Attached files

| file | filename |

|---|---|

| 8-K - SANDLER O'NEILL INVESTOR PRESENTATION NOVEMBER 2016 - INDEPENDENT BANK CORP | sandleroneillinvestorprese.htm |

Sandler O’Neill East Coast Financial Services

November 17, 2016

Robert Cozzone – Chief Financial Officer and Treasurer

Mark Ruggiero – SVP, Controller and Principal Accounting Officer

Exhibit 99.1

(2)

Who We Are

• Main Sub: Rockland Trust

• Market: Eastern Massachusetts

• Loans: $5.7 B

• Deposits: $6.3 B

• $AUA: $2.9 B

• Market Cap: $1.6 B

• NASDAQ: INDB

(3)

Key Messages

• Lengthy track record of consistent, solid performance

• Robust loan and core deposit activity

• Growing fee revenue sources, esp. Investment Mgmt.

• Expanding footprint in growth markets

• Tangible book value steadily growing *

• Well-positioned for rising rate environment

• Intelligent expense management

• Disciplined risk management culture

* See appendix A for reconciliation

(4)

Expanding Company Footprint

Rank 2016

1 23.5% 39%

Rank 2016

5 4.9% 18%

Rank 2016

3 12.3% 14%

Rank 2016

6 7.9% 12%

Rank 2016

19 1.2% 10%

Rank 2016

17 0.3% 4%

Rank 2016

2 19.7% 2%

Rank 2016

31 0.3% 1%

Suffolk County

Bristol County

Worcester County

Dukes County (MV)

Middlesex County

Norfolk County

% of

INDB Dep.Share

Barnstable County (Cape Cod)

Market

Plymouth County

Source: SNL Financial; Deposit/Market Share data as of October 20, 2016.

*Pro forma for pending Island Bancorp, Inc. acquisition

*

(5)

Recent Accomplishments

• Three consecutive years of record earnings

• Reached agreement to acquire Island Bancorp, Inc. of

Martha’s Vineyard

• Finalized acquisition of New England Bancorp, Inc. of

Cape Cod

• Capitalizing on expansion moves in vibrant Greater

Boston market

• Growth initiatives – new equipment leasing product, new

N. Quincy branch, expanded digital offerings

• Strong household growth rate

(6)

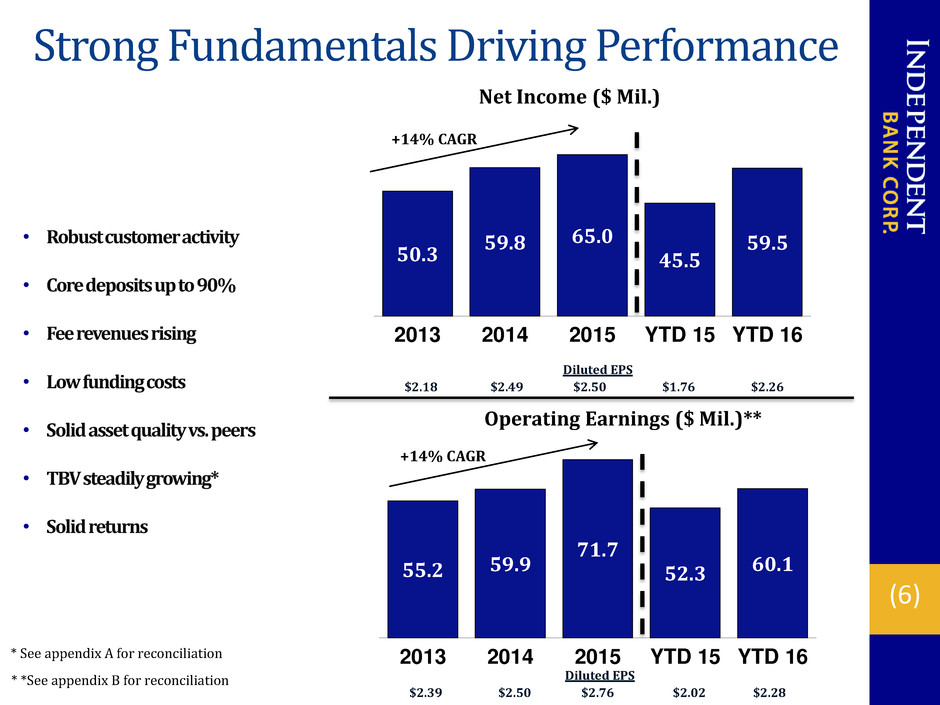

55.2 59.9

71.7

52.3 60.1

2013 2014 2015 YTD 15 YTD 16

Operating Earnings ($ Mil.)**

Strong Fundamentals Driving Performance

+14% CAGR

Diluted EPS

$2.18 $2.49 $2.50 $1.76 $2.26

• Robust customer activity

• Core deposits up to 90%

• Fee revenues rising

• Low funding costs

• Solid asset quality vs. peers

• TBV steadily growing*

• Solid returns

Diluted EPS

$2.39 $2.50 $2.76 $2.02 $2.28

* See appendix A for reconciliation

* *See appendix B for reconciliation

50.3

59.8 65.0

45.5

59.5

2013 2014 2015 YTD 15 YTD 16

Net Income ($ Mil.)

+14% CAGR

(7)

Vibrant Commercial Lending Franchise

TOTAL LOANS

$5.7 B

AVG. YIELD: 4.02%

3Q 2016

Comm'l

72%

Resi Mtg

11%

Home Eq

17%

• Long-term CRE/ C&I lender

• Strong name recognition in local markets

• Expanded market presence

• Experienced, knowledgeable lenders

• Commercial banker development program

• Growing in sophistication and capacity

• Increased small business focus

• Disciplined underwriting

(8)

Low Cost Deposit Base

Demand Deposits

32%

Money Market

19%

Savings/Now

39%

CDs

10%

TOTAL DEPOSITS

$6.3 B

AVG. COST: 0.17%

3Q 2016

• Sizable demand deposit

component

• Valuable source of liquidity

• Relationship-based approach

• Excellent household growth

• Expanded digital access

• Growing commercial base

CORE DEPOSITS: 90%

(9)

6.1

20.7

16.2

2006 2015 YTD 16

Revenues

($ Mil.)

816

2,883

2006 3Q16

AUAs

($ Mil.)

Investment Management :

Transformed Into High Growth Business

+253% +239%

• Successful business model

• Growing source of fee revenues

• Strong feeder business from Bank

• Expanding investment center locations

• Cross-sell opportunity in acquired bank markets

• Adding experienced professionals

(10)

Well-Positioned for Rising Rates:

Prudent Balance Sheet Management

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

Year 0 Year 1 Year 2

%

In

cr

ease

o

n

N

et

In

te

re

st

In

co

m

e

Interest Rate Sensitivity

Down 100

Up 200

Up 400

Flat Up 200

(11)

Asset Quality: Well Managed

34.7

27.5 27.7 24.8

2013 2014 2015 3Q16

NPLs

($ Mil.)

8.8 8.5

0.8

-0.3

2013 2014 2015 YTD 16

Net Chargeoffs

($ Mil.)

NPL/Loan %

0.73% 0.55% 0.50% 0.43%

Peers 0.68%*

Loss Rate

19bp 18bp 1bp (1)bp

Peers 11bp*

* Source: FFIEC Peer Group 2; $3-10 Billion in Assets, June 30, 2016

Incl. 90 days + overdue

(12)

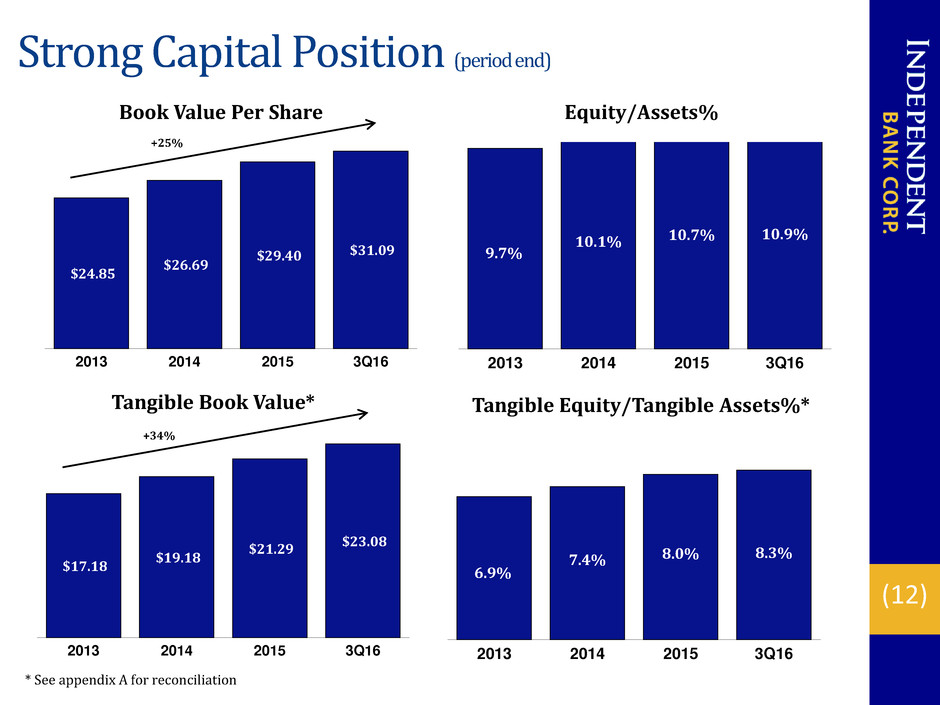

Strong Capital Position (period end)

6.9%

7.4% 8.0% 8.3%

2013 2014 2015 3Q16

Tangible Equity/Tangible Assets%*

$17.18

$19.18

$21.29

$23.08

2013 2014 2015 3Q16

Tangible Book Value*

+34%

* See appendix A for reconciliation

$24.85

$26.69

$29.40 $31.09

2013 2014 2015 3Q16

Book Value Per Share

+25%

Equity/Assets%

9.7%

10.1% 10.7% 10.9%

2013 2014 2015 3Q16

(13)

Strong Capital Position continued (period end)

8.6% 8.8%

9.3%

9.6%

2013 2014 2015 3Q16

Tier 1 Leverage %

• Strong internal capital generation

• No storehousing of excess capital

• No external equity raising

• No dividend cuts

(14)

Attentive to Shareholder Returns

$0.88

$0.96

$1.04

$0.87

2013 2014 2015 YTD 16

Cash Dividends Declared Per Share

(15)

Sustaining Business Momentum

Business Line

• Expand Market Presence/Recruit Seasoned Lenders

• Grow Client Base

• Expand Specialty Products, e.g. ABL, Leasing

• Lender Development Programs

Commercial

• Continue to Drive Household Growth

• Expand Digital Offerings

• Optimize Branch Network

Retail Delivery

• Capitalize on Strong Market Demographics

• Continue Strong Branch/Commercial Referrals

• Expand COI Relationships

Investment Management

• Continue Aggressive H.E. Marketing

• Scalable Resi Mortgage Origination Platform

Consumer Lending

Focal Points

(16)

Expanded Presence in Vibrant Greater Boston

Long-Term Commercial Lender in Greater Boston

Central Bancorp

$357MM Deposits

10 Branches – Nov. 2012

Investment Management

and Commercial Lending

Center

October 2013

Peoples Federal

Bancshares

$432MM Deposits

8 Branches – Feb. 2015

(17)

Island Bancorp Acquisition

Edgartown National Bank

• Profitable, well-managed community bank

• Provides first retail presence on M.V.

• Excellent complement to growing Cape Cod presence

• Financially attractive

• $0.03 - $0.04 EPS accretion expected in 2018

• Neutral to TBV

• Modest, low-risk deal

• Asset size: $194MM

• Transaction value: $24.5MM

• Expected to close in 2Q ‘17

INDB: A Proven Integrator

(18)

Building Franchise Value

Disciplined Acquisitions

Deal Value: $84.5MM

2% Core Dep. Premium*

Benjamin

Franklin Bancorp

Apr ‘09

$994mm Assets

$701mm Deposits

11 Branches

Deal Value: $52.0MM

8% Core Dep. Premium*

Central

Bancorp

Nov ‘12

$537mm Assets

$357mm Deposits

10 Branches

Deal Value: $40.3MM

8% Core Dep. Premium*

Mayflower

Bancorp

Nov’13

$243mm Assets

$219mm Deposits

8 Branches

$260 mm Assets

$214mm Deposits

Net 1 Branch

Deal Value: $41.7MM

12% Core Dep. Premium*

All Acquisitions Immediately Accretive

*Incl. CDs <$100k

Deal metrics based on closing price and actual acquired assets

New England Bancorp

Nov ‘16

Deal Value: $102.2 MM

17% Core Dep. Premium*

Slade’s Ferry

Bancorp

Mar ‘08

$630mm Assets

$411mm Deposits

9 Branches

Peoples Federal

Bancshares

Feb ’15

$640 mm Assets

$432mm Deposits

8 Branches

Deal Value: $141.8MM

10% Core Dep. Premium*

Island Bancorp

Q2 ‘17 (est.)

$194 mm Assets

$171mm Deposits

Net 4 Branches

Deal Value: $24.5MM

6% Core Dep. Premium*

(19)

Major Opportunities in Acquired Bank Markets:

Capitalizing on Rockland Trust Brand

Investment

Management

Commercial

Banking

Retail/

Consumer

• $2.9 billion AUA

• Wealth/Institutional

• Strong referral network

• Sophisticated products

• Expanded capacity

• In depth market knowledge

• Award winning customer service

• Electronic/mobile banking

• Competitive home equity products

Acquired Bank Customer Bases

(20)

Optimizing Retail Delivery Network

In the past twelve months we have:

• Acquired specialized analytics software/location model

• Shifted branch distribution

• Closed/consolidated 3

• Opened 1

• Redesigned 3

• Contracted ATM site in downtown Boston

• Implemented in-branch transaction balancing

• Transitioned to instant-issue debit cards

(21)

INDB Investment Merits

• High quality franchise in attractive markets

• Strong organic business volumes

• Growing brand recognition

• Operating platform that can be leveraged further

• Capitalizing on in-market consolidation opportunities

• Diligent stewards of shareholder capital

• Grounded management team

• Positioned to grow, build, and acquire to drive long-term value

creation

(22)

Appendix A

The following table reconciles Book Value per share, which is a GAAP based measure to Tangible Book Value per share, which

is a non-GAAP based measure. It also reconciles the ratio of Equity to Assets, which is a GAAP based measure, to Tangible

Equity to Tangible Assets, a non-GAAP measure, for the dates indicated:

2013 2014 2015 YTD16

(Dollars in thousands, except share and per share data)

Tangible common equity

Stockholders' equity (GAAP) $591,540 $640,527 $771,463 $818,242 (a)

Less: Goodwill and other intangibles 182,642 180,306 212,909 210,834

Tangible common equity 408,898 460,221 558,554 607,408 (b)

Tangible assets

Assets (GAAP) 6,099,234 6,364,912 7,210,038 7,502,009 (c)

Less: Goodwill and other intangibles 182,642 180,306 212,909 210,834

Tangible assets 5,916,592 6,184,606 6,997,129 7,291,175 (d)

Common shares 23,805,984 23,998,738 26,236,352 26,320,467 (e)

Common equity to assets ratio (GAAP) 9.70% 10.06% 10.70% 10.91% (a/c)

Tangible common equity to tangible assets ratio (Non-

GAAP) 6.91% 7.44% 7.98% 8.33% (b/d)

Book Value per share (GAAP) $24.85 $26.69 $29.40 $31.09 (a/e)

Tangible book value per share (Non-GAAP) $17.18 $19.18 $21.29 $23.08 (b/e)

(23)

Appendix B

The following table reconciles net income and diluted EPS, which are GAAP measures, to operating earnings and diluted EPS on an operating basis, which are Non-GAAP

measures as of the time periods indicated:

2013 2014 2015 YTD 15 YTD 16

(Dollars in thousands, except per share data)

Net income available to common shareholders (GAAP) $ 50,254 $ 2.18 $ 59,845 $ 2.49 $ 64,960 $ 2.50 $ 45,505 $ 1.76 $ 59,469 $ 2.26

Non-GAAP adjustments

Noninterest income components

Gain on extinguishment of debt (763) (0.03) - - - - - - - -

Gain on life insurance benefits (tax exempt) (227) (0.01) (1,964) (0.08) - - - - - -

Gain on sale of fixed income securities (258) (0.01) (121) (0.01) (798) (0.03) (798) (0.03) - -

Noninterest expense components

Impairment on acquired facilities - - 524 0.02 109 - 109 - - -

Loss on extinguishment of debt - - - - 122 0.01 122 0.01 437 0.02

Loss on sale of fixed income securities - - 21 0.00 1,124 0.04 1,124 0.04 - -

Loss on termination of derivatives 1,122 0.05 - - - -

Merger and acquisition expenses 8,685 0.38 1,339 0.06 10,501 0.41 10,501 0.41 691 0.03

Severance 325 0.01 - - - - - - - -

Total impact of noncore items 7,762 0.38 921 0.12 11,058 0.43 11,058 0.43 1,128 0.05

Net tax benefit associated with noncore items (2,837) (0.16) (866) (0.03) (4,285) (0.17) (4,285) (0.17) (461) (0.03)

Net operating earnings (Non-GAAP) $ 55,179 $ 2.40 $ 59,900 $ 2.58 $ 71,733 $ 2.76 $ 52,278 $ 2.02 $ 60,136 $ 2.28

(24)

NASDAQ Ticker: INDB

www.rocklandtrust.com

Robert Cozzone – CFO & Treasurer

Shareholder Relations:

(781) 982-6737

Statements contained in this presentation that are not historical facts are “forward-looking

statements” that are subject to risks and uncertainties which could cause actual results to differ

materially from those currently anticipated due to a number of factors, which include, but are not

limited to, factors discussed in documents filed by the Company with the Securities and Exchange

Commission from time to time.