Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Lonestar Resources US Inc. | lone-ex991_99.htm |

| 8-K - 8-K - Lonestar Resources US Inc. | lone-8k_20161110.htm |

Lonestar Resources US, Inc. Third Quarter Conference Call November 11, 2016 Ex-99.2

Forward-Looking Statements Safe Harbor & Disclaimer Lonestar Resources US, Inc. cautions that this presentation (including oral commentary that accompanies this presentation) contains forward-looking statements, including, but not limited to, statements about our business strategy and operations; discovery and development of crude oil, natural gas liquid (“NGL”) and natural gas reserves; drilling and completion of wells; and cash flows, liquidity, and availability and terms of capital. These statements involve substantial known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the following: volatility of oil, natural gas and NGL prices, and potential write-down of the carrying values of crude oil and natural gas properties; inability to successfully replace proved producing reserves; substantial capital expenditures required for exploration, development and exploitation projects; potential liabilities resulting from operating hazards, natural disasters or other interruptions; risks related using the latest available horizontal drilling and completion techniques; uncertainties tied to lengthy period of development of identified drilling locations; unexpected delays and cost overrun related to the development of estimated proved undeveloped reserves; concentration risk related to properties, which are located primarily in the Eagle Ford Shale of South Texas; loss of lease on undeveloped leasehold acreage that may result from lack of development or commercialization; inaccuracies in assumptions made in estimating proved reserves; our limited control over activities in properties Lonestar does not operate; potential inconsistency between the present value of future net revenues from our proved reserves and the current market value of our estimated oil and natural gas reserves; risks related to derivative activities; losses resulting from title deficiencies; risks related to health, safety and environmental laws and regulations; additional regulation of hydraulic fracturing; reduced demand for crude oil, natural gas and NGLs resulting from conservation measures and technological advances; inability to acquire adequate supplies of water for our drilling operations or to dispose of or recycle the used water economically and in an environmentally safe manner; climate change laws and regulations restricting emissions of “greenhouse gases” that may increase operating costs and reduce demand for the crude oil and natural gas; fluctuations in the differential between benchmark prices of crude oil and natural gas and the reference or regional index price used to price actual crude oil and natural gas sales; and the other important factors discussed under the caption “Risk Factors” in our Registration Statement on Form 10, as amended and filed with the Securities and Exchange Commission, or the SEC, on June 9, 2016, as well as other documents that we may file from time to time with the SEC. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to well performance, finding and development costs, recycle ratio and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. Lonestar Resources US, Inc. cautions that this presentation (including oral commentary that accompanies this presentation) contains forward-looking statements, including, but not limited to, statements about performance expectations related to our assets and technical improvements made thereto; drilling and completion of wells; and other statements regarding our business strategy and operations. These statements involve substantial known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the following: volatility of oil, natural gas and NGL prices, and potential write-down of the carrying values of crude oil and natural gas properties; inability to successfully replace proved producing reserves; substantial capital expenditures required for exploration, development and exploitation projects; potential liabilities resulting from operating hazards, natural disasters or other interruptions; risks related using the latest available horizontal drilling and completion techniques; uncertainties tied to lengthy period of development of identified drilling locations; unexpected delays and cost overrun related to the development of estimated proved undeveloped reserves; concentration risk related to properties, which are located primarily in the Eagle Ford Shale of South Texas; loss of lease on undeveloped leasehold acreage that may result from lack of development or commercialization; inaccuracies in assumptions made in estimating proved reserves; our limited control over activities in properties Lonestar does not operate; potential inconsistency between the present value of future net revenues from our proved reserves and the current market value of our estimated oil and natural gas reserves; risks related to derivative activities; losses resulting from title deficiencies; risks related to health, safety and environmental laws and regulations; additional regulation of hydraulic fracturing; reduced demand for crude oil, natural gas and NGLs resulting from conservation measures and technological advances; inability to acquire adequate supplies of water for our drilling operations or to dispose of or recycle the used water economically and in an environmentally safe manner; climate change laws and regulations restricting emissions of “greenhouse gases” that may increase operating costs and reduce demand for the crude oil and natural gas; fluctuations in the differential between benchmark prices of crude oil and natural gas and the reference or regional index price used to price actual crude oil and natural gas sales; and the other important factors discussed under the caption “Risk Factors” in our Registration Statement on Form 10, as amended and filed with the Securities and Exchange Commission, or the SEC, on June 9, 2016, as well as other documents that we have filed and may file from time to time with the SEC. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to well performance, finding and development costs, recycle ratio and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

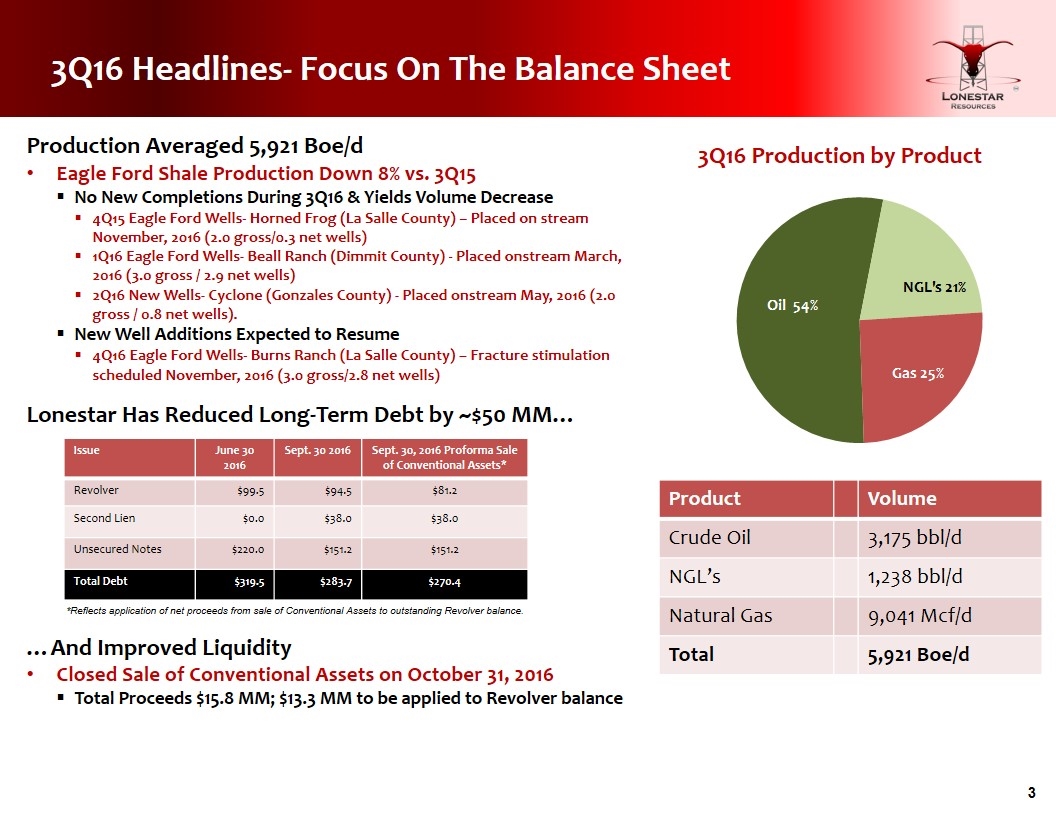

3Q16 Headlines- Focus On The Balance Sheet 3Q16 Production by Product Production Averaged 5,921 Boe/d Eagle Ford Shale Production Down 8% vs. 3Q15 No New Completions During 3Q16 & Yields Volume Decrease 4Q15 Eagle Ford Wells- Horned Frog (La Salle County) – Placed on stream November, 2016 (2.0 gross/0.3 net wells) 1Q16 Eagle Ford Wells- Beall Ranch (Dimmit County) - Placed onstream March, 2016 (3.0 gross / 2.9 net wells) 2Q16 New Wells- Cyclone (Gonzales County) - Placed onstream May, 2016 (2.0 gross / 0.8 net wells). New Well Additions Expected to Resume 4Q16 Eagle Ford Wells- Burns Ranch (La Salle County) – Fracture stimulation scheduled November, 2016 (3.0 gross/2.8 net wells) Lonestar Has Reduced Long-Term Debt by ~$50 MM… *Reflects application of net proceeds from sale of Conventional Assets to outstanding Revolver balance. …And Improved Liquidity Closed Sale of Conventional Assets on October 31, 2016 Total Proceeds $15.8 MM; $13.3 MM to be applied to Revolver balance Product Volume Crude Oil 3,175 bbl/d NGL’s 1,238 bbl/d Natural Gas 9,041 Mcf/d Total 5,921 Boe/d Issue June 30 2016 Sept. 30 2016 Sept. 30, 2016 Proforma Sale of Conventional Assets* Revolver $99.5 $94.5 $81.2 Second Lien $0.0 $38.0 $38.0 Unsecured Notes $220.0 $151.2 $151.2 Total Debt $319.5 $283.7 $270.4

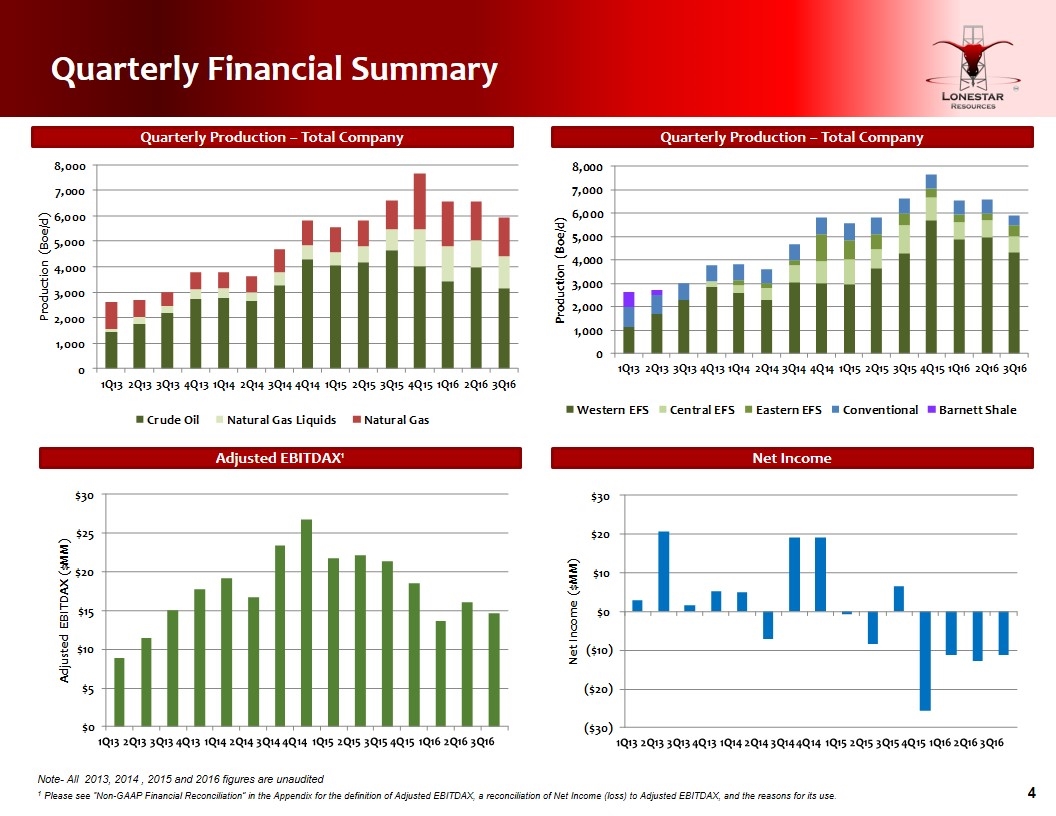

Quarterly Financial Summary Quarterly Production – Total Company Quarterly Production – Total Company Net Income Adjusted EBITDAX1 Note- All 2013, 2014 , 2015 and 2016 figures are unaudited 1 Please see “Non-GAAP Financial Reconciliation” in the Appendix for the definition of Adjusted EBITDAX, a reconciliation of Net Income (loss) to Adjusted EBITDAX, and the reasons for its use.

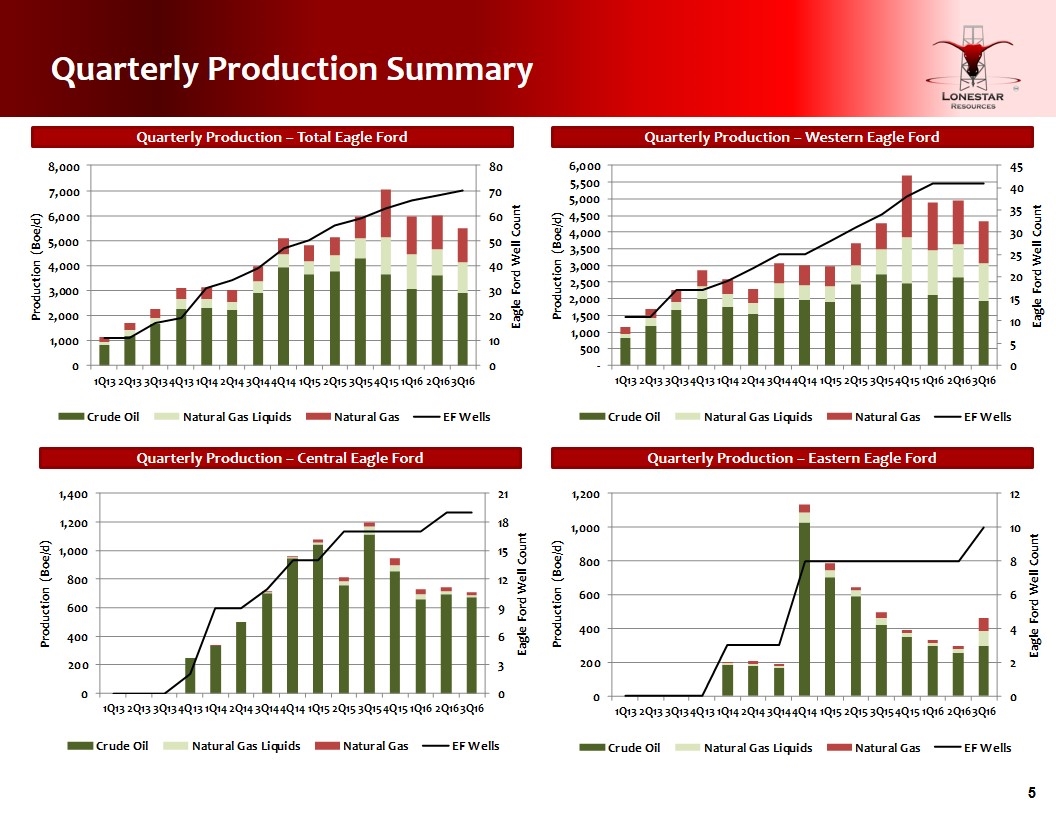

Quarterly Production Summary Quarterly Production – Total Eagle Ford Quarterly Production – Western Eagle Ford Quarterly Production – Eastern Eagle Ford Quarterly Production – Central Eagle Ford

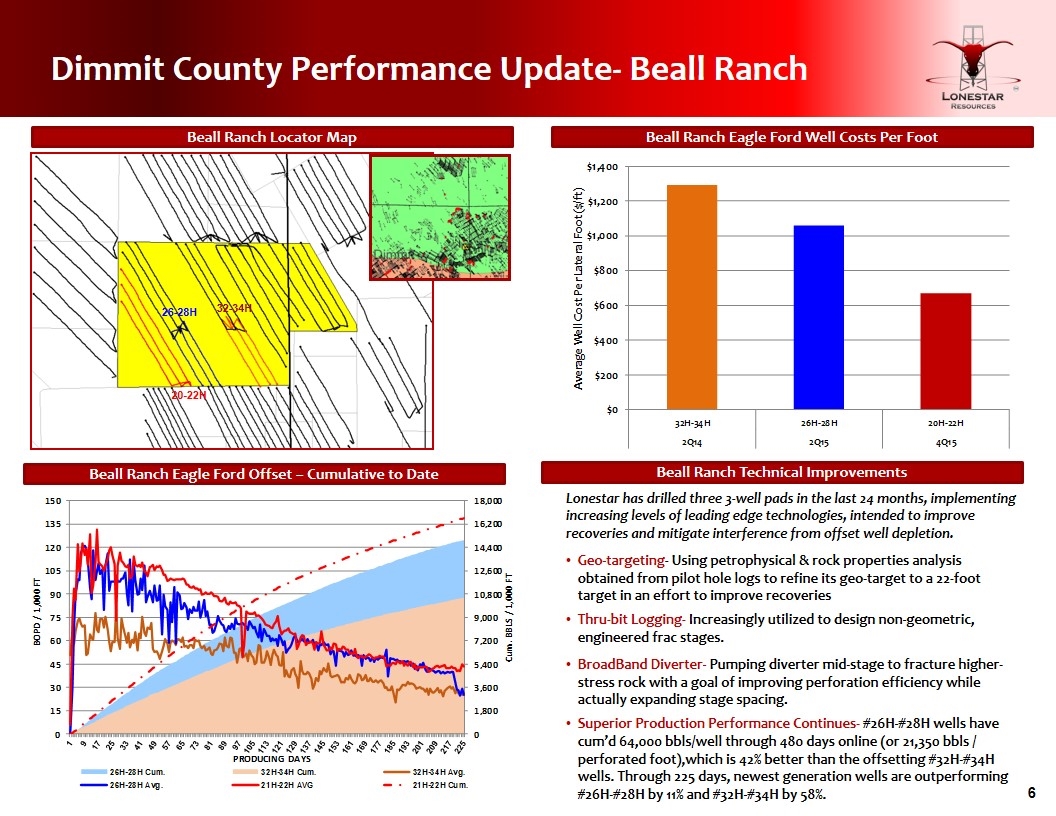

Dimmit County Performance Update- Beall Ranch Beall Ranch Locator Map Beall Ranch Eagle Ford Well Costs Per Foot Beall Ranch Eagle Ford Offset – Cumulative to Date Beall Ranch Technical Improvements 26-28H 32-34H 20-22H Lonestar has drilled three 3-well pads in the last 24 months, implementing increasing levels of leading edge technologies, intended to improve recoveries and mitigate interference from offset well depletion. Geo-targeting- Using petrophysical & rock properties analysis obtained from pilot hole logs to refine its geo-target to a 22-foot target in an effort to improve recoveries Thru-bit Logging- Increasingly utilized to design non-geometric, engineered frac stages. BroadBand Diverter- Pumping diverter mid-stage to fracture higher-stress rock with a goal of improving perforation efficiency while actually expanding stage spacing. Superior Production Performance Continues- #26H-#28H wells have cum’d 64,000 bbls/well through 480 days online (or 21,350 bbls / perforated foot),which is 42% better than the offsetting #32H-#34H wells. Through 225 days, newest generation wells are outperforming #26H-#28H by 11% and #32H-#34H by 58%.

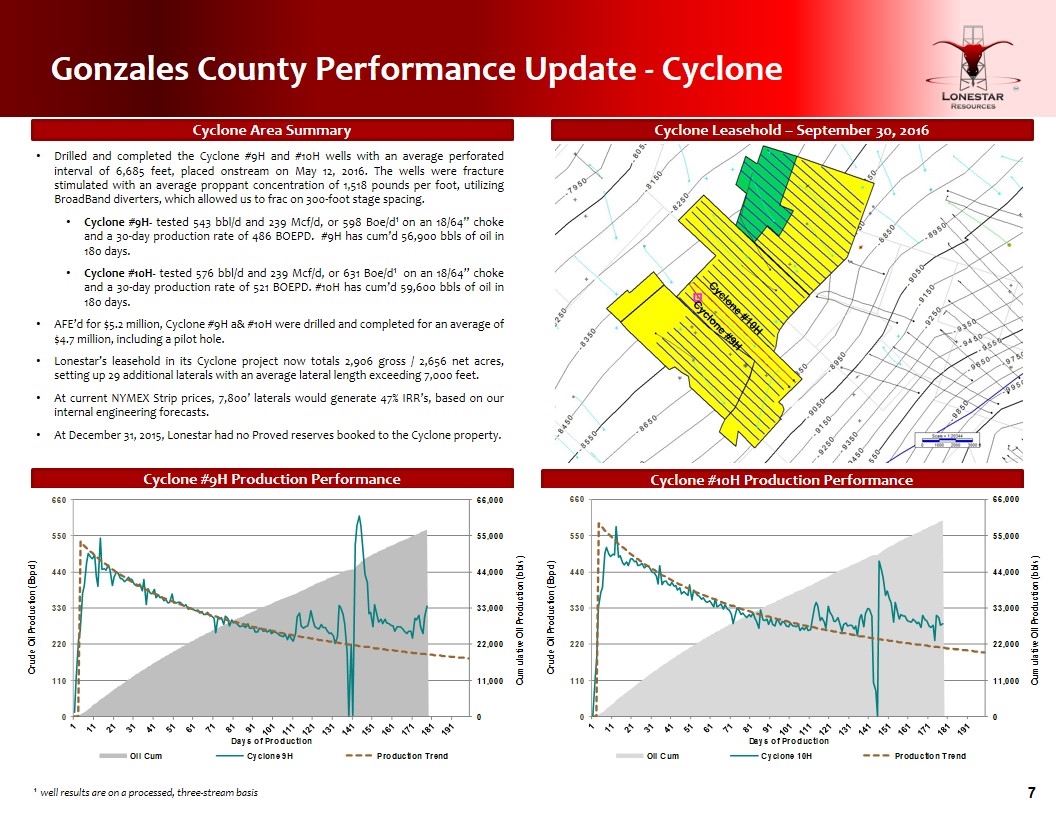

Gonzales County Performance Update - Cyclone Cyclone Area Summary Cyclone Leasehold – September 30, 2016 Cyclone #9H Production Performance Cyclone #10H Production Performance Drilled and completed the Cyclone #9H and #10H wells with an average perforated interval of 6,685 feet, placed onstream on May 12, 2016. The wells were fracture stimulated with an average proppant concentration of 1,518 pounds per foot, utilizing BroadBand diverters, which allowed us to frac on 300-foot stage spacing. Cyclone #9H- tested 543 bbl/d and 239 Mcf/d, or 598 Boe/d1 on an 18/64” choke and a 30-day production rate of 486 BOEPD. #9H has cum’d 56,900 bbls of oil in 180 days. Cyclone #10H- tested 576 bbl/d and 239 Mcf/d, or 631 Boe/d1 on an 18/64” choke and a 30-day production rate of 521 BOEPD. #10H has cum’d 59,600 bbls of oil in 180 days. AFE’d for $5.2 million, Cyclone #9H a& #10H were drilled and completed for an average of $4.7 million, including a pilot hole. Lonestar’s leasehold in its Cyclone project now totals 2,906 gross / 2,656 net acres, setting up 29 additional laterals with an average lateral length exceeding 7,000 feet. At current NYMEX Strip prices, 7,800’ laterals would generate 47% IRR’s, based on our internal engineering forecasts. At December 31, 2015, Lonestar had no Proved reserves booked to the Cyclone property. 1 well results are on a processed, three-stream basis Leased Top Leased Cyclone #10H Cyclone #9H

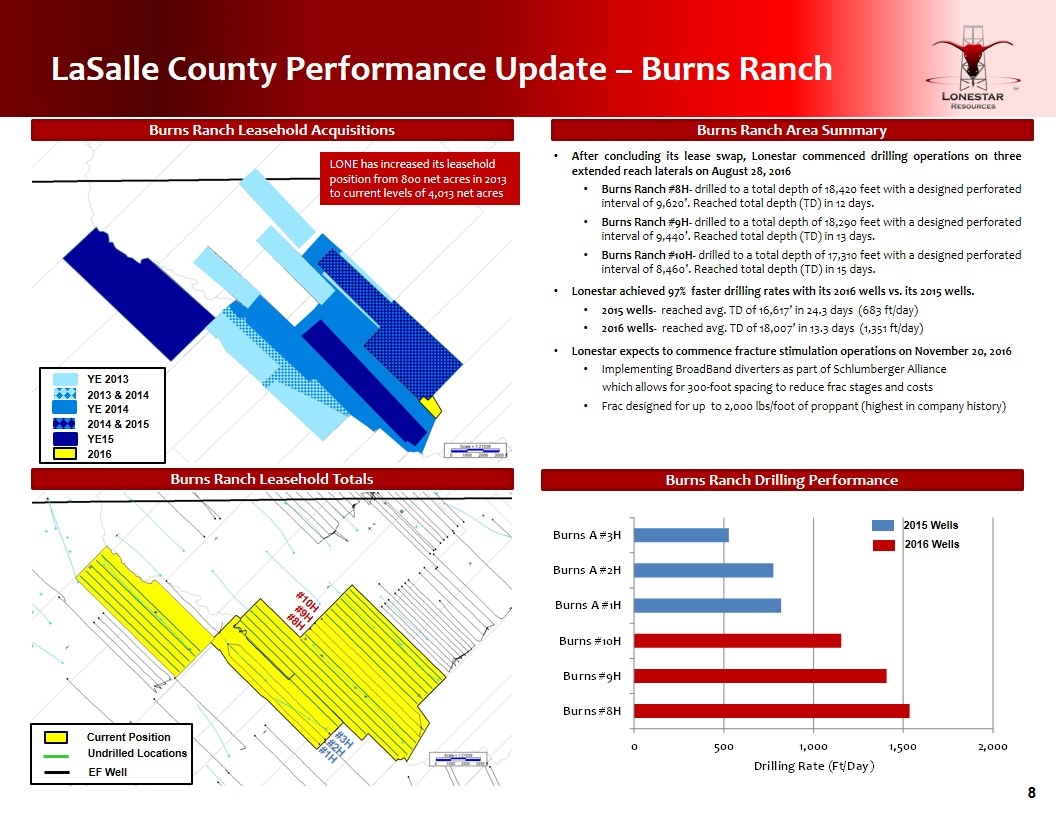

LaSalle County Performance Update – Burns Ranch Burns Ranch Leasehold Acquisitions Burns Ranch Area Summary Burns Ranch Leasehold Totals Burns Ranch Drilling Performance After concluding its lease swap, Lonestar commenced drilling operations on three extended reach laterals on August 28, 2016 Burns Ranch #8H- drilled to a total depth of 18,420 feet with a designed perforated interval of 9,620’. Reached total depth (TD) in 12 days. Burns Ranch #9H- drilled to a total depth of 18,290 feet with a designed perforated interval of 9,440’. Reached total depth (TD) in 13 days. Burns Ranch #10H- drilled to a total depth of 17,310 feet with a designed perforated interval of 8,460’. Reached total depth (TD) in 15 days. Lonestar achieved 97% faster drilling rates with its 2016 wells vs. its 2015 wells. 2015 wells- reached avg. TD of 16,617’ in 24.3 days (683 ft/day) 2016 wells- reached avg. TD of 18,007’ in 13.3 days (1,351 ft/day) Lonestar expects to commence fracture stimulation operations on November 20, 2016 Implementing BroadBand diverters as part of Schlumberger Alliance which allows for 300-foot spacing to reduce frac stages and costs Frac designed for up to 2,000 lbs/foot of proppant (highest in company history) YE 2013 2013 & 2014 YE 2014 YE15 2014 & 2015 2016 Current Position Undrilled Locations EF Well 2015 Wells 2016 Wells LONE has increased its leasehold position from 800 net acres in 2013 to current levels of 4,013 net acres #1H #2H #3H #8H #9H #10H

Lonestar Resources, Ltd. Appendix

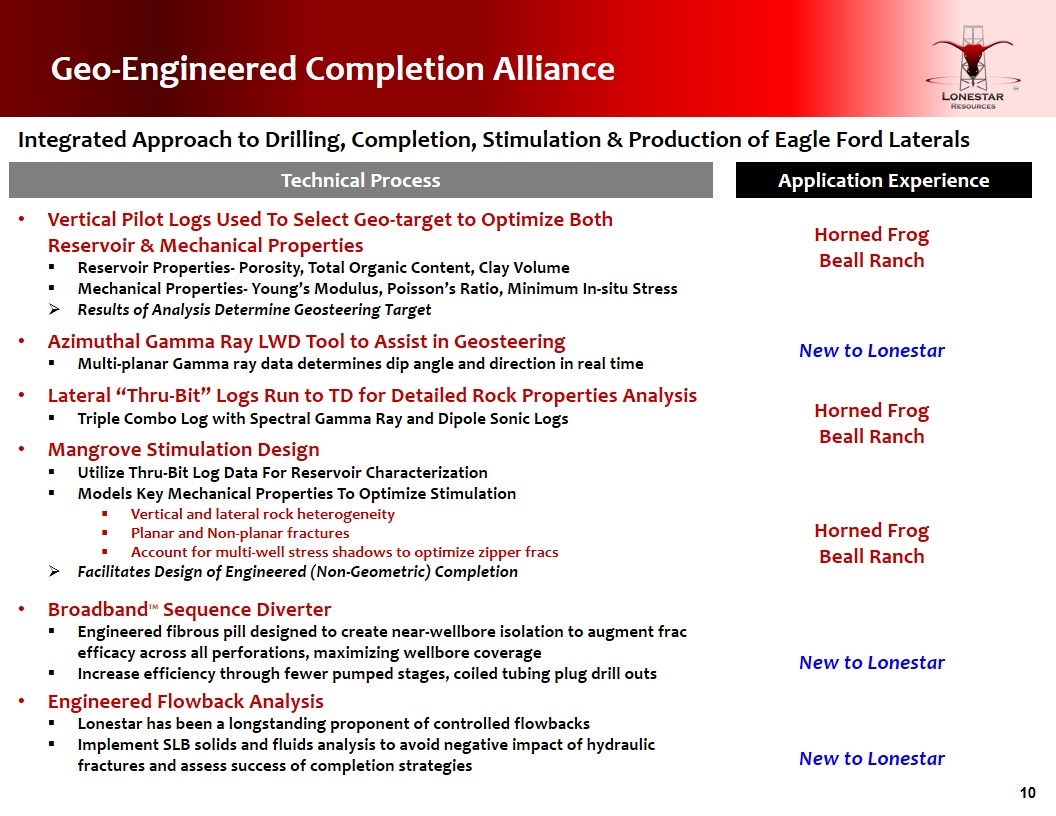

Geo-Engineered Completion Alliance Vertical Pilot Logs Used To Select Geo-target to Optimize Both Reservoir & Mechanical Properties Reservoir Properties- Porosity, Total Organic Content, Clay Volume Mechanical Properties- Young’s Modulus, Poisson’s Ratio, Minimum In-situ Stress Results of Analysis Determine Geosteering Target Azimuthal Gamma Ray LWD Tool to Assist in Geosteering Multi-planar Gamma ray data determines dip angle and direction in real time Lateral “Thru-Bit” Logs Run to TD for Detailed Rock Properties Analysis Triple Combo Log with Spectral Gamma Ray and Dipole Sonic Logs Mangrove Stimulation Design Utilize Thru-Bit Log Data For Reservoir Characterization Models Key Mechanical Properties To Optimize Stimulation Vertical and lateral rock heterogeneity Planar and Non-planar fractures Account for multi-well stress shadows to optimize zipper fracs Facilitates Design of Engineered (Non-Geometric) Completion BroadbandTM Sequence Diverter Engineered fibrous pill designed to create near-wellbore isolation to augment frac efficacy across all perforations, maximizing wellbore coverage Increase efficiency through fewer pumped stages, coiled tubing plug drill outs Engineered Flowback Analysis Lonestar has been a longstanding proponent of controlled flowbacks Implement SLB solids and fluids analysis to avoid negative impact of hydraulic fractures and assess success of completion strategies Integrated Approach to Drilling, Completion, Stimulation & Production of Eagle Ford Laterals Technical Process Application Experience Horned Frog Beall Ranch Horned Frog Beall Ranch Horned Frog Beall Ranch New to Lonestar New to Lonestar New to Lonestar

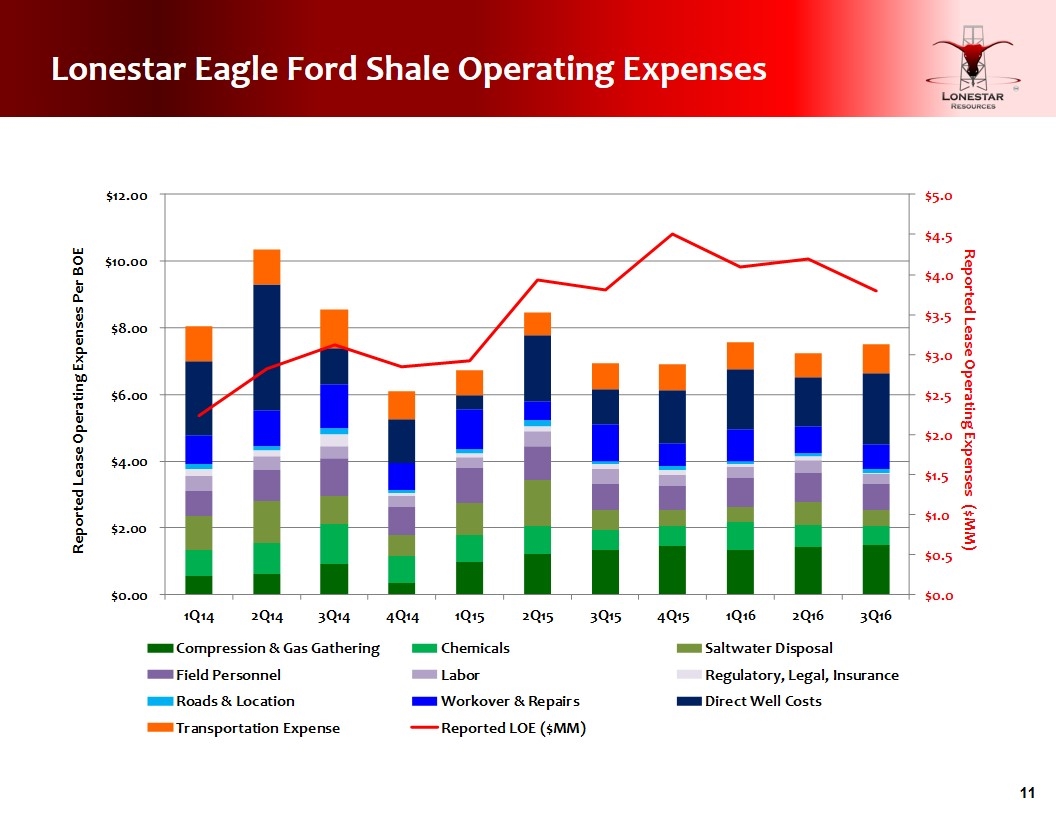

Lonestar Eagle Ford Shale Operating Expenses

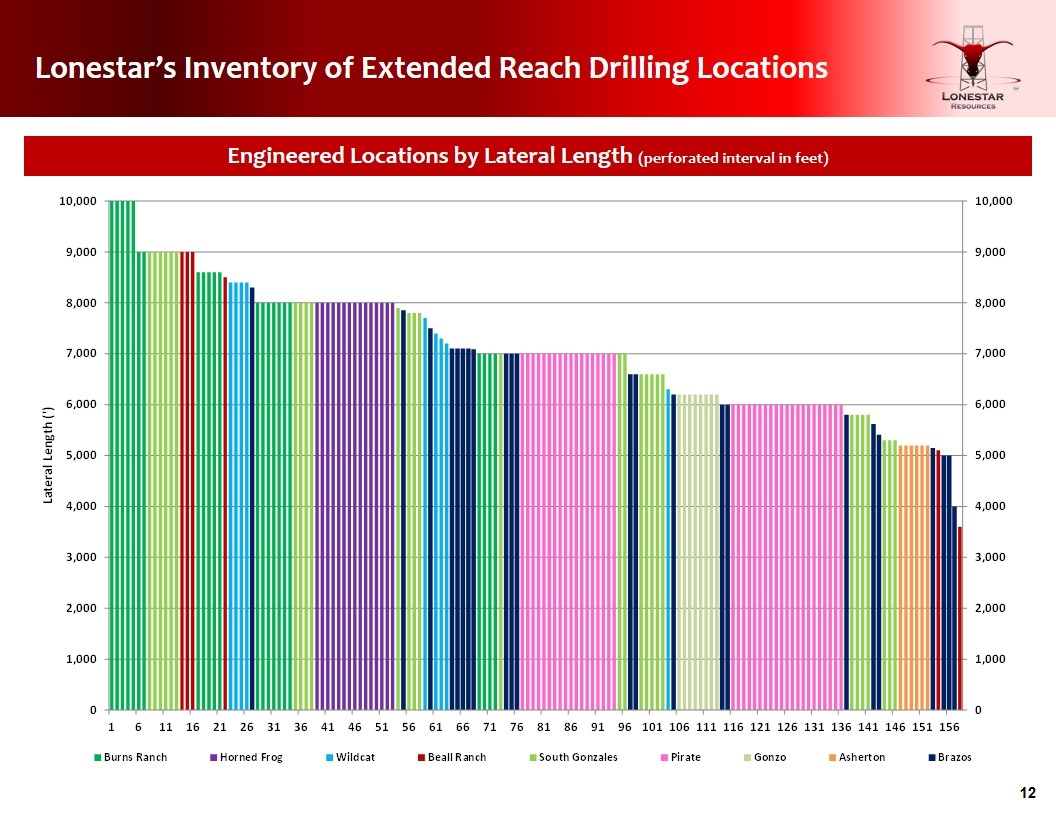

Lonestar’s Inventory of Extended Reach Drilling Locations Engineered Locations by Lateral Length (perforated interval in feet)

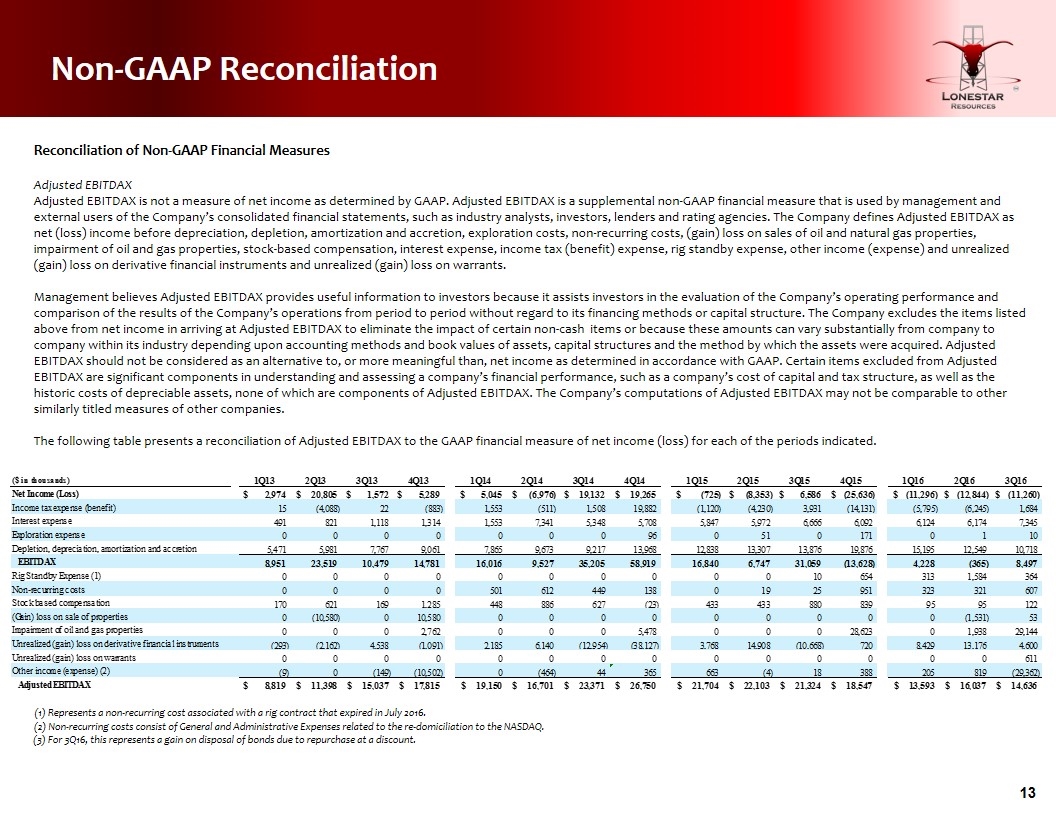

Non-GAAP Reconciliation Reconciliation of Non-GAAP Financial Measures Adjusted EBITDAX Adjusted EBITDAX is not a measure of net income as determined by GAAP. Adjusted EBITDAX is a supplemental non-GAAP financial measure that is used by management and external users of the Company’s consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. The Company defines Adjusted EBITDAX as net (loss) income before depreciation, depletion, amortization and accretion, exploration costs, non-recurring costs, (gain) loss on sales of oil and natural gas properties, impairment of oil and gas properties, stock-based compensation, interest expense, income tax (benefit) expense, rig standby expense, other income (expense) and unrealized (gain) loss on derivative financial instruments and unrealized (gain) loss on warrants. Management believes Adjusted EBITDAX provides useful information to investors because it assists investors in the evaluation of the Company’s operating performance and comparison of the results of the Company’s operations from period to period without regard to its financing methods or capital structure. The Company excludes the items listed above from net income in arriving at Adjusted EBITDAX to eliminate the impact of certain non-cash items or because these amounts can vary substantially from company to company within its industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDAX. The Company’s computations of Adjusted EBITDAX may not be comparable to other similarly titled measures of other companies. The following table presents a reconciliation of Adjusted EBITDAX to the GAAP financial measure of net income (loss) for each of the periods indicated. (1) Represents a non-recurring cost associated with a rig contract that expired in July 2016. (2) Non-recurring costs consist of General and Administrative Expenses related to the re-domiciliation to the NASDAQ. (3) For 3Q16, this represents a gain on disposal of bonds due to repurchase at a discount.

Glossary •“bbl” means barrel of oil. • bbls/d means the number of one stock tank barrel, or 42 US gallons liquid volume of oil or other liquid hydrocarbons per day. “Boe” means barrels of oil equivalent, with 6,000 cubic feet of natural gas being equivalent to one barrel of oil. •Boe/d means barrels of oil equivalent per day. “scf” means standard cubic feet. •“btu” means British thermal units. •“M” prefix means thousand. •“MM” prefix means million. •“B” prefix means billion. •“NGL” means Natural Gas Liquids– these products are stripped from the gas stream at 3rd party facilities remote to the field. •“TEV” means total enterprise value •“LTM” means last twelve months •“NTM” means next twelve months •“HBP” means held by production •“EPS” means earnings per share • “Mcf/d” means thousand cubic feet of natural gas per day • “IRR” means our internal rate of return, calculates the interest rate at which the net present value of all the cash flows (both positive and negative) from a project or investment equal zero • “EUR” means gross estimated ultimate recoveries for a single well Note: One Boe is equal to six Mcf of natural gas or one Bbl of oil or NGLs based on an industry-standard approximate energy equivalency. This is a physical correlation and does not reflect a value or price relationship between the commodities.