Attached files

| file | filename |

|---|---|

| 8-K - 8-K NOV 15 2016 - InvenTrust Properties Corp. | a201611-15form8xk.htm |

NAREIT REITWorld

Investor Presentation

November 15 – 16, 2016

1

Forward-Looking Statements in this presentation, which are not historical facts, are forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not

historical, including statements regarding management’s intentions, beliefs, expectations, representation, plans or predictions of

the future and are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar

expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon

estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that

may cause actual results to differ materially from current expectations include, among others, our ability to execute on our

strategy, our ability to return value to our stockholders, the availability of cash flow from operating activities to fund

distributions and our ability to manage our debt. For further discussion of factors that could materially affect the outcome of

our forward-looking statements and our future results and financial condition, see the Risk Factors included in InvenTrust’s

most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed

with the Securities and Exchange Commission. InvenTrust intends that such forward-looking statements be subject to the safe

harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended, except as may be required by applicable law. We caution you not to place undue reliance on any forward-

looking statements, which are made as of the date of this presentation. We undertake no obligation to update publicly any of

these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes

in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more

forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other

forward-looking statements.

The companies depicted in the photographs or otherwise herein may have proprietary interests in their trade names and

trademarks and nothing herein shall be considered to be an endorsement, authorization or approval of InvenTrust Properties

Corp. by the companies. Further, none of these companies are affiliated with InvenTrust Properties Corp. in any manner.

Forward Looking Statements

2

Company Snapshot

Non-traded public REIT founded in 2004. Independent & fully

internalized/self-managed as of January 1, 2015

88 open-air shopping centers / 15.1 million sq. ft. with a Sunbelt

concentration(1)

56% of gross leasable area (“GLA”) consists of grocery anchored

centers(2)

69% of GLA consists of power centers / 31% strip centers

Occupancy – 95%(3) / Average Base Rent (“ABR”) - $15.41(4)

Flexible capital structure with well-staggered maturities

(1) The analysis includes retail properties owned and IAGM JV as of 9/30/2016. GLA and metrics excludes properties under development/redevelopment

(2) % Grocery Anchored displays % of portfolio GLA with a grocery component (on a lease or shadow anchored).

(3) Occupancy includes ground and specialty leases.

(4) ABR is GAAP ABR per SF and includes ground rent and excludes specialty leases.

3

Our Journey to a Pure-Play Retail Platform

20

13

$460 million apartment portfolio sale to

Completed $1.8 billion sale of net lease (non-core) assets to

20

14

$395 million modified “Dutch Auction” tender offer(Repurchased shares at high-end of the range and all shares properly tendered were repurchased)

$1.1 billion sale of select service lodging portfolio to joint venture between

Internalized management and began implementing best-in-class systems

On 12/31/2012, our $12.7 billion diversified portfolio of assets consisted of 794 retail, office, industrial, prison & charter school

properties, 5,311 apartment units, 5,212 student housing beds, 16,345 hotel rooms, certain JVs and marketable securities.

20

15

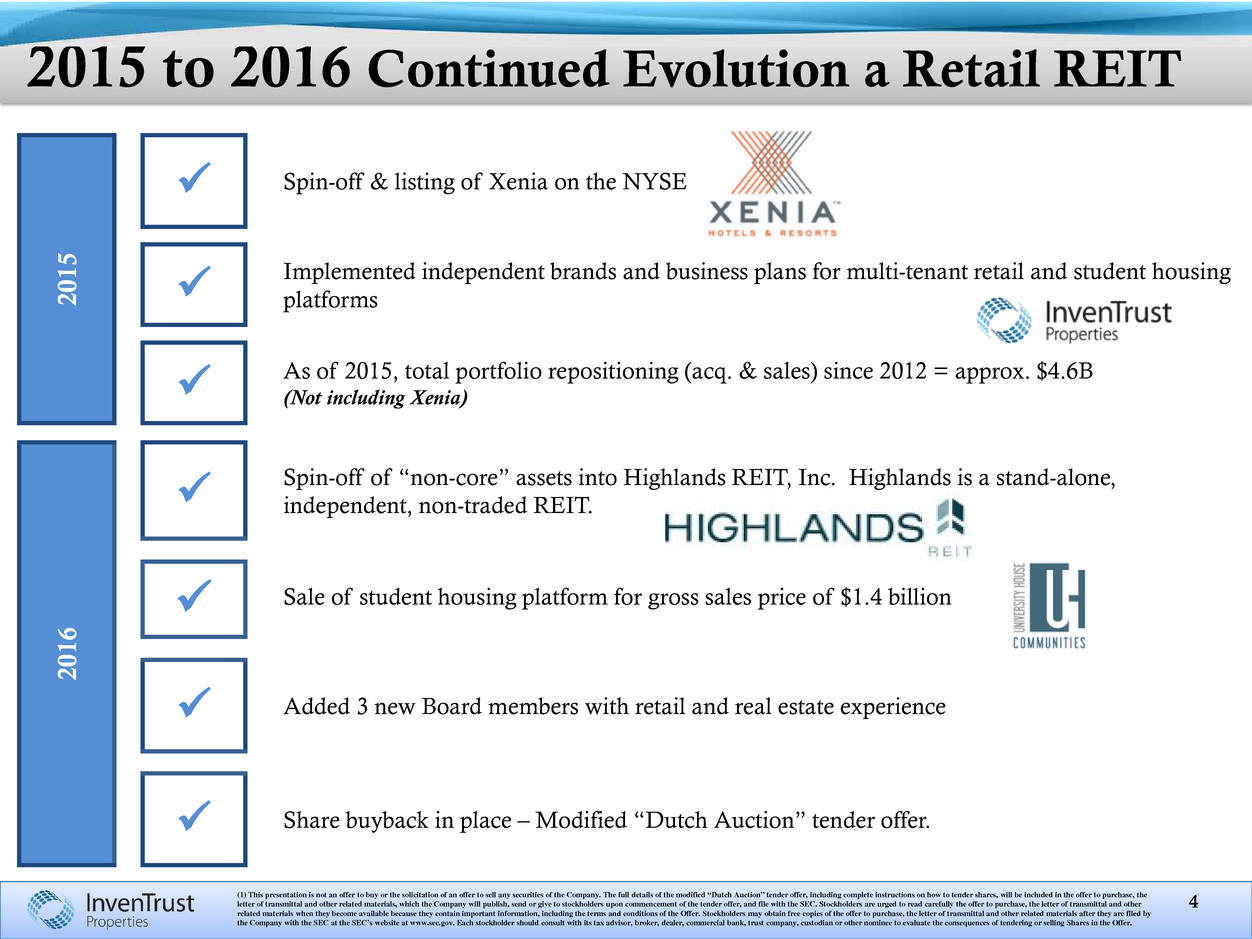

Spin-off & listing of Xenia on the NYSE

Implemented independent brands and business plans for multi-tenant retail and student housing platforms

As of 2015, total portfolio repositioning (acq. & sales) since 2012 = approx. $4.6B(Not including Xenia)

20

16

Spin-off of “non-core” assets into Highlands REIT, Inc. Highlands is a stand-alone, independent, non-traded REIT.

Sale of student housing platform for gross sales price of $1.4 billion

Added 3 new Board members with retail and real estate experience

Share buyback in place – Modified “Dutch Auction” tender offer.

4

2015 to 2016 Continued Evolution a Retail REIT

(1) This presentation is not an offer to buy or the solicitation of an offer to sell any securities of the Company. The full details of the modified “Dutch Auction” tender offer, including complete instructions on how to tender shares, will be included in the offer to purchase, the

letter of transmittal and other related materials, which the Company will publish, send or give to stockholders upon commencement of the tender offer, and file with the SEC. Stockholders are urged to read carefully the offer to purchase, the letter of transmittal and other

related materials when they become available because they contain important information, including the terms and conditions of the Offer. Stockholders may obtain free copies of the offer to purchase, the letter of transmittal and other related materials after they are filed by

the Company with the SEC at the SEC’s website at www.sec.gov. Each stockholder should consult with its tax advisor, broker, dealer, commercial bank, trust company, custodian or other nominee to evaluate the consequences of tendering or selling Shares in the Offer.

Strong Fundamentals for Open-Air Retail Centers

Retail supply remains at historic lows

High occupancy rates continue with solid demand from

small shops & specialty grocers opening up new stores

Pure-play online retailers opening up brick & mortar

stores

Discounters & off-price concepts are increasing store counts

5

6

Focus on Transformation of Portfolio Continues

Total(1)

Strategic Retail

Portfolio(1)

Non-Strategic

Retail Portfolio(1)

Properties 88 61 27

Gross GLA (2) 15.1M 10.6M 4.5M

% Economic Occupancy 95% 97% 90%

% Grocery Anchored(3) 56% 65% 35%

ABR per SF(3) $15.41 $15.92 $14.13

3-Mile Population ~77K ~79K ~74K

3-Mile Average HHI ~$83K ~89K ~71K

(1) The analysis includes retail properties owned and IAGM JV as of 9/30/2016. GLA and metrics excludes properties under development/redevelopment

(2) Includes ground leases and specialty leases

(3) % Grocery Anchored displays % of portfolio GLA with a grocery component (on a lease or shadow anchored)..

(4) ABR is GAAP ABR per SF and includes ground rent and excludes specialty leases.

7

Market Presence – Concentration on Demographics

88 15.1

# of Properties Million Retail Sq. Ft.

As of 09/30/16, includes IAGM JV

8

Focused on Growth Sunbelt Markets

Our Top Markets by Gross Leasable Area (GLA) as of 9/30/16(1)

(1) The analysis includes retail properties wholly owned and those owned with IAGM JV as of 9/30/2016

(2) Source: Green Street Advisors, as of 09/30/16

13.5%

11.1%

7.9%

6.9%

5.4% 5.3% 5.1%

4.3% 3.8%

3.2%

0.0%

4.0%

8.0%

12.0%

16.0%

Houston Dallas Atlanta Raleigh San Antonio Austin Oklahoma

City

Denver Tampa Orlando

Job Growth

(‘16 – ’20E)2

5.2% 11.8% 8.5% 10.5% 9.5% 13.77% 5.7% 10.6% 9.6% 13.2%

Pop. Growth

(‘16 – ’20E)2

9.6% 9.9% 7.8% 9.8% 9.6% 13.3% 4.8% 9.4% 7.6% 10.6%

Demographics for Top 50 Strip Center Markets in the U.S. (‘16 – ’20E): (2)

Job Growth – 7.1% / Population Growth – 5.3%

9

Staggered Lease Renewals & High Quality Tenants

11.8%

13.2%

15.5%

12.4% 12.2%

2017 2018 2019 2020 2021

0.0%

5.0%

10.0%

15.0%

20.0%

Lease Expiration by % of Total Annualized Rent

As of 09/30/16, includes IAGM JV

Diversified and Balanced Tenant Concentration (by GLA)

5.9%

4.2%

3.3% 2.4%

2.4%

3.0%

2.5%

2.5%

10

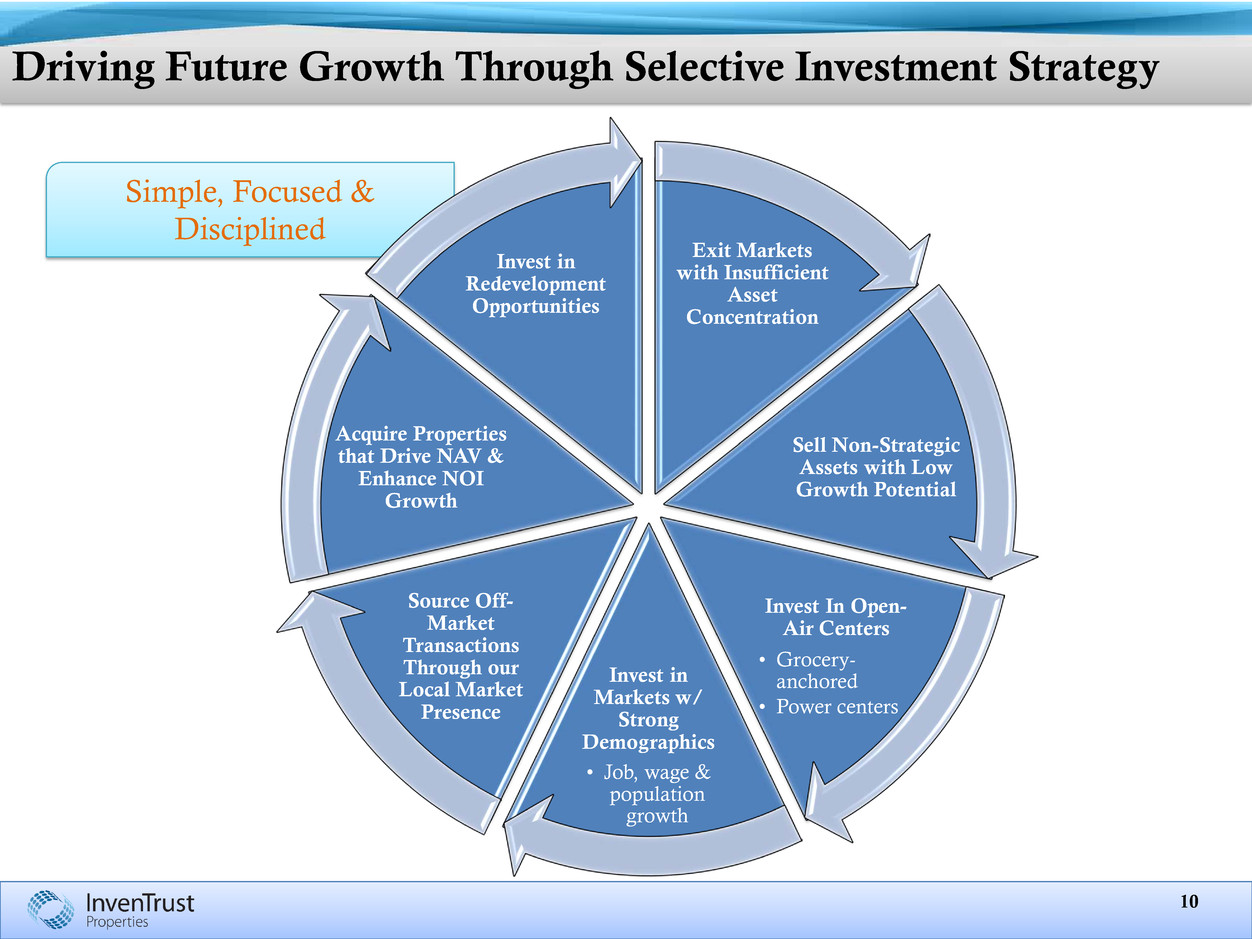

Driving Future Growth Through Selective Investment Strategy

Simple, Focused &

Disciplined

Exit Markets

with Insufficient

Asset

Concentration

Sell Non-Strategic

Assets with Low

Growth Potential

Invest In Open-

Air Centers

• Grocery-

anchored

• Power centers

Invest in

Markets w/

Strong

Demographics

• Job, wage &

population

growth

Source Off-

Market

Transactions

Through our

Local Market

Presence

Acquire Properties

that Drive NAV &

Enhance NOI

Growth

Invest in

Redevelopment

Opportunities

11

Investment Strategy Execution

Date Range:

1/1/15 to 11/7/2016

Acquisitions (1) Dispositions (1)

Number of Properties 13 38

GLA (2) 2.2M

Average (~169K)

3.9M

Average (~102K)

Occupancy (3) 96% 92%

ABR per SF(4) $17.71 $13.14

(1) The analysis includes retail properties owned and IAGM JV as of 11/7/2016

(2) Includes ground lease square footage

(3) Includes ground leases, excludes specialty leasing

(4) ABR is cash ABR per SF and excludes ground / specialty leases.

12

Recent Acquisitions – Upgrading the Portfolio

Old Grove

Marketplace

• Oceanside, CA (San Diego)

• Acquired August 2016

• Ralph’s anchored

• 91% occupied

• 81K sq. ft.

• 3-mile Avg. Income -

$68,000

• 3-mile Population –

113,000

Northcross

Commons

• Charlotte, NC

• Acquired Oct. 2016

• Whole Foods anchored

• 89% occupied

• 61K sq. ft.

• 3-mile Avg. Income -

$82,500

• 3-mile Population –

52,300

Windward

Commons

• Alpharetta, GA

• Acquired August 2016

• Kroger anchored

• 99% occupied

• 117K sq. ft.

• 3-mile Avg. Income -

$99,000

• 3-mile Population –

42,000

13

Long-Term Balance Sheet Management

Structure liabilities to reduce cyclical pressures

Well-staggered debt maturities

Increase unencumbered asset base

Maintain flexibility and access to a variety of capital

Use dispositions and student housing sale as a source of capital

Shape capital structure to facilitate investment grade rating

14

Balance Sheet Metrics

As of Sept. 30, 20161

Total Debt / Total Assets 26.6%

Weighted Avg. Interest Rate 4.37%

Weighted Avg. Maturity 3.71 years

Unsecured Credit Facility Availability $450M

$-

$100

$200

$300

$400

$500

2016 2017 2018 2019 2020 Thereafter

Manageable Debt Maturities as of 9/30/16

Term Loan

IVT Share of JV Debt

Wholly Owned

Strategy Moving Forward as a Pure-Play Retail REIT

Focus and drive value as a pure-play retail platform

Concentrate investment capital in high job & population

growth markets - Sunbelt focused

Opportunistically sell non-strategic retail properties

Continue to strengthen our balance sheet and capital

structure

Remain committed to creating stockholder value

15

Appendix

17

InvenTrust Executive Team

Tom McGuinness

President & CEO

35 years in commercial real estate

industry including several

leadership positions with notable

industry associations. McGuinness

was appointed as a director of

InvenTrust in Feb. 2015, Chief

Executive Officer in Nov. 2014 and

has served as President since the

Company initiated its self-

management transactions in March

2014. He is a licensed Real Estate

Broker in the State of Illinois and

holds CLS and CSM accreditations

from the International Council of

Shopping Centers.

Michael Podboy

EVP, CFO & CIO

Podboy’s real estate and retail

experience is evidenced by his

many industry leadership roles. He

is Executive Vice President – Chief

Financial Officer, Chief Investment

Officer and Treasurer for

InvenTrust, a role he assumed in

Nov. 2015. Prior to that, he was

Executive Vice President – Chief

Investment Officer since Nov. 2014

and EVP – Investments from March

2014 to Nov. 2014. Before coming

to InvenTrust Podboy was a senior

manager in the real estate division

for KPMG.

Dave Collins

EVP, Portfolio Mgmt.

Collins has an extensive

background in real estate and

financial management. He is EVP,

Portfolio Management for

InvenTrust, a position he has held

since Jan. 2015. Collins joined the

Company in Oct. 2014 as SVP of

Asset Management and Leasing.

Prior to that he held roles as SVP of

asset and property management for

American Realty Capital Properties

and SVP of development/asset

management for the Carlyle

Development Group.

Nicole Grimaldi

SVP, Capital Markets &

Corporate Finance

Grimaldi joined InvenTrust in 2011

and has more than 16 years of

commercial real estate experience

in varying roles involving debt and

equity investments, asset mgmt.,

and the monetization of complex

real estate transactions across all

asset classes. Prior to joining

InvenTrust, she served as Managing

Director at the Private Bank, where

she oversaw a portfolio of

commercial real estate loan

investments.