Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MBIA INC | d293729d8k.htm |

| EX-99.1 - EX-99.1 - MBIA INC | d293729dex991.htm |

Project Phantom ZOHAR COLLATERAL OVERVIEW NOVEMBER 2016 Exhibit 99.2

Disclaimer These materials, and any oral or video presentation that may supplement them (collectively, the “materials”) are being provided to your company by Houlihan Lokey in connection with an actual or potential engagement, are for discussion purposes only and may not be relied upon by any person or entity for any purpose except as expressly permitted by Houlihan Lokey’s engagement letter (if any). The materials are provided on a confidential basis and may not be disclosed, summarized, reproduced, disseminated or quoted or otherwise referred to, in whole or in part, without our express prior written consent. The information used in preparing the materials was obtained from or through your company and/or one or more other sources, and Houlihan Lokey makes no representations as to the accuracy or completeness of such information and expressly disclaims any liability associated therewith. Houlihan Lokey assumes no responsibility for independent verification of such information and has relied on such information being true, complete and accurate. To the extent such information includes estimates and forecasts of future financial performance (including estimates of potential cost savings and synergies), we have assumed that such estimates and forecasts have been reasonably prepared in good faith on bases reflecting the best currently available estimates and judgments of the management that provided such information (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). Any analyses contained herein (as well as any suggestions or recommendations contained herein and/or derived from the content of the materials) are preliminary in nature, speak as of the date hereof, and are subject to reconsideration and modification. Any statements and estimates contained in the materials constitute Houlihan Lokey’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In addition, our analyses are not and do not purport to be appraisals of the assets, stock, or business of your company or any other entity or opinions concerning the fairness of any proposal or “offer” price that may be referred to herein. Houlihan Lokey makes no representations as to the actual value which may be received in connection with any transaction. The materials should not be considered a recommendation with respect to any transaction or other matter. The materials were designed for use by specific persons familiar with the business and affairs of your company. Houlihan Lokey undertakes no obligation to update, revise or reaffirm the materials. Notwithstanding any other provision herein, your company (and each employee, representative or other agent of your company) may disclose to any and all persons without limitation of any kind, the tax treatment and tax structure of any transaction and all materials of any kind (including opinions or other tax analyses, if any) that are provided to your company relating to such tax treatment and structure. However, any information relating to the tax treatment and tax structure shall remain confidential (and the foregoing sentence shall not apply) to the extent necessary to enable any person to comply with securities laws. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. income or franchise tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. income or franchise tax treatment of the transaction. If your company plans to disclose information pursuant to the first sentence of this paragraph, your company shall inform those to whom it discloses any such information that they may not rely upon such information for any purpose without Houlihan Lokey’s prior written consent. Houlihan Lokey is not an expert on, and nothing contained in the materials should be construed as advice with regard to, legal, accounting, regulatory, insurance, tax or other specialist matters. Accordingly, Houlihan Lokey’s personnel may make statements or provide advice that is contrary to information contained in the materials. Houlihan Lokey is a trade name for Houlihan Lokey, Inc. and its subsidiaries and certain of its affiliates. Houlihan Lokey and its affiliates (collectively, the “Houlihan Lokey Group”) engage in providing investment banking, securities trading, financing, financial advisory, and consulting services and other commercial and investment banking products and services to a wide range of institutions and individuals. The materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by the Houlihan Lokey Group to provide or arrange any financing for any transaction or to purchase any security in connection therewith. In the ordinary course of business, the Houlihan Lokey Group and certain of its employees, as well as investment funds in which they may have financial interests or with which they may co-invest, may acquire, hold or sell, long or short positions, or trade or otherwise effect transactions, in debt, equity, and other securities and financial instruments (including bank loans and other obligations) of, or investments in, your company or any other party that may be involved in the matters mentioned in the materials or have other relationships with such parties. With respect to any such securities, financial instruments and/or investments, all rights in respect of such securities, financial instruments and investments, including any voting rights, will be exercised by the holder of the rights, in its sole discretion. In addition, the Houlihan Lokey Group may in the past have had, and may currently or in the future have, financial advisory or other investment banking or consulting relationships with parties involved in the matters mentioned in the materials, including parties that may have interests with respect to your company, any transaction or other parties involved in any transaction, from which conflicting interests or duties may arise. Although the Houlihan Lokey Group in the course of such other activities and relationships may acquire information about your company, any transaction or such other parties, or that otherwise may be of interest to your company, the Houlihan Lokey Group shall have no obligation to, and may not be contractually permitted to, disclose such information, or the fact that the Houlihan Lokey Group is in possession of such information, to your company or to use such information on your company’s behalf. The federal law of the United States may require us to obtain, verify and record information that identifies each person with whom we do business as a condition to doing business with that person. Such information includes certain identifying information necessary to verify your company's identity, such as a government-issued identification number (e.g., a U.S. taxpayer identification number), certified articles of incorporation, a government-issued business license, partnership agreement or trust instrument.

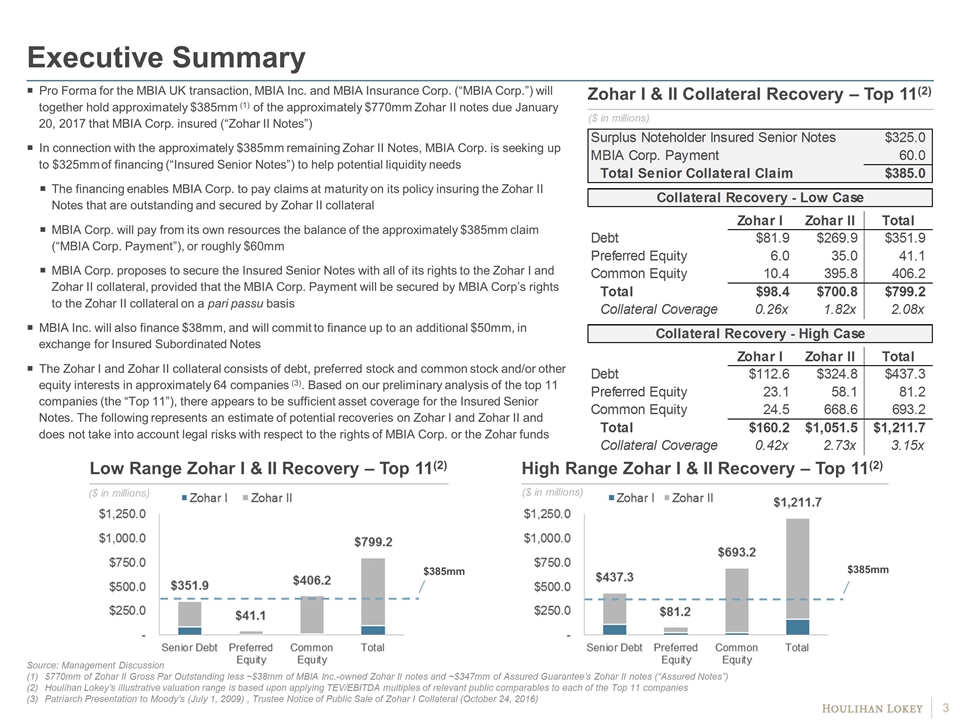

Pro Forma for the MBIA UK transaction, MBIA Inc. and MBIA Insurance Corp. (“MBIA Corp.”) will together hold approximately $385mm (1) of the approximately $770mm Zohar II notes due January 20, 2017 that MBIA Corp. insured (“Zohar II Notes”) In connection with the approximately $385mm remaining Zohar II Notes, MBIA Corp. is seeking up to $325mm of financing (“Insured Senior Notes”) to help potential liquidity needs The financing enables MBIA Corp. to pay claims at maturity on its policy insuring the Zohar II Notes that are outstanding and secured by Zohar II collateral MBIA Corp. will pay from its own resources the balance of the approximately $385mm claim (“MBIA Corp. Payment”), or roughly $60mm MBIA Corp. proposes to secure the Insured Senior Notes with all of its rights to the Zohar I and Zohar II collateral, provided that the MBIA Corp. Payment will be secured by MBIA Corp’s rights to the Zohar II collateral on a pari passu basis MBIA Inc. will also finance $38mm, and will commit to finance up to an additional $50mm, in exchange for Insured Subordinated Notes The Zohar I and Zohar II collateral consists of debt, preferred stock and common stock and/or other equity interests in approximately 64 companies (3). Based on our preliminary analysis of the top 11 companies (the “Top 11”), there appears to be sufficient asset coverage for the Insured Senior Notes. The following represents an estimate of potential recoveries on Zohar I and Zohar II and does not take into account legal risks with respect to the rights of MBIA Corp. or the Zohar funds Executive Summary Source: Management Discussion $770mm of Zohar II Gross Par Outstanding less ~$38mm of MBIA Inc.-owned Zohar II notes and ~$347mm of Assured Guarantee’s Zohar II notes (“Assured Notes”) Houlihan Lokey’s illustrative valuation range is based upon applying TEV/EBITDA multiples of relevant public comparables to each of the Top 11 companies Patriarch Presentation to Moody’s (July 1, 2009) , Trustee Notice of Public Sale of Zohar I Collateral (October 24, 2016) Zohar I & II Collateral Recovery – Top 11(2) ($ in millions) Low Range Zohar I & II Recovery – Top 11(2) High Range Zohar I & II Recovery – Top 11(2) $385mm $385mm ($ in millions) ($ in millions)

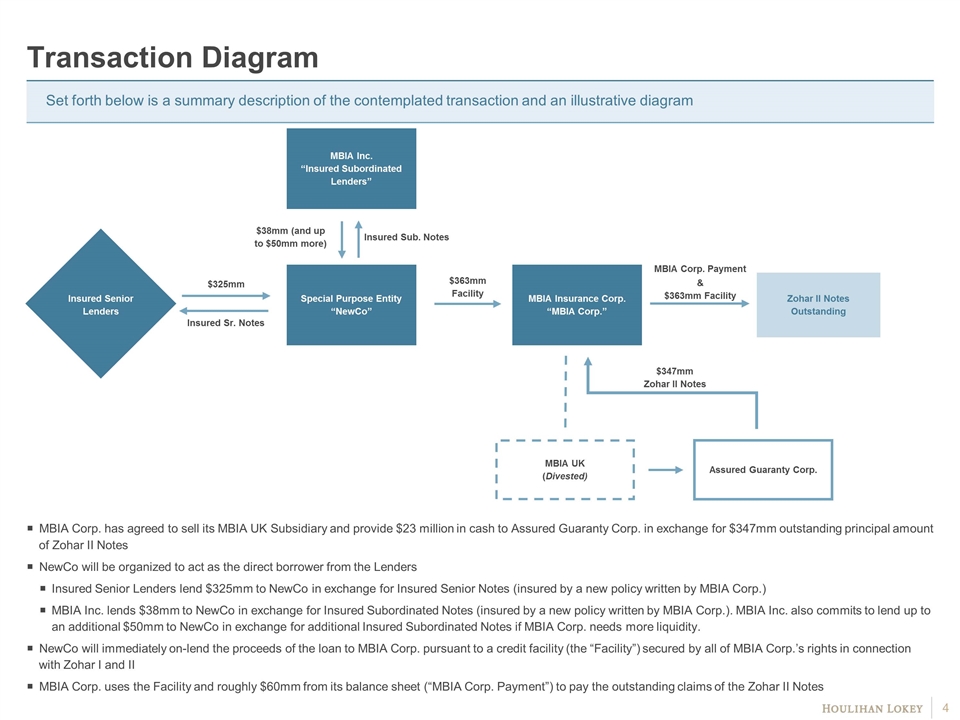

Transaction Diagram Insured Senior Lenders MBIA Insurance Corp. “MBIA Corp.” Zohar II Notes Outstanding Assured Guaranty Corp. MBIA UK (Divested) MBIA Corp. has agreed to sell its MBIA UK Subsidiary and provide $23 million in cash to Assured Guaranty Corp. in exchange for $347mm outstanding principal amount of Zohar II Notes NewCo will be organized to act as the direct borrower from the Lenders Insured Senior Lenders lend $325mm to NewCo in exchange for Insured Senior Notes (insured by a new policy written by MBIA Corp.) MBIA Inc. lends $38mm to NewCo in exchange for Insured Subordinated Notes (insured by a new policy written by MBIA Corp.). MBIA Inc. also commits to lend up to an additional $50mm to NewCo in exchange for additional Insured Subordinated Notes if MBIA Corp. needs more liquidity. NewCo will immediately on-lend the proceeds of the loan to MBIA Corp. pursuant to a credit facility (the “Facility”) secured by all of MBIA Corp.’s rights in connection with Zohar I and II MBIA Corp. uses the Facility and roughly $60mm from its balance sheet (“MBIA Corp. Payment”) to pay the outstanding claims of the Zohar II Notes Special Purpose Entity “NewCo” MBIA Inc. “Insured Subordinated Lenders” $325mm $38mm (and up to $50mm more) $363mm Facility $347mm Zohar II Notes MBIA Corp. Payment & $363mm Facility Set forth below is a summary description of the contemplated transaction and an illustrative diagram Insured Sr. Notes Insured Sub. Notes

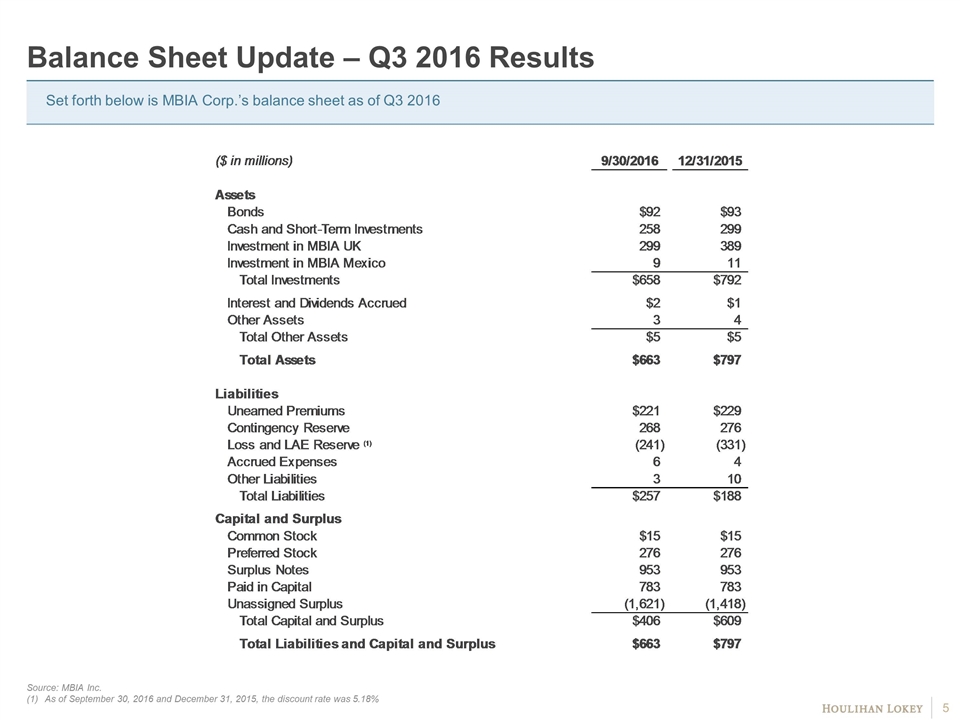

Balance Sheet Update – Q3 2016 Results Set forth below is MBIA Corp.’s balance sheet as of Q3 2016 Source: MBIA Inc. As of September 30, 2016 and December 31, 2015, the discount rate was 5.18%

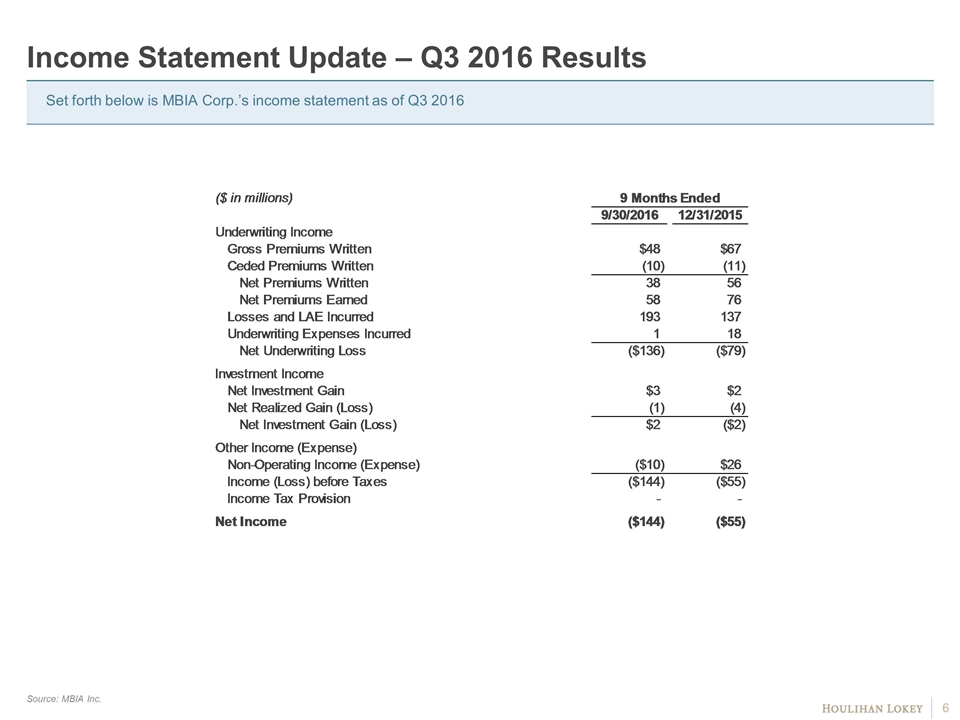

Income Statement Update – Q3 2016 Results Set forth below is MBIA Corp.’s income statement as of Q3 2016 Source: MBIA Inc.

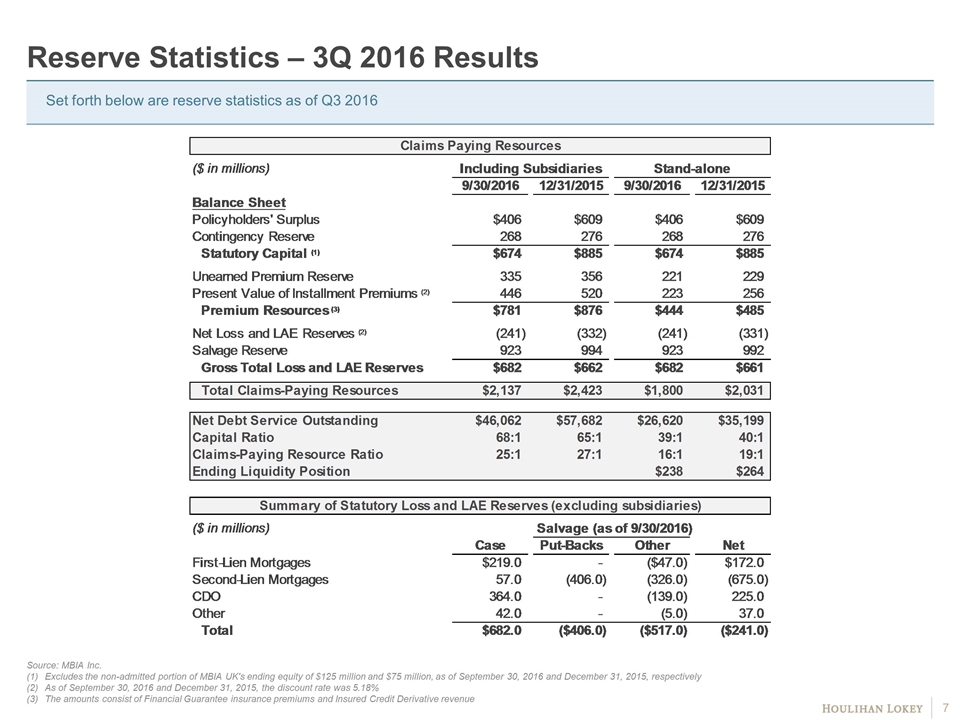

Reserve Statistics – 3Q 2016 Results Source: MBIA Inc. Excludes the non-admitted portion of MBIA UK's ending equity of $125 million and $75 million, as of September 30, 2016 and December 31, 2015, respectively As of September 30, 2016 and December 31, 2015, the discount rate was 5.18% The amounts consist of Financial Guarantee insurance premiums and Insured Credit Derivative revenue Set forth below are reserve statistics as of Q3 2016

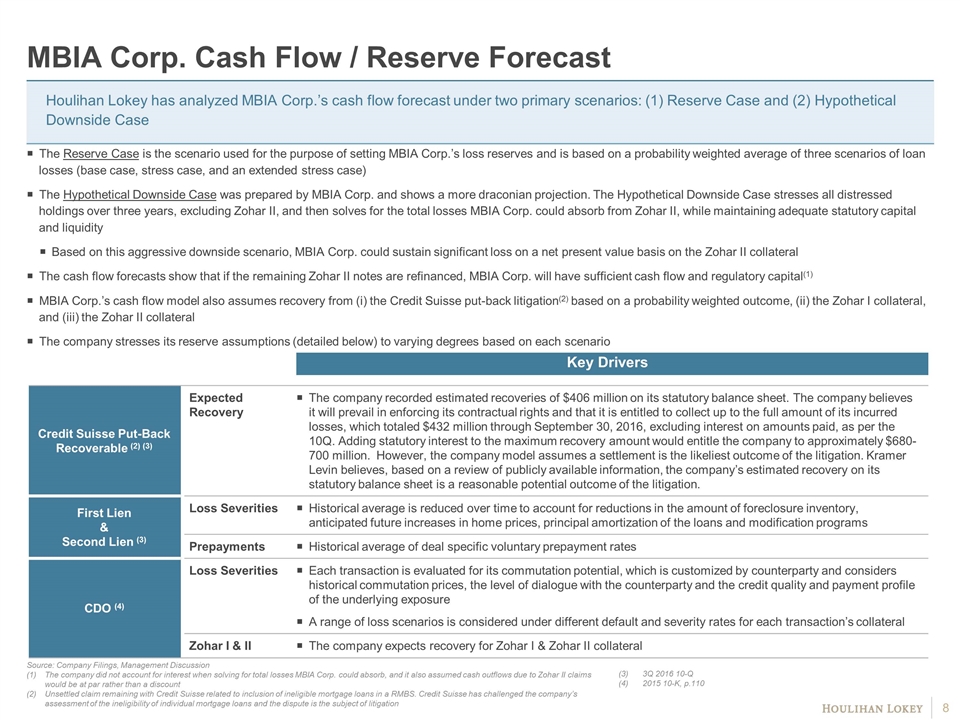

The Reserve Case is the scenario used for the purpose of setting MBIA Corp.’s loss reserves and is based on a probability weighted average of three scenarios of loan losses (base case, stress case, and an extended stress case) The Hypothetical Downside Case was prepared by MBIA Corp. and shows a more draconian projection. The Hypothetical Downside Case stresses all distressed holdings over three years, excluding Zohar II, and then solves for the total losses MBIA Corp. could absorb from Zohar II, while maintaining adequate statutory capital and liquidity Based on this aggressive downside scenario, MBIA Corp. could sustain significant loss on a net present value basis on the Zohar II collateral The cash flow forecasts show that if the remaining Zohar II notes are refinanced, MBIA Corp. will have sufficient cash flow and regulatory capital(1) MBIA Corp.’s cash flow model also assumes recovery from (i) the Credit Suisse put-back litigation(2) based on a probability weighted outcome, (ii) the Zohar I collateral, and (iii) the Zohar II collateral The company stresses its reserve assumptions (detailed below) to varying degrees based on each scenario MBIA Corp. Cash Flow / Reserve Forecast Houlihan Lokey has analyzed MBIA Corp.’s cash flow forecast under two primary scenarios: (1) Reserve Case and (2) Hypothetical Downside Case Key Drivers Credit Suisse Put-Back Recoverable (2) (3) Expected Recovery The company recorded estimated recoveries of $406 million on its statutory balance sheet. The company believes it will prevail in enforcing its contractual rights and that it is entitled to collect up to the full amount of its incurred losses, which totaled $432 million through September 30, 2016, excluding interest on amounts paid, as per the 10Q. Adding statutory interest to the maximum recovery amount would entitle the company to approximately $680-700 million. However, the company model assumes a settlement is the likeliest outcome of the litigation. Kramer Levin believes, based on a review of publicly available information, the company’s estimated recovery on its statutory balance sheet is a reasonable potential outcome of the litigation. First Lien & Second Lien (3) Loss Severities Historical average is reduced over time to account for reductions in the amount of foreclosure inventory, anticipated future increases in home prices, principal amortization of the loans and modification programs Prepayments Historical average of deal specific voluntary prepayment rates CDO (4) Loss Severities Each transaction is evaluated for its commutation potential, which is customized by counterparty and considers historical commutation prices, the level of dialogue with the counterparty and the credit quality and payment profile of the underlying exposure A range of loss scenarios is considered under different default and severity rates for each transaction’s collateral Zohar I & II The company expects recovery for Zohar I & Zohar II collateral Source: Company Filings, Management Discussion The company did not account for interest when solving for total losses MBIA Corp. could absorb, and it also assumed cash outflows due to Zohar II claims would be at par rather than a discount Unsettled claim remaining with Credit Suisse related to inclusion of ineligible mortgage loans in a RMBS. Credit Suisse has challenged the company’s assessment of the ineligibility of individual mortgage loans and the dispute is the subject of litigation 3Q 2016 10-Q 2015 10-K, p.110

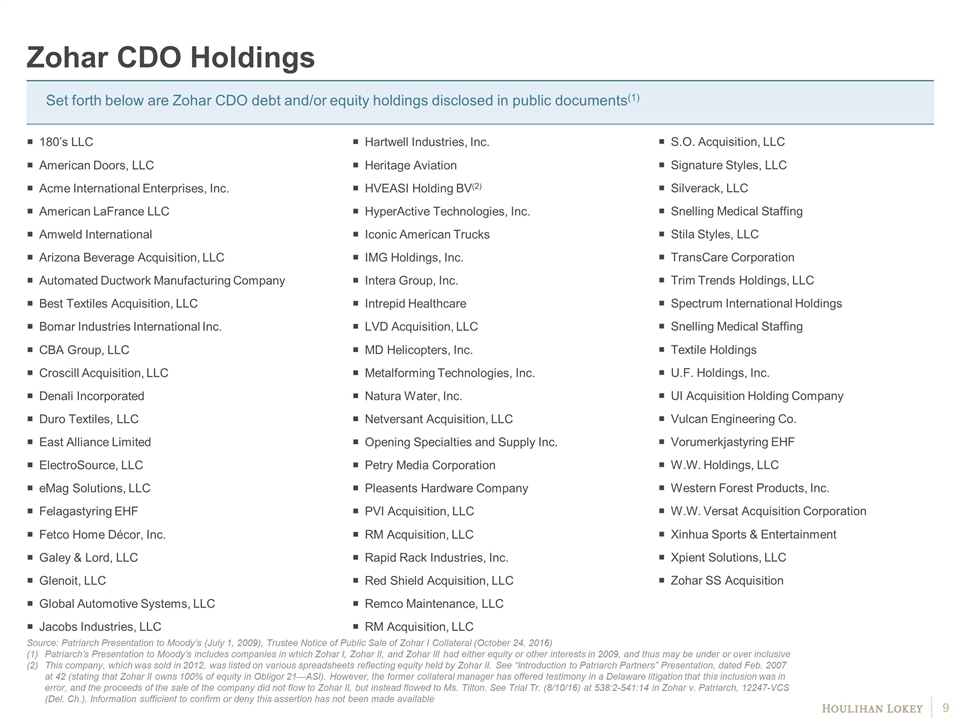

180’s LLC American Doors, LLC Acme International Enterprises, Inc. American LaFrance LLC Amweld International Arizona Beverage Acquisition, LLC Automated Ductwork Manufacturing Company Best Textiles Acquisition, LLC Bomar Industries International Inc. CBA Group, LLC Croscill Acquisition, LLC Denali Incorporated Duro Textiles, LLC East Alliance Limited ElectroSource, LLC eMag Solutions, LLC Felagastyring EHF Fetco Home Décor, Inc. Galey & Lord, LLC Glenoit, LLC Global Automotive Systems, LLC Jacobs Industries, LLC Zohar CDO Holdings Hartwell Industries, Inc. Heritage Aviation HVEASI Holding BV(2) HyperActive Technologies, Inc. Iconic American Trucks IMG Holdings, Inc. Intera Group, Inc. Intrepid Healthcare LVD Acquisition, LLC MD Helicopters, Inc. Metalforming Technologies, Inc. Natura Water, Inc. Netversant Acquisition, LLC Opening Specialties and Supply Inc. Petry Media Corporation Pleasents Hardware Company PVI Acquisition, LLC RM Acquisition, LLC Rapid Rack Industries, Inc. Red Shield Acquisition, LLC Remco Maintenance, LLC RM Acquisition, LLC Set forth below are Zohar CDO debt and/or equity holdings disclosed in public documents(1) Source: Patriarch Presentation to Moody’s (July 1, 2009), Trustee Notice of Public Sale of Zohar I Collateral (October 24, 2016) Patriarch’s Presentation to Moody’s includes companies in which Zohar I, Zohar II, and Zohar III had either equity or other interests in 2009, and thus may be under or over inclusive This company, which was sold in 2012, was listed on various spreadsheets reflecting equity held by Zohar II. See “Introduction to Patriarch Partners” Presentation, dated Feb. 2007 at 42 (stating that Zohar II owns 100% of equity in Obligor 21—ASI). However, the former collateral manager has offered testimony in a Delaware litigation that this inclusion was in error, and the proceeds of the sale of the company did not flow to Zohar II, but instead flowed to Ms. Tilton. See Trial Tr. (8/10/16) at 538:2-541:14 in Zohar v. Patriarch, 12247-VCS (Del. Ch.). Information sufficient to confirm or deny this assertion has not been made available S.O. Acquisition, LLC Signature Styles, LLC Silverack, LLC Snelling Medical Staffing Stila Styles, LLC TransCare Corporation Trim Trends Holdings, LLC Spectrum International Holdings Snelling Medical Staffing Textile Holdings U.F. Holdings, Inc. UI Acquisition Holding Company Vulcan Engineering Co. Vorumerkjastyring EHF W.W. Holdings, LLC Western Forest Products, Inc. W.W. Versat Acquisition Corporation Xinhua Sports & Entertainment Xpient Solutions, LLC Zohar SS Acquisition

Houlihan Lokey and Kramer Levin Naftalis & Frankel LLP (“Counsel”) performed the following diligence, which was limited by various constraints highlighted on the next slide and was therefore not subject to a usual degree of diligence verification The diligence process included discussions with MBIA, MBIA Corp.’s counsel and other advisors, and the current Collateral Manager of Zohar I and II Houlihan Lokey and Counsel reviewed materials in the following categories regarding the Zohar I and Zohar II assets, all of which were obtained from MBIA Corp. or its representatives, pursuant to non-disclosure agreements, or the public domain: Certain transaction documents and other documents relating to the collateral held by Zohar I and II in the portfolio companies Presentations, marketing materials, and other admissions by Patriarch Partners Zohar I Auction Notice and WSJ Advertisement (lists collateral in Zohar I held by the Zohar I Trustee) Certain court filings and testimony in various litigations including: Zohar CDO 2003-1, LLC v. Patriarch Partners, LLC, C.A. No. 12247-VCS (Del. Ch. Ct.) (Document Production Litigation) Patriarch Partners XV, LLC v. U.S. Bank, N.A., No. 654819/2016 (S.D.N.Y.) (Auction Litigation) In re Zohar CDO 2003-1, No. 15-23680, 15-23681, 15-23682 (RDD) (Bankr. S.D.N.Y.) (Zohar I Bankruptcy) In the Matter of Lynn Tilton and Patriarch Partners, No. 3-16462 (SEC Administrative Proceeding) Tilton v. Securities and Exchange Commission, No. 16-cv-7408 (S.D.N.Y.) (Challenge to SEC Proceeding) MBIA Ins. Corp. v. Patriarch Partners VIII, LLC, No. 09-cv-3255 (RWS) (S.D.N.Y.) (B Note Litigation) Houlihan Lokey also received an update from MBIA Inc. / MBIA Corp. detailing MBIA Corp.’s current financial situation after the sale of MBIA UK and the company’s liquidity forecast Diligence Process Overview Source: Management Discussion

Houlihan Lokey and Counsel were unable to conduct a full due diligence process due to the lack of complete and current available information, and lack of access to Patriarch Partners and management teams of each of the portfolio companies of Zohar I and II MBIA and its counsel and other advisors are subject to court orders and confidentiality agreements limiting the extent of information that can be provided as part of the diligence exercise The Zohar I and II Collateral Manager is similarly bound by confidentiality orders and restrictions The documents provided concerning, and as evidence of, the Zohar I and II collateral were outdated and incomplete, such that it was not possible to verify that the Zohar funds maintain many of the holdings that serve as a basis for this presentation The information provided did not include any documents evidencing third party verification of the authenticity of the debt- and equity-related documents The information provided did not contain any transfer agreements (or other evidence of transfers) and existing evidence of ownership is non-verifiable or often circumstantial in nature, such that it is not possible to conclusively trace the current chain of title of the collateral For example, it is possible that portions of the collateral may have been transferred out of the Zohar funds (although, in the materials reviewed, there was no evidence that such transfers occurred)(1) We have not seen, if they exist at all, any official registry or ledger listing the debt and equity interests held by Zohar I and II in the portfolio companies Risk Factors Source: Management Discussion Footnote 2 on Slide 9 indicates one possible exception to this revealed through trial testimony from Lynn Tilton

The SEC fraud allegations and various litigations surrounding Lynn Tilton and Patriarch Partners, as former collateral manager, raise concerns about the reliability of the information provided, much of which was provided to MBIA by Tilton or one of the Patriarch entities Patriarch is believed to be the CEO or manager of nearly all of the portfolio companies, in which Zohar I and II hold or held debt or equity interests Patriarch was also the Collateral Manager of Zohar I and II until March 2016 In a recent decision, the Delaware Chancery Court held that Patriarch failed to turn over to the successor Collateral Manager a substantial amount of documentation regarding the Zohar I and II collateral Patriarch Partners Agency Services, a Patriarch entity controlled by Lynn Tilton, was and (despite having been replaced by the Zohar funds and despite continuing litigation) continues to act as the agent under the Zohar indentures Estimates of timing / magnitude of cash flows provided by MBIA Corp. may not be accurate due to the uncertainty surrounding specific issues tied to these cash flows Thus, due to the various due diligence constraints and the risks identified, Houlihan Lokey’s valuation analysis should be viewed as illustrative Risk Factors (cont.) Source: Management Discussion