Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Aqua Metals, Inc. | s104574_ex99-1.htm |

| 8-K - 8-K - Aqua Metals, Inc. | s104574_8k.htm |

Exhibit 99.2

Dr. Steve Clarke, CEO November 7 th 2016 The World’s First Clean Lead Recycling Company 2016 Q3 Earnings Call NASDAQ: AQMS

Safe Harbor NASDAQ: AQMS This document contains forward - looking statements concerning Aqua Metals, Inc., the lead - acid battery recycling industry, the intended benefits of its agreements with Interstate Batteries, the Company’s pursuit of debt financing options, the future of lead - acid battery recycling via traditional smelters, the Company’s development of its commercial lead - acid battery recycling facilities and the quality, efficiency and profitability of Aqua Metals’ proposed lead - acid battery recycling operations. Those forward - looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially. Among those factors are: (1) the fact that Company only recently commenced limited lead - producing operations and completed its initial commercial recycling facility, thus subjecting the Company to all of the risks inherent in a pre - revenue start - up; (2) the uncertainties involved in any new commercial relationship and the risk that Aqua Metals will not receive the intended benefits of its agreements with Interstate Batteries; (3) the uncertainties involved in the Company’s potential acquisition of debt financing to develop additional recycling facilities; (4) risks related to Aqua Metals’ ability to raise sufficient capital, as and when needed, t o develop and operate its recycling facilities; (5) changes in the federal, state and foreign laws regulating the recycling of lead - acid batteries; (6) the Company’s ability to protect its proprietary technology, trade secrets and know - how and (7) those other risks disclosed in the section “Risk Factors” included in the Quarterly Report on Form 10 - Q filed with the SEC on November 7, 2016. Aqua Metals cautions readers not to place undue reliance on any forward - looking statements. The Company does not undertake, and specifically disclaims any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur. 2

Aqua Metals is proving it has the potential to change the $22billion lead market • Our first facility has the capacity to produce >120T/day of lead not 80T/day – One AquaRefining module commissioned, 5 being commissioned, more to come – Plan to sell pure lead in Q4 and to use short term intermediate products to accelerate revenue ramp - up and positive cash flow – Plan to expand to 120T/day in early 2017 • Evaluating options for non - equity funding for 4 – 5 facilities totaling ~800T/day – Progressed to the point that we are visiting sites for second and third AquaRefineries – Projecting ~30% IRR for each 160T/day AquaRefinery at a capital cost of ~$50mm – Establishing important permitting precedents, which could accelerate our roll out • We are generating strong interest in licensing to 3 rd parties – Already successfully tested 3 rd party feed stocks, with more to come – Expect to start shipping licensed AquaRefining equipment in 2017 – Developed a “Master License” approach for China and other large markets 3 We plan to do for lead what Bessemer and Nucor did for steel NASDAQ: AQMS

LAB 96% Li - ion 4% Lead acid batteries dominate the storage market ( GWh /year) LAB Li-ion NiMH Other • LABs are the world’s most recycled consumer product, at 100% recycled • Conventional recycling is expensive, polluting and does not produce ultra - pure lead • Primary lead mines, the main source of ultra - pure lead, are becoming depleted • Lead - acid batteries (LABs) are used in gas - powered electric vehicles and even Li - ion powered electric vehicles • LABs dominate data center, telecom and emerging energy storage applications • Evidence that China is re - focusing on low cost lead based EVs for mass transportation Source: Industry estimates Source: CHR Metals Lead production in million metric tons/year Lead still dominates global battery production and is continuing to grow 4 NASDAQ: AQMS

AquaRefining uses less energy, eliminates waste and toxic emissions NASDAQ: AQMS 5 • Only the lead compounds are converted back into lead • High value lead alloys recovered at source and converted directly into ingots • Much less energy required • No opportunity for fugitive emissions • Reduced permitting needs

Our first facility at TRIC has a capacity of >120T/day not 80T/day • Additional capacity through process improvements and short - term products • Started building high purity brand – Assayed at 99.99% – Providing samples to battery manufacturers • AquaRefining is not subject to NESHAP (the mandated standard for smelters) – Established important precedents that should help our roll - out and expansion – Now one of our core strengths – Accelerated interest within the battery industry – a majority of which has visited our facility NASDAQ: AQMS 6

NASDAQ: AQMS 7

NASDAQ: AQMS 8

NASDAQ: AQMS 9

NASDAQ: AQMS 10

NASDAQ: AQMS 11

NASDAQ: AQMS 12

• TRIC – Increase our projected capacity for TRIC from 120T/day to 160T/day – Establish “Aqua” branded premium high purity lead • Additional North American AquaRefineries – Discussions on non - diluting funding for up to 800T/day progressing well – We have started visiting potential sites for our second and third AquaRefineries • Launch equipment licensing during 2017 – Completed initial testing of feed stock from North American based potential licensees – Substantive discussions with highly credible potential China partners • Crafted “Master Franchise” approach – Planning on completing 9 months of operation before delivering modules to 3 rd parties Business Expansion: Expand our own capacity and initiate licensing NASDAQ: AQMS 13

Our opportunity is a global market of ≈ $22 billion NASDAQ: AQMS Capacity (tonnes/day) AquaRefining Modules % World lead production Potential annual revenue TRIC AquaRefinery 120 - 160 32 0.2% $100 - 120mm/year 5 AquaRefineries 800 160 2.1% $500 - 600mm/year Global lead market 38,000 7,500 100% $22billion/year 14 • The lead market is highly receptive to a clean alternative to smelting and high purity lead • Historically, step change improvements in commodity manufacturing have yielded exceptional returns – Precedents include Bessemer & Nucor (steel), Pilkington (glass), Siemens (silicon)

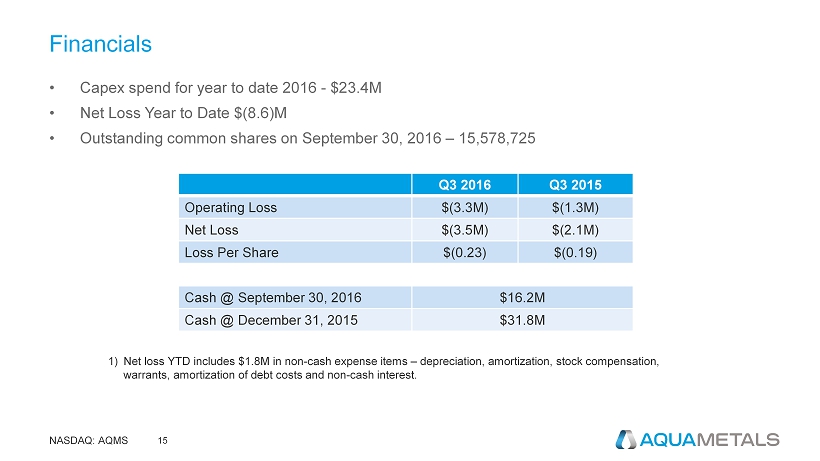

Financials • Capex spend for year to date 2016 - $23.4M • Net Loss Year to Date $(8.6)M • Outstanding common shares on September 30, 2016 – 15,578,725 Q3 2016 Q3 2015 Operating Loss $(3.3M) $(1.3M) Net Loss $(3.5M) $(2.1M) Loss Per Share $(0.23) $(0.19) Cash @ September 30 , 2016 $16.2M Cash @ December 31 , 2015 $31.8M 1) Net loss YTD includes $1.8M in non - cash expense items – depreciation, amortization, stock compensation, warrants, amortization of debt costs and non - cash interest. NASDAQ: AQMS 15

Key Takeaways • After less than 18 months, our 1 st recycling facility (TRIC) is starting to run! – 120T/day installed capacity exceeds 80T/day planned capacity by 50% – First lead samples assayed at 99.99% confirming our ability to produce premium lead – Potential customers and licensees recognize this significant achievement • Non - diluting funding for up to 800T/day is in play – We are evaluating sites for our second and third AquaRefineries • Transition to a licensing model in 2017 is underway – Completed trials with feed materials from potential North American licensees – Establishing Strategic Relationships and Master Licensing for China and other regions • We have built a strong team that delivers – Veterans from the lead recycling industry are seeing what we can do and asking to join • Established strong Strategic Relationships and building more NASDAQ: AQMS 16

INVESTOR RELATIONS CONTACT: Greg Falesnik Senior Vice President 1 - 949 - 385 - 6449 Greg.Falesnik@mzgroup.us www.AquaMetals.com NASDAQ: AQMS