Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - REGENCY CENTERS CORP | d292416dex993.htm |

| EX-99.1 - EX-99.1 - REGENCY CENTERS CORP | d292416dex991.htm |

| EX-10.2 - EX-10.2 - REGENCY CENTERS CORP | d292416dex102.htm |

| EX-10.1 - EX-10.1 - REGENCY CENTERS CORP | d292416dex101.htm |

| EX-2.1 - EX-2.1 - REGENCY CENTERS CORP | d292416dex21.htm |

| 8-K - FORM 8-K - REGENCY CENTERS CORP | d292416d8k.htm |

NOVEMBER 14, 2016 Regency Centers and Equity One Combine to Form the Preeminent Shopping Center Owner, Operator and Developer Exhibit 99.2

Disclaimer Cautionary Statement Regarding Forward-Looking Information The information presented herein may contain forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 giving Regency’s and Equity One’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. In addition to factors previously disclosed in Regency’s and Equity One’s reports filed with the Securities and Exchange Commission and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements and historical performance: the occurrence of any event, change or other circumstances that could give rise to right of one or both of the parties to terminate the definitive merger agreement between Regency and Equity One; the outcome of any legal proceedings that may be instituted against Regency or Equity One; the failure to obtain necessary shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of changes in the economy and competitive factors in the areas where Regency and Equity One do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; Regency’s ability to complete the acquisition and integration of Equity One successfully or fully realize cost savings and other benefits and other consequences associated with mergers, acquisitions and divestitures; changes in asset quality and credit risk; the potential liability for a failure to meet regulatory requirements, including the maintenance of REIT status; material changes in the dividend rates on securities or the ability to pay dividends on common shares or other securities; potential changes to tax legislation; changes in demand for developed properties; adverse changes in financial condition of joint venture partner(s) or major tenants; risks associated with the acquisition, development, expansion, leasing and management of properties; risks associated with the geographic concentration of Regency or Equity One; risks associated with the industry concentration of tenants; the potential impact of announcement of the proposed transactions or consummation of the proposed transactions on relationships, including with tenants, employees, customers and competitors; significant costs related to uninsured losses, condemnation, or environmental issues; the ability to retain key personnel; and changes in local, national and international financial market, insurance rates and interest rates. Regency and Equity One do not intend, and undertake no obligation, to update any forward-looking statement. Important Additional Information Investors and security holders are urged to carefully review and consider each of Regency’s and Equity One’s public filings with the Securities and Exchange Commission (the “SEC”), including but not limited to their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their Quarterly Reports on Form 10-Q. The documents filed by Regency with the SEC may be obtained free of charge at Regency’s website at http://www.regencycenters.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Regency by requesting them in writing to One Independent Drive, Suite 114, Jacksonville, FL 32202-3842, or by telephone at (904) 598-7000. The documents filed by Equity One with the SEC may be obtained free of charge at Equity One’s website at http://www.equityone.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Equity One by requesting them in writing to 410 Park Avenue, Suite 1220, New York, NY 10022, or by telephone at (212) 796-1760. In connection with the proposed transaction, Regency intends to file a registration statement on Form S-4 with the SEC which will include a joint proxy statement of Equity One and Regency and a prospectus of Regency, and each party will file other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, investors and security holders of Equity One and Regency are urged to carefully read the entire registration statement and joint proxy statement/prospectus, when they become available, as well as any amendments or supplements to these documents and any other relevant documents filed with the SEC, because they will contain important information about the proposed transaction. A definitive joint proxy statement/prospectus will be sent to the shareholders of each party seeking the required shareholder approval. Investors and security holders will be able to obtain the registration statement and the joint proxy statement/prospectus free of charge from the SEC’s website or from Regency or Equity One as described in the paragraphs above. Participants in the Solicitation Regency, Equity One, and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from Regency and Equity One shareholders in connection with the proposed transaction. Information about the directors and executive officers of Regency and their ownership of Regency common stock is set forth in the definitive proxy statement for Regency’s 2016 annual meeting of shareholders, as previously filed with the SEC on March 14, 2016. Information about the directors and executive officers of Equity One and their ownership of Equity One common stock is set forth in the definitive proxy statement for Equity One’s 2016 annual meeting of shareholders, as previously filed with the SEC on April 1, 2016. Regency and Equity One shareholders may obtain additional information regarding the interests of such participants by reading the registration statement and the joint proxy statement/prospectus when they become available. Free copies of these documents may be obtained as described in the paragraphs above.

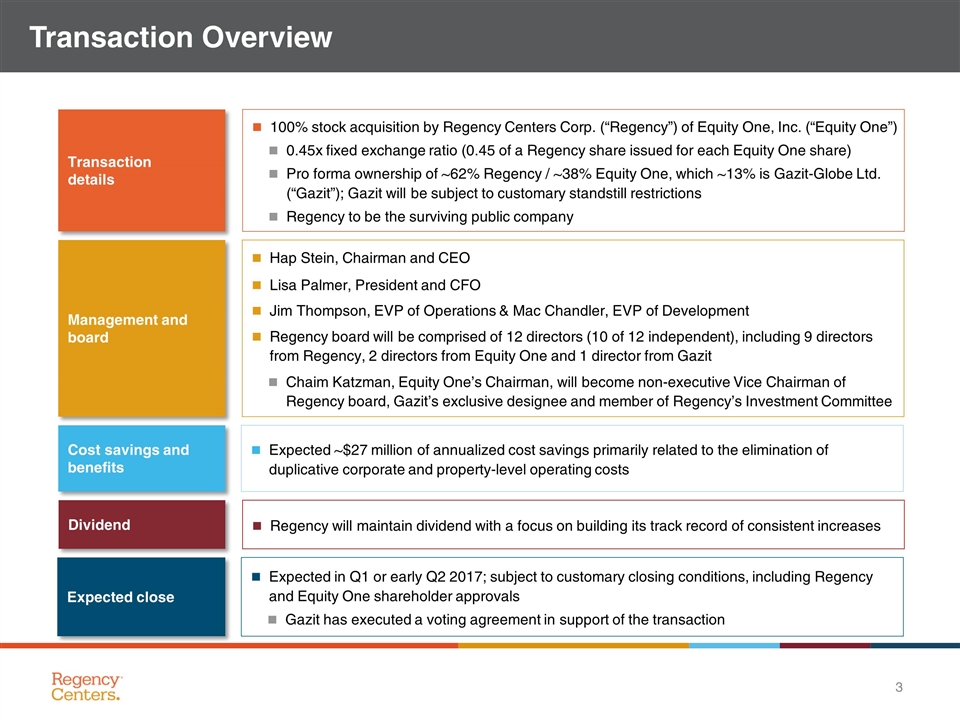

Transaction Overview 100% stock acquisition by Regency Centers Corp. (“Regency”) of Equity One, Inc. (“Equity One”) 0.45x fixed exchange ratio (0.45 of a Regency share issued for each Equity One share) Pro forma ownership of ~62% Regency / ~38% Equity One, which ~13% is Gazit-Globe Ltd. (“Gazit”); Gazit will be subject to customary standstill restrictions Regency to be the surviving public company Transaction details Hap Stein, Chairman and CEO Lisa Palmer, President and CFO Jim Thompson, EVP of Operations & Mac Chandler, EVP of Development Regency board will be comprised of 12 directors (10 of 12 independent), including 9 directors from Regency, 2 directors from Equity One and 1 director from Gazit Chaim Katzman, Equity One’s Chairman, will become non-executive Vice Chairman of Regency board, Gazit’s exclusive designee and member of Regency’s Investment Committee Management and board Cost savings and benefits Expected ~$27 million of annualized cost savings primarily related to the elimination of duplicative corporate and property-level operating costs Expected close Expected in Q1 or early Q2 2017; subject to customary closing conditions, including Regency and Equity One shareholder approvals Gazit has executed a voting agreement in support of the transaction Dividend Regency will maintain dividend with a focus on building its track record of consistent increases

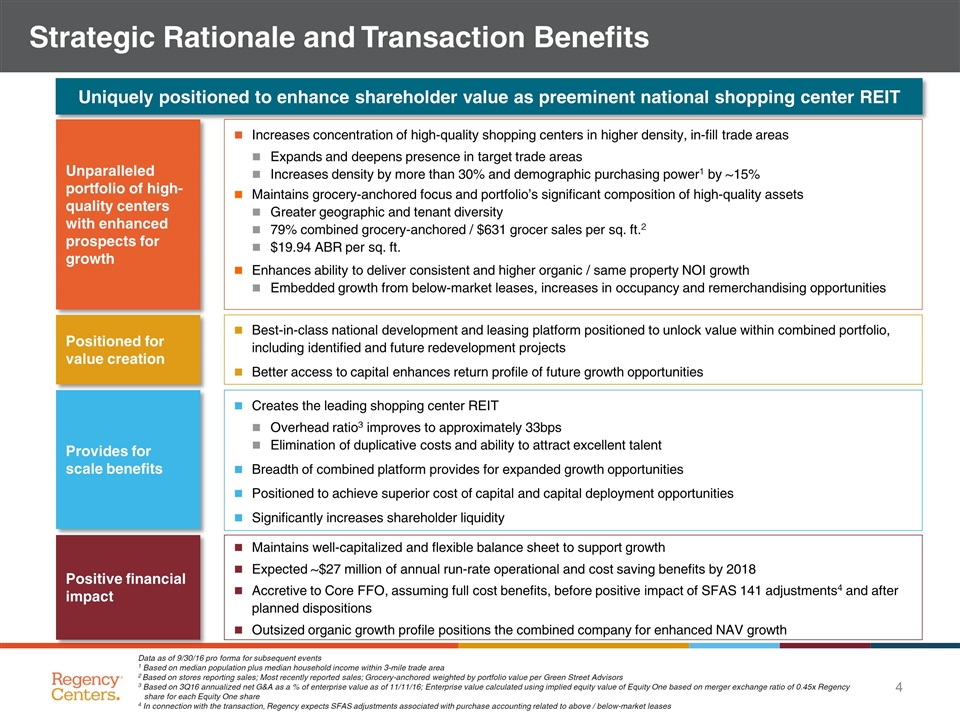

Strategic Rationale and Transaction Benefits Unparalleled portfolio of high-quality centers with enhanced prospects for growth Increases concentration of high-quality shopping centers in higher density, in-fill trade areas Expands and deepens presence in target trade areas Increases density by more than 30% and demographic purchasing power1 by ~15% Maintains grocery-anchored focus and portfolio’s significant composition of high-quality assets Greater geographic and tenant diversity 79% combined grocery-anchored / $631 grocer sales per sq. ft.2 $19.94 ABR per sq. ft. Enhances ability to deliver consistent and higher organic / same property NOI growth Embedded growth from below-market leases, increases in occupancy and remerchandising opportunities Positioned for value creation Best-in-class national development and leasing platform positioned to unlock value within combined portfolio, including identified and future redevelopment projects Better access to capital enhances return profile of future growth opportunities Provides for scale benefits Creates the leading shopping center REIT Overhead ratio3 improves to approximately 33bps Elimination of duplicative costs and ability to attract excellent talent Breadth of combined platform provides for expanded growth opportunities Positioned to achieve superior cost of capital and capital deployment opportunities Significantly increases shareholder liquidity Positive financial impact Maintains well-capitalized and flexible balance sheet to support growth Expected ~$27 million of annual run-rate operational and cost saving benefits by 2018 Accretive to Core FFO, assuming full cost benefits, before positive impact of SFAS 141 adjustments4 and after planned dispositions Outsized organic growth profile positions the combined company for enhanced NAV growth Uniquely positioned to enhance shareholder value as preeminent national shopping center REIT Data as of 9/30/16 pro forma for subsequent events 1 Based on median population plus median household income within 3-mile trade area 2 Based on stores reporting sales; Most recently reported sales; Grocery-anchored weighted by portfolio value per Green Street Advisors 3 Based on 3Q16 annualized net G&A as a % of enterprise value as of 11/11/16; Enterprise value calculated using implied equity value of Equity One based on merger exchange ratio of 0.45x Regency share for each Equity One share 4 In connection with the transaction, Regency expects SFAS adjustments associated with purchase accounting related to above / below-market leases

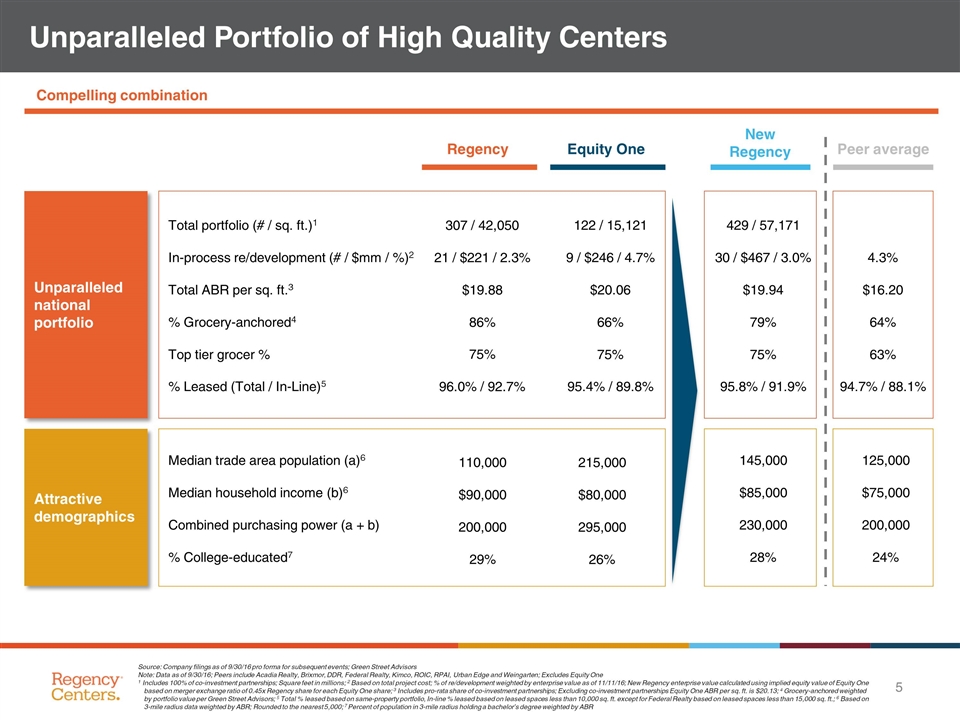

Unparalleled Portfolio of High Quality Centers Compelling combination Regency Equity One New Regency Unparalleled national portfolio Total portfolio (# / sq. ft.)1 In-process re/development (# / $mm / %)2 Total ABR per sq. ft.3 % Grocery-anchored4 Top tier grocer % % Leased (Total / In-Line)5 429 / 57,171 30 / $467 / 3.0% $19.94 79% 75% 95.8% / 91.9% 307 / 42,050 21 / $221 / 2.3% $19.88 86% 75% 96.0% / 92.7% 122 / 15,121 9 / $246 / 4.7% $20.06 66% 75% 95.4% / 89.8% Attractive demographics Median trade area population (a)6 Median household income (b)6 Combined purchasing power (a + b) % College-educated7 145,000 $85,000 230,000 28% 110,000 $90,000 200,000 29% 215,000 $80,000 295,000 26% Source: Company filings as of 9/30/16 pro forma for subsequent events; Green Street Advisors Note: Data as of 9/30/16; Peers include Acadia Realty, Brixmor, DDR, Federal Realty, Kimco, ROIC, RPAI, Urban Edge and Weingarten; Excludes Equity One 1 Includes 100% of co-investment partnerships; Square feet in millions; 2 Based on total project cost; % of re/development weighted by enterprise value as of 11/11/16; New Regency enterprise value calculated using implied equity value of Equity One based on merger exchange ratio of 0.45x Regency share for each Equity One share; 3 Includes pro-rata share of co-investment partnerships; Excluding co-investment partnerships Equity One ABR per sq. ft. is $20.13; 4 Grocery-anchored weighted by portfolio value per Green Street Advisors; 5 Total % leased based on same-property portfolio, In-line % leased based on leased spaces less than 10,000 sq. ft. except for Federal Realty based on leased spaces less than 15,000 sq. ft.; 6 Based on 3-mile radius data weighted by ABR; Rounded to the nearest 5,000; 7 Percent of population in 3-mile radius holding a bachelor’s degree weighted by ABR Peer average 4.3% $16.20 64% 63% 94.7% / 88.1% 125,000 $75,000 200,000 24%

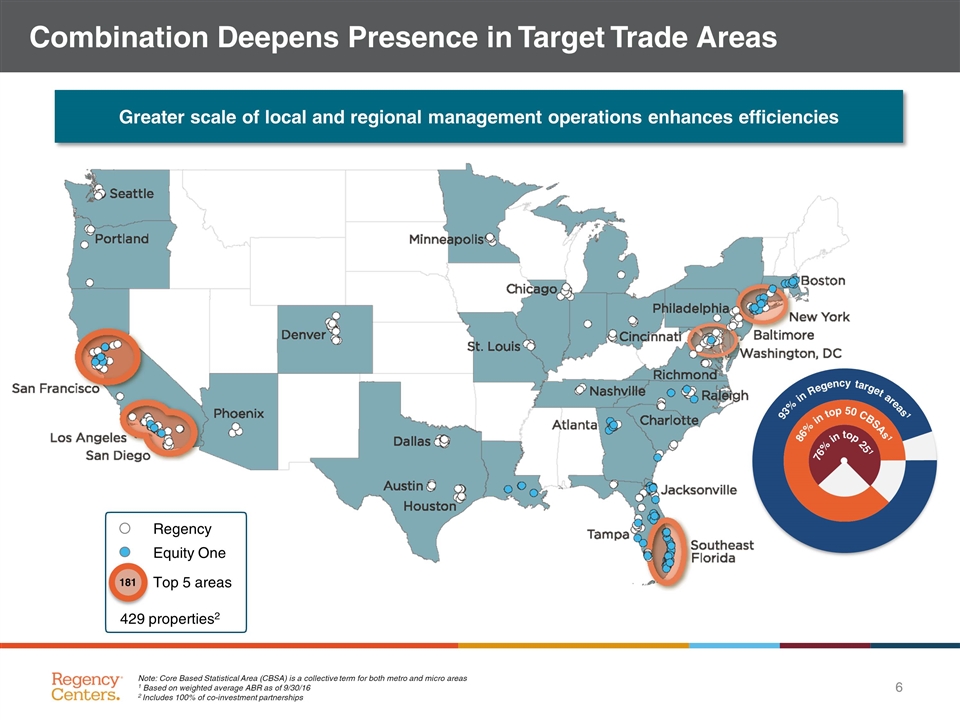

Combination Deepens Presence in Target Trade Areas Greater scale of local and regional management operations enhances efficiencies [X]% in top 25 93% in Regency target areas1 86% in top 50 CBSAs1 76% in top 251 Note: Core Based Statistical Area (CBSA) is a collective term for both metro and micro areas 1 Based on weighted average ABR as of 9/30/16 2 Includes 100% of co-investment partnerships Regency Equity One 429 properties2 Top 5 areas 181

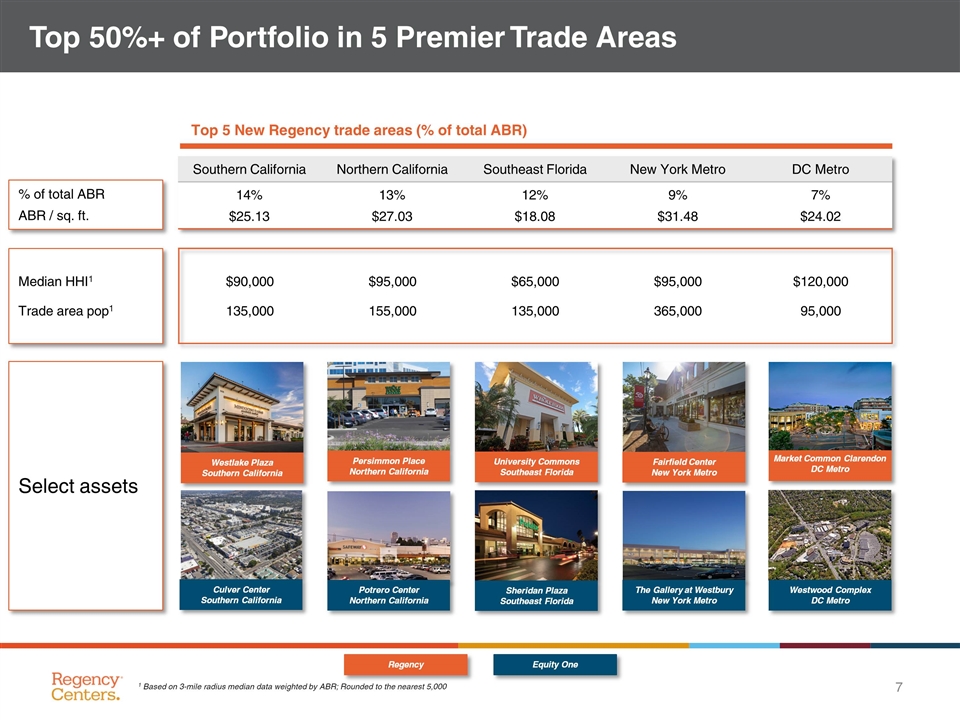

Fairfield Center New York Metro Westlake Plaza Southern California Culver Center Southern California Top 50%+ of Portfolio in 5 Premier Trade Areas Southern California Northern California Southeast Florida New York Metro DC Metro 14% $25.13 13% $27.03 12% $18.08 9% $31.48 7% $24.02 Top 5 New Regency trade areas (% of total ABR) Median HHI1 Trade area pop1 % of total ABR ABR / sq. ft. Select assets 1 Based on 3-mile radius median data weighted by ABR; Rounded to the nearest 5,000 $90,000 135,000 $95,000 155,000 $65,000 135,000 $95,000 365,000 $120,000 95,000 Market Common Clarendon DC Metro Persimmon Place Northern California University Commons Southeast Florida The Gallery at Westbury New York Metro Market Common Clarendon Encina Grande Northern California Sheridan Plaza Southeast Florida Regency Equity One Westwood Complex DC Metro Potrero Center Northern California

Well-Diversified, High-Quality Significant Tenants (% of total ABR) Largest single tenant represents only ~3% of estimated combined ABR Data as of 9/30/16

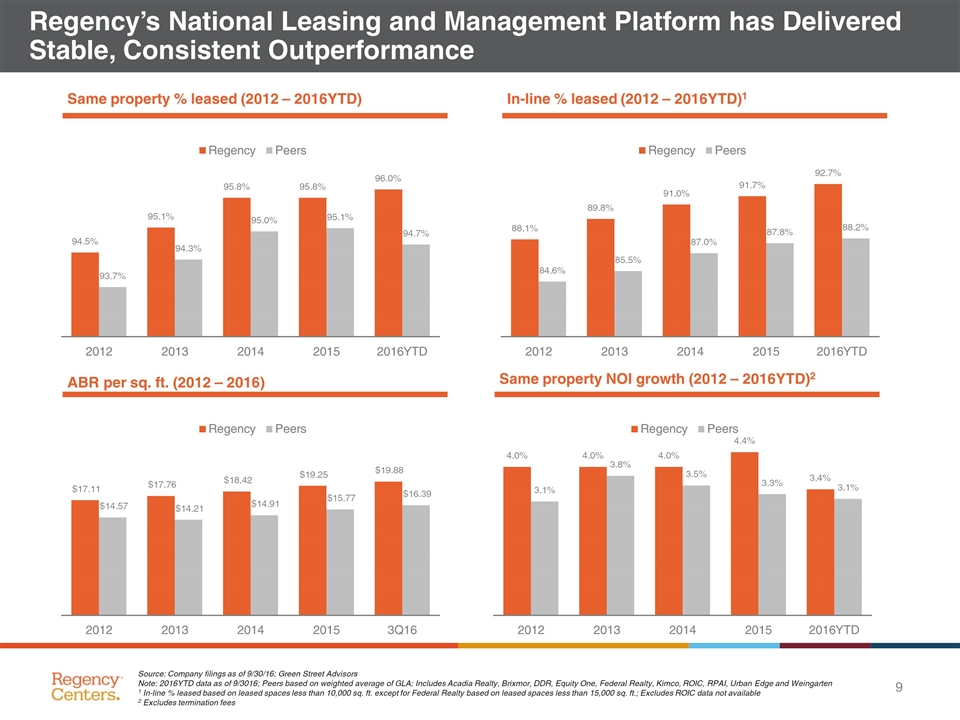

Regency’s National Leasing and Management Platform has Delivered Stable, Consistent Outperformance Source: Company filings as of 9/30/16; Green Street Advisors Note: 2016YTD data as of 9/3016; Peers based on weighted average of GLA; Includes Acadia Realty, Brixmor, DDR, Equity One, Federal Realty, Kimco, ROIC, RPAI, Urban Edge and Weingarten 1 In-line % leased based on leased spaces less than 10,000 sq. ft. except for Federal Realty based on leased spaces less than 15,000 sq. ft.; Excludes ROIC data not available 2 Excludes termination fees Same property % leased (2012 – 2016YTD) In-line % leased (2012 – 2016YTD)1 ABR per sq. ft. (2012 – 2016) Same property NOI growth (2012 – 2016YTD)2

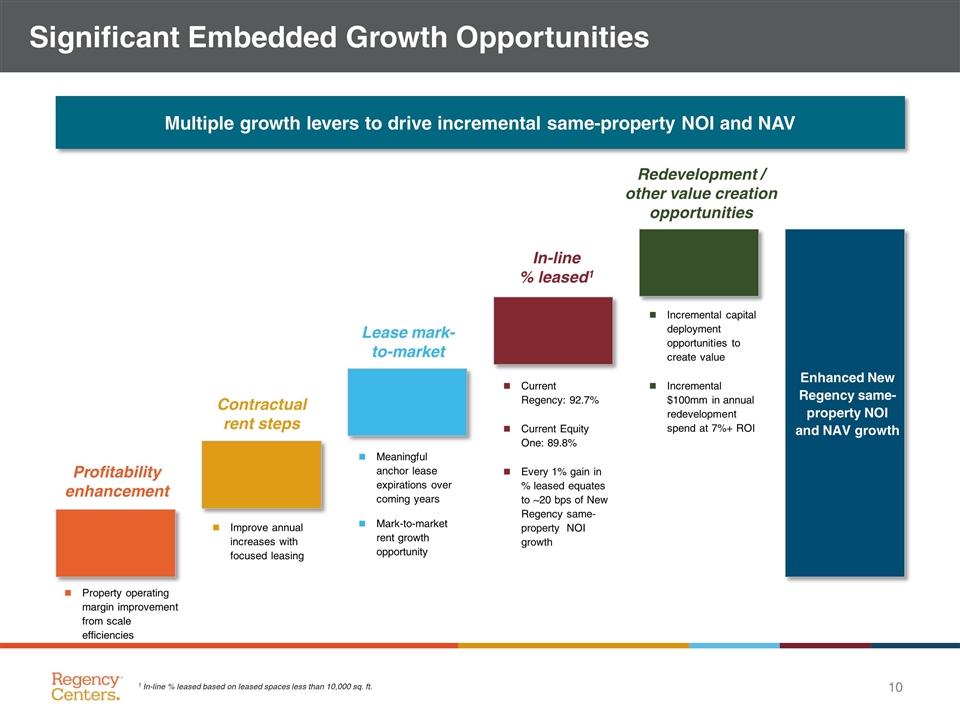

Significant Embedded Growth Opportunities Multiple growth levers to drive incremental same-property NOI and NAV Profitability enhancement Lease mark-to-market In-line % leased1 Redevelopment / other value creation opportunities Contractual rent steps Improve annual increases with focused leasing Meaningful anchor lease expirations over coming years Mark-to-market rent growth opportunity Current Regency: 92.7% Current Equity One: 89.8% Every 1% gain in % leased equates to ~20 bps of New Regency same-property NOI growth Incremental capital deployment opportunities to create value Incremental $100mm in annual redevelopment spend at 7%+ ROI Property operating margin improvement from scale efficiencies Enhanced New Regency same-property NOI and NAV growth 1 In-line % leased based on leased spaces less than 10,000 sq. ft.

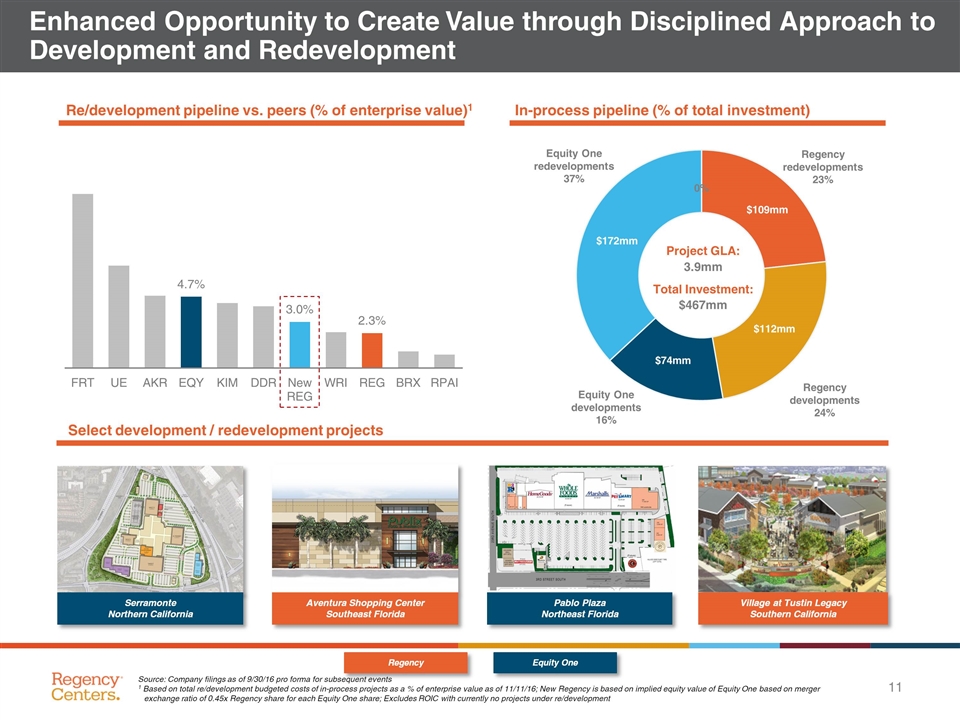

Enhanced Opportunity to Create Value through Disciplined Approach to Development and Redevelopment In-process pipeline (% of total investment) Project GLA: 3.9mm Total Investment: $467mm Source: Company filings as of 9/30/16 pro forma for subsequent events 1 Based on total re/development budgeted costs of in-process projects as a % of enterprise value as of 11/11/16; New Regency is based on implied equity value of Equity One based on merger exchange ratio of 0.45x Regency share for each Equity One share; Excludes ROIC with currently no projects under re/development Select development / redevelopment projects $109mm $172mm $74mm $112mm Re/development pipeline vs. peers (% of enterprise value)1 Regency Equity One Aventura Shopping Center Southeast Florida Serramonte Northern California Pablo Plaza Northeast Florida Village at Tustin Legacy Southern California

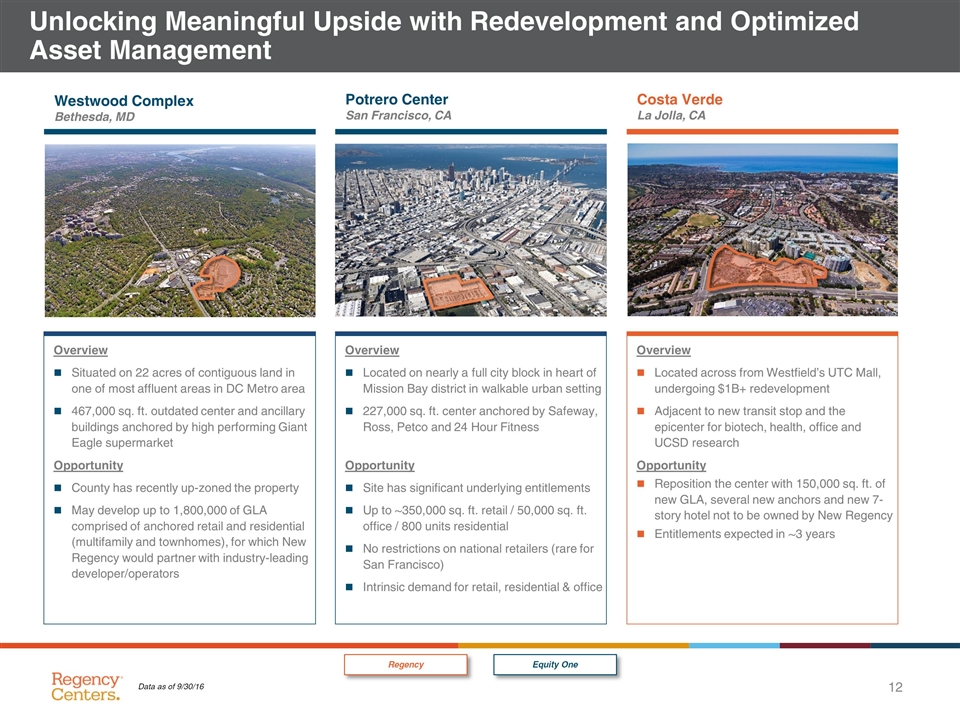

Unlocking Meaningful Upside with Redevelopment and Optimized Asset Management Overview Situated on 22 acres of contiguous land in one of most affluent areas in DC Metro area 467,000 sq. ft. outdated center and ancillary buildings anchored by high performing Giant Eagle supermarket Opportunity County has recently up-zoned the property May develop up to 1,800,000 of GLA comprised of anchored retail and residential (multifamily and townhomes), for which New Regency would partner with industry-leading developer/operators Westwood Complex Bethesda, MD Overview Located on nearly a full city block in heart of Mission Bay district in walkable urban setting 227,000 sq. ft. center anchored by Safeway, Ross, Petco and 24 Hour Fitness Opportunity Site has significant underlying entitlements Up to ~350,000 sq. ft. retail / 50,000 sq. ft. office / 800 units residential No restrictions on national retailers (rare for San Francisco) Intrinsic demand for retail, residential & office Potrero Center San Francisco, CA Overview Located across from Westfield’s UTC Mall, undergoing $1B+ redevelopment Adjacent to new transit stop and the epicenter for biotech, health, office and UCSD research Opportunity Reposition the center with 150,000 sq. ft. of new GLA, several new anchors and new 7-story hotel not to be owned by New Regency Entitlements expected in ~3 years Costa Verde La Jolla, CA Regency Equity One Data as of 9/30/16

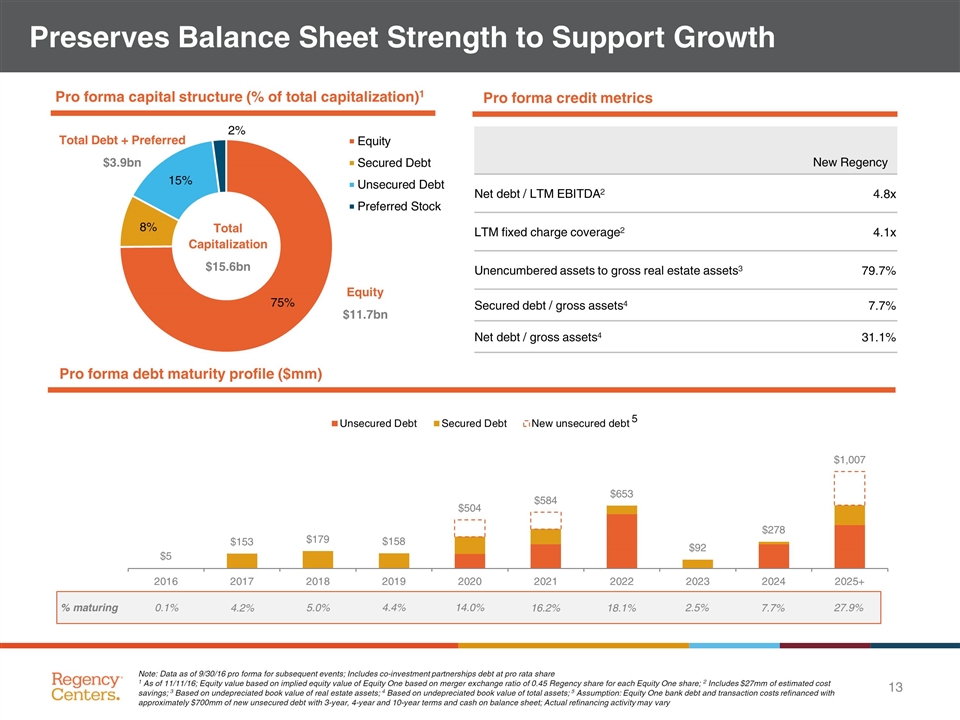

New Regency Net debt / LTM EBITDA2 4.8x LTM fixed charge coverage2 4.1x Unencumbered assets to gross real estate assets3 79.7% Secured debt / gross assets4 7.7% Net debt / gross assets4 31.1% Preserves Balance Sheet Strength to Support Growth Note: Data as of 9/30/16 pro forma for subsequent events; Includes co-investment partnerships debt at pro rata share 1 As of 11/11/16; Equity value based on implied equity value of Equity One based on merger exchange ratio of 0.45 Regency share for each Equity One share; 2 Includes $27mm of estimated cost savings; 3 Based on undepreciated book value of real estate assets; 4 Based on undepreciated book value of total assets; 5 Assumption: Equity One bank debt and transaction costs refinanced with approximately $700mm of new unsecured debt with 3-year, 4-year and 10-year terms and cash on balance sheet; Actual refinancing activity may vary % maturing 0.1% 5.0% 2.5% 27.9% Pro forma credit metrics Pro forma debt maturity profile ($mm) 4.2% 4.4% 14.0% 16.2% 18.1% 7.7% Pro forma capital structure (% of total capitalization)1 Equity $11.7bn 5 Total Debt + Preferred $3.9bn Total Capitalization $15.6bn

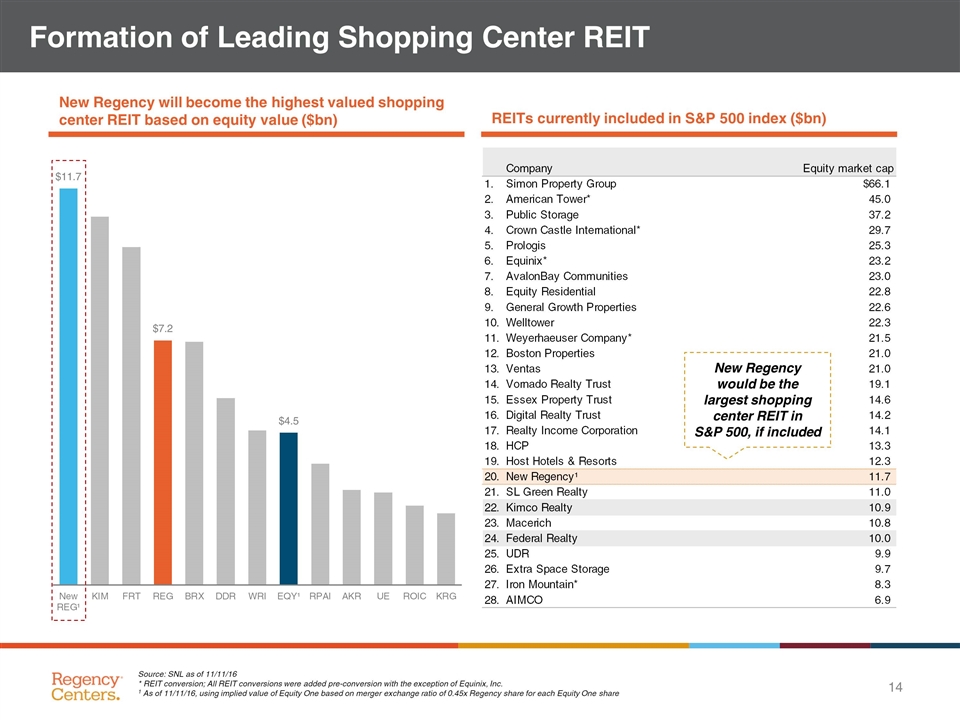

Formation of Leading Shopping Center REIT New Regency will become the highest valued shopping center REIT based on equity value ($bn) REITs currently included in S&P 500 index ($bn) Source: SNL as of 11/11/16 * REIT conversion; All REIT conversions were added pre-conversion with the exception of Equinix, Inc. 1 As of 11/11/16, using implied value of Equity One based on merger exchange ratio of 0.45x Regency share for each Equity One share New Regency would be the largest shopping center REIT in S&P 500, if included

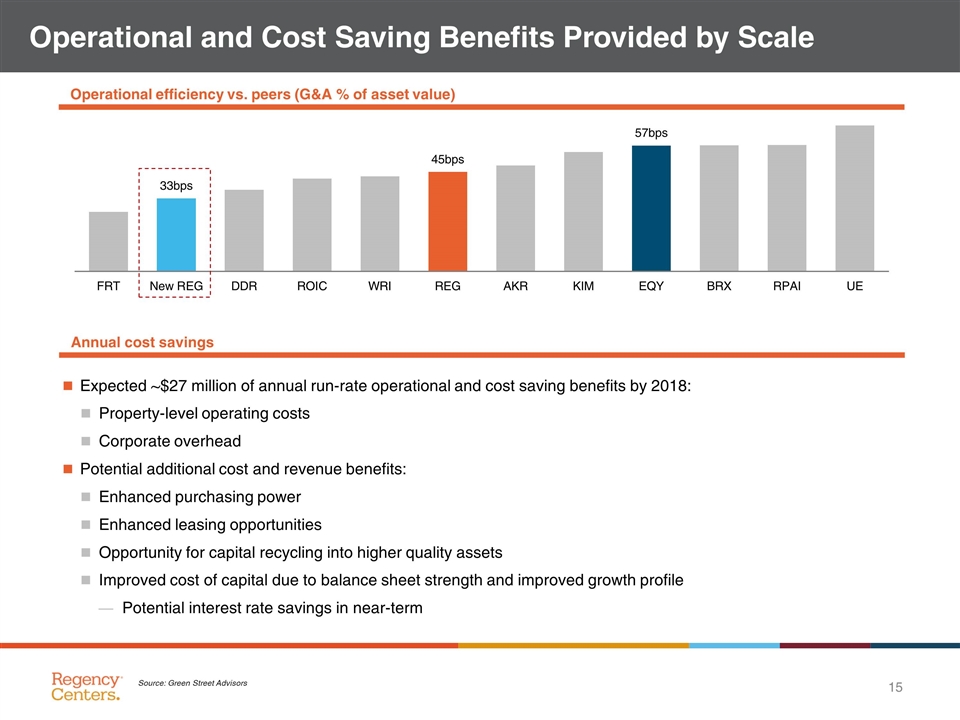

Operational and Cost Saving Benefits Provided by Scale Operational efficiency vs. peers (G&A % of asset value) Expected ~$27 million of annual run-rate operational and cost saving benefits by 2018: Property-level operating costs Corporate overhead Potential additional cost and revenue benefits: Enhanced purchasing power Enhanced leasing opportunities Opportunity for capital recycling into higher quality assets Improved cost of capital due to balance sheet strength and improved growth profile Potential interest rate savings in near-term Source: Green Street Advisors Annual cost savings

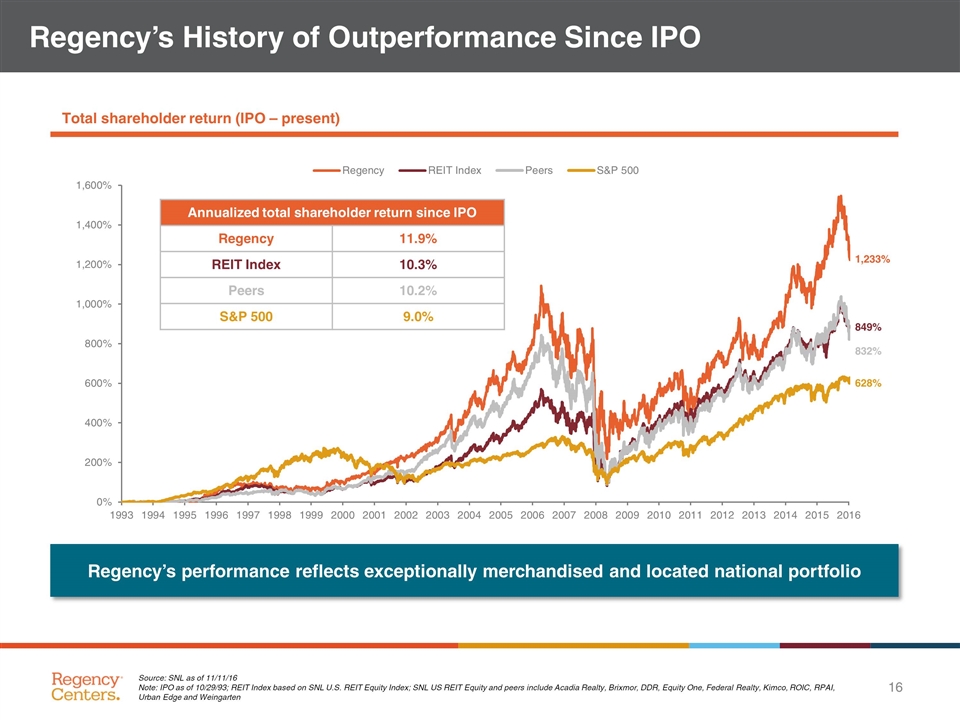

Regency’s History of Outperformance Since IPO Total shareholder return (IPO – present) Source: SNL as of 11/11/16 Note: IPO as of 10/29/93; REIT Index based on SNL U.S. REIT Equity Index; SNL US REIT Equity and peers include Acadia Realty, Brixmor, DDR, Equity One, Federal Realty, Kimco, ROIC, RPAI, Urban Edge and Weingarten Regency’s performance reflects exceptionally merchandised and located national portfolio Annualized total shareholder return since IPO Regency 11.9% REIT Index 10.3% Peers 10.2% S&P 500 9.0%

Strong Leadership Continuity and Best-In-Class Governance Cycle-tested leadership team Best-in-class governance practices 40 40 Martin E. “Hap” Stein, Jr. Chairman and Chief Executive Officer Lisa Palmer President and Chief Financial Officer Mac Chandler Executive Vice President, Development Jim Thompson Executive Vice President, Operations 20 20 17 25 35 35 Regency Peers ~ Non-staggered board ü ü High independent board composition ü û Shareholder access to proxy ü ü No current shareholder rights plan ü ~ Majority voting ü Years of experience Regency Industry Source: Green Street Advisors Note: Peers include Acadia Realty, Brixmor, DDR, Equity One, Federal Realty, Kimco, ROIC, RPAI, Urban Edge and Weingarten

Transaction Rationale and Benefits Unparalleled portfolio of high-quality centers, primarily grocery-anchored, located in dense in-fill and affluent trade areas with superior growth prospects Best-in-class capabilities position New Regency to harvest value creation opportunities from development, redevelopment and asset management Powerful shopping center platform provides for sizeable scale benefits Positive financial impact while maintaining balance sheet strength and flexibility