Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - Heyu Leisure Holidays Corp | v453519_ex32.htm |

| EX-31 - EXHIBIT 31 - Heyu Leisure Holidays Corp | v453519_ex31.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 2054

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-55068

| HEYU LEISURE HOLIDAYS CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Delaware | 46-3601223 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) |

Westwood Business Center

611 South Main Street

Grapevine, Texas 76051

(Address of principal executive offices) (zip code)

(+86)592 504 9622

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated Filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

| (do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes x No ¨

Indicate the number of shares outstanding of each of the issuer's classes of stock, as of the latest practicable date.

| Class | Outstanding at November 21, 2016 |

| Common Stock, par value $0.0001 | 60,001,000 |

| Documents incorporated by reference: | None |

FINANCIAL STATEMENTS

HEYU LEISURE HOLIDAYS CORPORATION

For the quarterly period ended September 30, 2016

2

HEYU LEISURE HOLIDAYS CORPORATION

Condensed Consolidated Balance Sheets

| September 30, | December 31, | |||||||

| 2016 | 2015 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | $ | 2,135 | $ | 2,762 | ||||

| Account receivable, net | 9,388 | |||||||

| Prepayment | 801 | |||||||

| Inventory | 74 | 1,429 | ||||||

| Amount due from related parties | 24,171 | 194,322 | ||||||

| 26,380 | 208,702 | |||||||

| Other assets | ||||||||

| Deposit, non-current | 23,462 | 21,138 | ||||||

| Prepayment | 343 | 669 | ||||||

| Property and leasehold improvement, net | 199,106 | 277,776 | ||||||

| Intangible asset | 4,482 | 5,210 | ||||||

| 227,393 | 304,793 | |||||||

| Total assets | 253,773 | 513,495 | ||||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current liabilities | ||||||||

| Account payable | 21,686 | 13,297 | ||||||

| Amount due to related parties | 1,212,336 | 1,192,387 | ||||||

| Other payables and accruals | 355,353 | 186,757 | ||||||

| Tax payable | 42,601 | 38,505 | ||||||

| Total liabilities | 1,631,976 | 1,430,946 | ||||||

| Stockholders' deficit | ||||||||

| Preferred stock, $0.0001 par value, 20,000,000 shares authorized; none issued and outstanding Common stock, $0.0001 par value, 100,000,000 shares authorized; 60,001,000 and 60,000,000 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively. | 6,000 | 6,000 | ||||||

| Additional paid-in capital | 5,098,747 | 5,098,747 | ||||||

| Accumulated deficit | (6,506,252 | ) | (6,039,956 | ) | ||||

| Accumulated other comprehensive income | 23,302 | 17,758 | ||||||

| Total stockholders' deficit | (1,378,203 | ) | (917,451 | ) | ||||

| Total liabilities and stockholders' Deficit | $ | 253,773 | $ | 513,495 | ||||

The accompanying notes are an integral part of these condensed consolidated unaudited financial statements

3

HEYU LEISURE HOLIDAYS CORPORATION

Condensed Consolidated Statements of Operations

(Unaudited)

| For Three Months Ended | For Nine Months Ended | |||||||||||||||

September,

30 | September,

30 | September,

30 | September, 30 2015 | |||||||||||||

| Revenue | $ | 46,978 | $ | 109,165 | $ | 106,247 | $ | 254,034 | ||||||||

| Cost of revenue | 69,660 | 141,703 | 253,457 | 391,774 | ||||||||||||

| Gross Loss | (22,682 | ) | (32,538 | ) | (147,210 | ) | (137,740 | ) | ||||||||

| Operating costs and expenses: | ||||||||||||||||

| Selling expenses | 99 | 3,688 | 909 | 6,911 | ||||||||||||

| Operating expenses | 96,851 | 226,541 | 317,559 | 741,428 | ||||||||||||

| Finance expenses | 181 | 716 | 618 | 731 | ||||||||||||

| Loss before income taxes | (119,813 | ) | (263,483 | ) | (466,296 | ) | (886,810 | ) | ||||||||

| Income tax | ||||||||||||||||

| Net loss | (119,813 | ) | (263,483 | ) | (466,296 | ) | (886,810 | ) | ||||||||

| Other comprehensive income | ||||||||||||||||

| Foreign currency translation adjustments | 1,341 | (5,065 | ) | 5,544 | 7,561 | |||||||||||

| Comprehensive income (loss) | $ | (118,472 | ) | $ | (268,548 | ) | $ | (460,752 | ) | $ | (879,249 | ) | ||||

| Loss per share-basic and diluted | $ | (0.00 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | ||||

| Weighted average shares-basic and diluted | 60,001,000 | 60,001,000 | 60,001,000 | 60,001,000 | ||||||||||||

The accompanying notes are an integral part of these condensed unaudited consolidated financial statements

4

HEYU LEISURE HOLIDAYS CORPORATION

Condensed Consolidated Statement of Cash Flows

(Unaudited)

| For nine months ended September 30, 2016 | For nine months ended September 30, 2015 | |||||||

| Cash flow from operating activities | ||||||||

| Net loss | $ | (466,296 | ) | $ | (886,810 | ) | ||

| Adjustment to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 72,779 | 104,341 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Account receivable | 9,263 | (6,910 | ) | |||||

| Inventory | 1,335 | 348 | ||||||

| Deposit | (2,934 | ) | - | |||||

| Prepaid expense and prepaid rent | 1,103 | 46,721 | ||||||

| Account payable | 8,870 | (22,826 | ) | |||||

| Other payables | 140,029 | 47,285 | ||||||

| Net cash used in operating activities | (235,851 | ) | (717,851 | ) | ||||

| Cash flow from investing activities: | ||||||||

| Disposal of leasehold improvement | - | 1,688 | ||||||

| Purchase of property and equipment | - | (7,545 | ) | |||||

| Amount due from related parties | 242,917 | (84,462 | ) | |||||

| Net cash provided by (used in) investing activities | 242,917 | (90,319 | ) | |||||

| Cash flows from financing activities | ||||||||

| Amount due to a related party | (7,675 | ) | 750,339 | |||||

| Net cash flows provided by (used in) financing activities | (7,675 | ) | 750,339 | |||||

| Effect of exchange rate changes on cash | (18 | ) | (427 | ) | ||||

| Net increase/(decrease) in cash | (627 | ) | (58,258 | ) | ||||

| Cash at the beginning of the period | 2,762 | 61,654 | ||||||

| Cash at the end of the period | $ | 2,135 | $ | 3,396 | ||||

The accompanying notes are an integral part of these condensed consolidated unaudited financial statements

5

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 1 NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

NATURE OF OPERATIONS

Heyu Leisure Holidays Corporation ("Heyu Leisure" or "the Group") was incorporated on July 9, 2013 under the laws of the state of Delaware.

On February 9, 2015, Heyu Leisure Holiday Corp. (“Heyu Leisure” or the “Group” or the “Registrant”) merged with Heyu Capital Ltd (“Heyu Capital”), a corporation existing under the laws of Hong Kong (Special Administrative Region of the PRC). Pursuant to the merger, the Registrant acquired all of the outstanding common shares of Heyu Capital through the issuance of common shares of the Registrant to the shareholders of Heyu Capital.

As a result of the Merger and pursuant to the Resolution, Heyu Capital has become a wholly-owned subsidiary of the Registrant and the Registrant issued shares of its common stock to shareholders of Heyu Capital at a rate of 1,000 shares of the Registrant’s common stock for all Heyu Capital common share. Immediately prior to the Merger, the Registrant had 60,000,000 shares of common stock outstanding.

Following the Merger, the Registrant has 60,001,000 shares of common stock outstanding after the share exchange and the issuance of 1,000 common shares to the shareholder of Heyu Capital.

The transaction has been accounted for as a business combination under a method similar to the pooling-of-interest method ("Pooling-of-Interest") as the Registrant and Heyu Capital are both under common control with by our majority shareholder. In accordance with Accounting Standards Codification (“ASC”) 805-50-25, it indicated that the financial statements of the receiving entity shall report results of operations for the period in which the transfer occurs as though the transfer of net assets or exchange of equity interests had occurred at the beginning of the period. Results of operations for that period will thus comprise those of the previously separate entities combined from the beginning of the period to the date the transfer is completed and those of the combined operations from that date to the end of the period. Further in 805-50-45-5, indicated that the financial statements and financial information presented for prior years also shall be retrospectively adjusted to furnish comparative information. All adjusted financial statements and financial summaries shall indicate clearly that financial data of previously separate entities are combined.

6

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

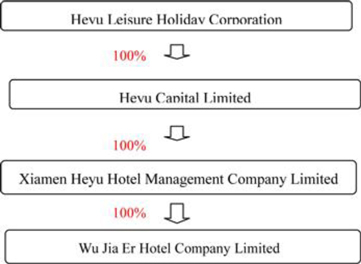

The operating entity- Wujiaer Hotel Co., Ltd (“Wujiaer”) has been acquired via Xiamen Heyu Hotel Management Co (“Xiamen Heyu”) on January 25, 2014. As a result of the acquisition, Xiamen Heyu has become its immediate holding company, Heyu Capital becomes its intermediate holding company and the Registrant has become an ultimate holding company of Wujiaer.

In accordance with Accounting Standards Codification (“ASC”) 805, Business Combinations, We evaluate each investment in a business to determine if we should account for the investment as a cost-basis investment, an equity investment, a business combination or a common control transaction. An investment in which we do not have a controlling interest and which we are not the primary beneficiary but where we have the ability to exert significant influence is accounted for under the equity method of accounting. For those investments that we account for in accordance ASC 805, Business Combinations, we record the assets acquired and liabilities assumed at our estimate of their fair values on the date of the business combination. Our assessment of the estimated fair value of each of these can have a material effect on our reported results as intangible assets are amortized over various lives. Furthermore, a change in the estimated fair value of an asset or liability often has a direct impact on the amount to recognize as goodwill, which is not amortized. Often determining the fair value of these assets and liabilities assumed requires an assessment of the expected use of the asset, the expected cost to extinguish a liability or our expectations related to the timing and the successful completion of the integration of the business. Such estimates are inherently difficult and subjective and can have a material impact on our financial statements.

ORGANIZATIONAL STRUCTURE

The following diagram illustrates our corporate and ownership structure, the place of formation and the ownership interests of our subsidiaries as of September 30, 2016 after the acquisition.

BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") for interim financial information. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. The accompanying unaudited financial statements include all adjustments, composed of normal recurring adjustments, considered necessary by management to fairly state our results of operations, financial position and cash flows. The operating results for interim periods are not necessarily indicative of results that may be expected for any other interim period or for the full year. These unaudited financial statements should be read in conjunction with the financial statements and notes thereto included in our annual report on Form 10-K for the period ended December 31, 2015 as filed with the SEC.

7

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

BASIS OF CONSOLIDATION

The consolidated financial statements include the financial statements of our company and its subsidiaries. All significant transactions and balances between our company and its subsidiaries have been eliminated upon consolidation.

A subsidiary is an entity in which our company, directly or indirectly, controls more than one half of the voting power, has the power to appoint or remove the majority of the members of the board of directors, and has the power to cast a majority of votes at meetings of the board of directors or to govern the financial and operating policies of the investee under a statute or agreement among the shareholders or equity holders.

ASC 810 “Consolidation”, which provides guidance on the identification of and financial reporting for entities over which control is achieved through means other than voting interests, requires certain variable interest entities to be consolidated by the primary beneficiary of the entity.

The Group evaluates our business relationships such as those with franchisees to identify potential variable interest entities. Generally, these businesses qualify for the business scope exception under the consolidation guidance. Therefore, we have concluded that consolidation of any such entities is not appropriate for the periods.

BUSINESS COMBINATIONS

U.S. GAAP requires that business combinations be accounted for under the acquisition purchase method. From January 1, 2009, the Group adopted ASC 805 “Business Combinations”. Following this adoption, the cost of an acquisition is measured as the aggregate of the fair values at the date of exchange of the assets given, liabilities incurred, and equity instruments issued. The costs directly attributable to the acquisition are expensed as incurred. Identifiable assets, liabilities and contingent liabilities acquired or assumed are measured separately at their fair value as of the acquisition date, irrespective of the extent of any non-controlling interests. The excess of (i) the total of cost of acquisition, the fair value of the non-controlling interests and the acquisition date fair value of any previously held equity interest in the acquired over (ii) the fair value of the identifiable net assets of the acquired is recorded as goodwill. If the cost of acquisition is less than the fair value of the net assets of the entity acquired, the difference is recognized directly in the statements of operations.

The determination and allocation of fair values to the identifiable assets acquired and liabilities assumed are based on various assumptions and valuation methodologies requiring considerable management judgment. The most significant variables in these valuations are discount rates, terminal values, the number of years on which to base the cash flow projections and the assumptions and estimates used to determine the cash inflows and outflows. Management determines discount rates to be used based on the risk inherent in the related activity’s current business model and industry comparisons. Terminal values are based on the expected life of assets and forecasted life cycle and forecasted cash flows over that period. Although the Group believe that the assumptions applied in the determinations that the Group have made are reasonable based on information available at the date of acquisition, actual results may differ from the forecasted amounts and the difference could be material.

USE OF ESTIMATES

The preparation of unaudited consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

REVENUE RECOGNITION

Revenue from leased hotel is derived from hotel operations, mainly including the rental of rooms, food and beverages sales from leased hotels. Revenue is recognized when rooms are occupied and food and beverage are sold. Persuasive evidence of an arrangement, fixed price, and service delivered and collection reasonably assured.

8

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

ACCOUNT RECEIVABLE, NET

Accounts receivables mainly consist of amounts due from corporate customers, travel agents, hotel guests and credit card receivables, which are recognized and carried at the original invoice amount less an allowance for doubtful accounts. The Group establishes an allowance for doubtful accounts primarily based on the age of the receivables and factors surrounding the credit risk of specific customers.

INVENTORIES

Inventories mainly consist of food and beverages, small appliances, bedding and daily consumables. Small appliances, bedding and daily consumables replacement are expensed when used.

PROPERTY AND LEASEHOLD IMPROVEMENTS, NET

Property and leasehold improvements, net are stated at cost less accumulated depreciation and amortization. The renovations, betterments and related expenses incurred during the construction are capitalized. Depreciation and amortization of property and equipment is provided using the straight line method over their expected useful lives. The expected useful lives are as follows:

| Leasehold improvements | 5-10 years |

| Furniture, fixtures and equipment | 3-5 years |

Construction in progress represents leasehold improvements under construction or being installed and is stated at cost. Cost comprises original cost of property and equipment, installation, construction and other direct costs. Construction in progress is transferred to leasehold improvements and depreciation commences when the asset is ready for its intended use. The useful live for leasehold improvement is shorter of the term of the lease or the estimated useful lives of the assets.

IMPAIRMENT OF LONG-LIVED ASSETS

The Group evaluates its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. When these events occur, the Group measures impairment by comparing the carrying amount of the assets to future undiscounted net cash flows expected to result from the use of the assets and their eventual disposition. If the sum of the expected undiscounted cash flows is less than the carrying amount of the assets, the Group recognizes an impairment loss equal to the difference between the carrying amount and fair value of these assets. There is no impairment as of September 30, 2016.

9

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

BUSINESS TAX AND RELATED TAXES

The Group is subject to business tax, education surtax and urban maintenance and construction tax on the services provided in the PRC. Such taxes are primarily levied based on revenue at applicable rates and are recorded as a reduction of revenue.

INCOME TAX

The Group has implemented certain provisions of ASC 740, Income Taxes (“ASC 740”), which clarifies the accounting and disclosure for uncertain tax positions, as defined. ASC 740 seeks to reduce the diversity in practice associated with certain aspects of the recognition and measurement related to accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Valuation allowances are established when it is more likely than not that some or all of the deferred tax assets will not be realized. The Group adopted the provisions of ASC 740 and have analyzed filing positions in each PRC jurisdictions where we are required to file income tax returns, as well as all open tax years in these jurisdictions. The Group has identified the PRC as our “major” tax jurisdiction. Generally, the Group remains subject to PRC examination of our income tax returns annually.

The Group believes that our income tax positions and deductions will be sustained by an audit and do not anticipate any adjustments that will result in a material change to our financial position. Therefore, no reserves for uncertain income tax positions have been recorded pursuant to ASC 740. In addition, the Group did not record a cumulative effect adjustment, related to the adoption of ASC 740. Our policy for recording interest and penalties associated with income-based tax audits is to record such items as a component of income taxes.

INTANGIBLE ASSETS

Intangible assets with definite useful lives, representing software, are amortized over their estimated useful lives of 5 years using the straight-line method, which represents the economic benefit pattern of the intangible assets.

LEASE

A lease of which substantially all the benefits and risks incidental to ownership remain with the lessor is classified as an operating lease. The Group is currently classified it as operating lease.

CONCENTRATION OF RISK

Financial instruments that potentially expose the Group to concentrations of credit risk consist principally of cash and accounts receivable. The Group places its cash with high quality banking institutions. The Group didn’t have cash balances in excess of the Federal Deposit Insurance Corporation limit as of September 30, 2016 and December 31, 2015 respectively. And the Group periodically evaluates the creditworthiness of the existing customers in determining an allowance for doubtful accounts primarily based upon the age of the receivables and factors surrounding the credit risk of specific customers.

FAIR VALUE

The Group follows guidance for accounting for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements on a recurring basis. The guidance establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

10

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Group has the ability to access at the measurement date.

Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 inputs are unobservable inputs for the asset or liability.

The Group monitors the market conditions and evaluates the fair value hierarchy levels at least quarterly. For any transfers in and out of the levels of the fair value hierarchy, the Group elects to disclose the fair value measurement at the beginning of the reporting period during which the transfer occurred.

FOREIGN CURRENCY TRANSLATION

The functional and reporting currency of the Company is the United States dollar ("U.S. dollar"). The financial records of the Company located in the Hong Kong and PRC are maintained in their local currency, the Renminbi ("RMB") and Hong Kong Dollar (“HKD”), which are the functional currency of these entities.

Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at the rates of exchange ruling at the balance sheet date. Revenues, expenses, gains and losses are translated using the average rate for the year. Retained earnings and equity are translated using the historical rate. Translation adjustments are reported as cumulative translation adjustments and are shown as a separate component of other comprehensive income.

COMPREHENSIVE LOSS

Comprehensive loss is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, ASC 220, Comprehensive Income requires that all items are required to be recognized under current accounting standards as components of comprehensive loss are reported in a financial statement that is displayed with the same prominence as other financial statements. For the periods presented, the Group’s comprehensive loss includes net loss and foreign currency translation adjustments and is presented in the statements of operations and comprehensive loss.

CONCENTRATION OF RISK

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash. The Company places its cash with high quality banking institutions. The Company did not have cash balances in excess of the Federal Deposit Insurance Corporation limit as of September 30, 2016 and December 31, 2015 respectively.

11

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

ACQUISITION OF BUSINESS

Acquisition of interest in Heyu Capital Limited

Pursuant to a Sale and Purchase Agreement dated February 9, 2015 between the Company and Ang Ban Siong, the Company issued shares of its common stock to shareholder of Heyu Capital at a rate of 1,000 shares of the Company’s common stock for 100% of the equity of Heyu Capital Limited.

The transaction has been accounted for as a business combination under a method similar to the pooling-of-interest method ("Pooling-of-Interest") as the Registrant and Heyu Capital are both under common control with by our majority shareholder In accordance with Accounting Standards Codification (“ASC”) 805, Business Combinations, We evaluate each investment in a business to determine if we should account for the investment as a cost-basis investment, an equity investment, a business combination or a common control transaction. An investment in which we do not have a controlling interest and which we are not the primary beneficiary but where we have the ability to exert significant influence is accounted for under the equity method of accounting. For those investments that we account for in accordance ASC 805, Business Combinations, we record the assets acquired and liabilities assumed at our estimate of their fair values on the date of the business combination. Our assessment of the estimated fair value of each of these can have a material effect on our reported results as intangible assets are amortized over various lives. Furthermore, a change in the estimated fair value of an asset or liability often has a direct impact on the amount to recognize as goodwill, which is not amortized. Often determining the fair value of these assets and liabilities assumed requires an assessment of the expected use of the asset, the expected cost to extinguish a liability or our expectations related to the timing and the successful completion of the integration of the business. Such estimates are inherently difficult and subjective and can have a material impact on our financial statements.

The operating entity- Wujiaer Hotel Co., Ltd (“Wujiaer”) has been acquired via Xiamen Heyu Hotel Management Co (“Xiamen Heyu”) on January 25, 2014. As a result of the acquisition, Xiamen Heyu has become its immediate holding company, Heyu Capital becomes its intermediate holding company and the Registrant has become an ultimate holding company of Wujiaer.

12

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 2 – PROPERTY AND EQUIPMENT, NET

Property and equipment, net consist of the following:

| As of September 30, 2016 (Unaudited) | As of December 31,2015 | |||||||

| Cost: | ||||||||

| Leasehold improvement | $ | 458,419 | $ | 471,110 | ||||

| Furniture, fixtures and equipment | 139,115 | 142,967 | ||||||

| 597,534 | 614,077 | |||||||

| Less: Accumulated depreciation | (398,428 | ) | (336,301 | ) | ||||

| $ | 199,106 | $ | 277,776 | |||||

Depreciation expense was $ 62,127 and $97,677 for the period ended September 30, 2016 and September 30, 2015 respectively.

NOTE 3 – DEPOSIT PAYMENT TO A RELATED PARTY

| As of September 30, 2016 (Unaudited) | As of December 31,2015 | |||||||

| Deposit for lease of the hotel building | $ | 23,462 | $ | 21,138 | ||||

The deposit is made to shareholder for the lease of the hotel building. The deposit is refundable upon the lease expiring on September 30, 2025.

The long term deposits are not within the scope of the accounting guidance regarding interests on receivables and payables, because they are intended to provide security for the counterparty to the office rental agreements. Therefore, the deposits are recorded at costs.

13

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 4 –OTHER PAYABLE

| As

of September 30, 2016 (Unaudited) | As of December 31,2015 | |||||||

| Payroll Payable | $ | 146,257 | $ | 117,590 | ||||

| Rent Payable | 209,096 | 69,167 | ||||||

| Total: | $ 355,353 | $ | 186,757 | |||||

NOTE 5 – COMMITMENT

Operating lease commitment

The Group has entered into lease agreement for a leased hotel which it operates. Such lease is classified as operating lease.

Future minimum lease payments under non-cancellable lease agreement as follow:

| Year: | ||||

| 2017 | $ | 275,659 | ||

| 2018 | 275,659 | |||

| 2019 | 282,551 | |||

| 2020 | 303,225 | |||

| 2021 and after | 1,531,288 | |||

| $ | 2,668,382 | |||

Under the lease arrangements, the Group pays rent on a quarterly basis.

14

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 6 – LOSS PER COMMON SHARE

Basic loss per common share excludes dilution and is computed by dividing net loss by the weighted average number of common shares outstanding during the period. Diluted loss per common share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the loss of the entity. As of September 30, 2016 and December 31, 2015, there are no outstanding dilutive securities.

NOTE 7 – GOING CONCERN

The Group has sustained operating losses of $6,506,252 since inception. The Group’s continuation as a going concern is dependent on management’s ability to develop profitable operations, and / or obtain additional financing from its stockholders and / or other third parties.

The accompanying financial statements have been prepared assuming that the Group will continue as a going concern; however, the above conditions raise substantial doubt about the Group’s ability to do so. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should the Group be unable to continue as a going concern.

If management projections are not met, the Group may have to reduce its operating expenses and to seek additional funding through debt and/or equity offerings.

15

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 8 – RECENT ACCOUNTING PRONOUNCEMENTS

In May 2014, the FASB issued Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (Topic 606). ASU 2014-09 creates a new topic in the ASC Topic 606 and establishes a new control-based revenue recognition model, changes the basis for deciding when revenue is recognized over time or at a point in time, provides new and more detailed guidance on specific topics, and expands and improves disclosures about revenue. In addition, ASU 2014-09 adds a new Subtopic to the Codification, ASC 340-40, Other Assets and Deferred Costs: Contracts with Customers, to provide guidance on costs related to obtaining a contract with a customer and costs incurred in fulfilling a contract with a customer that are not in the scope of another ASC Topic. The guidance in ASU 2014-09 is effective for public entities for annual reporting periods beginning after December 15, 2016, including interim periods therein. Early application is not permitted. The Company is in the process of assessing the impact of ASU 2014-09 on the Company’s financial statements.

In August 2014, the FASB issued Accounting Standards Update No. 2014-15, “Disclosure of Uncertainties About an Entity’s Ability to Continue as a Going Concern” (“ASU 2014-15”), which requires management to perform interim and annual assessments on whether there are conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year of the date the financial statements are issued and to provide related disclosures, if required. ASU 2014-15 is effective for the Company for our fiscal year ending October 31, 2017. Early adoption is permitted. The company adopted this pronouncement which did not have a significant impact on its consolidated financial statements.

In February 2015, the FASB issued Accounting Standards Update No. 2015-02 (ASU 2015-02) "Consolidation (Topic 810): Amendments to the Consolidation Analysis." ASU 2015-02 changes the analysis that a reporting entity must perform to determine whether it should consolidate certain types of legal entities. It is effective for annual reporting periods, and interim periods within those years, beginning after December 15, 2015. Early adoption is permitted, including adoption in an interim period. The Company is currently in the process of evaluating the impact of the adoption of ASU 2015-02 on our consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02 “Leases (Topic 842).” This standard requires entities that lease assets to recognize on the balance sheet the assets and liabilities for the rights and obligations created by those leases. The standard is effective for fiscal years and the interim periods within those fiscal years beginning after December 15, 2018. The guidance is required to be applied by the modified retrospective transition approach. Early adoption is permitted. The Company is currently assessing the impact of the adoption of this new guidance on its financial position, results of operations and disclosures.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force) and the United States Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company's present or future financial statements.

16

HEYU LEISURE HOLIDAYS CORPORATION

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 9 – STOCKHOLDER'S EQUITY

The Company is authorized to issue 100,000,000 shares of common stock and 20,000,000 shares of preferred stock.

On February 9, 2015, Heyu Leisure Holiday Corp. (“Heyu Leisure” or the “Company” or the “Registrant”) merged with Heyu Capital Ltd (“Heyu Capital”), a corporation existing under the laws of Hong Kong (Special Administrative Region of the PRC). Pursuant to the merger, the Company acquired all of the outstanding common shares of Heyu Capital through the issuance of common shares of the Company to the shareholders of Heyu Capital.

As a result of the Merger and pursuant to the Resolution, Heyu Capital has become a wholly-owned subsidiary of the Company and the Company issued shares of its common stock to shareholders of Heyu Capital at a rate of 1,000 shares of the Registrant’s common stock for all Heyu Capital common share. Immediately prior to the Merger, the Registrant had 60,000,000 shares of common stock outstanding.

Following the Merger, the Company has 60,001,000 shares of common stock outstanding after the share exchange and the issuance of 1,000 common shares to the shareholder of Heyu Capital.

NOTE 10 RELATED PARTY TRANSACTIONS

Parties are considered to be related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operational decisions. Parties are also considered to be related if they are subject to common control or common significant influence. Related parties may be individuals or corporate entities. Those related parties are controlled by Ang Ban Siong and who is served as the Director of the companies.

Amount due from related parties are related to the advances to stockholder/ related companies as $24,171 and $194,322 respectively for September 30, 2016 and December 31 2015, respectively.

Amount due to a related party is comprised of the advances from the stockholder/ related companies for working capital of group as of $ 1,212,336 and $1,192,387 respectively for September 30, 2016 and December 31 2015, respectively

17

| ITEM 2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Heyu Leisure Holidays Corporation (the "Company") was incorporated on July 2, 2013 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions.

On January 14, the Company issued 1,000,000 shares of its common stock at par representing 100% of the then total outstanding 1,000,000 shares of common stock.

On August 8, 2014, the Company issued additional 59,000,000 shares of its common stock at par. Accordingly, the total outstanding of common stock is 60,000,000 shares as at 30 September 2014.

Hung Seng Tan is appointed as the Executive Director and Guan Chuan Tan is appointed as the Director of the Company during the period. Ban Siong Ang is appointed as Managing Director and serves as Chief Executive Officer subsequent to the appointment of new Directors.

On February 9, 2015, Heyu Leisure Holiday Corp. (“Heyu Leisure” or the “Company” or the “Registrant”) merged with Heyu Capital Ltd (“Heyu Capital”), a corporation existing under the laws of Hong Kong (Special Administrative Region of the PRC). Pursuant to the merger, the Company acquired all of the outstanding common shares of Heyu Capital through the issuance of common shares of the Company to the shareholders of Heyu Capital.

As a result of the Merger and pursuant to the Resolution, Heyu Capital has become a wholly-owned subsidiary of the Company and the Company issued shares of its common stock to shareholders of Heyu Capital at a rate of 1,000 shares of the Registrant’s common stock for all Heyu Capital common share. Immediately prior to the Merger, the Registrant had 60,000,000 shares of common stock outstanding.

Following the Merger, the Company has 60,001,000 shares of common stock outstanding after the share exchange and the issuance of 1,000 common shares to the shareholder of Heyu Capital.

Results of Operations for three months and nine months ended September 30, 2016 and September 30, 2015

| For the three month ended September 30, | For the nine month ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Revenue | $ | 46,978 | $ | 109,165 | $ | 106,247 | $ | 254,034 | ||||||||

| Cost of revenue | (69,660 | ) | (141,703 | ) | (253,457 | ) | (391,774 | ) | ||||||||

| Operating expenses | (97,131 | ) | (230,945 | ) | (319,086 | ) | (749,070 | ) | ||||||||

18

The revenue decreased from $109,165 to $46,978 from the three months ended September 30, 2015 to the three months ended September 30, 2016. The revenue decreased from $254,034 to $106,247 from the nine months ended September 30, 2015 to the nine months ended September 30, 2016.These decreases resulted primarily from the external construction project in 2016.

The decrease in Cost of revenue is consistent with the decrease of revenue from the three, nine months ended September 30, 2015 to September 30, 2016, respectively. The cost of revenue consists of water, electricity, rental and related taxes of hotel.

The Group operating expenses decreased from $ 230,945 to $97,131from the three months ended September 30, 2015 to September 30, 2016. The Group operating expenses decreased from $ 749,070 to $319,086 from the nine months ended September 30, 2015 to September 30, 2016. The decrease in operating expense was consistent with decrease in revenue and the control of operation budget in 2016.

Liquidity and Capital Resources

Working Capital

| As at September 30, 2016 | As at December 31, 2015 | |||||||

| Total current assets | $ | 26,380 | $ | 208,702 | ||||

| Total current liabilities | 1,631,976 | 1,430,946 | ||||||

| Working capital (deficit) | (1,605,596 | ) | (1,222,244 | ) | ||||

As of September 30, 2016 and December 31, 2015, total current assets were $26,380 and $208,702 respectively. The decrease is mainly due to decrease in cash and cash equivalent as a result of payment of hotel daily operating expenses.

As of September 30, 2016 and December 31, 2015, total current liabilities were $1,631,976 and $1,430,946 respectively. The increase is mainly from the advances from shareholder, which paid for daily hotel operation expenses and staff salaries during the period.

The Company had negative working capital of $1,605,596 and an accumulated deficit of $ 6,506,252 as of September 30, 2016. The Company’s continuation as a going concern is dependent on our ability to develop profitable operations, and / or obtain additional financing from its stockholders and / or other third parties.

Cash Flows

| For nine months ended September 30, 2016 | For nine months ended September 30, 2015 | |||||||

| Net cash used in operating activities | $ | (235,851 | ) | $ | (717,851 | ) | ||

| Net cash provided by (used in) investing activities | 242,917 | (90,319 | ) | |||||

| Net cash provided by financing activities | (7,675 | ) | 750,339 | |||||

| Effect of exchange rate changes on cash and cash equivalent | (18 | ) | (427 | ) | ||||

| Net change in cash | (627 | ) | (58,258 | ) | ||||

19

For the nine month ended September 30, 2016 and 2015 we spent $235,851 and $717,851 on operating activities. The decrease in our expenditures on operating activities was primarily due to the payment to consultant in relation to the potential project acquisition and share listing expenses in prior period. However, there is no such expense incurred and therefore decrease in operating expenses during the period.

For the nine month ended September 30, 2016 and 2015, $242,917 was provided by and $90,319 was used in investing activities, the increase is from collection from the due from related parties during the period.

For the nine month ended September 30, 2016 and 2015, $7,675 and $750,339 were used in and provided by financing activities, the change is from repayment to related parties during the period.

Business

The Company was incorporated on July 2, 2013 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions. The Company has been in the developmental stage since inception.

The Company intends to operate and manage budget hotels chains in China. The Company intends that it will develop its business plan through the acquisition or business combination with an existing private company in China or otherwise through growth and development of its projects.

The Company may develop its operations by marketing and internal growth and/or by effecting a business combination with an operating company in the field. The Company anticipates that if it enters such a business combination it would likely take the form of a merger. It is anticipated that such private company will bring with it to such merger key operating business activities and a business plan. As of the date of this Report, no agreements have been executed to effect any business combination.

A combination will normally take the form of a merger, stock-for-stock exchange or stock-for-assets exchange. The Company may wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended.

On February 9, 2015, Heyu Leisure Holiday Corp.(“Heyu Leisure” or the “Company”)merged with Heyu Capital Ltd (“Heyu Capital”), a corporation existing under the laws of Hong Kong (Special Administrative Region of the PRC). Pursuant to the merger, the Registrant acquired all of the outstanding common shares of Heyu Capital through the issuance of common shares of the Registrant to the shareholders of Heyu Capital.

The Company's independent auditors have issued a report raising substantial doubt about the Company's ability to continue as a going concern. At present, the Company has no operations and the continuation of the Company as a going concern is dependent upon financial support from its stockholders, its ability to obtain necessary equity financing to continue operations and/or to successfully locate and negotiate with a business entity for a business combination that would provide a basis of possible operations.

20

| ITEM 3. | Quantitative and Qualitative Disclosures about Market Risk. |

| - | Information not required to be filed by Smaller reporting companies. |

| ITEM 4. | Controls and Procedures. |

Disclosures and Procedures

Pursuant to Rules adopted by the Securities and Exchange Commission, the Company carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures pursuant to Exchange Act Rules. This evaluation was done as of the end of the period covered by this report under the supervision and with the participation of the Company's principal executive officer (who is also the principal financial officer).

Based upon that evaluation, he believes that the Company's disclosure controls and procedures are effective in gathering, analyzing and disclosing information needed to ensure that the information required to be disclosed by the Company in its periodic reports is recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Act is accumulated and communicated to the issuer's management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

This Quarterly Report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this Quarterly Report.

Changes in Internal Controls

Although the Company has effected a change in control, the Company remains, as it was previously, a development stage company under the direct control of its officers. There was no change in the Company's internal control over financial reporting that was identified in connection with such evaluation that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Company's internal control over financial reporting.

PART II — OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

There are no legal proceedings against the Company and the Company is unaware of such proceedings contemplated against it.

21

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

During the past three years, the Company has issued common shares pursuant to Section 4(2) of the Securities Act of 1933 as follows:

| (1) | On July 9, 2013, 10,000,000 shares of common stock were issued to Tiber Creek Corporation for total consideration paid of $1,000.00. Subsequently, in January 2014, the Registrant redeemed an aggregate of 10,000,000 of these shares for the redemption price of $1,000.00. On July 9, 2013, 10,000,000 shares of common stock were issued to MB Americus, LLC for total consideration paid of $1,000.00. Subsequently, in January 2014, the Registrant redeemed an aggregate of 10,000,000 of these shares for the redemption price of $1,000.00 |

| (2) | On January 13, 2014, 1,000,000 shares of common stock were issued by the Registrant to Ban Siong Ang pursuant to a change of control in the Registrant. The aggregate consideration paid for these shares was $100. |

| (3) | From July 1, 2014 through September 1, 2014, 59,000,000 shares of common stock were issued by the Registrant to the shareholders named below pursuant to executed subscription agreements under a Regulation D offering or other private placement of securities. Each of these transactions was issued as part of the private placement of securities by the Registrant in which no underwriting discounts or commissions applied to any of the transactions set forth below. The Registrant conducted such private placement offering in order to build a base of shareholders and establish relationships with a variety of shareholders. Tiber Creek Corporation did not assist the Registrant in conducting the offering. |

| Shares Owned | ||||||||

| Name | Number | Percentage | ||||||

| Ban Siong Ang | 46,389,604 | 77 | % | |||||

| Tiang Lee Ng | 4,272,419 | 7 | % | |||||

| Hooi Pheng Ang | 254,569 | * | ||||||

| Teik Kui Ang | 651,854 | * | ||||||

| Xin Chen | 109,354 | * | ||||||

| Tek Mun Chin | 340,000 | * | ||||||

| ShuHui Dai | 257,416 | * | ||||||

| XieMing Fan | 66,000 | * | ||||||

| HaiBin Gao | 80,000 | * | ||||||

| Boon Hong Haw | 2,000,000 | 3.3 | % | |||||

| JianShu Huang | 60,000 | * | ||||||

| QingQiang Li | 42,854 | * | ||||||

| EnYu Lin | 70,000 | * | ||||||

| FenJin Lin | 40,000 | * | ||||||

| Wee Lee Sim | 60,000 | * | ||||||

| Swiss Teo Swee Kiong | 103,064 | * | ||||||

| Guan Chuan Tan | 300,000 | * | ||||||

| Hang Kiang Tan | 60,000 | * | ||||||

| Hung Seng Tan | 1,484,423 | 2.5 | % | |||||

| Hup Teong Tan | 90,000 | * | ||||||

| Kwee Huwa Tan | 349,550 | * | ||||||

| Lan Tan | 78,209 | * | ||||||

| Lee Hiang Tan | 97,355 | * | ||||||

| XiaoDi Rao | 153,709 | * | ||||||

| ShuYing Wang | 105,354 | * | ||||||

| MeiMei Weng | 147,355 | * | ||||||

| Kean Heong Wong | 76,203 | * | ||||||

| XiuHua Xian | 200,000 | * | ||||||

| MeiJiao Xu | 166,354 | * | ||||||

| ZhuEn Xu | 50,000 | * | ||||||

| TaoYing Yang | 241,098 | * | ||||||

| ZhenYu Zeng | 180,354 | * | ||||||

| DeZhao Zhang | 100,000 | * | ||||||

| XiuMei Zheng | 525,355 | * | ||||||

| BingRen Zhong | 408,387 | * | ||||||

| MeiYun Zhong | 119,064 | * | ||||||

| WenJin Zhong | 121,354 | * | ||||||

| XingEn Zhong | 84,710 | * | ||||||

| XingHua Zhong | 65,032 | * | ||||||

22

| (4) | On February 9, 2015, pursuant to the stock-for-stock acquisition of Heyu Capital Ltd, the Registrant issued 1,000 shares of Common stock to Ban Siong Ang. |

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

Not applicable.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Not applicable.

ITEM 5. OTHER INFORMATION

| (a) | Not applicable. |

| (b) | Item 407(c)(3) of Regulation S-K: |

During the quarter covered by this Report, there have not been any material changes to the procedures by which security holders may recommend nominees to the Board of Directors.

23

ITEM 6. EXHIBITS

| (a) | Exhibits |

| 31 | Certification of the Chief Executive Officer and Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32 | Certification of the Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101.INS XBRL Instance Document |

| 101.SCH XBRL Taxonomy Extension Schema Document |

| 101.CAL XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE XBRL Taxonomy Extension Presentation Linkbase Document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

HEYU LEISURE HOLIDAYS CORPORATION

| By: | /s/ Ban Siong Ang | |

| Chief Executive Officer (Principal Executive Officer) | ||

| By: | /s/ Ban Siong Ang | |

| Chief Executive Officer (Principal Executive Officer) | ||

| Dated: | November 21, 2016 | |

24