Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - China Soar Information Technology, Inc. | csit_exhibit321.htm |

| EX-31.1 - EXHIBIT 31.1 - China Soar Information Technology, Inc. | csit_exhibit311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

FOR THE FISCAL YEAR ENDED JULY 31, 2016

OR

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 000-55026

China Soar Information Technology, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 47-1722026 | ||

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | ||

|

12 Harcourt Road , Bank of America Tower, Suite 1308 Central, Hong Kong |

|||

| 02910 | |||

| (Address of Principal Executive Offices) | (Zip Code) |

(Former name, former address and former fiscal year, if changed since last report)

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Exchange Act:

Title of each class: Common Stock, $0.0001

Name of each exchange on which registered: N/A

-1-

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a small reporting company. See definition of large accelerated filer, accelerated filer and small reporting company in Rule 12b-2 of the Securities Exchange Act of 1934.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Small reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X ] No

At June 30, 2016, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $5,500.

At November 15, 2016, there were 75,000,000 shares of the Registrant’s common stock, par value $0.0001 per share, outstanding.

-2-

TABLE OF CONTENTS

CHINA SOAR INFORMATION TECHNOLOGY, INC.

| PART I | PAGE | ||

| Item 1 | Business | 4 | |

| Item 1A | Risk Factors | 5 | |

| Item 1B | Unresolved Staff Comments | 6 | |

| Item 2 | Properties | 6 | |

| Item 3 | Legal Proceedings | 6 | |

| Item 4 | Mine Safety Disclosures | 6 | |

| PART II | |||

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 6 | |

| Item 6 | Selected Financial Data | 7 | |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 7 | |

| Item 7A | Quantitative and Qualitative Disclosures about Market Risk | 7 | |

| Item 8 | Financial Statements and Supplementary Data | F1-F8 | |

| Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 8 | |

| Item 9A | Controls and Procedures | 8 | |

| Item 9B | Other Information | 8 | |

| PART III | |||

| Item 10 | Directors, Executive Officers and Corporate Governance | 9 | |

| Item 11 | Executive Compensation | 10 | |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 10 | |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 11 | |

| Item 14 | Principal Accounting Fees and Services | 11 | |

| PART IV | |||

| Item 15 | Exhibits, Financial Statement Schedules | 12 | |

| Signatures | 12 |

-3-

PART I

Item 1. Business.

China Soar Information Technology, Inc. fka Go Public II, Inc. (the “Company”) was incorporated under the laws of the State of Delaware on July 22, 2013 as a Form 10 blank check shell company with an objective to acquire, or merge with, an operating business. On August 24, 2015 the Company completed a transaction (the “Transaction”) in the form of a software license and royalty agreement, (the “License” or the “License Agreement”) with a foreign company organized under the laws of the Peoples Republic of China, known as “Zhengzhou Xiangtian Information Technology Company Limited,” ("ZXITC"). The president of ZXITC is our sole director, Mu Chun Lin. The License Agreement allows us to receive a revenue stream equal to 45% of the gross revenue of ZXITC in exchange for licensing our intellectual property which is a mobile phone internet marketing application program that we purchased from our CEO.

Therefore we have ceased to be a blank check shell company and have adopted a new business plan to provide mobile phone internet marketing services to business owners in China and Hong Kong. We plan on offering similar services in the U.S, Europe and South America. On May 26, 2015, Mu Chun Lin was appointed as sole Officer and sole Director of China Soar Information Technology, Inc., making Mu Chun Lin a related party as he is also the president and CEO of Zhengzhou Xiangtian Information Technology Company.

The License includes the right to enter into certain agreements and use our intellectual property. The Company did not acquire any plant and equipment, and any other business and operational assets of ZXITC as part of the License, and the Company did not hire any employees of ZXITC except for Mu Chun Lin. ZXITC will continue as an independent company, operating in the Peoples Republic of China after the Transaction. The License relates to the development and operation of an Internet and Mobile Marketing Platform in China and Hong Kong. ZXITC plans to utilize the License to provide unique online and mobile marketing services in China and Hong Kong. Our principal executive offices are located at 12 Harcourt Road, Bank of America Tower, Suite 1308, Central, Hong Kong.

Our activities have been limited to developing our business and financial plans. We will not have the necessary capital to develop or execute our business plan until we are able to secure financing. On June 6, 2015, the Company determined that it was in the best interests of the Company to issue 20,000,000 shares of common stock with a par value of $ .0001 to Mu Chun Lin, our sole officer and director as compensation for services rendered including but not limited to furthering the Company’s business plan. On June 12, 2015, the Company determined that it was in the best interests of the Company to offer for sale 55,000,000 shares of its restricted common stock with a par value of $.0001 to be used for general corporate purposes as determined by our sole officer and director, Mu Chun Lin. Proxy Management Consultants LTD of Hong Kong acted as the Company’s escrow agent. The foregoing shares were sold pursuant to Regulation S of the Act. We believe we need to raise $750,000 to execute our business plan over the next 12 months.

In their audit report dated November 15, 2016, our auditor has expressed an opinion that substantial doubt exists as to whether we can continue as an ongoing business. Because our President, Chief Executive Officer and sole Director Mu Chun Lin may be unwilling or unable to loan or advance any additional capital to us, we believe that if we do not raise additional capital within 12 months of the effective date of this registration statement, we may be required to suspend or cease the implementation of our business plan.

-4-

Item 1A. Risk Factors.

Risks Relating to the Company’s Securities

We may never have a public market for our common stock or may never trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with FINRA. In addition, it is possible that such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if it did develop, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

We may in the future issue additional shares of our common stock, which may have a dilutive effect on our stockholders.

Our Certificate of Incorporation authorizes the issuance of 500,000,000 shares of common stock, of which 75,000,000 shares are issued and outstanding as of October 31, 2015. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 20,000,000 shares of preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval.

Our preferred stock does not have any dividend, conversion, liquidation, or other rights or preferences, including redemption or sinking fund provisions. However, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

We do not currently intend to pay dividends on our common stock and consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore, you are not likely to receive any dividends on your common stock for the foreseeable future and the success of an investment in shares of our common stock will depend upon any future appreciation in its value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

-5-

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We neither rent nor own any properties. Until we pursue a viable business opportunity and recognize income, we will not seek office space. We currently have no policy with respect to investments or interests in real estate, real estate mortgages or securities of, or interests in, persons primarily engaged in real estate activities.

Item 3. Legal Proceedings.

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations. We may become involved in material legal proceedings in the future.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

ADMISSION TO QUOTATION ON THE OTC BULLETIN BOARD

We intend to have our common stock be quoted on the OTCQB operated by OTC Markets Group, Inc. and or Over the Counter Bulletin Board, “OTCBB”. There is no assurance that the shares will ever be quoted on the OTCQB or OTCBB. To be quoted on the OTCQB or OTCBB, a market maker must apply to make a market in our common stock. If our securities are not quoted on the OTC Bulletin Board, a security holder may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our securities. The OTCQB and OTC Bulletin Board differs from national and regional stock exchanges in that it:

(1) is not situated in a single location but operates through communication of bids, offers and confirmations between broker-dealers, and (2) securities admitted to quotation are offered by one or more Broker-dealers rather than the “specialist” common to stock exchanges.

To qualify for quotation on the OTC Bulletin Board, an equity security must have one registered broker-dealer, known as the market maker, willing to list bid or sale quotations and to sponsor the company listing. We do not yet have an agreement with a registered broker-dealer, as the market maker, willing to list bid or sale quotations and to sponsor the Company listing. If the Company meets the qualifications for trading securities on the OTC Bulletin Board our securities will trade on the OTC Bulletin Board until a future time, if at all. We may not now and it may never qualify for quotation on the OTC Bulletin Board.

Holders

As of November 15, 2016, there were approximately 41 shareholders of record of our common stock and 75,000,000 shares of common stock deemed outstanding.

Dividends and Share Repurchases

We have not paid any dividends to our shareholder. There are no restrictions which would limit our ability to pay dividends on common equity or that are likely to do so in the future.

Issuer Purchases of Equity Securities

None.

Equity Compensation Plan Information

Not applicable.

Recent Sales of Unregistered Securities; Uses of Proceeds from Registered Securities

None.

-6-

Item 6. Selected Financial Data.

Not applicable because the Company is a smaller reporting company.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of our financial condition and results of operations should be read in conjunction with the audited financial statements and notes thereto for the fiscal year ended July 31, 2016, found in this report. In addition to historical information, the following discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Where possible, we have tried to identify these forward looking statements by using words such as “anticipate,” “believe,” “intends,” or similar expressions. Our actual results could differ materially

from those anticipated by the forward-looking statements due to important factors and risks including, but not limited to, those set forth under “Risk Factors” as described in in Part I, Item 1A of this report.

Our cash balance is $159 as of July 31, 2016. Our cash balance is not sufficient to fund our limited levels of operations for any period of time. We have been utilizing and may utilize funds from Mu Chun Lin, our President, Chief Executive Officer and Director, who has informally agreed to advance funds to allow us to pay for offering costs, filing fees, and professional fees. Mu Chun Lin, however, has no formal commitment, arrangement or legal obligation to advance or loan funds to the company. In order to implement our plan of operations for the next twelve-month period, we require a minimum of $750,000 of funding. Therefore, we have filed an S-1 registration on September 3, 2015. Being a startup stage company, we have a very limited operating history. After a twelve-month period we may need additional financing but currently do not have any arrangements for such financing.

Long term financing beyond the maximum aggregate amount of this offering will be required to fully implement our business plan. The exact amount of funding will depend on funding required for full implementation of our business plan. Our expansion may include expanding our office facilities, hiring sales personnel and developing a customer base.

If we do not receive any proceeds from the offering or the minimum amount of $750,000 that we require to operate for the next 12 months Mu Chun Lin has informally agreed to advance us funds, however, he has no formal commitment, arrangement or legal obligation to advance or loan funds to the company.

If we need additional cash and cannot raise it, we will either have to suspend operations until we do raise the cash we need, or cease operations entirely. Even if we raise $750,000 from this offering, it will most likely only last one year. We may need more funds for business operations in the next year, and we will have to revert to obtaining additional money.

Company Overview

Corporate History

China Soar Information Technology, Inc., a Delaware corporation (“the Company”) fka Go Public II, Inc. was incorporated under the laws of the State of Delaware on July 22, 2013. We changed our name from Go Public II, Inc. to China Soar Information Technology with the Delaware Secretary of State on June 16, 2015.

On May 26, 2015, our former director, Thomas DeNunzio resigned and Mu Chun Lin was appointed as our sole President, CEO, CFO and Director.

Business Information

Introduction

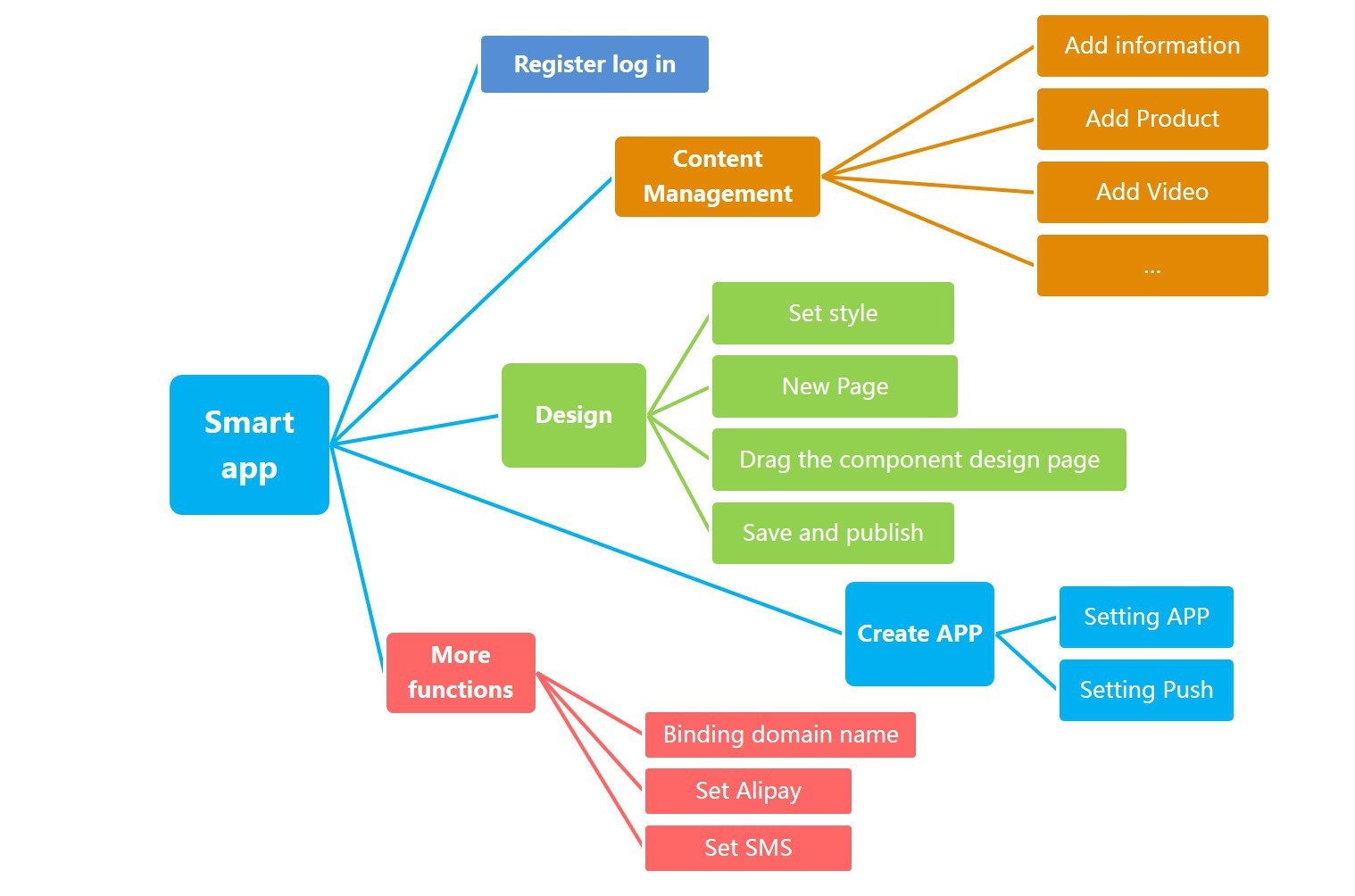

We currently own intellectual property to utilize, market, further develop and sell in North America a software application called (“MIMA”) to entrepreneurs and small businesses whereas any merchant can easily create a WEB/WAP e-commerce website or cell phone client and enterprise mobile management information system by themselves. Merchants will not have to rent network hardware operation system, entrust software development and recruit professional management. Instead, we can offer the required network infrastructure and software and hardware platform for the merchant with a low monthly fee. MIMA was created and developed by our director, Mu Chun Lin over the course of ten years.

OUR LICENSEE

Zhengzhou Xiangtian Information Technology Company Limited was established by our director Mu Chun Lin in December, 2005. Since inception, the Company has been concentrated on the research and development of software and hardware in the mobile internet industry and has achieved many technology achievements in the application field of big data. Over the five years, the Company has built an efficient project team, integrated mobile internet technology and self-developed mobile internet application platform; developing several products types and conducts

users’ test . China’s Central Government is giving supporting policy to “Internet Plus” Industries which will allow ZXITC to develop their products to provide mobile internet communication application system to users for the rapid development of mobile internet application in China.

In 2012, ZXITC had the advantage to work with China’s internet network information center, (CNNIC), the Issuer of internet content provider (ICP) of all the websites hosted in China on mobile URL, General URL and Trusted URL to integrate with their mobile Internet cloud application system. The joint development will expedite the construction of CNNIC public supporting service system with 10% of the original cost. Subsequently, the Company began to develop a website which allows their users to create and manage their own mobile application with minimal technical knowledge. The website developed exclusively for the Chinese market, is named “MOYUN”. Currently, MOYUN Internet Mobile Application (MIMA) cloud platform is the most comprehensive cloud infrastructure in the China’s Corporate Mobile Application systems. Since the free public test inception at January, 2012, MIMA has been one of the Chinese leading cross-platform mobile application developing tools. We believe that the market in North America is ripe for such an application notwithstanding that we will have to make definitive changes to utilize and maximize the mobile application system in North America.

ZXITC is the first company to utilize a “Drag and Drop” design interface for the Mobile Application development in order to provide a user friendly interface. The system reduces the cost of mobile application development, compatibility issues and other technical complication so that users can focus more on the product interface and business profile design.

The company is equipped with high performance server group and large bandwidth network to facilitate a stable and speedy access for their clients, so that they can enjoy an internet vendor class infrastructure through subscribing their services. The cloud system is implemented at software as a service level, (SaaS) whereas users can minimize their cost of establishing as e-commerce and for mobile application deployment.

PRODUCTS AND PROJECTS

The functions and features of MIMA (including services in-operation and not in- operation)

| 1. | Mobile website - for Corporate Mobile website, including contents management, and design interface. |

| 2. | Mobile client application (APP) development - content management and design interface. |

| 3. | Internet website - content management and design interface. |

| 4. | Business Mobile integrated information system(Customized) - develops comprehensive mobile system with Attendance, ERP, CRM functions with highly flexible design features to meet majority SME’s information technology demands. |

PLAN OF OPERATIONS

We plan to operate as a business to consumer, (B2C) to provide services to retailers that enable them to access, build, change, monitor and manage their e-commerce website from the convenience of their mobile telephone. We will have a full range of services and resources to work with customers towards achieving our customers’ mobile website and marketing goals. We will provide access to our services that are intended to be tailored to each customers’ marketing and website needs. We are not currently in any discussions with businesses or individuals but we do plan on it in order to maximize our business potential and distribution reach. No assurances can be provided that any agreement will be reached. We believe we are in a unique position to capitalize on the North American, European, South American market and gain a first move advantage to deliver a transparent and customer focused mobile marketing solution. Our primary focus will be small, middle and large businesses as well as individuals within North America. There are approximately 469.58 (according to Google) million people in North America, which makes it one of the most populous continents in the world and this represents our initial target market. We

plan to offer mobile website and marketing solutions for a monthly fee to customers in North America. At the initial stages of our business plan all of our customers will have access to the standard MIMA features, including, free mobile-optimized templates, Premium industry-specific templates, Premium customized templates, Free web address(domain name), Premium customized web address(domain name), SEO-friendly domain name suggestions, instant, easy search engine optimization, (SEO), Social apps, reach your audience instantly ability, with all features having the ability to build, promote and market a customer's website either online or from the convenience of your mobile phone or tablet, free software upgrades. In addition, we will also offer as standard MIMA features, add maps and directions, daily deals promotion, add photos and videos instantly, secure cloud storage, automatic data back-up, analytics and reports, mobile editing and updating, fast loading pages, E-commerce tools, easy-to-use dashboard, and click to call. A material challenge to our business operations will be getting enough customers. In order to achieve this goal we will have to create incentives through advertising and other marketing venues, also, through a referral program for our customers to inform others of our services. We will encourage customers to share news about their services through email, Facebook, and Twitter, and other social media websites. If we are unable to attract customers it may have a material impact on our revenues or income or may result in our liquidity decreasing.

INDUSTRY OVERVIEW

This Form 10-K includes market and industry data that we have developed from publicly available information; various industry publications and other published industry sources and our internal data and estimates. Although we believe the publications and reports are reliable, we have not independently verified the data. Our internal data, estimates and forecasts are based upon information obtained from trade and business organizations and other contacts in the market in which we operate and our management’s understanding of industry conditions.

As of the date of the preparation of this Prospectus, these and other independent government and trade publications cited herein are publicly available on the Internet without charge. Upon request, the Company will also provide copies of such sources cited herein.

THE MOBILE MARKETING INDUSTRY

Overview

Management contends that some perceive mobile advertising as closely related to online or internet advertising, though we believe its reach is far greater - currently, most mobile advertising is targeted at mobile phones, that came estimably to a global total of 6.9 billion as of 2014 (Source: mobithinking.com). Notably computers, including desktops and laptops, are currently estimated at approximately 1.9 billion globally (Source: ask.com).

It is probable, in our management’s opinion, that advertisers and media industry will increasingly take account of a bigger and fast-growing mobile market, though it remains at around 2.7% of global advertising spending and is estimated to increase to 7.6% by 2016 ( Source: statisa.com ). Mobile media is evolving rapidly, and while we believe mobile phones will continue to be the mainstay, it is not clear whether mobile phones based on cellular backhaul, or smart phones based on WiFi hot spot, or WiMAX hot zone, will also strengthen. However, as an illustration of the emergence of this form of advertising, that there is now a dedicated global advertising awards ceremony organized every year by Vision gain , a business information portal.

In information provided by the research firm Berg Insight, as mobile phones out number Television sets by over 3 to 1, and PC based internet users by over 4 to 1, and the total laptop and desktop PC population by nearly 5 to 1, advertisers in many markets, we contend, have recently rushed to this media. In Spain 75% of mobile phone owners receive ads, in France 62% and in Japan 54%.More remarkably as mobile advertising matures, like in the most advanced markets, the user involvement also matures. In Japan today, already 44% of mobile phone owners click on ads they receive on their phones. Mobile advertising was worth 900 million dollars in Japan alone. According to the research firm Berg Insight, the global mobile advertising market that was estimated to € 1 billion in 2008 Furthermore, Berg Insight forecasts the global mobile advertising market to grow at a compound annual growth rate of 43 percent to € 8.7 billion in 2014.

In the Q2 2013 "State of Mobile Advertising Report" by Opera Mediaworks, it is reported that mobile advertising is growing globally at a rapid rate. Opera Mediaworks reports that rich media ads are now averaging a 1.53 percentage click rate among users. App large banner ads are still the most popular, but they are on the decline.

In China, A study by iResearch finds no indication of a slowdown in mobile growth as mobile devices become more popular and e-retailers invest in making mobile sites easier to use.

Chinese consumers spent 929.71 billion yuan ($148.16 billion) on shopping from their smartphones and tablets in 2014, up 239% from 274.00 billion yuan ($43.66 billion) in 2013, according to Chinese research firm iResearch.

That is a significant leap in one year for mobile shopping, given that online shopping grew only 49.8% to 2.814 trillion yuan ($448.47 billion) in China in 2014, according to iResearch, a Beijing-based firm that tracks e-commerce. IResearch attributes the uptick in mobile shopping mainly to the growing popularity of mobile devices and leading e-retailers’ investments in better serving mobile shoppers.

Mobile commerce seems likely to keep growing: iResearch forecasts mobile shopping will grow more than fourfold to 4.504 trillion yuan ($717. 75 billion) in sales in 2018.

Purchases on mobile devices accounted for 33% of online sales in China in 2014, compared with 14.5% in the prior year, according to iResearch.

The Chinese research company also predicts that mobile sales will surpass sales on personal computers in 2016 and reach 61.7% of online sales in 2018.

Using a mobile phone to browse the internet in China has considerably taken off towards the end of 2012, with an ever increasing amount of the public deciding to choose their mobile phones to browse the internet rather than traditionally sitting in front of a desktop. The mobile internet now is the biggest new growth engine for e-commerce in China. Online shopping is booming because of its convenience and cost effectiveness. And it’s not only young affluent urban dwellers who are purchasing luxury items online at cheaper prices than shopping malls rather residents in less developed regions are buying products that are not available in their home towns as noted in the Wall Street Journal on August 31, 2015.

Some interesting statistics according to China’s internet network information center, (“CNNIC”), the Issuer of internet content provider (ICP) of all the websites hosted in China on mobile URL, General URL and Trusted URL to integrate with their mobile Internet cloud application system.

•At the end of 2012 there were 564 million internet users in China which calculates as 42.1% of the total population

•Out of 564 million internet users, 420 million decides to use their mobile to surf the internet which accounts for 74.5% of the total internet browsing population

•The level of mobile browsing in China has become significantly higher than in the West.

The stats indicate the significance of mobile internet browsing in China. Therefore, in order for a company to have a significant brand image standing in the competitive Chinese market, a well- designed mobile website is what a company should be looking to build.

About three-quarters of Chinese in first-tier cities such as Beijing, Shanghai, Guangzhou, and Chongqing are already online, but in rural areas it’s 19 percent, according to a survey by McKinsey Digital of Hong Kong, which helps companies shape their digital strategies. Even so, rural Chinese have an affinity for e-commerce. Close to two-thirds of rural Chinese who do use the Internet say they have purchased items online; that compares with 72 percent of users in the cities.

Types of Mobile Ads

In some markets, this type of advertising is most commonly seen as a Mobile Web Banner (top of page) or Mobile Web Poster (bottom of page banner), while in others, it is dominated by SMS advertising Other forms include MMS advertising, advertising within mobile games and mobile videos, during mobile TV receipt, full-screen interstitials,

which appear while a requested item of mobile content or mobile web page is loading up, and audio advertisements that can take the form of a jingle before a voicemail recording, or an audio recording played while interacting with a telephone-based service such as movie ticketing or directory assistance.

The Mobile Marketing Association and the IAB (Interactive Advertising Bureau) has published mobile advertising guidelines, but we contend that it is difficult to keep such guidelines current in such a fast-developing area.

The effectiveness of a mobile media ad campaign, in our estimation, can be measured in a variety of ways. The main measurements are impressions (views) and click-through rates

They are also sold to advertisers by views (Cost Per Impression) or by click-through (Cost Per Click). Additional measurements include conversion rates, such as click-to-call rates and other degrees of interactive measurement.

Mobile media can run on a mobile web page or within a mobile application, often referred to as in-App.

One of the popular models in mobile advertising, in our estimation, is Cost Per Install (CPI) where there the pricing model is based on the user installing an App on their mobile phone. CPI Mobile Advertising Networks work either as incent or non-incent. In the incent model the user is given virtual points or rewards to install the game or App.

Mobile Rich Media

In addition to standard mobile display banners, our management has observed a growing trend to include rich media execution within the banner ads. This includes banners that would expand to a larger size, offering advertisers a larger display to communicate their message. Games within the banner to make the experience more interactive or a video within the banner space.

There are limitations to rich media on mobile because all of the coding must be done in HTML5, since the iOS does not support flash.

COMPETITIVE ADVANTAGE

Customer Website creation

Website creation is a competitively open market focus on design level, the degree of grasping customers’ requirements and service ability. We have significant competitive advantages among other providers. Whereas our website system mainly includes WAP/WEB and SaaS.

FUTURE DEVELOPMENT AND PLANS

As part of our development plan to face the ever challenging mobile B2C software market in North America, Europe and South America, we plan to further develop a MIMA Professional version of its enterprise application and constantly perfect core technology to form a comprehensive service for basic informatization application of businesses. Through constant evaluation of end user’s requirements, we plan to focus on development of a leading cloud operation platform for mobile internet enterprise website which will gradually attract an increasing number of users. We also plan to establish a cloud operation platform which fully covers smart mobile client by strengthening the cooperation with application products provider, content service provider, E-commerce hosting provider and Wireless network address licensors.

Recent Developments:

We filed an S-1/A registration statement on October 14, 2015. The registration was deemed effective as of December 9, 2015.

Critical Accounting Policies

We prepare our financial statements in conformity with GAAP, which requires management to make certain estimates and assumptions and apply judgments. We base our estimates and judgments on historical experience, current trends and other factors that management believes to be important at the time the financial statements are prepared and actual results could differ from our estimates and such differences could be material. We have identified below the critical accounting policies which are assumptions made by management about matters that are highly uncertain and that are of critical importance in the presentation of our financial position, results of operations and cash flows. On a regular basis, we review our accounting policies and how they are applied and disclosed in our financial statements.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the amounts reported in the financial statements. Estimates are based on historical experience, management expectations for future performance, and other assumptions as appropriate. Key areas affected by estimates include the assessment of the recoverability of long-lived assets, which is based on such factors as estimated future cash flows. We re-evaluate estimates on an ongoing basis; therefore, actual results may vary from those estimates.

Fair Values of Financial Instruments

The carrying values of cash, accounts receivable, accounts payable and accrued expenses approximate the fair values of these instruments due to their short-term nature. The carrying amount for borrowings under the financing agreement approximates fair value because of the variable market interest rates charged for these borrowings.

Off Balance Sheet Arrangements

There are no off balance sheet arrangements.

Capital Resources.

We had no material commitments for capital expenditures as of July 31, 2016 and 2015.

Results of Operations for the years ended July 31, 2016 and 2015

For the fiscal year ended July 31, 2016 as compared to the fiscal year ended July 31, 2015, total revenues were $0 and $0, respectively; and net losses were $64,811 and $19,358 respectively. The net losses were attributable to operating expenses. The operating expenses for the year ended July 31, 2016 included, but were not limited to, professional, audit and bank fees. The operating expenses for the fiscal year ended July 31, 2015 included, but were not limited to, professional and audit fees.

Liquidity

As of July 31, 2016 and 2015 we had cash and cash equivalents of $159 and $0, respectively, and had working capital deficits of $9,262 and $0, respectively. We have incurred negative cash flows from operations since we started our business. We have spent and expect to continue to spend only those expenses and amounts necessary to maintain public company registration status. Based on our current plans, our sole officer and director will continue to fund operating expenses.

As of July 31, 2016 and 2015, we had zero cash used in and provided by investing activities.

As of July 31, 2016 and 2015, we had $7,958 and $5,500 cash provided by financing activities.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

-7-

Item 8. Financial Statements and Supplementary Data.

CHINA SOAR INFORMATION TECHNOLOGY, INC.

CONSOLIDATED FINANCIAL STATEMENTS

INDEX TO FINANCIAL STATEMENTS

| Pages | ||

| Report of Independent Registered Public Accounting Firm | F2 | |

| Balance Sheets at July 31, 2016 and 2015 | F3 | |

| Statements of Operations for the Years ended July 31, 2016 and 2015 | F4 | |

| Statements of Changes in Stockholders’ (Deficit) for the Years ended July 31, 2016 and 2015 | F5 | |

| Statements of Cash Flows for the Years ended July 31, 2016 and 2015 | F6 | |

| Notes to Financial Statements | F7-F8 |

Table of Contents

-F1-

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM MALONE-BAILEY

To the Board of Directors of

China Soar Information Technology, Inc.

Hong Kong

We have audited the accompanying balance sheets of China Soar Information Technology, Inc. (the "Company") as of July 31, 2016 and 2015, and the related statements of operations, stockholders' deficit and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company, as of July 31, 2016 and 2015, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has suffered recurring losses from operations and negative operating cash flows which raise substantial doubt about its ability to continue as a going concern. Management's plans regarding those matters also are described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

November 15, 2016

-F2-

CHINA SOAR INFORMATION TECHNOLOGY, INC.

BALANCE SHEETS

| July 31, 2016 |

July 31, 2015 | ||||||

| ASSETS | |||||||

| Current Assets | |||||||

| Cash | 159 | - | |||||

| Total Current Assets | 159 | - | |||||

| TOTAL ASSETS | $ | 159 | $ | - | |||

| LIABILITIES & STOCKHOLDERS’ DEFICIT | |||||||

| Current Liabilities | |||||||

| Accrued expenses | 9,421 | - | |||||

| Total Current Liabilities | 9,421 | - | |||||

| TOTAL LIABILITIES | 9,421 | - | |||||

| Stockholders’ Deficit | |||||||

| Preferred stock, $.0001 par value, 20,000,000 shares authorized; none issued and outstanding as of July 31, 2016 and 2015 | - | - | |||||

| Common stock , $.0001 par value, 500,000,000 shares authorized, 75,000,000 shares issued and outstanding as of July 31, 2016 and 2015 | 7,500 | 7,500 | |||||

| Additional Paid in Capital | 74,951 | 19,402 | |||||

| Accumulated Deficit | (91,713) | (26,902) | |||||

| Total Stockholders’ Deficit | $ | (9,262) | $ | - | |||

| TOTAL LIABILITIES & STOCKHOLDERS’ DEFICIT | $ | 159 | $ | - | |||

The accompanying notes are an integral part of these financial statements.

-F3-

CHINA SOAR INFORMATION TECHNOLOGY, INC.

STATEMENTS OF OPERATIONS

| Year Ended July 31, 2016 | Year Ended July 31, 2015 | ||||||

| Revenues | $ | - | $ | - | |||

| Total Revenues | - | - | |||||

|

General & Administrative Expenses |

|||||||

| Organization and Related Expenses |

2,131 |

1,308 |

|||||

| Professional fees | 62,680 | 18,050 | |||||

| Total General & Administrative Expenses |

64,811 |

19,358 |

|||||

| Net Loss | $ |

(64,811) |

$ |

(19,358) |

|||

|

Basic and Diluted Loss Per Share |

$ |

(0.00) |

$ |

(0.00) |

|||

|

Weighted average number of common shares outstanding |

$ |

75,000,000 |

$ |

27,383,562 |

|||

The accompanying notes are an integral part of these financial statements.

-F4-

China Soar Information TECHNOLOGY, INC.

STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE YEARS ENDED JULY 31, 2016 AND 2015

| Common Stock |

Par | Additional Paid-In Capital | Accumulated Deficit |

Total | ||||||||||||||||||||||||||||||||||||||||

| Balance July 31, 2014 | 20,000,000 | $ | 2,000 | $ | 3,544 | $ | (7,544) | (2,000) | ||||||||||||||||||||||||||||||||||||

| Net loss | (19,358) | (19,358) | ||||||||||||||||||||||||||||||||||||||||||

| Shareholder’s contributions | 15,858 | 15,858 | ||||||||||||||||||||||||||||||||||||||||||

| Issuance of 55,000,000 shares on June 12, 2015 | 55,000,000 | 5,500 | 5,500 | |||||||||||||||||||||||||||||||||||||||||

| Balance July 31, 2015 | 75,000,000 | 7,500 | 19,402 | (26,902) | - | |||||||||||||||||||||||||||||||||||||||

| Net loss | (64,811) | (64,811) | ||||||||||||||||||||||||||||||||||||||||||

| Shareholder’s contributions | 55,549 | 55,549 | ||||||||||||||||||||||||||||||||||||||||||

| Balance July 31, 2016 | 75,000,000 | $ | 7,500 | $ | 74,951 | $ | (91,713) | (9,262) | ||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

-F5-

CHINA SOAR INFORMATION TECHNOLOGY, INC.

STATEMENTS OF CASH FLOWS

| Year Ended July 31, 2016 |

Year Ended July 31, 2015 | ||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||

| Net loss | $ | (64,811) | $ | (19,358) | |

| Adjustment to reconcile net loss to net cash used in operating activities: | |||||

| Expenses contributed to capital | 47,591 | 15,858 | |||

| Changes in current assets and liabilities: | |||||

| Accrued expenses | 9,421 | (2,000) | |||

| Net cash used in operating activities | (7,799) | (5,500) | |||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||

| Proceeds from sale of common stock | - | 5,500 | |||

| Proceeds from related party's contribution | 7,958 | - | |||

| Net cash provided by financing activities | 7,958 | 5,500 | |||

| Net increase in cash and cash equivalents | 159 | - | |||

| Cash and cash equivalents at beginning of year | - | - | |||

| Cash and cash equivalents at end of year | 159 | - | |||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |||||

| Cash paid for: | |||||

| Interest | $ | - | $ | - | |

| Income taxes | $ | - | $ | - | |

The accompanying notes are an integral part of these financial statements.

-F6-

CHINA SOAR INFORMATION TECHNOLOGY, INC.

NOTES TO FINANCIAL STATEMENTS

FOR YEARS ENDED JULY 31, 2016 AND 2015

NOTE 1 - ORGANIZATION AND DESCRIPTION OF BUSINESS

China Soar Information Technology, Inc., a Delaware corporation (“the Company”) formerly known as Go Public II, Inc., was incorporated under the laws of the State of Delaware on July 22, 2013. On May 26, 2015, our former director, Thomas DeNunzio resigned and Mu Chun Lin was appointed as our president, CEO, CFO and sole director. We changed our name from Go Public II, Inc. to China Soar Information Technology with the Delaware Secretary of State on June 16, 2015.

We currently own a piece of intellectual property to utilize, market, further develop and sell in North America, South America and Europe a software application called (“MIMA”) to entrepreneurs and small businesses whereas any merchant can easily create a WEB/WAP e-commerce website or cell phone client and enterprise mobile management information system by themselves. Merchants will not have to rent network hardware operation system, entrust software development and recruit professional management. Instead, we can offer the required network infrastructure, software and hardware platform for the merchant with a low monthly fee. MIMA was created, owned and developed by our director, Mu Chun Lin over the course of ten years.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

USE OF ESTIMATES.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported amount of revenues and expenses during the reporting period. Actual results could differ from these estimates. Due to the limited level of operations, the Company has not had to make material assumptions or estimates other than the assumption that the Company is a going concern.

FISCAL YEAR END.

The Company elected July 31st as its fiscal year ending date.

CASH AND CASH EQUIVALENTS.

For the purpose of the financial statements cash equivalents include all highly liquid investments with original maturity of three months or less.

COMMITMENTS AND CONTINGENCIES.

The Company follows ASC 450-20, Loss Contingencies, to report accounting for contingencies. Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it

is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated.

EARNINGS (LOSS) PER SHARE.

The Company computes basic and diluted earnings per share amounts in accordance with ASC Topic 260, Earnings per Share. Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the

weighted average number of shares of common stock and potentially outstanding shares of common stock during each period. There were no potentially dilutive shares outstanding as of July 31, 2016.

FINANCIAL INSTRUMENTS.

ASC 820, Fair Value Measurements and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| · | Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities |

| · | Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| · | Level 3 - Inputs that are both significant to the fair value measurement and unobservable. |

The Company’s balance sheet includes certain financial instruments. The carrying amounts of current assets and current liabilities approximate their fair value because of the relatively short period of time between the origination of these instruments and their expected realization.

INCOME TAXES.

The Company accounts for income taxes under ASC 740, Income Taxes. Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations.

RELATED PARTY TRANSACTIONS.

The Company follows ASC 850, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions.

SHARE-BASED EXPENSE.

ASC 718, Compensation – Stock Compensation, prescribes accounting and reporting standards for all share-based payment transactions in which employee services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period).

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, Equity – Based Payments to Non-Employees. Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

-F7-

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS.

Management has considered all recent accounting pronouncements issued since the last audit of our financial statements. The Company's management believes that these recent pronouncements will not have a material effect on the Company's financial statements.

NOTE 3 - GOING CONCERN

The accompanying financial statements are prepared on a basis of accounting assuming that the Company is a going concern that contemplates realization of assets and satisfaction of liabilities in the normal course of business. The Company has no current revenue sources. This condition raises substantial doubt about the Company’s ability to continue as a going concern. The Company’s management plans to engage in very limited activities without incurring any liabilities that must be satisfied in cash until a source of funding is secured. The Company will offer noncash consideration and seek equity lines as a means of financing its operations. If the Company is unable to obtain revenue - producing contracts or financing or if the revenue or financing it does obtain is insufficient to cover any operating losses it may incur, it may substantially curtail or terminate its operations or seek other business opportunities through strategic alliances, acquisitions or other arrangements that may dilute the interests of existing stockholders.

The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 4 - INCOME TAXES

The Company has not recognized an income tax benefit for its operating losses generated based on uncertainties concerning its ability to generate taxable income in future periods. The tax benefit for the periods presented is offset by a valuation allowance established against deferred tax assets arising from the net operating losses and other temporary differences, the realization of which could not be considered more likely than not. In future periods, tax benefits and related deferred tax assets will be recognized when management considers realization of such amounts to be more likely than not. Section 382 of the Internal Revenue Code generally requires us to limit the amount of its income in future years that can be offset by historic losses, i.e. net operating loss (NOL) carryforwards and certain built-in losses, after a corporation has undergone an ownership change. As of July 31, 2016, the Company has incurred net losses of $(91,713) resulting in a net operating loss for income tax purposes. NOLs begin expiring in 2033 . The loss results in a deferred tax asset of approximately $32,110 at the effective statutory rate of 35%. The deferred tax asset has been off-set by an equal valuation allowance.

| July 31, | |||||||

| 2016 | 2015 | ||||||

| Deferred tax asset, generated from net operating loss at statutory rates | $ | 32,110 | $ | 9,415 | |||

| Valuation allowance | (32,110) | (9,415) | |||||

| $ | - | $ | - | ||||

The reconciliation of the effective income tax rate to the federal statutory rate is as follows:

| Federal income tax rate | 35.0 | % | ||

| Increase in valuation allowance | (35.0 | %) | ||

| Effective income tax rate | 0.0 | % |

NOTE 5 - STOCKHOLDER’S EQUITY

Preferred Stock

The authorized preferred stock of the Company consists of 20,000,000 shares. There were no shares issued and outstanding as of July 31, 2016 and 2015.

Common Stock

The authorized common stock of the Company consists of 500,000,000 shares with a par value if $0.0001. There were 75,000,000 issued and outstanding as of July 31, 2016 and 2015.

On June 12, 2015, the Company sold 55,000,000 shares of common stock at $.0001 totaling $5,500. This cash was received by the escrow agent named Proxy Management on behalf of the company.

Additional Paid in Capital

Amounts contributed to additional paid in capital for the years ended July 31, 2016 and 2015 totaled $55,549 and $15,858, respectively. (Note 6)

NOTE 6 - RELATED-PARTY TRANSACTIONS

Equity - Additional paid in capital

During the year ended July 31, 2016, Mu Chun Lin, our CEO, CFO and sole director, contributed $55,549 into additional paid-in capital to fund operating expenses including cash contribution of $7,958 and expenses paid by shareholder in the amount of $47,591.

During the fiscal year ended July 31, 2015, expenses of $15,858 were paid by the current and former directors and are considered as contributions to capital. Our current sole director, Mr. Mu and the former sole director contributed $9,694 and $6,164 to the Company, respectively.

-F8-

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Disclosure Controls and Procedures

The Company has adopted and maintains disclosure controls and procedures that are designed to provide reasonable assurance that information required to be disclosed in the reports filed under the Exchange Act, such as this annual report, is collected, recorded, processed, summarized and reported within the time periods specified in the rules of the SEC. The Company’s disclosure controls and procedures are also designed to ensure that such information is accumulated and communicated to management to allow timely decisions regarding required disclosure. As required under Exchange Act Rule 13a-15, the Company’s management, including the Chief Executive Officer who also serves as our Principal Financial Officer, has conducted an evaluation of the effectiveness of disclosure controls and procedures as of the end of the period covered by this report. Based on that evaluation, the Chief Executive Office who also serves as our Principal Financial Officer concluded that the disclosure controls and procedures are ineffective.

The matters involving internal controls and procedures that our management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: domination of management by a single individual without adequate compensating controls, lack of a majority of outside directors on board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; inadequate segregation of duties consistent with control objectives, and lack of an audit committee. These material weaknesses were identified by our Chief Executive Officer who also serves as our Chief Financial Officer in connection with the above annual evaluation.

Management believes that the material weaknesses did not have an effect on our financial results. However, management believes that the lack of a functioning audit committee and inadequate segregation of duties results in ineffective oversight in the establishment and monitoring of required internal controls and procedures, which could result in a material misstatement in our financial statements in future periods.

Management recognizes that its controls and procedures would be substantially improved if we had an audit committee and two individuals serving as officers and as such is actively seeking to remediate this issue.

Management’s Report on Internal Control over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Exchange Act Rule 13a-15(f). The Company’s internal control over financial reporting is designed to provide reasonable assurance to the Company’s management and board of directors regarding the preparation and fair presentation of published financial statements. Management conducted an assessment of the Company’s internal control over financial reporting based on the criteria set forth in Internal Control-Integrated framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework). Based on the assessment, management has concluded that, as of July 31, 2016, the Company’s internal control over financial reporting is ineffective based on those criteria.

The Company’s management, including its Chief Executive Officer who also serves as our Chief Financial Officer, does not expect that the Company’s disclosure controls and procedures and its internal control processes will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of error or fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that the breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, controls may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

Management’s Remediation Initiatives

In an effort to remediate the identified material weaknesses and other deficiencies and enhance our internal controls, we have initiated, or plan to initiate, the following series of measures:

We will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to us. And, we plan to appoint one or more outside directors to our board of directors who shall be appointed to an audit committee resulting in a fully functioning audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures such as reviewing and approving estimates and assumptions made by management when funds are available to us.

Management believes that the appointment of one or more outside directors, who shall be appointed to a fully functioning audit committee, will remedy the lack of a functioning audit committee and a lack of a majority of outside directors on our Board.

We will work as quickly as possible to implement these initiatives; however, the lack of adequate working capital and positive cash flow from operations will likely slow this implementation.

Changes in Internal Control

There have been no changes in internal controls over the financial reporting that occurred during the Company’s fourth quarter of 2016 that have materially affected, or are reasonably likely to materially affect our internal controls over financial reporting.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the SEC that permit the Company to provide only management’s report in this annual report.

Item 9B. Other Information.

None.

-8-

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

| Name | Age | Position(s) | ||

| Mu Chun Lin | 28 | President, CEO, Secretary, Treasurer and Director | ||

Mu Chun Lin, President, Secretary, Treasurer and Director

Mu Chun Lin

Mu Chun Lin has been the CEO of Zhengzhou Xiangtian Information Technology Company Limited since September 2006. He was responsible for the startup and development of the company into a high growth, e-commerce company. Also of note is the fact that he created procedures for hiring, training as well as management of sales team for business development with local state, government agencies which from company start-up has brought tremendous growth. Additionally, Mu Chun Lin has been responsible for developing internet mobile technology since 2006. Mu Chun Lin was assistant to the general manager and technical director of Henan Xinfeijinxin Computer Information Technology Co., LTD. Mu Chun Lin received a bachelor’s degree in journalism from Communication University of China in 2009.

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors, the Chief Executive Officer and the Chief Financial Officer of the Company review the Company's internal accounting controls, practices and policies.

Employees

At July 31, 2016 we had no employees.

Directors’ Term of Office

Directors will hold office until the next annual meeting of stockholders and the election and qualification of their successors. Officers are elected annually by our board of directors and serve at the discretion of the board of directors. Presently, we have a single director, Mu Chun Lin.

Director Independence

Although our securities do not trade on any national securities exchange, for purposes of independence we use the NASDAQ definition of independence. Our director, Mu Chun Lin, is not independent because of his position as an executive officer of the Company.

Audit Committee and Audit Committee Financial Expert

Our sole director acts as our audit committee and compensation committee. We do not have an “audit committee financial expert,” as that term is defined in Item 407(d) of Regulation S-K promulgated under the Securities Act. The sole director believes that he is financially literate and experienced in business matters and are capable of (1) understanding generally accepted accounting principles (“GAAP”) and financial statements, (2) assessing the general application of GAAP principles in connection with our accounting for estimates, accruals and reserves, (3) analyzing and evaluating our financial statements, (4) understanding internal controls and procedures for financial reporting, and (5) understanding audit committee functions, all of which are attributes of an audit committee financial expert. However, the sole director believes that no audit committee member has obtained these attributes through the experience specified in the SEC's definition of “audit committee financial expert.” Further, as is the case with many small companies, it would be difficult for us to attract and retain board members who qualify as “audit committee financial experts,” and competition for such individuals is significant. The sole director believes that its current audit committee is able to fulfill its role under SEC regulations despite not having a designated “audit committee financial expert.”

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s executive officers, directors and persons who beneficially own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of the Company’s common stock. Such officers, directors and persons are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms that they file with the SEC.

Based solely on a review of the copies of such forms that were received by the Company, or written representations from certain reporting persons that no Form 5s were required for those persons, the Company is not aware of any failures to file reports or report transactions in a timely manner during the Company’s fiscal year ended July 31, 2016.

Code of Ethics

We have not established a Code of Ethics applicable to our officers and directors.

Procedure for Nominating Directors

In 2016, we have not made any material changes to the procedures by which security holders may recommend nominees to our Board of Directors.

Family Relationships

There are no family relationships among our directors, executive officers or persons nominated to become executive officers or directors.

Involvement in Certain Legal Proceedings

During the past ten (10) years, none of our directors, persons nominated to become directors, executive officers, promoters or control persons was involved in any of the legal proceedings listen in Item 401 (f) of Regulation S-K.

Arrangements

There are no arrangements or understandings between an executive officer, director or nominee and any other person pursuant to which he was or is to be selected as an executive officer or director.

-9-

Item 11. Executive Compensation.

The table below summarizes all compensation awarded to, earned by, or paid to our named executive officer for all services rendered in all capacities to us for the years ended July 31, 2016 and 2015.

| SUMMARY COMPENSATION TABLE | |||||||||

|

Name and principal position |

Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

| Mu Chun Lin | 2016 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

|

Mu Chun Lin Chief Executive Officer Chief Financial Officer |

2015

|

0

|

0

|

2,000

|

0

|

0

|

0

|

0

|

$2,000

|

Option/SAR Grants in Last Fiscal Year

None.

Outstanding Equity Awards at Fiscal Year-End

None.

Compensation of Directors

The Company’s sole director Mu Chun Lin received 20,000,000 shares of stock as compensation for services including but not limited to developing our business plan as director during the last fiscal year.

Equity Compensation Plan Information

Not applicable.

Employment Agreements

None.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth certain information regarding beneficial ownership of our common stock and warrants to purchase shares of our common stock as of November 15, 2016 by (i) each person (or group of affiliated persons) who is known by us to own more than five percent of the outstanding shares of our common stock, (ii) each of our directors and executive officers, and (iii) all of our directors and executive officers as a group. As of November 15, 2016 , there were 75,000,000 shares of common stock outstanding.

Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. The principal address of each of the stockholders listed below is c/o 12 Harcourt Road, Bank of America Tower, Suite 1308 Central, Hong Kong. We believe that all persons named in the table have sole voting and investment power with respect to shares beneficially owned by them.

Principal Stockholders Table

| Name of Owner | Shares Owned |

Percentage of Shares Outstanding | ||||||

| Mu Chun Lin (1) | 20,000,000 | 26.667 | % | |||||

| Yang Zhi | 22,316,000 | 29.755 | % | |||||

| Duan Qiqing | 12,292,000 | 16.389 | % | |||||

| All officers and directors as a group (1 person) | 20,000,000 | 26.667 | % | |||||

(1) Mu Chun Lin serves as President, Secretary, Treasurer and Director of the Company.

-10-

Item 13. Certain Relationships and Related Transactions, and Director Independence.

None

Item 14. Principal Accounting Fees and Services.

Below is the aggregate amount of fees billed for professional services rendered by our principal accountants with respect to our last two fiscal years.

| 2016 | 2015 | ||||

| Audit fees | Malonebailey, LLP | $9,000 | $4,000 | ||

| Audit related fees | |||||

| Tax fees | |||||

| All other fees | |||||

| Total | $9,000 | $4,000 |

Board of Directors Pre-Approval Process, Policies and Procedures

Our principal auditors have performed their audit procedures in accordance with pre-approved policies and procedures established by our sole director. Our principal auditors have informed our sole director of the scope and

nature of each service provided. With respect to the provisions of services other than audit, review, or attest services, our principal accountants brought such services to the attention of our sole director prior to commencing such services.

-11-

PART IV

Item 15. Exhibits, Financial Statement Schedules.

(a) Financial Statements

1. Financial statements for our company are listed in the index under Item 8 of this document