Attached files

| file | filename |

|---|---|

| 8-K - 8-K VOLUNTARY FILING FOR BANKRUPTCY AND ERROR IN FINANCIAL STATEMENTS - ERICKSON INC. | a8k-voluntaryfilingforbank.htm |

| EX-99.4 - EXHIBIT 99.4 PRESS RELEASE - ERICKSON INC. | item994_pressreleasexnov8x.htm |

| EX-99.2 - EXHIBIT 99.2 OPERATRING AND MONTHLY CASH FLOW FORECAST - ERICKSON INC. | a992operatingandmonthlyc.htm |

| EX-99.1 - EXHIBIT 99.1 CASH FLOW FORECAST - ERICKSON INC. | a991cashflowforecast.htm |

| EX-10.1 - EXHIBIT 10.1 DIP TERM SHEET - ERICKSON INC. | item101_diptermsheet.htm |

CONFIDENTIAL

INVESTOR PRESENTATION

NOVEMBER 2016

CONFIDENTIAL

DISCLAIMER

3

This presentation contains information about our management’s view of our future expectations, plans and prospects that

constitute forward-looking statements. Actual results may differ materially from historical results or those indicated by these

forward-looking statements due to risks and uncertainties including, but not limited to, our substantial indebtedness and

significant debt service obligations, which could adversely affect our financial condition and impair our ability to grow and operate

our business; that we may be unable to access public or private debt markets to fund our operations and contractual

commitments at competitive rates, on commercially reasonable terms, or in sufficient amounts, if at all; that foreign, domestic,

federal, state and local government spending and mission priorities may change in a manner that materially and adversely

affects our future revenues and limits our growth prospects; that a number of risks inherent in international operations could have

a material adverse effect on our international operations and, consequently, on our results of operations; that emerging market

countries have less developed economies that are more vulnerable to economic and political problems and may experience

economic instability; that our operations in certain dangerous and war-affected areas may result in hazards to our fleet and

personnel; that our international sales and operations are subject to applicable laws relating to trade, export controls and foreign

corrupt practices, the violation of which could adversely affect our operations; that our business in countries with a history of

corruption and transactions with foreign governments increases the compliance risks associated with our international activities;

that claims against us by governmental agencies or other parties related to environmental matters could adversely affect us; that

our business is subject to laws limiting ownership or control of aircraft companies, which may increase our costs and adversely

affect us; and other risks and uncertainties more fully described under the heading “Risk Factors” in our most recently filed

Annual Report on Form 10-K as well as the other reports we file with the SEC from time to time. All of the information provided in

this presentation is as of today’s date and we undertake no duty to update this information, except as required by law.

This presentation contains financial measures not prepared in accordance with U.S. generally accepted accounting principles

(“GAAP”), including EBITDA and Adjusted EBITDA. These measures are in addition to, and not a substitute for or superior to,

measures of financial performance prepared in accordance with GAAP.

CONFIDENTIAL

BUSINESS OVERVIEW

CONFIDENTIAL

STRATEGIC PRIORITIES

5

• Become the global leader of utility aircraft services

– To consistently and continually deliver best-in-class metrics in the following areas:

– Safety

– Financial and operational efficiency metrics

– Customer satisfaction

– Employee engagement

• Create a balanced portfolio

‒ Civil versus Defense & Security

‒ Global enterprise

‒ Offer both products and services

‒ Increase in annualized long-term contracts

CONFIDENTIAL

CORE COMPETENCIES

6

1

2

4

5

3

Focus on medium, heavy and super heavy lift

Best-in-class globally at precision placement

Most differentiated operating in remote and austere environments

Self-sustainability via vertical integration

Ability to aggregate all capabilities to create differentiated solutions

CONFIDENTIAL

CIVIL AVIATION

CONFIDENTIAL

CIVIL AVIATION

8

Civil 2016 Revenue Mix (% of total)

Market Opportunities / Considerations

16%

17%

3%

64%

Captured

Addressable

Opportunities

Mature Markets

$400M

Total Addressable Market of Over $1 Billion

Emerging Markets

$700M

* Emerging Markets includes China, India, South America and Africa

• Leading position in the majority of our end markets

• Market is generally stable with moderate growth opportunities in select end markets

• Able to leverage competitive advantages, safety and past performance to defend and enhance our share in the civil

market

• Capital intensive nature of services, asset base, intellectual property and demonstrated capabilities serve as

barriers to entry

Firefighting

21%

Timber

Harvesting

11%

Infrastructure

Construction

8%

Oil & Gas

8%

CONFIDENTIAL FIREFIGHTING OVERVIEW

CIVIL AVIATION

9

Wildland and Urban Interface Aerial Firefighting and Disaster Response

– State, Federal, Government Agencies – (8-11 S64 AC)

• Tank system drop pattern and reliability as well as dual

snorkel and tanked salt water fill as a differentiator

• Tanked S64 Commercial category aircraft for WUI

(Wildland Urban Interface)

• Water cannon, grapples, tongs, and rescue basket as a multi-

purpose tool for urban emergency response

• Leverage our unmatched OEM support and reliability in the

high stress fire environment

• Market is stable, to slightly increasing due to long-term drought,

increasing fire budgets and more housing in WUI areas

• Core Competencies

• Precision Placement

• Remote Austere Operations

• Self Sustainment

• Medium & Heavy Lift

Segment Highlights

Market Size $400M

Market Share 12%

Historical Pipeline Conversion Rate

For 2016

50%

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

+20%

CONFIDENTIAL TIMBER HARVESTING OVERVIEW

CIVIL AVIATION

10

Timber Harvesting in remote, environmentally sensitive areas

(3-4 S64 E models)

• Utilize support structure, expertise, reliability to control and

grow market

• Market is stable to slightly increasing

• Heavy helicopter is the best way to remove high value large

logs in restricted areas

• Erickson is the market leader in this segment

• Core Competencies

• Precision Placement

• Remote Austere Operations

• Self Sustainment

Segment Highlights

Market Size $80M

Market Share 45%

Historical Pipeline Conversion Rate

For 2016

35%

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

+40%

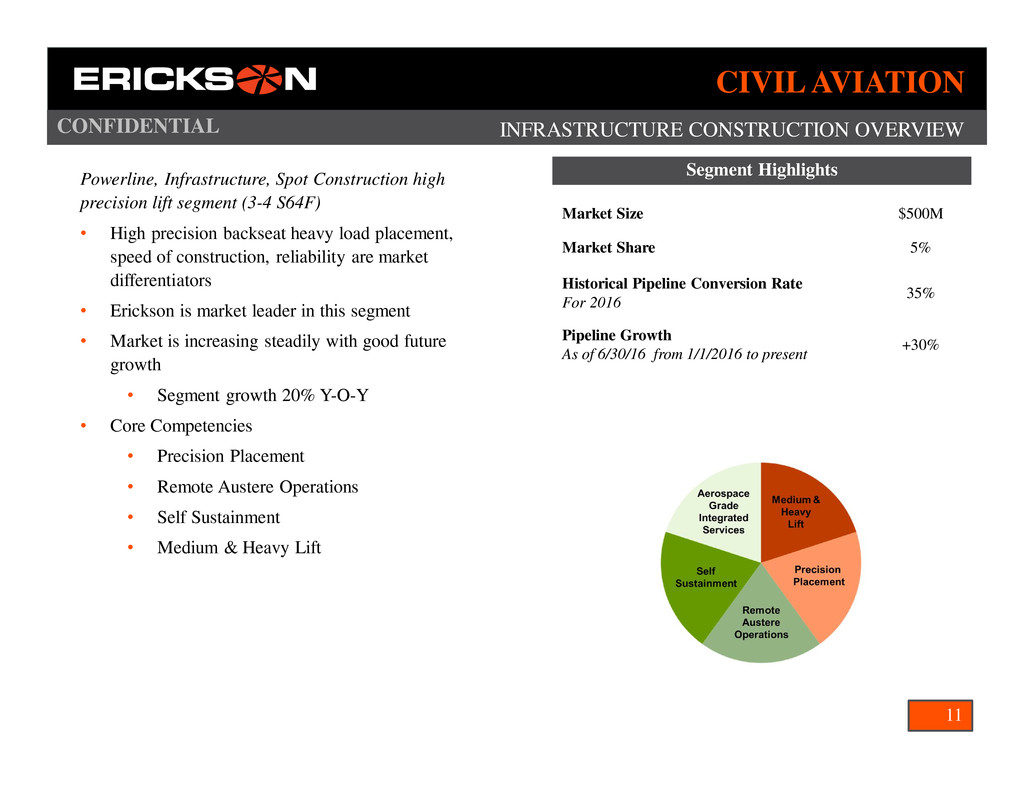

CONFIDENTIAL INFRASTRUCTURE CONSTRUCTION OVERVIEW

CIVIL AVIATION

11

Powerline, Infrastructure, Spot Construction high

precision lift segment (3-4 S64F)

• High precision backseat heavy load placement,

speed of construction, reliability are market

differentiators

• Erickson is market leader in this segment

• Market is increasing steadily with good future

growth

• Segment growth 20% Y-O-Y

• Core Competencies

• Precision Placement

• Remote Austere Operations

• Self Sustainment

• Medium & Heavy Lift

Segment Highlights

Market Size $500M

Market Share 5%

Historical Pipeline Conversion Rate

For 2016

35%

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

+30%

CONFIDENTIAL OIL & GAS OVERVIEW

CIVIL AVIATION

12

O&G Core business moving portable drill rigs and

personnel in remote, roadless environments and near

shore transport (1-3 S64 and 214ST)

• Safety record, reliability, OEM support and price

are differentiators

• Erickson has consistently won against competition

(HTS, Columbia)

• Market is declining due to worldwide slowdown in

frontier exploration because of low oil prices

• Market will contract through 2017

• Lease expirations will spur some resumption

of drill programs in late 2017-2018

• Core Competencies

• Precision Placement

• Remote Austere Operations

• Self Sustainment

• Medium & Heavy Lift

Segment Highlights

Market Size $50M

Market Share 24%

Historical Pipeline Conversion Rate

For 2016

35%

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

Flat

CONFIDENTIAL PIPELINE GROWTH

$246M $567M

35%

2016 Pipeline (12/1/15)

Current

CIVIL AVIATION

Historical (2015-

2016) Pwin of 35%

• Overall pipeline continues to show significant growth

13

CONFIDENTIAL ROTOR FLEET PLAN AND CAPITAL REQUIREMENTS

CIVIL AVIATION

14

0

2

2

1

3

0

0

0 2

Bell 212

3 total

Bell 412

5 total

AS350

3 total

Contracted

Available

Unserviceable

Opportunities

On-Going Maintenance

~10-12% of Revenue

For Contracted and Available Aircraft

Potential Growth

Capital Investment

$2-4M

2

1

0

Alaskan O&G Alaska

Alaska

Alaska FF

CONFIDENTIAL ROTOR FLEET PLAN AND CAPITAL REQUIREMENTS

CIVIL AVIATION

15

17

0

3

0

S-64 Fleet

20 total

Contracted

Available

Unserviceable

Opportunities

12 various contracts

On-Going Maintenance

10-12% of Revenue

Potential Growth

Capital Investment

$0M

CONFIDENTIAL OUTLOOK

CIVIL AVIATION

16

• Pipeline has expanded from $200M to over $550M but needs to be over $800M

• Growth in 2017 will come from:

• Construction & Powerline (20-30% YoY)

• Logging (25-30% YoY) (contracts already secured)

• Oil & Gas will be flat

• Fire will be flat or up to 20-30% depending on various opportunities

CONFIDENTIAL

GLOBAL DEFENSE & SECURITY

CONFIDENTIAL

SERVED MARKETS: GDS

18

Market Opportunities / Considerations

• Market contraction is abating with a return to more traditional opportunities

• Diversified between expeditionary aviation, aerial replenishment and sustainment and support aviation

• One of three providers globally with both fixed and rotor wing, CARB and Part 135 certifications create significant

barriers to entry

• Diverse fleet and vertically integrated MRO capabilities provide customers a compelling service offering

• Focused on developing bid as Prime capability and regain SBA status

Government 2016 Revenue Mix (% of total)Total Addressable Market of $3 Billion

3%

36%

0%

60%

Captured

Addressable

Opportunities

Government Services

$1.8B

Government Airlift

$1.2B

GDS

Expeditionary

Aviation

16%

GDS Aerial

Replenishment

25%

CONFIDENTIAL

• Pivot into Africa has opened Expeditionary Aviation

opportunities supporting special operating and

conventional forces globally

• Combination of rotary and fixed wing is a critical

differentiator to mission success, with past

performance a strong factor

• Focus on proxy wars countering ISIS in

developing countries

• Growing opportunity in the non-conventional or

“black” space

• Durability – Growing Market Supporting DoD, UN and

Foreign Militaries

• US Government raised priority for

counterterrorism efforts

• Top opportunities

• Being war fighter centric and continuing to

leverage relationships with combatant commands

• Core Competencies

• Remote Austere Locations

• Self Performance of Maintenance

• Integrated Services

EXPEDITIONARY AVIATION OVERVIEW

GLOBAL DEFENSE & SECURITY

19

Segment Highlights

Market Size ~$800M+

Market Share 5%

Historical Pipeline Conversion Rate

For 2016

75%

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

500%

CONFIDENTIAL

• Aerial replenishment focuses on aerial rotor and light lift fixed

wing markets supporting forward deployed operations at land

and at sea

• Erickson is the market leader providing aerial lift replenishment

at sea for the US Navy. Performs ship to ship resupply in remote

oceans worldwide

• $25M-$30M annual market

• Moved share from 25% to 75% in 2016

• Expanding opportunity of resupply of forward deployed

firebases in Afghanistan

• Established position in medium lift rotary support

• Durability: Very Solid – Long-Term Government Contracts

• War on terrorism is forecasted to continue with a

renewed commitment to Afghanistan

• Market is very stable with on going requirements for 4

detachments of vertical replenishment

• Core competencies leveraged

• Austere Operations

• Integrated Services

• Self Sustainment

AERIAL REPLENISHMENT OVERVIEW

GLOBAL DEFENSE & SECURITY

20

Segment Highlights

Market Size (Annual) $400M

Market Share 11%

Historical Pipeline Conversion Rate

For 2016

80%

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

200%

CONFIDENTIAL SUSTAINMENT SERVICES OVERVIEW

GLOBAL DEFENSE & SECURITY

21

• New sizeable market opportunity leveraging flight,

maintenance, training support and technology transfer

• Multi-billion dollar space is highly fragmented

• No single provider of end to end service and

support for legacy aircraft

• Superior opportunity to enter into a space

leveraging well developed and proven expertise

in maintaining and servicing airframes in remote

locations for 30+ years

• Durability: Solid – Long-Term Foreign Military and

Government Contracts

• Market continues to grow with US (Sikorsky,

Bell) and French (Airbus Helicopters) having

aging installed bases

• Core competencies leveraged

• Integrated Services

• Self Sustainment

• Remote Operations

Segment Highlights

Market Size (Annual) $1.8B

Market Share <1%

Historical Pipeline Conversion Rate

For 2016

New to

Market

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

0 to >$45M

CONFIDENTIAL ROTOR FLEET PLAN AND CAPITAL REQUIREMENTS

GLOBAL DEFENSE & SECURITY

22

2

7

3

6

7

0

2/2

0

0

4 0 5

Bell-214ST

12 total

Puma 330J/332L

13 total

Puma 332L1

4 total

Contracted

Available

Unserviceable

Opportunities

Africa Alion

Vert Rep

Vert Rep

Vert Rep

Afghanistan Fluor

Afghanistan Starlite

Afghanistan #1

Afghanistan #2

Afg Service Replacement

New Equipment

Africa #1

Africa #2

Africa #1

From Unserviceable

On-Going Maintenance

~10-12% of Revenue

For Contracted and Available Aircraft

Potential Growth

Capital Investment

$30-35M

Africa #1

NGO Work

Africa #1

NGO Work

Retire

CONFIDENTIAL FIXED WING FLEET PLAN AND CAPITAL REQUIREMENTS

GLOBAL DEFENSE & SECURITY

23

2

0

2

1

0

2

4

CASA 212

3 Total

Beech1900 D

4 Total

Contracted

Available

Unserviceable

Opportunities 1

On-Going Maintenance

~5-8% of Revenue

For Contracted and Available Aircraft

Potential Growth

Capital Investment

$5-10M

CONFIDENTIAL FINANCIAL OVERVIEW

GLOBAL DEFENSE & SECURITY

24

• 2015 to 2016: Strategy towards the war on terrorism began changed delaying

spending

• Pricing pressure as US Government continued transition from war time

spending to sustainment activities

• Transition induced a delay in previously forecasted programs

• Many programs were fully allocated but were not approved causing a

disconnect in program timing

• 2016 to 2017: Reinvigorated focus on counter terrorism on a world wide basis is

starting to materialize in global opportunities

• Strong investment in the front end created momentum and has provided

insight into market and ability to shape future requirements

• Pipeline has expanded from $200M to $800M+

CONFIDENTIAL

MRO

CONFIDENTIAL

SERVED MARKETS: MRO

26

Manufacturing & MRO 2016 Revenue Mix (% of total)

Market Opportunities / Considerations

Total Addressable Market of Multi-Billions

2%

47%

1%

50%

Captured

Addressable

Opportunities

Commercial Markets

>$500M

Military Markets

Multi Billion

• This business segment and market is our highest growth opportunity

• Stable due to exceptionally large installed base

• Currently no global legacy provider evident

• Unique and proven vertical integration capabilities in manufacturing, engineering, CRO and field support

• Must provide operational cost advantages and improved return to service times for aerial services

MRO:

Civil, 9%

MRO: GDS

3%

CONFIDENTIAL CIVILIAN MRO MARKET

MRO UPDATE

27

• The MRO organization supports the Aircrane fleet

as well as other aircraft types operated by Erickson

and other airlift providers

– New parts production, avionics components,

hard-to-locate parts, reverse engineering

– MRO services include repair and reassembly

of airframes, engines, components and

accessories

• Niche player in vast MRO market

• Established player in legacy aircraft S64 and B214

• Core competencies leveraged

• Aerospace grade integrated services

Segment Highlights

Market Size >$500M

Market Share Fractional

Historical Pipeline Conversion Rate

For 2016

33%

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

200%

CONFIDENTIAL GOVERNMENT AND DEFENSE MRO MARKET

MRO UPDATE

28

• GDS/MRO organization supports the refurbishment and rest

of legacy Government aircraft and components

– Defined processes to partner with the US

Government in aircraft processing and return to

service

– MRO services include full repair and reassembly of

airframes, engines, components, and accessories.

– Reverse engineering of long out of date parts and

components from aged drawings

• Established player in legacy aircraft (MH53/CH53)

• Core competencies leveraged

• Aerospace grade integrated services

Segment Highlights

Market Size for targeted legacy fleet $1-1.4B

Market Share Fractional

Historical Pipeline Conversion Rate

For 2016

30%+

Pipeline Growth

As of 6/30/16 from 1/1/2016 to present

$20-25M

CONFIDENTIAL

CONCLUSION

CONFIDENTIAL CHALLENGES FACED

SITUATIONAL UPDATE

30

• Company had previously been challenged by divergent priorities between key constituents (i.e. equity holders,

bondholders, leadership team and employee base)

Headwinds facing the business and management required a significant

re-calibration of operations

Challenges Faced

Cash

Management

Operational cash flow limitations

Working capital imbalances

Tight liquidity constrained operations and potential growth

Capital structure was onerous for the size of the business

Cost

Unprofitable subsidiaries and operations

Fleet composition and financing unsustainable

Cost structure too fixed in nature

Revenue

Lack of rigor and robustness around the front end

Lost SBA status which eliminated existing contracts and significant market opportunities

Oil & Gas market rapidly deteriorated and not fully addressable with asset base

Significant contraction and transition in GDS market

Operations

Duplication and redundancies due to lack of operational integration

Staffing and support levels disproportionate to the size of the business

Lack of clarity around accountability and goals

CONFIDENTIAL INITIATIVES UNDERTAKEN

SITUATIONAL UPDATE (CONT’D)

31

Initiatives Undertaken

Cash

Management

Cash management has improved consumption by $50 million

Cash conversion cycle management initiatives

Continued to monetize non-core assets

Heightened scrutiny around capital investing

Retained Imperial Capital to explore strategic alternatives surrounding our capital structure

Cost

Management headcount reduced by 30+%, new management team in place

Headcount reduction of over 16%, expected to reduce annual labor cost by ~$10 million

Total reduction in COGS and SG&A reduced by over $50M in 2016 as compared to 2015

Closed unprofitable subsidiaries and exited unprofitable contracts

Continue to increase variabilization in compensation, aircraft leases and operating expenses

Revenue

Established a new front end leadership team

Introduced enhanced sales metrics, governance and quotas

Seeing increased pipeline growth of greater than 20 %

Backlog has grown 15% since the first of the year

For the first time in 3 years, the backlog is growing

Operations

Consolidated facilities

Consolidated numerous redundant shared services

Fleet rationalization

Crew rotation extension schedules, localized operational capabilities

Continue to turn around or discontinue loss making operations

Engaged in discussions with lessors, targeting annual cash savings of over $5 million

CONFIDENTIAL PENDING INITIATIVES / NEXT STEPS

SITUATIONAL UPDATE (CONT’D)

32

Pending Initiatives / Next Steps

Cash

Management

Finalizing working capital initiatives

New capital structure plan with appropriate liquidity to support the business

Continue monetizing non-core assets

Introducing capital investment review process

Cost

Increased variabilization of cost

Continue to size direct labor to industry standard levels

Baseline compensation to industry standards

Variabilize compensation structure

Further consolidating facilities

Restructure leases

Revenue

Re-access SBA set aside contracts

Continue to refine and improve front end rigor and robustness (focus and accountability)

Open the aperture for adjacent opportunities

Convert to more annualized contracts with new and existing customers

Establish strategic partnerships and joint ventures

Develop capabilities to bid as Prime

Operations

Fleet rationalization to fewer types of aircraft as well as idle aircraft

Improve maintenance and supply chain efficiencies

Improve manufacturing efficiencies

Will create an enterprise that funds its operations from cash, a cost base that gives a

competitive advantage, best in class front end and meets and exceeds customer expectations

CONFIDENTIAL FLEET OVERVIEW

CONCLUSION

33

Picture Aircraft Picture Aircraft

Erickson S-64 (20)

(E & F models)

S76C+ (2)

Eurocopter AS332

Super Puma (2)

Eurocopter AS350 (3)

Bell 214ST (10) Bell 206 (5)

Eurocopter 300J

Puma (11)

Eurocopter BO-105 (1)

Bell 412 EP / SP (5) CASA 212 (3)

Bell 212 (3) Beechcraft 1900D (4)

Current Fleet (69 total) Illustrative Future Fleet

Picture Aircraft Description

Erickson S-64

(E & F models)

• Heavy-lift aircraft

• Twin-engine

• Civil version of the United States

Army's CH-54 Tarhe

Puma/Super Puma

• Medium-lift aircraft

• Four-bladed, twin-engine, utility

• 2 crew and up to 19 passengers

Bell 214ST

• Medium-lift aircraft

• 2 bladed, dual engine

• 1- 2 crew and up to 17 passengers

Bell 412 EP / SP

• Medium-lift aircraft

• 1- 2 pilots and up to 13 passengers

CASA 212

• Fixed wing

• Two turbo propeller engine aircraft,

for light transportation

• Cargo compartment can carry up to 18

passengers

Twin Otter / Dash-8

• Fixed wing

• Twin turboprop regional aircraft

• Up to 19 passengers (Twin Otter)

• Up to 39 passengers (Dash 8)

Long-term strategy to consolidate platforms

CONFIDENTIAL FLEET PLAN

CONCLUSION

34

• The Company currently owns 42 aircraft, with another 27 leased

• Company estimates leases are 40-50% out of market value

• In addition to renegotiating leases, the Company is actively looking to sell underutilized / idle aircraft

Current Pro-Forma

Aircraft Type

Total

Owned

Total

Leased

Total

Aircraft

Total

Aircraft

AS-350-B2/B3 2 1 3 2-3

BH-206/212/214/412 9 14 23 16-18

BO-105CBS5 1 0 1 0

Puma 330/332 6 7 13 10-12

S-64 E/F 19 1 20 20

S-76C+ 2 0 2 0

FW B-1900 2 2 4 0-1

FW CASA 212 1 2 3 2-3

Total 42 27 69 50-57