Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mead Johnson Nutrition Co | form8-kxnovember152016.htm |

Kasper Jakobsen

President and CEO

Morgan Stanley Global

Consumer & Retail Conference

November 15, 2016

Safe Harbor Statement

2

Forward-Looking Statements

Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements

may be identified by the fact they use words such as “should,” “expect,” “anticipate,” “estimate,” “target,” “may,” “project,” “guidance,” “intend,” “plan,” “believe” and

other words and terms of similar meaning and expression. Such statements are likely to relate to, among other things, a discussion of goals, plans and projections

regarding financial position, results of operations, cash flows, market position, market growth and trends, product development, product approvals, sales efforts,

expenses, capital expenditures, performance or results of current and anticipated products and the outcome of contingencies such as legal proceedings and

financial results. Forward-looking statements can also be identified by the fact that they do not relate strictly to historical or current facts. Such forward-looking

statements are based on current expectations that involve inherent risks, uncertainties and assumptions that may cause actual results to differ materially from

expectations as of the date of this presentation. These risks include, but are not limited to: (1) the ability to sustain brand strength, particularly the Enfa family of

brands; (2) the effect on the company's reputation of real or perceived quality issues; (3) the effect of regulatory restrictions related to the company’s products; (4)

the adverse effect of commodity costs; (5) increased competition from branded, private label, store and economy-branded products; (6) the effect of an economic

downturn on consumers' purchasing behavior and customers' ability to pay for product; (7) inventory reductions by customers; (8) the adverse effect of changes in

foreign currency exchange rates; (9) the effect of changes in economic, political and social conditions in the markets where we operate; (10) changing consumer

preferences; (11) the possibility of changes in the Women, Infant and Children (WIC) program, or participation in WIC; (12) legislative, regulatory or judicial action

that may adversely affect the company's ability to advertise its products, maintain product margins, or negatively impact the company’s reputation or result in fines

or penalties that decrease earnings; and (13) the ability to develop and market new, innovative products. For additional information regarding these and other

factors, see the company’s filings with the United States Securities and Exchange Commission (the SEC), including its most recent Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q, which filings are available upon request from the SEC or at www.meadjohnson.com. The company cautions readers not to

place undue reliance on any forward-looking statements, which speak only as of the date made. The company undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information, future events or otherwise.

Factors Affecting Comparability – Non-GAAP Financial Measures

This presentation contains non-GAAP financial measures. The items included in GAAP measures, but excluded for the purpose of determining the non-GAAP

financial measures, include significant income/expenses not indicative of underlying operating results, including the related tax effect and, at times, the impact of

foreign exchange. The non-GAAP measures represent an indication of the company’s underlying operating results and are intended to enhance an investor’s

overall understanding of the company’s financial performance and ability to compare the company’s performance to that of its peer companies. In addition, this

information is among the primary indicators the company uses as a basis for evaluating company performance, setting incentive compensation targets and

planning and forecasting of future periods. This information is not intended to be considered in isolation or as a substitute for financial measures prepared in

accordance with GAAP.

For more information:

Kathy MacDonald, Vice President – Investor Relations, Mead Johnson Nutrition Company, 847-832-2182, kathy.macdonald@mjn.com

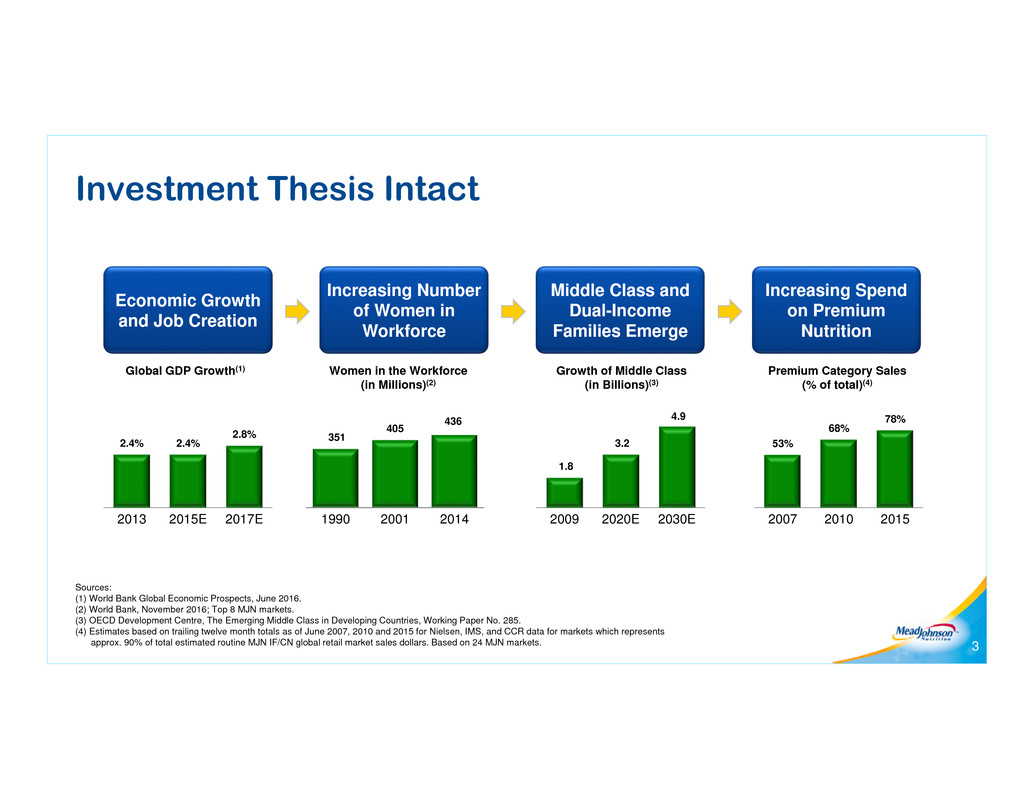

Investment Thesis Intact

3

2.4% 2.4%

2.8%

2013 2015E 2017E

Sources:

(1) World Bank Global Economic Prospects, June 2016.

(2) World Bank, November 2016; Top 8 MJN markets.

(3) OECD Development Centre, The Emerging Middle Class in Developing Countries, Working Paper No. 285.

(4) Estimates based on trailing twelve month totals as of June 2007, 2010 and 2015 for Nielsen, IMS, and CCR data for markets which represents

approx. 90% of total estimated routine MJN IF/CN global retail market sales dollars. Based on 24 MJN markets.

Global GDP Growth(1) Growth of Middle Class

(in Billions)(3)

Economic Growth

and Job Creation

Middle Class and

Dual-Income

Families Emerge

Increasing Spend

on Premium

Nutrition

1.8

3.2

4.9

2009 2020E 2030E

53%

68%

78%

2007 2010 2015

Premium Category Sales

(% of total)(4)

Women in the Workforce

(in Millions)(2)

Increasing Number

of Women in

Workforce

351

405

436

1990 2001 2014

Near-term Headwinds and Tailwinds

4

• Weak macroeconomic environment

• Hong Kong channel

• Mixed execution performance

– United States

– Philippines

• Well executed strategy yields results:

– China

– Mexico

– Canada

– Europe

ChallengesGood Progress

North America

and Europe

5

Despite Challenges, U.S. Market Remains Attractive

Infant Formula Value Share

34%

36%

38%

40%

42%

44%

6Source: Nielsen Total US XAOC, Infant includes routine and specialty products

• Strong competitive activity

• MJN execution lapses

• Addressing internal execution

• Increasing demand-generating

investments

• Recovery takes time—as we

acquire a new cohort of babies

Top Competitor

Enfamil

MJN Abbott Nestle

• In 2015, ~47% of babies in the U.S. benefited

from WIC; program participation is declining

• MJN is WIC segment leader

• Contracts for ~1/3 of WIC births up for bid in 2017

• Higher rebate levels in recently awarded contracts

Increasing Demand-Generating WIC* Investment

7

*WIC = Special Supplemental Nutrition Program for Women, Infants and Children

Source: CTS and CDC.gov and MJN company analysis as of November 2016.

In case of split Milk and Soy contracts, the map represents the Milk contract.

Benefit from Participating in WIC

• Full price sales from product purchased beyond

rebated volume

• WIC contracts boost presence in hospitals and

retailers

WIC Statistics

U.S. - Strong Brands and Competition

8

Invest to Drive

Market Share

Win with an Innovative

Portfolio

Drive Toddler

Growth

• Strong MJN Brand Equity

• Science-based brain benefit highly

compelling

• Inherent strong infrastructure

• Long history of market leadership

shifts

MJN’s Growth Ambition

9

Driving Success with High Value Offerings

* Source: Nielsen Infant Market Share (4 week value shares)

Market Share*

Focus on “winning in

allergy” in Western

Europe

Increasing diagnosis

of allergies

Build full portfolio in

Eastern Europe

EuropeCanada

10%

15%

20%

25%

30%

35%

40%

45%

Competitor 1

Competitor 2

China /

Hong Kong

10

China: Clear and Focused Strategy

11

Imported

Baby

Stores

B2C

Super

High

Premium

• Preferred country of origin

(e.g. the Netherlands)

• Strong brand equity

• Connection with Mothers

• Superior science

• Innovative packaging

• Preferred country of origin

(e.g. the Netherlands)

• Strength of product

portfolio

• Expanding coverage

• Building strong retailer

relationships

• Strength of product

portfolio

• Investment in growing

B2C e-commerce

• Advanced digital

capabilities

2014

Q4

2015

Q3

2016

Q1

2016

Q3

Industry Channels Shifting(1) Successful MJN Portfolio Transition(2)

(1) MJN analysis based on multiple sources.

(2) MJN mainland China sales.

China Evolving Channels

12

45%

Imported

Local

28%

60%

5%

Modern

Trade Hong Kong

e-Commerce

(includes

cross-border)

Baby Stores

Category

Growth

MJN

Market

Share

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

Recent HK Protests(2)

(1) MJN Hong Kong average offtake

(2) News article: Ming Pao Daily, Hong Kong, Nov 7, 2016

Hong Kong Channel Expected to Diminish

13

MJN Offtake: Shift to e-commerce(1)

• Expect fewer mainland visitors

• Channel shift to e-commerce

• Regulatory changes and unrest

Online

Offline

14

Growing Baby Store & B2C Presence

MJN analysis based on multiple sources.

2015 YTD Sept 2016 YTD Sept

Market Share

+ 1 point

May 2016 Jun 2016 Jul 2016 Aug 2016 Sep 2016

(Enfinitas)

Retail Offtake

B2C Market Share Growth

(1) Guidance provided in the company’s earnings release on October 27, 2016.

(2) The company is unable to reconcile 2017 non-GAAP expectations to GAAP because the following factors are not yet determinable: foreign exchange, mark-to-market pension adjustments and

restructuring charges.

Strategic Roadmap

15

• Operating expense reductions to support

investment

• Building capabilities needed for the future

• Enhancing China product portfolio

• Contribution from new

growth initiatives

• Emerging Markets

expected to stabilize

• China Portfolio and

Channel transition

completed and regulatory

environment rebalances

• Emerging market growth

expected to normalize

• Full effect of strategy and

mitigation plans

Transition Building Growth Momentum

Drive Profitable

Growth

2017 2018 & Beyond2016

2016(1) 2017(2)

Reiterate guidance

communicated on October

27, 2016

• Only modest constant dollar sales

and EPS improvement

• Expect constant dollar sales and

EPS above 2016 levels

Key Takeaways

16

• Strategy Remains Compelling

• Continue to Invest in Our Future

• Disciplined Approach to Cost Management

• Creating a Stronger and More Agile Company

• Commitment to Shareholder Value Creation