Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIRST INTERSTATE BANCSYSTEM INC | d293894dex991.htm |

| EX-2.1 - EX-2.1 - FIRST INTERSTATE BANCSYSTEM INC | d293894dex21.htm |

| 8-K - FORM 8-K - FIRST INTERSTATE BANCSYSTEM INC | d293894d8k.htm |

| Exhibit 99.2

|

First Interstate BancSystem

NOVEMBER 17, 2016

FIRST INTERSTATE EXPANDS INTO GROWTH MARKETS OF THE NORTHWEST WITH ACQUISITION OF CASCADE BANCORP

|

|

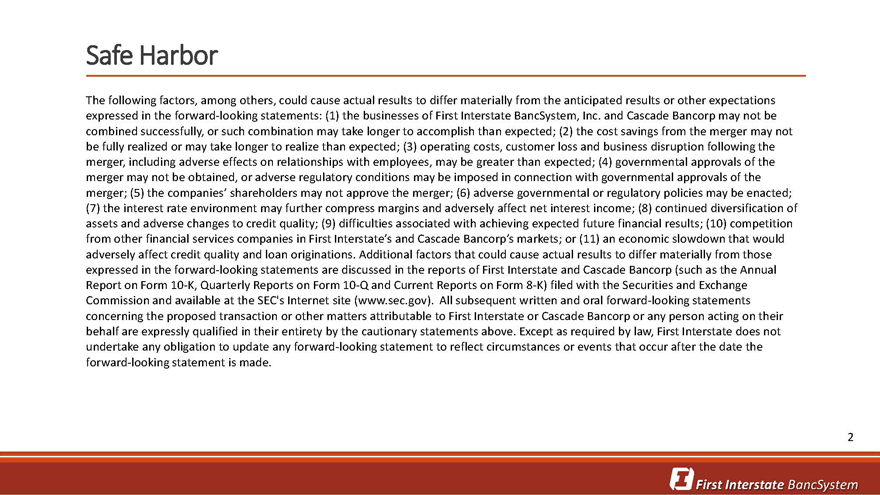

Safe Harbor

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of First Interstate BancSystem, Inc. and Cascade Bancorp may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the companies’ shareholders may not approve the merger; (6) adverse governmental or regulatory policies may be enacted;

(7) the interest rate environment may further compress margins and adversely affect net interest income; (8) continued diversification of assets and adverse changes to credit quality; (9) difficulties associated with achieving expected future financial results; (10) competition from other financial services companies in First Interstate’s and Cascade Bancorp’s markets; or (11) an economic slowdown that would adversely affect credit quality and loan originations. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the reports of First Interstate and Cascade Bancorp (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available at the SEC’s Internet site (www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to First Interstate or Cascade Bancorp or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, First Interstate does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

2

First Interstate BancSystem

|

|

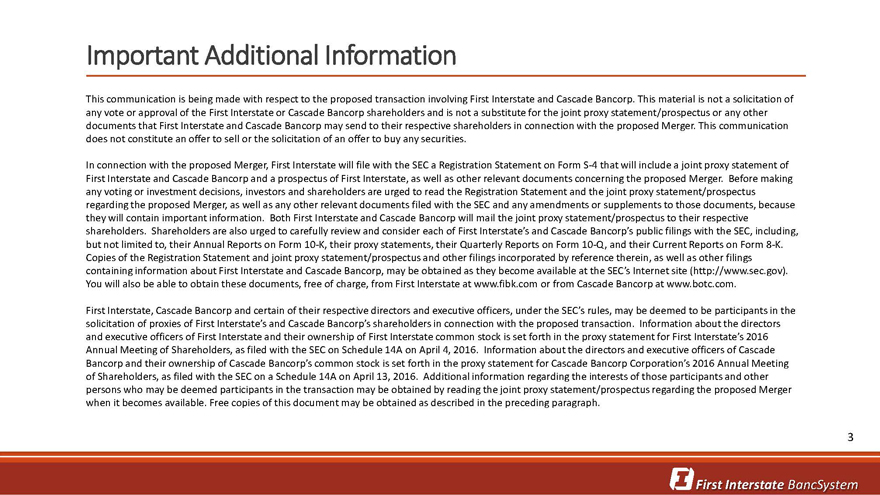

Important Additional Information

This communication is being made with respect to the proposed transaction involving First Interstate and Cascade Bancorp. This material is not a solicitation of any vote or approval of the First Interstate or Cascade Bancorp shareholders and is not a substitute for the joint proxy statement/prospectus or any other documents that First Interstate and Cascade Bancorp may send to their respective shareholders in connection with the proposed Merger. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities.

In connection with the proposed Merger, First Interstate will file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement of First Interstate and Cascade Bancorp and a prospectus of First Interstate, as well as other relevant documents concerning the proposed Merger. Before making any voting or investment decisions, investors and shareholders are urged to read the Registration Statement and the joint proxy statement/prospectus regarding the proposed Merger, as well as any other relevant documents filed with the SEC and any amendments or supplements to those documents, because they will contain important information. Both First Interstate and Cascade Bancorp will mail the joint proxy statement/prospectus to their respective shareholders. Shareholders are also urged to carefully review and consider each of First Interstate’s and Cascade Bancorp’s public filings with the SEC, including, but not limited to, their Annual Reports on Form 10-K, their proxy statements, their Quarterly Reports on Form 10-Q, and their Current Reports on Form 8-K. Copies of the Registration Statement and joint proxy statement/prospectus and other filings incorporated by reference therein, as well as other filings containing information about First Interstate and Cascade Bancorp, may be obtained as they become available at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from First Interstate at www.fibk.com or from Cascade Bancorp at www.botc.com.

First Interstate, Cascade Bancorp and certain of their respective directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of First Interstate’s and Cascade Bancorp’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of First Interstate and their ownership of First Interstate common stock is set forth in the proxy statement for First Interstate’s 2016 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on April 4, 2016. Information about the directors and executive officers of Cascade

Bancorp and their ownership of Cascade Bancorp’s common stock is set forth in the proxy statement for Cascade Bancorp Corporation’s 2016 Annual Meeting of Shareholders, as filed with the SEC on a Schedule 14A on April 13, 2016. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed Merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

3

First Interstate BancSystem

|

|

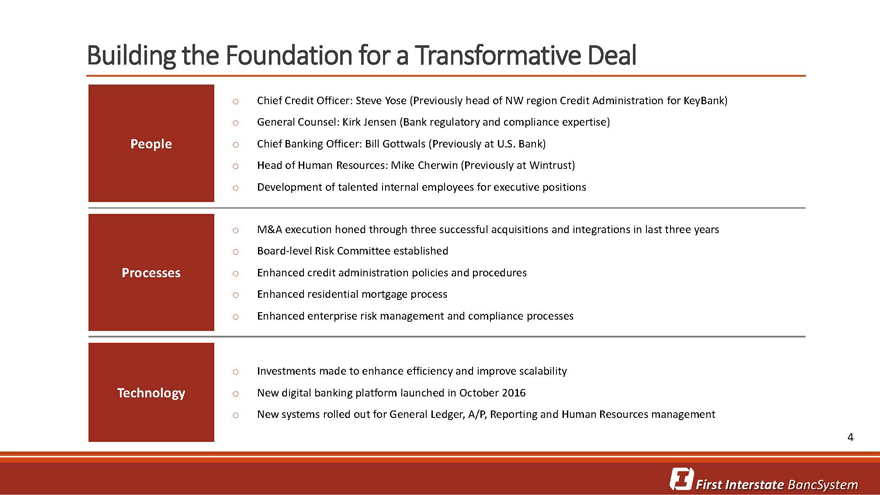

Building the Foundation for a Transformative Deal

Chief Credit Officer: Steve Yose (Previously head of NW region Credit Administration for KeyBank)

General Counsel: Kirk Jensen (Bank regulatory and compliance expertise)

People Chief Banking Officer: Bill Gottwals (Previously at U.S. Bank)

Head of Human Resources: Mike Cherwin (Previously at Wintrust)

Development of talented internal employees for executive positions

M&A execution honed through three successful acquisitions and integrations in last three years

Board-level Risk Committee established

Processes Enhanced credit administration policies and procedures

Enhanced residential mortgage process

Enhanced enterprise risk management and compliance processes

Investments made to enhance efficiency and improve scalability

Technology New digital banking platform launched in October 2016

New systems rolled out for General Ledger, A/P, Reporting and Human Resources management

4

First Interstate BancSystem

|

|

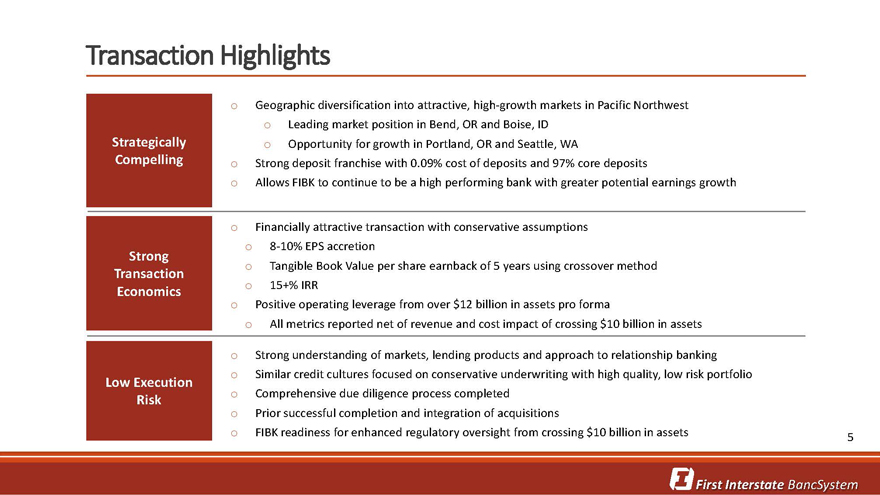

Transaction Highlights

Geographic diversification into attractive, high-growth markets in Pacific Northwest

Leading market position in Bend, OR and Boise, ID

Strategically Opportunity for growth in Portland, OR and Seattle, WA

Compelling Strong deposit franchise with 0.09% cost of deposits and 97% core deposits

Allows FIBK to continue to be a high performing bank with greater potential earnings growth

Financially attractive transaction with conservative assumptions

8-10% EPS accretion

Strong

Tangible Book Value per share earnback of 5 years using crossover method

Transaction

Economics 15+% IRR

Positive operating leverage from over $12 billion in assets pro forma

All metrics reported net of revenue and cost impact of crossing $10 billion in assets

Strong understanding of markets, lending products and approach to relationship banking

Similar credit cultures focused on conservative underwriting with high quality, low risk portfolio

Low Execution

Risk Comprehensive due diligence process completed

Prior successful completion and integration of acquisitions

FIBK readiness for enhanced regulatory oversight from crossing $10 billion in assets5

First Interstate BancSystem

|

|

Overview of Cascade Bancorp

As of September 30, 2016

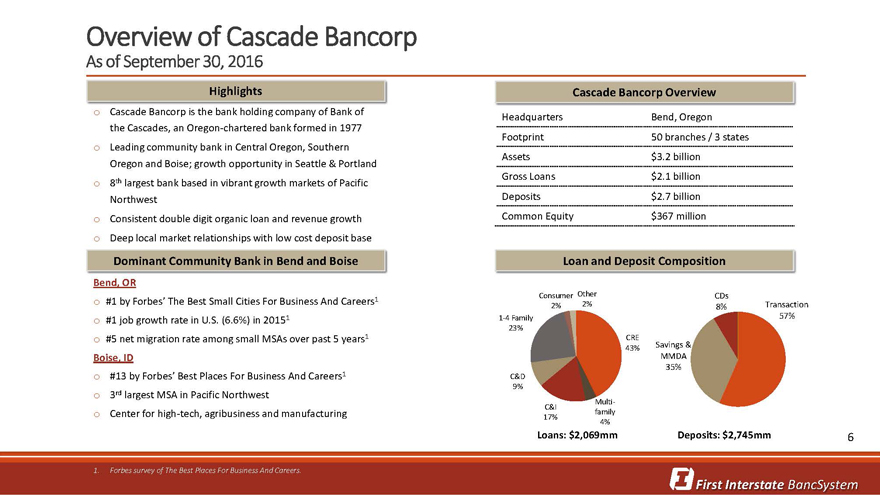

Highlights Cascade Bancorp Overview

Cascade Bancorp is the bank holding company of Bank ofHeadquartersBend, Oregon

the Cascades, an Oregon-chartered bank formed in 1977

Footprint50 branches / 3 states

Leading community bank in Central Oregon, Southern

Assets$3.2 billion

Oregon and Boise; growth opportunity in Seattle & Portland

8th largest bank based in vibrant growth markets of PacificGross Loans$2.1 billion

Northwest Deposits$2.7 billion

Consistent double digit organic loan and revenue growthCommon Equity$367 million

Deep local market relationships with low cost deposit base

Dominant Community Bank in Bend and Boise Loan and Deposit Composition

Bend, OR

Consumer OtherCDs

#1 by Forbes’ The Best Small Cities For Business And Careers12%2%8%Transaction

#1 job growth rate in U.S. (6.6%) in 201511-4 Family57%

23%

#5 net migration rate among small MSAs over past 5 years1CRE

43%Savings &

Boise, ID MMDA

35%

#13 by Forbes’ Best Places For Business And Careers1C&D

9%

3rd largest MSA in Pacific Northwest

Multi-

C&I

Center for high-tech, agribusiness and manufacturing17%family

4%

Loans: $2,069mmDeposits: $2,745mm6

1. Forbes survey of The Best Places For Business And Careers.

First Interstate BancSystem

|

|

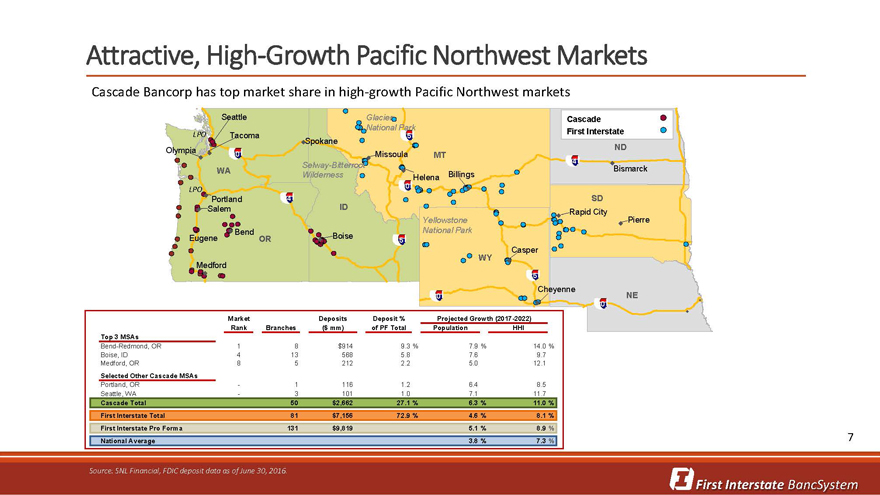

Attractive, High-Growth Pacific Northwest Markets

Cascade Bancorp has top market share in high-growth Pacific Northwest markets

Seattle GlacierCascade

National Park

LPO Tacoma 15First Interstate

w wSpokaneND

Olympia w w 90 w MissoulaMT

Selway-Bitterroot94w

WA WildernesswBillingsBismarck

Helena

LPO 90w

w Portland 84 SD

w Salem IDw Rapid City

Yellowstonew Pierre

w Bend National Park

Eugene OR w Boise15

Casper

WYw

Medford

w 25

Cheyenne

80NEw

w80

w

Market DepositsDeposit %Projected Growth (2017-2022)

Rank Branches($ mm)of PF TotalPopulationHHI

Top 3 MSAs

Bend-Redmond, OR 1 8$9149.3%7.9%14.0%

Boise, ID 4 135685.87.69.7

Medford, OR 8 52122.25.012.1

Selected Other Cascade MSAs

Portland, OR - 11161.26.48.5

Seattle, WA - 31011.07.111.7

Cascade Total 50$2,66227.1%6.3%11.0%

First Interstate Total 81$7,15672.9%4.6%8.1%

First Interstate Pro Forma 131$9,8195.1%8.9%

National Average 3.8%7.3%7

Source: SNL Financial, FDIC deposit data as of June 30, 2016.

First Interstate BancSystem

|

|

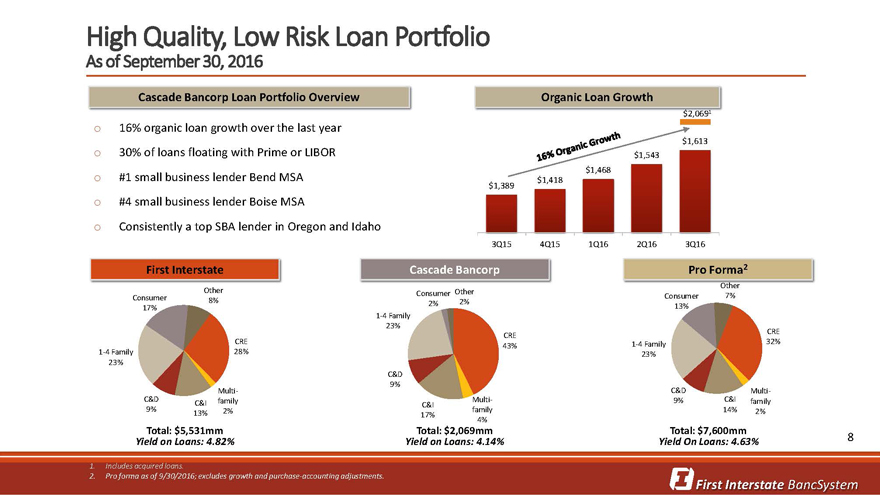

High Quality, Low Risk Loan Portfolio

As of September 30, 2016

Cascade Bancorp Loan Portfolio Overview Organic Loan Growth

$2,069

16% organic loan growth over the last year

$1,613

30% of loans floating with Prime or LIBOR$1,543

$1,468

#1 small business lender Bend MSA$1,418

$1,389

#4 small business lender Boise MSA

Consistently a top SBA lender in Oregon and Idaho

3Q154Q151Q162Q163Q16

First Interstate Cascade BancorpPro Forma2

Other

Consumer OtherConsumer OtherConsumer7%

8%2%2%

17% 13%

1-4 Family

23%

CRECRE

CRE43%1-4 Family32%

1-4 Family 28%23%

23%

C&D

9%

Multi-C&DMulti-

C&D C&I familyC&IMulti-9%C&Ifamily

9% 13%2%17%family14%2%

4%

Total: $5,531mm Total: $2,069mmTotal: $7,600mm

Yield on Loans: 4.82% Yield on Loans: 4.14%Yield On Loans: 4.63%8

1. Includes acquired loans.

2. Pro forma as of 9/30/2016; excludes growth and purchase-accounting adjustments.

First Interstate BancSystem

|

|

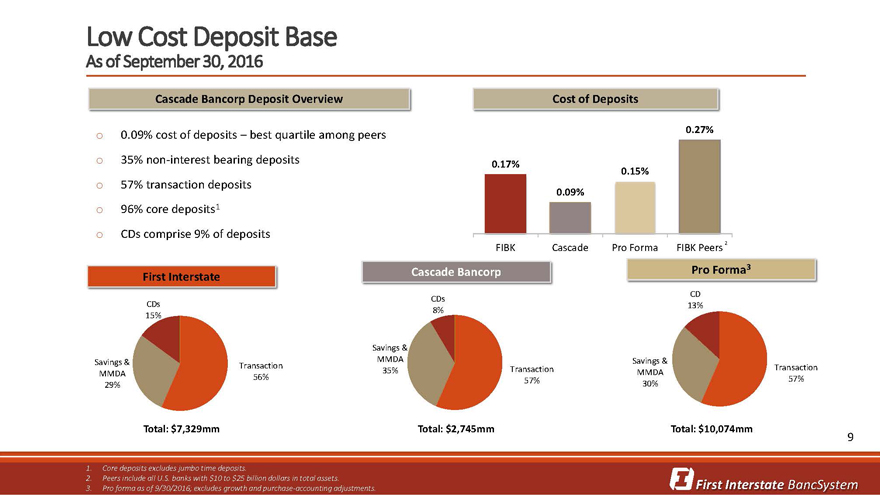

Low Cost Deposit Base

As of September 30, 2016

Cascade Bancorp Deposit OverviewCost of Deposits

0.09% cost of deposits – best quartile among peers0.27%

35% non-interest bearing deposits0.17%

0.15%

57% transaction deposits

0.09%

96% core deposits1

CDs comprise 9% of deposits

FIBKCascadePro FormaFIBK Peers 2

First InterstateCascade BancorpPro Forma3

CDsCD

CDs13%

8%

15%

Savings &

Savings & MMDASavings &

MMDA Transaction 35%TransactionMMDATransaction

56%57%57%

29% 30%

Total: $7,329mmTotal: $2,745mmTotal: $10,074mm

9

1. Core deposits excludes jumbo time deposits.

2. Peers include all U.S. banks with $10 to $25 billion dollars in total assets.

3. Pro forma as of 9/30/2016; excludes growth and purchase-accounting adjustments. First Interstate BancSystem

|

|

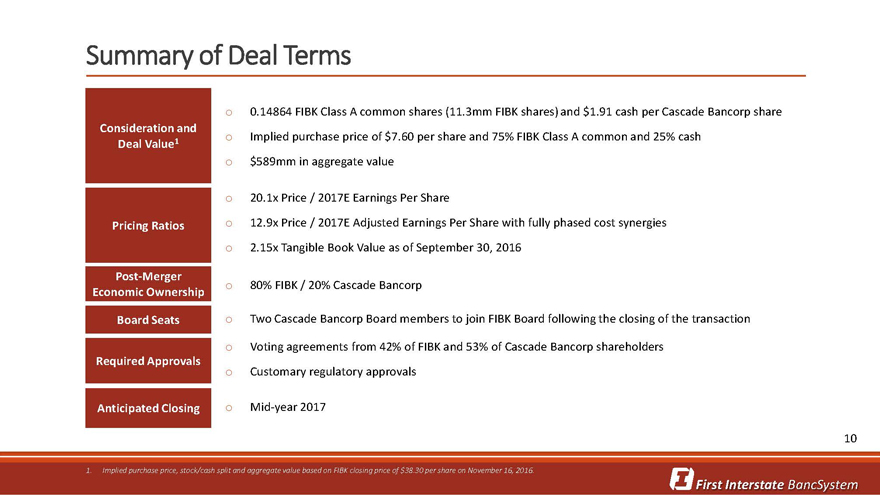

Summary of Deal Terms

0.14864 FIBK Class A common shares (11.3mm FIBK shares) and $1.91 cash per Cascade Bancorp share

Consideration and

Deal Value1 o Implied purchase price of $7.60 per share and 75% FIBK Class A common and 25% cash

$589mm in aggregate value

20.1x Price / 2017E Earnings Per Share

Pricing Ratios o 12.9x Price / 2017E Adjusted Earnings Per Share with fully phased cost synergies

2.15x Tangible Book Value as of September 30, 2016

Post-Merger

Economic Ownership o 80% FIBK / 20% Cascade Bancorp

Board Seats o Two Cascade Bancorp Board members to join FIBK Board following the closing of the transaction

Voting agreements from 42% of FIBK and 53% of Cascade Bancorp shareholders

Required Approvals

Customary regulatory approvals

Anticipated Closing o Mid-year 2017

10

1. Implied purchase price, stock/cash split and aggregate value based on FIBK closing price of $38.30 per share on November 16, 2016.

First Interstate BancSystem

|

|

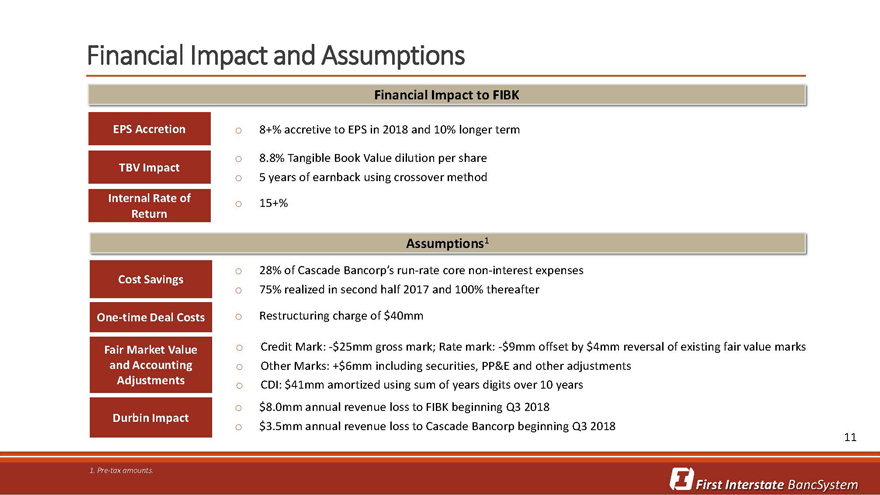

Financial Impact and Assumptions

Financial Impact to FIBK

EPS Accretion o 8+% accretive to EPS in 2018 and 10% longer term

8.8% Tangible Book Value dilution per share

TBV Impact

5 years of earnback using crossover method

Internal Rate of o 15+%

Return

Assumptions1

28% of Cascade Bancorp’s run-rate core non-interest expenses

Cost Savings

75% realized in second half 2017 and 100% thereafter

One-time Deal Costs o Restructuring charge of $40mm

Fair Market Value o Credit Mark: -$25mm gross mark; Rate mark: -$9mm offset by $4mm reversal of existing fair value marks

and Accounting o Other Marks: +$6mm including securities, PP&E and other adjustments

Adjustments o CDI: $41mm amortized using sum of years digits over 10 years

$8.0mm annual revenue loss to FIBK beginning Q3 2018

Durbin Impact

$3.5mm annual revenue loss to Cascade Bancorp beginning Q3 2018

11

1. Pre-tax amounts.

First Interstate BancSystem

|

|

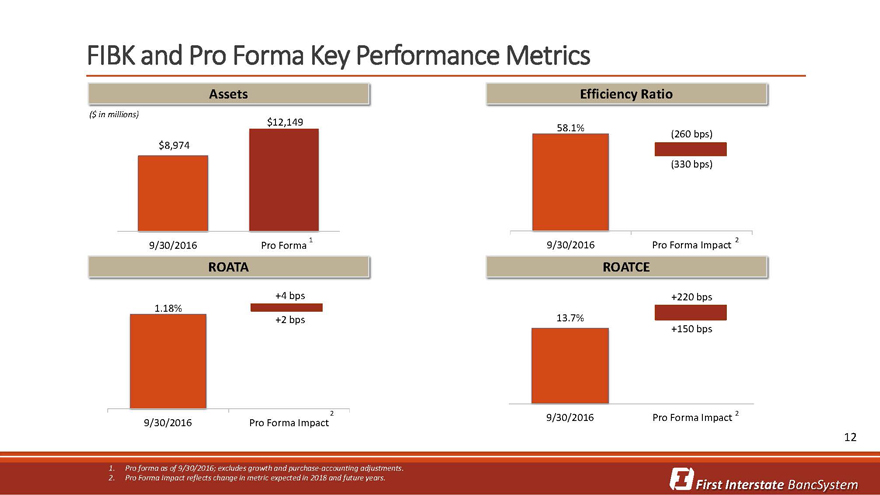

FIBK and Pro Forma Key Performance Metrics

AssetsEfficiency Ratio

($ in millions)

$12,14958.1%

(260 bps)

$8,974

(330 bps)

9/30/2016 Pro Forma 19/30/2016Pro Forma Impact 2

ROATAROATCE

+4 bps+220 bps

1.18%

+2 bps13.7%

+150 bps

29/30/2016Pro Forma Impact 2

9/30/2016 Pro Forma Impact

12

1. Pro forma as of 9/30/2016; excludes growth and purchase-accounting adjustments.

2. Pro Forma Impact reflects change in metric expected in 2018 and future years.

First Interstate BancSystem

|

|

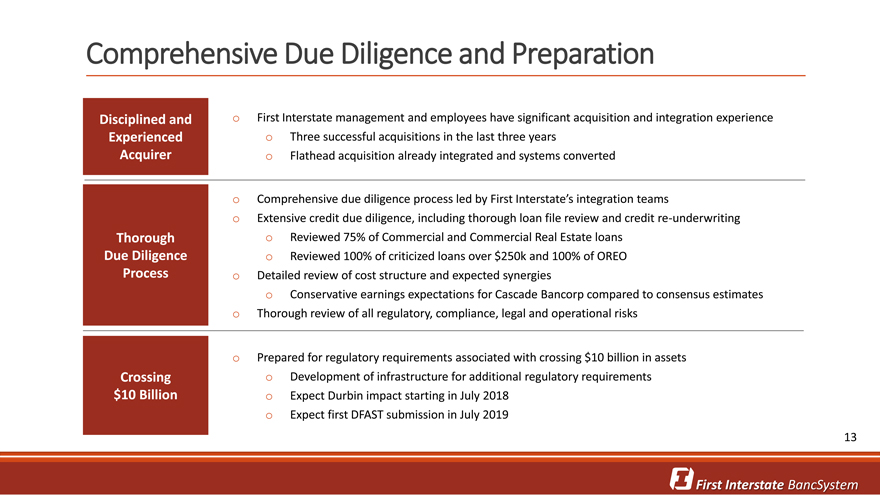

First Interstate BancSystem

Disciplined and Experienced Acquirer

Thorough

Due Diligence Process

Crossing

$10 Billion

Comprehensive Due Diligence and Preparation

oFirst Interstate management and employees have significant acquisition and integration experience

oThree successful acquisitions in the last three years

oFlathead acquisition already integrated and systems converted

oComprehensive due diligence process led by First Interstate’s integration teams

oExtensive credit due diligence, including thorough loan file review and credit re-underwriting

oReviewed 75% of Commercial and Commercial Real Estate loans

oReviewed 100% of criticized loans over $250k and 100% of OREO

oDetailed review of cost structure and expected synergies

oConservative earnings expectations for Cascade Bancorp compared to consensus estimates

oThorough review of all regulatory, compliance, legal and operational risks

oPrepared for regulatory requirements associated with crossing $10 billion in assets

oDevelopment of infrastructure for additional regulatory requirements

oExpect Durbin impact starting in July 2018

oExpect first DFAST submission in July 2019

13

|

|

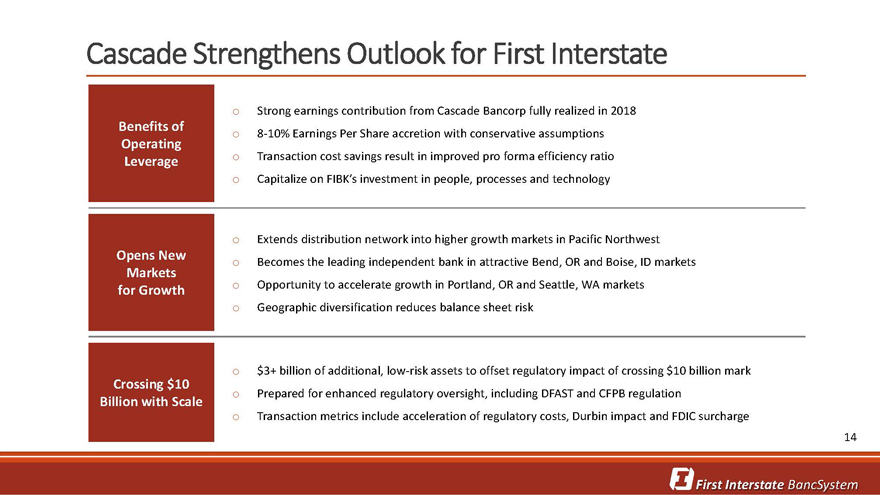

Cascade Strengthens Outlook for First Interstate

Strong earnings contribution from Cascade Bancorp fully realized in 2018

Benefits of o 8-10% Earnings Per Share accretion with conservative assumptions

Operating

Leverage o Transaction cost savings result in improved pro forma efficiency ratio

Capitalize on FIBK’s investment in people, processes and technology

Extends distribution network into higher growth markets in Pacific Northwest

Opens New o Becomes the leading independent bank in attractive Bend, OR and Boise, ID markets

Markets

for Growth o Opportunity to accelerate growth in Portland, OR and Seattle, WA markets

Geographic diversification reduces balance sheet risk

$3+ billion of additional, low-risk assets to offset regulatory impact of crossing $10 billion mark

Crossing $10

Prepared for enhanced regulatory oversight, including DFAST and CFPB regulation

Billion with Scale

Transaction metrics include acceleration of regulatory costs, Durbin impact and FDIC surcharge

14

First Interstate BancSystem