Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PAVmed Inc. | t1602901_8k.htm |

Exhibit 99.1

TM NASDAQ: PAVM CORPORATE PRESENTATION Fall 2016 1

Disclaimers This presentation contains certain forward-looking statements that involve risks and uncertainties. Actual results and events may differ significantly from results and events discussed in forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in “Risk Factors” in our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. We undertake no obligation to update publicly any forward-looking statements to reflect new information, events, or circumstances after the date they were made. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. PAVmed has not yet sought nor received clearance from the FDA or any other regulatory agency for any of the products described in this presentation. More information is available at www.pavmed.com or by contacting la@pavmed.com 2

Innovative multi-product medical device company… …employing a unique business model designed to advance products from concept to commercialization much more rapidly and with significantly less capital than the typical medical device company. 3

Investment Highlights Unique, proven business model focused on capital efficiency and speed to market Deep, expanding pipeline of innovative products across a broad spectrum of clinical conditions with clear paths to near-term commercialization Attractive market opportunities for lead products totaling over $4 billion Leadership team of entrepreneurs with a strong track record of value creation 4

Leadership team with strong record of value creation LISHAN MICHAEL BRIAN AKLOG, MD GLENNON DEGUZMAN, MD CHAIRMAN & CEO VICE CHAIRMAN CHIEF MEDICAL OFFICER A.B. Physics, magna B.A.,Business B.S.Biology cum laude Administration Phi Beta Kappa M.D., cum laude Endoscopy and M.D. Surgical Instrument General Surgery ORIGIN Territory Sales Resident MEDSYSTEMS Manager General Surgery Cardiothoracic Surgery Resident Resident Cardiac Surgery Assistant Professor Territory and Regional CardiacSurgery Associate Surgeon Sales Manager Research Fellow CRM Sales Manager Cardiothoracic Surgery Associate Chief of Resident Cardiac Surgery CRM District Sales Assistant Professor Manager Clinical Associate Director of Minimally Invasive Cardiac Associate Surgeon Surgery Senior Vice President, AssistantProfessor of Sales and Marketing Surgery Chair of the Cardiovascular Center FoundingPartner Associate Chief of Chief of CEO, Vortex Medical, Cardiovascular Surgery Cardiovascular Surgery Saphena Medical and Assistant Professor of Associate Professor of Cruzar Medical Surgery Surgery Senior Advisor, Director Kaleidoscope FoundingPartner FoundingPartner Medical CMO, Vortex Medical Chairman and CTO, CEO, Kaleidoscope Vortex Medical Medical Senior Advisor, Senior Advisor, Director Director, Saphena Saphena Medical and Medical, Kaleidoscope Cruzar Medical Medical and Cruzar Medical 5

Lead products provide near-term value creation opportunities PortIO CarpX Implantable Vascular Access Device Percutaneous Carpal Tunnel Device NextCath DisappEAR Self-Anchoring Short-Term Catheters Resorbable Antibiotic-Eluting Ear Tubes NextFlo Caldus Disposable Tissue Ablation Devices Highly Accurate Infusion System (*)PAVmed has not yet sought nor received clearance from the FDA or any other regulatory agency for any of these products. 6

The PAVmed Business Model 7

Proven record of capital efficiency and speed to market TIME AND CAPITAL TO FDA CLEARANCE PAVmed Model 23 months Typical Company 60months 0 12 24 36 48 60 Months PAVmed Model $3 million Typical Company $31 million $0 $10,000,000 $20,000,000 $30,000,000 Dollars (*)Typical Company data from Markower, et al. FDA Impact on US Medical Technology Innovation 2010 8

Commercial opportunity drives project selection criteria Reimbursement Profile High Margin Product Technology Profile Commercial Opportunity Unmet Clinical Need Attractive Market Regulatory Profile 9

Key business processes deliver capital and time efficiency Outsourced Parallel Regulatory Best-in-class Development Strategy Process Experts Processes Capital Speed To Efficiency Market Light Flexible Infrastructure Commercialization Low Fixed Costs Strategy 10

Multi-product strategy enhances value creation Economies Of Risk Mitigation Scale Flexible, Dynamic Non-binary Allocation Of Success Resources Enhanced Value Creation 11

Flexible commercialization strategy accelerates value creation Remain Opportunistic Initiate Accelerate To Maximize Commercialization Revenue Growth Value Creation INDEPENDENT CORPORATE CORPORATE REGULATORY DISTRIBUTOR PARTNER PARTNER CLEARANCE NETWORK Sales and Distribution Licensing agreement Call-point specific Agreement Acquisition of product DIRECT SALES FORCE Call-point specific 12

Lead Product Development Pipeline 13

Lead products provide near-term value creation opportunities COMMERCIALIZATION REGULATORY PRODUCT ADDRESSABLE MARKET INITIAL TARGET PATH CHANNEL DATE PortIO Independent Q2 Long-term Implantable Vascular Access Ports $500M 510(k) Distributors 2017 Vascular Access Devices CarpX Percutaneous Treatment Carpal Tunnel Independent Q3 $1B 510(k) of Carpal Tunnel Syndrome Distributors 2017 Syndrome Independent Q3 EndovenousAblation $240M 510(k) Distributors 2017 Caldus Independent Q3 Disposable Tissue Fistulae $300M 510(k) Distributors 2017 Ablation Devices CE Mark / Independent Q3 Renal Denervation $1B Emerging Markets Distributors 2018 NextCath Corporate Percutaneous Drainage Q3 Self-Anchoring Short- $200M 510(k) Distribution Catheters 2017 Term Catheters Agreement DisappEAR Independent Q3 Antibiotic-eluting Pediatric Ear Tubes $300M 510(k) Distributors 2018 Resorbable Ear Tubes NextFlo Corporate Disposable Infusion Q4 Highly Accurate $500M 510(k) Distribution Pumps 2017 Disposable Infusion Pump Agreement (*)PAVmed has not yet sought nor received clearance from the FDA or any other regulatory agency for any of these products. 14

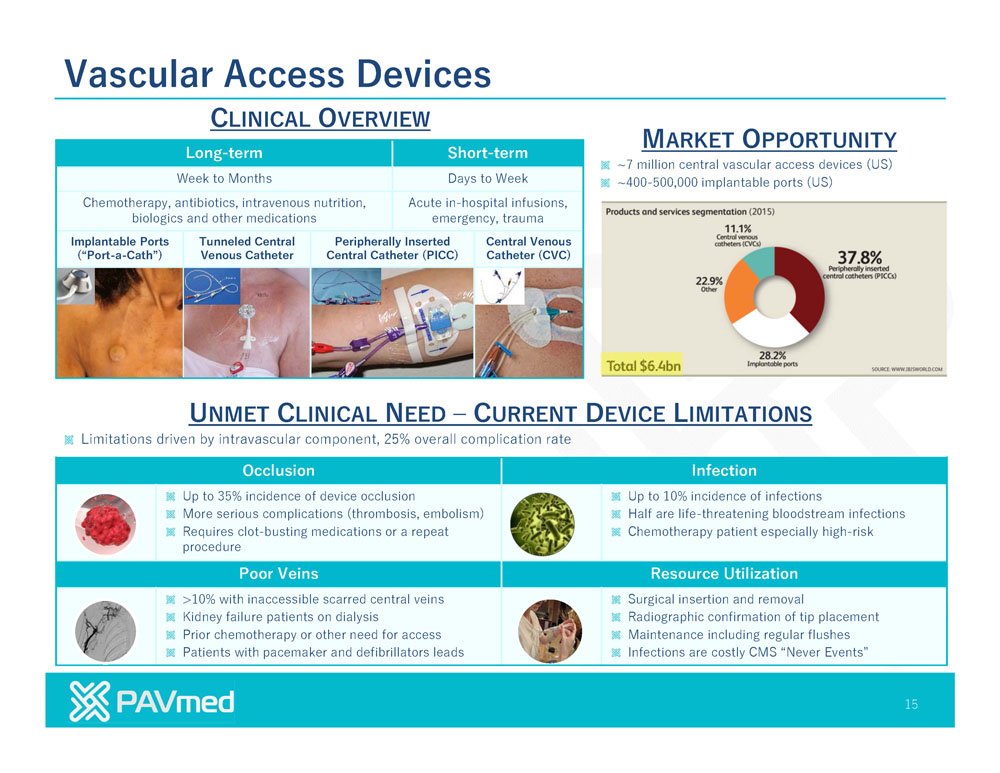

Vascular Access Devices CLINICAL OVERVIEW MARKET OPPORTUNITY Long-term Short-term ~7 million central vascular access devices (US) Weekto Months Days to Week ~400-500,000 implantable ports (US) Chemotherapy, antibiotics, intravenous nutrition, Acute in-hospitalinfusions, biologics and other medications emergency, trauma Implantable Ports TunneledCentral PeripherallyInserted Central Venous (“Port-a-Cath”) Venous Catheter Central Catheter (PICC) Catheter (CVC) UNMET CLINICAL NEED CURRENT DEVICE LIMITATIONS Limitations driven by intravascular component, 25% overall complication rate Occlusion Infection Up to 35% incidenceof device occlusion Up to10% incidence of infections More serious complications (thrombosis, embolism) Half are life-threatening bloodstream infections Requires clot-busting medications or a repeat Chemotherapy patient especially high-risk procedure Poor Veins Resource Utilization >10% with inaccessible scarred central veins Surgical insertion and removal Kidney failure patients on dialysis Radiographic confirmation of tip placement Prior chemotherapy or other need for access Maintenance including regular flushes Patients with pacemaker and defibrillators leads Infections are costly CMS “Never Events” 15

PortIO The PAVmed Solution INTRAOSSEOUS VASCULAR ACCESS IMPLANTABLE INTRAOSSEOUS PORT Infusion directly into the bone marrow cavity NO INTRAVASCULAR COMPONENT Rapid, direct drainage into central venous circulation via Subcutaneous, implantable intraosseous vascular access nutrient/emissary veins Self-tapping/drilling hollow bone screw, septum, body with internal conical needle guide but no reservoir, “Non-collapsible” vascular access route Implanted into cortical bone over a guide through a small skin incision Infusion needle inserted through skin, septum and channel directly accessing bone marrow cavity Well established infusion route for adults and children trauma, military, emergency setting Bioequivalent to intravenous infusion Few contraindications, low complication rates Target commercialization Q2 2017 Expanding use in non-emergent clinical scenarios Initial target poor venous access patients Fewer Complications Less Invasive Fewer occlusions Simple, near-percutaneous insertion and removal Potential for fewer, less serious infections More Cost Effective More Versatile No need for regular flush Rapid, predictable, repeatable No radiographic confirmation Near limitless number of potential access sites critical in Shift procedures out of OR to less expensive locale patients those with poor veins 16

Carpal Tunnel Syndrome CLINICAL OVERVIEW MARKET OPPORTUNITY Estimated prevalence 3-8% of adults = 5 million Estimated $1 billion market Not considering 1.4M patients/year who choose not to >3M office visits per year undergo surgery but might consider percutaneous approach Over 600,000 U.S. procedures annually Most common cumulative trauma disorder Half of all occupational injuries in the U.S. and over $20 billion in annual workers' compensation costs Inflammation of transverse carpal ligament leads to entrapment of the median nerve and hand pain, numbness and weakness UNMET CLINICAL NEED CURRENT LIMITATIONS TraditionalSurgery is Invasive Endoscopic Surgery is Less Effective Up to 2 inch incision Remains a surgical procedure Open surgical procedure performed in an operating room performed in an operating Higher recurrence rate room Higher reoperation rate Post-operative pain Increased nerve injury Atleast 3-4 month recovery Higher costs 17

CarpX The PAVmed Solution PERCUTANEOUS DEVICETOTREAT CARPAL TUNNEL SYNDROME NO SURGICAL INCISION Balloon catheter with bipolar radiofrequency cutting electrode Device inserted into tunnel percutaneously over a guidewire under ultrasound guidance Balloon inflated, stretching the ligament over the electrodes and pushing the median nerve safely away Electrode activated, cleanly cutting ligament from inside out in <1.5 sec with no visible injury to surrounding structures Successful completion of pre-clinical cadaver study demonstrating reliable and effective transection of the transverse carpal ligament, replicating anatomic result of traditional, invasive carpal tunnel surgery Completing commercial design, expect to begin pre-submission validation/verification testing in 2016 Target commercialization Q3 2017 Fewer Complications Less Invasive Better nerve protection Truly percutaneous Greater lateral dissection may decrease recurrence rates No surgical incision or dissection No riskof infection Less pain, scarring and recovery time More Cost Effective Expanded Market Shift procedures to interventional lab or office Lower threshold for intervention for patients “suffering in Shorten procedural times silence”, delaying treatment until symptoms become Shortenrecovery time and return to work debilitating 18

Caldus MARKET OPPORTUNITY THE PAVMED SOLUTION CLINICAL CALDUS Ablation of pathologic soft tissues Completely disposable tissue ablation devices including for Varicose veins renal denervation Fistulae Direct thermal ablation using proprietary infusion device and Renal denervation for refractory hypertension continuous flow balloon catheter Multiple other targets MORE COST EFFECTIVE TOTAL/IMMEDIATE ADDRESSABLE MARKET No capital and maintenance costs $240M to $1B Lower procedural cost while maintaining margin Higher temperatures allow shorter ablation times CURRENT DEVICE LIMITATIONS Expensive, difficult to maintain capital equipment (console) EXPANDED MARKET required to generate ablation energy Lower distribution costs to OUS markets Complex algorithms and other features necessary to achieve Attractive to emerging markets with limited resources to wide ablation field distribute and maintain capital equipment 19

NextCath MARKET OPPORTUNITY THE PAVMED SOLUTION CLINICAL NEXTCATH Short-term catheters Self-anchoring, short-term catheters ADDRESSABLE MARKET Integrated semi-stiff helical portion Total: All short-term vascular catheters ~$1-2B Resists forceful dislodgement while allowing it to be Immediate: Interventional radiology catheters ~$240M advanced/withdrawn with gentle rotation (pleural, nephrostomy, abscess, etc.) Applicable to most, if not all, short-term catheters L Sits flush with the skin, more comfortable CURRENT DEVICE IMITATIONS Catheter dislodgement leads to pain, increased costs and MORE COST EFFECTIVE potentially more serious complications Eliminate need for costly catheter securement devices Monitoring catheter patency and security is labor intensive Decrease need for monitoring catheter security Separate catheter securement devices add complexity and Decrease number of labor-intensive re-insertions cost to patient care FEWER COMPLICATIONS More secure than traditional approaches Decreases complications associated with dislodgement 20

DisappEAR MARKET OPPORTUNITY ANTIBIOTIC-ELUTING RESORBABLE EAR TUBES CLINICAL REVOLUTIONARY DEVICE TO TREAT PEDIATRIC EAR INFECTIONS Population = Children with persistent ear infections (otitis DISAPPEAR media) or those with middle ear fluid collections (effusions) Antibiotic-eluting ear tube made from a new proprietary Procedure = Placement of metal, plastic or latex bilateral ear bioabsorbable silk material tubes to ventilate and drain Intellectual property owned jointly by Tufts/Mass General #1 ambulatory surgery in kids Hospital/Mass Eye and Ear Infirmary (MEEI) CURRENT DEVICE LIMITATIONS Conceived by Dr. Chris Hartnick, Chief of Pediatric ENT at MEEI Requires general anesthesia for placement AND removal and Harvard Medical School Requires 7-10 days of difficult-to-administer post-procedure Successful animal studies completed using working prototypes antibiotic ear drops Tube dislodgment into the middle ear a difficult, permanent Market, regulatory (510k) and manufacturability analysis completed problem which results in pain, bleeding and requiring second including target COGS and ASP procedure PAVmed entered into definitive licensing agreement with above Require water precautions institutions providing it with exclusive worldwide license to develop and commercialize antibiotic-eluting resorbable ear tubes ADDRESSABLE MARKET 670,000-1M procedures annually in US, 20-50% need repeat MAJOR CLINICAL BENEFITS surgery No need for second general anesthesia procedure to remove ear Estimate $200-300M market opportunity based on premium tube pricing incorporating cost savings from replacing post-procedure No need for difficult-to-administer post-procedure antibiotic ear antibiotic drops drop regimen No need for water precautions FEWER COMPLICATIONS Less chance of tube falling into the middle ear causing pain bleeding and no long-term risk of damage if it does Reduce risk of permanent perforation 21

NextFlo MARKET OPPORTUNITY THE PAVMED SOLUTION CLINICAL NEXTFLO Disposable infusion pumps (DIP) Highly accurate DIP using variable flow resistors Increasing numbers receiving infusions outside hospital Resistance varies inversely to driving pressure, maintaining DIPs favored for home infusions because they are small, easy constant flow to conceal, enhance mobility Incapable of flowing above designated flow rate ADDRESSABLE MARKET FEWER COMPLICATIONS Total/Immediate: DIPs for home use ~$500M Prevents complications associated with infusions running too CURRENT DEVICE LIMITATIONS slow/fast Highly inaccurate in actual use MORE COST EFFECTIVE Susceptible to changes in operating conditions Reduces or eliminates need for trained healthcare personnel Safety profiles unsuitable for use with medications where flow to initiate or monitor infusion accuracy is critical Decreases hospital stay by transitioning more infusions to Numerous reports of complications and even deaths from outpatient setting infusions running too slow or too fast EXPANDS MARKET Broadens range DIP-administered medications 22

Strong expanding intellectual property portfolio Our proprietary designs, technologies, methods and know-how are of critical importance and we seek to secure patent protection to protect them in the U.S. and throughout the rest of the world Our patent portfolio currently consists of the following: 2 issued patents 9 pending patent applications 5 patent applications to be filed We will actively pursue additional patents as we enhance our existing products and develop/in-license new products We also require all employees and third-party consultants and agents to execute protective agreements providing for confidentiality, non-competition and intellectual property assignment rights in favor of the company to further protect our intellectual property 23

Growth Strategy Advance lead products to commercialization quickly and efficiently PortIO, CarpX, NextCath, Caldus, DisappEAR and NextFlo Discussions with large corporate strategics on commercial partnerships Expand product pipeline Ongoing discussions with innovative clinicians and academic medical centers using collaboration models focused on licensing technologies Advancing conceptual phase projects through patent submission and early testing Explore synergistic acquisition targets 24

Near-and long-term opportunities for value creation Q4-2018 Caldus Renal Denervation EU/Emerging Market Commercialization DisappEAR Commercialization Q2-2018 Q3-2017 Caldus Renal Denervation CarpX Commercialization CE Mark Submission NextCath Commercialization DisappEAR FDA Submission Q4-2017 Caldus Fistula/Vein FDA Caldus Fistula/Vein Submission Commercialization NextFlo Commercialization Q2-2017 PortIO Commercialization NextCath FDA Submission NextFlo FDA Submission Q1-2017 CarpX FDA Submission Q4-2016 PortIO FDA Submission 25

26 Equity Securities Overview Market Capitalization Calculation Common Shares Outstanding (21-Nov-2016) 13,310,000 Share Price (21-Nov-2016) $9.20 Market Capitalization $122,452,000 Fully-Diluted Market Capitalization(1) $167,057,243 Warrant Summary Warrants Outstanding (21-Nov-2016) 10,620,295 Warrant Price (21-Nov-2016) $8.00 Exercise Price $5.00 Exercisability Date October 28, 2016 Expiration Date April 28, 2022 Call Price $0.01 Call Trigger Price(2) $10.00 Expiration of Call Protection April 28, 2017 (1) Assumes treasury method treatment for in-the-money warrants (2) Volume-weighted average price of common stock must equal or exceed the call trigger price for 20 consecutive trading days FULLY DILUTED OWNERSHIP HCFP Capital Partners III 48% Pavilion Venture Partners 21% Other 31%

Investment Highlights Unique, proven business model focused on capital efficiency and speed to market Deep, expanding pipeline of innovative products across a broad spectrum of clinical conditions with clear paths to near-term commercialization Attractive market opportunities for lead products totaling over $4 billion Leadership team of entrepreneurs with a strong track record of value creation 27

Appendix 28

Board of Directors with industry and capital markets experience LISHANAKLOG, MD MICHAEL GLENNON Chairman, Chief Executive Officer Vice-Chairman RONALD M. Former Healthcare Industry Executive, Avista Capital Partners SPARKS Former Chairman and CEO, Navilyst, Inc. Former President and CEO, Accellent Director Former Division President, Smith & Nephew Nominating Led the commercialization of over 50 medical device products Committee Chair JAMES L. Professor of Surgery Emeritus, Washington University School COX, MD ofMedicine Creator of the Cox-Maze procedure for atrialfibrillation Director Former President, American Association of Thoracic Surgery Instrumental in founding six medical device companies DAVIDWEILD Chairman and CEO, Weild & Co. IV Former Vice Chairman,NASDAQ Former Head of Corporate Finance, Prudential Securities Director Recognized expert on capital formation Audit Committee Chair JOSHUA R. Partner and COO, HCFP LAMSTEIN Partner, KEC Ventures Former Co-Founderand COO, Soli Inc. Director Former positions in financial services firms including Apollo Compensation Advisers and Lehman Brothers Committee Chair IRA SCOTT Co-Managing Partner,HCFP GREENSPAN Former Managing Partner HCFP/Brenner Former securities attorney and partner at major law firm Director Pioneering role in innovative corporate finance products and HCFP/Brenner Senior Advisor strategies for small and mid-market companies 29

Multi-Specialty Medical Advisory Board of renowned physician innovators ALBERT Co-founding Partner and Chief Innovation Officer, CHIN Pavilion MedicalInnovations MD Former Vice President of Research and Chief Innovation Officer,Maquet Cardiovascular/ Guidant Cardiac Surgery Inventor on 184 issued patents and of 12 commercialized ORIGIN products MEDSYSTEMS MARC Assistant Professor, Loyola University Medical Center GERDISCH Chief of Cardiovascular and Thoracic Surgery, Franciscan MD St. Francis Health Heart Center, Indianapolis Clinicalinnovator in heart valves and atrial fibrillation TIMOTHY Professor of Diagnostic Imaging and Director of the MURPHY Vascular DiseasesResearch Center, Warren Alpert MD Medical School of Brown University Former President, Society of Interventional Radiology Co-founder of four medical device companies TODD Professor and Chairman, Debakey Department of ROSENGART Surgery, BaylorMedical College MD Professor of Heart and Vascular Disease and DeBakey-Bard Chair ofSurgery, Texas Heart Institute Co-founder of five medical device and healthcare IT companies PHILLIP Professor and Chairman of Neurological Surgery, Weil STIEG Cornell MedicalCollege MD Neurosurgeon-in-Chief and Chairman of Neurological Surgery, NewYork-Presbyterian Hospital Former President, Society of University Neurosurgeons CHRISTOPHER Professorof Otolaryngology, Harvard Medical School HARTNICK Director, Division of Pediatric Otolaryngology, MD Massachusetts Eye and Ear Infirmary 30

Leadership team's prior track record of success ANGIOVAC® VENOPAX® HOUDINI® KALEIDOSCOPE Endovascular device to Endoscopic vessel Device to treat chronic Reversible remove large clots and harvest device for total occlusionof inferior vena cavafilter other material coronary bypass peripheral arteries surgery Acquired for 3(rd)Gen device FDA 510(k) clearance Submitted to FDA for $55 Million now marketed across the December 2015 510(k) clearance by Angiodynamics US (Nasdaq:ANGO) Commercial Launch in Evaluating acquisition Evaluating acquisition progress with Key Opinion overtures by large overtures fromfour Leaders strategics companies 31