Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERTZ GLOBAL HOLDINGS, INC | q32016earnings8-k.htm |

| EX-99.3 - EXHIBIT 99.3 - HERTZ GLOBAL HOLDINGS, INC | q32016exhibit993.htm |

| EX-99.1 - EXHIBIT 99.1 - HERTZ GLOBAL HOLDINGS, INC | pressreleaseq32016.htm |

1

3Q 2016 Earnings Call

November 8, 2016

8:00am ET

2

Safe Harbor Statement

Certain statements made within this presentation contain forward-looking statements, within the

meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are

not guarantees of performance and by their nature are subject to inherent uncertainties. Actual

results may differ materially. Any forward-looking information relayed in this presentation speaks

only as of November 7, 2016, and Hertz Global Holdings, Inc (the “Company”). The Company

undertakes no obligation to update that information to reflect changed circumstances.

Additional information concerning these statements is contained in the Company’s press release

regarding its Third Quarter 2016 results issued on November 7, 2016, and the Risk Factors and

Forward-Looking Statements sections of the Company’s Second Quarter 2016 Quarterly Report on

Form 10-Q filed on August 8, 2016 and Third Quarter 2016 Quarterly Report on Form 10-Q filed on

November 8, 2016. Copies of these filings are available from the SEC, the Hertz website or the

Company’s Investor Relations Department.

3Q

3

Non-GAAP Measures

THE FOLLOWING NON-GAAP* MEASURES WILL BE USED IN THE PRESENTATION:

Adjusted corporate EBITDA

Adjusted corporate EBITDA margin

Adjusted pre-tax income (loss)

Adjusted net income (loss)

Adjusted earnings (loss) per share

(Adjusted EPS)

Revenue per available car day (RACD)

Total RPD

Net depreciation per unit per month

Net non-vehicle debt

Net vehicle debt

Free cash flow

*Definitions and reconciliations of these non-GAAP measures are provided in the Company’s

third quarter 2016 press release and in the Company’s form 8-K filed on November 8, 2016.

3Q

4

Agenda

BUSINESS

OVERVIEW

John Tague

President & Chief Executive Officer

Hertz Global Holdings, Inc.

FINANCIAL RESULTS

OVERVIEW

Tom Kennedy

Chief Financial Officer

Hertz Global Holdings, Inc.

3Q

5

3Q/YTD:16 Consolidated Results

*Definitions and reconciliations of these non-GAAP measures are provided in the Company’s third quarter 2016 press release.

NM – Not Meaningful

3Q

GAAP

3Q:16

Results

3Q:15

Results

YoY

Change

3Q

YTD:16

Results

3Q

YTD:15

Results

YoY

Change

Revenue $2,542M $2,575M (1)% $6,794M $6,991M (3)%

Income (loss) from continuing operations

before income taxes

$108M $256M (58)% $(3)M $185M NM

Net Income (loss) from continuing operations $44M $217M (80)% $(36)M $152M NM

Diluted earnings (loss) per share from

continuing operations

$0.52 $2.38 (78)% $(0.42) $1.65 NM

Weighted Average Shares outstanding: Diluted 85M 91M 85M 92M

Non-GAAP*

Adjusted corporate EBITDA $329M $430M (23)% $541M $768M (30)%

Adjusted corporate EBITDA margin 13% 17% (370 bps) 8% 11% (300 bps)

Adjusted pre-tax income $212M $289M (27)% $159M $368M (57)%

Adjusted net income from continuing operations $134M $182M (26)% $100M $232M (57)%

Adjusted diluted EPS from continuing

operations

$1.58 $2.00 (21)% $1.18 $2.52 (53)%

6

3Q:16 YoY Adjusted Corporate EBITDA Bridge 3Q

1Vehicle contribution includes net depreciation rate, utilization and vehicle interest

• Cost savings not sufficient to fully offset revenue and vehicle contribution pressures

$430M

$329MAll Other

items

Full Potential Plan

Cost Savings

U.S. RAC

Vehicle

Contribution1

U.S. RAC

Revenue

Contribution

International RAC

Contribution

3Q:15 Actual 3Q:16 Actual

Annualization of 2015 Programs

IT Transformation/Integration

International fleet, DOE, SG&A

Personnel Productivity Savings

Fleet Efficiency Improvement

Off-Airport Footprint Rationalization

SG&A Optimization

Strategic Investments

Unique / 1x Items

Gross Collision

Storm Damages / Recall Activity

Delivery / Transportation

Reduction in China Auto Rental Equity Pickup

7

3Q 3Q YTD:16 Adjusted Corporate EBITDA Bridge

Consolidated Cost Savings

• FY:16E $350M full year savings

– 3Q:16 realized savings of ~$90M

– YTD 9/30/16 realized savings of

~$260M

• FY:15 realized savings of ~$230M

$768M

$541M

All Other

Items

Full Potential Plan

Cost Savings

U.S. RAC

Revenue

Contribution

U.S. RAC

Vehicle

Contribution1

International RAC

Contribution

3Q YTD:15 Actual

3Q YTD:16 Actual

• Cost savings offset by operation headwinds

1Vehicle contribution includes net depreciation rate, utilization and vehicle interest

Annualization of 2015 Programs

IT Transformation/Integration

International fleet, DOE, SG&A

Personnel Productivity Savings

Fleet Efficiency Improvement

Off-Airport Footprint Rationalization

SG&A Optimization

Strategic Investments

Gross Collisions

Storms Damage / Recall Activity

Reduction in China Auto Rental Equi y Pickup

8

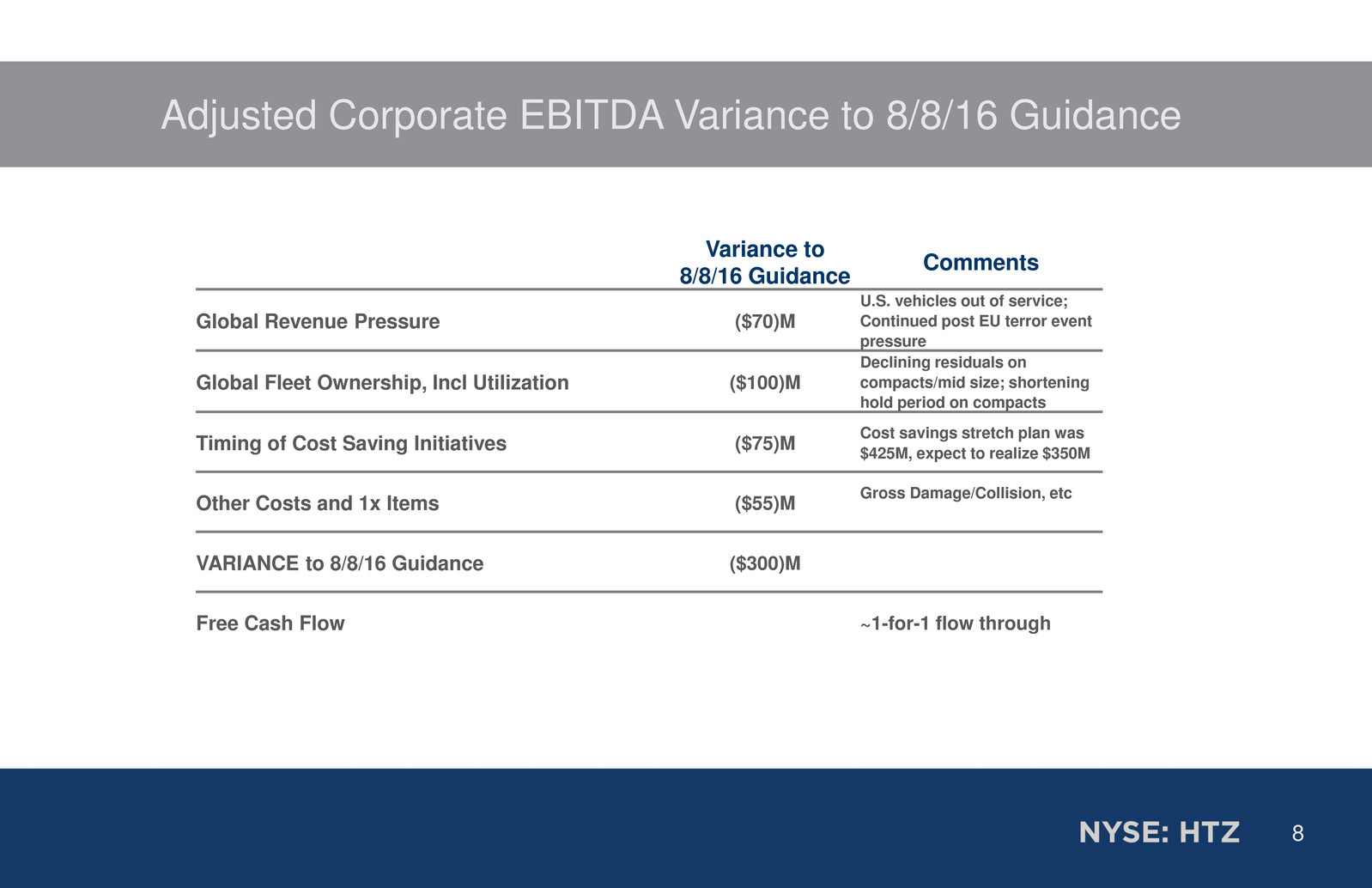

Adjusted Corporate EBITDA Variance to 8/8/16 Guidance

Variance to

8/8/16 Guidance

Comments

Global Revenue Pressure ($70)M

U.S. vehicles out of service;

Continued post EU terror event

pressure

Global Fleet Ownership, Incl Utilization ($100)M

Declining residuals on

compacts/mid size; shortening

hold period on compacts

Timing of Cost Saving Initiatives ($75)M

Cost savings stretch plan was

$425M, expect to realize $350M

Other Costs and 1x Items ($55)M

Gross Damage/Collision, etc

VARIANCE to 8/8/16 Guidance ($300)M

Free Cash Flow ~1-for-1 flow through

9

TOM KENNEDY

CHIEF FINANCIAL OFFICER

Hertz Global Holdings, Inc.

Quarterly Overview

10

3Q:16 U.S. RAC Revenue Performance

Revenue Days Rate

Vehicle Utilization (bps) Capacity RACD

-2% -2%

-8%

-2%

6%

2%

0% 1%

-8%

-10%

-5%

-3%

660 540 440

60 -2%

-5% -5%

2% 0%

-3%

0%

-4%

U.S. RAC (YOY quarterly results)

Revenue is defined as total revenue excluding ancillary retail car sales. Capacity is available cars days, see calculation in Q3:16 press release. Vehicle utilization is

calculated as transaction days divided by capacity. RACD calculated as Revenue divided by Capacity.

• Rate

• Q2:16 to Q3:16 YoY pricing improved 500bps

• RPD declined 1% YoY when adjusted for DTG

days counting methodology and non-rental related

declines such as fuel-related ancillary

• Volume

• Out-of-service vehicles due to recalls and weather

damage reduced utilization and capacity available

for rent

• Leisure volume flat, impacted by discontinuation

of Firefly brand in North America and YoY decline

in opaque channel use

• Business volume increased 3% on double-digit

increases in insurance replacement and

government offset by continued weakness in

corporate contracted volume

3Q:16 Performance Drivers

3Q

-5%

0%

-2%

260

-3%

1%

11

3Q

• Q3:16 last quarter of impact from DTG

transaction day counting methodology

• Expect ancillary fuel pricing pressure to

anniversary mid-Q1:17

• Customer mix shifted to lower yielding segments

due to corporate volume weakness

• Higher mix of longer-length rental volumes YoY,

OAP insurance replacement volume returns to

more normal demand levels

o Q3:16 insurance replacement volume +14%

YoY after 14% volume decline Q3:15 vs.

Q3:14

o Avg. length of insurance replacement rental

~15 days

• YoY impact of compact mix will anniversary by

1Q:17

3Q:16 U.S. RAC YoY Total RPD Bridge

3Q:16 Total RPD - Contribution to Negative YoY Variance (%)

Mix Impact:

higher rental

length, customer

mix, fleet mix

1.0%

1.0%

DTG Days

counting

Total RPD

decline

-2.9%

0.6%

1.0%

"Organic"

RPD

Growth

Fuel,

concessions

and other

non-rental

1.4% 1.5%

12

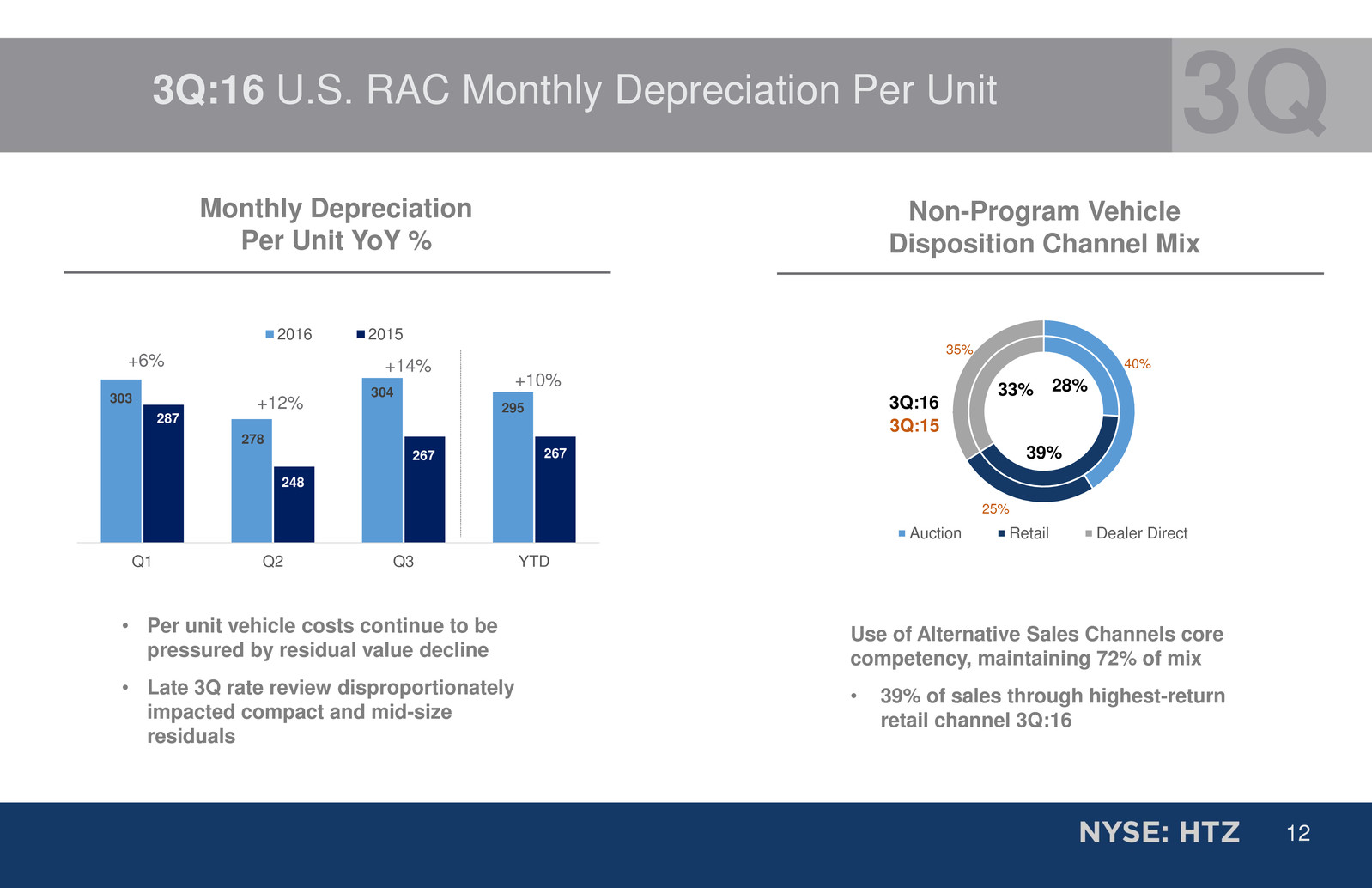

3Q:16 U.S. RAC Monthly Depreciation Per Unit 3Q

28%

39%

33%

40%

25%

35%

Auction Retail Dealer Direct

3Q:16

3Q:15

Use of Alternative Sales Channels core

competency, maintaining 72% of mix

• 39% of sales through highest-return

retail channel 3Q:16

Non-Program Vehicle

Disposition Channel Mix

Monthly Depreciation

Per Unit YoY %

• Per unit vehicle costs continue to be

pressured by residual value decline

• Late 3Q rate review disproportionately

impacted compact and mid-size

residuals

303

278

304

295

287

248

267 267

Q1 Q2 Q3 YTD

2016 2015 2015

+6%

+12%

+10%

+14%

13

3Q:16 International RAC 3Q

• 3Q:16 revenue increased 1% YoY, excluding FX

- Volume increased 2% despite greater than expected weakness in inbound long-haul business following recent terrorist attacks

in Europe

- Total RPD declined 1%, on a constant currency basis, due to impact of reduced pace of high-yielding inbound rentals

• Revenue per available car day decreased 2% YoY, on a constant currency basis

• Vehicle utilization remains unchanged YoY at 81%

• Net monthly depreciation per unit increased 1%, on a constant currency basis

• Adjusted corporate EBITDA declined $11M YoY

14

CASH FLOW / BALANCE SHEET

OVERVIEW

TOM KENNEDY

CHIEF FINANCIAL OFFICER

Hertz Global Holdings, Inc.

15

Liquidity and Debt Overview

9/30/16

Proforma for

6.75% Note

Redemption

Senior RCF

Availability

$1,100M $1,100M

Unrestricted Cash 1,430M 616M

Corporate Liquidity $2,530M $1,716M

• Executed ~$1.6 billion 3Q:16 financing transactions

– $800 million 5.50% Senior Note Issuance

– Proceeds used to refinance $800 million of 6.75% senior notes

maturing in 2019

– €225 million 4.125% European Vehicle Notes issuance

– Extension of $500 million Donlen (HFLF) VFN maturity date to

September, 2018.

• 4Q:16 planned refinancing activity focused on extending

three existing bank funded vehicle facilities

• Only $7M in non-vehicle debt maturities in 2017

• 5.2x net non-vehicle debt/LTM adj. corporate EBITDA;

Covenant leverage at 4.5x

Corporate Liquidity at September 30, 2016

16

1Reflects redemption of $800 million of the 6.75% Senior Notes due 2019 which occurred in October 2016. Excludes $27 million of Promissory Notes due

2028, and $11 million of other non-vehicle debt

2$600 million of letters of credit outstanding under the Senior RCF resulting in approximately $1.1 billion of available borrowing capacity.

$250

$450

$700

$500 $500

$800

$7

$7

$7

$7

$7 $7

$655

$1,700

2017 2018 2019 2020 2021 2022 2023 2024

Senior Notes Term Loan Undrawn Senior RCF

Non-Vehicle Debt Maturity Profile

• Pro Forma 9/30/16 Hertz Global Non-Vehicle Debt Maturity Stack12

($ in millions)

17

OUTLOOK

18

FY:16 Updated Financial Guidance

FY:16 Guidance

Adjusted Corporate EBITDA $575M - $625M

Non-vehicle capital expenditures, net $75M – $85M

Non-Vehicle cash interest expense $280M – $285M

Cash income taxes $60M – $65M

Free cash flow $250M – $300M

U.S. RAC net depreciation per unit per month $295 - $300

U.S. RAC fleet capacity growth (1.0)% to (1.5)%

U.S. RAC revenue growth (2.0)% to (3.0)%

Adjusted earnings per share1 $0.51-$0.88

1Assumes Tax rate 37%, shares outstanding 85M

19

Q&A