Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RENASANT CORP | form8-k_4q16investorpresen.htm |

4th Quarter 2016 Investor Presentation

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Congress passed the Private Securities Litigation Act of 1995 in an

effort to encourage companies to provide information about companies’ anticipated future financial

performance. This act provides a safe harbor for such disclosure, which protects the companies from

unwarranted litigation if actual results are different from management expectations. This news release may

contain, or incorporate by reference, statements which may constitute “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Such forward looking statements usually include words such as

“expects,” “projects,” “anticipates,” “believes,” “intends,” “estimates,” “strategy,” “plan,” “potential,”

“possible” and other similar expressions.

Prospective investors are cautioned that any such forward-looking statements are not

guarantees for future performance and involve risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking statements. Important factors currently

known to management that could cause actual results to differ materially from those in forward-looking

statements include significant fluctuations in interest rates, inflation, economic recession, significant

changes in the federal and state legal and regulatory environment, significant underperformance in our

portfolio of outstanding loans, and competition in our markets. We undertake no obligation to update or

revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events

or changes to future operating results over time.

2

More than 175 banking, lending, financial services and insurance offices

3

Western

29%

Northern

22%

Eastern

27%

Central

22%

Portfolio Loans

Western

44%

Northern

13%

Eastern

26%

Central

17%

Total Deposits

4

Enhance Profitability

Capitalize on

Opportunities

Aggressively Manage

Problem Credits

Build Capital Ratios

• Focus on highly-accretive acquisition opportunities

• Leverage existing markets

• Seek new markets

• New lines of business

• Selective balance sheet growth

• Maintain dividend

• Prudently manage capital

• Identify problem assets and risks early

• Quarantine troubled assets

• Superior returns

• Revenue growth / Expense control

• Net interest margin expansion / mitigate interest rate risk

• Loan growth

• Core deposit growth

Nashville

Memphis

TENNESSEE

Tupelo

Jackson

MISSISSIPPI

Birmingham

Huntsville

Montgomery

Atlanta

GEORGIA

ALABAMA

Source: SNL Financial

5

Financial Highlights

Assets $3.59 Billion

Gross Loans $2.28 Billion

Deposits $2.69 Billion

6

De novo expansion:

Columbus, MS

2010

De novo expansion:

Montgomery, AL

Starkville, MS

Tuscaloosa, AL

De novo expansion:

Maryville, TN

Jonesborough, TN

FDIC-Assisted

Transaction:

Crescent Bank and

Trust

Jasper, GA

Assets: $1.0 billion

FDIC-Assisted

Transaction:

American Trust

Bank

Roswell, GA

Assets: $147 million

Trust Acquisition:

RBC (USA) Trust

Unit

Birmingham, AL

Assets: $680 million

Whole Bank

Transaction:

First M&F

Corporation

Kosciusko, MS

Assets: $1.5 billion

2011 2013

De novo expansion:

Bristol, TN

Johnson City, TN

2015

Whole Bank

Transaction:

Heritage Financial

Group, Inc.

Albany, GA

Assets: $1.9 billion

2012

Whole Bank

Transaction

Announcement:

KeyWorth Bank

Atlanta, GA

Assets: $399 million

Over 175 banking, lending, financial services and insurance offices

7

Assets $8.5 billion

Gross Loans $6.1 billion

Deposits $6.8 billion

Highlights

8

Enhance Profitability

Capitalize on

Opportunities

Aggressively Manage

Problem Credits

Build Capital Ratios

• Focus on highly-accretive acquisition opportunities

• Leverage existing markets

• Seek new markets

• New lines of business

• Selective balance sheet growth

• Maintain dividend

• Prudently manage capital

• Identify problem assets and risks early

• Quarantine troubled assets

• Superior returns

• Revenue growth / Expense control

• Net interest margin expansion / mitigate interest rate risk

• Loan growth

• Core deposit growth

• Managed deposit mix by

emphasizing core deposit growth

while allowing higher-priced,

non-core deposits to erode

• Significantly paid down high-

cost borrowings

• Restructured asset mix by

redeploying excess cash levels

into higher yielding investments

and loans

• Loan demand will drive

deposit/funding growth going

forward

(in millions)

9

4,179 4,268 4,249

5,736 5,746

5,903 5,826 5,752 5,805 5,882 5,899

7,911 7,926

8,146

8,530 8,542

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

Total Assets Deposits

2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Not

Acquired

$2,242 $2,573 $2,886 $3,268 $3,274 $3,408 $3,607 $3,830 $4,075 $4,292 $4,526

Acquired

Covered*

$339 $237 $182 $143 $126 $121 $101 $93 $45 $42 $30

Acquired

Not Covered

- - $813 $577 $554 $508 $1,570 $1,490 $1,453 $1,631 $1,549

Total Loans $2,581 $2,810 $3,881 $3,988 $3,954 $4,037 $5,278 $5,413 $5,573 $5,965 $6,105

• Loans not acquired increased

$233M or 22% (annualized)

during 3Q16

• Company maintained strong

pipelines throughout all

markets which will continue to

drive further loan growth

$0

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$6,000,000

2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Not Acquired Acquired Covered Acquired

10

*Covered loans are subject to loss-share agreements with FDIC

• Loans totaled $6.1B

26% of portfolio is acquired and carried at fair value

• Owner occupied/C&I loans comprise 32% of the acquired not

covered loan portfolio

Const

8%

Land Dev

4%

1-4 Family

29%

Non Owner

Occupied

25%

Owner Occupied

20%

C&I

12%

Consumer

2%

Not Covered Loans $6.07B

11

DDA

9%

Other Int

Bearing

Accts

26%

Time

Deposits

37% Borrowed

Funds

28%

4Q 2008

Cost of Funds

2.81%

$3.28B

DDA

21% Other Int

Bearing

Accts

50%

Time

Deposits

22%

Borrowed

Funds

7%

3Q 2016

$7.3B

Cost of Funds

.40%

-

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Non Interest Bearing Demand Deposits

• Non-interest bearing deposits

represent 22% of deposits, up

from 12% at year end 2008

• Less reliance on borrowed

funds

Borrowed funds as a percentage

of funding sources declined

from 28% at year end 2008 to

7% at the end of 3Q16

12

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

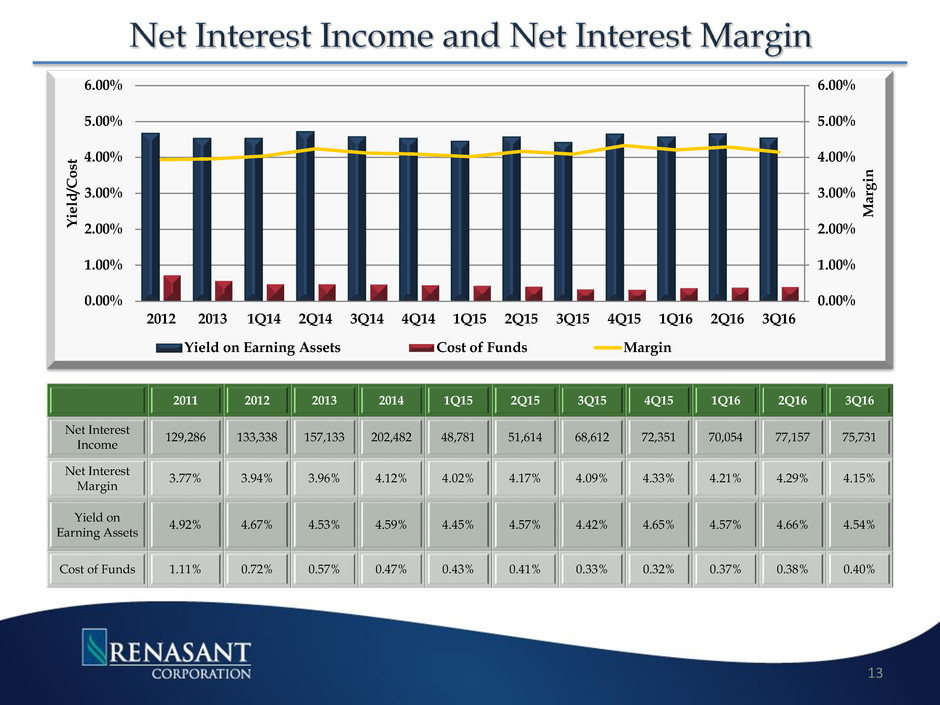

2012 2013 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Marg

in

Y

ie

ld

/C

os

t

Yield on Earning Assets Cost of Funds Margin

2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Net Interest

Income

129,286 133,338 157,133 202,482 48,781 51,614 68,612 72,351 70,054 77,157 75,731

Net Interest

Margin

3.77% 3.94% 3.96% 4.12% 4.02% 4.17% 4.09% 4.33% 4.21% 4.29% 4.15%

Yield on

Earning Assets

4.92% 4.67% 4.53% 4.59% 4.45% 4.57% 4.42% 4.65% 4.57% 4.66% 4.54%

Cost of Funds 1.11% 0.72% 0.57% 0.47% 0.43% 0.41% 0.33% 0.32% 0.37% 0.38% 0.40%

13

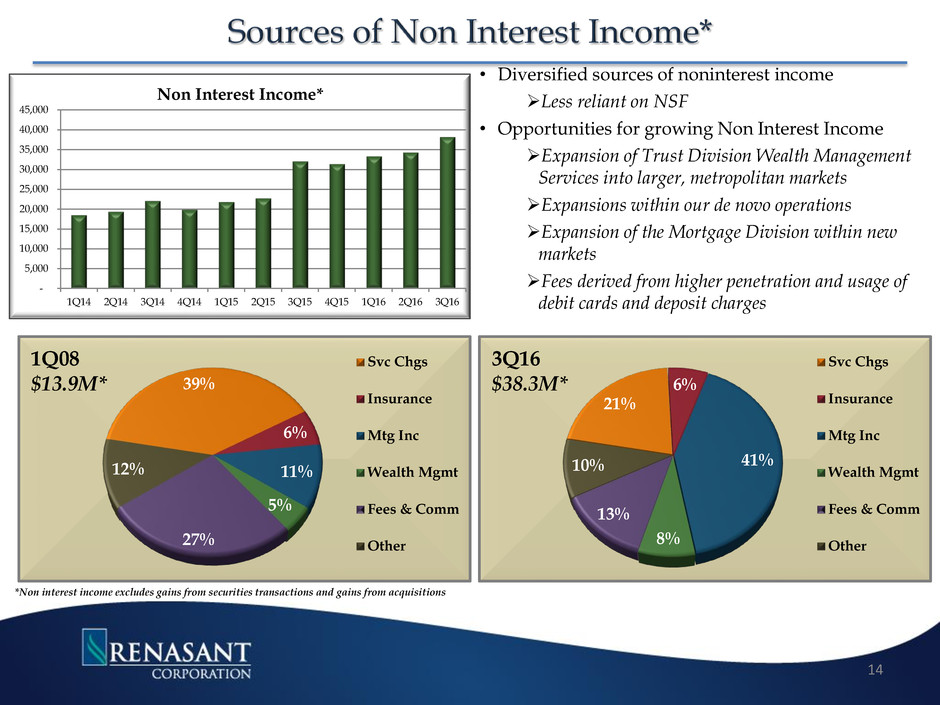

21%

6%

41%

8%

13%

10%

3Q16

$38.3M*

Svc Chgs

Insurance

Mtg Inc

Wealth Mgmt

Fees & Comm

Other

• Diversified sources of noninterest income

Less reliant on NSF

• Opportunities for growing Non Interest Income

Expansion of Trust Division Wealth Management

Services into larger, metropolitan markets

Expansions within our de novo operations

Expansion of the Mortgage Division within new

markets

Fees derived from higher penetration and usage of

debit cards and deposit charges

*Non interest income excludes gains from securities transactions and gains from acquisitions

39%

6%

11%

5%

27%

12%

1Q08

$13.9M*

Svc Chgs

Insurance

Mtg Inc

Wealth Mgmt

Fees & Comm

Other

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Non Interest Income*

14

• Continued focus on managing

noninterest expenses and

improving efficiency

• Provided resources for eight

de novo expansions since 2011

• Fluctuations in mortgage loan

expense driven by higher

mortgage production

• Incurred merger related

expenses during 2011, 2013,

2014, 2015 and 2016

15

40.00%

45.00%

50.00%

55.00%

60.00%

65.00%

70.00%

75.00%

80.00%

85.00%

90.00%

2011 2012 2013 2014 2015 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Efficiency Ratio* Efficiency Ratio ex. Mortgage*

*Excludes debt extinguishment penalties, amortization of intangibles and merger-related expenses from noninterest expense and profit (loss) on sales of

securities and gains on acquisitions from noninterest income

16

Enhance Profitability

Capitalize on

Opportunities

Aggressively Manage

Problem Credits

Build Capital Ratios

• Focus on highly-accretive acquisition opportunities

• Leverage existing markets

• Seek new markets

• New lines of business

• Selective balance sheet growth

• Maintain dividend

• Prudently manage capital

• Identify problem assets and risks early

• Quarantine troubled assets

• Superior returns

• Revenue growth / Expense control

• Net interest margin expansion / mitigate interest rate risk

• Loan growth

• Core deposit growth

Not acquired NPAs

approaching pre-credit cycle

levels.

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Non-Acquired Acquired Covered Acquired Not Covered

75

22

As a percentage of total assets

83

17

Not

Acquired

Acquired

Covered

Acquired

Not

Covered

NPL’s $14.8M $2.4M $24.7M

ORE $ 8.4M $0.9M $17.0M

Total

NPA’s $23.2M $3.3M $41.7M

22

*Ratios excludes loans and assets acquired in connection with the recent acquisitions or loss share transactions

0.00%

50.00%

100.00%

150.00%

200.00%

250.00%

300.00%

350.00%

400.00%

$-

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

($)Provision for Loan Losses ($)Net Charge Offs Coverage Ratio*

• Net charge-offs in 3Q16 totaled

$824K

• Provision for loan losses totaled

$2.65 million in 3Q16

Allowance for Loan Losses as % of Non-Acquired Loans*

2010 2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

2.07% 1.98% 1.72% 1.65% 1.29% 1.29% 1.23% 1.17% 1.11% 1.05% 1.03% 1.01%

18

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

2011 2012 2013 2014 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

35

30

19

20

19

21

16 15 14

12

15

16

8

9

10

12

6

8 8

7

9

10

NPLs

30-89

Days

Continued Improvement

NPLs and Early Stage Delinquencies

(30-89 Days Past Due Loans)*

• NPL’s to total loans were 0.33%

19

*Ratios excludes loans and assets acquired in connection with recent acquisitions or loss share transactions

20

Enhance Profitability

Capitalize on

Opportunities

Aggressively Manage

Problem Credits

Build Capital Ratios

• Focus on highly-accretive acquisition opportunities

• Leverage existing markets

• Seek new markets

• New lines of business

• Selective balance sheet growth

• Maintain dividend

• Prudently manage capital

• Identify problem assets and risks early

• Quarantine troubled assets

• Superior returns

• Revenue growth / Expense control

• Net interest margin expansion / mitigate interest rate risk

• Loan growth

• Core deposit growth

4.50%

5.00%

5.50%

6.00%

6.50%

7.00%

7.50%

8.00%

8.50%

2009 2010 2011 2012 2013 2014 4Q15 1Q16 2Q16 3Q16

Tangible Common Equity Ratio*

Renasant

Capital 2009 2010 2011 2012 2013 2014 2015 1Q16 2Q16 3Q16

Tangible

Common

Equity*

6.34% 6.76% 7.35% 7.71% 6.64% 7.52% 7.54% 7.52% 7.80% 8.03%

Leverage 8.68% 8.97% 9.44% 9.86% 8.68% 9.53% 9.16% 9.19% 9.18% 9.38%

Tier 1 Risk

Based

11.12% 13.58% 13.32% 12.74% 11.41% 12.45% 11.51% 11.38% 11.56% 11.57%

Total Risk

Based

12.37% 14.83% 14.58% 14.00% 12.58% 13.54% 12.32% 12.17% 12.31% 13.84%

Tier 1

Common

Equity

N/A N/A N/A N/A N/A N/A 9.99% 9.88% 10.13% 10.16%

• Maintained dividend throughout economic

downturn

• Regulatory capital ratios are above the

minimum for well-capitalized classification

• Capital level positions the Company for

future growth and geographic expansion

• Did not participate in the TARP program

21

* See slide 29 for reconciliation of Non-GAAP disclosure to GAAP

22

$8.5B franchise well positioned in attractive

markets in the Southeast

Merger with KeyWorth added $399M in

assets, $347M in deposits, $284M in loans

and 4 branches in Atlanta MSA

Strategic focus on expanding footprint

• Acquisition

• De Novo

• New lines of business

Opportunity for further profitability

improvement

Organic loan growth

Core deposit growth

Revenue growth

Declining credit costs

Strong capital position

Consistent dividend payment history

Appendix

23

12.4%

0.3% 0.5%

1.5% 1.0%

17.3%

6.2%

7.1%

0.9%

0.0%

5.0%

10.0%

15.0%

20.0%

Ch

am

be

rs

Je

ffe

rs

on Le

e

M

ad

iso

n

M

on

tg

om

er

y

M

or

ga

n

Sh

elb

y

Ta

lla

de

ga

Tu

sc

al

oo

sa

Birmingham leads the state in the health care industry with an annual payroll

of approximately $2.9 billion, followed by Huntsville with $998 million

Honda, Hyundai, Mercedes-Benz increasingly large presence

Merger with HBOS added approximately $90.0 million in loans, $141 million

in deposits and 9 branches

Montgomery

Huntsville

Birmingham

24

Deposit Market Share by County – Top 5 Presence in 4 of 9 counties

3 5 4 2

Deposit

Market

Share

Rank 16 17 10 14 14

Alabama Deposit Market Share

Source: SNL Financial

Green highlighting denotes top 5 deposit market share in respective county

Deposit data as of 6/30/16

RNST Branches

Deposits Market

Rank Institution ($mm) Share Branches

1 Regions Financial Corp. $22,587 22.68 % 231

2 Banco Bilbao Vizcaya Argentaria SA 15,356 15.42 88

3 Wells Fargo & Co. 8,978 9.01 139

4 ServisFirst Bancshares Inc. 3,993 4.01 11

5 BB&T Corp. 3,991 4.01 86

6 Synovus Financial Corp. 3,967 3.98 38

7 Cadence Bancorp LLC 3,072 3.08 26

8 PNC Financial Services Group Inc. 2,967 2.98 69

9 Trustmark Corp. 1,326 1.33 38

10 Bryant Bank 1,198 1.20 14

16 Renasant Corp. 908 0.91 18

Jacksonville

Miami

Tallahassee

Tampa

Orlando

RNST Branches

10

10

95

Gainesville

Ocala

Entered the Florida market through the acquisition of Heritage Financial Group, Inc.

(Nasdaq: HBOS), which closed on 7/1/15

Moved into FL with 8 full-services branches along I-75

Florida has the 19th largest economy in the world, if it were a country

Publix Super Markets, Southern Wine & Spirits, and JM Family Enterprises are all

headquartered in Florida

Florida projected population growth is approximately 6.0% compared to the national

average of 3.7%

25

Deposit Market Share by County – Top 5 Presence in 0 of 3 counties

Deposit

Market

Share

Rank

10

Florida Deposit Market Share

6 11

Source: SNL Financial

Deposit data as of 6/30/16

2.2%

2.5%

2.0%

0.0%

1.0%

2.0%

3.0%

4.0%

Alachua Columbia Marion

Deposits Market

Rank Institution ($mm) Share Branches

1 Bank of America Corp. $102,957 19.18 % 573

2 Wells Fargo & Co. 79,086 14.73 648

3 SunTrust Banks Inc. 48,251 8.99 484

4 JPMorgan Chase & Co. 28,837 5.37 397

5 TIAA Board of Overseers 18,934 3.53 12

6 Regions Financial Corp. 18,817 3.51 347

7 BB&T Corp. 17,509 3.26 322

8 Citigroup Inc. 16,531 3.08 54

9 BankUnited Inc. 14,951 2.79 96

10 Raymond James Financial Inc. 14,241 2.65 1

129 Renasant Corp. 226 0.04 8

4

Entered the North GA market through two FDIC loss share transactions

12 full-service locations

Expanded services include mortgage and wealth management personnel

Grew GA presence by completing acquisition of Heritage Financial Group, Inc. ($1.7 billion in assets)

Added 20 full-service branches and 4 mortgage offices

Significantly ramps up our mortgage division

Enhanced GA presence by acquisition of KeyWorth Bank ($399 million in assets)

Approximately $284 million in loans, $347 million in deposits, and 4 full-service branches

Recently established an asset based lending division headquartered in Atlanta

26

Deposit Market Share by County – Top 5 Presence in 10 of 22 counties

5 6 9 7

Deposit

Market

Share

Rank

4 25 1 12 13 3

Georgia Deposit Market Share

Source: SNL Financial

Green highlighting denotes top 5 deposit market share in respective county

Deposit data as of 6/30/16

4 11 15 22 2 16 2 4 13

Atlanta

Savannah

Albany

11.6%

7.2%

1.3%

12.4%

0.5%

4.9%

0.0%

20.7%

0.4%

21.4%

26.9%

2.2%

0.3% 0.9%

25.6%

10.8%

2.2%

0.0%

13.3%

9.1%

1.1%

15.4%

0.0%

8.0%

16.0%

24.0%

32.0%

Ap

plin

g

Bar

tow Bib

b

Bul

loc

h

Ch

ath

am

Ch

ero

kee Cob

b

Coo

k

DeK

alb

Do

ugh

erty

Eff

ing

ham

For

syt

h

Ful

ton

Gw

inn

ett

Jeff

Da

vis Lee

Low

nde

s

Mu

sco

gee

Pic

ken

s

Tat

tna

ll

Tro

up

Wo

rth

4 2 20

RNST Branches

Deposits Market

Rank Institution ($mm) Share Branches

1 SunTrust Banks Inc. $49,481 19.94 % 243

2 Wells Fargo & Co. 35,245 14.21 278

3 Bank of America Corp. 32,878 13.25 172

4 Synchrony Financial 22,707 9.15 1

5 Synovus Financial Corp. 13,788 5.56 116

6 BB&T Corp. 12,369 4.99 157

7 Regions Financial Corp. 5,868 2.37 129

8 United Community Banks Inc. 5,348 2.16 70

9 Bank of the Ozarks Inc. 4,031 1.62 73

10 Royal Bank of Canada 3,434 1.38 2

18 Renasant Corp. 1,739 0.70 37

Macon

27

Deposit Market Share by County – Top 5 Presence in 24 of 27 counties

6 1

Entered the Columbus, MS market in November 2010 and opened an office in Starkville, home of

Mississippi State University, during late Q3 ‘11

Columbus Air Force Base trains 1/3 of the nation’s pilots, with an economic impact of $250 million

Yokohama Tire Corporation announces plans to locate new commercial tire plant in West Point with an initial

investment of $300 million and potentially more than $1 billion.

The Tupelo/Lee County

Recently completed a $12 million aquatic center and a $4 million expansion of the Elvis Presley Birthplace and

Museum

Hosts one of the largest furniture markets in the U.S.

Oxford, Tupelo and Columbus were noted by American Express as three of the best small towns in

America for business

5 2 4 2 3 4 3

Deposit

Market

Share

Rank

2 3 4 1 5 5 1 4 5 1 4 2 7 3 3 2 2 10

Mississippi Deposit Market Share

Source: SNL Financial

Green highlighting denotes top 5 deposit market share in respective county

Deposit data as of 6/30/16

RNST Branches

Tupelo

Jackson

6.5%

49.2%

8.6%

30.6%

5.0%

47.2%

23.0%

7.7%

16.8%

0.6%

11.8%10.9%

41.5%

9.0%

6.8%

25.4%

10.3%

4.4%

26.4%

9.3%

26.0%27.6%

4.4%

8.5%8.7%

28.3%

20.6%

0.0%

15.0%

30.0%

45.0%

60.0%

Alc

orn Atta

la

Boli

var

Cal

hou

n

Chi

cka

saw

Cho

ctaw Cla

y

Des

oto

Gre

nad

a

Hin

ds

Hol

mes

Lafa

yett

e Lee

Low

nde

s

Mad

ison

Mo

nro

e

Mo

ntg

ome

ry

Nes

hob

a

Okt

ibbe

ha

Pan

ola

Pon

toto

c

Pre

ntis

s

Ran

kin

Tish

om

ingo Uni

on

Win

ston

Yal

obu

sha

Deposits Market

Rank Institution ($mm) Share Branches

1 Regions Financial Corp. $7,043 13.91 % 134

2 Trustmark Corp. 6,618 13.07 125

3 BancorpSouth Inc. 5,440 10.74 98

4 Hancock Holding Co. 3,029 5.98 40

5 Renasant Corp. 2,999 5.92 70

6 Community Bancshares of Mississippi Inc. 2,174 4.29 35

7 BancPlus Corp. 2,111 4.17 59

8 Citizens National Banc Corp. 1,095 2.16 26

9 Planters Holding Co. 899 1.78 19

10 BankFirst Capital Corp. 805 1.59 17

Our Tennessee Operations

The Knoxville/Maryville MSA location opened in late Q2 ‘12

East Tennessee operations currently have 4 full-service branches, $258 million in

loans and $105 million in deposits

New lending teams added in both Memphis and Nashville during 2013

New Healthcare Lending Group added in Nashville during 2015

Tennessee ranked 7th best state to do business, per Area Development magazine

Driven by VW, Nissan and GM, Tennessee named the #1 state in the nation for

automotive manufacturing strength

Unemployment rate continues to improve declining to 5.7% from 6.6% on a Y-O-Y

basis.

28

Deposit Market Share by County – Top 5 Presence in 1 of 8 counties

Deposit

Market

Share

Rank

3 11 15 13 17 9

Tennessee Deposit Market Share

12 22

Source: SNL Financial

Green highlighting denotes top 5 deposit market share in respective county

Deposit data as of 6/30/16

In the Nashville market, Hospital Corporation of American announced an

expansion that will create 2,000 jobs

Nashville housing sales increased 17.6% Y-O-Y

The median home price increased approximately 5.8% on a Y-O-Y basis

The Memphis MSA market ranked #1 for Logistics Leaders both nationally and

globally

Bass Pro Shops, $70 million hotel in conjunction with their Pyramid flagship store

to open in 2015

Electrolux has begun the hiring of some 1,200 workers from its expansion

announcement in 2010

Nashville

Knoxville

Memphis

RNST Branches

40

2.4%

11.3%

1.1% 1.2% 0.6%

1.5%

2.5%

0.5%

0.0%

3.0%

6.0%

9.0%

12.0%

Bl

ou

nt

Cr

oc

ke

tt

Da

vi

ds

on

Sh

elb

y

Su

lli

va

n

Su

m

ne

r

W

as

hi

ng

to

n

W

ill

iam

so

n

Deposits Market

Rank Institution ($mm) Share Branches

1 First Horizon National Corp. $19,774 14.29 % 152

2 Regions Financial Corp. 17,748 12.82 236

3 SunTrust Banks Inc. 13,436 9.71 138

4 Bank of America Corp. 10,929 7.90 57

5 Pinnacle Financial Partners Inc. 8,297 5.99 45

6 U.S. Bancorp 2,941 2.12 104

7 BB&T Corp. 2,419 1.75 49

8 Franklin Financial Network Inc. 2,365 1.71 14

9 FB Financial Corp 2,316 1.67 48

10 Wells Fargo & Co. 1,941 1.40 19

23 Renasant Corp. 835 0.60 15

E. Robinson McGraw

Chairman and

Chief Executive Officer

Kevin D. Chapman

Executive Vice President and

Chief Financial Officer

209 TROY STREET

TUPELO, MS 38804-4827

PHONE: 1-800-680-1601

FACSIMILE: 1-662-680-1234

WWW.RENASANT.COM

WWW.RENASANTBANK.COM

29