Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HOME BANCSHARES INC | d288562dex991.htm |

| 8-K - FORM 8-K - HOME BANCSHARES INC | d288562d8k.htm |

Exhibit 99.2

Forward Looking Statement This presentation contains forward-looking statements which include, but are not limited to, statements about the benefits of the business combination transaction described herein, including the combined company’s future financial and operating results, plans, expectations, goals and outlook for the future. Statements in this presentation that are not historical facts should be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements speak only as of the date hereof and, by nature, involve inherent risk and uncertainties. Various factors could cause actual results to differ materially from those contemplated by the forward-looking statements, including, but not limited to, (i) the possibility that the acquisition does not close when expected or at all because required judicial, regulatory, or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; (ii) the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which the Company and the target operate; (iii) the ability to promptly and effectively integrate the businesses of the Company and the target; (iv) the reaction to the transaction of the companies’ customers, employees and counterparties; and (v) diversion of management time on acquisition-related issues. Additional information on factors that might affect the Company’s financial results is included in its most recent Form 10-K and Form 10-Q as filed with the Securities and Exchange Commission. We do not intend and disclaim any duty or obligation to update or revise any forward-looking statements in this presentation to reflect new information, future events or otherwise.

Headquartered in Conway, Arkansas, Operates 142 branches in Arkansas, Alabama, Florida and New York Bank holding company focused on commercial and retail banking services for businesses and individuals Financial Highlights at 9/30/16 Total Assets - $9.8 Billion Total Loans - $7.0 Billion Total Deposits - $6.8 Billion Home BancShares, Inc.

Purchase all of the issued and outstanding shares of common stock of The Bank of Commerce, a Florida state-chartered bank for approximately $3.8 million, which includes the settlement of the Bank’s subordinated debt, plus up to an additional $400,000 in expense reimbursement for approved administrative claims As of June 30, 2016, Commerce had $196 million in total assets, $130 million in loans and $153 million in customer deposits No additional capital required to complete the transaction Acquired branches will operate as Centennial Bank, a wholly-owned subsidiary of Home BancShares, Inc. Bank of commerce transaction overview

Additive to current Central Florida footprint Financially attractive transaction – immediately accretive to: Diluted earnings per share Book Value This transaction will result in a small bargain purchase gain; therefore, excluding CDI, it will be accretive to Tangible Book Value on day 1. Strategic Opportunity

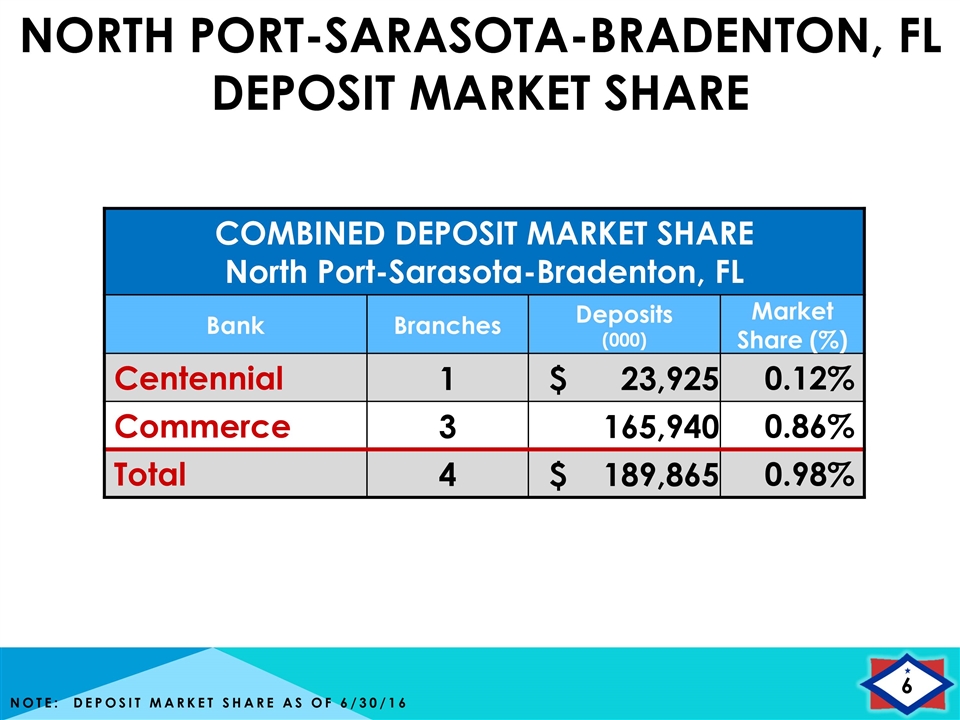

North Port-Sarasota-bradenton, fl Deposit Market Share Note: Deposit market share as of 6/30/16 COMBINED DEPOSIT MARKET SHARE North Port-Sarasota-Bradenton, FL Bank Branches Deposits (000) Market Share (%) Centennial 1 $ 23,925 0.12% Commerce 3 165,940 0.86% Total 4 $ 189,865 0.98%

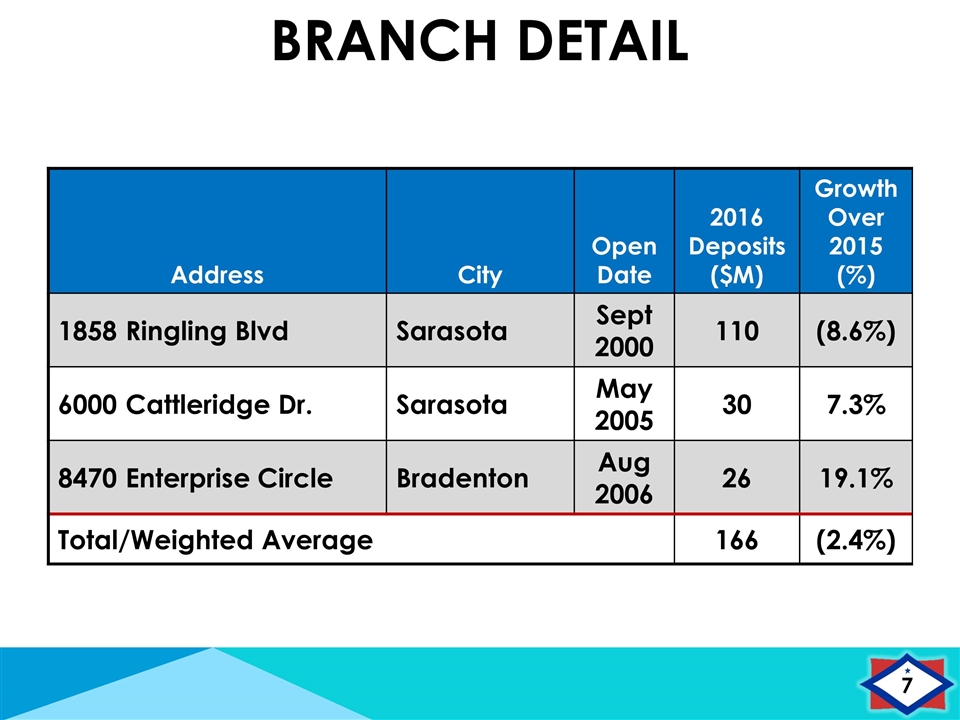

Branch Detail Address City Open Date 2016 Deposits ($M) Growth Over 2015 (%) 1858 Ringling Blvd Sarasota Sept 2000 110 (8.6%) 6000 Cattleridge Dr. Sarasota May 2005 30 7.3% 8470 Enterprise Circle Bradenton Aug 2006 26 19.1% Total/Weighted Average 166 (2.4%)

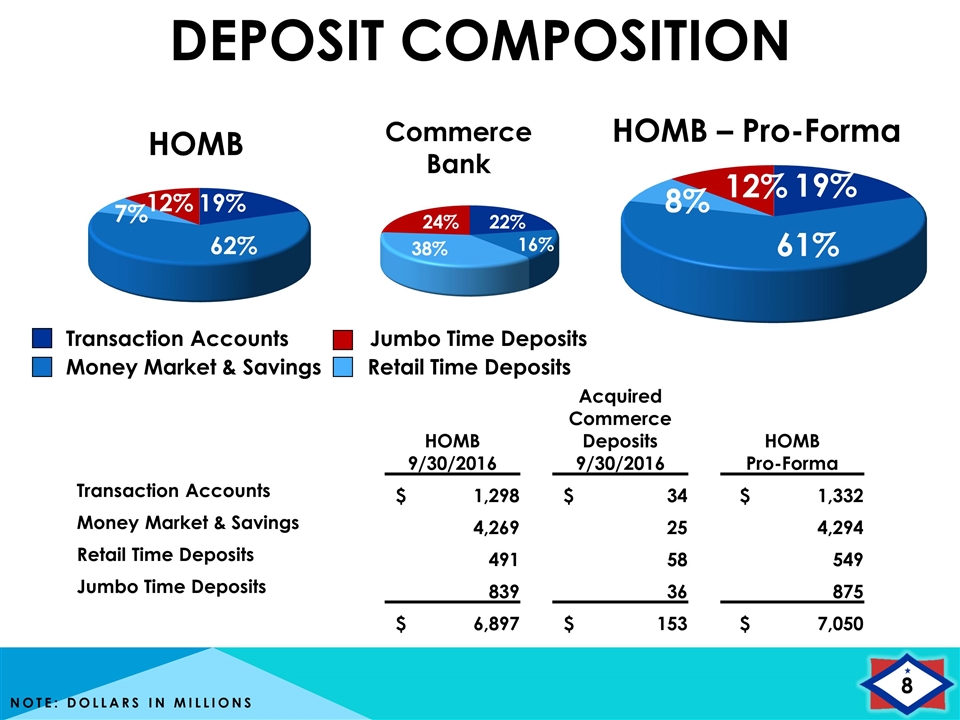

Deposit Composition Note: Dollars in Millions HOMB HOMB – Pro-Forma Transaction Accounts Money Market & Savings Jumbo Time Deposits Retail Time Deposits HOMB 9/30/2016 Acquired Commerce Deposits 9/30/2016 HOMB Pro-Forma Transaction Accounts $ 1,298 $ 34 $ 1,332 Money Market & Savings 4,269 25 4,294 Retail Time Deposits 491 58 549 Jumbo Time Deposits 839 36 875 $ 6,897 $ 153 $ 7,050 12% 19% 7% 62% 12% 19% 8% 61% 24% 22% 38% 16% Commerce Bank

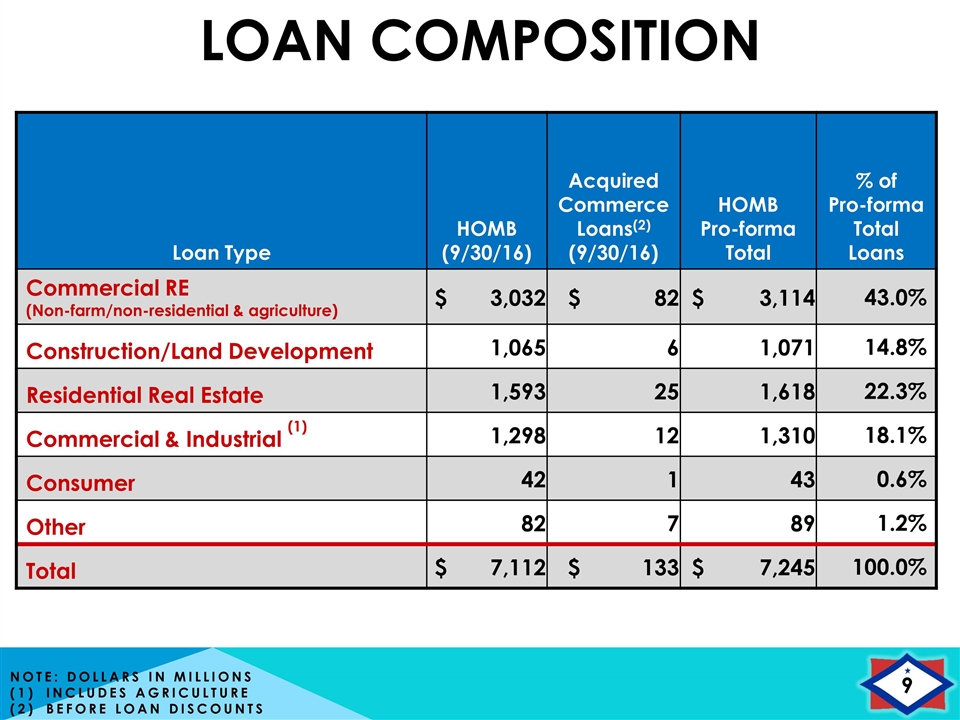

Loan Composition Note: Dollars in Millions Includes Agriculture Before loan discounts Loan Type HOMB (9/30/16) Acquired Commerce Loans(2) (9/30/16) HOMB Pro-forma Total % of Pro-forma Total Loans Commercial RE (Non-farm/non-residential & agriculture) $ 3,032 $ 82 $ 3,114 43.0% Construction/Land Development 1,065 6 1,071 14.8% Residential Real Estate 1,593 25 1,618 22.3% Commercial & Industrial (1) 1,298 12 1,310 18.1% Consumer 42 1 43 0.6% Other 82 7 89 1.2% Total $ 7,112 $ 133 $ 7,245 100.0%

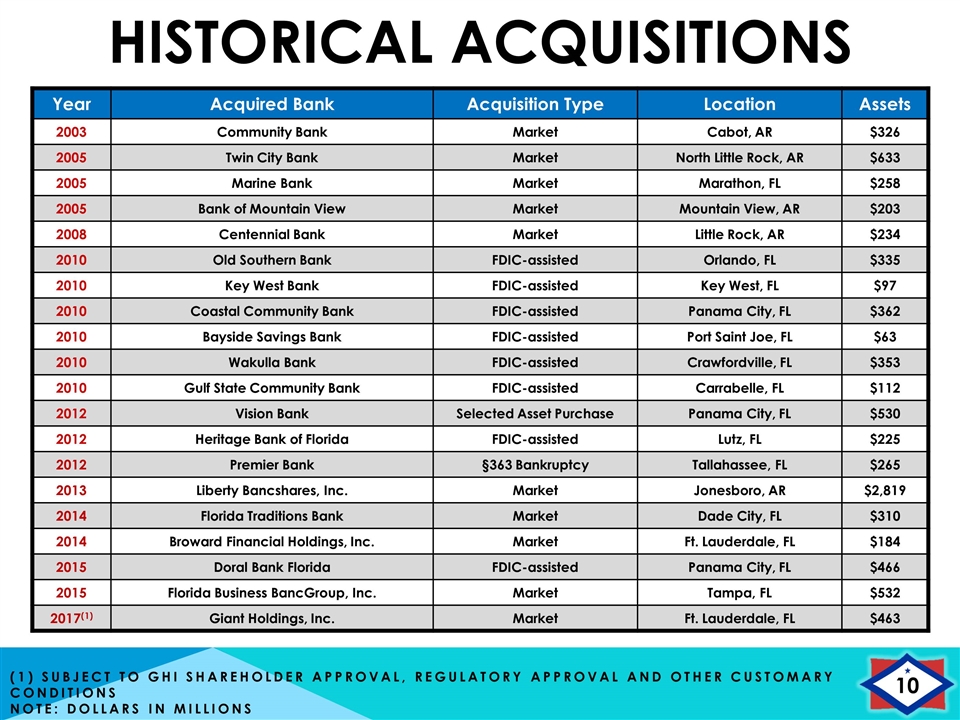

Historical Acquisitions Year Acquired Bank Acquisition Type Location Assets 2003 Community Bank Market Cabot, AR $326 2005 Twin City Bank Market North Little Rock, AR $633 2005 Marine Bank Market Marathon, FL $258 2005 Bank of Mountain View Market Mountain View, AR $203 2008 Centennial Bank Market Little Rock, AR $234 2010 Old Southern Bank FDIC-assisted Orlando, FL $335 2010 Key West Bank FDIC-assisted Key West, FL $97 2010 Coastal Community Bank FDIC-assisted Panama City, FL $362 2010 Bayside Savings Bank FDIC-assisted Port Saint Joe, FL $63 2010 Wakulla Bank FDIC-assisted Crawfordville, FL $353 2010 Gulf State Community Bank FDIC-assisted Carrabelle, FL $112 2012 Vision Bank Selected Asset Purchase Panama City, FL $530 2012 Heritage Bank of Florida FDIC-assisted Lutz, FL $225 2012 Premier Bank §363 Bankruptcy Tallahassee, FL $265 2013 Liberty Bancshares, Inc. Market Jonesboro, AR $2,819 2014 Florida Traditions Bank Market Dade City, FL $310 2014 Broward Financial Holdings, Inc. Market Ft. Lauderdale, FL $184 2015 Doral Bank Florida FDIC-assisted Panama City, FL $466 2015 Florida Business BancGroup, Inc. Market Tampa, FL $532 2017(1) Giant Holdings, Inc. Market Ft. Lauderdale, FL $463 (1) subject to GHI Shareholder approval, regulatory approval and other customary conditions Note: DOLLARS IN MILLIONS

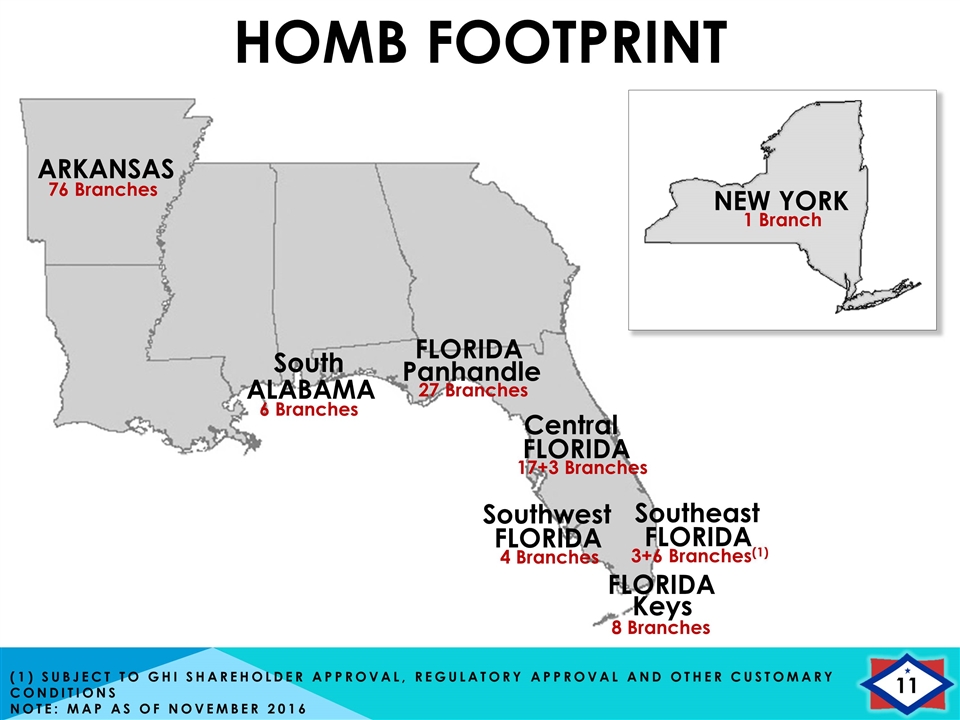

HOMB Footprint (1) subject to GHI Shareholder approval, regulatory approval and other customary conditions Note: Map as of November 2016 ARKANSAS 76 Branches ALABAMA 6 Branches Panhandle 27 Branches FLORIDA 17+3 Branches FLORIDA 4 Branches FLORIDA 8 Branches South Central Southwest Keys FLORIDA FLORIDA 3+6 Branches(1) Southeast NEW YORK 1 Branch

Branch Locations Mountain View (2) Searcy (3) Beebe (2) Ward Cabot (4) Jacksonville (2) Sherwood Greenbrier Vilonia Conway (7) Mayflower Maumelle Little Rock (8) Bryant Quitman North Little Rock (5) Morrilton Heber Springs ARKANSAS Jonesboro (5) Batesville (2) Highland Monette Mountain Home Paragould (3) Rector Bentonville Fayetteville (2) Fort Smith (3) Rogers Siloam Springs (2) Springdale Tontitown Atkins Clarksville Dardanelle Russellville (3) Pottsville Van Buren Branch Locations (76) Arkansas Footprint Note: Map as of November 2016

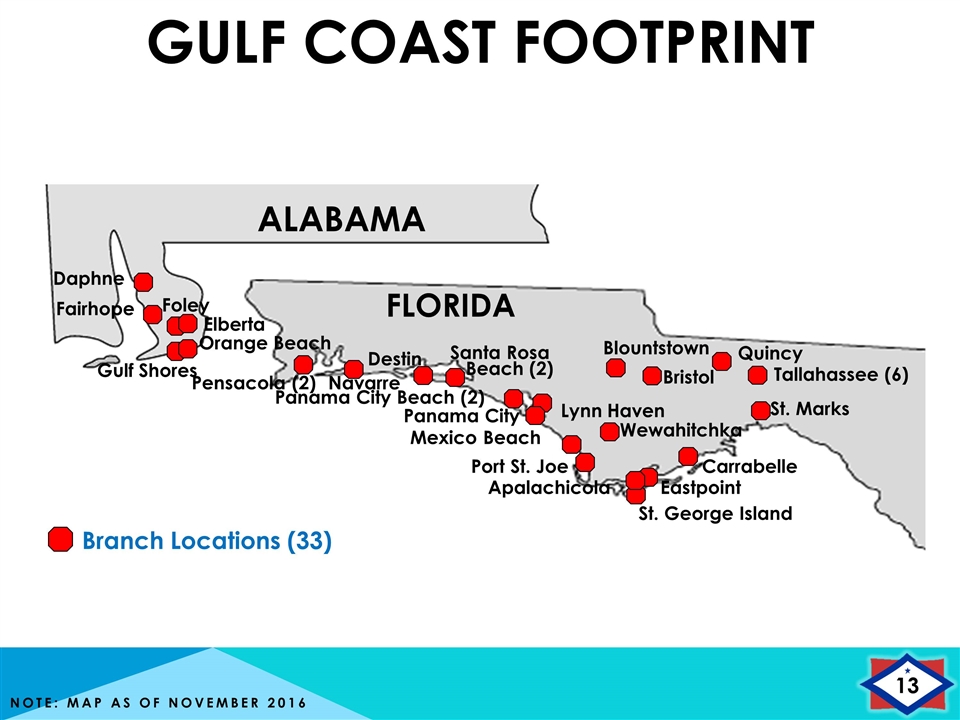

Gulf Coast FOOTPRINT Note: Map as of November 2016 Eastpoint Apalachicola Carrabelle Port St. Joe Lynn Haven Panama City St. George Island Panama City Beach (2) Mexico Beach Blountstown Bristol Tallahassee (6) Daphne Fairhope Elberta Foley Orange Beach Gulf Shores Navarre Destin Wewahitchka ALABAMA FLORIDA Quincy St. Marks Pensacola (2) Santa Rosa Beach (2) Branch Locations (33)

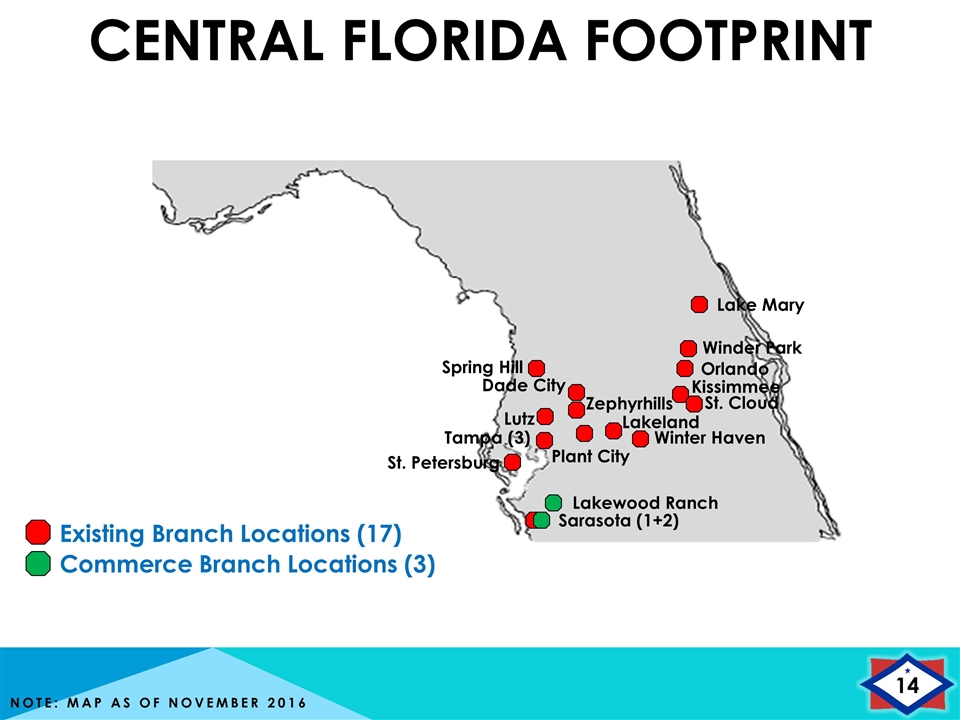

Central Florida Footprint Note: Map as of November 2016 Lake Mary Winder Park Orlando Kissimmee St. Cloud Winter Haven Lakeland Zephyrhills Plant City Tampa (3) Lutz Dade City Spring Hill Existing Branch Locations (17) St. Petersburg Sarasota (1+2) Commerce Branch Locations (3) Lakewood Ranch

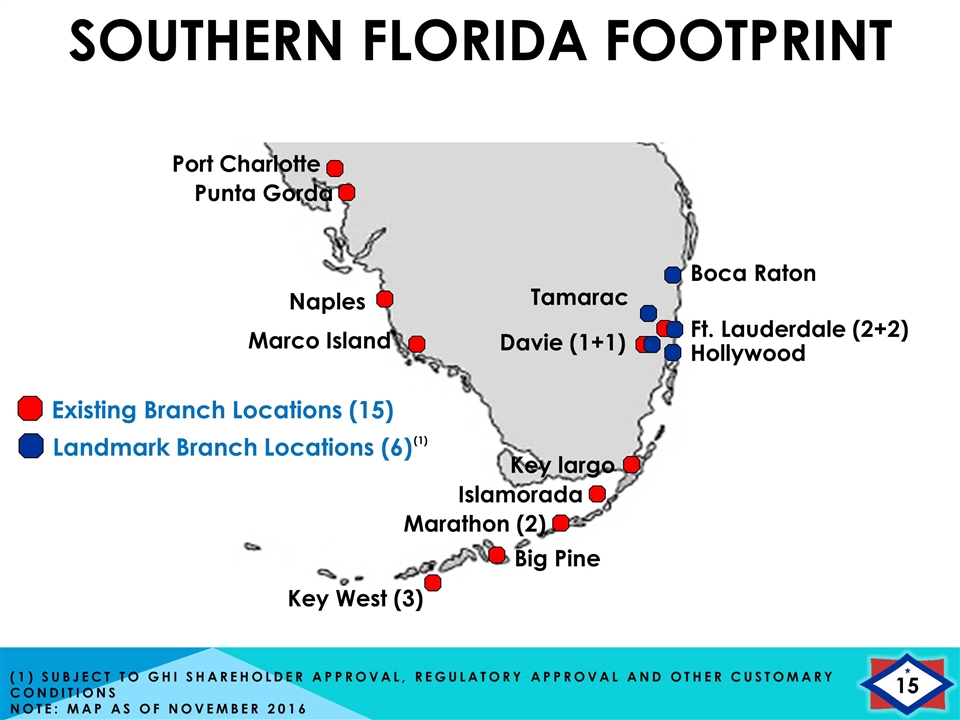

Southern Florida Footprint (1) subject to GHI Shareholder approval, regulatory approval and other customary conditions Note: Map as of November 2016 Existing Branch Locations (15) Naples Marco Island Tamarac Key largo Islamorada Marathon (2) Key West (3) Big Pine Hollywood Ft. Lauderdale (2+2) Boca Raton Davie (1+1) Landmark Branch Locations (6) Port Charlotte Punta Gorda (1)

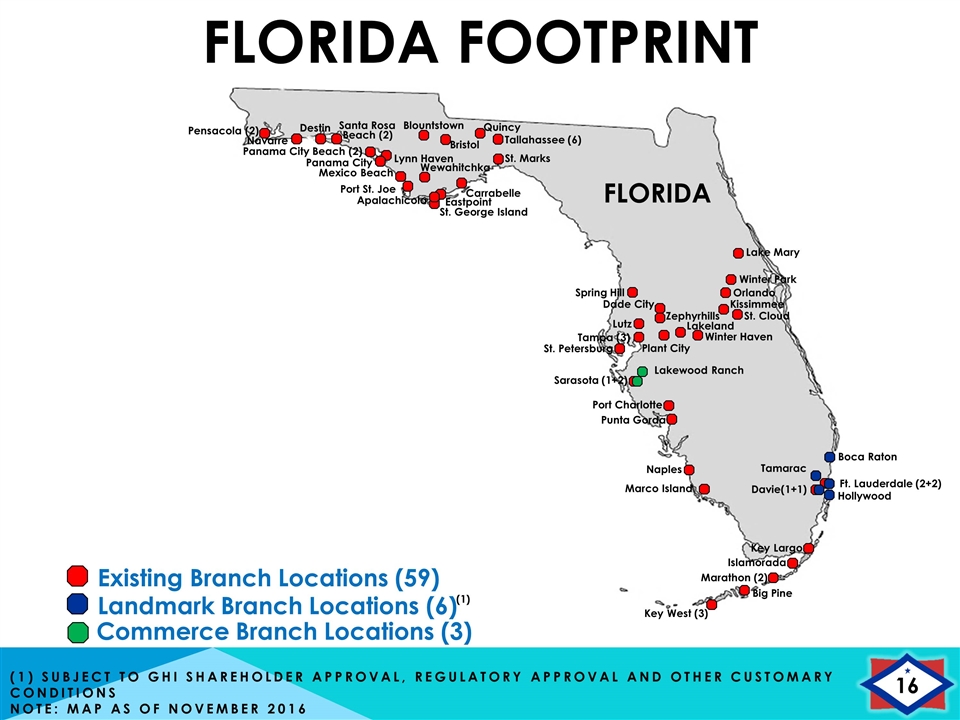

Florida Footprint (1) subject to GHI Shareholder approval, regulatory approval and other customary conditions Note: Map as of November 2016 FLORIDA Port Charlotte Punta Gorda Marco Island Key Largo Islamorada Marathon (2) Big Pine Key West (3) Eastpoint Apalachicola Carrabelle Port St. Joe Lynn Haven Panama City St. George Island Panama City Beach (2) Mexico Beach Blountstown Bristol Tallahassee (6) Navarre Wewahitchka Destin Quincy Landmark Branch Locations (6) St. Marks Pensacola (2) Santa Rosa Beach (2) Orlando Winter Park Lutz Tampa (3) Lake Mary Kissimmee St. Cloud Zephyrhills Dade City Plant City Lakeland Winter Haven Spring Hill Naples Ft. Lauderdale (2+2) St. Petersburg Sarasota (1+2) Davie(1+1) Boca Raton Hollywood Tamarac Existing Branch Locations (59) Lakewood Ranch Commerce Branch Locations (3) (1)

Contact Information Corporate Headquarters Home BancShares, Inc. 719 Harkrider Street, Suite 100 P.O. Box 966 Conway, AR 72033 Financial Information Jennifer C. Floyd Investor Relations Officer (501) 339-2929 Website www.homebancshares.com