Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ICONIX BRAND GROUP, INC. | d295287d8k.htm |

NOVEMBER

15, 2016 INVESTOR DAY

Exhibit 99.1 |

| 1 FORWARD LOOKING STATEMENTS & DISCLAIMER In addition to historical information, this presentation contains forward-looking statements within the meaning of the federal

securities laws. Such forward- looking statements include

projections regarding the Company's beliefs and expectations about future performance and, in some cases, may be identified by words like "anticipate," "assume," "believe," "continue," "could," "estimate,"

"expect," "intend," "may," "plan," "potential," "predict," "project," "future," "will," "seek" and similar terms or phrases. These statements are based on the Company's beliefs and assumptions, which

in turn are based on currently available information.

Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement and could harm the Company's business, prospects, results of operations,

liquidity and financial condition and cause its stock price to

decline significantly. Many of these factors are beyond the Company's ability to control or predict. Important factors that could cause the Company's actual results to differ materially from those indicated in the forward-looking statements include, among

others: the ability of the Company's licensees to maintain their

license agreements or to produce and market products bearing the Company's brand names, the Company's ability to retain and negotiate favorable licenses, the Company's ability to meet its outstanding debt obligations and the events and risks

referenced in the sections titled "Risk Factors" in the

Company's Annual Report on Form 10-K for the year ended December 31, 2015, as amended, subsequent Quarterly Reports on Form 10-Q and in other documents filed or furnished with the Securities and Exchange Commission. These forward-looking statements are made only

as of the date hereof, and, except as required by applicable law,

the Company undertakes no obligation to update or revise publicly any forward-looking statements.

This presentation contains projections which are based on numerous assumptions

about revenue, margins, competitive factors, industry performance, general business and economic conditions and other factors which cannot be accurately predicted. Any information provided herein related to

periods subsequent to the date of this presentation shall be

deemed projections for purposes hereof. Although the Company believes that such assumptions are reasonable, they may be incomplete or incorrect, and unanticipated events and circumstances may occur. The projects are subject to uncertainties

inherent in any attempt to predict the results of operations for

a company over a prolonged period. Therefore, the actual results of operations are likely to vary from the projections and the variations may be material and adverse. The projections should not be regarded as a representation or prediction that the

Company will achieve or is likely to achieve any particular

results. The financial projections have not been prepared, reviewed, or compiled by any firm of independent accountants. The projections were not prepared with a view to compliance with published guidelines of the Securities and Exchange Commission or any state

securities commission, or the guidelines established by the

American Institute of Certified Public Accountants. All retail equivalent sales in this presentation are based on sales of Iconix brands in 2015.

|

| AGENDA • OVERVIEW • ICONIX TODAY • COMPREHENSIVE STRATEGIC REVIEW • ROADMAP TO VALUE CREATION • Q&A 2 |

OVERVIEW 3 |

| 4 EXECUTIVE SUMMARY • Iconix is the Leader in Large and Highly Profitable Global Brand Management Industry • New Management Team with Deep Industry Experience • Path to Organic Growth Driven By Strategic Choices, Enhanced Toolset • Portfolio Management Approach to M&A and Brand Ownership • Plan for Reduced Leverage and Improved Capital Structure |

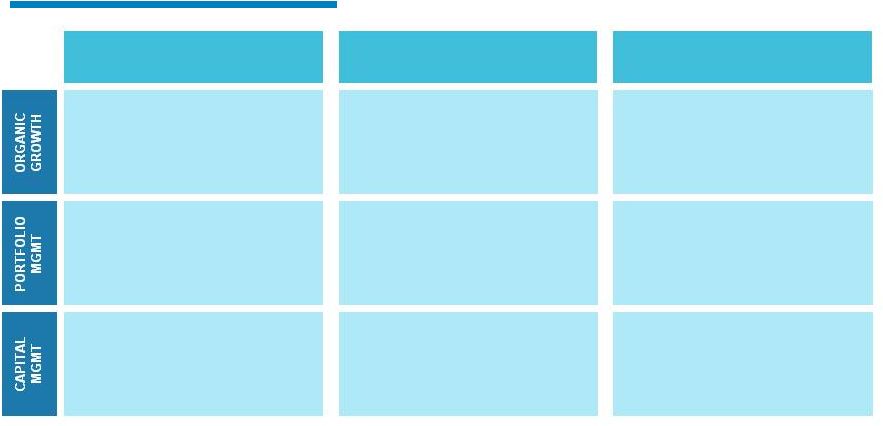

5 PORTFOLIO MANAGEMENT GLOBAL ORGANIC GROWTH PRUDENT CAPITAL MANAGEMENT HIGH OPERATING MARGIN, STRONG FREE CASH FLOW, ASSET LIGHT EXPERIENCED LEADERSHIP, WORLD CLASS IP PORTFOLIO, ACTIVE BRAND MANAGEMENT + + TOP 25% TSR PERFORMANCE ROADMAP TO VALUE CREATION |

STRATEGIC

PLAN 2017 EVOLUTION • Solve 2018 convertible notes • Leverage ratio < 7.0x • Active brand management & new brand building tools • Prioritize resources • Modest organic growth • Domestic, international & global targets • Maximize available capital 2018 / 2019 GROWTH • Mid single digit organic growth, margin expansion • Enhanced toolset generates return • Leverage ratio ~5.0x • Solve securitization facility • $25M annual royalty revenue from acquisitions 2016 TRANSITION • Analysis of market, consumer, brands & partnerships • Identify growth opportunities • New management team • Refinanced $300M • Repurchased ~$105M of 2018s • Develop targeted acquisition strategy • Evaluate brands for long-term viability 6 |

7 ICONIX TODAY |

PREEMINENT GLOBAL BRAND MANAGEMENT COMPANY

ACTIVE BRAND MARKETERS DTRs 60 $13 BILLION RETAIL EQUIVALENT SALES WORLDWIDE

30 BRANDS OWNERS 1,700

LICENSES INNOVATIVE PARTNER TO WORLD’S LEADING RETAILERS 8 ICONIX – THE PREMIER GLOBAL BRAND MANAGEMENT COMPANY 100+ COUNTRIES |

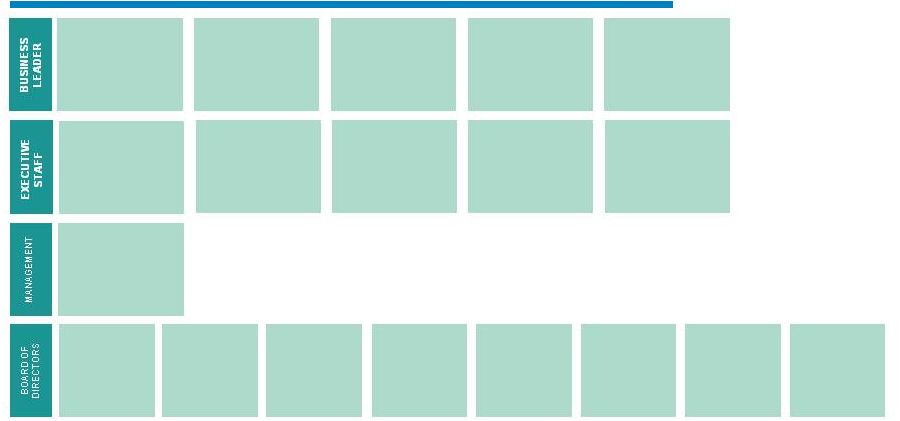

John

Haugh CEO Carolyn D’Angelo Women’s & Home Vincent Nesi Men’s Willy Burkhardt International Roz Nowicki Entertainment Mary Gleason Incubator EXPERIENCED LEADERSHIP TEAM WITH DEEP INDUSTRY KNOWLEDGE Peter Cuneo Chairman (Entertainment) Drew Cohen (Licensing) Sue Gove (CEO/CFO Retail) Jim Marcum (CEO Retail) Mark Friedman (Apparel/ Retail) Sanjay Khosla (International, BoDs) Kristen O’Hara (CMO Digital) Kenneth Slutsky (Governance) Dave Jones CFO Jason Schaefer GC David Blumberg M&A Peggy Eskenasi Design, PD, Sourcing TBA CMO |

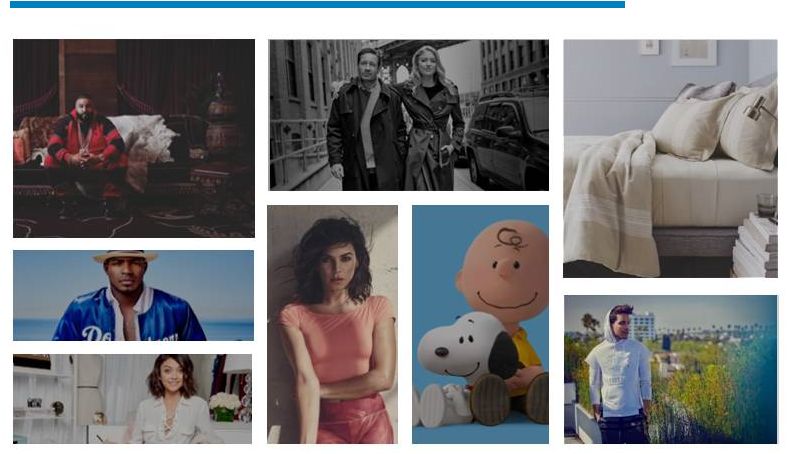

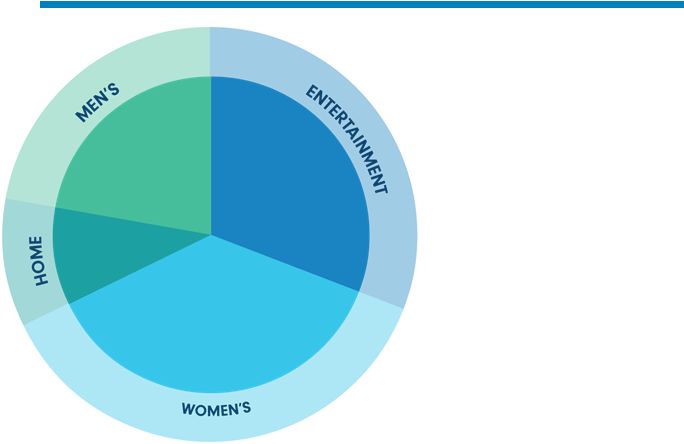

WOMEN’S CANDIES BONGO JOE BOXER RAMPAGE MUDD LONDON FOG MOSSIMO OCEAN PACIFIC DANSKIN MATERIAL GIRL HYDRAULIC MEN’S ROCAWEAR STARTER ECKO UNLTD. ZOO YORK MODERN AMUSEMENT ED HARDY NICK GRAHAM UMBRO PONY ARTFUL DODGER LEE COOPER HOME CANNON FIELDCREST CHARISMA ROYAL VELVET SHARPER IMAGE WAVERLY ENTERTAINMENT PEANUTS STRAWBERRY SHORTCAKE 10 WORLD CLASS BRAND PORTFOLIO 32% 22% 11% 35% Note: Chart represents trailing 12-month revenue |

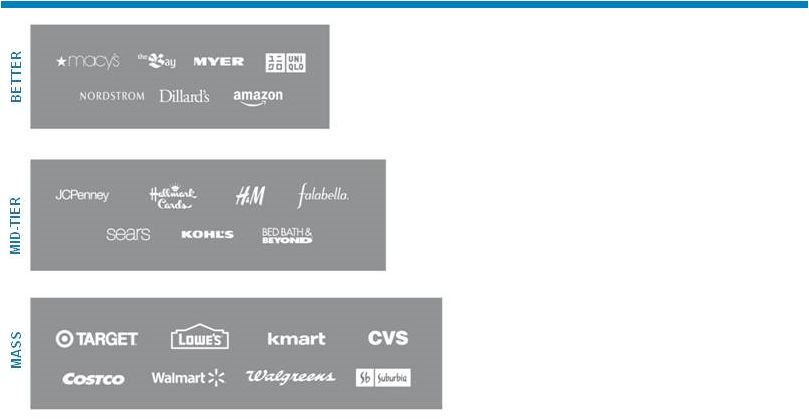

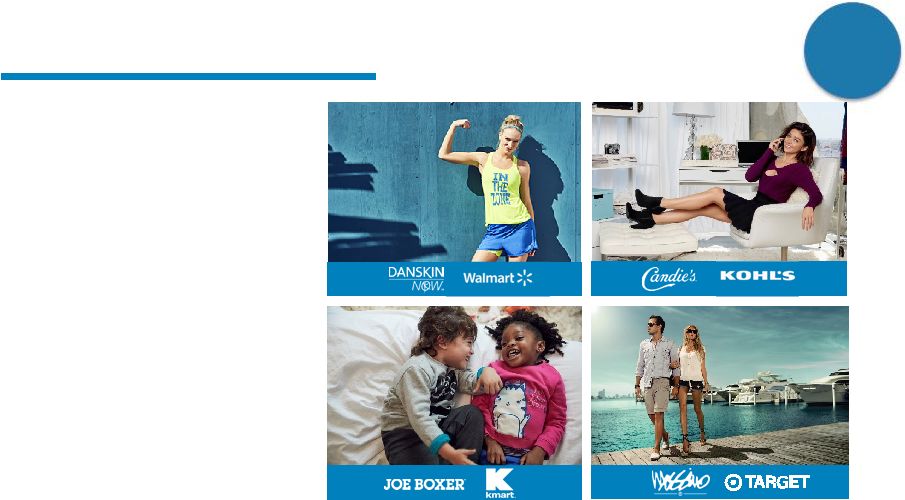

Bongo Candie’s Cannon Charisma Joe Boxer Mudd Peanuts Royal Velvet Sharper Image Waverly Zoo York Danskin Ecko Unltd. Material Girl Peanuts Rocawear Starter London Fog Cannon Charisma Danskin Now Fieldcrest Joe Boxer Waverly 11 Mossimo OP Peanuts Sharper Image Starter PARTNERING WITH BEST-IN-CLASS RETAILERS AT ALL TIERS OF DISTRIBUTION |

37 TOTAL

LARGE DTR RENEWALS INDUSTRY LEADING RECORD OF RENEWALS

12 RETAILER BRAND RENEWALS 10x 3x 1x 8x 8x 3x 4x RETAILER BRAND RENEWALS |

13 BUSINESS UNDERPINNED BY SIGNIFICANT GMRs AGGREGATE FUTURE GUARANTEED MINIMUMS 2016 GUARANTEED MINIMUMS $800M+ OVER OF EXPECTED REVENUE GUARANTEED 60% Note: Aggregate guaranteed minimums as of 10/1/16 |

14 COMPREHENSIVE STRATEGIC REVIEW |

| 15 Iconix Position: • Strong base of powerful brands, important retail relationships, financially attractive business model • Business had become dependent on acquisitions; brand management was passive New Approach: • Assessed every value-creating component: Geographies, Channels, Consumer, Categories, Marketing, Brands WHAT IS OUR VALUE CREATION STRATEGY? |

16 1. Market & Consumer Analysis 2. In-Depth Review of Iconix Business 3. Individual Brand Assessment VALUE CREATION ASSESSMENT • Adopting more data-driven, fact-based, analytical and objective approach |

DISTRIBUTION CHANNELS GLOBAL LICENSING INDUSTRY APPAREL HOME ENTERTAINMENT • $13+ billion industry • Fragmented market • Apparel, Accessories, Home & Toys lead • $500 billion market • 4% CAGR 2011-2015 • Highest growth categories o Sports Apparel o Footwear o Accessories • $27 billion market • 1% CAGR 2011-2015 • Highest growth categories o Top of Bed • $320 billion market • 4% CAGR 2011-2015 • Highest growth categories o Digital Content o Social Media • Fastest growing channels: Digital, Off-Price • Mass, Mid-Tier and Department Stores under indexing in growth 1. MARKET & CONSUMER ANALYSIS 17 CONSUMER TRENDS • Accelerating shift to digital • Divergence of boomer and millennial • Increasing consumer discount demand Source: Boston Consulting Group (“BCG”) Market Analytics |

18 BUSINESS MODEL SEGMENTS DISTRIBUTION CHANNELS INTERNATIONAL • Over 50% of International revenue driven by two brands (Umbro, Lee Cooper) • Global break-out potential for additional brands • High concentration of revenue generated by Mass & Mid-Tier retail partners • DTR business dependable with large volume programs • Wholesale less successful (driven by Men’s challenges) • Partners seeking our expertise and support • Women’s and Home source of high visibility revenue • Men’s Fashion cause of historical organic growth weakness • Entertainment strength driven by new content 2. IN-DEPTH REVIEW OF ICONIX BUSINESS Note: International excludes Entertainment |

19 RETAILER LANDSCAPE BRAND POSITIONING & STRENGTHS MARKET TRENDS & OPPORTUNITIES LICENSE STRUCTURE • Royalty rate • Advertising fee • Expiration • Categories • Geographies • Brand DNA • Core consumer • Price and product positioning • Competition • Distribution channel volume • Retailer initiatives and financial health • Category trends • Demographic specific behavior • Shopping and buying habits 3. INDIVIDUAL BRAND ASSESSMENT |

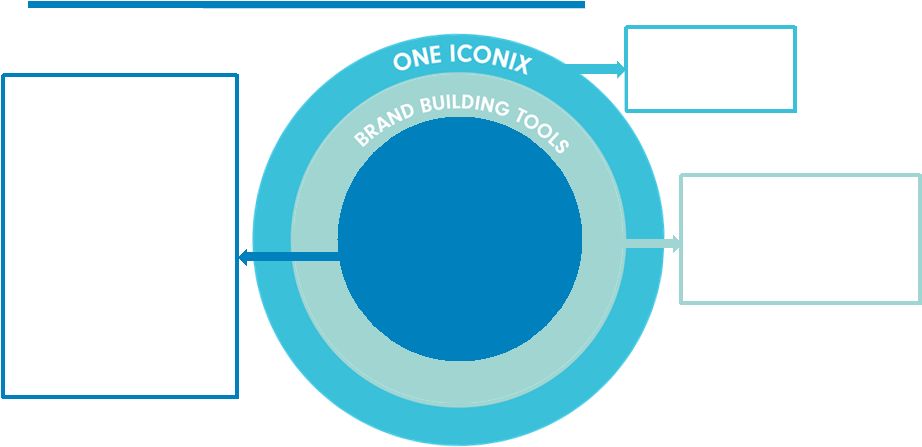

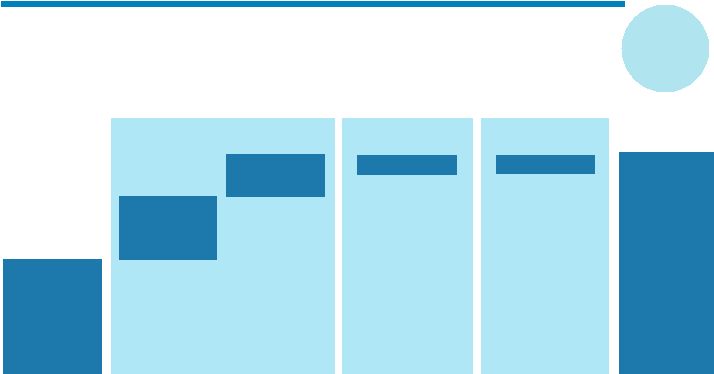

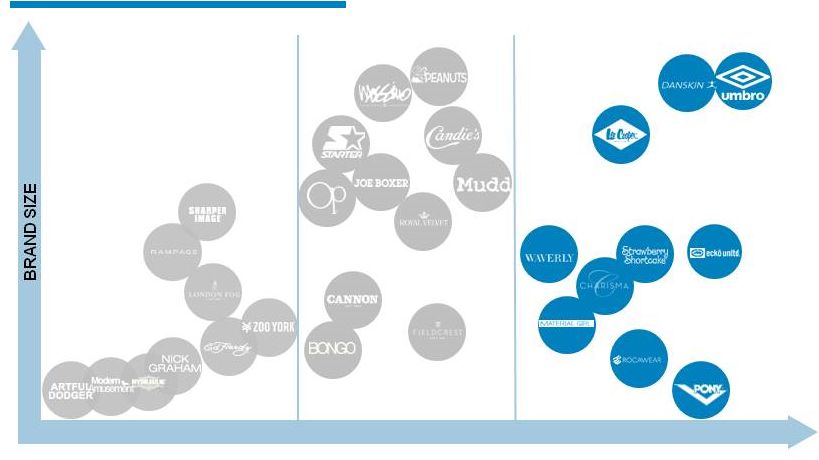

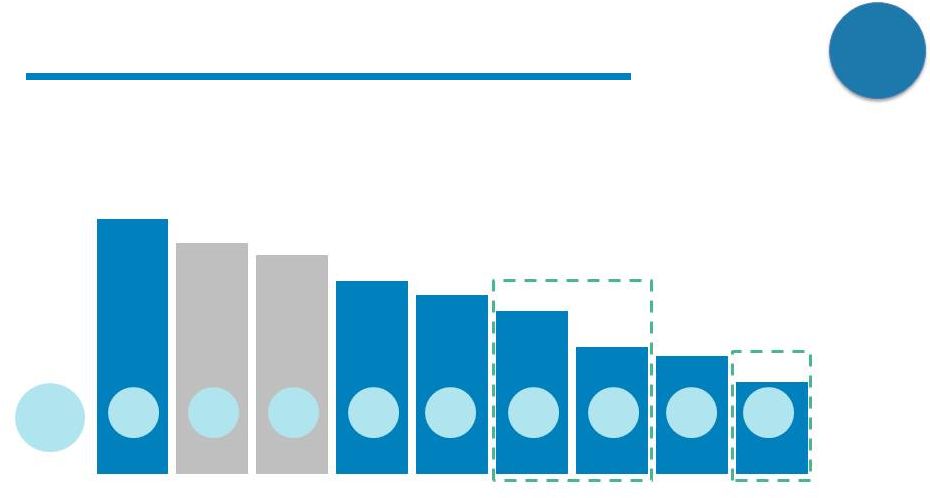

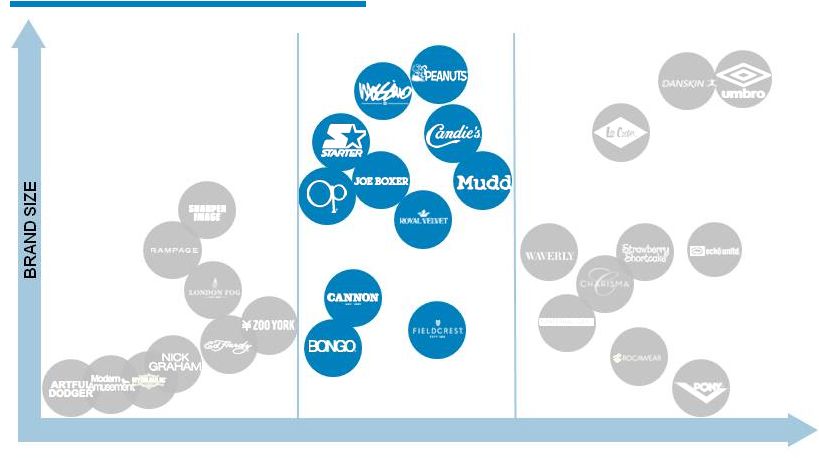

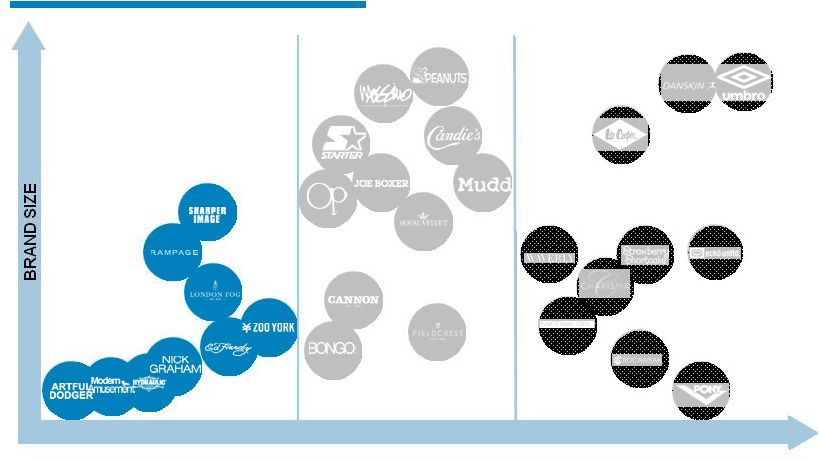

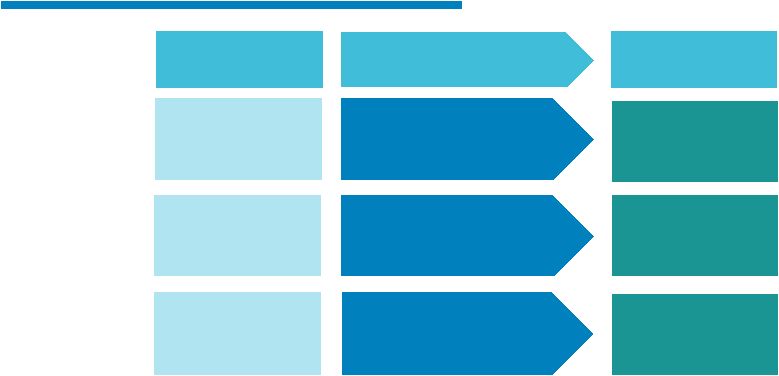

20 STRATEGIC REVIEW LED TO… ONE ICONIX • Deeper relationships • Holistic approach BRAND BUILDING TOOLS • Marketing • Trend and merchandising • Design, product development, sourcing DRIVERS Significant growth initiatives across market segments, distribution channels & geographies MAINTAIN Active brand management to maintain existing revenue streams INCUBATE Evaluation and dedicated resources for brands that are small in size or have faced certain growth challenges BRAND CATEGORIZATION DRIVERS MAINTAIN INCUBATE |

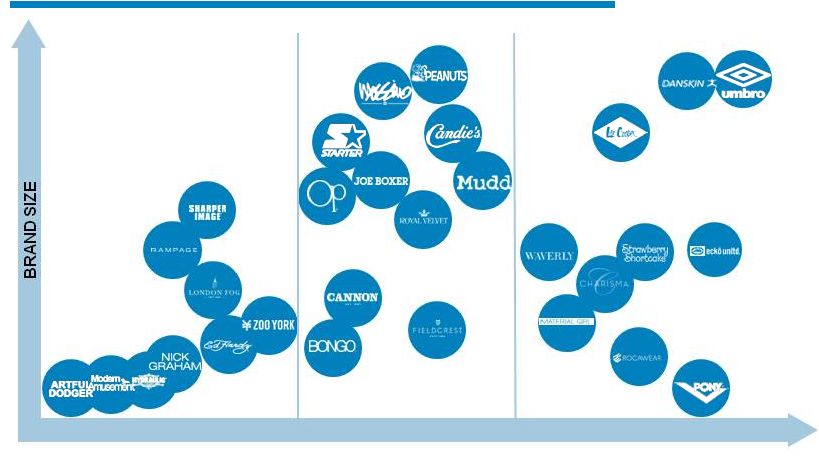

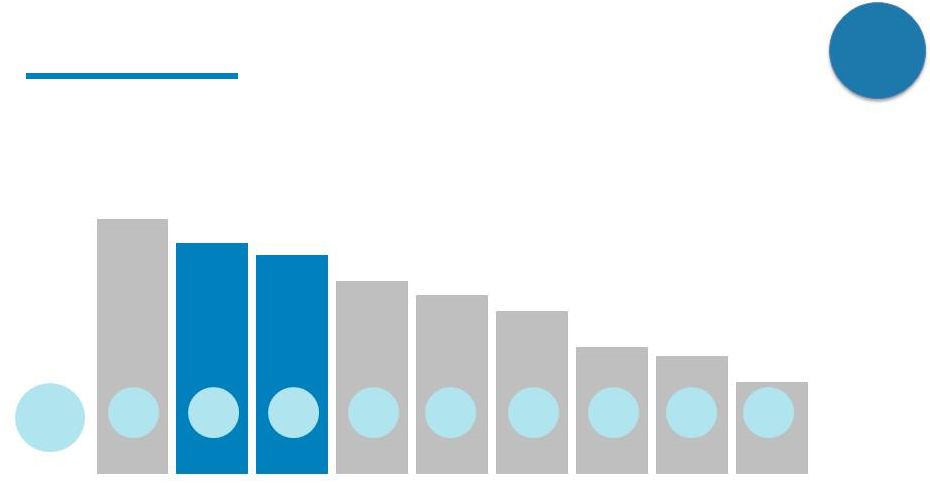

21 INCUBATE MAINTAIN DRIVERS REVENUE GROWTH POTENTIAL ICONIX BRAND CATEGORIZATION |

22 ROADMAP TO VALUE CREATION |

23 PORTFOLIO MANAGEMENT GLOBAL ORGANIC GROWTH PRUDENT CAPITAL MANAGEMENT HIGH OPERATING MARGIN, STRONG FREE CASH FLOW, ASSET LIGHT EXPERIENCED LEADERSHIP, WORLD CLASS IP PORTFOLIO, ACTIVE BRAND MANAGEMENT + + TOP 25% TSR PERFORMANCE ROADMAP TO VALUE CREATION |

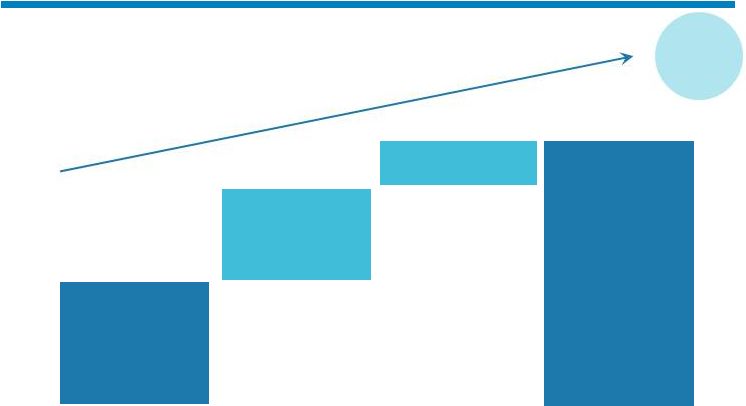

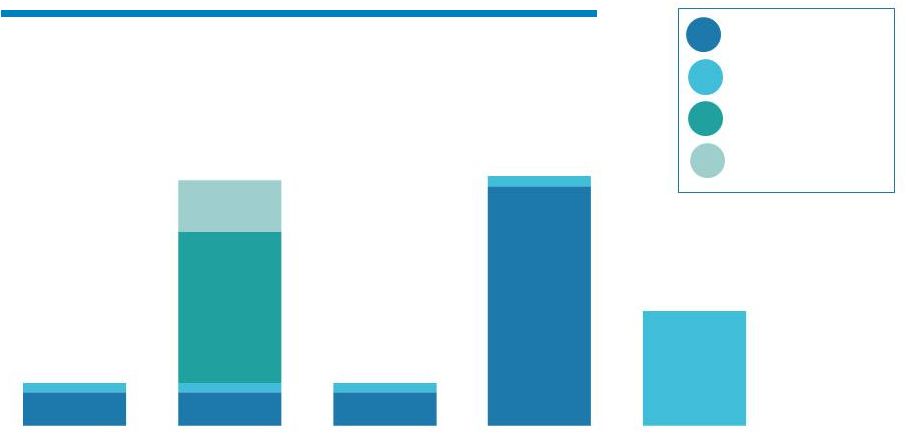

($7M) MAINTAIN INCUBATE +$7M PATH TO ORGANIC REVENUE GROWTH OF $50 MILLION BY 2019 24 +$20M +$30M DRIVERS 2016 2019 International 4% CAGR Domestic |

25 INCUBATE MAINTAIN DRIVERS DRIVERS BRANDS REVENUE GROWTH POTENTIAL |

ACTIVE

SEGMENT NEW DISTRIBUTION

CHANNELS DIRECT-TO-CONSUMER “DTC” INTERNATIONAL OPPORTUNITY BACKGROUND Danskin, Umbro, Starter, PONY High brand equity Strong growth market Penetrate untapped, large distribution channels Control brand and gain knowledge about consumer Maximize value of brands that have equity outside the U.S. 26 DRIVERS - KEY OPPORTUNITIES DRIVERS |

• Heritage and brand equity • 100+ years old • 1st women’s only activewear and dancewear brand • Ageless consumer BRAND DNA RETAIL POSITIONING • $1B+ DanskinNow business at Walmart this year • Halo, gymnastics, and dancewear lines 27 ACTIVE - DANSKIN GO FORWARD STRATEGY • Actively maintain core Walmart business • Further develop elevated collection DRIVERS |

BRAND

DNA RETAIL POSITIONING

• 90+ year brand history • Rich heritage blends performance with style for players, teams and fans • Ignite Umbro brand in U.S. • Dominate teamwear • Leverage growing soccer popularity in U.S. • 2018 World Cup marketing exposure • DTR license with Dick’s Sporting Goods for sporting goods channel ACTIVE - UMBRO U.S. 28 GO FORWARD STRATEGY DRIVERS |

BRAND

DNA RETAIL POSITIONING

• Performance everyday athleticwear with quality and style • Founded in 1971, pioneered fusion of sports and culture by partnering with leagues and colleges • Infusion of new design for men and women that leverages everyday athleticwear heritage • Grow curated halo line with collaborations • Drive League business • Starter Active at Walmart • Starter Black halo line at specialty stores and online, featuring League merchandise ACTIVE - STARTER 29 GO FORWARD STRATEGY DRIVERS |

BRAND

DNA RETAIL POSITIONING

• Retro footwear inspired brand for fashionable sports minded consumer • Three tiers – PONY Sport, PONY Classics, Product of New York • Launch core footwear in Spring 2017 with strong marketing activation • Expand product assortment and brand presence with ambassadors and collaborations • Halo brand Product of New York at high-end retailers Limited distribution ACTIVE - PONY U.S. 30 GO FORWARD STRATEGY DRIVERS |

$90B • Strength in Mass & Mid-Tier; $175B+ addressable market Total Estimated Apparel, Footwear & Accessories Market by Channel 68% $65B 14% $35B 0% $16B 1% $15B 4% $4B 0% $86B 5% $40B 4% 4% MASS MID-TIER DOLLAR CLUB PURE E-COM OFF-PRICE DRUG DEPT STORE SPECIALTY % of ICONIX REV CHANNELS 31 Source: BCG Market Analytics $106B DRIVERS |

CHANNELS

- NEW OPPORTUNITY

32 • Penetrate untapped, large distributions channels; addressable market of $280B+ • Momentum for our brands in Drug, Dollar and E-Commerce $90B Total Estimated Apparel, Footwear & Accessories Market by Channel 68% $65B 14% $35B 0% $16B 1% $15B 4% $4B 0% $86B 5% $40B 4% 4% MASS MID-TIER DOLLAR CLUB PURE E-COM OFF-PRICE DRUG DEPT STORE SPECIALTY $106B % of ICONIX REV Source: BCG Market Analytics DRIVERS |

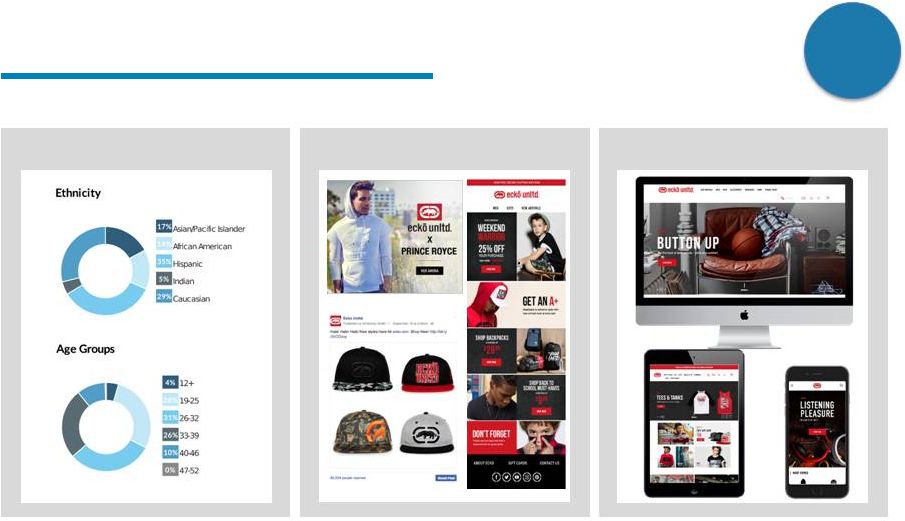

DIRECT-TO-CONSUMER

CONSUMER INTELLIGENCE/DATA* CONSUMER ENGAGEMENT E-COMMERCE • Control brand and gain knowledge about consumer *For illustrative purposes only DRIVERS |

CONSUMER ENAGEMENT &

E-COMMERCE REVENUE

34 CONSUMER ENGAGEMENT & LINK TO RETAIL PARTNER DIRECT-TO-CONSUMER DRIVERS |

BRANDING COMMUNICATION ASSORTMENT OPERATING PARTNER ICONIX INVENTORY ORDER MANAGEMENT SYSTEM DISTRIBUTION 35 • E-Commerce asset-light business model DIRECT-TO-CONSUMER DRIVERS |

NYC

HEADQUARTERS 24%

EUROPE LONDON, MANCHESTER OFFICES 24% LATIN AMERICA SANTIAGO, SAO PAULO OFFICES 8% CANADA 11% MEA 6% SOUTHEAST ASIA 4% CHINA HONG KONG, SHANGHAI OFFICES • Expertise on the ground • Growing network in-market 6% AUSTRALIA 5% INDIA 36 INTERNATIONAL - ICONIX TODAY Note: Percentages are based on 2016 revenue forecast, excludes Entertainment DRIVERS ~$70M 2016 Est. Revenue |

37 INTERNATIONAL - ICONIX GROWTH • 6 brands driving over 80% of growth • 4 territories driving over 70% of growth TERRITORY % OF INT’L GROWTH (2016-2019) EUROPE LATIN AMERICA CHINA MEA 24% 23% 16% 10% DRIVERS UMBRO 38% LEE COOPER 23% MOSSIMO 8% ECKO 5% DANSKIN 4% STARTER 3% OTHER 19% 2016 estimated International revenue by brand Note: International excludes Entertainment |

TRADITIONAL LICENSING LICENSING/EQUITY HYBRID EQUITY IN OPERATING COMPANIES IP SALES • LEE COOPER • JOE BOXER • ROCAWEAR • RAMPAGE • UMBRO • DANSKIN • CANDIES • MATERIAL GIRL • ECKO UNLTD • MARC ECKO CUT & SEW • ZOO YORK • ARTFUL DODGER • BADGLEY MISCHKA • LONDON FOG • ED HARDY $8M+ GMRs To be monetized $20M+ IP sales INTERNATIONAL - CHINA • Built strong infrastructure (brand management, marketing and retail/online) • International knowledge and localized know-how • Multiple paths to value creation 38 DRIVERS $37M GMRs $43M cash expected from sales of equity interest in brands |

39 MAINTAIN BRANDS INCUBATE MAINTAIN DRIVERS REVENUE GROWTH POTENTIAL |

40 • Maintain core business to protect foundation of portfolio’s cash flow • Renewed focus on keeping brands strong and in front of consumers • Prioritize marketing and other resources where able to achieve greatest return • Mitigate risk in changing retailer landscape MAINTAIN STRATEGY MAINTAIN |

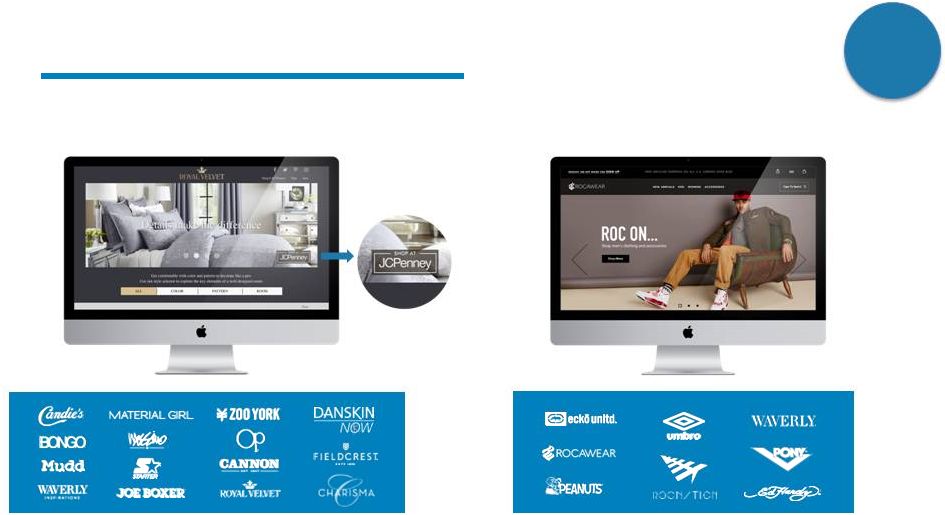

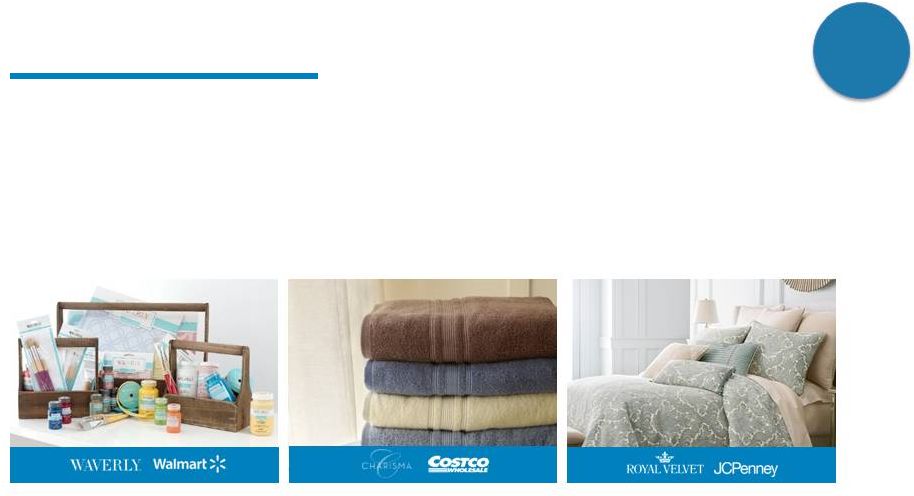

$6B+ RETAIL EQUIVALENT 41 WOMEN’S BUSINESS • Anchored by large and stable direct-to-retail businesses with best-in- class partners • Improving trend and design, social media presence and in-store experience • Maintain high margins MAINTAIN |

• Healthy home business in the U.S. driven by successful DTR strategy with major retailers • Charisma and Waverly largest growth opportunities 42 HOME BUSINESS $1B+ RETAIL EQUIVALENT MAINTAIN |

• Stabilizing business • Executing on e-commerce strategy • Mid-Tier distribution opportunity 43 MEN’S BUSINESS $2.5B+ RETAIL EQUIVALENT MAINTAIN |

• Global brand with 99% consumer awareness • 1,000 licenses globally • Strong movie momentum • Iconic girls property with over 35 years heritage • 350+ licenses globally • Investing in new content PEANUTS STRAWBERRY SHORTCAKE 44 ENTERTAINMENT BUSINESS $2.5B RETAIL EQUIVALENT MAINTAIN |

INCUBATE

BRANDS INCUBATE

MAINTAIN DRIVERS REVENUE GROWTH POTENTIAL 45 |

STRATEGY Brand Size Unclear Fit Market Position BRANDS 9 REVENUE $30M 46 • Allocate separate, dedicated leadership to potentially valuable but challenged brands • Prioritize resources focused on greatest return INCUBATE STRATEGY Note: Revenue refers to 2016 expectations INCUBATE |

Maintain or Drivers Divest CORE BUSINESS BRAND INCUBATOR • Continuous evaluation process for incubate brands FUTURE POSITION WITHIN ICONIX 47 INCUBATE |

48 BRAND BUILDING TOOLS BRAND CATEGORIZATION DRIVERS MAINTAIN INCUBATE BRAND BUILDING TOOLS • Marketing • Trend and merchandising • Design, product development, sourcing |

49 • Create long-term opportunities for organic growth MARKETING Build brands with new 360 Communication Strategy TREND & MERCHANDISING Support partners with enhanced services to maintain and grow market share DESIGN, PRODUCT DEVELOPMENT & SOURCING Provide leadership and expertise to drive product quality and competitiveness STRENGTHEN & ADD TOOLS |

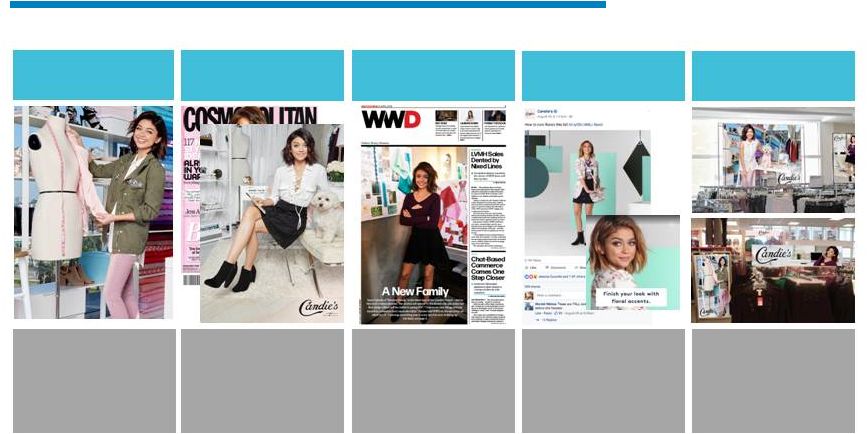

IN-STORE EXPERIENCE VISUAL MERCHANDISING DIGITAL BANNERS OUTDOOR PAID SEARCH PR SOCIAL MEDIA EMAILS NATIONAL ADVERTISING BRAND AMBASSADORS MARKETING EVOLUTION 360 COMMUNICATION STRATEGY • Maintain national brand image and awareness • Driving sales to our retail partners: brick & mortar and e-commerce • Adopt omni-channel approach: meet consumers everywhere they are |

PR • Online/Print Editorial • Fashion, Trade, Lifestyle, and Entertainment Features MEDIA PARTNERSHIPS • Refinery29 • Cosmopolitan • WhoWhatWear.com IN-STORE • Campaign Signage DIGITAL/SOCIAL • Social Media Activations & Takeovers • Website Re-launch PRODUCT • Creative direction for capsule collections • Styling and product development • Concept generation • Sarah Hyland, Creative Director for Candie’s 360 COMMUNICATION STRATEGY 51 |

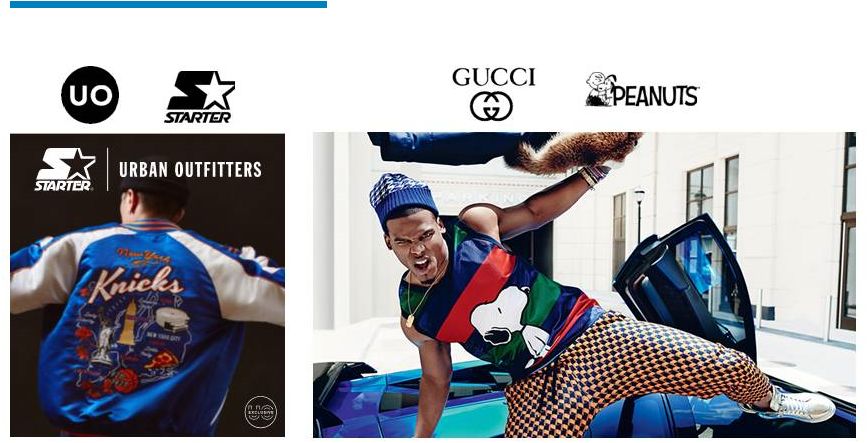

X • Strategic collaborations and capsule collections to drive brand relevancy X BRAND BUILDING |

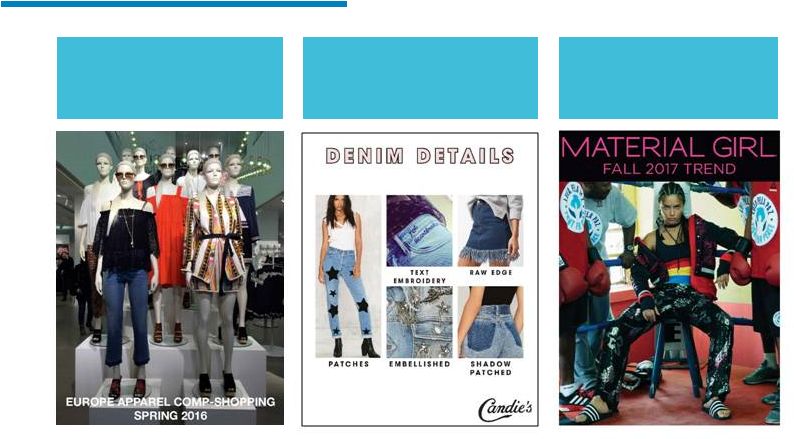

TREND

EXPERTISE SHOP GLOBAL

MARKET FOR TRENDS TRANSLATE INTO SPECIFIC APPLICATIONS FOR ICONIX BRANDS PRESENT QUARTERLY STRATEGY TO PARTNERS |

MERCHANDISING SUPPORT CREATE IN-STORE FIXTURE CONCEPTS PROVIDE ONLINE ENVIRONMENTS EVOLVE PACKAGING & LOGOS |

DESIGN,

PRODUCT DEVELOPMENT & SOURCING •

Creating value for brands and products

DESIGN • Clearly defined aesthetic standards across categories • Superior materials and execution SOURCING • Competitive quality • Optimized profitability • Increased speed to market PRODUCT DEVELOPMENT • Leadership of collaborative process • Consistent, competitive designs • Differentiation from private brands BRAND & PRODUCT SOURCING PRODUCT DEVELOPMENT DESIGN |

DIAMOND

ICON 56 • Leverage existing design, product development and sourcing platform • 30+ person team based in Manchester, UK • Over 5,500 SKUs per year across footwear, apparel, accessories and equipment • Facilitate placement and production of orders for ~$300M retail sales Note: Iconix owns 51% of Diamond ICON |

57 ONE ICONIX ONE ICONIX • Deeper relationships • Holistic approach BRAND CATEGORIZATION DRIVERS MAINTAIN INCUBATE |

BROADER,

DEEPER RELATIONSHIPS WITH RETAILERS

58 |

59 HOLISTIC APPROACH TO KEY CATEGORIES • Leverage knowledge and total category volume across brands FOOTWEAR DENIM $1B+ Retail Equivalent Sales $500M+ Retail Equivalent Sales Candie’s, Bongo, Rampage, London Fog, OP, Danskin, Material Girl, Joe Boxer, Mudd, Mossimo, Starter, Zoo York, Ecko Unltd., Rocawear, Pony Mossimo, Lee Cooper, Bongo, Material Girl, Mudd, Candie’s, Rocawear |

60 PORTFOLIO MANAGEMENT GLOBAL ORGANIC GROWTH PRUDENT CAPITAL MANAGEMENT HIGH OPERATING MARGIN, STRONG FREE CASH FLOW, ASSET LIGHT EXPERIENCED LEADERSHIP, WORLD CLASS IP PORTFOLIO, ACTIVE BRAND MANAGEMENT + + TOP 25% TSR PERFORMANCE ROADMAP TO VALUE CREATION |

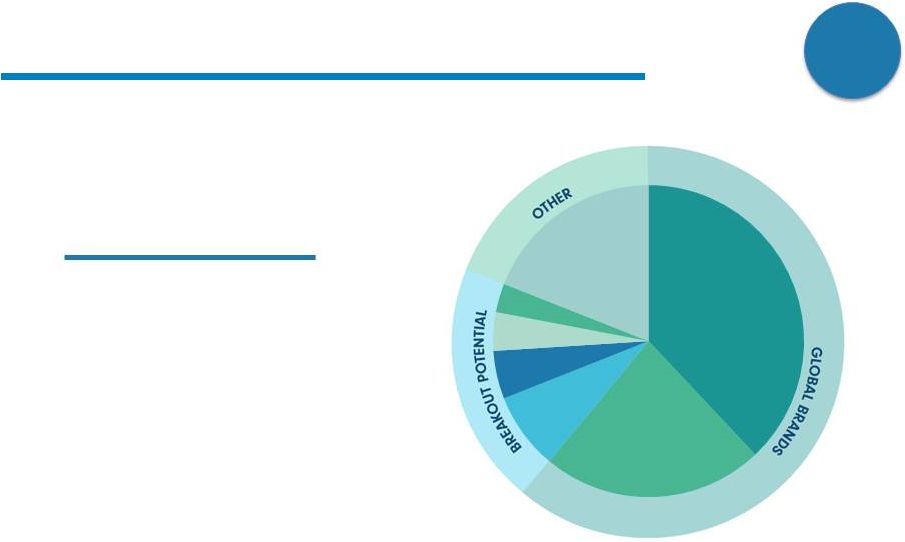

| 61 • Strategic approach to acquisitions – Leverage existing platform – International, domestic and global targets – Maximize available capital • Review of brands for portfolio optimization – Divest when strategically advantageous – Continue to assess incubate brands – Focused on generating greatest returns PRINCIPLES OF PORTFOLIO MANAGEMENT |

• Additional $25M of annual royalty revenue by year-end 2019 • Focus on core categories of Fashion, Active and Home 62 INTERNATIONAL GLOBAL DOMESTIC ACQUISITION GOALS • Tuck-in; leverage existing network and expertise • Utilize growing teams on the ground to source, structure and diligence • Transformative transaction; add to brand building tools • Seek targets adding $10M+ annual royalty revenue • Utilize permitted domestic restricted cash • Seek targets adding $25M+ annual royalty revenue • Seek targets adding $5M+ annual royalty revenue • Utilize International cash |

63 PROPOSED ICONIX CANADA & BUFFALO IP TRANSACTIONS Expected to be net neutral to earnings and positive to cash flow Proceeds to be used to reduce debt or strategic acquisition Expected to close within 60 days Note: There can be no assurance the proposed transactions will be consummated PLAN TO ACQUIRE 100% OF ICONIX CANADA • Iconix owns 51% (consolidated JV) • Master licensee has call option on brand in 2026 • Selling back to founders • Consolidated annual royalty revenue ~$17M • Current contribution to Iconix pre-tax income ~$5.5M PLAN TO DIVEST OWNERSHIP OF BUFFALO IP • Iconix owns 50% (consolidated JV) • Consistent with strategy to have control • Consolidated annual royalty revenue ~$6M • Current contribution to Iconix pre-tax income ~$2.3M |

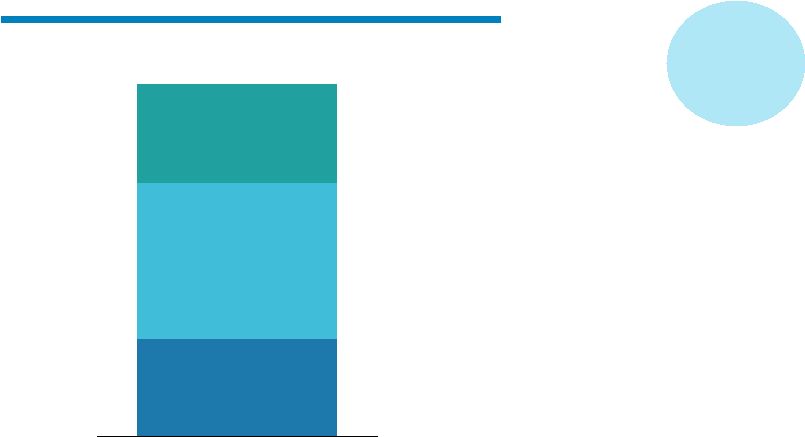

ORGANIC 2016 REVENUE 2019 REVENUE $350M $425M $50M ACQUISITIONS $25M 64 TOTAL PROJECTED REVENUE GROWTH Note: 2016 Revenue adjusted for Buffalo transaction +7% CAGR |

REVENUE OPERATING MARGIN 2016 ESTIMATED 2019 PROJECTED $350M $425M 48% 50% • $50M organic • $25M acquisitions • Profitable organic • Accretive acquisitions PATH TO GROWTH 65 EPS: • NON-GAAP • GAAP $1.06 $0.89 $1.25 $1.25 3 YEAR FINANCIAL PLAN Note: 2016 Revenue adjusted for Buffalo transaction 2016 Non-GAAP EPS includes approximately $0.12 related to the sale of the Badgley

Mischka brand • Revenue growth • Margin expansion |

| 66 • 60% of total compensation based on Iconix performance – Annual incentive awards • 75% Net Income and Revenue • 25% Strategic/functional objectives – Long-term incentive awards • Two-thirds tied to cumulative operating income with a TSR qualifier to earn over 100% – Stock ownership guidelines in place EXECUTIVE TEAM INCENTIVIZED TO DRIVE BUSINESS RESULTS |

67 PORTFOLIO MANAGEMENT GLOBAL ORGANIC GROWTH PRUDENT CAPITAL MANAGEMENT HIGH OPERATING MARGIN, STRONG FREE CASH FLOW, ASSET LIGHT EXPERIENCED LEADERSHIP, WORLD CLASS IP PORTFOLIO, ACTIVE BRAND MANAGEMENT + + TOP 25% TSR PERFORMANCE ROADMAP TO VALUE CREATION |

| • Refinancing upcoming debt top priority • Target leverage ~5.0x by 2019 • Use all available unrestricted domestic cash to de-lever • Disciplined approach to acquisitions utilizing available restricted cash and international cash 68 CAPITAL MANAGEMENT STRATEGY |

$250M TOTAL CASH 69 CURRENT CASH SUMMARY $69M U.S. Unrestricted $110M U.S. Restricted $74M International Unrestricted • $46M wholly owned • $23M consolidated JVs • $64M available for acquisitions • $46M securitization facility • $74M available for international acquisitions $138M available for acquisitions |

70 • Plan to extend $100M VFN maturity to January 2020 • Repurchased ~$105M of 2018 convertible notes at a discount • ~$295M convertible notes due March 2018 CURRENT CAPITAL STRUCTURE 2017 2018 2019 2020 2021 $471M $484M $228M $76M $76M Securitization Term Loan Convertible Note VFN |

71 2018 CONVERTIBLE NOTES • ~$295M outstanding ~$70M expected to be paid with existing cash and free cash flow ~$225M expected to be refinanced • Top priority • Healthy lending environment • Stabilized business and new management team • SEC accounting review/restatements completed |

$1.35B $1.0B ~8.0x ~5.0x 72 DE-LEVERING • Expect to generate over $400M of free cash flow over next 3 years • Natural de-levering via $76M amortization per year • Projecting EBITDA growth • Asset dispositions could accelerate de-levering • Target leverage ~5.0x by 2019 Year-end 2016 Year-end 2019 TOTAL DEBT |

73 KEY TAKEAWAYS • Iconix is the Leader in Large and Highly Profitable Global Brand Management Industry • New Management Team with Deep Industry Experience • Path to Organic Growth Driven By Strategic Choices, Enhanced Toolset • Portfolio Management Approach to M&A and Brand Ownership • Plan for Improved Leverage and Capital Structure Transparent, Proactive Shareholder Communication |

74 Q&A |

NOVEMBER 15, 2016 INVESTOR DAY |