our products in international and domestic markets and competition in the fruit juice industry.

The price of our principal raw materials, fresh fruit, is subject to market volatility as a result of numerous factors including, but not limited to, general economic conditions, governmental regulations, weather, transportation delays and other uncertainties that are beyond our control. Due to such market volatility, we generally do not, nor do we expect to, have long-term contracts with our fresh fruit suppliers. Other significant raw materials used in our business include packing barrels, pectic enzyme, amylase and auxiliary materials such as coal, electricity and water. Prices for these items may be volatile as well and we may experience shortages in these items from time to time. As a result, we cannot guarantee that the necessary raw materials to produce our products will continue to be available to us at prices currently in effect or acceptable to us. In the event raw material prices increase materially, we may not be able to adjust our product prices, especially in the short term, to recover such cost increases. If we are not able to effectively offset these cost increases by adjusting the price of our products, our margins will decrease and earnings will suffer accordingly.

Weather and other environmental factors affect our raw material supply and a reduction in the quality or quantity of our fresh fruit supplies may have material adverse consequences on our financial results.

Our business may be adversely affected by weather and environmental factors beyond our control, such as adverse weather conditions during the growing or squeezing seasons. A significant reduction in the quantity or quality of fresh fruit harvested resulting from adverse weather conditions, disease or other factors could result in increased per unit processing costs and decreased production, with adverse financial consequences to us.

We sell our products primarily through distributors and delays in delivery or poor handling by distributors may affect our sales and damage our reputation.

We primarily sell our products through our distributors and rely on these distributors for the distribution of our products. These distributors are not obligated to continue to sell our products. Any disruptions in our relationships with our distributors could cause interruption to the supply of our products to retailers, which would harm our revenue and results of operations. In addition, delivery disruptions may occur for various reasons beyond our control, including poor handling by distributors or third party transport operators, transportation bottlenecks, natural disasters and labor strikes, and could lead to delayed or lost deliveries. Some of our products are perishable and poor handling by distributors and third party transport operators could also result in damage to our products that would make them unfit for sale. If our products are not delivered to retailers on time, or are delivered damaged, we may have to pay compensation, we could lose business and our reputation could be harmed.

| 17 |

Because we experience seasonal fluctuations in our sales, our quarterly results will fluctuate and our annual performance will depend largely on results from our first and fourth quarters.

Our business is highly seasonal, reflecting the harvest season of our primary source fruits from July or August of a year to April the following year. Typically, a substantial portion of our revenue is earned during our first and fourth quarters. We generally experience lower revenue during our second and third quarters. Generally, sales in the first and fourth quarters accounted for approximately 65% to 72% of our revenue of the whole year. If sales in our first and fourth quarters are lower than expected, our operating results would be adversely affected and it would have a disproportionately large impact on our annual operating results.

If we are unable to gain market acceptance or significant market share for the new products we introduce, our results of operations and profitability could be adversely impacted.

Our future business and financial performance depends, in part, on our ability to successfully respond to consumer preferences by introducing new products and improving existing products. We cannot guarantee that we will be able to gain market acceptance or significant market share for our new products. Consumer preferences change, and any new products that we introduce may fail to meet the particular tastes or requirements of consumers, or may be unable to replace their existing preferences. Our failure to anticipate, identify or react to these particular tastes or changes could result in reduced demand for our products, which could in turn cause us to be unable to recover our development, production and marketing costs, thereby leading to a decline in our profitability.

The development and introduction of new products is key to our expansion strategy. We incur significant development and marketing costs in connection with the introduction of new products. Successfully launching and selling new products puts pressure on our sales and marketing resources, and we may fail to invest sufficient funds in order to market and sell a new product effectively. If we are not successful in marketing and selling new products, our results of operations could be materially adversely affected.

Economic conditions have had and may continue to have an adverse effect on consumer spending on our products.

The worldwide economy has not yet fully recovered from a recession, which has reduced discretionary income of consumers. The adverse effect of a sustained international economic downturn, including sustained periods of decreased consumer spending, high unemployment levels, declining consumer or business confidence and continued volatility and disruption in the credit and capital markets, will likely result in reduced demand for our products as consumers turn to less expensive substitute goods or forego certain purchases altogether. To the extent the international economic downturn continues or worsens, we could experience a reduction in sales volume. If we are unable to reduce our operating costs and expenses proportionately, many of which are fixed, our results of operations would be adversely affected.

| 18 |

Concerns over food safety and public health may affect our operations by increasing our costs and negatively impacting demand for our products.

We could be adversely affected by diminishing confidence in the safety and quality of certain food products or ingredients. As a result, we may elect or be required to incur additional costs aimed at increasing consumer confidence in the safety of our products. For example, a crisis in the PRC over melamine contaminated milk in 2008 has adversely impacted Chinese food exports since October 2008, as reported by the Chinese General Administration of Customs, although most foods exported from the PRC were not significantly affected by the melamine contamination. In addition, our concentrated fruit juices exported to foreign countries must comply with quality standards in those countries. Our success depends on our ability to maintain the quality of our existing and new products. Product quality issues, real or imagined, or allegations of product contamination, even if false or unfounded, could tarnish the image of our brands and may cause consumers to choose other products.

We face increasing competition from both domestic and foreign companies, and any failure by us to compete effectively could adversely affect our results of operations.

The juice beverage industry is highly competitive, and we expect it to continue to become even more competitive. Our ability to compete in the industry depends, to a significant extent, on our ability to distinguish our products from those of our competitors by providing high quality products at reasonable prices that appeal to consumers’ tastes and preferences. There are currently a number of well-established companies producing products that compete directly with ours. Some of our competitors may have been in business longer than we have, may have substantially greater financial and other resources than we have and may be better established in their markets. We anticipate that our competitors will continue to improve their products and introduce new products with competitive price and performance characteristics.

We cannot guarantee that our current or potential competitors will not provide products comparable or superior to those we provide or adapt more quickly than we do to evolving industry trends or changing market requirements. It is also possible that there will be significant consolidation in the juice beverage industry among our competitors, and alliances may develop among competitors. These alliances may rapidly acquire significant market share, and some of our distributors may commence production of products similar to those we sell to them. Increased competition may result in price reductions, reduced margins and loss of market share, any of which could materially adversely affect our profit margins. We cannot guarantee that we will be able to compete effectively against current and future competitors. Aggressive marketing or pricing by our competitors or the entrance of new competitors into our markets could have a material adverse effect on our business, results of operations and financial condition.

We may engage in future acquisitions involving significant expenditures of cash, the incurrence of debt or the issuance of stock, all of which could have a materially adverse effect on our operating results.

As part of our business strategy, we review acquisition and strategic investment prospects that we believe would complement our current product offerings, augment our market coverage, enhance our technological capabilities or otherwise offer growth opportunities. From time to time, we review investments in new businesses and we expect to make investments in, and to acquire, businesses, products or technologies in the future. In the event of any future acquisitions, we may expend significant cash, incur substantial debt and/or issue equity securities and dilute the percentage ownership of current shareholders, all of which could have a material adverse effect on our operating results and the price of our Common Stock. We cannot guarantee that we will be able to successfully integrate any businesses, products, technologies or personnel that we may acquire in the future, and our failure to do so could have a material adverse effect on our business, operating results and financial condition.

| 19 |

We require various licenses and permits to operate our business, and the loss of or failure to renew any or all of these licenses and permits could materially adversely affect our business.

In accordance with PRC laws and regulations, we have been required to maintain various licenses and permits in order to operate our business at the relevant manufacturing facilities including, without limitation, industrial product production permits. We are required to comply with applicable hygiene and food safety standards in relation to our production processes. Our premises and transportation vehicles are subject to regular inspections by the regulatory authorities for compliance with the Detailed Rules for Administration and Supervision of Quality and Safety in Food Producing and Processing Enterprises. Failure to pass these inspections, or the loss of or failure to renew our licenses and permits, could require us to temporarily or permanently suspend some or all of our production activities, which could disrupt our operations and adversely affect our business.

Governmental regulations affecting the import or export of products could negatively affect our revenue.

The United States and various other governments have imposed controls, export license requirements and restrictions on the export of some of our products. Governmental regulation of exports, or our failure to obtain required export approval for our products, could harm our international sales and adversely affect our revenue and profits. In addition, failure to comply with such regulations could result in penalties, costs and restrictions on export privileges.

We do not presently maintain product liability insurance, and our property and equipment insurance does not cover the full value of our property and equipment, which leaves us with exposure in the event of loss or damage to our properties or claims filed against us.

We currently do not carry any product liability or other similar insurance. Product liability claims and lawsuits in the PRC generally are still rare, unlike in some other countries. Product liability exposures and litigation, however, could become more commonplace in the PRC. Moreover, we have product liability exposure in countries in which we sell our products, such as the United States, where product liability claims are more prevalent. As we expand our international sales, our liability exposure will increase.

We may be required from time to time to recall products entirely or from specific copackers, markets or batches. Although historically we have not had any recall of our products, we cannot guarantee that circumstances or incidents will not occur that will require us to recall our products. We do not maintain recall insurance. In the event we experience product liability claims or a product recall, our business operations and financial condition could be materially adversely affected.

| 20 |

Our business and operations may be subject to disruption from work stoppages, terrorism or natural disasters.

Our operations may be subject to disruption for a variety of reasons, including work stoppages, acts of war, terrorism, pandemics, fire, earthquake, flooding or other natural disasters. If a major incident were to occur in either of the regions where our facilities or main offices are located, our facilities or offices or those of critical suppliers could be damaged or destroyed. Such a disruption could result in a reduction in available raw materials, the temporary or permanent loss of critical data, suspension of operations, delays in shipment of products and disruption of business generally, which would adversely affect our revenue and results of operations.

Our success depends substantially on the continued retention of certain key personnel and our ability to hire and retain qualified personnel in the future to support our growth.

If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. While we depend on the abilities and participation of our current management team generally, we rely particularly upon Mr. Yongke Xue, a member of the Company’s Board of Directors (the “Board”); and Mr. Hanjun Zheng, our interim chief financial officer (“CFO”). The loss of the services of Mr. Yongke Xue or Mr. Hanjun Zheng for any reason could significantly adversely impact our business and results of operations. Competition for senior management and senior technology personnel in the PRC is intense and the pool of qualified candidates is very limited. Accordingly, we cannot guarantee that the services of our senior executives and other key personnel will continue to be available to us, or that we will be able to find a suitable replacement for them if they were to leave.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by the Sarbanes-Oxley Act of 2002, (“Sarbanes-Oxley”). Our senior management does not have experience managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may be unable to implement programs and policies in an effective and timely manner or that adequately respond to the increased legal, regulatory and reporting requirements associated with being a publicly traded company. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties, distract our management from attending to the management and growth of our business, result in a loss of investor confidence in our financial reports and have an adverse effect on our business and stock price.

| 21 |

As a public company, we are obligated to maintain effective internal controls over financial reporting. Our internal controls may be determined not to be effective, which may adversely affect investor confidence in us and, as a result, decrease the value of our Common Stock.

The PRC has not adopted management and financial reporting concepts and practices similar to those in the United States. We may have difficulty in hiring and retaining a sufficient number of qualified finance and management employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing and maintaining accounting and financial controls, collecting financial data, budgeting, managing our funds and preparing financial statements, books of account and corporate records and instituting business practices that meet investors’ expectations in the United States.

Rules adopted by the SEC, or the Commission, pursuant to Sarbanes-Oxley Section 404 require annual assessment of our internal controls over financial reporting. This requirement first applied to our annual report on Form 10-K for the fiscal year ended December 31, 2008. The standards that must be met for management to assess the internal controls over financial reporting as effective are relatively new and complex, and they require significant documentation, testing and possible remediation to meet the detailed standards. This assessment will need to include disclosure of any material weaknesses identified by our management in our internal control over financial reporting. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting, we will be unable to assert that our internal controls are effective. If we are unable to conclude that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which could harm our business and cause the price of our Common Stock to decline.

We may have inadvertently violated Sarbanes-Oxley Section 402 and Section 13(k) of the Securities Exchange Act and may be subject to sanctions for such violations.

Section 13(k) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) provides that it is unlawful for a company such as ours, which has a class of securities registered under Section 12(b) of the Exchange Act to, directly or indirectly, including through any subsidiary, extend or maintain credit in the form of a personal loan to or for any director or executive officer of the company. Issuers violating Section 13(k) of the Exchange Act may be subject to civil sanctions, including injunctive remedies and monetary penalties, as well as criminal sanctions. The imposition of any of such sanctions on the Company may have a material adverse effect on our business, financial position, results of operations or cash flows.

In February 2008, we purchased Pacific, which is the holding company for our operating subsidiary, SkyPeople (China). At the time, Hede, a PRC company owned by Yongke Xue, a member of the Board and our former chief executive officer, and Xiaoqin Yan, a former director on the Board, was indebted to SkyPeople (China) on account of previous loans and advances made by SkyPeople (China) to Hede. Such loans and advances totaled RMB 31,544,043 in the aggregate (or $4,318,281 based on the exchange rate as of December 31, 2007) and were made during the period from June 6, 2007 to December 29, 2007 that were used by Hede to pay a portion of the purchase price for Hede’s acquisition of Huludao Wonder Fruit Co., Ltd., or Huludao Wonder. In May 2008, SkyPeople (China) also assumed Hede’s obligation of RMB 18,000,000 (or $2,638,329 based on the exchange rate December 31, 2008) for the balance of the purchase price for Huludao Wonder.

On June 10, 2008, Hede sold Huludao Wonder to SkyPeople (China) for a total price of RMB 48,250,000 (or $6,308,591 based on the exchange rate on June 1, 2007) the same price that Hede paid for Huludao Wonder. As of May 31, 2008, SkyPeople (China) had a related party receivable of RMB 48,929,272 (or $7,171,751 based on the exchange rate December 31, 2008) from Hede, which was credited against the purchase price, so that SkyPeople (China) did not pay any cash to Hede for the purchase, and the remaining balance of the loans and advances of RMB 679,272 (or $99,564 based on the exchange rate as of December 31, 2008) to Hede was repaid to us on June 11, 2008. Hede paid no interest or other consideration to us on account of the time value of money with respect to the loans and advances made by SkyPeople (China) to Hede.

Notwithstanding Hede’s repayment in full of loans made by SkyPeople (China) to Hede, the existence of indebtedness of Hede to SkyPeople (China) at the time we acquired Pacific and the continuation of such indebtedness thereafter until it was fully repaid in June 2008 may constitute a violation of Section 13(k) of the Exchange Act and Section 402(a) of Sarbanes-Oxley.