Attached files

| file | filename |

|---|---|

| 10-Q - FORM 10-Q - Akebia Therapeutics, Inc. | akba-10q_20160930.htm |

| EX-99.1 - EX-99.1 - Akebia Therapeutics, Inc. | akba-ex991_6.htm |

| EX-32.1 - EX-32.1 - Akebia Therapeutics, Inc. | akba-ex321_9.htm |

| EX-31.2 - EX-31.2 - Akebia Therapeutics, Inc. | akba-ex312_8.htm |

| EX-31.1 - EX-31.1 - Akebia Therapeutics, Inc. | akba-ex311_7.htm |

Exhibit 10.1

THIRD AMENDMENT TO LEASE

This Third Amendment to Lease (this “Third Amendment”) is entered into as of July 25, 2016, (the “Execution Date”) by and between JAMESTOWN PREMIER 245 FIRST, LLC, a Delaware limited liability company (the “Landlord”), and AKEBIA THERAPEUTICS, INC., a Delaware corporation (the “Tenant”).

WHEREAS, Landlord’s predecessor and Tenant entered into that certain Office Lease Agreement dated as of December 3, 2013, as amended by a First Amendment to Lease dated as of December 15, 2014 (the “First Amendment”) and a Second Amendment to Lease dated as of November 23, 2015 (the “Second Amendment”) (as amended, the “Lease”) for the lease of certain premises containing a total of 39,411 rentable square feet of office space (the “Existing Premises”) on the eleventh (11th) and fourteenth (14th) floors of the Office Building located at 245 First Street, Cambridge, MA 02142 (the “Office Building”) located in Cambridge Science Center (the “Property”), consisting of the Office Building and a second building referred to as the “Science Building”. The Science Building and Office Building are collectively referred to as the “Buildings” and in this Third Amendment, the Science Building is also referred to as the “Building”. The “Rentable Square Footage of the Buildings” is deemed to be 297,632 square feet. The “Rentable Square Footage of the Science Building” is deemed to be 132,928 square feet, and “Rentable Square Footage of the Office Building” is deemed to be 164,704 square feet;

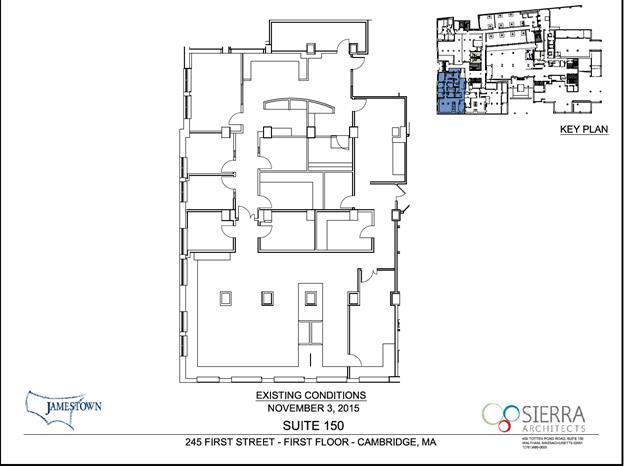

WHEREAS, Tenant desires to lease approximately 5,951 rentable square feet of office, research, development, and laboratory space (the “First Floor Premises”) as shown on Exhibit A, Third Amendment, attached hereto and incorporated herein, located on the first (1st) floor of the Science Building with an appurtenant right, in common with others, to use the PH neutralization room (the “PH System Room”) that contains the PH systems of other tenants, including Tenant, on the first (1st) floor of the Science Building; and to pay a Tank Fee (as hereinafter defined) for its use of the PH System Room.

WHEREAS, Landlord and Tenant desire to amend the Lease to reflect (i) the expansion of the Existing Premises to include the First Floor Premises and (ii) Tenant’s appurtenant right to use the PH System Room.

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree that the Lease is hereby amended as follows:

1

|

which date is anticipated to occur on or about October 1, 2016 (the “Estimated First Floor Premises Commencement Date”) and expiring on the date (the “First Floor Premises Termination Date”) that is the last day of the sixtieth (60th) full calendar month after the First Floor Premises Rent Commencement Date, as hereinafter defined. The “First Floor Premises Rent Commencement Date” shall be the date that is the earlier of (i) the date Tenant occupies the First Floor Premises for the conduct of Tenant’s business and (ii) the date that is two (2) months after the First Floor Premises Commencement Date. Landlord shall use all commercially reasonable efforts to deliver the First Floor Premises to Tenant on or before the Estimated First Floor Premises Commencement Date in the condition required hereunder; however, the failure of Landlord to do so shall in no way affect the validity of the Lease, this Third Amendment, or the obligations of Tenant hereunder, and Tenant shall not have any claim against Landlord by reason thereof. Notwithstanding the foregoing, if Landlord does not deliver the First Floor Premises to Tenant on or before December 1, 2016 (which date shall be extended automatically for such periods of time as Landlord is prevented from delivering the First Floor Premises by reason of causes beyond Landlord’s reasonable control or any act or failure to act of Tenant which interferes with Landlord’s ability to deliver the First Floor Premises, without limiting Landlord’s other rights on account thereof, provided Landlord shall notify Tenant of any action or inaction of Tenant that is preventing Landlord from delivering the First Floor Premises) (the “Outside Date”), then Tenant shall be entitled to a credit (to be applied following the First Floor Premises Rent Commencement Date) in an amount equal to the product of: (i) $1,141.29 multiplied by (ii) the number of days that elapse after December 1, 2016, as the same may be extended as aforesaid, until the date Landlord delivers the First Floor Premises to Tenant. After the First Floor Premises Commencement Date, the First Floor Premises Rent Commencement Date, and the First Floor Premises Termination Date are determined, the parties shall, upon the written request of either party, execute an agreement confirming such dates. |

Said lease of the First Floor Premises shall be upon all of the terms and conditions set forth in the Lease applicable to the Existing Premises, except to the extent inconsistent with the provisions set forth in this Third Amendment. Effective as of the First Floor Premises Commencement Date, (x) the “First Floor Premises” shall be included in the definition of “Premises” for all purposes of the Lease, (y) “Tenant’s First Floor Premises Building Pro Rata Share” shall be 4.48% (i.e., a fraction, the numerator of which is the rentable area of the First Floor Premises, and the denominator of which is the Rentable Square Footage of the Science Building), and (z) “Tenant’s First Floor Premises Common Area Pro Rata Share” shall be 2% (i.e., a fraction, the numerator of which is the rentable area of the First Floor Premises, and the denominator of which is the Rentable Square Footage of the Buildings).

A.Rent--First Floor Premises. Commencing on the First Floor Premises Rent Commencement Date, Tenant shall pay Base Rent and Additional Rent for the First Floor Premises as set forth below.

(i)Base Rent—First Floor Premises.

2

|

|

*“Lease Year” shall be defined as a twelve-(12)-month period beginning on the First Floor Premises Rent Commencement Date or an anniversary of the First Floor Premises Rent Commencement Date, except that if the First Floor Premises Rent Commencement Date does not fall on the first day of a calendar month, then the first Lease Year shall begin on the First Floor Premises Rent Commencement Date and end on the last day of the month containing the first anniversary of the First Floor Premises Rent Commencement Date, and each succeeding Lease Year shall begin on the day following the last day of the prior Lease Year, and the monthly Base Rent for the first month of such Lease Year shall be appropriately prorated. |

(ii)Expenses and Taxes—First Floor Premises. Commencing on the First Floor Premises Rent Commencement Date, Tenant shall pay, as Additional Rent, (x) Tenant’s First Floor Premises Building Pro Rata Share of Expenses, (y) Tenant’s First Floor Premises Common Area Pro Rata Share of Common Area Expenses, and (z) Tenant’s First Floor Premises Common Area Pro Rata Share Taxes relating to or allocable to the Land, in accordance with the provisions of Exhibit B, Third Amendment, attached hereto and incorporated herein.

(iii)Electricity—First Floor Premises. Landlord shall provide electricity for lights and plugs in the First Floor Premises, which electricity shall be measured by a meter serving the First Floor Premises together with certain other premises on the first floor of the Building. Tenant agrees to pay Landlord, as Additional Rent, an annual charge for such electrical consumption (the “Tenant Electricity Charge”) payable, on an estimated basis, in twelve (12) equal monthly installments, payable in advance on the first day of each calendar month during the Term hereof, in an amount reasonably estimated by Landlord. The actual Tenant Electricity Charge shall be calculated by multiplying the total annual amount billed to such meter by the applicable utility company by a fraction, the numerator of which is the number of rentable square feet in the First Floor Premises, and the denominator of which is the number of rentable square feet in all areas served by such meter, including the First Floor Premises, which were occupied during the period covered by each such bill (appropriately pro-rated to reflect any partial occupancy). Following the end of each calendar year (or partial calendar year), Landlord shall furnish to Tenant a comparative statement showing Tenant’s actual

3

consumption of electric energy and the amounts paid by Tenant for such electricity on an estimated basis during such year. Based on Tenant’s actual usage, any underpayment by Tenant shall be promptly adjusted by payment to Landlord within thirty (30) days of the balance of any underpayment for such year, and any overpayment by Tenant shall be applied as a credit to the next succeeding monthly installment of the Tenant Electricity Charge.

Notwithstanding the foregoing, upon prior written notice to Landlord, Tenant shall have the right, at its sole cost and expense, to install a submeter in the First Floor Premises to measure the electrical consumption in the First Floor Premises.

(iv)Other Utilities. Tenant shall pay directly to the proper authorities charged with the collection thereof, all charges for (i) telephone (Tenant shall be responsible for installing high-speed fiber data service from the first floor communications closet to the First Floor Premises), and (ii) other separately metered or check metered utilities or services used or consumed on the First Floor Premises, including, without limitation, HVAC provided to the First Floor Premises, whether called charge, tax, assessment, fee or otherwise, including, without limitation, all such charges to be paid as the service from time to time becomes due. In the event Tenant desires to establish gas service in connection with Tenant’s use of the First Floor Premises, Tenant shall arrange to install, at Tenant’s sole cost and expense, a check meter(s) and any other related infrastructure improvements necessary to provide such gas service, subject to Landlord’s approval thereof.

B.First Floor Premises Condition/Tenant’s First Floor Premises Work.

(i)Except for Landlord’s obligation to provide Landlord’s First Floor Premises Contribution, as hereinafter defined, the First Floor Premises shall be leased by Tenant “as-is” and “where is”, in the condition in which the First Floor Premises is in as of the Execution Date, and in the condition in which Landlord is required to deliver the First Floor Premises to Tenant under this Third Amendment, and as further provided in this paragraph, and without Landlord or Landlord’s agents having made any representations or warranties with respect to the First Floor Premises or the Science Building or the Property except as expressly set forth herein. Except for Landlord’s obligations to provide Landlord’s First Floor Premises Contribution and to deliver the First Floor Premises in the condition required by this Third Amendment, Landlord has no obligation to perform any work, supply any materials, incur any expense or make any alterations, additions or improvements to the First Floor Premises. Notwithstanding the foregoing, Landlord agrees that as of the First Floor Premises Commencement Date, (x) Landlord shall deliver the First Floor Premises to Tenant decontaminated by a Certified Industrial Hygienist free of any Hazardous Materials (as hereinafter defined) and provide written evidence of such decontamination, (y) the roof of the Building shall be watertight, and (z) the common building systems (including the HVAC, electrical, life safety and plumbing systems, the Acid Neutralization Tank and Emergency Generator) of the Science Building shall be in good working order.

(ii)Tenant’s First Floor Premises Work. Tenant shall perform the leasehold improvements to prepare the First Floor Premises for Tenant’s occupancy (“Tenant’s First Floor Premises Work”) in accordance with plans and specifications (“Tenant’s First Floor Premises Plans”), which shall be submitted to Landlord for its approval. Tenant’s First

4

Floor Premises Work shall be performed, and Landlord’s approval of Tenant’s First Floor Premises Plans shall be delivered, in accordance with Section 9.03 of the Lease except that (i) after Landlord’s initial approval of Tenant’s First Floor Premises Plans, Landlord’s approval shall only be required for material changes to Tenant’s First Floor Premises Plans, and (ii) Landlord shall provide its approval (or disapproval) of Tenant’s First Floor Premises Plans within the Initial Submittal Response Period, as hereinafter defined, after receipt thereof (and with respect to any material changes to Tenant’s First Floor Premises Plans, or resubmissions of Tenant’s First Floor Premises Plans following Landlord’s disapproval thereof, within the Resubmittal Response Period, as hereinafter defined, after receipt thereof) and any disapproval shall be accompanied by a detailed written explanation for the basis of such disapproval. For the purposes of this Section 1.B(ii):

(1)the “Initial Submittal Response Period” shall be defined as ten (10) Business Days, except that if, in Landlord’s reasonable judgment, Tenant’s First Floor Premises Plans must be reviewed by a third party engineer or consultant (e.g., because Tenant’s First Floor Premises Work, as shown on Tenant’s First Floor Premises Plans, affect the structure or systems of the Science Building), then the Initial Submittal Respond Period shall be fifteen (15) Business Days;

(2)the “Resubmittal Response Period” shall be defined as five (5) Business Days, except that if, in Landlord’s reasonable judgment, Tenant’s First Floor Premises Plans must be reviewed by a third party engineer or consultant (e.g., because Tenant’s First Floor Premises Work, as shown on Tenant’s First Floor Premises Plans, affect the structure or systems of the Science Building), then the Resubmittal Response Period shall be ten (10) Business Days.

(iii)Except for Landlord’s First Floor Premises Contribution, Tenant’s First Floor Premises Work shall be performed at Tenant’s sole cost and expense, using Building standard methods, materials, and finishes. Notwithstanding anything to the contrary contained in the Lease, Tenant shall be permitted to use its own general contractor and subcontractors to perform Tenant’s First Floor Premises Work, which general contractor and subcontractors shall be subject to Landlord’s prior approval, which shall not be unreasonably withheld, conditioned or delayed.

C.Landlord’s First Floor Premises Contribution. Landlord shall, in the manner hereinafter set forth, provide Tenant with Landlord’s First Floor Premises Contribution to be used to pay for Permitted Costs, as hereinafter defined, incurred by Tenant in connection with Tenant’s First Floor Premises Work. Landlord’s First Floor Premises Contribution shall not exceed $89,265.00 (i.e., $15.00 per rentable square foot of the First Floor Premises) (“Maximum Contribution”). “Permitted Costs” shall be defined as Hard Costs and Soft Costs, each as hereinafter defined. “Hard Costs” shall be defined as the cost of acquisition, installation, and performance of leasehold improvements, demolition, and building permits. “Soft Costs” shall include the costs of furniture, fixtures and equipment installed by Tenant in the First Floor Premises, fees of any owner’s construction representative, architectural and design fees, data/telecom cabling, and moving costs. “Landlord’s First Floor Premises Contribution” shall be the lesser of (i) the actual Permitted Costs incurred by Tenant and (ii) the Maximum Contribution. Landlord shall receive a construction management fee equal to one

5

percent (1%) of the Hard Costs of Tenant’s First Floor Premises Work. Such fee shall be deducted from Landlord’s First Floor Premises Contribution. In addition to Landlord’s First Floor Premises Contribution, Landlord shall provide Tenant with a “test fit” allowance of up to ten cents ($0.10) per rentable square foot of the First Floor Premises (i.e., a maximum of $595.10), which test fit allowance shall be used solely to reimburse Tenant for any expenses incurred in connection with the preparation of “test fit” plans and drawings in connection with the preparation of the First Floor Premises Plans.

(i)Disbursement Procedures. Provided there shall then exist no Default (as said term is defined in Section 18 of the Lease) beyond any applicable notice and cure period under the Lease at the time that Tenant submits any Requisition (as defined in Section 8 of the Second Amendment) of Landlord’s First Floor Premises Contribution, Landlord shall pay the cost of the work shown on each Requisition submitted by Tenant to Landlord within twenty (20) days of submission thereof by Tenant to Landlord. If requested by Tenant at the time of Tenant’s submission of such Requisition, Landlord shall make such payment directly to Tenant’s contractor. If Landlord declines to fund any Requisition on the basis of a Default of Tenant under the Lease, provided that the Lease is in full force and effect and Tenant cures such Default in accordance with the terms and conditions of the Lease, then, subject to the provisions set forth herein, Tenant shall have the right to resubmit such declined Requisition, and Landlord shall pay any amounts properly due under such resubmitted Requisition.

(ii)Each Tenant Requisition shall be accompanied by the following: (1) a detailed breakdown of the costs of Tenant’s First Floor Premises Work for which Tenant is seeking payment, (2) a copy of each Application for Payment (substantially on the standard AIA form) from Tenant’s contractor for all contractor charges included in the Requisition, (3) copies of invoices for any architectural fees and other costs not covered by a contractor’s Application for Payment that are included in Tenant’s Requisition, (4) a certification by an appropriate officer of Tenant or by Tenant’s architect that all of the construction work to be paid for with Landlord’s First Floor Premises Contribution has been completed in a good and workmanlike manner, in accordance with Tenant’s First Floor Premises Plans, as the case may be, (5) executed waivers of mechanic’s or material supplier’s liens from contractors who have performed work in excess of $10,000.00 (in such form as Landlord shall reasonably require) waiving, releasing and relinquishing all liens, claims and rights to lien under applicable laws on account of any labor, materials and/or equipment furnished by any party through the date of Tenant’s Requisition (provided that any such waiver may be conditioned upon receipt of the amount requested for such party in Tenant’s Requisition), and (6) a certification by an appropriate officer of Tenant that Tenant has made (or upon receipt of the amount requested in the Tenant’s Requisition shall make) full payment for all of the work and other costs of Tenant’s First Floor Premises Work, as the case may be, covered by the Requisition. Upon the earlier to occur of the date that is (A) fifteen (15) days following Substantial Completion (as hereinafter defined), or (B) the date of submission of a Requisition for the final ten percent (10%) of Landlord’s First Floor Premises Contribution (the “Final Requisition”), in addition to delivering the documentation required in subclauses (1) through (6) above, such Final Requisition shall also be accompanied by all items required to be delivered by Tenant pursuant to Section 9.03 of the Lease. For the purposes of this Third Amendment, “Substantial Completion” shall mean that Tenant’s First Floor Premises Work is completed in such a fashion as to enable Tenant, upon furnishing the same, to open for business in the normal course.

6

D.Conditions to Payment of Landlord’s First Floor Premises Contribution. Notwithstanding anything to the contrary herein contained:

(i)Except with respect to work and/or materials previously paid for by Tenant, as evidenced by paid invoices and written lien waivers provided to Landlord, Landlord shall have the right with respect to any Tenant contractor or vendor that has filed a lien against the Property for work performed, or claimed to be performed, which has not been discharged or bonded over to Landlord’s reasonable satisfaction in accordance with Section 12 of the Lease, to have Landlord’s First Floor Premises Contribution paid to both Tenant and such contractor or vendor jointly, or directly to such contractor or vendor.

(ii)Landlord shall have no obligation to pay Landlord’s First Floor Premises Contribution in respect of any Requisition submitted after the date (the “Outside Requisition Date”) that is twelve (12) months after the First Floor Premises Rent Commencement Date.

(iii)Tenant shall not be entitled to any unused portion of Landlord’s First Floor Premises Contribution provided, however, that notwithstanding the foregoing, Tenant shall be entitled to apply up to twenty percent (20%) of the Landlord’s First Floor Contribution towards Base Rent due hereunder.

(iv)Tenant may not use more than $13,389.75 of Landlord’s First Floor Premises Contribution to pay for Soft Costs.

(v)If Landlord fails timely to pay any portion of Landlord’s First Floor Premises Contribution when properly due to Tenant, and if Landlord fails to cure such failure within twenty (20) days after notice from Tenant, Tenant shall have the right to offset such past due amount from the next installment(s) of Base Rent and other charges due under the Lease.

E.First Floor Premises--Cleaning. Tenant shall be responsible, at its sole cost and expense, for janitorial and trash removal services and other biohazard disposal services for the First Floor Premises, including the laboratory areas thereof. Such services shall be performed by licensed (where required by law or governmental regulation), insured and qualified contractors approved in advance, in writing, by Landlord (which approval shall not be unreasonably withheld, delayed or conditioned) and on a sufficient basis to ensure that the First Floor Premises is at all times kept neat and clean.

F.First Floor Premises--Maintenance and Repairs by Tenant. Tenant shall keep the First Floor Premises neat and clean and free of insects, rodents, vermin and other pests and in the same repair, order and condition as on the First Floor Premises Commencement Date, including without limitation the entire interior of the First Floor Premises, all electronic, phone and data cabling and related equipment that is installed by or for the exclusive benefit of the Tenant (whether located in the First Floor Premises or other portions of the Science Building), all fixtures, equipment and lighting therein, electrical equipment wiring, doors, nonstructural walls, windows and floor coverings, reasonable wear and tear and damage by Casualty excepted. Tenant shall be solely responsible, at Tenant’s sole cost and expense, for the proper maintenance

7

of the Science Building systems, life safety, sanitary, electrical, heating, air conditioning, plumbing, security or other systems and of all equipment and appliances located within and/or exclusively serving the First Floor Premises. Tenant agrees to provide regular maintenance by a contract with a reputable qualified service contractor for the heating and air conditioning equipment servicing the First Floor Premises. Such maintenance contract and contractor shall be subject to Landlord’s reasonable approval. Tenant, at Landlord’s request, shall at reasonable intervals provide Landlord with copies of such contract and maintenance and repair records and/or reports. Landlord hereby agrees to provide access to those areas of the Building located outside the First Floor Premises, which are necessary for Tenant to perform its maintenance obligations hereunder.

G.First Floor Premises—Permitted Use. Subject to all applicable Law(s), including, without limitation, Environmental Laws (as hereinafter defined), Tenant may use the First Floor Premises for general office, research, development and laboratory use and other ancillary uses related to the foregoing in accordance with Section 5 of the Lease.

|

H.First Floor Premises—Hazardous Materials. Tenant shall not, without the prior review and approval of Landlord (which approval shall not be unreasonably withheld, conditioned or delayed), generate, produce, bring in, use, store, treat or dispose of any Hazardous Materials in or about or on the Buildings other than those Hazardous Materials set forth on Exhibit C, Third Amendment; provided that such Hazardous Materials set forth on Exhibit C, Third Amendment, shall only be generated, produced, brought upon, used, stored, treated or disposed of in the First Floor Premises. If Tenant desires to generate, produce, bring in, use, store, treat or dispose of any Hazardous Materials in or about the Buildings other than those Hazardous Materials set forth in Exhibit C, Third Amendment, Tenant shall request Landlord’s consent thereto in writing (“Tenant’s Request”) setting forth the name(s) of such Hazardous Materials, the anticipated quantities of such Hazardous Materials, and the intended use of such Hazardous Materials, and Landlord shall use commercially reasonable efforts to respond to Tenant’s Request within five (5) Business Days of receipt thereof. If Landlord shall fail to respond to Tenant’s Request within such five-(5)-Business-Day period, then Tenant may, after the expiration of such five-(5)-Business-Day period, give Landlord another request (“Second Request”) therefor, which shall state in bold face, capital letters at the top thereof: “WARNING: SECOND REQUEST. FAILURE TO RESPOND TO THIS REQUEST WITHIN THREE (3) BUSINESS DAYS SHALL RESULT IN DEEMED APPROVAL THEREOF.” If Landlord does not respond within three (3) Business Days after receipt of the Second Request, then Landlord’s consent to Tenant’s Request shall be deemed to have been granted. From time to time at Landlord’s request, Tenant shall execute affidavits, representations and the like concerning Tenant’s best knowledge and belief regarding the presence or absence of Hazardous Materials on the Premises or the Property, and shall provide copies of all required permits for Tenant’s activities in the Premises. Furthermore, upon written request from Landlord from time to time, Tenant shall provide Landlord with a list detailing the types and amounts of all Hazardous Materials being generated, produced, brought upon, used, stored, treated or disposed of by or on behalf of Tenant in or about or on the First Floor Premises, the Buildings, or Property, and upon Landlord’s written request (not to be made more frequently that quarterly), copies of any reasonable manifests or other federal, state or municipal filings by Tenant with respect to such Hazardous Materials used in the First Floor Premises`. |

8

|

A.Tank Fee. Commencing on the First Floor Premises Rent Commencement Date, Tenant shall pay, as Additional Rent, a “Tank Fee” for its use of the PH System Room as set forth below. The Tank Fee shall be paid at the same time and in the same manner as Annual Base Rent and shall be subject to the terms and conditions set forth in Section 5.4 of the Lease. |

|

Lease Year |

Annual License Fee |

Monthly License Fee |

|

First Floor Premises Rent Commencement Date through the end of Lease Year 1 |

$3,150.00 |

$262.50 |

|

Lease Year 2 |

$3,213.00 |

$267.75 |

|

Lease Year 3 |

$3,277.35 |

$273.11 |

|

Lease Year 4 |

$3,343.05 |

$278.59 |

|

Lease Year 5 |

$3,410.10 |

$284.18 |

B.Condition of PH System Room. The PH System Room shall be used by Tenant “as-is” and “where is”, in the condition in which the PH System Room is in as of the First Floor Premises Commencement Date, and without Landlord or Landlord’s agents having made any representations or warranties with respect to the PH System Room or the Science Building or the Property except as expressly set forth herein. Except as otherwise expressly provided in this Third Amendment, Landlord has no obligation to perform any work, supply any materials, incur any expense or make any alterations, additions or improvements to the PH System Room. Tenant shall have no right to make any improvements to the PH System Room.

C.Acid Neutralization Tank. As of the Execution Date, there is an acid neutralization tank (the “Acid Neutralization Tank”) that is located in the PH System Room on the first (1st) floor of the Science Building, which shall be connected to the First Floor Premises. Tenant shall have the appurtenant right, throughout the First Floor Premises Term, to use the Acid Neutralization Tank in accordance with applicable Law(s). Tenant shall obtain, and maintain, all governmental permits and approvals necessary for Tenant’s use of the Acid Neutralization Tank. Landlord shall maintain all permits and approvals necessary for the operation of the Acid Neutralization Tank and the connection to the MWRA (as such term is

9

defined herein) system. In addition to paying the Tank Fee, Tenant shall be responsible for paying, as Additional Rent, Tenant’s Tank Costs Share, as hereinafter defined, of all costs, charges and expenses incurred from time to time in connection with or arising out of the operation, use, maintenance, repair or replacement of the Acid Neutralization Tank, including all clean-up costs relating to the Acid Neutralization Tank (collectively, “Tank Costs”) unless caused by the negligence or willful misconduct of Landlord. As used herein, as of the Execution Date, “Tenant’s Tank Costs Share” shall mean fifty percent (50%). Tenant shall indemnify, save, defend (at Landlord’s option and with counsel reasonably acceptable to Landlord) and hold Landlord harmless from and against any and all claims and sums paid in settlement of claims that arise during or after the First Floor Premises Term as a result of Tenant’s improper use of the Acid Neutralization Tank, except to the extent such claims result from the negligence or willful misconduct of Landlord or any other party using the Acid Neutralization Tank. This indemnification by Tenant includes costs incurred in connection with any investigation of site conditions or any clean-up, remediation, removal or restoration required by any governmental authority to the extent caused by Tenant’s improper use of the Acid Neutralization Tank. In the event Landlord deems it necessary to replace the Acid Neutralization Tank, the cost of purchasing and installing such replacement acid neutralization tank shall be amortized over the useful life of the new acid neutralization tank at an interest rate of eight percent (8%) and the annual amortization of such amount shall be included in Tank Costs from and after the date of such replacement.

D.Chemical Safety Program. Tenant shall establish and maintain a chemical safety program administered by a licensed, qualified individual in accordance with the requirements of the Massachusetts Water Resources Authority (“MWRA”) and any other applicable governmental authority. Tenant shall be solely responsible for all costs incurred in connection with such chemical safety program, and Tenant shall provide Landlord with such documentation as Landlord may reasonably require evidencing Tenant’s compliance with the requirements of (a) the MWRA and any other applicable governmental authority with respect to such chemical safety program and (b) this Section 2.D. Tenant shall provide all such information regarding Tenant’s activities in the First Floor Premises as may reasonably be necessary in order for Landlord to obtain and maintain during the First Floor Premises Term (i) any permit required by the MWRA (“MWRA Permit”) and (ii) a wastewater treatment operator license from the Commonwealth of Massachusetts with respect to Tenant’s use of the Acid Neutralization Tank serving the Science Building. Tenant shall not introduce anything into the Acid Neutralization Tank serving the Science Building (x) in violation of the terms of the MWRA Permit, (y) in violation of applicable Law(s) or (z) that would interfere with the proper functioning of the Acid Neutralization Tank.

E.Surrender of First Floor Premises. Prior to the expiration of the First Floor Premises Term (or within thirty (30) days after any earlier termination), Tenant shall clean and otherwise decommission all interior surfaces (including floors, walls, ceilings, and counters), piping, supply lines, waste lines, acid neutralization systems and plumbing in and/or exclusively serving the First Floor Premises, and all exhaust or other ductwork in and/or exclusively serving the First Floor Premises, in each case which has carried or released or been contacted by any Hazardous Materials or other chemical or biological materials used in the operation of the First Floor Premises, and shall otherwise clean the First Floor Premises so as to permit the Surrender Plan (defined below) to be issued. At least thirty (30) days prior to the expiration of the First

10

Floor Premises Term (or, if applicable, within five (5) Business Days after any earlier termination of the Lease), Tenant shall deliver to Landlord a reasonably detailed narrative description of the actions proposed (or required by any applicable Law(s)) to be taken by Tenant in order to render the First Floor Premises (including any Alterations permitted or required by Landlord to remain therein) free of Hazardous Materials (other than any Hazardous Materials that may have been present therein as of the First Floor Premises Commencement Date) and otherwise released for unrestricted use and occupancy including without limitation, causing the First Floor Premises to be decommissioned in accordance with the regulations of the U.S. Nuclear Regulatory Commission and/or the Massachusetts Department of Public health (the “MDPH”), if applicable, for the control of radiation, and cause the First Floor Premises to be released for unrestricted use by the Radiation Control Program of the MDPH (the “Surrender Plan”). The Surrender Plan (i) shall be accompanied by a current list of (A) all Required Permits held by or on behalf of any Tenant Party with respect to Hazardous Materials in, on, under, at or about the First Floor Premises, and (B) Tenant’s Hazardous Materials, and (ii) shall be subject to the review and approval of Landlord’s environmental consultant. In connection with review and approval of the Surrender Plan, upon request of Landlord, Tenant shall deliver to Landlord or its consultant such additional non-proprietary information concerning the use of and operations within the First Floor Premises as Landlord shall reasonably request. On or before the expiration of the First Floor Premises Term (or within thirty (30) days after any earlier termination of the Lease, during which period Tenant’s use and occupancy of the First Floor Premises shall be governed by Section 22 of the Lease), Tenant shall deliver to Landlord a certification from a third party certified industrial hygienist reasonably acceptable to Landlord certifying that the First Floor Premises do not contain any Hazardous Materials, and evidence that the approved Surrender Plan shall have been satisfactorily completed by a contractor reasonably acceptable to Landlord, and Landlord shall have the right, subject to reimbursement at Tenant’s expense as set forth below, to cause Landlord’s environmental consultant to inspect the First Floor Premises and perform such additional procedures as may be deemed reasonably necessary to confirm that the First Floor Premises are, as of the expiration of the First Floor Premises Term (or, if applicable, the date which is thirty (30) days after any earlier termination of the Lease), free of Hazardous Materials (other than any Hazardous Materials that may have been present therein as of the First Floor Premises Commencement Date) and otherwise available for unrestricted use and occupancy as aforesaid. Landlord shall have the unrestricted right to deliver the Surrender Plan and any report by Landlord’s environmental consultant with respect to the surrender of the First Floor Premises to third parties; provided, however, that if the Surrender Plan contains any confidential information as reasonably determined by Tenant, Landlord shall not be entitled to share the Surrender Plan with any consultants, advisors, or any other person or entity without such person or entity being subject to and bound by a commercially reasonable Confidentiality and Non-Disclosure Agreement in favor of Tenant. Such third parties and the Landlord shall be entitled to rely on the Surrender Plan. If Tenant shall fail to prepare or submit a Surrender Plan reasonably approved by Landlord, or if Tenant shall fail to complete the reasonably approved Surrender Plan, or if such Surrender Plan, whether or not reasonably approved by Landlord, shall fail to adequately address the use of Hazardous Materials by any of the Tenant Related Parties in, on, at, under or about the Premises, Landlord shall have the right to take any such actions as Landlord may deem reasonable or appropriate to assure that the First Floor Premises and the Property are surrendered in the condition required hereunder, the cost of which actions shall be

11

reimbursed by Tenant as Additional Rent upon demand. Tenant’s obligations under this Section 2.E shall survive the expiration or earlier termination of the First Floor Premises Term.

3.Landlord Addresses. Effective as of the date hereof, Landlord’s notice addresses set forth in Section 1.12 of the Lease, as amended by Section 9 of the First Amendment, shall be deleted in their entirety, and the following addresses shall be substituted therefor:

Jamestown Premier 245 First, LLC

c/o Jamestown LP

675 Ponce de Leon Avenue, 7th Floor

Atlanta, GA 30308

Attn: Managing Director/Asset Management

Jamestown Premier 245 First, LLC

Attn: Asset Manager/245 First Street, Cambridge, Massachusetts

With a copy to:

Goulston & Storrs PC

400 Atlantic Avenue

Boston, MA 02110-3333

Attn: Amy Moody McGrath, Esq.

4.Extension Option—First Floor Premises.

|

A. |

Grant of Option; Conditions. Tenant shall have the right to extend the First Floor Premises Term (the “First Floor Premises Extension Option”) for one (1) additional period of two (2) years commencing on the day following the First Floor Premises Termination Date and ending on the second (2nd) anniversary of the First Floor Premises Termination Date (the “First Floor Premises Option Term”), if: |

(i)Landlord receives an unconditional notice of exercise (“Extension Notice”) not later than twelve (12) full calendar months prior to the expiration of the First Floor Premises Term and not earlier than eighteen (18) full calendar months prior to the expiration of the First Floor Premises Term; and

(ii)No Default of Tenant exists at the time that Tenant delivers its Extension Notice or at the time Tenant delivers its Acceptance Notice (as defined below), if any; and

(iii)No more than thirty (30%) percent of the First Floor Premises is sublet (other than pursuant to a Business Transfer, as defined in Article 11 of the Lease) at the

12

time that Tenant delivers its Extension Notice or at the time Tenant delivers its Acceptance Notice, if any; and

(iv)The Lease has not been assigned (other than pursuant to a Business Transfer, as defined in Article 11 of the Lease) prior to the date that Tenant delivers its Extension Notice or prior to the date Tenant delivers its Acceptance Notice, if any.

B.Terms Applicable to the First Floor Premises during the First Floor Premises Option Term. The initial Base Rent rate per rentable square foot for the First Floor Premises during the First Floor Premises Option Term shall equal the Prevailing Market rate (hereinafter defined) per rentable square foot for the First Floor Premises. Base Rent during the First Floor Premises Option Term shall increase, if at all, in accordance with the increases assumed in the determination of Prevailing Market rate. Base Rent attributable to the First Floor Premises shall be payable in monthly installments in accordance with the terms and conditions of Article 4 of the Lease.

Tenant shall pay Additional Rent on account of Expenses, Common Area Expenses, and Taxes for the First Floor Premises during the First Floor Premises Option Term in accordance with the terms of Exhibit B, Third Amendment.

|

C. |

Procedure for Determining Prevailing Market. Within thirty (30) days after receipt of Tenant’s Extension Notice (but no sooner than twelve (12) months prior to the expiration of the First Floor Premises Term), Landlord shall advise Tenant of the applicable Base Rent rate for the First Floor Premises for the First Floor Premises Option Term. Tenant, within fifteen (15) Business Days after the date on which Landlord advises Tenant of the applicable Base Rent rate for the First Floor Premises Option Term, shall either (x) give Landlord written notice that Tenant accepts Landlord’s Base Rent for the First Floor Premises Option Term (“Acceptance Notice”) or (y) if Tenant disagrees with Landlord’s determination, provide Landlord with written notice of rejection (the “Rejection Notice”). If Tenant fails to provide Landlord with either an Acceptance Notice or a Rejection Notice within such fifteen-(15)-Business-Day period, Tenant shall be deemed to have provided a Rejection Notice. If Tenant provides Landlord with an Acceptance Notice, Landlord and Tenant shall enter into the Extension Amendment (as defined below) upon the terms and conditions set forth herein and in Landlord’s notice as to Base Rent for the First Floor Premises Option Term. If Tenant provides, or is deemed to have provided, Landlord with a Rejection Notice, Landlord and Tenant shall work together in good faith to agree upon the Prevailing Market rate for the First Floor Premises during the First Floor Premises Option Term. Upon agreement, Landlord and Tenant shall enter into the Extension Amendment in accordance with the terms and conditions hereof. Notwithstanding the foregoing, if Landlord and Tenant fail to agree upon the Prevailing Market rate within thirty (30) days after the date Tenant provides (or is deemed to have provided) Landlord with the Rejection Notice, then the Prevailing Market rate shall be determined in accordance with the arbitration procedures described in Section D below. |

D.Arbitration Procedure.

(1)If Landlord and Tenant have failed to reach agreement as to the Prevailing Market rate within thirty (30) days after the date (or deemed date) of the Rejection

13

Notice, then, within ten (10) days after the expiration of such thirty-(30)-day period, Landlord and Tenant shall each simultaneously submit to the other, in a sealed envelope, its good faith estimate of the Prevailing Market rate for the First Floor Premises during the First Floor Premises Option Term (collectively referred to as the “Estimates”). If the higher of such Estimates is not more than 105% of the lower of such Estimates, then Prevailing Market rate shall be the average of the two Estimates. If the Prevailing Market rate is not resolved by the exchange of Estimates, then, within ten (10) days after the exchange of Estimates, Landlord and Tenant shall each select an appraiser to determine which of the two Estimates most closely reflects the Prevailing Market rate for the First Floor Premises during the First Floor Premises Option Term. Each appraiser so selected shall be certified as an MAI appraiser or as an ASA appraiser and shall have had at least five (5) years’ experience within the previous ten (10) years as a real estate appraiser working in the Kendall Square area of Cambridge, with working knowledge of current rental rates and practices. For purposes hereof, an “MAI” appraiser means an individual who holds an MAI designation conferred by, and is an independent member of, the American Institute of Real Estate Appraisers (or its successor organization, or in the event there is no successor organization, the organization and designation most similar), and an “ASA” appraiser means an individual who holds the Senior Member designation conferred by, and is an independent member of, the American Society of Appraisers (or its successor organization, or, in the event there is no successor organization, the organization and designation most similar).

(2)Upon selection, Landlord’s and Tenant’s appraisers shall work together in good faith to agree upon which of the two Estimates most closely reflects the Prevailing Market rate for the First Floor Premises. The Estimate chosen by such appraisers shall be binding on both Landlord and Tenant as the Base Rent rate for the First Floor Premises during the First Floor Premises Option Term. If either Landlord or Tenant fails to appoint an appraiser within the ten-(10)-day period referred to above, which failure continues for more than five (5) days after notice thereof to the failing party, the appraiser appointed by the other party shall be the sole appraiser for the purposes hereof. If the two appraisers cannot agree upon which of the two Estimates most closely reflects the Prevailing Market within twenty (20) days after their appointment, then, within ten (10) days after the expiration of such twenty-(20)-day period, the two appraisers shall select a third appraiser meeting the aforementioned criteria. Once the third appraiser (i.e., arbitrator) has been selected as provided for above, then, as soon thereafter as practicable but in any case within fourteen (14) days, the arbitrator shall make his determination of which of the two Estimates most closely reflects the Prevailing Market rate, and such Estimate shall be binding on both Landlord and Tenant as the Prevailing Market rate for the First Floor Premises for the purpose of determining Base Rent for the First Floor Premises Option Term. If the arbitrator believes that expert advice would materially assist him, he may retain one or more qualified persons to provide such expert advice. The parties shall share equally in the costs of the arbitrator and of any experts retained by the arbitrator. Any fees of any appraiser, counsel or experts engaged directly by Landlord or Tenant, however, shall be borne by the party retaining such appraiser, counsel or expert.

(3)If the Prevailing Market rate has not been determined by the commencement of Tenant’s obligation to pay Base Rent and other charges payable under the Lease based upon such Prevailing Market rate, Tenant shall pay Base Rent upon the terms and conditions in effect during the last month of the First Floor Premises Term until such time as the Prevailing Market rate has been determined. Upon such determination, the Base Rent for the

14

First Floor Premises shall be retroactively adjusted to the commencement of the First Floor Premises Option Term for the First Floor Premises.

E.Extension Amendment. If Tenant is entitled to and properly exercises its First Floor Premises Option Term, Landlord shall prepare an amendment (the “Extension Amendment”) to reflect changes in the Base Rent, Term, and Termination Date as expressly provided herein and other mutually agreeable appropriate terms. The Extension Amendment shall be sent to Tenant within a reasonable time after final determination of the Prevailing Market rate applicable during the First Floor Premises Option Term, and if the terms and provisions of the Extension Amendment are reasonably acceptable to Tenant, then Tenant shall execute and return the Extension Amendment to Landlord within fifteen (15) Business Days after Tenant’s receipt of same, but an otherwise valid exercise of the First Floor Premises Extension Option shall be fully effective whether or not the Extension Amendment is executed.

F.Prevailing Market. For purposes hereof, “Prevailing Market” shall mean the arms’ length fair market annual rental rate per rentable square foot under direct leases entered into on or about the date as of which the Prevailing Market is being determined hereunder (i.e., in connection with the Tenant’s First Floor Premises Extension Option, such date shall be the commencement of the First Floor Premises Option Term), and for space comparable to the First Floor Premises in the Science Building and science buildings comparable to the Science Building in the Kendall Square area of Cambridge, taking into account all relevant factors including proximity to public transportation and retail amenities, and age and quality of finish, and tenant improvement allowance, if any.

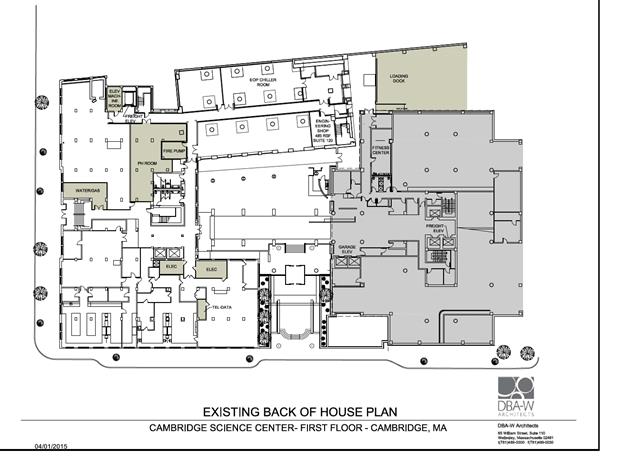

5.Loading Dock. Tenant shall have the right to use the common loading dock shown on the attached Exhibit A-2, Third Amendment, on a non-discriminatory, first-come, first-served basis, twenty-four (24) hours per day, seven (7) days per week, it being understood that the use of the loading dock must be scheduled in advance with Landlord, but there shall be no charge for any such usage.

6.Parking. Notwithstanding anything to the contrary set forth in the Lease, effective as of the First Floor Premises Commencement Date (unless prior to the First Floor Premises Commencement Date, Tenant notifies Landlord in writing that Tenant elects to start on the First Floor Premises Rent Commencement Date) and continuing thereafter throughout the remainder of the First Floor Premises Term, Tenant shall have the right to five (5) additional unreserved parking spaces (at the ratio of 0.9 parking spaces per 1,000 rentable square feet of the First Floor Premises of 5,951 rentable square feet) (“Tenant’s Additional Parking Spaces”). Tenant’s right to use Tenant’s Additional Parking Spaces shall be on a first-come, first-served basis at the then prevailing monthly parking rate, as adjusted from time to time in accordance with the published rates applicable to all tenants of the Buildings, and otherwise shall be on the terms and conditions set forth in Section 1 of Exhibit F to the Lease, except to the extent the same are inconsistent with the provisions of this Section 6. As of the Execution Date of this Third Amendment, the current monthly rate is $300.00 per unreserved parking space per month.

7.Security Deposit. Reference is made to the fact that Landlord is presently holding a Security Deposit in the total amount of $1,280,857.00 (the “Total Security Deposit”), of

15

which $1,155,512.00 is in the form of cash (the “Cash Security Deposit”), and $125,345.00 is in the form of a letter of credit (the “Current Letter of Credit Security Deposit”).

With respect to the First Floor Premises, Landlord shall not require Tenant to provide any additional Security Deposit therefor; however, Landlord shall require that the Total Security Deposit be in the form of a letter of credit only. Therefore, on or before October 1, 2016, Tenant shall deliver to Landlord either (i) a new irrevocable letter of credit in the amount of $1,280,857.00 or (ii) an amendment to the Current Letter of Credit Security Deposit increasing the Current Letter of Credit Security Deposit by the amount of $1,155,512.00. Upon receipt of same, Landlord shall return the Cash Security Deposit to Tenant, and, if Tenant provides a new letter of credit in the amount of $1,280,857.00, Landlord shall also return the Current Letter of Credit Security Deposit to Tenant. Landlord shall continue to hold the Total Security Deposit to secure Tenant’s obligations under the Lease, in accordance with the provisions of Section 6 of the Lease, as amended by Section 8 of the First Amendment, Section 14 of the Second Amendment, and this Section 7.

9.Emergency Generator. Tenant shall have the right to use the existing generator on the Property that currently serves tenants located on the first floor of the Science Building (the “Existing Generator”). Landlord makes no representation whatsoever about the condition or functionality of the Existing Generator. Landlord shall, or shall arrange for a third party to, operate, maintain, and promptly repair the Existing Generator in good working condition, and Tenant shall reimburse Landlord for Tenant’s pro rata share of all costs, charges and expenses incurred from time to time in connection with or arising out of the operation, use, maintenance, repair, and replacement of the Existing Generator, including, without limitation, electricity charges connected with the Existing Generator (collectively, “Generator Costs”). In the event Landlord deems it necessary to replace the Existing Generator, the cost of purchasing and installing such replacement generator shall be amortized over the useful life of the new generator at an interest rate of eight percent (8%) and the annual amortization of such amount shall be included in Generator Costs from and after the date of such replacement. Landlord and Tenant agree that Tenant’s pro rata share of such costs is fifty percent (50%). Landlord shall use reasonable efforts to provide at least seven (7) days’ prior written notice to Tenant before any scheduled Generator repair that will result in the Generator being offline for any amount of time. Tenant’s use of the Existing Generator shall be limited to 2.2 watts per square foot or 12.9 kilowatts in total. In no event shall Landlord be liable to Tenant or any other party for any damages of any type, whether actual or consequential, suffered by Tenant or any such other person in the event that the Existing Generator fails or does not provide sufficient power provided, however, that Tenant shall have the rights set forth in Section 7.03 relating to the abatement of rent in the event of a Service Failure.

10.Hazardous Materials.

. Tenant shall not, without the prior written consent of Landlord, bring or permit to be brought or kept in or on the First Floor Premises or elsewhere in the Building or the Property (i) any inflammable, combustible or explosive fluid, material, chemical or substance (except for standard office

16

supplies stored in proper containers); and (ii) any Hazardous Material (hereinafter defined), other than the types and quantities of Hazardous Materials which are listed on Exhibit C, Third Amendment, attached hereto (“Tenant’s Hazardous Materials”), provided that the same shall at all times be brought upon, kept or used in so-called ‘control areas’ within the First Floor Premises (the number and size of which shall be reasonably determined by Landlord) and in accordance with all applicable Environmental Laws and prudent environmental practice and (with respect to medical waste and so-called “biohazard” materials) good scientific and medical practice. Tenant shall be responsible for assuring that all laboratory uses are adequately and properly vented. Landlord shall have the right, from time to time, upon reasonable advance notice to inspect the Premises for compliance with the terms of this Section 10; provided, however, that no notice shall be required in case of emergency. Notwithstanding the foregoing, with respect to any of Tenant’s Hazardous Materials which Tenant does not properly handle, store or dispose of in compliance with all applicable Environmental Laws, prudent environmental practice and (with respect to medical waste and so-called “biohazard materials”) good scientific and medical practice, Tenant shall, upon written notice from Landlord, no longer have the right to bring such material into the Building or the Property until Tenant has demonstrated, to Landlord’s reasonable satisfaction, that Tenant has implemented programs to thereafter properly handle, store or dispose of such material.

|

With respect to the laboratory portion of the First Floor Premises (the “Secured Area”), if Landlord must gain access to a Secured Area in a non-emergency situation, Landlord shall contact Tenant, and Landlord and Tenant shall arrange a mutually agreed upon time for Landlord to have such access. Landlord shall be accompanied by an employee of Tenant or a party designated by Tenant (the “Escort”). Tenant shall make an Escort available to Landlord during business hours. Landlord shall comply with all reasonable security measures of the Tenant pertaining to the Secured Area. If an emergency representing an imminent risk of injury to persons or material property damage in the Building or the Premises, including, without limitation, a suspected fire or flood, requires Landlord to gain access to the Secured Area, Landlord may enter the Secured Area without an Escort. If practicable under the circumstances, Landlord shall immediately notify (which may be oral notification) and request that Tenant make an Escort available to Landlord if time permits. In any event, if Tenant shall not make an Escort available to accompany Landlord, then Tenant hereby authorizes Landlord to enter the Secured Area forcibly or with a master key, and to enter without an Escort. In any such event, except to the extent resulting from Landlord’s negligence or willful misconduct, Landlord shall have no liability whatsoever to Tenant, and Tenant shall pay all reasonable expenses incurred by Landlord in repairing or reconstructing any entrance, corridor, door or other portions of the Premises damaged as a result of a forcible entry by Landlord. Landlord shall have no obligation to provide either janitorial service or cleaning in the Secured Area unless Tenant shall make arrangements to have an Escort in the Secured Area at the time such service or cleaning is provided to the remainder of the Premises. |

B.Environmental Laws. For purposes hereof, “Environmental Laws”

shall mean all laws, statutes, ordinances, rules and regulations of any local, state or federal governmental authority having jurisdiction concerning environmental, health and safety matters,

17

including but not limited to any discharge by Tenant or its agents, employees, contractors, representatives or affiliates into the air, surface water, sewers, soil or groundwater of any Hazardous Material (hereinafter defined) whether within or outside the Premises, including, without limitation (a) the Federal Water Pollution Control Act, 33 U.S.C. Section 1251 et seq., (b) the Federal Resource Conservation and Recovery Act, 42 U.S.C. Section 6901 et seq., (c) the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. Section 9601 et seq., (d) the Toxic Substances Control Act of 1976, 15 U.S.C. Section 2601 et seq., and (e) Chapter 21E of the General Laws of Massachusetts. Tenant, at its sole cost and expense, shall comply with (i) Environmental Laws, and (ii) any rules, requirements and safety procedures of the Massachusetts Department of Environmental Protection, the City of Cambridge and any insurer of the Building or the First Floor Premises with respect to Tenant’s use, storage and disposal of any Hazardous Materials in the First Floor Premises.

C.Hazardous Material Defined. As used herein, the term “Hazardous Material” means asbestos, oil or any hazardous, radioactive or toxic substance, material or waste or petroleum derivative which is or becomes regulated by any Environmental Law, including without limitation live organisms, viruses and fungi, medical waste and any so-called “biohazard” materials. The term “Hazardous Material” includes, without limitation, oil and/or any material or substance which is (i) designated as a “hazardous substance,” “hazardous material,” “oil,” “hazardous waste” or toxic substance under any Environmental Law.

|

D.Testing. If any Mortgagee or governmental authority requires testing to determine whether there has been any release of Hazardous Materials and such testing is required as a result of the acts or omissions of Tenant, then Tenant shall reimburse Landlord upon demand, as Additional Rent, for the reasonable costs thereof, together with interest at the Default Rate until paid in full. Tenant shall execute affidavits, certifications and the like, as may be reasonably requested by Landlord from time to time concerning Tenant's best knowledge and belief concerning the presence of Hazardous Materials in or on the First Floor Premises, the Building or the Property. |

(i)Tenant hereby covenants and agrees to indemnify, defend and hold the Landlord Related Parties harmless from and against any and all claims against any of the Landlord Related Parties arising out of contamination of any part of the Property or other adjacent property, which contamination arises as a result of: (i) the presence of Hazardous Material in the Premises, the presence of which is caused by any act or omission of any of the Tenant Related Parties, or (ii) from a breach by Tenant of its obligations under this Section 10, except to the extent directly caused by Landlord’s negligence or willful misconduct. This indemnification of the Landlord Related Parties by Tenant includes, without limitation, reasonable costs incurred in connection with any investigation of site conditions or any cleanup, remedial, removal or restoration work required by any federal, state or local governmental agency or political subdivision because of Hazardous Material present in the soil or ground water on or under the Building based upon the circumstances identified in the first sentence of this Section 10.E. The indemnification and hold harmless obligations of Tenant under this Section 10.E shall survive the expiration or any earlier termination of this Lease. Without limiting the foregoing, if the presence of any Hazardous Material in the Building or otherwise in the Property

18

is caused or permitted by any of the Tenant Related Parties and results in any contamination of any part of the Property or any adjacent property, Tenant shall promptly take all actions at Tenant’s sole cost and expense as are necessary to return the Property and/or the Building or any adjacent property to their condition as of the date of this Lease, provided that Tenant shall first obtain Landlord’s written approval of such actions, which approval shall not be unreasonably withheld, conditioned or delayed so long as such actions, in Landlord’s reasonable discretion, would not potentially have any adverse effect on the Property, and, in any event, Landlord shall not withhold its approval of any proposed actions which are required by applicable Environmental Laws. The provisions of this Section 10.E shall survive the expiration or earlier termination of the Lease.

(ii)Without limiting the obligations set forth in Section 10.E. above, if any Hazardous Material not otherwise present in the First Floor Premises as of the First Floor Premises Commencement Date, is in, on, under, at or about the Building or the Property as a result of the acts or omissions of any of the Tenant Related Parties and results in any contamination of any part of the Property or any adjacent property that is in violation of any applicable Environmental Law or that requires the performance of any response action pursuant to any Environmental Law, Tenant shall promptly take all actions at Tenant’s sole cost and expense as are necessary with respect to such Hazardous Material to comply with any Environmental Law; provided that Tenant shall first obtain Landlord’s written approval of such actions, which approval shall not be unreasonably withheld, conditioned or delayed so long as such actions would not be reasonably expected to have an adverse effect on the market value or utility of the Property for the Permitted Uses, and in any event, Landlord shall not withhold its approval of any proposed actions which are required by applicable Environmental Laws (such approved actions, “Tenant’s Remediation”).

(iii)In the event that Tenant fails to complete Tenant’s Remediation prior to the end of the Term, then, from and after the expiration of the Term:

(x)until the completion of Tenant’s Remediation (as evidenced by the certification of Tenant’s Licensed Site Professional (as such term is defined by applicable Environmental Laws), who shall be reasonably acceptable to Landlord) (the “Remediation Completion Date”), Tenant shall pay to Landlord, with respect to the portion of the Premises which reasonably cannot be occupied by a new tenant until completion of Tenant’s Remediation, (A) Additional Rent on account of Operating Costs and Taxes and (B) Base Rent in an amount equal to the greater of (1) the Prevailing Market rental value of such portion of the Premises (determined in substantial accordance with the process described in Section 4.F above), and (2) Base Rent attributable to such portion of the Premises in effect immediately prior to the end of the Term; and

(y)Tenant shall maintain responsibility for Tenant’s Remediation and Tenant shall complete Tenant’s Remediation as soon as reasonably practicable in accordance with Environmental Laws, and Landlord shall provide access to Tenant to any portions of the Property necessary for Tenant to complete Tenant’s remediation. If Tenant does not diligently pursue completion of Tenant’s Remediation, Landlord shall have the right to either (A) assume control for overseeing Tenant’s Remediation, in which event Tenant shall pay all reasonable costs and expenses of Tenant’s Remediation (it being understood and agreed that all

19

costs and expenses of Tenant’s Remediation incurred pursuant to contracts entered into by Tenant shall be deemed reasonable) within thirty (30) days of demand therefor (which demand shall be made no more often than monthly), and Landlord shall be substituted as the party identified on any governmental filings as the party responsible for the performance of such Tenant’s Remediation or (B) require Tenant to maintain responsibility for Tenant’s Remediation, in which event Tenant shall complete Tenant’s Remediation as soon as reasonably practicable in accordance with Environmental Laws, it being understood that Tenant’s Remediation shall not contain any requirement that Tenant remediate any contamination to levels or standards more stringent than those associated with the Property’s current office, research and development, laboratory, and vivarium uses.

(z)The provisions of this Section 10.E shall survive the expiration or earlier termination of this Lease.

G.Removal. Tenant shall be responsible, at its sole cost and expense, for Hazardous Material and other biohazard disposal services for the First Floor Premises. Such services shall be performed by contractors reasonably acceptable to Landlord and on a sufficient basis to ensure that the Premises are at all times kept neat, clean and free of Hazardous Materials and biohazards except in appropriate, specially marked containers reasonably approved by Landlord.

|

11. |

Medical Waste/Lab Standards. |

A.Tenant shall, at Tenant’s expense, be responsible for the separation of and disposal of all trash containing any medical waste and/or biohazard materials that is generated in the First Floor Premises from the typical trash found in typical offices (i.e., paper and any non-medical and/or biohazard materials) (“Typical Office Trash”). Tenant's contractor(s) shall dispose of all trash containing medical waste and biohazard materials in accordance with Applicable Requirements, as hereinafter defined, and shall not commingle it with Typical Office Trash. Without limiting the foregoing, Tenant shall be responsible, at its sole cost and expense, for the safe and complete disposal of all items that are by applicable law defined as medical waste and biohazard materials or items that have been exposed to medical waste and biohazard materials such as syringes, bandages, medical instruments, tissues, containers, receptacles, cotton packing, swabs, etc., as well as any and all potentially, possibly or actually contaminated, hazardous, diseased, infected or infectious material, substance or thing utilized or brought upon the First Floor Premises by Tenant or others.

|

B.Tenant’s disposal of medical or other waste resulting from its operation of the First Floor Premises shall comply, without limitation, with the following: (i) all applicable |

20

|

federal (including, without limitation, OSHA), state and local laws, regulations and rules, written policies, standards and guidance documents; (ii) all written instructions and guidelines given by the manufacturers of any processing systems and chemicals used in Tenant’s operations within the First Floor Premises; and (iii) all written specifications and requirements with respect to the operation and maintenance of any sewage treatment plant serving the First Floor Premises and/or the Building. The aforementioned requirements are hereinafter collectively referred to as the “Applicable Requirements.” Tenant is responsible for ascertaining all of the Applicable Requirements. |

C.Tenant shall not be permitted to place any medical waste and biohazard materials receptacles or courier lock boxes (such as those used for the pick-up and delivery of samples or impressions, laboratory samples, or prosthetic dental devices) in any common areas of the Building.

12.Inapplicable/Deleted Lease Provisions.

A.Inapplicable Lease Provisions. The Base Rent Abatement Period set forth in Section 1.03, Section 1.04 (Tenant’s Pro Rata Share), Section 1.05 (Base Year), Section 3.03 (Rent Abatement), Exhibit B (Expenses and Taxes),Exhibit C (Work Letter) and Exhibit C-1 (Space Plans) of the Lease; the Expansion Premises A Rent Credit portion of Section 1.A, Section 3 (Landlord’s Work and Landlord’s Contribution), Section 4 (Base Building) of the First Amendment, and Section 6 (Existing Premises Condition/Existing Premises Work), Section 7 (Second Amendment Premises Condition/Second Amendment Premises Work), Section 8 (Landlord’s Base Contribution), Section 9 (Fit Plan Contributions/Space B Demolition Contribution), Section 10 (Heat Pump Replacement), and Section 11 (Extension Option) of the Second Amendment shall have no applicability with respect to the First Floor Premises and this Third Amendment.

B.Deleted Lease Provisions. All references in the Lease, including, without limitation, Section 26.05 thereof, to “Equity Office Properties Management Corp.” or “Equity Office” are hereby deleted in their entirety and are of no further force and effect.

|

13. |

Broker. Landlord and Tenant warrant and represent that neither party has dealt with any broker in connection with the consummation of this Third Amendment, other than Newmark Grubb Knight Frank and Transwestern RBJ (collectively, the “Broker”) and in the event of any brokerage claims or liens, other than by Broker, against Landlord or Tenant or the Science Building predicated upon or arising out of prior dealings with Tenant and Landlord with respect to this Third Amendment, Tenant and Landlord each agree to defend the same and indemnify and hold each other harmless against any such claim, and to discharge any such lien. Any commission due in connection with this Third Amendment shall be paid by Landlord pursuant to a separate agreement between Landlord and Broker. |

|

14. |

Miscellaneous. Capitalized terms used and not otherwise defined herein shall have the meanings ascribed to such terms in the Lease. Except as amended hereby, the Lease is hereby ratified and confirmed. |

[Signatures on following page]

21

EXECUTED under seal as of the date first above written.

LANDLORD:

JAMESTOWN PREMIER 245 FIRST, LLC,

a Delaware limited liability company

By:_\s\ Renee J. Bergeron________________

Name:_\s\ Renee J. Bergeron__________

Title:_VP__________________________

TENANT:

AKEBIA THERAPEUTICS, INC.,

a Delaware corporation

By:_\s\ John P. Butler__________________

Name:_\s\ John P. Butler ____________

Title:_President and Chief Executive Officer

By:_\s\ Jason A. Amello________________

Name:_\s\ Jason A. Amello__________

Title:_SVP, Chief Financial Officer____

22

PLAN OF FIRST FLOOR PREMISES (5,951 RSF—Floor 1)

EXHIBIT A-1, THIRD AMENDMENT

LOCATION OF COMMON LOADING DOCK

.

.

8737712.11

OPERATING COSTS AND TAXES

With respect to this Exhibit B, Third Amendment, all references herein to (i) “Building” shall be deemed to mean the “Science Building”, and (ii) “Term” shall be deemed to mean “First Floor Premises Term”.

|

(i) |

Expenses. “Expenses” means all costs and expenses incurred in each calendar year in connection with operating, maintaining, repairing, and managing the Building, including the Common Areas located within the Building, but excluding the Common Areas located in the Office Building and the shared Common Areas for both the Office Building and the Building. Landlord shall act in a commercially reasonable manner in incurring Expenses. Expenses include, without limitation: (a) all labor and labor related costs, including wages, salaries, bonuses, taxes, insurance, uniforms, training, retirement plans, pension plans and other employee benefits; (b) management fees in an amount equal to 3% of the gross revenues from the Building and the Property; (c) the cost of equipping, staffing and operating an on-site and/or off-site management office for the Building, provided if the management office services one or more other buildings or properties, the shared costs and expenses of equipping, staffing and operating such management office(s) shall be equitably prorated and apportioned between the Building and the other buildings or properties; (d) accounting costs for the Building; (e) the cost of services; (f) rental and purchase cost of parts, supplies, tools and equipment; (g) insurance premiums and deductibles; (h) electricity, gas and other utility costs attributable to the Building; (i) expenses of periodic routine testing to assure that the Premises and surrounding land are free of hazardous materials, agents or substances, and to assure compliance with codes, regulations and Laws; and (j) the amortized cost of capital improvements (as distinguished from replacement parts or components installed in the ordinary course of business) made subsequent to the First Floor Premises Commencement Date which are: (1) reasonably projected by Landlord to reduce current or future Expenses or (2) required under any Law that first becomes applicable to the Property after the Execution Date. The cost of capital improvements shall be amortized by Landlord over the lesser of the Payback Period (defined below) or the useful life of the capital improvement as reasonably determined by Landlord. The amortized cost of capital improvements may, at Landlord’s option, include actual or imputed interest at the rate that Landlord would reasonably be required to pay to finance the cost of the capital improvement. “Payback Period” means the reasonably estimated period of time that it takes for the cost savings resulting from a capital improvement to equal the total cost of the capital improvement. Landlord, by itself or through an affiliate, shall have the right to directly perform, provide and be compensated for any services under the Lease. If Landlord incurs Expenses for the Building or Property together with one or more other buildings or properties, whether pursuant to a reciprocal easement agreement, common area agreement or otherwise, the shared costs and expenses shall be equitably prorated and apportioned between the Building and Property and the other buildings or properties. Expenses shall not include Excluded Costs (hereinafter defined). |

1

|

(ii) |

Common Area Expenses. “Common Area Expenses” means all costs and expenses as set forth in Section 2.02 of Exhibit B to the Lease. |

|

(iii) |