Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Altisource Portfolio Solutions S.A. | asps8-k201611investorpresent.htm |

© 2016 Altisource. All rights reserved.

Morgan Stanley

Leveraged Finance

Conference

November 2016

Any copying, distribution or use of any of the information contained herein that is not expressly permitted

by Altisource in writing is STRICTLY PROHIBITED. Altisource, the Altisource logo, the “REAL” family of

trademarks and service marks, and certain other marks identified herein are trademarks or service marks

of Altisource Solutions S.á r.l. or its subsidiaries. © 2016 Altisource. All rights reserved.

Exhibit 99.1

1 © 2016 Altisource. All rights reserved.

Forward-Looking Statements, Estimates and

Non-GAAP Measures

This presentation contains forward-looking statements that involve a number of risks and uncertainties. These forward-looking

statements include all statements that are not historical fact, including statements about management’s beliefs and expectations.

These statements may be identified by words such as “anticipate,” “intend,” “expect,” “may,” “could,” “should,” “would,” “plan,”

“estimate,” “seek,” “believe,” “potential” and similar expressions. Forward-looking statements are based on management’s beliefs

as well as assumptions made by and information currently available to management. Because such statements are based on

expectations as to the future and are not statements of historical fact, actual results may differ materially from what is

contemplated by the forward-looking statements. Altisource undertakes no obligation to update any forward-looking statements

whether as a result of new information, future events or otherwise. The risks and uncertainties to which forward-looking

statements are subject include, but are not limited to, Altisource’s ability to integrate acquired businesses, retain key executives or

employees, retain existing customers and attract new customers, general economic and market conditions, behavior of customers,

suppliers and/or competitors, technological developments, governmental regulations, taxes and policies, availability of adequate

and timely sources of liquidity and other risks and uncertainties detailed in the “Forward-Looking Statements,” “Risk Factors” and

other sections of Altisource’s Form 10-K and other filings with the Securities and Exchange Commission.

Altisource management utilizes certain non-GAAP measures such as earnings before interest, taxes, depreciation and

amortization (“EBITDA”), earnings before interest and taxes (“EBIT”), operating cash flow minus capital expenditures (“Free Cash

Flow”), Adjusted Operating Income, Adjusted Net Income Attributable to Altisource, Adjusted Service Revenue Unrelated to

Ocwen, Net Debt and Adjusted Net Debt as key metrics in evaluating its financial performance. These measures should be

considered in addition to, rather than as a substitute for, net income (loss) attributable to Altisource, operating cash flow, income

(loss) from operations, service revenue and long-term debt, including current portion. These non-GAAP measures are presented

as supplemental information and reconciled to net income (loss) attributable to Altisource, operating cash flow, operating income

(loss), service revenue or long-term debt, including current portion in the Appendix to this presentation.

2 © 2016 Altisource. All rights reserved.

Overview …………….………………………………………........... 3

Key Investment Highlights ………….………………..…….......... 8

Appendix ………………………….………………………………… 21

Table of Contents

3 © 2016 Altisource. All rights reserved.

Overview

4 © 2016 Altisource. All rights reserved.

About Altisource®

A trusted provider of marketplace transaction solutions for the real estate,

mortgage and consumer debt industries.

William B. Shepro, Chief Executive Officer

Approximately 8,500 Employees

Traded NASDAQ: ASPS

Service Revenue: $966 million1

1 For the twelve months ended September 30, 2016

5 © 2016 Altisource. All rights reserved.

Vision and Mission

Vision

To be the premier real estate and mortgage marketplace connecting

market participants and providing related services

Mission

To offer homeowners, buyers, sellers, agents, mortgage originators

and servicers trusted and efficient marketplaces to conduct real estate

and mortgage transactions and improve outcomes for participants

Consumer Real Estate Solutions

Real Estate Investor Solutions

Origination Solutions

Servicer Solutions

Real Estate Marketplace Mortgage Marketplace

6 © 2016 Altisource. All rights reserved.

Real Estate Marketplace

Home Sales Home Rentals Home Maintenance

Home buyers (and

their agents)

Home sellers (and

their agents)

Homeowners (and

their agents)

Renters (and their

agents)

Connecting

with

Homeowners (and their

agents)

Renters (and their agents)

Service Providers Service Providers

Service Providers

offering

solutions

Brokerage, on-line

sales and auction,

title and escrow,

valuation,

insurance, etc.

Brokerage, on-line

rental, renovation

management, property

management, valuation

etc.

Property inspection,

preservation and

renovation

management, etc.

and tools to

order and pay

for services

<-------- Order and vendor management technology, payment ----->

and presentment technology, document management, etc.

7 © 2016 Altisource. All rights reserved.

Mortgage Marketplace

Mortgage Origination Mortgage Servicing

Mortgage Originators

Service Providers

Mortgage Servicers

Service Providers

Investors

Title and escrow, valuation,

quality control, underwriting,

certified loan, vendor oversight,

loan origination system, flood

certifications, etc.

Servicing technology, title and

escrow, insurance services,

valuation, property inspection and

preservation, default management

services, etc.

Borrowers

Borrowers

Connecting

with

offering

solutions

and tools to

order and pay

for services

<-------- Order and vendor management technology, payment ----->

and presentment technology, document management, etc.

8 © 2016 Altisource. All rights reserved.

Key Investment Highlights

9 © 2016 Altisource. All rights reserved.

Key Investment Highlights

• Strong revenue, EBITDA and earnings

• Attractive operating and free cash flow and debt metrics

• Strategic initiatives position the Company for longer term revenue growth

and customer diversification

• Investment in and commitment to quality and control environment positions

Altisource as a strong competitor

1

2

3

4

10 © 2016 Altisource. All rights reserved.

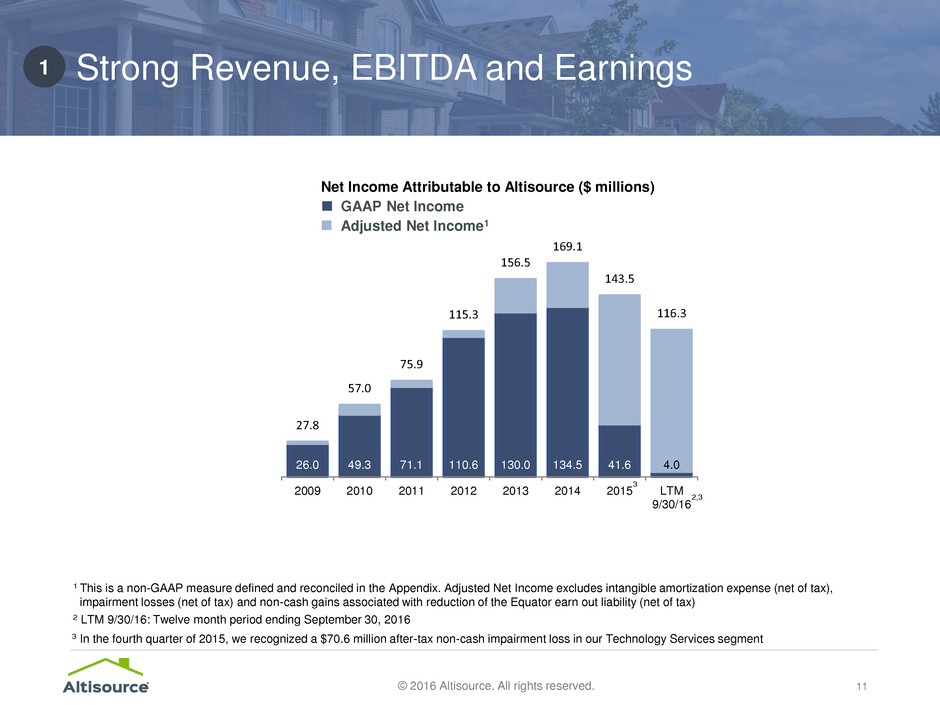

Strong Revenue, EBITDA and Earnings 1

186.7 247.0 334.8 466.9 662.1 938.7 940.9 966.4

20%

22%

26%

27%

24%

18%

8% 4%

21%

25%

27%

28% 29%

22%

20%

17%

0%

5%

10%

15%

20%

25%

30%

35%

$10 0

$20 0

$30 0

$40 0

$50 0

$60 0

$70 0

$80 0

$90 0

$1, 000

$1, 100

2009 2010 2011 2012 2013 2014 2015 LTM

9/30/16

Service Revenue ($ millions)

Operating Income Margin%

Adjusted Operating Income1 Margin%

2

2 LTM 9/30/16: Twelve month period ending September 30, 2016

1 This is a non-GAAP measure defined and reconciled in the Appendix

47.3

63.8

92.8

138.2

205.1

234.2

219.7

199.9

25% 26%

28%

30%

31%

25%

23%

21%

-2%

3%

8%

13%

18%

23%

28%

33%

38%

$0

$50

$10 0

$15 0

$20 0

$25 0

2009 2010 2011 2012 2013 2014 2015 LTM

9/30/16

EBITDA1 ($ millions)

% of Service Revenue

2

11 © 2016 Altisource. All rights reserved.

1

26.0 49.3 71.1 110.6 130.0 134.5 41.6 4.0

27.8

57.0

75.9

115.3

156.5

169.1

143.5

116.3

$0

$20

$40

$60

$80

$10 0

$12 0

$14 0

$16 0

$18 0

2009 2010 2011 2012 2013 2014 2015 LTM

9/30/16

Net Income Attributable to Altisource ($ millions)

GAAP Net Income

Adjusted Net Income1

2,3

3

1 This is a non-GAAP measure defined and reconciled in the Appendix. Adjusted Net Income excludes intangible amortization expense (net of tax),

impairment losses (net of tax) and non-cash gains associated with reduction of the Equator earn out liability (net of tax)

2 LTM 9/30/16: Twelve month period ending September 30, 2016

3 In the fourth quarter of 2015, we recognized a $70.6 million after-tax non-cash impairment loss in our Technology Services segment

Strong Revenue, EBITDA and Earnings

12 © 2016 Altisource. All rights reserved.

Attractive Operating and Free Cash Flow and

Debt Metrics

25.7 41.2 95.2 81.0 151.3 132.6 159.2 167.2

14%

17%

28%

17%

23%

14%

17% 17%

12%

22%

32%

$0

$20

$40

$60

$80

$10 0

$12 0

$14 0

$16 0

$18 0

$20 0

2009 2010 2011 2012 2013 2014 2015 LTM

9/30/16

Free Cash Flow1 ($ millions)

% of Service Revenue

1 This is a non-GAAP measure defined and reconciled in the Appendix

2

2

2 LTM 9/30/16: Twelve month period ending September 30, 2016

33.3 52.8 111.6 116.5 185.5 197.5 195.4 192.2

18%

21%

33%

25%

28%

21% 21%

20%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

$0

$50

$10 0

$15 0

$20 0

$25 0

2009 2010 2011 2012 2013 2014 2015 LTM

9/30/16

Operating Cash Flow ($ millions)

% of Service Revenue

2

13 © 2016 Altisource. All rights reserved.

Attractive Operating and Free Cash Flow and

Debt Metrics

2

4.5x

2.4x

1.7x 1.5x

$0

$1

$1

$2

$2

$3

$3

$4

$4

$5

$5

Interest Coverage Debt / EBITDA Net Debt / EBITDA Adjusted Net Debt /

EBITDA

Twelve Months Ended September 30, 2016

1. Interest coverage is defined as EBIT as a ratio of interest expense. EBIT is defined as net income attributable to Altisource plus income taxes, net interest expense and

impairment losses. Please see Appendix for reconciliation

2. Debt represents outstanding balance at the end of the period

3. Net debt is defined as debt minus cash and cash equivalents at the end of the period. Please see Appendix for reconciliation

4. Adjusted net debt is defined as debt minus cash and cash equivalents minus marketable securities at the end of the period. Please see Appendix for reconciliation

1 2 3 4

14 © 2016 Altisource. All rights reserved.

Strategic Initiatives Position the Company for Longer

Term Revenue Growth and Customer Diversification

Mortgage Market

– Grow our Servicer Solutions business

– Grow our Origination Solutions

business

Real Estate Market

– Grow our Consumer Real Estate

Solutions business

– Grow our Real Estate Investor

Solutions business

3

15 © 2016 Altisource. All rights reserved.

Demonstrated Progress on Revenue Diversification

1 This is a non-GAAP measure defined and reconciled in the Appendix

Note: Numbers may not sum due to rounding

32 33

89

63

109

56 55

54

42

41

7

47

51

40

33

$96

$135

$193

$145

$183

2013 2014 2015 YTD 9/30/15 YTD 9/30/16

Adjusted Service Revenue Unrelated to Ocwen1

($ millions)

Mortgage Services Financial Services Technology Services, net of inter-company

41% growth

43% growth

2

3

27% growth

16 © 2016 Altisource. All rights reserved.

Our scale, technology and full suite of services position us for growth

with large banks and servicers

• Large addressable market: estimated to

be $6 billion1 in 2016

• Altisource is one of a few service

providers with a full suite of services and

a national footprint

• We stand to gain market share as

customers consolidate to larger full-

service vendors

• We have a strong customer base and a

robust sales pipeline

• Existing customers include 6 of the top 10

servicers and 1 of the GSEs

1 Internal estimate

Servicer Solutions 3

17 © 2016 Altisource. All rights reserved.

Our suite of services, channel partners and sales and marketing efforts

position us for longer term growth

• Large addressable services market:

estimated to be $27 billion1 in 2016

• Lenders are focused on growing revenue

and maintaining margins while the costs

of regulatory compliance and quality

increases

• Through our management of the Lenders

One® cooperative and the Mortgage

Builder® loan origination system, we

have a strong customer base and a

robust sales pipeline

1 Internal estimate

Origination Solutions 3

18 © 2016 Altisource. All rights reserved.

Owners.com® offers self-directed home buyers and sellers the

tools and personal service to transact and save

• Massive brokerage and

related services market:

estimated to be $68 billion1

in 2016

• Consumers are

demonstrating a greater

desire to engage in self-

directed transactions

• We are establishing the

platform and personal

service to help self-directed

buyers and sellers achieve

greater value on every

transaction

1 Source: Internal estimate

2 Certain features and functionality described herein are under development

2

Complete inventory of

homes for sale (MLS,

FSBO, REO)

Web and human interface

to assist with research,

marketing, negotiating and

closing

Streamlined

ordering of real

estate services

directly from the

platform

Brokerage

operation to provide

the access to

transact – offering a

balance of service

and savings

Unmatched

Variety and

Choice

Robust

Information

and Service

Integrated End

to End

Services

Transact and

Save

Consumer Real Estate Solutions 3

19 © 2016 Altisource. All rights reserved.

Our suite of services, channel partner and online transaction

platform position us for longer term growth

Home

sale

Home

purchase

Renovation

Leasing

Maintenance

• Very large market with

approximately 15 million single

family rental homes in the U.S.1

• Institutional investors only account

for a small percentage of single

family rental real estate investors

• Most investors lack the buying

power to lower their capital and

operating costs

• We have the services, technology

and buying power to help investors

across the rental property

investment lifecycle

1 Source: U.S. Census Bureau

Real Estate Investor Solutions 3

20 © 2016 Altisource. All rights reserved.

Investment in and Commitment to Quality and Control

Environment Positions Altisource as a Strong Competitor

Strive to do the right thing

for all stakeholders

Foster a culture of

compliance across all

teams, all services

Deliver a focus on

continuous improvement

and pursue excellence in

everything we do

Strive to lead the industry

through innovative

technology and solutions

4

At our core, we have a relentless focus on our customers, controls, continuous

innovation and performance

21 © 2016 Altisource. All rights reserved.

• Non-GAAP Measures………………………………….……. 22

• Investor Relations Information……………………..………. 25

Appendix

22 © 2016 Altisource. All rights reserved.

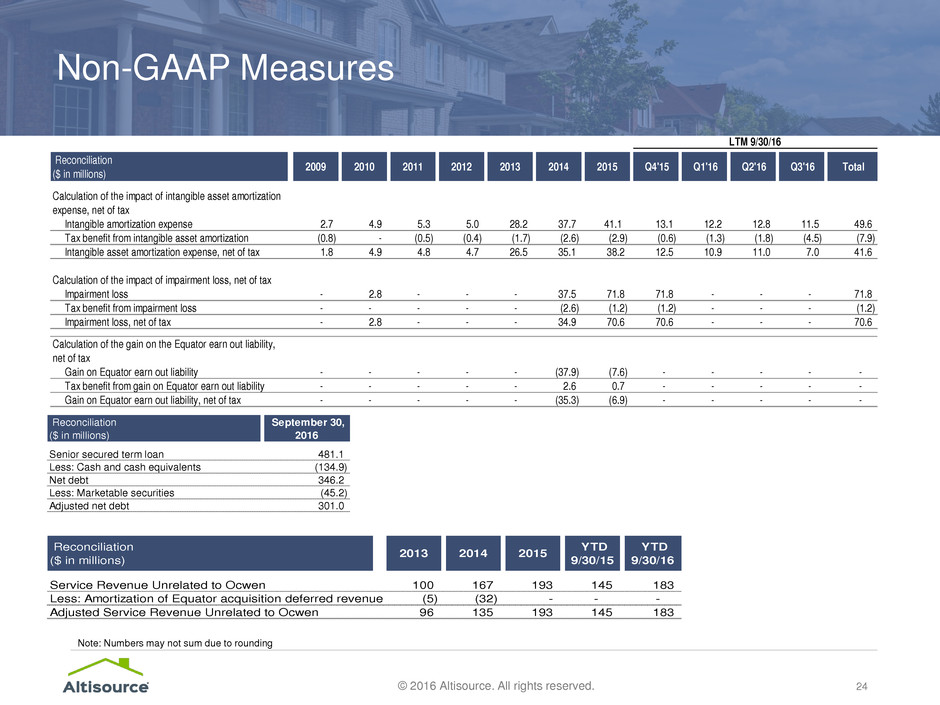

Non-GAAP Measures

• EBITDA, EBIT, Free Cash Flow, Adjusted Operating Income, Adjusted Net Income Attributable to Altisource, Adjusted Service Revenue Unrelated

to Ocwen, Net Debt and Adjusted Net Debt are non-GAAP measures used by our Chief Operating Decision Maker, existing shareholders and

potential shareholders to measure Altisource’s performance

• EBITDA is calculated by adding the income tax provision, interest expense (net of interest income), non-cash impairment losses and depreciation

and amortization to, and deducting non-cash gains associated with reductions of the Equator earn out liability from, GAAP net income (loss)

attributable to Altisource

• EBIT is calculated by adding income tax provision, interest expense (net of interest income) and non-cash impairment losses to, and deducting

non-cash gains associated with reductions of the Equator earn out liability from, GAAP net income (loss) attributable to Altisource

• Free Cash Flow is calculated by deducting capital expenditures from operating cash flow

• Adjusted Operating Income is calculated by adding intangible asset amortization expense and non-cash impairment losses to, and deducting non-

cash gains associated with reductions of the Equator earn out liability from, GAAP income (loss) from operations

• Adjusted Net Income Attributable to Altisource is calculated by adding intangible asset amortization expense (net of tax) and non-cash impairment

losses (net of tax) to, and deducting non-cash gains associated with reductions of the Equator earn out liability (net of tax) from, GAAP net income

(loss) attributable to Altisource

• Adjusted Service Revenue Unrelated to Ocwen is calculated by reducing the amortization of deferred revenue recorded in connection with the

2013 Equator acquisition from the applicable GAAP service revenue amount

• Net Debt is calculated as long-term debt, including current portion, minus cash and cash equivalents

• Adjusted Net Debt is calculated as long-term debt, including current portion, minus cash and cash equivalents and marketable securities

• The reconciliations of non-GAAP measures to GAAP measures are shown on slides 23 and 24

23 © 2016 Altisource. All rights reserved.

Reconciliation

($ in millions)

2009 2010 2011 2012 2013 2014 2015 Q4'15 Q1'16 Q2'16 Q3'16 Total

GAAP Operating Income (Loss) 36.5 55.0 85.7 127.4 162.1 170.5 79.1 (39.9) 27.7 27.2 24.9 39.8

Add: Intangible amortization expense 2.7 4.9 5.3 5.0 28.2 37.7 41.1 13.1 - 12.2 - 12.8 - 11.5 49.6

Add: Impairment loss - 2.8 - - - 37.5 71.8 71.8 - - - 71.8

Gain on Equator earn out liability - - - - - (37.9) (7.6) - - - - -

Adjusted Operating Income 39.2 62.7 91.0 132.5 190.2 207.7 184.4 45.0 39.9 40.0 36.3 161.1

GAAP Net Income (Loss)

1

26.0 49.3 71.1 110.6 130.0 134.5 41.6 (45.1) 18.5 20.0 10.6 4.0

Add: Intangible amortization expense, net of tax 1.8 4.9 4.8 4.7 26.5 35.1 38.2 12.5 10.9 11.0 7.0 41.6

Add: Impairment loss, net of tax - 2.8 - - - 34.9 70.6 70.6 - - - 70.6

Gain on Equator earn out liability, net of tax - - - - - (35.3) (6.9) - - - - -

Adjusted Net Income

1

27.8 57.0 75.9 115.3 156.5 169.1 143.5 38.0 29.4 31.0 17.6 116.3

GAAP Net Income (loss)

1

26.0 49.3 71.1 110.6 130.0 134.5 41.6 (45.1) 18.5 20.0 10.6 4.0

Income tax provision 11.6 (0.4) 7.9 8.7 8.5 10.2 8.3 0.2 2.2 3.3 7.3 13.0

Interest expense, net of interest income 1.6 0.1 0.1 1.0 19.4 23.3 28.1 6.8 6.5 6.0 5.9 25.2

Impairment losses - 2.8 - - - 37.5 71.8 71.8 - - - 71.8

Gain on Equator earn-out - - - - - (37.9) (7.6) - - - - -

EBIT 39.2 51.8 79.1 120.4 157.9 167.5 142.1 33.6 27.2 29.3 23.9 114.0

Depreciation and amortization 8.1 12.0 13.6 17.8 47.2 66.7 77.6 22.0 21.4 21.9 20.6 85.9

EBITDA 47.3 63.8 92.8 138.2 205.1 234.2 219.7 55.6 48.6 51.2 44.5 199.9

Operating Cash Flow 33.3 52.8 111.6 116.5 185.5 197.5 195.4 86.2 29.0 40.4 36.6 192.2

Capital expenditures 7.5 11.6 16.4 35.6 34.1 64.8 36.2 8.5 6.0 6.5 4.1 25.0

Free Cash Flow 25.7 41.2 95.2 81.0 151.3 132.6 159.2 77.7 23.1 33.9 32.5 167.2

LTM 9/30/16

Non-GAAP Measures

Note: Numbers may not sum due to rounding

1 Attributable to Altisource

24 © 2016 Altisource. All rights reserved.

Reconciliation

($ in millions)

2009 2010 2011 2012 2013 2014 2015 Q4'15 Q1'16 Q2'16 Q3'16 Total

Calculation of the impact of intangible asset amortization

expense, net of tax

Intangible amortization expense 2.7 4.9 5.3 5.0 28.2 37.7 41.1 13.1 12.2 12.8 11.5 49.6

Tax benefit from intangible asset amortization (0.8) - (0.5) (0.4) (1.7) (2.6) (2.9) (0.6) (1.3) (1.8) (4.5) (7.9)

Intangible asset amortization expense, net of tax 1.8 4.9 4.8 4.7 26.5 35.1 38.2 12.5 10.9 11.0 7.0 41.6

Calculation of the impact of impairment loss, net of tax

Impairment loss - 2.8 - - - 37.5 71.8 71.8 - - - - - - 71.8

Tax benefit from impairment loss - - - - - (2.6) (1.2) (1.2) - - - - - - (1.2)

Impairment loss, net of tax - 2.8 - - - 34.9 70.6 70.6 - - - - - - 70.6

Calculation of the gain on the Equator earn out liability,

net of tax

Gain on Equator earn out liability - - - - - (37.9) (7.6) - - - - - - - -

Tax benefit from gain on Equator earn out liability - - - - - 2.6 0.7 - - - - - - - -

Gain on Equator earn out liability, net of tax - - - - - (35.3) (6.9) - - - - - - - -

LTM 9/30/16

Non-GAAP Measures

Note: Numbers may not sum due to rounding

Reconciliation

($ in millions)

September 30,

2016

Senior secured term loan 481.1

Less: Cash and cash equivalents (134.9)

Net debt 346.2

Less: Marketable securities (45.2)

Adjusted net debt 301.0

Reconciliation

($ in millions)

2013 2014 2015

YTD

9/30/15

YTD

9/30/16

Service Revenue Unrelated to Ocwen 100 167 193 145 183

Less: Amortization of Equator acquisition deferred revenue (5) (32) - - -

Adjusted Service Revenue Unrelated to Ocwen 96 135 193 145 183

25 © 2016 Altisource. All rights reserved.

Investor Relations Information

About Altisource

We are a premier marketplace and transaction solutions provider for

the real estate, mortgage and consumer debt industries.

Altisource’s proprietary business processes, vendor and electronic

payment management software and behavioral science-based

analytics improve outcomes for marketplace participants.

Contact Information

All Investor Relations inquiries should be sent to:

Investor.relations@altisource.com

Exchange NASDAQ Global Select Market

Ticker ASPS

Headquarters Luxembourg

Employees Approximately 8,500

© 2016 Altisource. All rights reserved.