Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - IMMUNE PHARMACEUTICALS INC | v452803_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - IMMUNE PHARMACEUTICALS INC | v452803_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - IMMUNE PHARMACEUTICALS INC | v452803_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - IMMUNE PHARMACEUTICALS INC | v452803_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-36602

IMMUNE PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 52-1841431 | |

| (State or other jurisdiction of | (IRS Employer Id. No.) | |

| incorporation or organization) |

430 East 29th Street, Suite 940

New York, NY 10016

(Address of principal executive offices)

Registrant’s telephone number, including area code: (646) 440-9310

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of November 17, 2016, 131,291,362 shares of the registrant’s common stock, par value $0.0001 per share, were outstanding.

TABLE OF CONTENTS

2

Immune Pharmaceuticals Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

($ in thousands, except share and per share amounts)

| September 30, 2016 (Unaudited) | December 31, 2015 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 317 | $ | 4,543 | ||||

| Restricted cash | 43 | 31 | ||||||

| Other current assets | 138 | 258 | ||||||

| Total current assets | 498 | 4,832 | ||||||

| Property and equipment, net of accumulated depreciation of $145 and $77 | 335 | 371 | ||||||

| In-process research and development acquired | 27,500 | 27,500 | ||||||

| Intangible assets, net | 2,882 | 3,111 | ||||||

| Other assets | 339 | 370 | ||||||

| Total assets | $ | 31,554 | $ | 36,184 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 3,501 | $ | 2,439 | ||||

| Accrued expenses | 1,861 | 2,660 | ||||||

| Derivative financial instruments, warrants | - | 84 | ||||||

| Obligations under capital lease, current portion | 25 | 106 | ||||||

| Notes and loans payable, current portion, net of debt discount | 1,691 | 997 | ||||||

| Total current liabilities | 7,078 | 6,286 | ||||||

| Notes and loans payable, net of current portion and debt discount | 1,847 | 2,886 | ||||||

| Obligations under capital lease, net of current portion | 91 | 91 | ||||||

| Series D Preferred Stock derivative liability | - | 6,529 | ||||||

| Deferred tax liability | 10,870 | 10,870 | ||||||

| Total liabilities | 19,886 | 26,662 | ||||||

| Series D Preferred Stock, net of discount, par value $0.0001, 12,000 shares authorized, 1,263 shares issued and 0 shares outstanding as of September 30, 2016 and 1,263 shares issued and 963 outstanding as of December 31, 2015 | - | 1,659 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ Equity | ||||||||

| Common stock, $0.0001 par value; authorized 225,000,000 shares; 112,691,362 and 32,434,942 shares issued and outstanding at September 30, 2016 and December 31, 2015, respectively | 11 | 3 | ||||||

| Additional paid-in capital | 95,680 | 70,846 | ||||||

| Accumulated deficit | (84,023 | ) | (62,986 | ) | ||||

| Total stockholders’ equity | 11,668 | 7,863 | ||||||

| Total liabilities and stockholders’ equity | $ | 31,554 | $ | 36,184 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Immune Pharmaceuticals Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

($ in thousands, except share and per share amounts)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Revenue: | ||||||||||||||||

| Licensing and other revenue | $ | - | $ | - | - | - | ||||||||||

| Costs and expenses: | ||||||||||||||||

| Research and development | 2,338 | 1,127 | 6,294 | 3,404 | ||||||||||||

| General and administrative | 1,646 | 2,227 | 4,982 | 6,211 | ||||||||||||

| Total costs and expenses | 3,984 | 3,354 | 11,276 | 9,615 | ||||||||||||

| Loss from operations | (3,984 | ) | (3,354 | ) | (11,276 | ) | (9,615 | ) | ||||||||

| Non-operating expense: | ||||||||||||||||

| Interest expense | (291 | ) | (197 | ) | (1,002 | ) | (363 | ) | ||||||||

| Change in fair value of derivative liability instrument | (7,964 | ) | (141 | ) | (8,656 | ) | (141 | ) | ||||||||

| Loss on extinguishment of debt | - | (465 | ) | - | (465 | ) | ||||||||||

| Other expense, net | (10 | ) | (3 | ) | (22 | ) | (8 | ) | ||||||||

| Total non-operating expense | (8,265 | ) | (806 | ) | (9,680 | ) | (977 | ) | ||||||||

| Net loss before income taxes | (12,249 | ) | (4,160 | ) | (20,956 | ) | (10,592 | ) | ||||||||

| Income tax expense | - | - | 81 | — | ||||||||||||

| Net loss | $ | (12,249 | ) | $ | (4,160 | ) | (21,037 | ) | (10,592 | ) | ||||||

| Series C Preferred dividend | - | (7 | ) | - | (121 | ) | ||||||||||

| Deemed dividend | (5,059 | ) | (5,363 | ) | (7,973 | ) | (5,363 | ) | ||||||||

| Net loss attributable to common stockholders | $ | (17,308 | ) | $ | (9,530 | ) | (29,010 | ) | (16,076 | ) | ||||||

| Basic and diluted net loss per common share | $ | (0.16 | ) | $ | (0.35 | ) | (0.46 | ) | (0.63 | ) | ||||||

| Weighted average common shares outstanding – basic and diluted | 110,267,239 | 27,418,854 | 62,691,361 | 25,490,630 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Immune Pharmaceuticals Inc. and Subsidiaries

Condensed Consolidated Statement of Changes in Stockholders’ Equity

($ in thousands, except share and per share amounts)(Unaudited)

| Common Stock | Additional | |||||||||||||||||||

| Shares | Amount | Paid-In Capital | Accumulated Deficit | Total | ||||||||||||||||

| Balance at December 31, 2015 | 32,434,942 | $ | 3 | $ | 70,846 | $ | (62,986 | ) | $ | 7,863 | ||||||||||

| Conversion of Series D Preferred Stock to common stock and accretion of deemed dividend | 61,273,400 | 6 | 16,875 | - | 16,881 | |||||||||||||||

| Capital Access Agreements | 7,200,000 | 1 | 1,923 | - | 1,924 | |||||||||||||||

| Share Purchase Agreements | 8,141,269 | 1 | 3,347 | - | 3,348 | |||||||||||||||

| Costs related to equity financing | 350,000 | - | (252 | ) | - | (252 | ) | |||||||||||||

| Promissory note conversions to common stock | 2,313,347 | - | 1,006 | - | 1,006 | |||||||||||||||

| Reclassification of Hercules warrants derivative liability to additional paid-in capital | - | - | 46 | - | 46 | |||||||||||||||

| Common stock issued to settle liabilities | 412,019 | - | 210 | - | 210 | |||||||||||||||

| Exercise of stock options | 216,385 | - | 16 | - | 16 | |||||||||||||||

| Share-based compensation | 350,000 | - | 1,663 | - | 1,663 | |||||||||||||||

| Net loss | - | - | - | (21,037 | ) | (21,037 | ) | |||||||||||||

| Balance at September 30, 2016 | 112,691,362 | $ | 11 | $ | 95,680 | $ | (84,023 | ) | $ | 11,668 | ||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Immune Pharmaceuticals Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

($ in thousands)

(Unaudited)

| Nine Months Ended September 30, | ||||||||

| 2016 | 2015 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (21,037 | ) | $ | (10,592 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 296 | 242 | ||||||

| Share-based compensation | 1,663 | 2,635 | ||||||

| Common shares issued for services | - | 280 | ||||||

| Derivative liability loss | 8,656 | 141 | ||||||

| Amortization of debt issuance costs | 463 | 71 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Increase (decrease) in other assets | 151 | (90 | ) | |||||

| Increase in security deposits | - | (177 | ) | |||||

| Increase in accounts payable | 1,223 | 7 | ||||||

| Decrease in due to related parties | - | (30 | ) | |||||

| Decrease in long term grants payable | - | (4 | ) | |||||

| Decrease in accrued expenses | (751 | ) | (2,340 | ) | ||||

| Net cash used in operating activities | (9,336 | ) | (9,857 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Decrease in restricted cash | (12 | ) | (49 | ) | ||||

| Purchase of property and equipment | (102 | ) | (31 | ) | ||||

| Net cash used in investing activities | (114 | ) | (80 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds received from exercise of options | 16 | 143 | ||||||

| Proceeds from Series D Preferred Stock issuance | - | 12,000 | ||||||

| Proceeds from July 2015 debt financing | - | 4,500 | ||||||

| Payment of fees in connection with Series D Preferred Stock issuance | - | (764 | ) | |||||

| Payment of fees in connection with July 2015 debt financing | - | (556 | ) | |||||

| Proceeds received from sale of common stock | 5,272 | - | ||||||

| Payments of transaction costs related to sale of common stock | (202 | ) | - | |||||

| Proceeds from advances from related parties | 946 | - | ||||||

| Principal repayment of notes and loans payable | (808 | ) | (3,197 | ) | ||||

| Net cash provided by financing activities | 5,224 | 12,126 | ||||||

| Increase (decrease) in cash | (4,226 | ) | 2,189 | |||||

| Cash at beginning of period | 4,543 | 6,767 | ||||||

| Cash at end of period | $ | 317 | $ | 8,956 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for interest | $ | 327 | $ | 271 | ||||

| Cash paid for income taxes | 81 | - | ||||||

| Supplemental disclosure of non-cash financing activities: | ||||||||

| Conversion of Series D Preferred Stock to common stock and accretion of deemed dividend | 16,881 | 5,363 | ||||||

| Reclassification of Hercules warrants derivative liability to additional paid-in-capital | 46 | - | ||||||

| Common stock issued to settle liabilities | 210 | - | ||||||

| Settlement of liability with promissory note | 60 | - | ||||||

| Conversion of promissory notes to common stock | 1,006 | - | ||||||

| Dividends settled in common stock | - | 340 | ||||||

| Accrued dividends on Series C Preferred Stock | - | 121 | ||||||

| Conversion of Series C Preferred Stock into common stock | - | 818 | ||||||

| Services expensed and accrued in 2014 and settled in common stock in 2015 | - | 258 | ||||||

| Common stock issued for future financing | - | 100 | ||||||

| Warrants issued to Series D Preferred Stock placement agents | - | 758 | ||||||

| Warrants issued to July 2015 debt financing placement agents | - | 731 | ||||||

| Series D Preferred Stock original issue discount | - | 630 | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Immune Pharmaceuticals Inc. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 1. DESCRIPTION OF BUSINESS

Organization and Description of Business

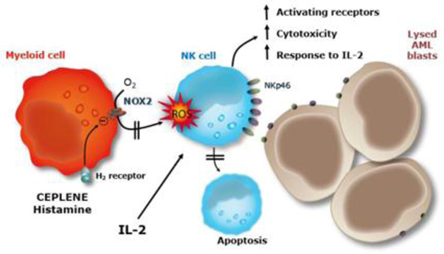

Immune Pharmaceuticals Inc., together with its subsidiaries (“Immune” or the “Company”), is a clinical stage biopharmaceutical company specializing in the development and commercialization of novel targeted therapeutics in the fields of immuno-inflammation and immuno-oncology. The Company focuses on a precision medicine approach to treatment of diseases by incorporating methods for better patient selection in its clinical trials and the potential for development of companion diagnostics. The Company’s Immuno-inflammation product pipeline includes: bertilimumab, a clinical-stage first-in-class fully human antibody, targeting eotaxin-1, a key regulator of immuno-inflammation a portfolio of clinical-stage immune oncology products and NanoCyclo, a topical nanocapsule formulation of cyclosporine-A, for the treatment of atopic dermatitis and psoriasis. The Company’s immune-oncology pipeline includes Ceplene, an early immune-oncology treatment effective for the maintenance of remission in patients with Acute Myeloid Leukemia (“AML”) in combination with IL-2, as well as two vascular disrupting agents, which are ready for Phase II clinical trials. In addition, the Company has two platform assets, which provide an opportunity for broad application: a bispecific antibody platform and a nanotechnology combination platform.

NOTE 2. GOING CONCERN UNCERTAINTY, FINANCIAL CONDITION AND MANAGEMENT’S PLANS

The Company believes that its available cash as of the date of this filing will not be sufficient to fund its anticipated level of operations for the next 12 months. The Company’s ability to continue as a “going concern” is dependent on a combination of several of the following factors: the Company’s ability to raise capital, the Company’s ability to monetize assets and the receipt of grants. The Company has limited capital resources and its operations have been funded by the proceeds of equity and debt offerings. The Company has devoted substantially all of its cash resources to research and development (“R&D”) activities and incurred significant general and administrative expenses to enable it to finance and grow its business and operations. To date, the Company has not generated any revenue and may not generate any revenue for a number of years, if at all. If the Company is unable to raise additional funds in the future on acceptable terms, or at all, it may be forced to curtail its development activities. In addition, the Company could be forced to delay or discontinue certain or all product development, and forego attractive business opportunities.

At September 30, 2016, the Company had a working capital deficit of approximately $6.6 million. Accumulated deficit amounted to $84.0 million and $63.0 million at September 30, 2016 and December 31, 2015 respectively. Net loss for the three and nine months ended September 30, 2016 was $12.2 million and $21.0 million, respectively. Net loss for the three and nine months ended September 30, 2015 was $4.2 million and $10.6 million, respectively. Net cash used in operating activities was $9.3 million and $9.9 million for the nine months ended September 30, 2016 and 2015, respectively.

The Company has historically funded its operations primarily through the sale of equity and/or debt securities, including the sale of common stock, convertible notes, preferred stock and warrants. On April 19, 2016, the Company entered into a Capital Access Agreement (“Regatta Capital Access Agreement”) with Regatta Select Healthcare, LLC (“Regatta”), pursuant to which Regatta agreed to purchase up to an aggregate of 3,500,000 shares of the Company’s common stock, at the Company’s discretion. Gross proceeds from the sale of common stock under the Regatta Capital Access Agreement were $0.8 million. In addition, on June 10, 2016, the Company entered into a second Capital Access Agreement with Regatta, pursuant to which Regatta agreed to purchase up to an aggregate of 3,700,000 shares of the Company’s common stock, at the Company’s discretion. Gross proceeds from the sale of common stock under this second Capital Access Agreement with Regatta were $1.1 million. During the second quarter of 2016, the Company executed share purchase agreements with two accredited investors for the sale of 966,666 shares of the Company’s common stock for aggregate gross proceeds of approximately $0.3 million. On July 29, 2016, the Company entered into a securities purchase agreement (the “July SPA”) with certain institutional investors for the sale of an aggregate of 3,174,603 shares of the Company’s common stock, for aggregate gross proceeds of $1.0 million. Under the July SPA, the Company also issued to the investors warrants to purchase 500,000 shares of its common stock. On September 7, 2016, the Company entered into a securities purchase agreement with an existing investor for the sale of 4,000,000 shares of the Company’s common stock in a registered direct offering, for aggregate gross proceeds of $2.0 million. See Note 10.

7

The Company will require additional financing for the remainder of 2016 and 2017 in order to continue at its expected level of operations. If the Company fails to obtain the needed capital, it will be forced to delay, scale back, partner out or eliminate some or all of its R&D programs, which could result in an impairment of the Company’s intangible assets and have a material adverse impact on its financial condition and results of operation and the value of its common stock. There is no assurance that the Company will be successful in any capital-raising efforts that it may undertake to fund operations during the remainder of 2016, in 2017 or in future years. The Company anticipates that it will continue to issue equity and/or debt securities as a source of liquidity, when needed, until it is able to generate positive cash flow to support its operations. The Company cannot give any assurance that the necessary capital will be raised or that, if funds are raised, it will be on favorable terms. Any future sales of equity securities to finance the Company’s operations will dilute existing stockholders' ownership. The Company cannot guarantee when or if it will ever generate positive cash flow. In addition, the Company may partner or license the Company’s assets, which may allow for additional non-dilutive financing in the future. The Company has previously received grants in Israel and the Company is seeking, and may receive, additional grant funding in 2016 or in future years. The Independent Registered Public Accounting Firms’ Reports issued in connection with the Company’s audited consolidated financial statements for the year ended December 31, 2015 stated that there is “substantial doubt about the Company’s ability to continue as a going concern.”

NOTE 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of Immune and its wholly-owned subsidiaries: Immune Pharmaceuticals Ltd., Immune Pharmaceuticals USA Corp., Maxim Pharmaceuticals, Inc. and Cytovia, Inc. All inter-company transactions and balances have been eliminated.

The accompanying unaudited condensed consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and instructions to Form 10-Q and do not include all disclosures necessary for a complete presentation of financial position, results of operations, and cash flows in conformity with U.S. GAAP. These financial statements should be read in conjunction with the consolidated financial statements and related notes for the year ended December 31, 2015, which are included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 filed with the Securities and Exchange Commission (the “SEC”) on March 30, 2016. The results of operations for the three and nine months ended September 30, 2016 and 2015 are not necessarily indicative of the results that may be expected for the entire fiscal year or for any other interim period. In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements contain all material adjustments consisting of normal and recurring accruals necessary to present fairly the Company's consolidated financial position as of September 30, 2016, the results of operations for the three and nine months ended September 30, 2016 and 2015 and cash flows for the nine months ended September 30, 2016 and 2015.

Use of Estimates

In preparing condensed consolidated financial statements in conformity with U.S. GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported periods. Significant estimates include impairment and amortization of long-lived assets (including intangible assets and in-process research and development (“IPR&D”)), valuation of options, warrants and derivative liabilities and valuation of uncertain tax positions. Actual results could differ from those estimates.

Recently Issued Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board ("FASB") or other standard setting bodies.

8

In October 2016, the FASB issued ASU No. 2016-16, Income Taxes (Topic 740), Intra-Entity Transfers of Assets Other Than Inventory. The ASU was issued to improve the accounting for the income tax consequences of intra-entity transfers of assets other than inventory. Current U.S. GAAP prohibits the recognition of current and deferred income taxes for an intra-entity asset transfer until the asset has been sold to an outside party which has resulted in diversity in practice and increased complexity within financial reporting. The ASU would require an entity to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs and do not require new disclosure requirements. The ASU are effective for annual reporting periods beginning after December 15, 2017, and interim periods within those annual periods. Early adoption is permitted and the adoption of the ASU should be applied on a modified retrospective basis through a cumulative-effect adjustment directly to retained earnings as of the beginning of the period of adoption. The Company is currently evaluating the impact of the standard on the Company’s results of operations, cash flows and financial position.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230), Classification of Certain Cash Receipts and Cash Payments. The ASU was issued to address eight specific cash flow issues for which stakeholders have indicated to the FASB that a diversity in practice existed in how entities were presenting and classifying these items in the statement of cash flows. The issues addressed by the ASU include but are not limited to the classification of debt prepayment and debt extinguishment costs, payments made for contingent consideration for a business combination, proceeds from the settlement of insurance proceeds, distributions received from equity method investees and separately identifiable cash flows and the application of the predominance principle. The ASU is effective for public entities for fiscal years beginning after December 15, 2017 and interim periods in those fiscal years. Early adoption is permitted, including adoption in an interim fiscal period with all amendments adopted in the same period. The adoption of the ASU is required to be applied retrospectively. The Company is currently evaluating the impact of the standard on the Company's statement of cash flows.

In March 2016, the FASB issued ASU 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share Based Payment Accounting ("ASU 2016-09") as part of the FASB simplification initiative. The new standard provides for changes to accounting for stock compensation including 1) excess tax benefits and tax deficiencies related to share based payment awards will be recognized as income tax expense in the reporting period in which they occur; 2) excess tax benefits will be classified as an operating activity in the statement of cash flows; 3) the option to elect to estimate forfeitures or account for them when they occur; and 4) increase tax withholding requirements threshold to qualify for equity classification. The ASU is effective for public companies for annual periods, and interim periods within those annual periods, beginning after December 15, 2016, and early adoption is permitted. The Company early adopted the guidance during the first quarter of 2016 and it did not have a material impact on its condensed consolidated financial statements.

In February 2016, the FASB issued Accounting Standards Update No. 2016-02, Leases. The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. The Company is currently evaluating the impact of the standard on its condensed consolidated financial statements.

In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. The ASU enhances the reporting model for financial instruments, which includes amendments to address aspects of recognition, measurement, presentation and disclosure. The update to the standard is effective for public companies for interim and annual periods beginning after December 15, 2017. The Company is currently evaluating the impact that the standard will have on its condensed consolidated financial statements.

NOTE 4. DERIVATIVE FINANCIAL INSTRUMENTS

The Company accounts for derivative financial instruments in accordance with ASC 815-40, “Derivative and Hedging – Contracts in Entity’s Own Equity” (“ASC 815-40”) for instruments which do not have fixed settlement provisions and are deemed to be derivative instruments.

9

Hercules Warrants

On July 29, 2015, the Company and Immune Pharmaceuticals USA Corp., a wholly-owned subsidiary of the Company entered into a Loan and Security Agreement (“Loan Agreement”) with Hercules Capital (“Hercules”) pursuant to which Hercules agreed to lend $4.5 million to the Company with an option to borrow an additional $5.0 million prior to June 15, 2016, subject to the achievement of certain clinical milestones and satisfaction of certain other conditions. As of June 15, 2016, the Company had not met certain of the milestones as defined in the Hercules agreement in order to draw down upon the additional $5.0 million and as a result the option expired. In connection with the execution of the Loan Agreement, the Company has issued to Hercules a five-year warrant (“Hercules Warrant”) to purchase an aggregate of 214,853 shares of its common stock at an exercise price of $1.70 per share, subject to certain adjustments, including, if lower, the effective price of any financing occurring six months after the issuance date (the “Hercules Warrants”).

The Company determined the fair value of the Hercules Warrants to be $0.3 million on July 29, 2015 using the Binomial Lattice pricing model and recorded that amount as part of debt discount in its condensed consolidated balance sheets since the Hercules Warrant was considered part of the cost of the financing and is being amortized over the life of the Hercules Loan Agreement using the effective interest method. The Hercules Warrants were re-measured at each balance sheet date until the expiration of the anti-dilution provision on January 29, 2016. For the three and nine months ended September 30, 2016, the Company recorded a gain on the change in the estimated fair value of the Hercules Warrants of approximately $0 and $38,000, respectively, which was recorded as non-operating expense in its condensed consolidated statements of operations. For the three and nine months ended September 30, 2015, the Company recorded a gain on the change in the estimated fair value of the Hercules Warrants of approximately $0.1 million, which was recorded as non-operating expense in its condensed consolidated statements of operations. Upon the expiration of the anti-dilution provision on January 29, 2016, the remaining balance of $46,000 of the derivative liability associated with the Hercules Warrant was reclassified to additional paid-in-capital in the Company’s condensed consolidated balance sheets (see Note 5).

Discover Series D Convertible Preferred Stock

During the third quarter of 2015, the Company issued Series D Redeemable Convertible Preferred Stock (“Series D Preferred Stock”) to Discover Growth Fund (“Discover”), with a conversion price of $2.50 per share. The Company received total gross proceeds of $12.0 million in connection with the issuance of the Series D Preferred Stock to Discover after taking into account a 5% original issue discount. Discover could convert at any time and at conversion Discover would receive a conversion premium equal to the amount of dividends it would have received with respect to the Series D Preferred Stock if the Series D Preferred Stock had been held to the term of agreement of 6.5 years. The Series D Preferred Stock dividend rate included an adjustment feature that fluctuated inversely to the changes in the value of the Company’s common stock price. The conversion premium and dividends were redeemed upon conversion of the Series D Preferred Stock. The Company determined that the conversion premium and dividends with the features described above required liability accounting. Accordingly, the conversion premium and the dividend feature were bifurcated from the Series D Preferred Stock on the Company’s condensed consolidated balance sheet and were recorded as a derivative liability at fair value. Changes in the fair value of the derivative liability were recognized in the Company’s condensed consolidated statement of operations for each reporting period. During the third quarter of 2016, Discover converted all of its remaining Series D Preferred Stock outstanding. For the three and nine months ended September 30, 2016, the Company recorded a loss of $8.0 million and $8.7 million, respectively, on the change in the estimated fair value of the Discover derivative liability, which was recorded as a non-operating expense in the condensed consolidated statements of operations. For the three and nine months ended September 30, 2015, the Company recorded a loss of $0.3 million, on the change in the estimated fair value of the Discover derivative liability, which was recorded as a non-operating expense in the condensed consolidated statements of operations. The fair value of the Discover derivative liability as of September 30, 2016 and December 31, 2015 was $0 and $6.5 million, respectively (see Notes 5 and 11).

NOTE 5. FAIR VALUE INSTRUMENTS

Financial Instruments and Fair Value

The Company accounts for financial instruments in accordance with ASC 820, “Fair Value Measurements and Disclosures” (“ASC 820”). ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under ASC 820 are described below:

10

Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly; and

Level 3 – Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

The financial instruments recorded in the Company’s condensed consolidated balance sheets consist primarily of cash, restricted cash, debt and accounts payable. The carrying amounts of the Company’s cash and accounts payable approximate fair value due to their short-term nature. The fair value of the Company’s debt approximates its gross carrying value of approximately $4.1 million (which has been presented net of issuance costs), due to its variable interest rate. In estimating the fair value of the Company’s derivative liabilities associated with the Hercules Warrant and the Series D Preferred Stock issued to Discover, the Company used the Binomial Lattice options pricing model at inception and on each subsequent valuation date. Based on the fair value hierarchy, the Company classified the derivative liability associated with the Hercules Warrant and the Series D Preferred Stock issued to Discover within Level 3.

As of September 30, 2016, the Company had no assets or liabilities that were measured and recognized at fair value on a recurring basis. The following table presents the Company’s liabilities that are measured and recognized at fair value on a recurring basis classified under the appropriate level of the fair value hierarchy as of December 31, 2015 ($ in thousands).

| As of December 31, 2015 | Fair Value Hierarchy at December 31, 2015 | |||||||||||||||

| Total carrying and estimated fair value | Quoted prices in active markets (Level 1) | Significant other observable inputs (Level 2) | Significant unobservable inputs (Level 3) | |||||||||||||

| Liabilities: | ||||||||||||||||

| Derivative liability related to Series D Preferred Stock | $ | 6,529 | $ | - | $ | - | $ | 6,529 | ||||||||

| Derivative liability related to Hercules Warrants | $ | 84 | $ | - | $ | - | $ | 84 | ||||||||

Hercules Warrants

The following table sets forth a summary of changes in the estimated fair value of the derivative liability related to the Hercules Warrant for the period from January 1, 2016 through September 30, 2016 ($ in thousands):

| Fair Value Measurements of Hercules Common Stock Warrants Using Significant Unobservable Inputs (Level 3) | ||||

| Balance at January 1, 2016 | 84 | |||

| Change in estimated fair value of liability classified warrants | (38 | ) | ||

| Reclassification from liability to additional paid-in capital | (46 | ) | ||

| Balance at September 30, 2016 | $ | - | ||

11

Series D Preferred Stock

The following table sets forth a summary of changes in the estimated fair value of the derivative liability related to the Series D Preferred Stock for the period from January 1, 2016 through September 30, 2016 ($ in thousands):

| Fair Value Measurements of Series D Preferred Stock Derivative Liability Using Significant Unobservable Inputs (Level 3) | ||||

| Balance at January 1, 2016 | $ | 6,529 | ||

| Change in estimated fair value of Series D Preferred Stock derivative liability | 8,695 | |||

| Reclassification from liability to Additional Paid in Capital upon conversion | (15,224 | ) | ||

| Balance at September 30, 2016 | $ | - | ||

NOTE 6. INTANGIBLE ASSETS

The Company’s amortizable intangible assets consist of licenses and patents relating to the Company’s bertilimumab, NanomAbs and AMB8LK technologies and were determined by management to have a useful life between 7 and 15 years.

The value of the Company’s amortizable intangible assets as of September 30, 2016 is summarized below ($ in thousands):

| Bertilimumab iCo | NanomAbs Yissum | Human Antibodies Kadouche | Anti-ferritin Antibody MabLife | Total | ||||||||||||||||

| Balance as of December 31, 2015 | $ | 1,753 | $ | 475 | $ | 475 | $ | 408 | $ | 3,111 | ||||||||||

| Amortization | (125 | ) | (35 | ) | (35 | ) | (34 | ) | (229 | ) | ||||||||||

| Balance, September 30, 2016 | $ | 1,628 | $ | 440 | $ | 440 | $ | 374 | $ | 2,882 | ||||||||||

| Gross asset value | $ | 2,509 | $ | 694 | $ | 700 | $ | 547 | $ | 4,450 | ||||||||||

| Accumulated Amortization | (881 | ) | (254 | ) | (260 | ) | (173 | ) | (1,568 | ) | ||||||||||

| Balance, September 30, 2016 | $ | 1,628 | $ | 440 | $ | 440 | $ | 374 | $ | 2,882 | ||||||||||

Amortization expense amounted to $0.1 million and $0.2 million for the three and nine months ended September 30, 2016, respectively. Amortization expense amounted to $0.1 million and $0.2 million for the three and nine months ended September 30, 2015, respectively.

Estimated amortization expense for each of the five succeeding years, based upon intangible assets at September 30, 2016 is as follows ($ in thousands):

| Period Ending December 31, | Amount | |||

| 2016 (3 months) | $ | 76 | ||

| 2017 | 305 | |||

| 2018 | 305 | |||

| 2019 | 305 | |||

| 2020 | 305 | |||

| Thereafter | 1,586 | |||

| Total | $ | 2,882 | ||

NOTE 7. ACCRUED EXPENSES

Accrued expenses consist of the following ($ in thousands):

| September 30, 2016 | December 31, 2015 | |||||||

| Salaries and employee benefits | $ | 860 | $ | 545 | ||||

| Rent | 67 | 691 | ||||||

| Provision for a claim (see Note 13) | 300 | 300 | ||||||

| Financing costs and accrued interest | 320 | 88 | ||||||

| Professional fees | 83 | 549 | ||||||

| Severance | 50 | 180 | ||||||

| Other | 181 | 307 | ||||||

| Total | $ | 1,861 | $ | 2,660 | ||||

12

NOTE 8. NOTES AND LOANS PAYABLE

The Company is party to loan agreements as follows ($ in thousands):

| September 30, | December 31, | |||||||

| 2016 | 2015 | |||||||

| Loan and security agreement, net of debt discount of $0.5 million and $1.0 million, respectively (1) | $ | 3,151 | $ | 3,496 | ||||

| Note payable (2) (3) | 387 | 387 | ||||||

| Total notes and loans payable | $ | 3,538 | $ | 3,883 | ||||

| Notes and loans payable, current portion | $ | 1,691 | $ | 997 | ||||

| Notes and loans payable, long-term | 1,847 | 2,886 | ||||||

| Total notes and loans payable, net of original issue discount of $0.5 million and $1.0 million, respectively | $ | 3,538 | $ | 3,883 | ||||

Repayments under the Company’s existing debt agreements consist of the following ($ in thousands):

| Period Ending September 30, | Amount | |||

| 2016 (3 months) | $ | 752 | ||

| 2017 | 1,810 | |||

| 2018 | 1,496 | |||

| 2019 | 21 | |||

| Total | $ | 4,079 | ||

Loan and Security Agreement (1)

On July 29, 2015, the Company and Immune Pharmaceuticals USA Corp., a wholly-owned subsidiary of the Company, entered into a Loan and Security Agreement (“Loan Agreement”) pursuant to which Hercules agreed to lend $4.5 million to the Company with an option to borrow an additional $5.0 million prior to June 15, 2016, subject to the achievement of certain clinical milestones and other conditions. As of June 15, 2016, the Company had not met certain of the milestones described in the Loan Agreement required in order to borrow an additional $5.0 million and as a result the option expired. The Loan Agreement is collateralized by a first priority perfected security interest in all tangible and intangible assets of the Company and its subsidiaries. The Loan Agreement is senior in priority to all other Company indebtedness. The interest rate on the Hercules Loan is calculated at the greater of 10% or the prime rate plus 5.25%. The Company may prepay the Hercules Loan at any time, subject to certain prepayment penalties. Hercules may optionally convert up to $1.0 million of the unpaid principal balance of the loan in any subsequent institutionally led Company financing on the same terms, conditions and pricing applicable to such subsequent financing. This option to convert the loan to equity would be at the then fair value of the Company’s equity. Because the option to convert will be at the same terms and pricing, as the new investors will be paying in the subsequent Company financing, the option is deemed to have minimal value for financial reporting purposes. The Hercules Loan’s matures on September 1, 2018 and included an interest-only payment period for the first nine months following initial funding of the loan, after which escalating principal payments of $0.1 million per month began on April 1, 2016. Interest expense for the three and nine months ended September 30, 2016 was $0.1 million and $0.3 million, respectively. Interest expense for both the three and nine months ended September 30, 2015 was $43,000. As of September 30, 2016, the Company made $0.8 million in principal repayments.

13

The Loan Agreement includes an end of term charge of $0.5 million payable on the earliest to occur of (i) the Term Loan Maturity Date, (ii) the date that Borrower prepays the outstanding secured obligations under the Loan Agreement in full, or (iii) the date that the secured obligations under the Loan Agreement become due and payable in full (as described in the Loan Agreement). The Company accrues a portion of the end of term charge for each reporting period and will accrue up to the full $0.5 million charge over the 37-month term of the Hercules Loan because this charge is deemed a cost of the debt. For the three and nine months ended September 30, 2016, the Company recorded a charge of approximately $0.1 million and $0.2 million, respectively, in interest expense in its condensed consolidated statements of operations related to the Loan Agreement. For the three and nine months ended September 30, 2015, the Company recorded a charge of approximately $24,000, in interest expense in its condensed consolidated statements of operations related to the Loan Agreement.

The Company recorded $1.3 million in debt issuance costs relating to placement agent fees, legal fees, closing costs and the fair value of the placement agent warrants in its condensed consolidated balance sheet upon execution of the Loan Agreement. The Company early adopted ASU 2015-03 Simplifying the Presentation of Debt Issuance Costs, ASU 2015-03 requires the use of the effective interest method for the amortization of the debt discount. The Company will amortize the debt issuance costs over the term of the Loan Agreement, which matures on September 1, 2018. For the three and nine months ended September 30, 2016, the Company recorded $0.1 million and $0.5 million, respectively, in interest expense related to the amortization of the debt issuance costs. For the three and nine months ended September 30, 2015, the Company recorded $0.1 million, in interest expense related to the amortization of the debt issuance costs. At September 30, 2016 and December 31, 2015, the Company had approximately $0.5 million and $1.0 million, respectively, in debt issuance costs remaining to be amortized in its condensed consolidated balance sheets.

On July 21, 2016, Hercules, the Company and the holders of certain promissory notes entered into a Subordination Agreement to the Loan Agreement whereby the holders of such promissory notes agreed that their debt shall be subordinated to the Loan Agreement with respect to any security interest or lien that such creditors may have in any assets of the Company. See Notes 14.

MabLife Notes Payable (2)

In March 2012, the Company acquired from MabLife SAS (“MabLife”) through an assignment agreement, all rights, titles and interests in and to the patent rights, technology and deliverables related to the anti-Ferritin mAb, AMB8LK, including its nucleotide and protein sequences and its ability to recognize human acid and basic ferritins. The consideration was as follows: (i) $0.6 million payable in six annual installments (one of such installments being an upfront payment made upon execution of the agreement), and (ii) royalties of 0.6% of net sales of any product containing AMB8LK or the manufacture, use, sale, offering or importation of which would infringe on the patent rights with respect to AMB8LK. The Company is required to assign the foregoing rights back to MabLife, if it fails to make any of the required payments, is declared insolvent or bankrupt or terminates the agreement. In February 2014, the parties revised the payment arrangement for the purchase of the original assignment rights. Pursuant to the amendment to the assignment agreement, remaining payments of $0.1 million per year are due each year in 2016 and 2017.

In February 2014, the Company acquired from MabLife, through an irrevocable, exclusive, assignment of all rights, titles and interests in and to the secondary patent rights related to the use of anti-ferritin monoclonal antibodies in the treatment of some cancers, nucleotide and protein sequences of an antibody directed against an epitope common to human acidic and basic ferritins, monoclonal antibodies or antibody-like molecules comprising these sequences. As full consideration for the secondary patent rights, the Company will pay a total of $150,000 of which $15,000 and $25,000 was paid in 2014 and 2013, respectively, and $25,000 will be paid on the second through fourth anniversary of the agreement and an additional $35,000 on the fifth anniversary of the agreement.

During the first quarter of 2015, MabLife informed the Company that it has filed for bankruptcy. The Company is considering its options relating to the MabLife assignment agreement. For the three and nine months ended September 30, 2016, the Company recorded $3,000 and $41,000, respectively, in interest expense. No interest expense was recorded for the three and nine months ended September 30, 2015. Subsequent to the announcement of the MabLife bankruptcy through September 30, 2016, no principal payments have been made by the Company.

Revolving Line of Credit (3)

In April 2014, the Company entered into a three-year, $5.0 million revolving line of credit with Melini Capital Corp. (“Melini”), an existing stockholder who is related to Daniel Kazado, who was the Company’s Chairman of the Board until October 19, 2016 and a member of the Board of Directors. Borrowings under the revolving line of credit will incur interest at a rate of 12% per year, payable quarterly. The revolving line of credit is unsecured and subordinated to the Loan Agreement. To date, no amounts have been drawn under the revolving line of credit. Any amounts borrowed under the revolving line of credit must be repaid upon the maturity date of November 30, 2016 (see Note 14).

14

NOTE 9. INCOME TAXES

The Company has recognized a deferred tax liability of $10.9 million as of September 30, 2016 and December 31, 2015 related to the purchase of the AmiKet IPR&D. This deferred tax liability was recorded to account for the difference between the book basis and tax basis related to the IPR&D intangible asset, which was recorded in connection with the Merger. This deferred tax liability was excluded from sources of future taxable income, as the timing of its reversal cannot be predicted due to the indefinite life of the IPR&D. As such, this deferred tax liability cannot be used to offset the valuation allowance.

Deferred income taxes reflect the net effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The Company’s deferred tax assets relate primarily to its net operating loss carryforwards and other balance sheet basis differences. In accordance with ASC 740, “Income Taxes,” the Company recorded a valuation allowance to fully offset the gross deferred tax asset, because it is not more likely than not that the Company will realize future benefits associated with these deferred tax assets at September 30, 2016 and December 31, 2015.

During the second quarter of 2015, the Company received notices from New York State relating to audits of the 2011 to 2013 tax years. In June 2016, the Company paid $9,000 in full settlement of taxes and interest owed to New York State relating to the audits of the 2011 to 2013 tax years. During the third quarter of 2015, the Company received tax notices from the Israeli Tax Authority relating to the 2010 to 2014 tax years. During the third quarter of 2016, the Company paid $70,000 in full settlement of taxes and interest owed to the Israeli Tax Authority relating to the audits of the 2010 to 2014 tax years.

NOTE 10. STOCKHOLDERS’ EQUITY

(a) Stock options and stock award activity

The following table sets forth the common stock options granted during the nine months ended September 30, 2016:

| Title | Grant date | No. of options | Weighted average exercise price | Weighted average grant date fair value | Vesting terms | Assumptions used in Black-Scholes option pricing model | ||||||||||||||

| Management, Directors and Employees | January - September 2016 | 2,740,000 | $ | 0.57 | $ | 0.36 | Immediately -3 years | Volatility Risk free interest rate Expected term, in years Dividend yield | 991.55%-102.12% 1.39%-2.06% 6-10 0.00% | |||||||||||

| Consultants | January - September 2016 | 485,000 | $ | 0.31 | $ | 0.23 | Immediately-3 years | Volatility Risk free interest rate Expected term, in years Dividend yield | 91.55%-102.12% 1.12%-1.69% 10 0.00% | |||||||||||

The following table sets forth the stock awards granted during the nine months ended September 30, 2016:

| Title | Grant date | No. of stock awards | Weighted average grant date fair value | Vesting terms | ||||||||

| Consultants | January - September 2016 | 900,000 | $ | 0.44 | Immediately | |||||||

The fair value of stock awards is determined using the share price on the date of grant.

15

The following table sets forth the stock options granted during the nine months ended September 30, 2015:

| Title | Grant date | No. of options | Weighted average exercise price | Weighted average grant date fair value | Vesting terms | Assumptions used in Black-Scholes option pricing model | ||||||||||||||

| Management, Directors and Employees | January - September 2015 | 1,141,000 | $ | 1.95 | $ | 1.63 | 3 years | Volatility Risk free interest rate Expected term, in years Dividend yield | 84.33%-96.49% 0.23%-2.17% 6-10 0.00% | |||||||||||

| Consultants | January - September 2015 | 160,000 | $ | 1.99 | $ | 1.46 | 1 years | Volatility Risk free interest rate Expected term, in years Dividend yield | 91.55% 0.23%-0.27% 6 0.00% | |||||||||||

The following table sets forth the stock awards granted during the nine months ended September 30, 2015:

| Title | Grant date | No. of stock awards | Weighted average grant date fair value | Vesting terms | ||||||||

| Employees | January 2015 | 14,000 | $ | 2.47 | Immediately | |||||||

| Consultants | January - September 2015 | 744,469 | $ | 1.20 | Immediately | |||||||

The following table sets forth information about stock option activity during the nine months ended September 30, 2016:

| Options | ||||||||||||||||||||

| No. of options | Weighted average exercise price | Exercise price range | Weighted average grant date fair value | Aggregate Intrinsic Value (in thousands) | ||||||||||||||||

| Outstanding at December 31, 2015 | 4,988,988 | $ | 1.56 | $0.04 - $4.00 | $ | 1.97 | $ | 527 | ||||||||||||

| Granted | 3,225,000 | $ | 0.46 | $0.28-$0.73 | $ | 0.33 | $ | 3 | ||||||||||||

| Exercised | (476,694 | ) | $ | 0.04 | $0.04 | $ | - | $ | 114 | |||||||||||

| Forfeited/Expired | (184,667 | ) | $ | 0.91 | $0.53-$3.58 | $ | 0.82 | $ | - | |||||||||||

| Outstanding at September 30, 2016 | 7,552,627 | $ | 1.20 | $0.04 - $4.00 | $ | 1.36 | $ | 3 | ||||||||||||

| Exercisable at September 30, 2016 | 4,299,088 | $ | 1.30 | $0.04 - $4.00 | $ | 1.61 | $ | 69 | ||||||||||||

At September 30, 2016, unamortized stock-based compensation for stock options was $1.4 million, with a weighted-average recognition period of approximately 1.7 years.

(b) Warrants

The following table sets forth warrants granted during the nine months ended September 30, 2016:

| Title | Grant date | No. of warrants | Weighted average exercise price | Weighted average grant date fair value | Vesting terms | Assumptions used in Black-Scholes option pricing model | ||||||||||||||

| Consultants | January - September 2016 | 976,000 | $ | 0.82 | $ | 0.26 | Immediately | Volatility Risk free interest rate Expected term, in years Dividend yield | 92.15%-102.12% 1.09%-1.73% 5 0.00% | |||||||||||

16

The following table illustrates warrants granted for the nine months ended September 30, 2015

| Title | Grant date | No. of warrants | Weighted average exercise price | Weighted average grant date fair value | Vesting terms | Assumptions used in Black-Scholes option pricing model | ||||||||||||||

| Consultants | January - September 2015 | 1,933,403 | $ | 2.35 | $ | 1.19 | Immediately | Volatility Risk free interest rate Expected term, in years Dividend yield | 91.55%-96.49% 1.52%-1.75% 5 0.00% | |||||||||||

The following table summarizes information about warrants outstanding at September 30, 2016:

| Number of warrants | Weighted average exercise price | Exercise price range | ||||||||||

| Warrants outstanding at December 31, 2015 | 10,692,138 | $ | 3.93 | $1.66-$65.60 | ||||||||

| Warrants issued to consultants | 976,000 | $ | 0.82 | $0.47-$1.00 | ||||||||

| Expired | (382,561 | ) | $ | 19.19 | $1.85-$65.60 | |||||||

| Warrants outstanding and exercisable at September 30, 2016 | 11,285,576 | $ | 3.14 | $0.47-$32.40 | ||||||||

Stock-based compensation expense for stock options and awards and warrants for the three and nine months ended September 30, 2016 was $0.4 million and $1.7 million, respectively, which has not been tax-effected due to the recording of a full valuation allowance against net deferred tax assets. Stock-based compensation expense for stock options and awards and warrants for the three and nine months ended September 30, 2015 was $0.9 million and $2.6 million, respectively, which has not been tax-effected due to the recording of a full valuation allowance against net deferred tax assets.

(c) Capital Access Agreements

April 19, 2016 Agreement

On April 19, 2016, the Company entered into a Capital Access Agreement (“April 2016 Agreement”) with Regatta Select Healthcare, LLC (“Regatta”), pursuant to which Regatta agreed to purchase up to an aggregate of 3,500,000 shares of the Company’s common stock, par value $0.0001 per share (“Purchase Shares”) over the 12-month term of the April 19, 2016 Agreement. The Company had the right, but not the obligation, to direct Regatta via written notice (a “Put Notice”) to purchase up to a specific number of Purchase Shares. The purchase price per a Purchase Share pursuant to such Put Notice (the “Purchase Price”) was equal to 83% of the lowest trading price of the Company’s common stock on the NASDAQ Stock Market during the five consecutive trading days immediately following the date of such Put Notice (the “Put Date”). The number of Purchase Shares that may be purchased under each Put Notice was subject to a ceiling of the lesser of (a) $250,000 in market value of Purchase Shares or (b) 200% of average daily volume of the shares traded on the market on which the Company’s common stock is traded, computed using the 10 business days prior to the Put Date multiplied by the average of the daily closing price for the 10 business days immediately preceding the Put Date. The Purchase Price was additionally subject to a floor price equal to 75% of the average closing bid price for the common stock for the 10 trading days prior to the Put Date.

During the term of the April 2016 Agreement and for a period of one year thereafter, Regatta had a right of first offer to purchase any equity securities of the Company, as well as any rights, options, or warrants to purchase such equity securities, and any securities of any type whatsoever that are, or may become, convertible or exchangeable into or exercisable for such equity securities, in each case, which the Company makes a bona fide proposal to sell or offers to sell, other than equity securities offered or sold in an underwritten public offering. On June 10, 2016, the Company entered into an amendment to the April 2016 Agreement pursuant to which during the term of the April 2016 Agreement and for a period of one year thereafter, should the Company execute an agreement to sell its equity securities to a third party at a fixed price within a 15 day period after the settlement of a Put Notice at a price lower than that paid by Regatta pursuant to a Put Notice, the Company would be required to pay Regatta an aggregate fee of approximately $30,000. As of September 30, 2016, the Company had sold all of the 3,500,000 shares of its common stock under the April 2016 Agreement to Regatta for aggregate gross proceeds of $0.8 million. The Company incurred approximately $0.1 million in transaction fees related to this transaction.

17

June 10, 2016 Agreement

On June 10, 2016, the Company entered into a Capital Access Agreement (“June 2016 Agreement”) with Regatta, pursuant to which Regatta agreed to purchase up to an aggregate of 3,700,000 shares of the Company’s common stock, par value $0.0001 per share over the 12-month term of the June 10, 2016 Agreement.

Beginning on the day following the date that certain closing conditions in the June 2016 Agreement were satisfied (the “Commencement Date”), which conditions were satisfied on June 10, 2016, the Company had the right, but not the obligation, to direct Regatta via written notice (a “June Put Notice”) to purchase up to a specific number of June Purchase Shares. The purchase price per June Purchase Share pursuant to such June Put Notice (the “June Purchase Price”) shall be equal to 83% of the lowest trading price of the Company’s common stock on the NASDAQ Stock Market during the five consecutive trading days immediately following the date of such June Put Notice (the “June Put Date”). The number of Purchase Shares that may be purchased under each June Put Notice was subject to a ceiling of the lesser of (a) $250,000 in market value of the June Purchase Shares or (b) 200% of average daily volume of the shares traded on the market on which the Company’s common stock is traded, computed using the 10 business days prior to the June Put Date multiplied by the average of the daily closing price for the 10 business days immediately preceding the June Put Date. The June Purchase Price was additionally subject to a floor price equal to 75% of the average closing bid price for the Company’s common stock for the 10 trading days prior to the June Put Date. The Company incurred approximately $0.1 million in transaction fees related to this transaction.

During the term of the June 2016 Agreement and for a period of one year thereafter, should the Company execute an agreement to sell fixed price equity securities to any third party at a price lower than that paid by Regatta within a 15 day period from the settlement of a put notice, then the Company would be required to pay Regatta an aggregate fee of approximately $30,000. As of September 30, 2016, the Company had sold the 3,700,000 shares of its common stock under the June 10, 2016 Agreement for aggregate gross proceeds of $1.1 million.

(d) Share Purchase Agreements

During the second quarter of 2016, the Company entered into share purchase agreements with two accredited investors to sell 966,666 restricted shares of the Company’s common stock at a price of $0.36 per share for aggregate gross proceeds of $0.3 million. Pursuant to applicable securities laws these restricted shares may not be transferred or sold for a period of at least six months or unless they have been registered for resale pursuant to the Securities Act of 1933, as amended. As of September 30, 2016, 966,666 shares of the Company’s common stock had been issued with respect to these share purchase agreements for aggregate gross proceeds of $0.3 million.

On July 29, 2016, the Company entered into a securities purchase agreement with certain institutional investors for issuance and sale of 3,174,603 shares of the Company’s common stock, for aggregate gross proceeds of $1,000,000. Under this securities purchase agreement, the Company also agreed to issue to the institutional investors warrants to purchase 500,000 shares of common stock. The warrants were sold concurrently with the sale of the shares of common stock, pursuant to the securities purchase agreement, in a concurrent private placement. The warrants are exercisable for a period of five years from the date of issuance at an exercise price equal to $1.00 per share. In connection with the sale of the shares of common stock and the warrants pursuant to this securities purchase agreement, the Company relied upon the exemption from registration provided by Section 4(a)(2) under the Securities Act of 1933, as amended, for transactions not involving a public offering. Pursuant to this securities purchase agreement, the Company also agreed to pay to the institutional investors a commitment fee of $100,000, in cash or alternatively, 350,000 shares of common stock. On August 3, 2016, the Company issued 350,000 shares of its common stock as payment for the commitment fee. The Company incurred approximately $40,000 in transaction fees related to this transaction. The Company determined that based on the terms and the features of the warrants they should be classified in equity. As a result, the proceeds received for the issuance on the common stock and warrants were recorded within stockholders equity in its condensed consolidated balance sheet and the transaction fees and the value of the consideration paid to the institutional investors were recorded as a reduction to additional paid in capital in the Company’s condensed consolidated balance sheet.

18

On September 6, 2016, the Company entered into a stock purchase agreement with an existing stockholder for the sale of 4,000,000 shares of the Company’s common stock for gross proceeds of $2.0 million. These shares of common stock were issued in a registered direct offering pursuant to a prospectus supplement filed with the SEC on September 7, 2016, in connection with a takedown from the Registration Statement on Form S-3 (File No. 333-198647).

NOTE 11. SERIES D PREFERRED STOCK

During 2015, the Company entered into Stock Purchase Agreements (the “Purchase Agreements”) with Discover Growth Fund (“Discover”) pursuant to which the Company agreed to issue and sell up to an aggregate of 1,263 shares of the Company’s Series D Redeemable Convertible Preferred Stock (“Series D Preferred Stock”) of the Company, par value $0.0001 per share (“Series D Preferred Stock”), which were convertible into shares of the Company’s common stock, at a purchase price of $10,000 per share, for total gross proceeds of $12.0 million after taking into account a 5% original issue discount.

The Series D Preferred Stock was convertible at a price of $2.50 per share (“Conversion Price”) and had a six and a half year maturity term, at which time it would have converted automatically into shares of common stock based on the Conversion Price. The Series D Preferred Stock bore an accrued annual dividend rate which ranged from 0% to 15%, based on certain adjustments and conditions, including changes in the volume weighted average price of the Company’s common stock. Upon conversion, the Company was obligated to pay the holders of the Series D Preferred Stock being converted a conversion premium equal to the amount of dividends that such shares would have otherwise been issued if they had been held through the entire 6.5-year term.

The dividends and conversion premium was payable at the Company’s option in shares of common stock with the number of shares issued calculated as follows: (i) if there was no triggering event (as such term is defined in the Certificate of Designations), 90.0% of the average of the five lowest individual daily volume weighted average prices during the applicable measurement period, which may be non-consecutive, less $0.05 per share of common stock, not to exceed 100% of the lowest sales price on the last day of such measurement period, less $0.05 per share of common stock, or (ii) following a triggering event, 80.0% of the lowest daily volume weighted average price during any measurement period, less $0.05 per share of common stock, not to exceed 80.0% of the lowest sales price on the last day of any measurement period, less $0.05 per share of common stock. In addition, in a triggering event the dividend rate would adjust upwards by 10%.

The Series D Preferred Stock had been accounted for as mezzanine equity in the Company’s condensed consolidated balance sheet in accordance with ASC 480 “Distinguishing Liabilities from Equity,” as upon liquidation, the Company would be required to redeem the outstanding Series D Preferred Stock for cash. The conversion premium and the dividends associated with the Series D Preferred Stock contained an anti-dilution feature within the dividend rate, which fluctuated inversely to the changes in the value of the Company’s stock price. The conversion premium and dividends with the features noted above were to be redeemed upon conversion of the Series D Preferred Stock. The Company’s management had analyzed the conversion premium and dividends with the features noted and had determined that they required liability treatment. Accordingly, the conversion premium and the dividends were bifurcated from the Series D Preferred Stock for financial reporting purposes. Initial and subsequent measurements of this derivative liability were at fair value, with changes in fair value recognized in the Company’s condensed consolidated statement of operations on a quarterly basis.

During the third quarter of 2016, a triggering event occurred resulting in the dividend rate adjusting upward by 10% to 25% which impacted the calculation of the dividend and conversion premium pursuant to the terms of the Purchase Agreements. In addition, during the third quarter of 2016, Discover converted all of its remaining outstanding Series D Preferred Stock into 78,293,892 shares of common stock, in accordance with the terms of such Series D Preferred Stock. For the three and nine months ended September 30, 2016, the Company recorded a loss on the change in the estimated fair value of the derivative liability associated with the Series D Preferred Stock of $8.0 million and $8.7 million, respectively, which was recorded in non-operating expense in the Company’s condensed consolidated statements of operations. For both the three and nine months ended September 30, 2015, the Company recorded a loss on the change in the estimated fair value of the derivative liability associated with the Series D Preferred Stock of $0.3 million, which was recorded in non-operating expense in the Company’s condensed consolidated statements of operations.

19

For the nine months ended September 30, 2016, Discover had converted all of its remaining 963 shares of Series D Preferred Stock into a total of 3,852,000 shares of the Company’s common stock. For the nine months ended September 30, 2016, the Company issued an additional 57,421,400 shares of its common stock to Discover as payment of dividends and conversion premium. The Company also recorded a proportionate amount of the Series D Preferred Stock as a deemed dividend of approximately $8.0 million upon conversion, which was charged to additional paid-in capital in its condensed consolidated balance sheets. As of September 30, 2016, the Company expects to issue an additional 33,438,372 shares of its common stock to Discover in full satisfaction of dividends and conversion premium due on shares of Series D Preferred Stock already converted as a result of an issuance limitation, preventing Discover from owning more than 4.99% of the Company’s common stock outstanding at any time, per the Purchase Agreements. The issuance of these shares of common stock would be at Discover’s discretion. These shares of common stock have been included in the calculation of the weighted average shares outstanding for purposes of calculating the Company’s basic and diluted earnings per share.

Below is the activity for the Company’s Series D Preferred Stock issuances for the periods presented ($ in thousands, except share amounts):

| Shares | Amount | |||||||

| Balance at December 31, 2015 | 963 | $ | 1,659 | |||||

| Conversion of Series D Preferred Stock | (963 | ) | (9,632 | ) | ||||

| Accretion of Series D Preferred Stock | - | 7,973 | ||||||

| Balance at September 30, 2016 | - | $ | - | |||||

NOTE 12. LOSS PER SHARE

Basic and diluted loss per share is computed by dividing loss attributable to common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted weighted average shares outstanding for the three and nine months ended September 30, 2016 and 2015 excludes shares underlying stock options and warrants and convertible preferred, since the effects would be anti-dilutive. Accordingly, basic and diluted loss per share is the same.

Such excluded shares are summarized as follows:

| Three month period | Nine month period | |||||||||||||||

| ended September 30, | ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Shares of common stock underlying outstanding stock options | 7,552,627 | 3,733,503 | 7,552,627 | 3,733,503 | ||||||||||||

| Shares of common stock issuable upon conversion of Series D Preferred Stock (not including dividends and conversion premium paid in common stock) | - | 4,652,632 | - | 4,652,632 | ||||||||||||

| Shares of common stock issuable upon conversion of Series C Preferred Stock | - | 27,404 | - | 27,404 | ||||||||||||

| Warrants | 11,285,576 | 10,782,405 | 11,285,576 | 10,782,405 | ||||||||||||

| Total shares excluded from calculation | 18,838,203 | 19,195,944 | 18,838,203 | 19,195,944 | ||||||||||||

NOTE 13. COMMITMENTS AND CONTINGENCIES

(a) Leases

In February 2015, the Company’s corporate headquarters was relocated to New York, NY under a lease agreement with Alexandria Real Estate, which expires in 2020. On August 31, 2015, the Company signed an amendment to the New York, NY lease agreement with Alexandria Real Estate for lab space and offices for an additional 1,674 square feet commencing on September 1, 2015 and ending in 2020. The total base rent for offices and lab space under the amended lease agreement, is approximately $30,000 per month, subject to annual rent escalations. On January 15, 2016, the Company signed a one-year lease agreement with an option for an additional year for new office space in Israel. For the three and nine months ended September 30, 2016, the Company recorded rent expense of $0.1 million and $0.4 million, respectively. For the three and nine months ended September 30, 2015, the Company recorded rent expense of $0.1 million and $0.2 million, respectively.

20

Future minimum lease payments under non-cancelable leases for office space, as of September 30, 2016, are as follows ($ in thousands):

| Period ending December 31, | Amount | |||

| 2016 (3 months) | $ | 113 | ||

| 2017 | 378 | |||

| 2018 | 392 | |||

| 2019 | 405 | |||

| 2020 | 139 | |||

| $ | 1,427 | |||

(b) Licensing Agreements

The Company is a party to a number of research and licensing agreements with various organizations and institutions, including iCo Therapeutics Inc., MabLife, Yissum Research Development Company of The Hebrew University of Jerusalem, Ltd (“Yissum”), Dalhousie University, Lonza Sales AG and Shire Biochem Inc., which may require the Company to make payments to the other party upon the other party attaining certain milestones as defined in the agreements. The Company may be required to make future milestone payments under these agreements.

On January 1, 2016, the Company, through its wholly owned subsidiary, Immune Pharmaceuticals Ltd. entered into a definitive research and license agreement (the “License”) with BioNanoSim Ltd., (“BNS”). The License was entered into pursuant to an existing binding MOU, dated June 10, 2015, by and between the Company and Yissum. Under the License, the Company obtained from BNS an exclusive, worldwide sublicense, with a right to further sublicense, for the development, manufacturing and commercialization of certain inventions and research results regarding Yissum’s patents in connection with nanoparticles for topical delivery of cyclosporine-A (“Nanocyclo”), for all topical skin indications. In consideration for the License, the Company will pay BNS the following payments throughout the term of the License:

| · | an annual maintenance fee of $30,000, commencing on January 1, 2021, which maintenance fee shall increase by 30% each year, up to a maximum annual maintenance fee of $0.1 million and may be credited against royalties or milestone payments payable in the same calendar year; |

| · | a license fee in the amount of $0.5 million, to be paid in four equal installments to be made between January 4, 2016 and October 1, 2016; and |

| · | royalties on net sales of products (as such term is defined in the License) by the Company in the amount of up to 5%, subject to certain possible reductions in certain jurisdictions; |

| · | sublicense fees in the amount of 18% of any non-sales related consideration received by the Company from a sublicense or an option to receive a sublicense for the products and/or the licensed technology (as such terms are defined in the license); and |

| · | milestones payments of up to approximately $4.5 million and 250,000 shares of the Company’s common stock upon the achievement of certain regulatory, clinical development and commercialization milestones, provided, however, that in the event that the Company receives consideration from a sublicensee for any such milestones, the Company will pay to BNS the higher of either (a) the amount of the particular milestone payment enumerated in the License or (b) the amount of the sublicense fees that are due for such sublicensee consideration paid to the Company. |

In addition, the Company shall reimburse BNS within 60 days for expenses relating to patent fees and will sponsor a 12-month research program to prepare the program for investigational new drug (“IND”) submission. The Company recorded an expense of $0.5 million for the license fee of which $0.4 million was paid through the third quarter of 2016.

21

(c) Litigation

Immune Pharmaceuticals Inc. was the defendant in litigation involving a dispute with the plaintiffs Kenton L. Cowley and John A. Flores. The complaint alleges breach of contract, breach of covenant of good faith and fair dealing, fraud and rescission of contract with respect to the development of a topical cream containing ketamine and butamben, known as EpiCept NP-2. A summary judgment in the Company’s favor was granted in January 2012 and the plaintiffs filed an appeal in the United States Court of Appeals for the Ninth Circuit in September 2012. A hearing on the motion occurred in November 2013. In May 2014, the court scheduled the trial to begin in November 2014 and a mandatory settlement conference to occur in July 2014. In July 2014, the parties failed to reach a settlement at the mandatory settlement conference. The case was tried by a jury, which rendered a decision on March 23, 2015, in favor of the Company on all causes of action. In April 2015, the plaintiffs filed a motion for a new trial, which was heard by the Court on June 8, 2015. In October 2015, the court denied the plaintiff’s motion for a new trial. On October 9, 2015, the plaintiffs filed a notice of appeal to the United States Court of Appeals for the Ninth Circuit and, as of September 30, 2016, the court has made no ruling. During the three and nine months ended September 30, 2016, in connection with this litigation matter, the Company incurred approximately $0 and $39,000, respectively, of legal costs. During the three and nine months ended September 30, 2015, in connection with this litigation matter, the Company incurred approximately $0.4 million of legal costs.