Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Medtronic plc | fy17q2earningsrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - Medtronic plc | exhibit991-fy17q2earningsr.htm |

MEDTRONIC PLC

Q2 FY17

EARNINGS PRESENTATION

NOVEMBER 22, 2016

• CONSOLIDATED RESULTS & GROUP

REVENUE HIGHLIGHTS

• EPS GUIDANCE, REVENUE OUTLOOK, &

OTHER ASSUMPTIONS

Q2 FY17 Earnings Results | November 22, 2016 | 2

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements which provide current expectations or forecasts, including those

relating to market and sales growth, growth strategies, financial results, use of capital, product development and introduction,

partnerships, regulatory matters, restructuring initiatives, mergers/acquisitions/divestitures and related effects, accounting

estimates, working capital adequacy, competitive strengths and sales efforts. They are based on current assumptions and

expectations that involve uncertainties or risks. These uncertainties and risks include, but are not limited to, those described in

the filings we make with the U.S. Securities and Exchange Commission (SEC). Actual results may differ materially from

anticipated results. Forward-looking statements are made as of today's date, and we undertake no duty to update them or any

of the information contained in this presentation.

Financial Data

Certain information in this presentation includes calculations or figures that have been prepared internally and have not been

reviewed or audited by our independent registered public accounting firm. Use of different methods for preparing, calculating

or presenting information may lead to differences and such differences may be material. This presentation contains financial

measures and guidance, including free cash flow figures (defined as operating cash flows less property, plant and equipment

additions), revenue, margin and growth rates on a constant currency basis, and adjusted EPS, all of which are considered “non-

GAAP” financial measures under applicable SEC rules and regulations. We believe these non-GAAP measures provide a useful

way to evaluate our underlying performance. Medtronic calculates forward-looking non-GAAP financial measures based on

internal forecasts that omit certain amounts that would be included in GAAP financial measures. For instance, forward-looking

revenue growth and EPS projections exclude the impact of foreign currency exchange fluctuations. Forward-looking non-GAAP

EPS guidance also excludes other potential charges or gains that would be recorded as non-GAAP adjustments to earnings

during the fiscal year, such as amortization of intangible assets and acquisition-related, certain tax and litigation, and

restructuring charges or gains. Medtronic does not attempt to provide reconciliations of forward-looking non-GAAP EPS

guidance to projected GAAP EPS guidance because the combined impact and timing of recognition of these potential charges

or gains is inherently uncertain and difficult to predict, and is unavailable without unreasonable efforts. In addition, we believe

such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have

a substantial impact on GAAP measures of financial performance. Detail concerning how all non-GAAP measures are

calculated, including all GAAP to non-GAAP reconciliations, are provided on our website and can be accessed using this link.

CONSOLIDATED

RESULTS & GROUP

REVENUE HIGHLIGHTS

Q2 FY17 Earnings Results | November 22, 2016 | 4

Number of issues contributed to lower than expected revenue; largest

impact from CVG and Diabetes

• 3% revenue growth3 was below our Q2 expectations. Items are identifiable, and in

many cases, temporary.

• CVG: CRHF core implantables market decline; TAVR- lack of XL valve; DES-US / Japan

declines

• Diabetes: Pump approval dynamics affected US growth

• Several new product introductions in back half of the fiscal year to drive revenue

growth back to normal range.

• Growth Vector Performance:

• New Therapies: below our 200 to 350 bps goal, contributing ~195 bps

• Emerging Markets: below our 150 to 200 bps goal, contributing ~120 bps

• Services & Solutions: below our 40 to 60 bps goal, contributing ~20 bps

• Acquisitions & divestitures contributed a net 120 bps to Q2 revenue growth

Strong improvement in operating margins and double-digit EPS3 growth

• EPS: 15% EPS1,3 growth; EPS lev. ~1,120 bps1

• Operating Margin: ~150 bps improvement Y/Y1; Operating lev. ~570 bps1

• One time tax-benefit offset higher than expected earnings impact from FX

• Covidien synergies: remain on track to deliver $225-250M in FY17

Outlook: Continue to expect MSD revenue and double-digit EPS3 growth

for the full fiscal year and on a sustained basis

• H2 revenue3 growth of 4.5 – 5.0%

• H2 EPS3 growth of 9 – 11%

Capital allocation: Strategically deploying capital against priorities

• Q2: 101% Payout Ratio3; $593M in dividends and $985M in net share repurchases

• FY17 Free Cash Flow4 outlook of $5B - $6B

MDT

Q2 FY17 HIGHLIGHTS

1 Figures represent comparison to Q2 FY16 on a constant currency basis.

2 Diluted EPS

3 Non-GAAP

4 Operating cash flows less property, plant and equipment additions

REVENUE BELOW EXPECTATIONS;

STRONG OPERATING AND EARNINGS GROWTH

Revenue:

Other Financial Highlights:

U.S.

57%

Non-

U.S.

Dev

30%

EM

13%

1

EPS2 Y/Y

CC1

Y/Y%

GAAP $0.80 122% NC

Non-GAAP $1.12 9% 15%

Cash Flow

from Ops $1.5B

Free Cash

Flow4 $1.2B

CVG

35%

MITG

34%

RTG

25%

DIAB

6%

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

CVG 2,584 4 3

MITG 2,473 5 4

RTG 1,826 4 3

Diabetes 462 3 3

Total $7,345 4% 3%

U.S. 4,152 1 1

Non-U.S. Dev 2,209 8 5

EM 984 8 10

Total $7,345 4% 3%

Q2 FY17 Earnings Results | November 22, 2016 | 5

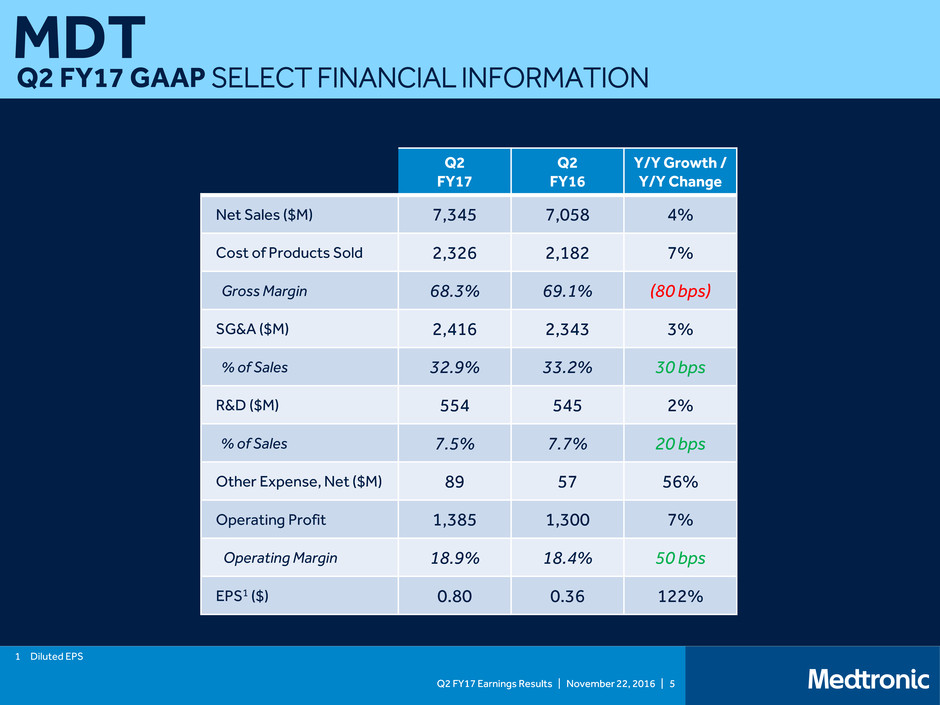

MDT

Q2 FY17 GAAP SELECT FINANCIAL INFORMATION

Q2

FY17

Q2

FY16

Y/Y Growth /

Y/Y Change

Net Sales ($M) 7,345 7,058 4%

Cost of Products Sold 2,326 2,182 7%

Gross Margin 68.3% 69.1% (80 bps)

SG&A ($M) 2,416 2,343 3%

% of Sales 32.9% 33.2% 30 bps

R&D ($M) 554 545 2%

% of Sales 7.5% 7.7% 20 bps

Other Expense, Net ($M) 89 57 56%

Operating Profit 1,385 1,300 7%

Operating Margin 18.9% 18.4% 50 bps

EPS1 ($) 0.80 0.36 122%

1 Diluted EPS

Q2 FY17 Earnings Results | November 22, 2016 | 6

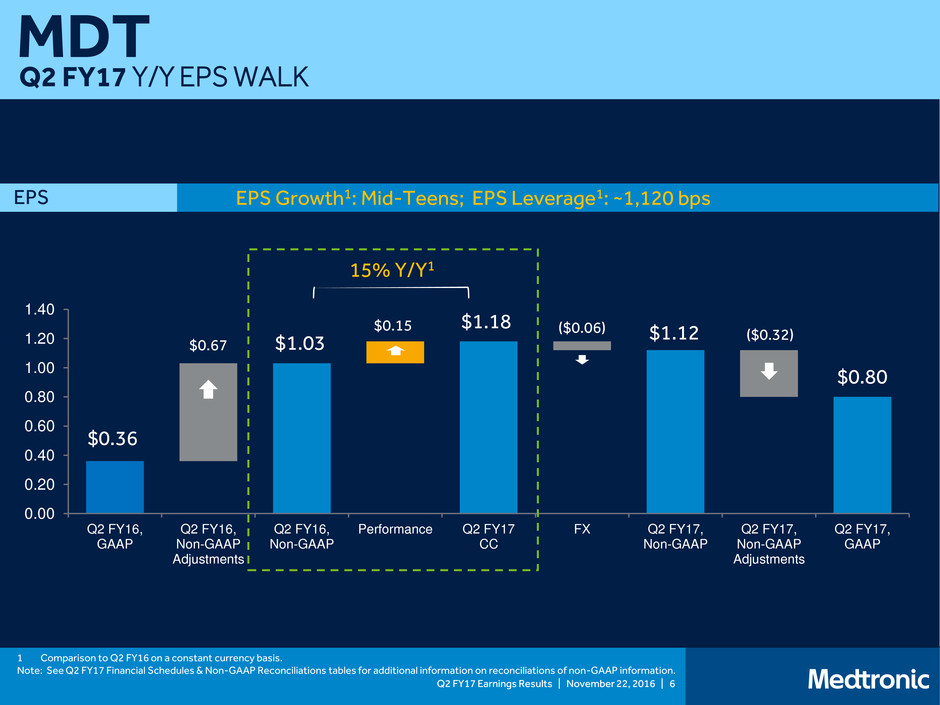

MDT

Q2 FY17 Y/Y EPS WALK

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

Q2 FY16,

GAAP

Q2 FY16,

Non-GAAP

Adjustments

Q2 FY16,

Non-GAAP

Performance Q2 FY17

CC

FX Q2 FY17,

Non-GAAP

Q2 FY17,

Non-GAAP

Adjustments

Q2 FY17,

GAAP

EPS Growth1: Mid-Teens; EPS Leverage1: ~1,120 bps EPS

$0.36

$0.67 $1.03

1 Comparison to Q2 FY16 on a constant currency basis.

Note: See Q2 FY17 Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information.

$1.18 ($0.06) $1.12 ($0.32)

$0.80

15% Y/Y1

$0.15

Q2 FY17 Earnings Results | November 22, 2016 | 7

MDT

Q2 FY17 Y/Y OPERATING MARGIN CHANGES

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

Q2 FY16,

GAAP

Q2 FY16,

Non-GAAP

Adjustments

Q2 FY16,

Non-GAAP

Performance Q2 FY17

CC

FX Q2 FY17,

Non-GAAP

Q2 FY17,

Non-GAAP

Adjustments

Q2 FY17,

GAAP

~150 bps Operational Improvement1 Operating Margin

18.4%

9.0% 27.4%

1.5% 28.9% (1.7%) 27.2% (8.3%)

18.9%

1 Comparison to Q2 FY16 on a constant currency basis.

Note: See Q2 FY17 Financial Schedules & Non-GAAP Reconciliations tables for additional information on reconciliations of non-GAAP information.

Q2 FY17 Earnings Results | November 22, 2016 | 8

MDT

Q2 FY17 NON-GAAP SELECT FINANCIAL INFORMATION

Q2

FY17

Q2

FY16

FX

Impact

$M / Change

Q2 FY17

Constant

Currency1

Q2 FY17

CC Growth /

Change

Net Sales ($M) 7,345 7,058 50 -- 3%

Cost of Products Sold 2,288 2,182 (58) -- 2%

Gross Margin1 68.8% 69.1% (60) bps 69.4% 30 bps

SG&A ($M) 2,416 2,343 (10) -- (3%)

% of Sales 32.9% 33.2% 10 bps 33.0% 20 bps

R&D ($M) 554 545 0 -- (2%)

% of Sales 7.5% 7.7% 10 bps 7.6% 10 bps

Other Expense, Net ($M) 89 57 (90) -- 102%

Operating Profit1 1,998 1,931 (108) -- 9%

Operating Margin 1 27.2% 27.4% (170) bps 28.9% 150 bps

Diluted EPS1 ($) 1.12 1.03 (0.06) -- 15%

1 Non-GAAP measure – see Q2 FY17 Financial Schedules & Non-GAAP Reconciliations

tables for additional information on reconciliations of non-GAAP information

2 Figures represent comparison to Q2 FY16 on a constant currency basis.

Operating

Leverage2

+570bps

EPS

Leverage2

+1,120bps

Q2 FY17 Earnings Results | November 22, 2016 | 9

CVG

Q2 FY17 HIGHLIGHTS

CRHF

54%

CSH

29%

APV

17%

U.S.

52%

Non-

U.S.

Dev

32%

EM

16%

Cardiac Rhythm & Heart Failure (CRHF)

KEY PERFORMANCE DRIVERS1

Heart Failure: +HSD

• Driven by recent HeartWare

acquisition; integration on track

• US market decline in MSD

• CRT-D: LSD decline

• US: Share gains on Amplia quad

launch

• Japan: Strong launch of Compia

MRI continues to drive share gains

• CRT-P: share loss from lack of quad

Arrhythmia Mgmt: +LSD

• WW Tachy: LSD decline due to market

replacements, TYRX™ product hold

• WW Brady: LSD decline

• US: Modest share decline

• Reveal LINQ™ pull-through

• Diagnostics: Mid-teens – Reveal LINQ™

• AF Solutions: High-twenties – Arctic

Front Advance continues to gain share

Coronary & Structural Heart (CSH)

Aortic & Peripheral Vascular (APV)

Services & Solutions: +Mid 20’s

Heart Valve Therapies: +HSD

• WW TAVR market growing ~30%

• TAVR : High teens WW; LSD US

• Europe: continue to gain share

• US: lack of a large size Evolut™ R XL

limiting share; expect gains given recent

FDA approval

• Japan: continued strength in CoreValve®

launch; recent Shonin approval; expect

reimbursement & launch in H2 FY17

Coronary: -MSD

• DES: HSD decline

• OUS: LSD growth-Resolute

Onyx™

• US: DD decline - competitive

product launches

Aortic: +LSD

• US: Flat growth; Heli-FX ® EndoAnchor®:

driving strong growth and AAA pull-

through, offset by competitive

headwinds in AAA

• OUS: MSD growth

Peripheral & endoVenous:

+MSD

• DCB: US & WW market share leader

• IN.PACT ® Admiral DCB mid-20s

• Received ISR indication (only DCB

with ISR in US)

• HawkOne 6F™ atherectomy launch

MSD Growth in CRHF and APV

Offset Partially by CSH

Extracorp. Therapies: -LSD

• Cannulae and Revasc growth offset

by Surgical Ablation decline

Evera MRI™

SureScan®

ICD

CoreValve®

Evolut® R

Resolute

Onyx ®

IN.PACT

Admiral ®

WW implantables market down LSD; MDT growing in line with global market

Heli-FX ®

EndoAnchor

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

CRHF 1,400 6 5

CSH 753 Flat Flat

APV 431 5 4

Total $2,584 4% 3%

U.S. 1,353 1 1

Non-U.S. Dev 823 7 5

EM 408 9 10

Total $2,584 4% 3%

H2 Growth Outlook: MSD

(Q3 greater than Q4)

Arctic Front

Advance®

1 Figures represent comparison to Q2 FY16 on a constant currency basis.

Q2 FY17 Earnings Results | November 22, 2016 | 10

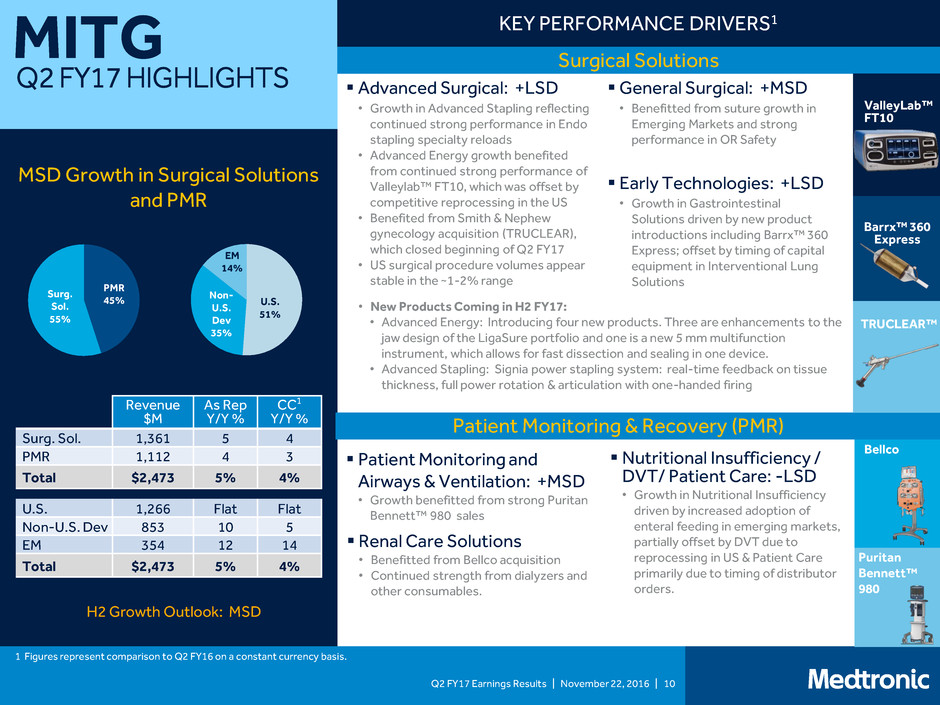

MITG

Q2 FY17 HIGHLIGHTS

Surgical Solutions

KEY PERFORMANCE DRIVERS1

MSD Growth in Surgical Solutions

and PMR

Patient Monitoring & Recovery (PMR)

Early Technologies: +LSD

• Growth in Gastrointestinal

Solutions driven by new product

introductions including Barrx™ 360

Express; offset by timing of capital

equipment in Interventional Lung

Solutions

General Surgical: +MSD

• Benefitted from suture growth in

Emerging Markets and strong

performance in OR Safety

Nutritional Insufficiency /

DVT/ Patient Care: -LSD

• Growth in Nutritional Insufficiency

driven by increased adoption of

enteral feeding in emerging markets,

partially offset by DVT due to

reprocessing in US & Patient Care

primarily due to timing of distributor

orders.

Endo GIA™

Bellco

Renal Care Solutions

• Benefitted from Bellco acquisition

• Continued strength from dialyzers and

other consumables.

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

Surg. Sol. 1,361 5 4

PMR 1,112 4 3

Total $2,473 5% 4%

U.S. 1,266 Flat Flat

Non-U.S. Dev 853 10 5

EM 354 12 14

Total $2,473 5% 4%

H2 Growth Outlook: MSD

ValleyLab™

FT10

PMR

45%

Surg.

Sol.

55%

U.S.

51%

Non-

U.S.

Dev

35%

EM

14%

Puritan

Bennett™

980

1 Figures represent comparison to Q2 FY16 on a constant currency basis.

Barrx™ 360

Express

TRUCLEAR™

Advanced Surgical: +LSD

• Growth in Advanced Stapling reflecting

continued strong performance in Endo

stapling specialty reloads

• Advanced Energy growth benefited

from continued strong performance of

Valleylab™ FT10, which was offset by

competitive reprocessing in the US

• Benefited from Smith & Nephew

gynecology acquisition (TRUCLEAR),

which closed beginning of Q2 FY17

• US surgical procedure volumes appear

stable in the ~1-2% range

• New Products Coming in H2 FY17:

• Advanced Energy: Introducing four new products. Three are enhancements to the

jaw design of the LigaSure portfolio and one is a new 5 mm multifunction

instrument, which allows for fast dissection and sealing in one device.

• Advanced Stapling: Signia power stapling system: real-time feedback on tissue

thickness, full power rotation & articulation with one-handed firing

Patient Monitoring and

Airways & Ventilation: +MSD

• Growth benefitted from strong Puritan

Bennett™ 980 sales

Q2 FY17 Earnings Results | November 22, 2016 | 11

RTG

Q2 FY17 HIGHLIGHTS

Spine

36%

Brain

28%

Specialty

20%

Pain

16%

US

69%

Non-US

Dev

21%

EM

10%

KEY PERFORMANCE DRIVERS1

Continued Improvement in Spine;

Solid Brain Therapies & Specialty

Therapies Growth Offsets

Declines in Pain Therapies

Neurosurgery: +HSD

• US O-arm® O2 penetration; core

navigation instruments; services

Core Spine: +LSD

• TL Fixation growth driven by US; strong

performance in new Solera Voyager

• Interbody launches (Elevate, Divergence

L, Capstone PTC, Pivox) driving growth

• Cervical challenged by pricing pressure,

flat unit volumes, EMEA weakness

BMP: +LSD

• US: HSD Infuse® growth

• OUS: InductOs™ ship hold in Europe

resulted in ~$5M lost revenue in Q2;

expect to resolve in H1 FY18

Brain Modulation: +LSD

• Strong US replacement demand

partially offset by continued weakness

in new implants

• European competitive headwinds

ENT: +LSD

• Continued strong NuVent growth partially

offset by weakness in disposables and

EMEA tender delays

Advanced Energy: +LDD

• AEX ® Generator combo platform

driving continued adoption

• WW growth of Aquamantys and

PlasmaBlade disposables

• Strong US Core 4 (Ortho, Oncology,

CRM Leads, ENT) execution

InterStim II®

O-arm® O2

Infuse®

Bone Graft

Spine

Brain Therapies

Specialty Therapies

Pain Therapies

Neurovascular: +MSD

Pelvic Health: +HSD

• Balanced US / OUS growth driven by healthy

new implant and replacement demand

• Voluntary recall of NV products in Q2

negatively impacted growth in Flow

Diversion and Neuro Access

• Medina embolization product hold

affecting Coil and Intrassacular growth

• Recent launch of Axium Prime Detachable

Coil (Extra Soft) gaining traction

Kanghui: +HSD

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

Spine 663 2 1

Brain 506 7 6

Specialty 369 6 6

Pain 288 (2) (2)

Total $1,826 4% 3%

U.S. 1,261 4 4

Non-U.S. Dev 383 4 1

EM 182 1 2

Total $1,826 4% 3%

H2 Growth Outlook: Low End of MSD Range

(Ramp Q3 to Q4)

• New product launches driving growth

SCS/Pumps: -MSD

• Growth in US replacement demand offset

by new implant declines

• Ongoing SCS competitive pressure

leading to share loss

Interventional: +HSD

• Balanced US/OUS growth

• OsteoCool ™ ablation system

generating BKP pull-through

OsteoCoolTM

1 Figures represent comparison to Q2 FY16 on a constant currency basis.

Continued improvement in Spine; gained global share

Q2 FY17 Earnings Results | November 22, 2016 | 12

DIABETES

Q2 FY17 HIGHLIGHTS

US

59% Non-US

Dev

32%

EM

9%

KEY PERFORMANCE DRIVERS1

Intensive Insulin Management (IIM)

Temporary Disruption to Pump

Buying Patterns, Robust

Product Pipeline

MiniMed®

630G

MiniMed®

Connect

12

Total Group

Revenue

$462M

Revenue

$M

As Rep

Y/Y %

CC1

Y/Y %

IIM ND LSD MSD

NDT ND >40 >35

DSS ND LSD LSD

Total $462 3% 3%

U.S. 272 (3) (3)

Non-U.S. Dev 150 11 12

EM 40 14 14

Total $462 3% 3%

H2 Growth Outlook: MSD to HSD

(Ramp Q3 to Q4)

MiniMed®

640G

Non-Intensive Diabetes Therapies (NDT)

iPro®2 CGM

w/ Pattern

Snapshot

Diabetes Service & Solutions (DSS)

Product Approval Dynamics

Affected Growth

• US insulin pump sales slowed in

anticipation of MiniMed® 670G System

launch

• Deferring portion of MiniMed® 630G

System revenue due to Priority Access

Program; early adopters participating in

program

CGM Reimbursement:

• Secured in Germany, Greece, and Czech

Republic

MiniMed® 670G System:

• Earlier-than-expected FDA approval

• World’s first hybrid closed loop system

with advanced SmartGuard® HCL

algorithm and Guardian ® Sensor 3

• On track for initial shipments in Spring

2017; see full benefit in FY18

Another Strong Quarter:

• iPro® Pattern Snapshot driving growth

• iPro® 2 with Sof-Sensor® approved in

China

i-Port Advance Technology:

• iPort DTC campaign launched with

strong US sales in Q2

International Growth:

• Continued success of 640G launch and

customer care programs to improve

adherence /retention

MiniMed® Connect:

• Solid initial uptake of recently launched

Android version

Sugar.IQ™ with Watson:

• First live experience of cognitive

app; first application of IBM Watson

technology collaboration

Guardian® Connect:

• Launched in October in select countries

in EMEA with Enhanced Enlite® sensor.

• US launch with the Guardian® Sensor 3

expected later this fiscal year

MiniMed® 640G System:

• Continued strong sales in Europe

• Will continue to launch throughout Latin

America and APAC countries over the

course of FY17

Henry Schein:

• Continued progress on distribution

agreement; developing new ease-of-

use tools that will help drive

professional CGM awareness

1 Figures represent comparison to Q2 FY16 on a constant currency basis.

Diabeter

• Opened 5th clinic in the Netherlands

FY17 EPS GUIDANCE,

REVENUE OUTLOOK, &

OTHER ASSUMPTIONS

Q2 FY17 Earnings Results | November 22, 2016 | 14

MDT

FY17 EPS GUIDANCE, REVENUE OUTLOOK & OTHER ASSUMPTIONS

H2 FY17 FY17

Revenue Growth Outlook – CCCW1 MSD MSD

CVG Growth – CCCW MSD,

Q3 greater than Q4

--

MITG Growth – CCCW MSD --

RTG Growth – CCCW Low-end of MSD,

Ramp Q3 to Q4

--

Diabetes Growth – CCCW MSD to HSD,

Ramp Q3 to Q4

--

COV Synergies -- ~$225-250M

EPS Growth Guidance– CCCW2 8-10% Double Digit

Free Cash Flow3 -- $5B - $6B

Other than noted, revenue and EPS growth guidance do not include any charges or gains that would be recorded as non-GAAP adjustments to earnings during the fiscal year

1 While FX rates are fluid, based on current rates, the FX impact to H2 revenue would be +$63M to +$103M

2 Estimated FX impact to FY17 EPS of ($0.20) to ($0.22)

3 Operating cash flows less property, plant and equipment additions

Note: Medtronic does not intend to adopt FASB ASU 2016-09 regarding the

change in tax treatment of stock-based compensation until our fiscal year 2018.

Updated Guidance

Q2 FY17 Earnings Results | November 22, 2016 | 15

MDT

Q2 FY17 REVENUE REPORTING CHANGES – NEW CRHF STRUCTURE

CRHF – Prior View

Low Power

AF & Other

High Power

Tachy

HF (partial)

Brady

HF (partial)

Diagnostics

AF Solutions

Hosp. Solutions

MCMS

Revenue

Grouping

Product

Lines

CRHF – New View

Heart

Failure

Arrhythmia

Mgmt.

S&S

Tachy

Brady

Diagnostics

(partial)

AF Solutions

HF

Diagnostics

(partial)

Hosp. Solutions

MCMS

Business

Unit

ICDs

CRT-Ds

Pacemakers

CRT-Ps

Reveal, LINQ,

SEEQ

AF Ablation

CLMS, ORMS,

Post-Acute Care

Svcs.

Revenue

Grouping

Business

Unit

Product

Lines

CRTs

LVADs

ICDs

Pacemakers

Reveal, LINQ

AF Ablation

SEEQ

CLMS, ORMS

Post Acute

Care Svcs.

Recast to better align with management/GM structure and the recent acquisition of HeartWare

Q2 FY17 Earnings Results | November 22, 2016 | 16

APPENDIX

ACRONYMS / ABBREVIATIONS

1

Growth

DD Double Digits

HSD High-Single Digit

LDD Low-Double Digits

LSD Low-Single Digit

MSD Mid-Single Digit

ASP Average Selling Price H1 / H2

First Half / Second

Half

APAC Asia Pacfic M&A

Mergers &

Acquisit ions

Bps Basis Points Mgmt. Management

CC Constant Currency Ops Operations

CCCW

Constant Currency

Constant Weeks

OM Operating Margins

Dev Developed OUS

Outside the United

States

EM Emerging Markets R&D

Research &

Development

EMEA

Europe, Middle East &

Africa

Rep Reported

EPS Earnings per Share SG&A

Selling, General &

Administrative

FCF Free Cash Flow WW Worldwide

FX Foreign Exchange Y/Y Year-over-Year

FY Fiscal Year

Other

AAA Abdominal Aortic Aneurysms HF Heart Failure

AF Atrial Fibrillation Hosp. Hospitals

APV Aortic & Peripheral Vascular ICD Implantable Cardioverter Defibrillator

BKP Balloon Kyphoplasty IIM Intensive Insulin Management

BMP Bone Morphogenetic Protein ISR In-Stent Restenosis

Brady Bradycardia LVAD left Ventricular Assist Device

CGM Continuous Glucose Monitoring MCMS

Medtronic Care Management

Services

CLMS Cath Lab Managed Services MDT Medtronic

CRHF Cardiac Rhythm & Heart Failure MITG Minimally Invasive Therapies Group

CRM Cardiac Rhythm Management MIS Minimally Invasive Surgery

CRT-D

Cardiac Resynchronization Therapy –

Defibrillator

MRI Magnetic Resonance Imaging

CRT-P

Cardiac Resynchronization Therapy –

Pacemakers

NDT Non- Intensive Diabetes Therapies

CSH Coronary & Structural Heart NV Neurovascular

CVG Cardiac & Vascular Group OR Operating Room

DBS Deep Brain Stimulation ORMS Operating Room Managed Services

DVT Deep Vein Thrombosis PMR Patient Monitoring & Recovery

DCB Drug Coated Balloon PTC Pure Titanium Coating

DES Drug Eluting Stent RTG Restorative Therapies Group

DSS Diabetes Services & Solutions SCS Spinal Cord Stimulation

ENDO Endovascular Sol Solutions

ENT Ear, Nose, & Throat ST Surgical Technologies

Extracorp Extracorporeal Tachy Tachycardia

FDA Food and Drug Administration TAVR

Transcatheter Aortic Valve

Replacement

HCL Hybrid Closed Loop TL Transforaminal Lumbar

Business Specific