Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - MOOG INC. | exhibit312nov14w_conformed.htm |

| EX-32.1 - EXHIBIT 32.1 - MOOG INC. | exhibit321nov14w_conformed.htm |

| EX-31.1 - EXHIBIT 31.1 - MOOG INC. | exhibit311nov14w_conformed.htm |

| EX-23 - EXHIBIT 23 - MOOG INC. | exhibit23-consentofindepen.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 1, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to Commission file number 1-05129

Inc.

Inc.(Exact Name of Registrant as Specified in its Charter)

New York | 16-0757636 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

East Aurora, New York | 14052-0018 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (716) 652-2000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Class A Common Stock, $1.00 Par Value | New York Stock Exchange | |

Class B Common Stock, $1.00 Par Value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T

(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.ý

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No ý

The aggregate market value of the common stock outstanding and held by non-affiliates (as defined in Rule 405 under the Securities Act of 1933) of the registrant, based upon the closing sale price of the common stock on the New York Stock Exchange on April 2, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $1,462 million.

The number of shares of common stock outstanding as of the close of business on November 8, 2016 was: Class A 32,144,998 Class B 3,717,259.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Moog Inc. Proxy Statement for the Annual Meeting of Shareholders to be held on February 15, 2017 (“2016 Proxy”) are incorporated by reference into Part III of this Form 10-K.

2

Inc.

Inc.FORM 10-K INDEX

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

3

Disclosure Regarding Forward-Looking Statements

Information included or incorporated by reference in this report that does not consist of historical facts, including statements accompanied by or containing words such as “may,” “will,” “should,” “believes,” “expects,” “expected,” “intends,” “plans,” “projects,” “approximate,” “estimates,” “predicts,” “potential,” “outlook,” “forecast,” “anticipates,” “presume” and “assume,” are forward-looking statements. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and are subject to several factors, risks and uncertainties, the impact or occurrence of which could cause actual results to differ materially from the expected results described in the forward-looking statements. Certain of these factors, risks and uncertainties are discussed in the sections of this report entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” New factors, risks and uncertainties may emerge from time to time that may affect the forward-looking statements made herein. Given these factors, risks and uncertainties, investors should not place undue reliance on forward-looking statements as predictive of future results. We disclaim any obligation to update the forward-looking statements made in this report.

4

PART I

The Registrant, Moog Inc., a New York corporation formed in 1951, is referred to in this report as “Moog” or in the nominative “we” or the possessive “our.”

Unless otherwise noted or the context otherwise requires, all references to years in this report are to fiscal years.

Item 1. | Business. | |

Description of the Business. Moog is a worldwide designer, manufacturer and systems integrator of high performance precision motion and fluid controls and controls systems for a broad range of applications in aerospace and defense and industrial markets. We have four operating segments: Aircraft Controls, Space and Defense Controls, Industrial Systems and Components.

Additional information describing the business and comparative segment revenues, operating profits and related financial information for 2016, 2015 and 2014 are provided in Note 17 of Item 8, Financial Statements and Supplementary Data of this report.

Distribution. Our sales and marketing organization consists of individuals possessing highly specialized technical expertise. This expertise is required in order to effectively evaluate a customer’s precision control requirements and to facilitate communication between the customer and our engineering staff. Our sales staff is the primary contact with customers. Manufacturers’ representatives are used to cover certain domestic aerospace markets. Distributors are used selectively to cover certain industrial and medical markets.

Industry and Competitive Conditions. We experience considerable competition in our aerospace and defense and industrial markets. We believe that the principal points of competition in our markets are product quality, reliability, price, design and engineering capabilities, product development, conformity to customer specifications, timeliness of delivery, effectiveness of the distribution organization and quality of support after the sale. We believe we compete effectively on all of these bases. Competitors in our four operating segments include:

• | Aircraft Controls: Curtiss-Wright, Liebherr, Nabtesco, Parker Hannifin, UTC (Goodrich, Hamilton Sundstrand) and Woodward. |

• | Space and Defense Controls: Aeroflex, Airbus, ATA Engineering, BAE, Chess Dynamics, Cohu, Curtiss-Wright, ESW, Flowserve Limitorque, Honeywell, Marotta, RUAG, Lord Corp., Pelco, SABCA, Sargent Aerospace & Defense, SEAKR, Sierra Nevada Corp., Southwest Research Institute, UTC, Vacco, Valcor, Videotec, ValveTech and Woodward. |

• | Industrial Systems: Allen-Bradley, Bosch Rexroth, Danaher, DEIF Wind Power, KEB, MTS Systems Corp., Parker Hannifin, Siemens and SSB Wind Systems. |

• | Components: Allied Motion Technologies, Ametek, Cobham, CME Medical, General Dynamics Mission Systems, Kearfott, Kollmorgen, Medtronic, Pfizer, Schleifring, Smiths Medical, Stemmann, Woodward and Whippany Actuation Systems. |

Government Contracts. All U.S. Government contracts are subject to termination by the U.S. Government. In 2016, sales under U.S. Government contracts represented 30% of total sales and were primarily within our Aircraft Controls, Space and Defense Controls and Components segments.

Backlog. Our twelve-month backlog represents confirmed orders we believe will be recognized as revenue within the next twelve months. As noted in Item 6, Selected Financial Data of this report, as of October 1, 2016, our twelve-month backlog was $1.2 billion, a decline of 4% compared to October 3, 2015. See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this report for a discussion on the various business drivers and conditions contributing to the twelve-month backlog change.

Raw Materials. Materials, supplies and components are purchased from numerous suppliers. We believe the loss of any one supplier, although potentially disruptive in the short-term, would not materially affect our operations in the long-term.

Working Capital. See the discussion on operating cycle in Note 1 of Item 8, Financial Statements and Supplementary Data of this report.

Seasonality. Our business is generally not seasonal; however, certain products and systems, such as those in the energy market of our Industrial Systems segment, do experience seasonal variations in sales levels.

5

Patents. We maintain a patent portfolio of issued or pending patents and patent applications worldwide that generally includes the U.S., Europe, China, Japan and India. The portfolio includes patents that relate to electrohydraulic, electromechanical, electronics, hydraulics, components and methods of operation and manufacture as related to motion control and actuation systems. The portfolio also includes patents related to wind turbines, robotics, surveillance/security, vibration control and medical devices. We do not consider any one or more of these patents or patent applications to be material in relation to our business as a whole. The patent portfolio related to certain medical devices is significant to our position in this market as several of these products work exclusively together, and provide us future revenue opportunities.

Research Activities. Research and development activity has been, and continues to be, significant for us. Research and development expense was at least $130 million in each of the last three years and represented over 6% of sales in 2016.

Employees. On October 1, 2016, we employed 10,497 full-time employees.

Customers. Our principal customers are Original Equipment Manufacturers, or OEMs, and end users for whom we provide aftermarket support. Aerospace and defense OEM customers collectively represented 52% of 2016 sales. The majority of these sales are to a small number of large companies. Due to the long-term nature of many of the programs, many of our relationships with aerospace and defense OEM customers are based on long-term agreements. Our industrial OEM sales, which represented 31% of 2016 sales, are to a wide range of global customers and are normally based on lead times of 90 days or less. We also provide aftermarket support, consisting of spare and replacement parts and repair and overhaul services, for all of our products. Our major aftermarket customers are the U.S. Government and commercial airlines. In 2016, aftermarket sales accounted for 17% of total sales.

Significant customers in our four operating segments include:

• | Aircraft Controls: Boeing, Airbus, Lockheed Martin, Japan Aerospace, United Technologies, Honeywell, Goodrich, Gulfstream, Bombardier, Embraer and the U.S. Government. |

• | Space and Defense Controls: Lockheed Martin, Raytheon, Aerojet Rocketdyne, Boeing, Airbus, General Dynamics, Orbital ATK, United Launch Alliance, Northrup Grumman and the U.S. Government. |

• | Industrial Systems: CAE, Alstom, FlightSafety, Senvion, Rockwell Automation, Japan Aerospace, Arburg, Schuler, Husky Energy and Doosan. |

• | Components: Philips Healthcare, Northrup Grumman, Nestle, Raytheon, Lockheed Martin, Nutricia, Turbo Chef Technologies, MacArtney, Boeing, General Dynamics and the U.S. Government. |

International Operations. Our operations outside the United States are conducted through wholly-owned foreign subsidiaries and are located predominantly in Europe and the Asia-Pacific region. See Note 17 of Item 8, Financial Statements and Supplementary Data of this report for information regarding sales by geographic area and Exhibit 21 of Item 15, Exhibits and Financial Statement Schedules of this report for a list of subsidiaries. Our international operations are subject to the usual risks inherent in international trade, including currency fluctuations, local government contracting regulations, local governmental restrictions on foreign investment and repatriation of profits, exchange controls, regulation of the import and distribution of foreign goods, as well as changing economic and social conditions in countries in which our operations are conducted.

Environmental Matters. See the discussion in Note 18 of Item 8, Financial Statements and Supplementary Data of this report.

Website Access to Information. Our internet address is www.moog.com. We make our annual reports on Form 10‑K, quarterly reports on Form 10-Q, current reports on Form 8-K and, if applicable, amendments to those reports, available on the investor relations portion of our website. The reports are free of charge and are available as soon as reasonably practicable after they are filed with the Securities and Exchange Commission. We have posted our corporate governance guidelines, Board committee charters and code of ethics to the investor relations portion of our website. This information is available in print to any shareholder upon request. All requests for these documents should be made to Moog’s Manager of Investor Relations by calling 716-687-4225.

6

Executive Officers of the Registrant. Other than the changes noted below, the principal occupations of our executive officers for the past five years have been their employment with us in the same positions they currently hold.

On August 11, 2015, Maureen M. Athoe was named Vice President and President, Space and Defense Group. Previously, she was a Group Vice President, Group General Manager and Site Manager.

On August 11, 2015, R. Eric Burghardt was named Vice President and President, Aircraft Group. Previously, he was a Group Vice President and Financial Director.

On August 11, 2015, Mark J. Trabert was named Vice President and President, Aircraft Group. Previously, he was a Group Vice President and Deputy General Manager.

On September 1, 2012, Patrick J. Roche was named Vice President. Previously, he was a Group Vice President and General Manager of the Moog Ireland operation.

Executive Officers | Age | Year First Elected Officer | ||

John R. Scannell | ||||

Chairman of the Board; Chief Executive Officer | ||||

Director | 53 | 2006 | ||

Richard A. Aubrecht | ||||

Vice Chairman of the Board; Vice President - Strategy and Technology; | ||||

Director | 72 | 1980 | ||

Donald R. Fishback | ||||

Director; Vice President; Chief Financial Officer | 60 | 1985 | ||

Lawrence J. Ball | ||||

Vice President | 62 | 2004 | ||

Harald E. Seiffer | ||||

Vice President | 57 | 2005 | ||

Gary A. Szakmary | ||||

Vice President | 65 | 2011 | ||

Patrick J. Roche | ||||

Vice President | 53 | 2012 | ||

Maureen M. Athoe | ||||

Vice President | 58 | 2015 | ||

R. Eric Burghardt | ||||

Vice President | 57 | 2015 | ||

Mark J. Trabert | ||||

Vice President | 57 | 2015 | ||

Jennifer Walter | ||||

Controller; Principal Accounting Officer | 45 | 2008 | ||

Timothy P. Balkin | ||||

Treasurer; Assistant Secretary | 57 | 2000 | ||

In addition to the executive officers noted above, Robert J. Olivieri, 66, was elected Secretary in 2014. Mr. Olivieri's principal occupation is partner in the law firm of Hodgson Russ LLP.

7

Item 1A. | Risk Factors. | |

The markets we serve are cyclical and sensitive to domestic and foreign economic conditions and events, which may cause our operating results to fluctuate. The markets we serve are sensitive to fluctuations in general business cycles as well as domestic and foreign economic conditions and events. For example, our defense programs are largely contingent on U.S. Department of Defense funding. In addition, our space programs rely on the same governmental funding as well as investment for commercial and exploration activities. Our aerospace programs are dependent on the highly cyclical commercial airline industry, driven by fuel price increases, demand for travel and economic conditions. Demand for our industrial products is dependent upon several factors, including capital investment, product innovations, economic growth, the price of oil and natural gas, cost-reduction efforts and technology upgrades. Our sales and operating profit have been affected by the continued low rates of recovery in the economies in which we conduct business. If these economic conditions continue or deteriorate, our operations could be negatively impacted through declines in our sales, profitability and cash flows due to lower orders, payment delays and price pressures for our products.

We operate in highly competitive markets with competitors who may have greater resources than we possess. Many of our products are sold in highly competitive markets. Some of our competitors, especially in our industrial markets and medical markets, are larger, more diversified and have greater financial, marketing, production and research and development resources. As a result, they may be better able to withstand the effects of periodic economic downturns. Our sales and operating margins will be negatively impacted if our competitors:

• | develop products that are superior to our products, |

• | develop products of comparable quality and performance that are more competitively priced than our products, |

• | develop methods of more efficiently and effectively providing products and services, or |

• | adapt more quickly than we do to new technologies or evolving customer requirements. |

We believe that the principal points of competition in our markets are product quality, reliability, price, design and engineering capabilities, product development, conformity to customer specifications, timeliness of delivery, effectiveness of the distribution organization and quality of support after the sale. Maintaining or improving our competitive position requires continued investment in manufacturing, engineering, quality standards, marketing, customer service and support and our distribution networks. If we do not maintain sufficient resources to make these investments or are not successful in maintaining our competitive position, we could face pricing pressures or loss in market share, causing our operations and financial performance to suffer.

We depend heavily on government contracts that may not be fully funded or may be terminated, and the failure to receive funding or the termination of one or more of these contracts could reduce our sales and increase our costs. Sales to the U.S. Government and its prime contractors and subcontractors represent a significant portion of our business. In 2016, sales under U.S. Government contracts represented 30% of our total sales, primarily within Aircraft Controls, Space and Defense Controls and Components. Sales to foreign governments represented 7% of our total sales. Funding for government programs can be structured into a series of individual contracts and depend on annual congressional appropriations, which are subject to change. Additionally, the 2011 Budget Control Act reduced the Department of Defense spending (or sequestration) by approximately $500 billion over the next decade. The Bipartisan Budget Act of 2013 and the Bipartisan Budget Act of 2015 provided stability and modest growth in the Department of Defense spending through 2017. However, future budgets beyond 2017 are uncertain with respect to the overall levels of defense spending. As a result of this uncertainty, we expect we will continue to face significant challenges over the next decade. Any reduction in future Department of Defense spending levels could adversely impact our sales, operating profit and our cash flow. We have resources applied to specific government contracts and if any of those contracts are rescheduled or terminated, we may incur substantial costs redeploying those resources.

8

We make estimates in accounting for long-term contracts, and changes in these estimates may have significant impacts on our earnings. We have long-term contracts with some of our customers. These contracts are predominantly within Aircraft Controls and Space and Defense Controls. Revenue representing 34% of 2016 sales was accounted for using the percentage of completion, cost-to-cost method of accounting. Under this method, we recognize revenue as work progresses toward completion as determined by the ratio of cumulative costs incurred to date to estimated total contract costs at completion, multiplied by the total estimated contract revenue, less cumulative revenue recognized in prior periods. Changes in these required estimates could have a material adverse effect on sales and profits. Any adjustments are recognized in the period in which the change becomes known using the cumulative catch-up method of accounting. For contracts with anticipated losses at completion, we establish a provision for the entire amount of the estimated remaining loss and charge it against income in the period in which the loss becomes known. Amounts representing performance incentives, penalties, contract claims or impacts of scope change negotiations are considered in estimating revenues, costs and profits when they can be reliably estimated and realization is considered probable. Due to the substantial judgments involved with this process, our actual results could differ materially or could be settled unfavorably from our estimates.

We enter into fixed-price contracts, which could subject us to losses if we have cost overruns. In 2016, fixed-price contracts represented 94% of our sales that were accounted for using the percentage of completion, cost-to-cost method of accounting. On fixed-price contracts, we agree to perform the scope of work specified in the contract for a predetermined price. Depending on the fixed price negotiated, these contracts may provide us with an opportunity to achieve higher profits based on the relationship between our total contract costs and the contract's fixed price. However, we bear the risk that increased or unexpected costs may reduce our profit or cause us to incur a loss on the contract, which would reduce our net earnings. Loss reserves are most commonly associated with fixed-price contracts that involve the design and development of new and unique controls or control systems to meet the customer's specifications.

We may not realize the full amounts reflected in our backlog as revenue, which could adversely affect our future revenue and growth prospects. As of October 1, 2016, our twelve-month backlog was $1.2 billion, which represents confirmed orders we believe will be recognized as revenue within the next twelve months. There is no assurance that our customers will purchase all the orders represented in our backlog, due in part to the U.S. Government's ability not to exercise contract options or to modify, curtail or terminate major programs. Due to the uncertain nature of our contracts with the U.S. Government, we may never realize revenue from some of the orders that are included in our backlog. A portion of our backlog also relates to commercial aircraft programs. If there are entry into service delays or lower than anticipated deliveries due to production issues, we may never realize the full amounts included in our backlog. If this occurs, our future revenue and growth prospects may be adversely affected.

If our subcontractors or suppliers fail to perform their contractual obligations, our prime contract performance and our ability to obtain future business could be materially and adversely impacted. We rely on subcontracts with other companies to perform a portion of the service we provide to our customers on many of our contracts. There is a risk that we may have disputes with our subcontractors, including disputes regarding the quality and timeliness of work performed by the subcontractor, customer concerns about the subcontractor, our failure to extend existing task orders or issue new task orders under a subcontract or our hiring of personnel of a subcontractor. Failure by our subcontractors to satisfactorily provide on a timely basis the agreed-upon supplies or perform the agreed-upon services may materially and adversely impact our ability to perform our obligations as the prime contractor. Subcontractor performance deficiencies could result in a customer terminating our contract for default. A default termination could expose us to liability and substantially impair our ability to compete for future contracts and orders. In addition, a delay or failure in our ability to obtain components and equipment parts from our suppliers may adversely affect our ability to perform our obligations to our customers.

Contracting on government programs is subject to significant regulation, including rules related to bidding, billing and accounting kickbacks and false claims, and any non-compliance could subject us to fines and penalties or possible debarment. Like all government contractors, we are subject to risks associated with this contracting, including substantial civil and criminal fines and penalties. These fines and penalties could be imposed for failing to follow procurement integrity and bidding rules, employing improper billing practices or otherwise failing to follow cost accounting standards, receiving or paying kickbacks or filing false claims. We have been, and expect to continue to be, subjected to audits and investigations by U.S. and foreign government agencies and authorities. The failure to comply with the terms of our government contracts could harm our business reputation. It could also result in our progress payments being withheld or our suspension or debarment from future government contracts, which could have a material affect on our operational and financial results.

9

The loss of The Boeing Company as a customer or a significant reduction in sales to The Boeing Company could adversely impact our operating results. We provide The Boeing Company, or Boeing, with controls for both military and commercial applications, which, in total, were 14% of our 2016 sales. Sales to Boeing's commercial airplane group are generally made under a long-term supply agreement through 2021 for the Boeing 787 and through 2019 for other commercial airplanes. The loss of Boeing as a customer or a significant reduction in sales to Boeing could reduce our sales and earnings.

Our new product research and development efforts may not be successful which could reduce our sales and earnings. Technologies related to our products have undergone, and in the future may undergo, significant changes. We have incurred, and we expect to continue to incur, expenses associated with research and development activities and the introduction of new products in order to succeed in the future. Our technology has been developed through customer-funded and internally-funded research and development, as well as through business acquisitions. If we fail to predict customers' preferences or fail to provide viable technological solutions, we may experience difficulties that could delay or prevent the acceptance of new products or product enhancements. Also, the research and development expenses we incur may exceed our cost estimates and new products we develop may not generate sales sufficient to offset our costs. Additionally, our competitors may develop technologies and products that have more competitive advantages than ours and render our technology uncompetitive or obsolete.

Our inability to adequately enforce and protect our intellectual property or defend against assertions of infringement could prevent or restrict our ability to compete. In order to maintain a competitive advantage, we rely on internally developed and acquired patents, trademarks and proprietary knowledge and technologies. Our inability to defend against the unauthorized use of these rights and assets could have an adverse effect on our competitive position and on our results of operations and financial condition. Litigation may be necessary to protect our intellectual property rights or defend against claims of infringement. This litigation could result in significant costs and divert management's focus away from operations.

Our business operations may be adversely affected by information systems interruptions, intrusions or new software implementations. We are dependent on various information technologies throughout our company to administer, store and support multiple business activities. Disruptions, equipment failures or cybersecurity attacks, such as unauthorized access, malicious software and other intrusions, may lead to potential data corruption and exposure of proprietary and confidential information. Any intrusion may cause operational stoppages, diminished competitive advantages through reputational damages and increased operational costs. In addition, we are in the early stages of a multi-year business information system transformation and standardization project. This endeavor will occupy additional resources, diverting attention from other operational activities, and may cause our information systems to perform unexpectedly. While we expect to invest significant resources throughout the planning and project management process, unanticipated delays could occur.

Our indebtedness and restrictive covenants under our credit facilities could limit our operational and financial flexibility. We have incurred significant indebtedness, and may incur additional debt for acquisitions, operations, research and development and capital expenditures. Our ability to make interest and scheduled principal payments and meet restrictive covenants could be adversely impacted by changes in the availability, terms and cost of capital, changes in interest rates or changes in our credit ratings or our outlook. These changes could increase our cost of business, limiting our ability to pursue acquisition opportunities, react to market conditions and meet operational and capital needs, thereby placing us at a competitive disadvantage.

Significant changes in discount rates, rates of return on pension assets, mortality tables and other factors could adversely affect our earnings and equity and increase our pension funding requirements. Pension costs and obligations are determined using actual results as well as actuarial valuations that involve several assumptions. The most critical assumptions are the discount rate, the long-term expected return on assets and mortality tables. Other assumptions include salary increases and retirement age. Some of these assumptions, such as the discount rate and return on pension assets, are reflective of economic conditions and largely out of our control. Changes in the pension assumptions could adversely affect our earnings, equity and funding requirements.

10

A write-off of all or part of our goodwill or other intangible assets could adversely affect our operating results and net worth. Goodwill and other intangible assets are a substantial portion of our assets. At October 1, 2016, goodwill was $740 million and other intangible assets were $114 million of our total assets of $3.0 billion. Our goodwill and other intangible assets may increase in the future since our growth strategy includes acquisitions. However, we may have to write off all or part of our goodwill or other intangible assets if their value becomes impaired. Although this write-off would be a non-cash charge, it could reduce our earnings and net worth significantly. Among other adverse impacts, this could result in our inability to refinance or renegotiate the terms of our bank indebtedness. In 2016, we took a $5 million goodwill impairment charge for a reporting unit within our Space and Defense Controls Segment.

Our sales and earnings may be affected if we cannot identify, acquire or integrate strategic acquisitions, or if we engage in divesting activities. Acquisitions are a key part of our growth strategy. Our historical growth has depended, and our future growth is likely to depend, in part, on our ability to successfully identify, acquire and integrate acquired businesses. We intend to continue to seek additional acquisition opportunities, both to expand into new markets and to enhance our position in existing markets throughout the world. Growth by acquisition involves risk that could adversely affect our financial condition and operating results. We may not know the potential exposure to unanticipated liabilities. Additionally, the expected benefits or synergies might not be fully realized, integrating operations and personnel may be slowed and key employees, suppliers or customers of the acquired business may depart. We may also continue to engage in divesting activities if we deem the operations as non-strategic or underperforming. Divestitures could adversely affect our profitability and, under certain circumstances, require us to record impairment charges or a loss as a result of a transaction. In pursuing acquisition opportunities, integrating acquired businesses, or divesting business operations, management's time and attention may be diverted from our core business, while consuming resources and incurring expenses for these activities.

Our operations in foreign countries expose us to political and currency risks and adverse changes in local legal and regulatory environments. We have significant manufacturing and sales operations in foreign countries. In addition, our domestic operations sell to foreign customers. In 2016, 44% of our net sales were to customers outside of the United States. Our financial results may be adversely affected by fluctuations in foreign currencies and by the translation of the financial statements of our foreign subsidiaries from local currencies into U.S. dollars. We expect international operations and export sales to contribute to our earnings for the foreseeable future. Both the sales from international operations and export sales are subject in varying degrees to risks inherent in doing business outside of the United States. Such risks include the possibility of unfavorable circumstances arising from host country laws or regulations, changes in tariff and trade barriers and import or export licensing requirements. In addition, any local or global health issue or uncertain political climates, international hostilities, natural disasters, or any other terrorist activities could adversely affect customer demand, our operations and our ability to source and deliver products and services to our customers.

Unforeseen exposure to additional income tax liabilities may affect our operating results. Our distribution of taxable income is subject to domestic and, as a result of our significant manufacturing and sales presence in foreign countries, foreign tax jurisdictions. Our effective tax rate and earnings may be affected by shifts in our mix of earnings in countries with varying statutory tax rates, changes in reinvested foreign earnings, changes in the valuation of deferred tax assets, alterations to tax regulations or interpretations and outcomes of any audits performed on previous tax returns.

11

Government regulations could limit our ability to sell our products outside the United States and otherwise adversely affect our business. In 2016, approximately 19% of our sales were subject to compliance with the United States export regulations. Our failure to obtain, or fully adhere to the limitations contained in the requisite licenses, meet registration standards or comply with other government export regulations would hinder our ability to generate revenues from the sale of our products outside the United States. The absence of comparable restrictions on competitors in other countries may adversely affect our competitive position. In order to sell our products in European Union countries, we must satisfy certain technical requirements. If we are unable to comply with those requirements with respect to a significant quantity of our products, our sales in Europe would be restricted. Doing business internationally also subjects us to numerous U.S. and foreign laws and regulations, including regulations relating to import-export control, technology transfer restrictions, foreign corrupt practices and anti-boycott provisions. From time to time, we may file voluntary disclosure reports with the U.S. Department of State and the Department of Commerce regarding certain violations of U.S. export laws and regulations discovered by us in the course of our business activities, employee training or internal reviews and audits. To date, our voluntary disclosures have not resulted in a fine, penalty, or export privilege denial or restriction that has had a material adverse impact on our financial condition or ability to export. Our failure, or failure by an authorized agent or representative that is attributable to us, to comply with these laws and regulations could result in administrative, civil or criminal liabilities. In the extreme case, these failures could result in financial penalties, suspension or debarment from government contracts or suspension of our export privileges, which could have a material adverse effect on us.

Governmental regulations and customer demands related to conflict minerals may adversely impact our operating results. Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, required the Securities and Exchange Commission to establish disclosure requirements for publicly-traded companies whose products contain metals derived from conflict minerals originating from the Democratic Republic of Congo (DRC) and its neighboring countries. The implementation of these requirements could result in additional costs associated with complying with the disclosure requirements. As this regulation will likely impact our suppliers, the availability of raw materials used in our operations could be negatively impacted, including an increase in the price of raw materials. In addition, because our global supply chain is complex, we may face commercial challenges if we are unable to sufficiently verify the origins for all metals used in our products through the due diligence procedures that we have implemented. We have, and will continue to, work with our suppliers and customers to exclude, to the extent feasible, from our product supply chain the use of conflict minerals originating from the DRC or adjoining countries.

The failure or misuse of our products may damage our reputation, necessitate a product recall or result in claims against us that exceed our insurance coverage, thereby requiring us to pay significant damages. Defects in the design and manufacture of our products may necessitate a product recall. We include complex system designs and components in our products that could contain errors or defects, particularly when we incorporate new technologies into our products. If any of our products are defective, we could be required to redesign or recall those products, pay substantial damages or warranty claims and face actions by regulatory bodies and government authorities. Such an event could result in significant expenses, disrupt sales, affect our reputation and that of our products and cause us to withdraw from certain markets. We are also exposed to product liability claims. Many of our products are used in applications where their failure or misuse could result in significant property loss and serious personal injury or death. We carry product liability insurance consistent with industry norms. However, these insurance coverages may not be sufficient to fully cover the payment of any potential claim. A product recall or a product liability claim not covered by insurance could have a material adverse effect on our business, financial condition and results of operations.

We are involved in various legal proceedings, the outcome of which may be unfavorable to us. Our business may be adversely impacted by the outcome of legal proceedings and other contingencies that cannot be predicted with certainty. We estimate loss contingencies and establish reserves based on our assessment where liability is deemed probable and reasonably estimable given the facts and circumstances known to us at a particular point in time. Subsequent developments may affect our assessment and estimates of the loss contingencies recorded as liabilities.

12

Future terror attacks, war, natural disasters or other catastrophic events beyond our control could negatively impact our business. Terror attacks, war or other civil disturbances, natural disasters and other catastrophic events could lead to economic instability and decreased demand for commercial products, which could negatively impact our business, financial condition, results of operations and cash flows. From time to time, terrorist attacks worldwide have caused instability in global financial markets and the aviation industry. In 2016, 24% of our net sales were in the commercial aircraft market. Also, our facilities and suppliers are located throughout the world and could be subject to damage from fires, floods, earthquakes or other natural or man-made disasters. Although we carry third party property insurance covering these and other risks, our inability to meet customers' schedules as a result of a catastrophe may result in the loss of customers or significantly increase costs, including penalty claims under customer contracts.

Our operations are subject to environmental laws, and complying with those laws may cause us to incur significant costs. Our operations and facilities are subject to numerous stringent environmental laws and regulations. Although we believe that we are in material compliance with these laws and regulations, future changes in these laws, regulations or interpretations of them, or changes in the nature of our operations may require us to make significant capital expenditures to ensure compliance. We have been and are currently involved in environmental remediation activities. The cost of these activities may become significant depending on the discovery of additional environmental exposures at sites that we currently own or operate, at sites that we formerly owned or operated, or at sites to which we have sent hazardous substances or wastes for treatment, recycling or disposal.

13

Item 1B. | Unresolved Staff Comments. | |

None.

Item 2. | Properties. | |

On October 1, 2016, we occupied 5,181,000 square feet of space, distributed by segment as follows:

Square Feet | |||||||||

Owned | Leased | Total | |||||||

Aircraft Controls | 1,431,000 | 422,000 | 1,853,000 | ||||||

Space and Defense Controls | 486,000 | 446,000 | 932,000 | ||||||

Industrial Systems | 737,000 | 535,000 | 1,272,000 | ||||||

Components | 835,000 | 267,000 | 1,102,000 | ||||||

Corporate Headquarters | 20,000 | 2,000 | 22,000 | ||||||

Total | 3,509,000 | 1,672,000 | 5,181,000 | ||||||

We have principal manufacturing facilities in the United States and countries throughout the world in the following locations:

• | Aircraft Controls - U.S., Philippines and United Kingdom. |

• | Space and Defense Controls - U.S., United Kingdom, Netherlands, Ireland and Germany. |

• | Industrial Systems - Germany, Italy, U.S., China, Netherlands, Luxembourg, Philippines, Japan, India, Ireland, Brazil and United Kingdom. |

• | Components - U.S., United Kingdom, Costa Rica, Canada and Lithuania. |

Our corporate headquarters is located in East Aurora, New York.

We believe that our properties have been adequately maintained and are generally in good condition. Operating leases for our properties expire at various times from 2017 through 2036. Upon the expiration of our current leases, we believe that we will be able to either secure renewal terms or enter into leases for alternative locations at market terms.

Item 3. | Legal Proceedings. | |

From time to time, we are involved in legal proceedings. We are not a party to any pending legal proceedings that management believes will result in a material adverse effect on our financial condition, results of operations or cash flows.

Item 4. | Mine Safety Disclosures. | |

Not applicable.

14

PART II

Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |

Our two classes of common shares, Class A common stock and Class B common stock, are traded on the New York Stock Exchange ("NYSE") under the ticker symbols MOG.A and MOG.B. The following chart sets forth, for the periods indicated, the high and low sales prices of the Class A common stock and Class B common stock on the NYSE.

Quarterly Stock Prices

Class A | Class B | |||||||||||||||

Fiscal Year Ended | High | Low | High | Low | ||||||||||||

October 1, 2016 | ||||||||||||||||

1st Quarter | $ | 67.92 | $ | 54.93 | $ | 67.46 | $ | 55.35 | ||||||||

2nd Quarter | 59.66 | 38.11 | 59.17 | 38.32 | ||||||||||||

3rd Quarter | 55.96 | 42.61 | 55.50 | 42.90 | ||||||||||||

4th Quarter | 61.64 | 50.96 | 61.24 | 51.11 | ||||||||||||

October 3, 2015 | ||||||||||||||||

1st Quarter | $ | 79.24 | $ | 65.80 | $ | 78.51 | $ | 66.60 | ||||||||

2nd Quarter | 77.28 | 68.07 | 76.77 | 69.23 | ||||||||||||

3rd Quarter | 75.69 | 65.72 | 75.26 | 66.11 | ||||||||||||

4th Quarter | 71.55 | 52.33 | 70.11 | 52.74 | ||||||||||||

The number of shareholders of record of Class A common stock and Class B common stock was 769 and 331, respectively, as of November 8, 2016.

We did not pay cash dividends on our Class A common stock or Class B common stock in 2015 or 2016 and have no current plans to do so.

15

The following table summarizes our purchases of our common stock for the quarter ended October 1, 2016.

Issuer Purchases of Equity Securities

Period | (a) Total Number of Shares Purchased (1)(2) | (b) Average Price Paid Per Share | (c) Total number of Shares Purchased as Part of Publicly Announced Plans or Programs (3) | (d) Maximum Number (or Approx. Dollar Value) of Shares that May Yet Be Purchased Under Plans or Programs (3) | ||||||||

July 3, 2016 - July 31, 2016 | 8,113 | $ | 55.47 | — | 3,352,009 | |||||||

August 1, 2016 - August 31, 2016 | 30,469 | 59.12 | — | 3,352,009 | ||||||||

September 1, 2016 - October 1, 2016 | 42,119 | 59.22 | — | 3,352,009 | ||||||||

Total | 80,701 | $ | 58.81 | — | 3,352,009 | |||||||

(1) | Reflects purchases by the Moog Inc. Stock Employee Compensation Trust Agreement ("SECT") of shares of Class B common stock from the Moog Inc. Retirement Savings Plan ("RSP") as follows: 8,113 shares at $55.47 per share during July; 16,402 shares at $60.11 per share during August; and 10,467 shares at $55.22 per share during September. Excluded above is the SECT purchase of 425,148 shares of Class A common stock from the RSP in exchange for an equivalent value of Class B common stock. |

(2) | In connection with the exercise of equity-based compensation awards, we accept delivery of shares to pay for the exercise price and withhold shares for tax withholding obligations. In August, we accepted delivery of 14,067 shares at $57.97 per share and in September, we accepted delivery of 31,652 shares at $60.55 per share, in connection with the exercise of equity-based awards. |

(3) | The Board of Directors has authorized a share repurchase program. This program has been amended from time to time to authorize additional repurchases up to an aggregate 13 million common shares. The program permits the purchase of shares of Class A or Class B common stock in open market or privately negotiated transactions at the discretion of management. |

16

Performance Graph

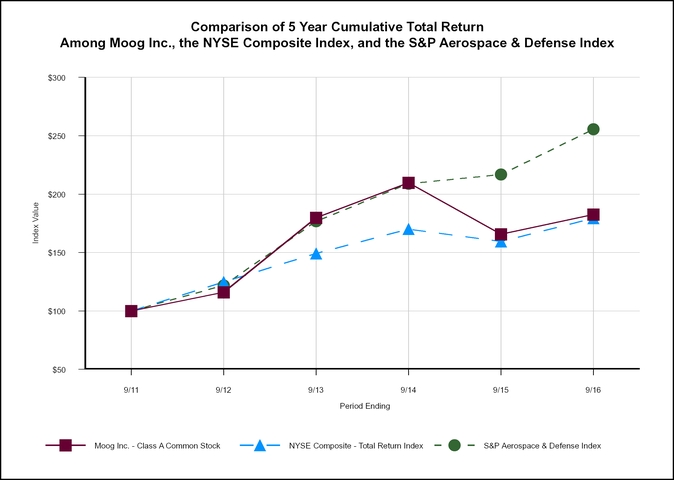

The following graph and tables show the performance of the Company's Class A common stock compared to the NYSE Composite-Total Return Index and the S&P Aerospace & Defense Index for a $100 investment made on September 30, 2011, including reinvestment of any dividends.

9/11 | 9/12 | 9/13 | 9/14 | 9/15 | 9/16 | |||||||||||||||||||

Moog Inc. - Class A Common Stock | $ | 100.00 | $ | 116.09 | $ | 179.86 | $ | 209.69 | $ | 165.76 | $ | 182.53 | ||||||||||||

NYSE Composite - Total Return Index | 100.00 | 124.79 | 149.27 | 170.05 | 159.55 | 179.25 | ||||||||||||||||||

S&P Aerospace & Defense Index | 100.00 | 121.88 | 176.78 | 208.93 | 216.77 | 255.50 | ||||||||||||||||||

17

Item 6. | Selected Financial Data. | |

For a more detailed discussion of 2014 through 2016, refer to Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this report and Item 8, Financial Statements and Supplementary Data of this report.

(dollars in thousands, except per share data) | 2016(1)(2)(3) | 2015(1) | 2014(1) | 2013(2)(3) | 2012(3) | ||||||||||

RESULTS FROM OPERATIONS | |||||||||||||||

Net sales | $ | 2,411,937 | $ | 2,525,532 | $ | 2,648,385 | $ | 2,610,311 | $ | 2,469,536 | |||||

Net earnings (4) | 126,745 | 131,883 | 158,198 | 120,497 | 152,462 | ||||||||||

Net earnings per share (4) | |||||||||||||||

Basic | $ | 3.49 | $ | 3.39 | $ | 3.57 | $ | 2.66 | $ | 3.37 | |||||

Diluted | $ | 3.47 | $ | 3.35 | $ | 3.52 | $ | 2.63 | $ | 3.33 | |||||

Weighted-average shares outstanding | |||||||||||||||

Basic | 36,277,445 | 38,945,880 | 44,362,412 | 45,335,336 | 45,246,960 | ||||||||||

Diluted | 36,529,344 | 39,334,520 | 44,952,437 | 45,823,720 | 45,718,324 | ||||||||||

FINANCIAL POSITION | |||||||||||||||

Cash and cash equivalents | $ | 325,128 | $ | 309,853 | $ | 231,292 | $ | 157,090 | $ | 148,841 | |||||

Working capital | 1,030,915 | 1,021,990 | 941,260 | 924,145 | 885,032 | ||||||||||

Total assets | 3,041,859 | 3,086,471 | 3,208,452 | 3,237,095 | 3,105,907 | ||||||||||

Indebtedness - total | 1,011,850 | 1,075,184 | 874,036 | 709,157 | 764,622 | ||||||||||

Shareholders’ equity | 988,411 | 994,532 | 1,347,415 | 1,535,765 | 1,304,790 | ||||||||||

Shareholders’ equity per common share outstanding | $ | 27.56 | $ | 27.09 | $ | 32.51 | $ | 33.86 | $ | 28.80 | |||||

SUPPLEMENTAL FINANCIAL DATA | |||||||||||||||

Capital expenditures | $ | 67,208 | $ | 80,693 | $ | 78,771 | $ | 93,174 | $ | 107,030 | |||||

Depreciation and amortization | 98,732 | 103,609 | 109,259 | 108,073 | 100,816 | ||||||||||

Research and development | 147,336 | 132,271 | 139,462 | 134,652 | 116,403 | ||||||||||

Twelve-month backlog (5) | 1,224,878 | 1,273,495 | 1,339,959 | 1,296,371 | 1,279,307 | ||||||||||

RATIOS | |||||||||||||||

Net return on sales | 5.3 | % | 5.2 | % | 6.0 | % | 4.6 | % | 6.2 | % | |||||

Return on shareholders’ equity | 12.6 | % | 11.3 | % | 10.4 | % | 8.6 | % | 12.1 | % | |||||

Current ratio | 2.7 | 2.7 | 2.3 | 2.3 | 2.3 | ||||||||||

Net debt to capitalization (6) | 41.0 | % | 43.5 | % | 32.3 | % | 26.4 | % | 32.1 | % | |||||

(1) | Includes the effects of our share repurchase program. See the Consolidated Statements of Shareholders' Equity and Consolidated Statements of Cash Flow at Item 8, Financial Statements and Supplementary Data of this report. |

(2) | Includes goodwill impairment charge. See Note 6 of the Consolidated Financial Statements at Item 8, Financial Statements and Supplementary Data of this report. |

(3) | Includes the effects of acquisitions. See Note 2 of the Consolidated Financial Statements at Item 8, Financial Statements and Supplementary Data of this report. In 2013, we acquired two businesses, one in our Space and Defense Controls segment and one in our Components segment. In 2012, we acquired four businesses, two each in our Components and Space and Defense Controls segments. |

(4) | Represents net earnings attributable to common shareholders and net earnings per share attributable to common shareholders. |

(5) | Twelve-month backlog is defined as confirmed orders we believe will be recognized as revenue within the next twelve months. |

(6) | Net debt is total debt less cash and cash equivalents. Capitalization is the sum of net debt and shareholders’ equity. |

18

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | |

OVERVIEW

We are a worldwide designer, manufacturer and systems integrator of high performance precision motion and fluid controls and control systems for a broad range of applications in aerospace and defense and industrial markets.

Within the aerospace and defense market, our products and systems include:

• | Defense market - primary and secondary flight controls for military aircraft, stabilization and automatic ammunition loading controls for armored combat vehicles, tactical and strategic missile steering controls and gun aiming controls. |

• | Commercial aircraft market - primary and secondary flight controls for commercial aircraft. |

• | Commercial space market - satellite positioning controls and thrust vector controls for space launch vehicles. |

In the industrial market, our products are used in a wide range of applications including:

• | Industrial automation market - injection molding, metal forming, heavy industry, material and automotive testing and pilot training simulators. |

• | Energy market - wind energy, power generation and oil and gas exploration. |

• | Medical market - enteral clinical nutrition and infusion therapy pumps, CT scanners and ultrasonic sensors and surgical handpieces. |

We operate under four segments, Aircraft Controls, Space and Defense Controls, Industrial Systems and Components. Our principal manufacturing facilities are located in the United States, United Kingdom, Philippines, Germany, Italy, Netherlands, China, Costa Rica, Japan, Luxembourg, India, Canada and Ireland.

We have long-term contracts with some of our customers. These contracts are predominantly within Aircraft Controls and Space and Defense Controls and represent 34%, 33% and 34% of our sales in 2016, 2015 and 2014, respectively. We recognize revenue on these contracts using the percentage of completion, cost-to-cost method of accounting as work progresses toward completion. The remainder of our sales are recognized when the risks and rewards of ownership and title to the product are transferred to the customer, principally as units are delivered or as service obligations are satisfied. This method of revenue recognition is predominantly used within the Industrial Systems and Components segments, as well as with aftermarket activity.

We concentrate on providing our customers with products designed and manufactured to the highest quality standards. Our products are applied in demanding applications, "When Performance Really Matters®." We believe we have achieved a leadership position in the high performance, precision controls market, by capitalizing on our strengths, which include:

• | superior technical competence in delivering mission-critical solutions, |

• | an innovative customer-intimacy approach, |

• | a diverse base of customers and end markets served by a broad product portfolio, and |

• | a well-established international presence serving customers worldwide. |

These strengths afford us the ability to innovate our current solutions into new, complimentary technologies. They also provide us the opportunity to expand our control product franchise from one market to another, organically growing us from a high-performance components supplier to a high-performance systems supplier. In addition, we will continue to strive to achieve substantial content positions on the platforms on which we currently participate, seeking to be the dominant supplier in the current niche markets we serve. We also look for innovation in all aspects of our business, employing new technologies to improve productivity and to develop innovative business models.

19

These activities will help us achieve our financial objectives of increasing our revenue base and improving our long term profitability and cash flow from operations. In doing so, we expect to maintain a balanced, diversified portfolio in terms of markets served, product applications, customer base and geographic presence. Our fundamental strategies to achieve our goals center around talent, lean and innovation and include:

• | maintaining our technological excellence by building upon our systems integration capabilities while solving our customers’ most demanding technical problems in applications "When Performance Really Matters®," |

• | utilizing our global capabilities and strong engineering heritage to innovate, |

• | maximizing customer value by implementing lean enterprise principles, and |

• | investing in talent development to strengthen our leadership capability and employee performance. |

We focus on improving shareholder value through strategic revenue growth, both acquired and organic, through improving operating efficiencies and manufacturing initiatives and through utilizing low cost manufacturing facilities without compromising quality. Additionally, we take a balanced approach to capital deployment, which may include strategic acquisitions or further share buyback activity in order to maximize shareholder returns over the long-term. We face numerous challenges to improving shareholder value. These include, but are not limited to, adjusting to dynamic global economic conditions that are influenced by governmental, industrial and commercial factors, pricing pressures from customers, strong competition, foreign currency fluctuations and increases in employee benefit costs. We may also engage in restructuring and divesting activities, including reducing overhead, consolidating facilities and exiting some product lines if we deem the operations as non-strategic or underperforming.

Financial Highlights

• | Net sales for fiscal 2016 decreased 4% to $2.4 billion, as sales were lower across all of our segments. |

• | Total operating profit decreased 3% to $238 million. |

• | Net earnings attributable to common shareholders decreased 4% to $127 million. |

• | We repurchased 1 million shares of common stock in 2016, lowering our average outstanding shares 7%. |

• | Diluted earnings per share increased 4% to $3.47. |

• | Strong cash from operating activities at $216 million, continuing the strong pattern of recent years. |

Acquisitions and Divestitures

All of our acquisitions are accounted for under the purchase method and, accordingly, the operating results for the acquired companies are included in the consolidated statements of earnings from the respective dates of acquisition. Under purchase accounting, we record assets and liabilities at fair value and such amounts are reflected in the respective captions on the consolidated balance sheets. The purchase price described for each acquisition below is net of any cash acquired, includes debt issued or assumed and the fair value of contingent consideration.

In 2016, we acquired a 70% ownership in Linear Mold and Engineering ("Linear"), a Livonia, Michigan-based company specializing in metal additive manufacturing that provides engineering, manufacturing and production consulting services to customers across a wide range of industries, including aerospace, defense, energy and industrial. We acquired our share in Linear Mold and Engineering for $23 million. The acquisition also includes a redeemable noncontrolling interest in the remaining 30%, which is exercisable beginning three years from the date of acquisition. This acquisition is included in our Space and Defense Controls segment.

We did not complete any acquisitions in 2014 or in 2015.

In 2015, we completed one divestiture in our Components segment. We sold our Rochester, New York and Erie, Pennsylvania life sciences operations for $3 million.

On November 3, 2016, we sold our Bradford Engineering B.V. operation located in the Netherlands for approximately $1 million in cash. This operation was included in our Space and Defense Controls segment. This transaction will be recorded in our financial statements in the first quarter of 2017. We are currently evaluating the financial statement impact, which potentially includes an income tax benefit associated with this transaction.

20

CRITICAL ACCOUNTING POLICIES

Our financial statements and accompanying notes are prepared in accordance with U.S. generally accepted accounting principles. The preparation of these consolidated financial statements requires us to make estimates, assumptions and judgments that affect the amounts reported. These estimates, assumptions and judgments are affected by our application of accounting policies, which are discussed in Note 1 of Item 8, Financial Statements and Supplementary Data of this report. We believe the accounting policies discussed below are the most critical in understanding and evaluating our financial results. These critical accounting policies have been reviewed with the Audit Committee of our Board of Directors.

Revenue Recognition on Long-Term Contracts

Revenue representing 34% of 2016 sales was accounted for using the percentage of completion, cost-to-cost method of accounting. This method of revenue recognition is predominantly used within the Aircraft Controls and Space and Defense Controls segments due to the contractual nature of the business activities, with the exception of their respective aftermarket activities. The contractual arrangements are either firm fixed-price or cost-plus contracts and are with the U.S. Government or its prime subcontractors, foreign governments or commercial aircraft manufacturers, including Boeing and Airbus. The nature of the contractual arrangements includes customers’ requirements for delivery of hardware as well as funded nonrecurring development work in anticipation of follow-on production orders.

We recognize revenue on contracts in the current period using the percentage of completion, cost-to-cost method of accounting as work progresses toward completion as determined by the ratio of cumulative costs incurred to date to estimated total contract costs at completion, multiplied by the total estimated contract revenue, less cumulative revenue recognized in prior periods. Changes in estimates affecting sales, costs and profits are recognized in the period in which the change becomes known using the cumulative catch-up method of accounting, resulting in the cumulative effect of changes reflected in the period. Estimates are reviewed and updated quarterly for substantially all contracts. A significant change in an estimate on one or more contracts could have a material effect on our results of operations.

Occasionally, it is appropriate to combine or segment contracts. Contracts are combined in those limited circumstances when they are negotiated as a package in the same economic environment with an overall profit margin objective and constitute, in essence, an agreement to do a single project. In such cases, we recognize revenue and costs over the performance period of the combined contracts as if they were one. Contracts are segmented in limited circumstances if the customer had the right to accept separate elements of the contract and the total amount of the proposals on the separate components approximated the amount of the proposal on the entire project. For segmented contracts, we recognize revenue and costs as if they were separate contracts over the performance periods of the individual elements or phases.

Contract costs include only allocable, allowable and reasonable costs which are included in cost of sales when incurred. For applicable U.S. Government contracts, contract costs are determined in accordance with the Federal Acquisition Regulations and the related Cost Accounting Standards. The nature of these costs includes development engineering costs and product manufacturing costs such as direct material, direct labor, other direct costs and indirect overhead costs. Contract profit is recorded as a result of the revenue recognized less costs incurred in any reporting period. Amounts representing performance incentives, penalties, contract claims or change orders are considered in estimating revenues, costs and profits when they can be reliably estimated and realization is considered probable. Revenue recognized on contracts for unresolved claims or unapproved contract change orders was not material in 2016, 2015 or 2014.

Contract Loss Reserves

At October 1, 2016, we had contract loss reserves of $33 million. For contracts with anticipated losses at completion, a provision for the entire amount of the estimated remaining loss is charged against income in the period in which the loss becomes known. Contract losses are determined considering all direct and indirect contract costs, exclusive of any selling, general or administrative cost allocations that are treated as period expenses. Loss reserves are more common on firm fixed-price contracts that involve, to varying degrees, the design and development of new and unique controls or control systems to meet the customers’ specifications. Reserves are also recorded for the additional work on completed products in order for them to meet contract specifications.

21

Reserves for Inventory Valuation

At October 1, 2016, we had net inventories of $479 million, or 30% of current assets. Reserves for inventory were $109 million, or 17% of gross inventories. Inventories are stated at the lower-of-cost-or-market with cost determined primarily on the first-in, first-out method of valuation.

We record valuation reserves to provide for slow-moving or obsolete inventory by principally using a formula-based method that increases the valuation reserve as the inventory ages. We also take specific circumstances into consideration. We consider overall inventory levels in relation to firm customer backlog in addition to forecasted demand including aftermarket sales. Changes in these and other factors such as low demand and technological obsolescence could cause us to increase our reserves for inventory valuation, which would negatively impact our gross margin. As we record provisions within cost of sales to increase inventory valuation reserves, we establish a new, lower cost basis for the inventory.

Reviews for Impairment of Goodwill

At October 1, 2016, we had $740 million of goodwill, or 24% of total assets. We test goodwill for impairment for each of our reporting units at least annually, during our fourth quarter, and whenever events occur or circumstances change, such as changes in the business climate, poor indicators of operating performance or the sale or disposition of a significant portion of a reporting unit. We also test goodwill for impairment when there is a change in reporting units.

We identify our reporting units by assessing whether the components of our operating segments constitute businesses for which discrete financial information is available and segment management regularly reviews the operating results of those components. As of the date of our impairment test, our reporting units are the same as our operating segments.

Companies may perform a qualitative assessment as the initial step in the annual goodwill impairment testing process for all or selected reporting units. Companies are also allowed to bypass the qualitative analysis and perform a quantitative analysis if desired. Economic uncertainties and the length of time from the calculation of a baseline fair value are factors that we consider in determining whether to perform a quantitative test.

When we evaluate the potential for goodwill impairment using a qualitative assessment, we consider factors including, but not limited to, macroeconomic conditions, industry conditions, the competitive environment, changes in the market for our products and services, regulatory and political developments, entity specific factors such as strategy and changes in key personnel and overall financial performance. If, after completing this assessment, it is determined that it is more likely than not that the fair value of a reporting unit is less than its carrying value, we proceed to a quantitative two-step impairment test.

Quantitative testing first requires a comparison of the fair value of each reporting unit to its carrying value. We principally use the discounted cash flow method to estimate the fair value of our reporting units. The discounted cash flow method incorporates various assumptions, the most significant being projected revenue growth rates, operating margins and cash flows, the terminal growth rate and the discount rate. Management projects revenue growth rates, operating margins and cash flows based on each reporting unit's current business, expected developments and operational strategies typically over a five-year period. If the carrying value of the reporting unit exceeds its fair value, goodwill is considered impaired and any loss must be measured.

In measuring the impairment loss, the implied fair value of goodwill is determined by assigning a fair value to all of the reporting unit's assets and liabilities, including any unrecognized intangible assets, as if the reporting unit had been acquired in a business combination at fair value. If the carrying amount of the reporting unit goodwill exceeds the implied fair value of that goodwill, an impairment loss would be recognized in an amount equal to that excess.

The determination of our assumptions is subjective and requires significant estimates. Changes in these estimates and assumptions could materially affect the results of our reviews for impairment of goodwill.

22

For our annual test of goodwill for impairment in 2016, we performed a quantitative assessment for each of our six reporting units.

Reporting Units other than Linear

We determined the fair value of our reporting units other than Linear using discounted cash flows. We projected sales, operating margins and working capital requirements. We applied a 3% terminal value growth rate, which is supported by our historical growth rate, near-term projections and long-term expected market growth. We then discounted our projected cash flows using weighted-average costs of capital that ranged from 9.5% to 11.0% for our various reporting units. These discount rates reflect management’s assumptions of marketplace participants’ cost of capital. Based on our tests, the fair value of each reporting unit exceeded its carrying amount. Therefore, we concluded that goodwill was not impaired.

The fair value of each reporting unit exceeded its carrying amount by at least 30%. While any individual assumption could differ from those that we used, we believe the overall fair values of our reporting units are reasonable as the values are derived from a mix of reasonable assumptions. Had we used discount rates that were 100 basis points higher or a terminal growth rate that was 100 basis points lower than those we assumed, the fair values of each of our reporting units would have continued to exceed their carrying amounts by at least 15%.

We evaluate the reasonableness of the resulting fair values of our reporting units by comparing the aggregate fair value to our market capitalization and assessing the reasonableness of any resulting premium.

Linear Reporting Unit

We tested goodwill of our Linear reporting unit for impairment in our fourth quarter as part of our annual test. In performing this assessment, we estimated fair value using both a discounted cash flow analysis, which we weighted more heavily, and a market-multiple approach. In our discounted cash flow analysis, we projected sales and operating margins based on our current outlook for this business. We assumed a 5% terminal growth rate, which is supported by our near-term projections and long-term market growth potential in additive manufacturing. We then discounted our projected cash flows using a 15.5% weighted-average cost of capital that reflects management’s assumptions of marketplace participants’ costs of capital and business risk. Our test resulted in a fair value of Linear that was less than its carrying amount, requiring us to measure goodwill for impairment.

We determined the implied fair value of goodwill and recorded a $5 million impairment charge in our fourth quarter of 2016 for the excess of the carrying amount of goodwill over its implied fair value. We determined the implied fair value of goodwill by taking the difference between the fair value of the reporting unit that we determined using the weighted-average discounted cash flow and market multiple approach and the fair value of the net assets of the reporting unit.

During the fourth quarter, we transferred the management of Linear to Space and Defense Controls. Until that time, Linear was its own operating segment. Effective with this transfer, Linear is now part of the Space and Defense Controls operating segment and no longer qualifies as a separate reporting unit. Since we had a change in reporting units, we considered if an interim goodwill impairment test was necessary. However, in this case, two reporting units are simply being combined into a new reporting unit. We had a considerable excess of fair value over carrying value in our Space and Defense Controls reporting unit as of the beginning of the fourth quarter of 2016 and no adverse changes have occurred in that business since the 2016 annual impairment test date. As we had also just written down Linear’s goodwill as a result of the 2016 annual impairment test, we determined that it is not more likely than not that the new Space and Defense Controls reporting unit would yield a fair value less than the carrying value.

Pension Assumptions

We maintain various defined benefit pension plans covering employees at certain locations. Pension expense for all defined benefit plans for 2016 was $45 million. Pension obligations and the related costs are determined using actuarial valuations that involve several assumptions. The most critical assumptions are the discount rate, mortality rates and the long-term expected return on assets. Other assumptions include salary increases and retirement age.

23

The discount rate is used to state expected future cash flows at present value. Using a higher discount rate decreases the present value of pension obligations and decreases pension expense. We use the Mercer Pension Above Mean Discount Yield Curve to determine the discount rate for our U.S. defined benefit plans at year end. The discount rate is constructed from bonds included in the Mercer Yield Curve that have a yield higher than the mean yield curve. We believe that the Mercer Pension Above Mean Discount Yield Curve best mirrors the yields of bonds that would be selected by management if actions were taken to settle our obligation. The discount rate used in determining expense for the U.S. Employees’ Retirement Plan, our largest plan, in 2016 was 4.5% compared to 4.4% in 2015, and this increase caused expense to decrease by $1 million this year. We changed the method used to estimate the service and interest cost components of net periodic pension costs as of October 1, 2016, which is expected to lower our 2017 expense by approximately $7 million solely due to the change in method. Previously, these costs were determined using a single-weighted average discount rate. The change does not affect the measurement of our benefit obligations. The new method will provide a more precise measure of service and interest costs by improving the correlation between projected benefit cash flows and the discrete spot yield curve rates and will be accounted for as a change in estimate prospectively beginning in the first quarter of 2017. We will use a 3.96% service cost discount rate and a 3.21% interest cost discount rate to determine our expense in 2017 for this plan. The change in discount rates, after considering a $7 million favorable effect of the refined approach to determine service and interest cost, will cause 2017 expense to increase by $2 million.

Mortality rates are used to estimate the life expectancy of plan participants during which they are expected to receive benefit payments. We use a modified version of the mortality table and projection scale published by the Society of Actuaries (SOA), which reflects improvements consistent with the Social Security Administration, as a basis for our mortality assumptions for our U.S. plans. We believe the use of this modified table and projection scale best reflects our demographics and anticipated plan outcomes. We began using this table in October of 2015 which increased expense by $6 million in 2016.