Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Veritiv Corp | v452583_ex99-1.htm |

| 8-K - 8-K - Veritiv Corp | v452583_8k.htm |

Veritiv Corporation Third Quarter 2016 Financial Results November 9, 2016 Exhibit 99.2

Tom Morabito Director of Investor Relations 2

Safe Harbor Provision Certain statements contained in this presentation regarding Veritiv Corporation’s (the “Company”) future operating results, performance, business plans, prospects, guidance and any other statements not constituting historical fact are “forward - looking statements” subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995 . Where possible, the words “believe,” “expect,” “anticipate,” “intend,” “should,” “will,” “would,” “planned,” “estimated,” “potential,” “goal,” “outlook,” “may,” “predicts,” “could,” or the negative of such terms, or other comparable expressions, as they relate to the Company or its business, have been used to identify such forward - looking statements . All forward - looking statements reflect only the Company’s current beliefs and assumptions with respect to future operating results, performance, business plans, prospects, guidance and other matters, and are based on information currently available to the Company . Accordingly, the statements are subject to significant risks, uncertainties and contingencies, which could cause the Company’s actual operating results, performance, business plans, prospects or guidance to differ materially from those expressed in, or implied by, these statements . Factors that could cause actual results to differ materially from current expectations include risks and other factors described under "Risk Factors" in our Annual Report on Form 10 - K and elsewhere in the Company’s publicly available reports filed with the Securities and Exchange Commission (“SEC”), which contain a discussion of various factors that may affect the Company’s business or financial results . Such risks and other factors, which in some instances are beyond the Company’s control, include : the industry - wide decline in demand for paper and related products ; increased competition from existing and non - traditional sources ; adverse developments in general business and economic conditions as well as conditions in the global capital and credit markets ; foreign currency fluctuations ; our ability to collect trade receivables from customers to whom we extend credit ; our ability to attract, train and retain highly qualified employees ; the effects of work stoppages, union negotiations and union disputes ; loss of significant customers ; changes in business conditions in our international operations ; procurement and other risks in obtaining packaging, paper and facility products from our suppliers for resale to our customers ; changes in prices for raw materials ; fuel cost increases ; inclement weather, anti - terrorism measures and other disruptions to the transportation network ; our dependence on a variety of IT and telecommunications systems and the Internet ; our reliance on third - party vendors for various services ; cyber - security risks ; costs to comply with laws, rules and regulations, including environmental, health and safety laws, and to satisfy any liability or obligation imposed under such laws ; regulatory changes and judicial rulings impacting our business ; adverse results from litigation, governmental investigations or audits, or tax - related proceedings or audits ; our inability to renew existing leases on acceptable terms, negotiate rent decreases or concessions and identify affordable real estate ; our ability to adequately protect our material intellectual property and other proprietary rights, or to defend successfully against intellectual property infringement claims by third parties ; our pension and health care costs and participation in multi - employer plans ; increasing interest rates ; our ability to generate sufficient cash to service our debt ; our ability to comply with the covenants contained in our debt agreements ; our ability to refinance or restructure our debt on reasonable terms and conditions as might be necessary from time to time ; changes in accounting standards and methodologies ; our ability to realize the anticipated synergies, cost savings and growth opportunities from the Merger, our ability to integrate the xpedx business with the Unisource business, the possibility of incurring expenditures in excess of those currently budgeted in connection with the integration, and other events of which we are presently unaware or that we currently deem immaterial that may result in unexpected adverse operating results . The Company is not responsible for updating the information contained in this presentation beyond the published date, or for changes made to this document by wire services or Internet service providers . This presentation is being furnished to the SEC through a Form 8 - K . The Company’s Quarterly Report on Form 10 - Q for the three and nine months ended September 30 , 2016 to be filed with the SEC may contain updates to the information included in this presentation . We reference non - GAAP financial measures in this presentation . Please see the appendix for reconciliations of non - GAAP measures to the most comparable GAAP measures . 3

Mary Laschinger Chairman & CEO 4

Financial Results 1. Please see the appendix for reconciliations of non - GAAP measures to the most comparable GAAP measures. 2. Expected 2016 GAAP net income (loss) and a reconciliation to expected 2016 Adjusted EBITDA guidance cannot be provided withou t u nreasonable efforts due to the uncertainty and variability on a forward - looking basis of certain items that impact net income (loss) such as restructuri ng charges, integration expenses, taxes, and other items, any of which may be significant. $57.1M Adjusted EBITDA 1 (5.8)% 3Q16 Actual YOY% Change $2.1B Net Sales (4.2)% 2016 Adjusted EBITDA guidance continues to be near the upper end of the previously announced $185 - $195 million range 2 5 Adjusted EBITDA 1

Third Quarter 2016 Veritiv Net Sales 6 3Q15 Net Sales 3Q16 Net Sales $2,127 $2,220 FX Effect (0.2%) (Dollars In Millions) Reported Net Sales = (4.2)% Core Net Sales (4.0%)

3Q16 Highlights and 4Q16 Outlook 7 • 3Q16 Highlights: ▪ Systems integration on track ▪ Final step in the separation from International Paper: Cincinnati office relocation • 4Q16 Outlook: ▪ Continued economic uncertainty and monthly revenue volatility ▪ On track to meet or exceed 2016 synergy capture and Adjusted EBITDA commitments ▪ Facility Solutions: at an inflection point? ▪ Publishing continuing to face industry pressures

Stephen Smith CFO 8

(Unaudited, Dollars In Millions, Except Per Share Amounts) 3Q16 YOY % Change Three Months Ended September 30 Net sales $2,127 (4.2 )% Net sales per shipping day _ (4.2 )% Cost of products sold $1,744 (4.5 )% Net sales less cost of products sold $383 (2.8 )% Adjusted EBITDA $57.1 (5.8 )% Adjusted EBITDA as a % of net sales 2.7 % 0 BPS Net income $5.6 (61 )% Basic Earnings Per Share $0.35 (62 )% Diluted Earnings Per Share $0.34 (63 )% Veritiv Financial Results 1 Third Quarter 2016 1) Please see the appendix for reconciliations of non - GAAP measures to the most comparable GAAP measures. 9

Veritiv Segment Financial Results Third Quarter 2016 10 Print Publishing Packaging Facility Solutions 3Q16 Three Months Ended September 30 YOY % Change Net Sales $248 (18.0 )% Net sales per shipping day _ (18.0 )% Adjusted EBITDA $6.6 (29.0 )% Adj. EBITDA as a % of net sales 2.7 % (40 BPS) 3Q16 Three Months Ended September 30 YOY % Change Net Sales $730 1.1 % Net sales per shipping day _ 1.1 % Adjusted EBITDA $59.5 0.8 % Adj. EBITDA as a % of net sales 8.1 % (10 BPS) 3Q16 Three Months Ended September 30 YOY % Change Net Sales $329 (0.8 )% Net sales per shipping day _ (0.8 )% Adjusted EBITDA $13.0 2.4 % Adj. EBITDA as a % of net sales 4.0 % 20 BPS 3Q16 Three Months Ended September 30 YOY % Change Net Sales $788 (5.3 )% Net sales per shipping day _ (5.3 )% Adjusted EBITDA $20.0 (13.8 )% Adj. EBITDA as a % of net sales 2.5 % (30 BPS) (Unaudited, Dollars In Millions)

• Key areas that synergies will be derived from include supply chain efficiencies and SG&A Synergies & One - Time Integration Costs 1) Includes ~ $55 million of one - time integration capital expenditures; does not include approximately $27 million of merger re lated expenses. For 2016, likely to achieve high end of synergy range 11 Management intends to improve Adjusted EBITDA by an incremental $100 million over the first few years post - merger Cumulative forecasted synergies ($150M - $225M) ~ 55% 60% - 70% 80% - 90% ~ 10% Forecasted costs to achieve 1 ($225M): ~ 30% ~ 60% ~ 80 - 90% ~ 90 - 100%

Asset Based Loan Facility & Capital Allocation Capital Structure Capital Allocation ▪ Capital Allocation Priorities: ▪ Invest in the company ◦ YTD: CapEx totaled ~ $30M, with ~ $17M related to integration ▪ Expect 2016 incremental CapEx for integration projects of $10M - $20M ▪ Ordinary course 2016 CapEx expected to be $20 - $30M ▪ Pay down debt ▪ Return value to shareholders ▪ At the end of September 2016: ▪ The borrowing base availability for the ABL facility was ~ $1.2 billion ▪ $753 million drawn against the ABL facility ▪ $442 million of available borrowing capacity ▪ Net debt to Adj. EBITDA 3.6x for the trailing 12 months 12

Appendix: Reconciliation of Non - GAAP Financial Measures We supplement our financial information prepared in accordance with GAAP with certain non - GAAP measures including Adjusted EBITDA (earnings before interest, income taxes, depreciation and amortization, restructuring charges, stock - based compensation expense, LIFO (income) expense, non - restructuring asset impairment charges, non - restructuring severance charges, non - restructuring pension charges, integration expenses, fair value adjustments on the contingent liability associated with the Tax Receivable Agreement ("TRA") and certain other adjustments) because we believe investors commonly use Adjusted EBITDA and these other non - GAAP measures as key financial metrics for valuing companies . In addition, the credit agreement governing our asset - based lending facility permits us to exclude the foregoing and other charges in calculating “Consolidated EBITDA”, as defined in the facility . We approximate foreign currency effects by applying the foreign currency exchange rate for the prior period to the local currency results for the current period . Adjusted EBITDA and these other non - GAAP measures are not alternative measures of financial performance under GAAP . Non - GAAP measures do not have definitions under GAAP and may be defined differently by, and not be comparable to, similarly titled measures used by other companies . As a result, we consider and evaluate non - GAAP measures in connection with a review of the most directly comparable measure calculated in accordance with GAAP . We caution investors not to place undue reliance on such non - GAAP measures and to consider them with the most directly comparable GAAP measures . Adjusted EBITDA and these other non - GAAP measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analyzing our results as reported under GAAP . Please see the following tables for reconciliations of non - GAAP measures to the most comparable GAAP measures . 13

Table I VERITIV CORPORATION RECONCILIATION OF NON - GAAP MEASURES NET INCOME TO ADJUSTED EBITDA; ADJUSTED EBITDA MARGIN (in millions, unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2016 2015 2016 2015 Net income $ 5.6 $ 14.5 $ 16.8 $ 16.6 Interest expense, net 8.2 7.0 21.1 19.8 Income tax expense 8.0 8.9 18.4 15.5 Depreciation and amortization 13.4 13.7 40.5 42.5 EBITDA 35.2 44.1 96.8 94.4 Restructuring charges 5.8 3.0 7.2 8.6 Stock - based compensation 2.1 1.0 7.2 3.0 LIFO (income) expense 0.4 2.2 (2.7 ) (7.8 ) Non - restructuring asset impairment charges 3.1 — 4.0 — Non - restructuring severance charges 0.2 0.5 2.4 1.9 Non - restructuring pension charges 2.3 — 2.3 — Integration expenses 7.3 8.3 19.6 28.6 Fair value adjustments on TRA contingent liability 1.0 0.3 4.8 (0.1 ) Other (0.3 ) 1.2 0.5 1.1 Adjusted EBITDA $ 57.1 $ 60.6 $ 142.1 $ 129.7 Net sales $ 2,126.6 $ 2,219.8 $ 6,207.2 $ 6,517.0 Adjusted EBITDA as a % of net sales 2.7 % 2.7 % 2.3 % 2.0 % Appendix: Reconciliation of Non - GAAP Financial Measures 14

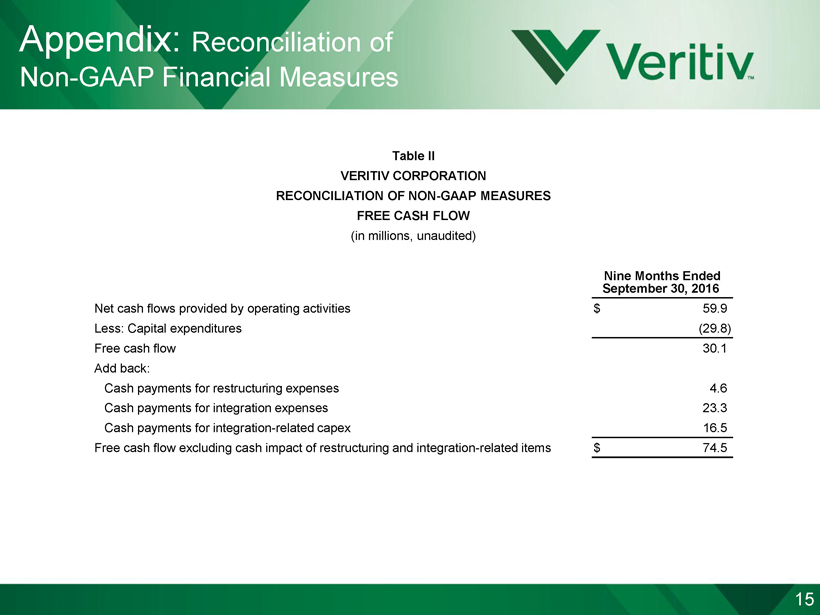

15 Appendix: Reconciliation of Non - GAAP Financial Measures Table II VERITIV CORPORATION RECONCILIATION OF NON - GAAP MEASURES FREE CASH FLOW (in millions, unaudited) Nine Months Ended September 30, 2016 Net cash flows provided by operating activities $ 59.9 Less: Capital expenditures (29.8 ) Free cash flow 30.1 Add back: Cash payments for restructuring expenses 4.6 Cash payments for integration expenses 23.3 Cash payments for integration - related capex 16.5 Free cash flow excluding cash impact of restructuring and integration - related items $ 74.5

16 Appendix: Reconciliation of Non - GAAP Financial Measures Table III VERITIV CORPORATION RECONCILIATION OF NON - GAAP MEASURES NET DEBT TO ADJUSTED EBITDA (in millions, unaudited) September 30, 2016 Amount drawn on ABL Facility $ 753.4 Less: Cash (59.2 ) Net debt 694.2 Last Twelve Months Adjusted EBITDA $ 194.4 Net debt to Adjusted EBITDA 3.6x Last Twelve Months September 30, 2016 Net income $ 26.9 Interest expense, net 28.3 Income tax expense 21.1 Depreciation and amortization 54.9 EBITDA 131.2 Restructuring charges 9.9 Stock - based compensation 8.0 LIFO (income) expense (2.2 ) Non - restructuring asset impairment charges 6.6 Non - restructuring severance charges 3.8 Non - restructuring pension charges 2.3 Integration expenses 25.9 Fair value adjustments on TRA contingent liability 6.8 Other 2.1 Adjusted EBITDA $ 194.4

Questions 17

Mary Laschinger Chairman & CEO 18

Veritiv Corporation Third Quarter 2016 Financial Results November 9, 2016