Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Conifer Holdings, Inc. | a8-k3rdquarterinvestorpres.htm |

THIRD QUARTER 2016

INVESTOR CONFERENCE CALL

November 10, 2016

1

SAFE HARBOR STATEMENT

This presentation contains “forward-looking” statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

that are based on our management’s beliefs and assumptions and on information currently available to

management. These forward-looking statements include, without limitation, statements regarding our

industry, business strategy, plans, goals and expectations concerning our market position, product

expansion, future operations, margins, profitability, future efficiencies, and other financial and operating

information. When used in this discussion, the words “may,” “believes,” “intends,” “seeks,” “anticipates,”

“plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “potential,” “could,” “will,” “future” and the

negative of these or similar terms and phrases are intended to identify forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties, inherent risks and other

factors that may cause our actual results, performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by the forward-looking statements.

Forward-looking statements represent our management’s beliefs and assumptions only as of the date of

this presentation. Our actual future results may be materially different from what we expect due to factors

largely outside our control, including the occurrence of severe weather conditions and other catastrophes,

the cyclical nature of the insurance industry, future actions by regulators, our ability to obtain reinsurance

coverage at reasonable rates and the effects of competition. These and other risks and uncertainties

associated with our business are described under the heading “Risk Factors” in our Annual Report on Form

10-K for the year ended December 31, 2015, which should be read in conjunction with this presentation.

The company and subsidiaries operate in a dynamic business environment, and therefore the risks

identified are not meant to be exhaustive. Risk factors change and new risks emerge frequently. Except as

required by law, we assume no obligation to update these forward-looking statements publicly, or to update

the reasons actual results could differ materially from those anticipated in the forward-looking statements,

even if new information becomes available in the future.

1

$16.7

$20.8

$7.5

$7.7

$0

$5

$10

$15

$20

$25

$30

Q3 2015 Q3 2016

M

I

L

L

I

O

N

S

Commercial Lines Personal Lines

Significant top line growth:

• Total gross written premium was

$28.5 million for Q3 2016

Up 17.6% over the same period in 2015

Net earned premium was up 30.7%

for the same period

• Factors driving premium growth include:

Strong commercial lines experience in

hospitality & small business accounts,

particularly in commercial multi-peril

and workers’ compensation lines

Personal lines focus on low-value dwellings and

wind-exposed homeowners

• Active claims management

Select reserve strengthening in the quarter

(added roughly 11 points to the loss ratio)

Still generated a loss ratio of 61.6% in Q3 2016

• Expense ratio showing improvement

Sequential quarterly reduction

• 170 basis point improvement over Q2 2016

• 780 basis point improvement over Q4 2015

Expect continued downward trend as

earned premiums ramp up

• Book Value of $9.76 per share, or $74.5 million,

of shareholders’ equity

2

RESULTS OVERVIEW: Q3 2016

GROSS WRITTEN PREMIUM

3

BUSINESS MIX – GROSS WRITTEN PREMIUM

Personal

Lines

27.2%

Commercial

Lines

72.8%

Hospitality

41.6%

Small Business

31.2%

Wind-Exposed

18.0%

Low-Value Dwelling

9.2%

$0

$5

$10

$15

$20

$25

Q3 2015 Q3 2016

M

I

L

L

I

O

N

S

Commercial Multi-Peril Other Liability

Commercial Auto Other Commercial

COMMERCIAL LINES OVERVIEW

• Seek leading position in niche markets we write

• Focused on small to medium sized owner operators

• 24.6% growth in commercial gross written premium to

$20.8 million for the third quarter of 2016

• Writing commercial lines in all 50 states

4

10 to 25% of GWP

2 to 9.9% of GWP

1 to 1.9% of GWP

Less than 1% of GWP

GROSS WRITTEN PREMIUM

5

460

295

0

50

100

150

200

250

300

350

400

450

500

$9,549

$11,960

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

UNDERWRITING ENHANCEMENTS & POLICIES IN FORCE REDUCTION

• Increased rates an average of 25%

• Curtailed new business in select geographies

• Focus on smaller operators (1-3 vehicles)

• Total repo policies in force down almost 36%

REPOSSESSION & TOWING COMMERCIAL AUTO: Q3 2016

9/30/2015 9/30/2016

25.2%

rate increase

35.9%

fewer policies in force

9/30/2015 9/30/2016

AVERAGE PREMIUM PER POLICY POLICIES IN FORCE

6

• Reserve strengthening impact: added 11 percentage points to Q3 2016 loss ratio

(50.6% without impact) – largest impact from:

Florida homeowners: 3.2 percentage points

Commercial auto: 2.5 percentage points

Commercial multi-peril: 4.0 percentage points (favorable for the 9 months)

• Even with full impact of reserve strengthening, loss ratio was 61.6% for Q3 2016

50.3% 53.3%

63.3%

89.5%

53.3%

61.6%

Q3 2015 Q3 2016

Commercial Lines Personal Lines Consolidated

RESULTS OVERVIEW: Q3 2016 LOSS RATIO

6

Loss Ratio Target:

55%

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

Q3 2015 Q3 2016

M

I

L

L

I

O

N

S

Wind-Exposed Low-Value Dwelling Personal Auto (run-off)

• Gross written premium was up 2.0% during the third quarter

• Increase in wind-exposed homeowners focusing on coastal exposures in Hawaii, Texas and Florida

• Low-value dwelling ramp up primarily in southern states, such as Texas and northern Louisiana

PERSONAL LINES: LOW-VALUE DWELLING & WIND-EXPOSED HOMEOWNERS

GROSS WRITTEN PREMIUM

$ in thousands

Q3 2016

Top Five States

Texas $ 3,211 41.5%

Florida 2,430 31.4%

Hawaii 1,018 13.2%

Indiana 834 10.8%

Illinois 173 2.2%

All Other 72 1.1%

Total $ 7,738 100.0%

7

GROSS WRITTEN PREMIUM

8

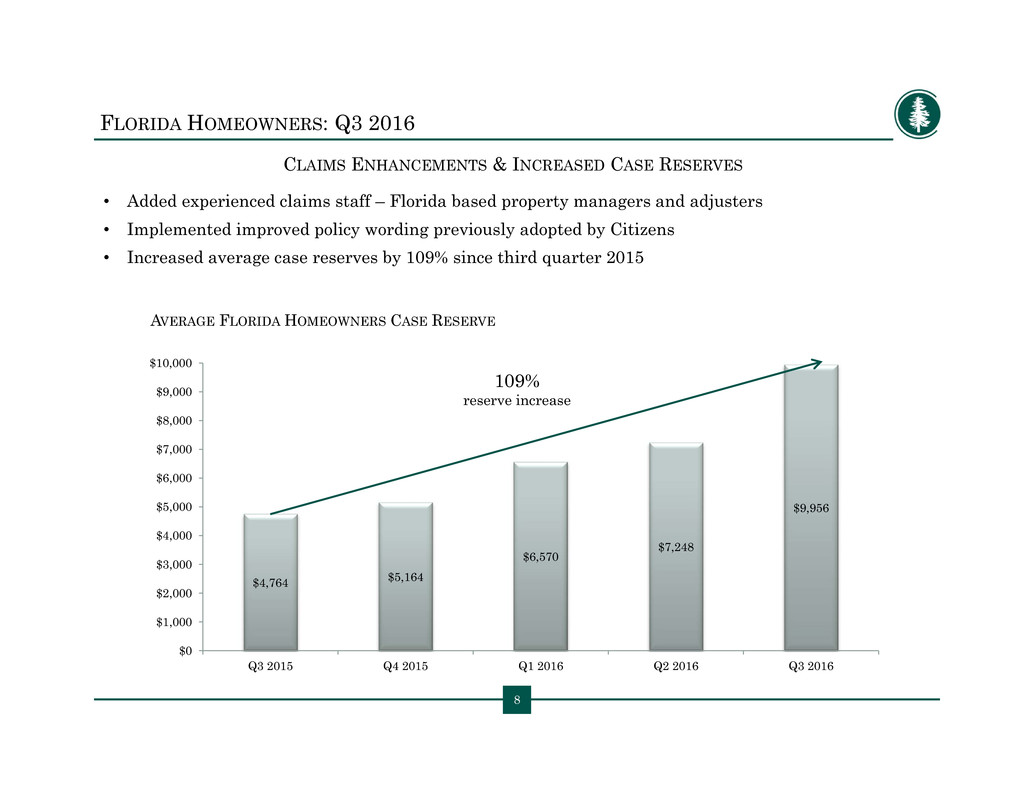

$4,764 $5,164

$6,570

$7,248

$9,956

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016

CLAIMS ENHANCEMENTS & INCREASED CASE RESERVES

• Added experienced claims staff – Florida based property managers and adjusters

• Implemented improved policy wording previously adopted by Citizens

• Increased average case reserves by 109% since third quarter 2015

FLORIDA HOMEOWNERS: Q3 2016

8

109%

reserve increase

AVERAGE FLORIDA HOMEOWNERS CASE RESERVE

9

Q3 2016 INCOME STATEMENT

• Increased production in hospitality, small business, security services and select homeowners

lines of business

• 2015 investments in experienced underwriting teams are driving organic growth

• Operating loss of $0.20 per diluted share for Q3 2016

• $9.76 per share, or $74.5 million, of shareholders’ equity

Three Months Ended September 30,

($ in thousands, except per share data and ratios) 2016 2015

Gross Written Premium $28,497 $24,242

Net Written Premium 24,634 28,599

Net Earned Premium 23,380 17,883

Net Income (Loss) (1,475) 1,145

Net Income (Loss) Allocable to Common Shareholders (1,475) 1,212

EPS, Basic and Diluted (0.19) 0.21

Operating Income (Loss) (1,546) 1,102

Operating Income (Loss) per share (0.20) 0.19

9

10

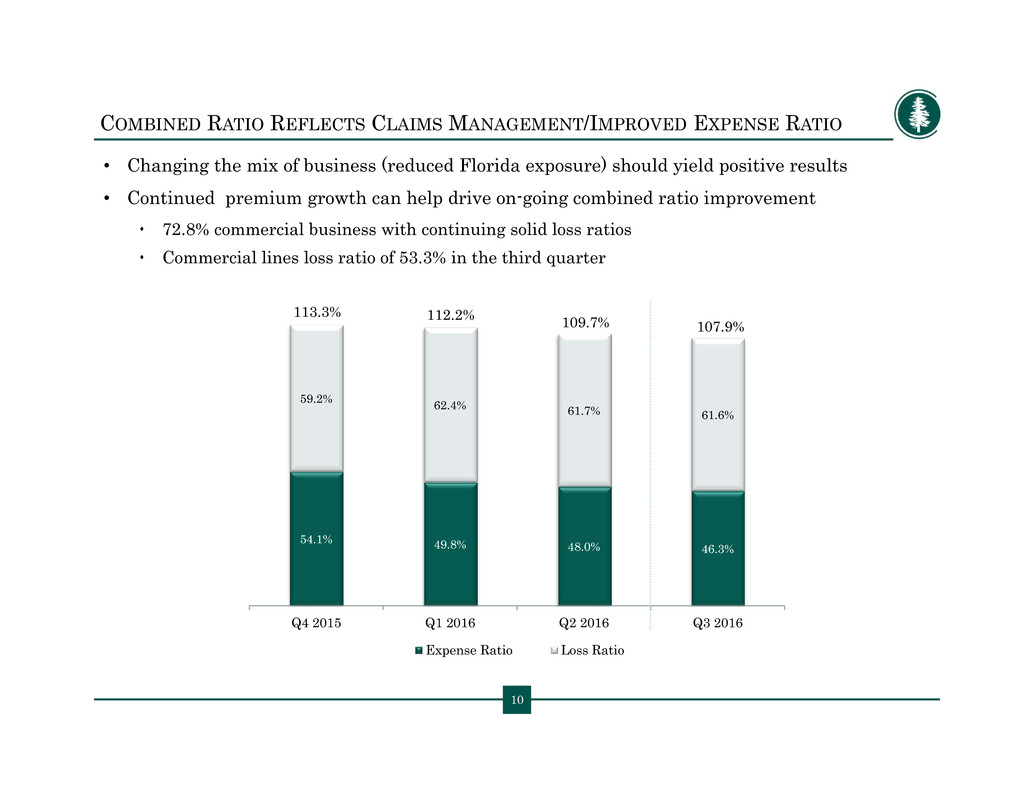

54.1% 49.8% 48.0% 46.3%

59.2% 62.4% 61.7% 61.6%

Q4 2015 Q1 2016 Q2 2016 Q3 2016

Expense Ratio Loss Ratio

COMBINED RATIO REFLECTS CLAIMS MANAGEMENT/IMPROVED EXPENSE RATIO

• Changing the mix of business (reduced Florida exposure) should yield positive results

• Continued premium growth can help drive on-going combined ratio improvement

72.8% commercial business with continuing solid loss ratios

Commercial lines loss ratio of 53.3% in the third quarter

10

113.3%

109.7%112.2% 107.9%

11

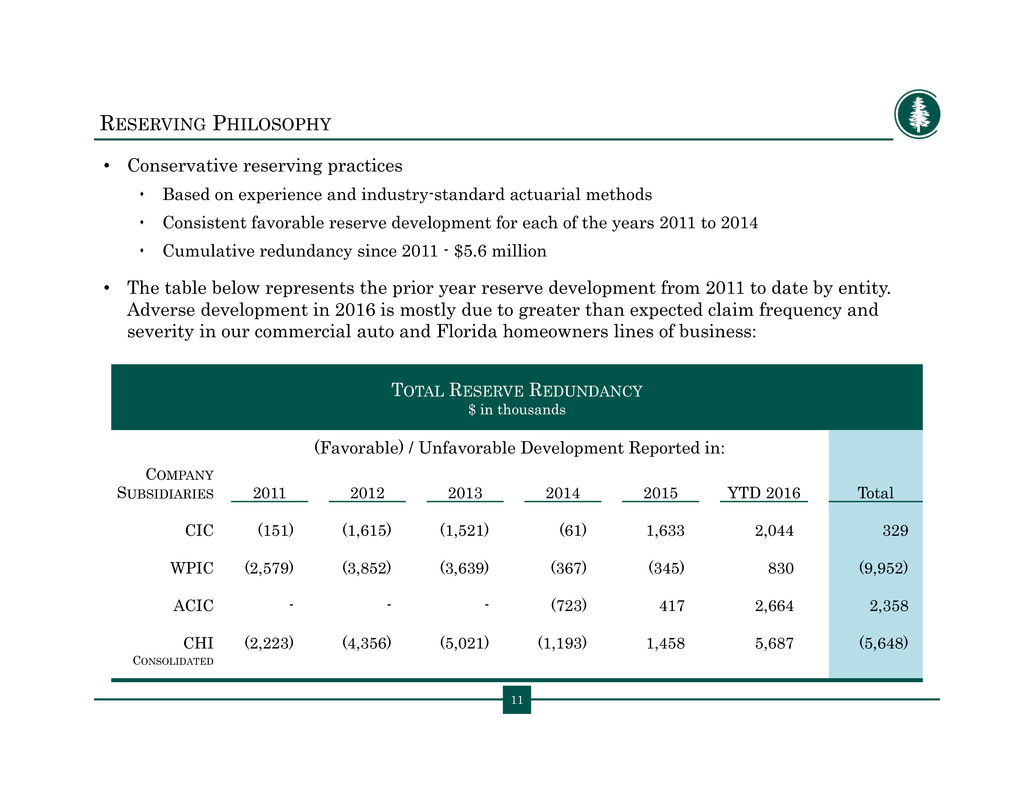

RESERVING PHILOSOPHY

• Conservative reserving practices

Based on experience and industry-standard actuarial methods

Consistent favorable reserve development for each of the years 2011 to 2014

Cumulative redundancy since 2011 - $5.6 million

• The table below represents the prior year reserve development from 2011 to date by entity.

Adverse development in 2016 is mostly due to greater than expected claim frequency and

severity in our commercial auto and Florida homeowners lines of business:

TOTAL RESERVE REDUNDANCY

$ in thousands

(Favorable) / Unfavorable Development Reported in:

COMPANY

SUBSIDIARIES 2011 2012 2013 2014 2015 YTD 2016 Total

CIC (151) (1,615) (1,521) (61) 1,633 2,044 329

WPIC (2,579) (3,852) (3,639) (367) (345) 830 (9,952)

ACIC - - - (723) 417 2,664 2,358

CHI (2,223) (4,356) (5,021) (1,193) 1,458 5,687 (5,648)

CONSOLIDATED

12

54.1%

49.8% 48.0% 46.3%

Q4 2015 Q1 2016 Q2 2016 Q3 2016

EXPENSE RATIO: TRENDING DOWNWARD

• Total expense ratio of 46.3% in Q3 2016

Versus 54.1% in Q4 2015

Versus 49.8% in Q1 2016

Versus 48.0% in Q2 2016

• Sequential expense ratio improvement quarter to quarter

780 basis point improvement overall since Q4 2015

• Expect continuing downward trend as earned premiums grow quarter to quarter

12

Expense Ratio Target :

35%

13

CONSERVATIVE INVESTMENT STRATEGY

• Investment philosophy is to maintain a

highly liquid portfolio of investment-grade

fixed income securities

• Total cash & investment securities of $140.9M

at September 30, 2016:

Average duration to worst: 3.0 years

Average tax-equivalent yield: ~2%

Average credit quality: AA

FIXED INCOME PORTFOLIO CREDIT RATING

$ in thousands September 30, 2016

Fair Value % of Total

AAA $ 33,014 29%

AA 48,952 43%

A 17,076 15%

BBB 13,661 12%

BB 1,138 1%

TOTAL FIXED INCOME

INVESTMENTS $ 113,841 100%

Short-Term

Investments

10.6%

U.S.

Government

Obligations

4.5%

State & Local

Governments

9.0%

Corporate Debt

26.2%

Commercial

Mortgage &

Asset-Backed

Securities

46.3%

Equity

Securities

3.4%

PORTFOLIO ALLOCATION

APPENDIX

16

FINANCIAL RESULTS: CHI CONSOLIDATED BALANCE SHEET

SUMMARY BALANCE SHEET

$ in thousands

September 30, 2016 December 31, 2015

Cash and invested assets $ 140,934 $ 130,427

Reinsurance recoverables 9,953 7,044

Goodwill and intangible assets 1,412 1,427

Total assets $ 195,919 $ 177,927

Unpaid losses and loss adjustment expenses 45,994 35,422

Unearned premiums 55,475 47,916

Senior debt 14,250 12,750

Total Liabilities $ 121,415 $ 100,665

Total Shareholders' Equity $ 74,504 $ 77,262

17

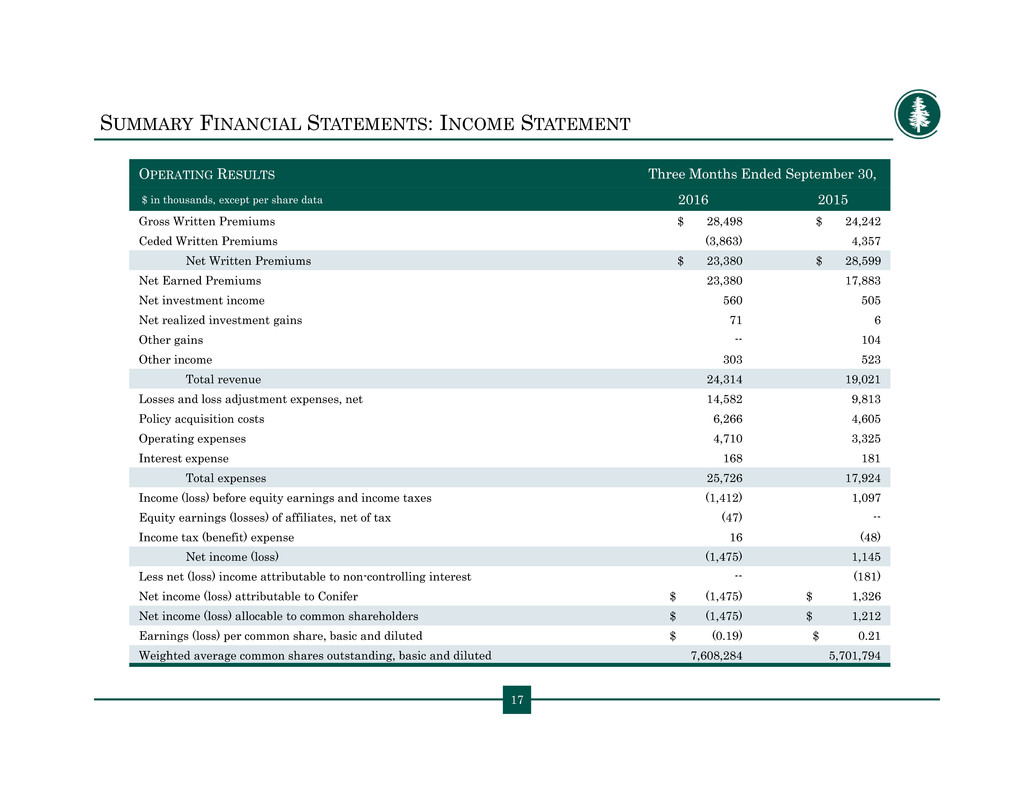

SUMMARY FINANCIAL STATEMENTS: INCOME STATEMENT

17

OPERATING RESULTS Three Months Ended September 30,

$ in thousands, except per share data 2016 2015

Gross Written Premiums $ 28,498 $ 24,242

Ceded Written Premiums (3,863) 4,357

Net Written Premiums $ 23,380 $ 28,599

Net Earned Premiums 23,380 17,883

Net investment income 560 505

Net realized investment gains 71 6

Other gains -- 104

Other income 303 523

Total revenue 24,314 19,021

Losses and loss adjustment expenses, net 14,582 9,813

Policy acquisition costs 6,266 4,605

Operating expenses 4,710 3,325

Interest expense 168 181

Total expenses 25,726 17,924

Income (loss) before equity earnings and income taxes (1,412) 1,097

Equity earnings (losses) of affiliates, net of tax (47) --

Income tax (benefit) expense 16 (48)

Net income (loss) (1,475) 1,145

Less net (loss) income attributable to non-controlling interest -- (181)

Net income (loss) attributable to Conifer $ (1,475) $ 1,326

Net income (loss) allocable to common shareholders $ (1,475) $ 1,212

Earnings (loss) per common share, basic and diluted $ (0.19) $ 0.21

Weighted average common shares outstanding, basic and diluted 7,608,284 5,701,794

18

REINSURANCE: PRUDENT RISK MANAGEMENT TO PROTECT CAPITAL

• Retain first $500,000 of each

specific loss/risk

Reinsurance coverage in excess

of $500,000 up to policy limits

• Catastrophe (CAT) reinsurance

program provides $165M of protection

All providers are rated minimum A-

Corresponds to the estimated

1-in-200 year probable

maximum loss (PML)

Net retention of $5M for first event

Following reinstatement, net retention

of $1M for each of the next two

subsequent events

• Equipment Breakdown Reinsurance Treaty

100% Quota Share through

Hartford Steam Boiler (A+)

$25M in coverage

$165,000,000

Retention

Property-

CAT:

$165M

XS

$5M

$5,000,000

$2,000,000

$20,000,000

$500,000

$1,000,000

$10,000,000

Multi-Line

Excess of

Loss

Workers’

Comp. /

Casualty

Clash

Retention

CIC / WPIC

Specific Loss Reinsurance Treaties

Effective 01/01/2016 to 01/01/2017

CIC / WPIC / ACIC

Property-CAT Reinsurance Treaties

All layers 06/01/2016 to 06/01/2017

19

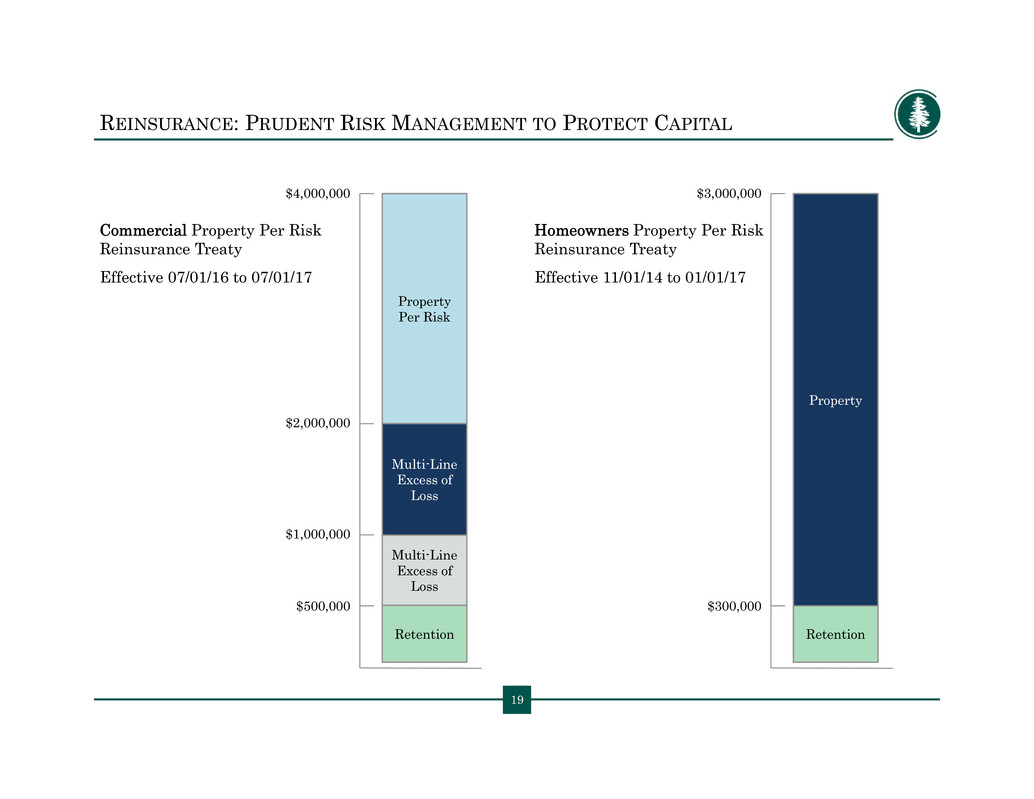

REINSURANCE: PRUDENT RISK MANAGEMENT TO PROTECT CAPITAL

Commercial Property Per Risk

Reinsurance Treaty

Effective 07/01/16 to 07/01/17

$2,000,000

$500,000

$1,000,000

Retention

Multi-Line

Excess of

Loss

Property

Per Risk

Multi-Line

Excess of

Loss

$4,000,000

Homeowners Property Per Risk

Reinsurance Treaty

Effective 11/01/14 to 01/01/17

$300,000

Retention

Property

$3,000,000

20

ORGANIZATION STRUCTURE: CORPORATE OVERVIEW

CONIFER HOLDINGS, INC.

Insurance Holding Company

MI Domicile

Incorporated: 10/27/09

RED CEDAR

INSURANCE COMPANY

Pure Captive

Insurance Company

100% owned by CHI

DC Domicile

Formed : 10/12/11

WHITE PINE

INSURANCE COMPANY

Property & Casualty

Insurance Company

100% owned by CHI

MI Domicile

Acquired: 12/28/10

AMERICAN COLONIAL

INSURANCE COMPANY

Property & Casualty

Insurance Company

100% owned by CHI

FL Domicile

Acquired: 11/30/2013

SYCAMORE

INSURANCE AGENCY

Insurance Agency

100% owned by CHI

MI Domicile

Created: 5/9/12

CONIFER

INSURANCE COMPANY

Property & Casualty

Insurance Company

100% owned by CHI

MI Domicile

Acquired: 12/22/09

AMERICAN COLONIAL

INSURANCE SERVICES

(F/K/A/ EGI – FL)

Managing General Agency

100% owned by CHI

FL Domicile

Acquired: 11/30/2013