Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TOYS R US INC | d285163d8k.htm |

| EX-10.7 - EX-10.7 - TOYS R US INC | d285163dex107.htm |

| EX-10.6 - EX-10.6 - TOYS R US INC | d285163dex106.htm |

| EX-10.5 - EX-10.5 - TOYS R US INC | d285163dex105.htm |

| EX-10.3 - EX-10.3 - TOYS R US INC | d285163dex103.htm |

| EX-10.2 - EX-10.2 - TOYS R US INC | d285163dex102.htm |

| EX-10.1 - EX-10.1 - TOYS R US INC | d285163dex101.htm |

Exhibit 10.4

MEZZANINE LOAN AGREEMENT

Dated as of November 3, 2016

between

GIRAFFE JUNIOR HOLDINGS, LLC,

as Borrower,

and

BRIGADE LEVERAGED CAPITAL STRUCTURES FUND LTD.,

BRIGADE CREDIT FUND II LTD.,

BRIGADE STRUCTURED CREDIT FUND LTD.,

LOS ANGELES COUNTY EMPLOYEES RETIREMENT ASSOCIATION,

BRIGADE DISTRESSED VALUE MASTER FUND LTD.,

THE COCA-COLA COMPANY MASTER RETIREMENT TRUST,

FEDEX CORPORATION EMPLOYEES’ PENSION TRUST,

DELTA MASTER TRUST,

BRIGADE OPPORTUNISTIC CREDIT FUND—ICIP, LTD., and

BRIGADE OPPORTUNISTIC CREDIT FUND 16 LLC,

collectively, as Lender

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I GENERAL TERMS |

28 | |||||

| Section 1.1. |

The Loan; Term | 28 | ||||

| Section 1.2. |

Interest | 29 | ||||

| Section 1.3. |

Method and Place of Payment | 30 | ||||

| Section 1.4. |

Taxes; Regulatory Change | 31 | ||||

| Section 1.5. |

Intentionally Omitted | 34 | ||||

| Section 1.6. |

Release | 34 | ||||

| ARTICLE II VOLUNTARY PREPAYMENT AND ASSUMPTION |

34 | |||||

| Section 2.1. |

Voluntary Prepayment | 34 | ||||

| Section 2.2. |

Property/Collateral Releases | 35 | ||||

| Section 2.3. |

Assumption | 37 | ||||

| Section 2.4. |

Transfers of Equity Interests in Borrower or Master Tenant | 38 | ||||

| ARTICLE III ACCOUNTS |

39 | |||||

| Section 3.1. |

Mortgage Loan Cash Management Account | 39 | ||||

| Section 3.2. |

Distributions from Cash Management Account | 40 | ||||

| Section 3.3. |

Mortgage Loan Covenants; Replacement of Mortgage Loan Collateral Accounts | 40 | ||||

| Section 3.4. |

Intentionally Omitted | 41 | ||||

| Section 3.5. |

Bankruptcy | 41 | ||||

| ARTICLE IV REPRESENTATIONS |

41 | |||||

| Section 4.1. |

Organization | 41 | ||||

| Section 4.2. |

Authorization | 42 | ||||

| Section 4.3. |

No Conflicts | 42 | ||||

| Section 4.4. |

Consents | 42 | ||||

| Section 4.5. |

Enforceable Obligations | 42 | ||||

| Section 4.6. |

No Event of Default | 42 | ||||

| Section 4.7. |

Payment of Taxes | 42 | ||||

| Section 4.8. |

Compliance with Law | 43 | ||||

| Section 4.9. |

ERISA | 43 | ||||

| Section 4.10. |

Investment Company Act | 43 | ||||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 4.11. |

No Bankruptcy Filing | 43 | ||||

| Section 4.12. |

Other Debt | 43 | ||||

| Section 4.13. |

Litigation | 43 | ||||

| Section 4.14. |

Intentionally Omitted | 44 | ||||

| Section 4.15. |

Full and Accurate Disclosure | 44 | ||||

| Section 4.16. |

Financial Condition | 44 | ||||

| Section 4.17. |

Single-Purpose Requirements | 44 | ||||

| Section 4.18. |

Use of Loan Proceeds | 44 | ||||

| Section 4.19. |

Not Foreign Person | 45 | ||||

| Section 4.20. |

Labor Matters | 45 | ||||

| Section 4.21. |

Title | 45 | ||||

| Section 4.22. |

Fraudulent Conveyance | 45 | ||||

| Section 4.23. |

Management | 45 | ||||

| Section 4.24. |

Federal Trade Embargos | 45 | ||||

| Section 4.25. |

Ground Leased Parcel | 46 | ||||

| Section 4.26. |

Four-Wall EBITDAR to Rent Ratio | 47 | ||||

| Section 4.27. |

Irrevocable Redirection Letter | 47 | ||||

| Section 4.28. |

Mortgage Loan Representations | 47 | ||||

| Section 4.29. |

Survival | 47 | ||||

| ARTICLE V AFFIRMATIVE COVENANTS |

48 | |||||

| Section 5.1. |

Existence; Licenses; Tax Status | 48 | ||||

| Section 5.2. |

Maintenance of Properties | 48 | ||||

| Section 5.3. |

Compliance with Legal Requirements | 49 | ||||

| Section 5.4. |

Impositions and Other Claims | 49 | ||||

| Section 5.5. |

Access to Properties | 49 | ||||

| Section 5.6. |

Cooperate in Legal Proceedings | 50 | ||||

| Section 5.7. |

Leases | 50 | ||||

| Section 5.8. |

Plan Assets, etc. | 52 | ||||

| Section 5.9. |

Further Assurances | 52 | ||||

| Section 5.10. |

Management Agreement | 53 | ||||

-ii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 5.11. |

Notice of Material Event | 53 | ||||

| Section 5.12. |

Annual Financial Statements | 53 | ||||

| Section 5.13. |

Quarterly Financial Statements | 54 | ||||

| Section 5.14. |

Intentionally Omitted | 55 | ||||

| Section 5.15. |

Insurance | 55 | ||||

| Section 5.16. |

Casualty and Condemnation | 55 | ||||

| Section 5.17. |

Annual Budget | 56 | ||||

| Section 5.18. |

Venture Capital Operating Companies; Nonbinding Consultation | 56 | ||||

| Section 5.19. |

Compliance with Encumbrances and Material Agreements | 56 | ||||

| Section 5.20. |

Prohibited Persons | 57 | ||||

| Section 5.21. |

Ground Lease | 57 | ||||

| Section 5.22. |

Condominium | 58 | ||||

| Section 5.23. |

Mortgage Loan | 59 | ||||

| ARTICLE VI NEGATIVE COVENANTS |

59 | |||||

| Section 6.1. |

Liens on the Collateral | 59 | ||||

| Section 6.2. |

Ownership | 59 | ||||

| Section 6.3. |

Transfer; Prohibited Change of Control | 59 | ||||

| Section 6.4. |

Debt | 60 | ||||

| Section 6.5. |

Dissolution; Merger or Consolidation | 60 | ||||

| Section 6.6. |

Change in Business | 60 | ||||

| Section 6.7. |

Debt Cancellation | 60 | ||||

| Section 6.8. |

Affiliate Transactions | 60 | ||||

| Section 6.9. |

Misapplication of Funds | 60 | ||||

| Section 6.10. |

Jurisdiction of Formation; Name | 60 | ||||

| Section 6.11. |

Modifications and Waivers | 60 | ||||

| Section 6.12. |

ERISA | 61 | ||||

| Section 6.13. |

Alterations and Expansions | 62 | ||||

| Section 6.14. |

Advances and Investments | 62 | ||||

| Section 6.15. |

Single-Purpose Entity | 62 | ||||

-iii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 6.16. |

Zoning and Uses | 62 | ||||

| Section 6.17. |

Waste | 63 | ||||

| Section 6.18. |

Irrevocable Redirection Letter | 63 | ||||

| ARTICLE VII DEFAULTS |

63 | |||||

| Section 7.1. |

Event of Default | 63 | ||||

| Section 7.2. |

Remedies | 67 | ||||

| Section 7.3. |

Application of Payments after an Event of Default | 69 | ||||

| ARTICLE VIII CONDITIONS PRECEDENT |

69 | |||||

| Section 8.1. |

Conditions Precedent to Closing | 69 | ||||

| ARTICLE IX MISCELLANEOUS |

72 | |||||

| Section 9.1. |

Successors | 72 | ||||

| Section 9.2. |

GOVERNING LAW | 72 | ||||

| Section 9.3. |

Modification, Waiver in Writing | 73 | ||||

| Section 9.4. |

Notices | 73 | ||||

| Section 9.5. |

TRIAL BY JURY | 74 | ||||

| Section 9.6. |

Headings | 74 | ||||

| Section 9.7. |

Assignment and Participation | 75 | ||||

| Section 9.8. |

Severability | 77 | ||||

| Section 9.9. |

Preferences; Waiver of Marshalling of Assets | 77 | ||||

| Section 9.10. |

Remedies of Borrower | 77 | ||||

| Section 9.11. |

Offsets, Counterclaims and Defenses | 77 | ||||

| Section 9.12. |

No Joint Venture | 78 | ||||

| Section 9.13. |

Conflict; Construction of Documents | 78 | ||||

| Section 9.14. |

Brokers and Financial Advisors | 78 | ||||

| Section 9.15. |

Counterparts | 78 | ||||

| Section 9.16. |

Estoppel Certificates | 78 | ||||

| Section 9.17. |

General Indemnity; Payment of Expenses | 79 | ||||

| Section 9.18. |

No Third-Party Beneficiaries | 81 | ||||

| Section 9.19. |

Recourse | 82 | ||||

| Section 9.20. |

Right of Set-Off | 85 | ||||

-iv-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| Section 9.21. |

Exculpation of Lender | 85 | ||||

| Section 9.22. |

Servicer | 86 | ||||

| Section 9.23. |

No Fiduciary Duty | 86 | ||||

| Section 9.24. |

Borrower Information | 87 | ||||

| Section 9.25. |

PATRIOT Act Records | 88 | ||||

| Section 9.26. |

EU Bail-in Rule | 88 | ||||

| Section 9.27. |

Prior Agreements | 89 | ||||

| Section 9.28. |

Publicity | 89 | ||||

| Section 9.29. |

Delay Not a Waiver | 89 | ||||

| Section 9.30. |

Schedules and Exhibits Incorporated | 89 | ||||

| Section 9.31. |

Intercreditor Agreement | 89 | ||||

| Section 9.32. |

Senior Loan | 90 | ||||

-v-

Exhibits

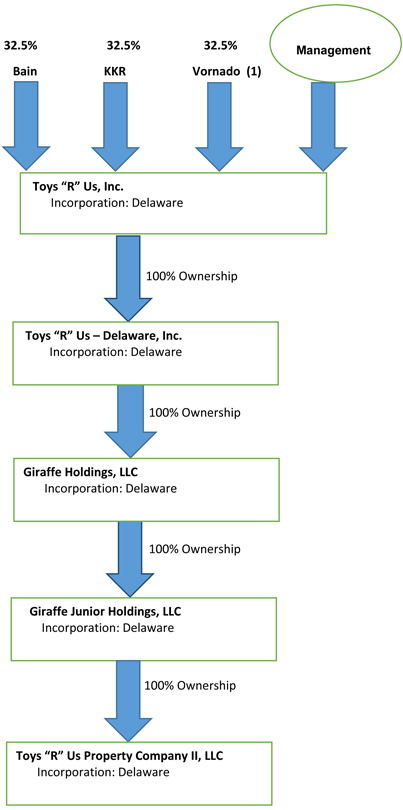

| A | Organizational Chart |

| B | Tax Certificate |

| Schedules |

| A | Properties |

| B | Exception Report |

| C | Deferred Maintenance Conditions |

| D | Allocated Loan Amounts |

Annex

| I | Mortgage Loan Agreement |

-vi-

MEZZANINE LOAN AGREEMENT

This Mezzanine Loan Agreement (this “Agreement”) is dated November 3, 2016, and is between BRIGADE LEVERAGED CAPITAL STRUCTURES FUND LTD., BRIGADE CREDIT FUND II LTD., BRIGADE STRUCTURED CREDIT FUND LTD., LOS ANGELES COUNTY EMPLOYEES RETIREMENT ASSOCIATION, BRIGADE DISTRESSED VALUE MASTER FUND LTD., THE COCA-COLA COMPANY MASTER RETIREMENT TRUST, FEDEX CORPORATION EMPLOYEES’ PENSION TRUST, DELTA MASTER TRUST, BRIGADE OPPORTUNISTIC CREDIT FUND—ICIP, LTD. and BRIGADE OPPORTUNISTIC CREDIT FUND 16 LLC, collectively, as lender (“Lender”), and GIRAFFE JUNIOR HOLDINGS, LLC, a Delaware limited liability company, as borrower (together with its successors and permitted assigns, “Borrower”).

RECITALS

Borrower desires to obtain from Lender the Loan (as hereinafter defined) in connection with the financing of the Properties (as hereinafter defined).

Lender is willing to make the Loan on the terms and subject to the conditions set forth in this Agreement if Borrower joins in the execution and delivery of this Agreement, the Note and the other Loan Documents.

In consideration of the agreements, provisions and covenants contained herein and in the other Loan Documents, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Lender and Borrower agree as follows:

DEFINITIONS

(a) When used in this Agreement, the following capitalized terms have the following meanings:

“Account Collateral” means, collectively, the Collateral Accounts and all sums at any time held, deposited or invested therein, together with any interest and other earnings thereon, and all securities and investment property credited thereto and all proceeds thereof (including proceeds of sales and other dispositions), whether accounts, general intangibles, chattel paper, deposit accounts, instruments, documents or securities.

“Affiliate” shall mean, as to any Person, any other Person that, directly or indirectly, (i) is in Control of, is Controlled by or is under common Control with such Person or (ii) is a director or officer of such Person or of an Affiliate of such Person.

“Agent” has the meaning set forth in Section 9.7(e).

“Agreement” means this Mezzanine Loan Agreement, as the same may from time to time hereafter be amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Allocated Loan Amount” means, for the Collateral relating to each Property, the portion of the Loan Amount allocated thereto as set forth in Schedule D.

“Alteration” means any demolition, alteration, installation, improvement or expansion of or to any of the Properties or any portion thereof.

“Annual Budget” means a capital and operating expenditure budget for the Properties prepared by Property Owner that specifies amounts to operate and maintain the Properties in accordance with past practices of Property Owner and Master Tenant.

“Appraisal” means, with respect to each Property, an as-is appraisal of such Property that is prepared by a member of the Appraisal Institute selected by Lender, meets the minimum appraisal standards for national banks promulgated by the Comptroller of the Currency pursuant to Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended (FIRREA) and complies with the Uniform Standards of Professional Appraisal Practice (USPAP).

“Approved Annual Budget” has the meaning set forth in Section 5.17.

“Approved Sublease Parameters” shall mean a sublease between Master Tenant, as landlord, and a subtenant, as tenant meeting the following parameters:

| (1) | such sublease is an arm’s length transaction on commercially reasonable terms; |

| (2) | (a) the subtenant shall be of a type that complies with Legal Requirements and (b) the use of the applicable Property shall not be a Prohibited Use and shall otherwise be in compliance with the terms hereof; |

| (3) | such sublease provides for rental rates and terms comparable to existing local market rates and terms (taking into account the type and quality of the subtenant); |

| (4) | such sublease demises fifty percent (50%) or less than the total rental square footage of the applicable Property and/or such sublease, when aggregated with all other subleases then in effect for the Properties, demises not more than fifty percent (50%) of the total rental square footage of the Properties; |

| (5) | such sublease does not contain any terms which would reasonably be expected to have or do have a Material Adverse Effect; |

| (6) | such sublease has a term of, (x) with respect to any Ground Leased Parcel, ending on or before the term of the applicable Ground Lease (including possible extensions and renewals thereof) in effect for such Ground Leased Parcel and (y) with respect to all other Properties, at least 60 months and not more than 360 months (including all possible extensions and renewals thereof), but in no event ending on or after the term of the Master Lease (including possible extensions and renewals thereof); |

2

| (7) | such sublease does not impose any obligations or liabilities on Property Owner, Borrower or Master Tenant other than those obligations or liabilities imposed on commercially reasonable terms in the ordinary course of business; |

| (8) | such sublease does not contain any option to purchase, or any right of first refusal to purchase or other similar right to acquire all or any portion of the applicable Property unless such option or right requires the holder thereof to pay Borrower and Property Owner a purchase price equal to or greater than the sum of the Principal Release Price for the Collateral relating to such Property and the “Principal Release Price” (as defined in the Mortgage Loan Agreement) for the related Property; |

| (9) | such sublease provides that no further sublease shall be permitted unless such sublease satisfies the Approved Sublease Parameters; |

| (10) | such sublease does not prevent Loss Proceeds from being held and disbursed by Lender in accordance with the terms of the Loan Documents; and |

| (11) | such sublease does not conflict with any Legal Requirements, any Ground Lease, the terms and conditions of Section 5.15 hereof, or any of the terms of the Master Lease. |

“Assignment” has the meaning set forth in Section 9.7(b).

“Assumption” has the meaning set forth in Section 2.3.

“Available Excess Cash” has the meaning set forth in the Mortgage Loan Agreement.

“Bankruptcy Code” has the meaning set forth in Section 7.1(d).

“Borrower” has the meaning set forth in the first paragraph of this Agreement.

“Borrower Tax” means any U.S. Tax and any present or future tax, assessment or other charge or levy imposed by, or on behalf of, any jurisdiction through which or from which payments due hereunder are made by or on behalf of Borrower (or any taxing authority thereof).

“Braintree Condominium” means the Marketplace at Braintree Condominium governing Store #6383 in Braintree, Massachusetts.

“Budgeted Operating Expense” has the meaning set forth in the Mortgage Loan Agreement.

“Business Day” means any day other than (i) a Saturday and a Sunday and (ii) a day on which federally insured depository institutions in the State of New York or the state in which the offices of Lender, its trustee, its Servicer or its Servicer’s collection account are located are authorized or obligated by law, governmental decree or executive order to be closed.

3

“Capital Expenditure” means, with respect to any Property, hard and soft costs incurred by Property Owner with respect to replacements and capital repairs or improvements made to such Property (including repairs to, and replacements of, structural components, roofs, building systems, parking garages and parking lots), in each case to the extent capitalized in accordance with GAAP.

“Casualty” means a fire, explosion, flood, collapse, earthquake or other casualty affecting all or any portion of any Property.

“Cause” means, with respect to an Independent Director, (i) acts or omissions have been committed by such Independent Director that constitute systematic and persistent or willful disregard of such Independent Director’s duties, (ii) such Independent Director has been indicted or convicted for any crime or crimes of moral turpitude or dishonesty or for any violation of any Legal Requirements, (iii) such Independent Director no longer satisfies the requirements set forth in the definition of “Independent Director” or if such Person is no longer employed by the independent director service provider set forth in the definition of “Independent Director”, (iv) the fees charged for the services of such Independent Director are materially in excess of the fees charged by the other providers of Independent Directors listed in the definition of “Independent Director” or (v) any other reason for which the prior written consent of Lender shall have been obtained.

“Certificates” means, collectively, any senior and/or subordinate notes, debentures or pass-through certificates, or other evidence of indebtedness, or debt or equity securities, or any combination of the foregoing, representing a direct or beneficial interest, in whole or in part, in the Loan or the Mortgage Loan, as the case may be.

“Closing Date” means the date of this Agreement.

“Code” means the Internal Revenue Code of 1986, as amended, and as it may be further amended from time to time, any successor statutes thereto, and applicable U.S. Department of Treasury regulations issued pursuant thereto in temporary or final form.

“Collateral” means all assets owned from time to time by Borrower, including (i) 100% of the issued and outstanding limited liability company interests in Property Owner, (ii) the Account Collateral, (iii) all other collateral pledged under the Pledge Agreement, and (iv) all other tangible and intangible property in respect of which Lender is granted a Lien under the Loan Documents, and all proceeds thereof.

“Collateral Account” means each of the accounts and sub-accounts established pursuant to Article III hereof.

“Condemnation” means a taking or voluntary conveyance of all or part of any of the Properties or any interest therein, as the result of, or in settlement of, any condemnation or other eminent domain proceeding by any Governmental Authority; provided, however, that “Condemnation” shall not include the grant of any easement to the extent that the same would not reasonably be expected to have a Material Adverse Effect on such Property.

4

“Condominium” means the Braintree Condominium and the Northville Condominium.

“Condominium Act” means, collectively, all Legal Requirements applicable to the respective Condominium.

“Condominium Association” means, collectively, (i) the “Trust” as such term is defined in the Condominium Documents of the Braintree Condominium and (ii) the “Administrator” as such term is defined in the Condominium Documents of the Northville Condominium.

“Condominium Documents” means, collectively, the condominium declaration, the condominium by-laws, any rules and regulations promulgated thereunder, and any and all other documents and agreements binding upon, governing or otherwise pertaining to each respective Condominium and/or the respective Condominium Association.

“Condominium Unit” means each individual unit in the respective Condominium (together with all interests appurtenant thereto).

“Contingent Obligation” means, with respect to any Person, any obligation of such Person directly or indirectly guaranteeing any Debt of any other Person in any manner and any contingent obligation to provide funds for payment, or to supply funds to invest in any other Person.

“Control” of any entity means the ownership, directly or indirectly, of at least 51% of the equity interests in, and the right to at least 51% of the distributions from, such entity and the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such entity, whether through the ability to exercise voting power, by contract or otherwise (“Controlled” and “Controlling” each have the meanings correlative thereto).

“Damages” to a Person means any and all actual, documented, out-of-pocket liabilities, obligations, losses, demands, damages, penalties, assessments, actions, causes of action, judgments, proceedings, suits, claims, costs, expenses and disbursements of any kind or nature whatsoever (including reasonable attorneys’ fees and other costs of defense and/or enforcement whether or not suit is brought), fines, charges, fees, settlement costs and disbursements imposed on, incurred by or asserted against such party, whether based on any federal, state, local or foreign laws, statutes, rules or regulations (including securities and commercial laws, statutes, rules or regulations and Environmental Laws), on common law or equitable cause or on contract or otherwise; provided, however, that “Damages” shall not include special, consequential or punitive damages, except to the extent imposed upon Lender by one or more third parties.

“Dark” means, with respect to any Property, if such Property is not open for business to the public for a period of one hundred twenty (120) consecutive days, unless (i) such Property is temporarily closed for maintenance or compliance with Legal Requirements or (ii) such closure is a result of a Casualty or Condemnation and Property Owner or Master Tenant (A) promptly and diligently pursues and completes repair or restoration of such Property, or takes other appropriate actions to resolve such closure and (B) reopens such Property to the public no later than two hundred seventy (270) days after the date of the initial closure.

5

“Dark Limit” means, as of any date of determination, twenty percent (20%) of the Properties that remain subject to the Lien of the Mortgages as of such date.

“Dark Property” means, as of any date of determination, any Property that is Dark.

“Debt” means, with respect to any Person, without duplication:

(i) all indebtedness of such Person to any other party (regardless of whether such indebtedness is evidenced by a written instrument such as a note, bond or debenture), for borrowed money or for the deferred purchase price of property or services;

(ii) all letters of credit issued for the account of such Person and all unreimbursed amounts drawn thereunder;

(iii) all indebtedness secured by a Lien on any property owned by such Person (whether or not such indebtedness has been assumed) except obligations for impositions that are not yet due and payable;

(iv) all Contingent Obligations of such Person;

(v) all payment obligations of such Person under any interest rate protection agreement (including any interest rate swaps, floors, collars or similar agreements) and similar agreements; and

(vi) any material actual or contingent liability to any Person or Governmental Authority with respect to any employee benefit plan (within the meaning of Section 3(3) of ERISA) subject to Title IV of ERISA, Section 302 of ERISA or Section 412 of the Code.

“Default” means the occurrence of any event that, but for the giving of notice or the passage of time, or both, would be an Event of Default.

“Default Rate” means, with respect to any Note, 3% per annum in excess of the interest rate otherwise applicable to such Note hereunder; provided that, if the foregoing would result in an interest rate in excess of the maximum rate permitted by applicable law, the Default Rate shall be limited to the maximum rate permitted by applicable law.

“Deferred Maintenance Conditions” has the meaning set forth in the Mortgage Loan Agreement.

“Domestic Services Agreement” means that certain Domestic Services Agreement, dated as of January 29, 2006, by and among, Master Tenant, Property Owner and certain Affiliates of Property Owner party thereto, as the same may from time to time be amended, restated, replaced, supplemented or otherwise modified.

6

“EEA Bail-In Action” means the exercise of any EEA Write-Down and Conversion Powers by the applicable EEA Resolution Authority in respect of any liability of an EEA Financial Institution.

“EEA Bail-In Legislation” means, with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law for such EEA Member Country from time to time which is described in the EEA Bail-In Legislation Schedule.

“EEA Bail-In Legislation Schedule” means the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor person), as in effect from time to time.

“EEA Financial Institution” means (a) any credit institution or investment firm established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any financial institution established in an EEA Member Country which is a subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent.

“EEA Member Country” means any of the member states of the European Union, Iceland, Liechtenstein, and Norway.

“EEA Resolution Authority” means any public administrative authority or any person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution.

“EEA Write-Down and Conversion Powers” means, with respect to any EEA Resolution Authority, the write-down and conversion powers of such EEA Resolution Authority from time to time under the EEA Bail-In Legislation for the applicable EEA Member Country, which write-down and conversion powers are described in the EEA Bail-In Legislation Schedule.

“Eligible Account” means an account or book-entry subaccount maintained with a federal or state-chartered depository institution or trust company that complies with the definition of Eligible Institution.

“Eligible Institution” has the meaning set forth in the Mortgage Loan Agreement.

“Embargoed Person” means any Person subject to trade restrictions under any Federal Trade Embargo.

“Engineering Report” means a structural and seismic engineering report or reports (including a “probable maximum loss” calculation, if applicable) with respect to each of the Properties prepared by an independent engineer reasonably approved by Lender and delivered to Lender in connection with the Loan, and any amendments or supplements thereto delivered to Lender.

7

“Environmental Indemnity” means that certain environmental indemnity agreement executed by Borrower and Sponsor as of the Closing Date, as the same may from time to time be amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Environmental Laws” means any and all federal, state and local laws, statutes, ordinances, orders, rules, regulations and the like, as well as principals of common law, and any judicial or administrative orders, decrees or judgments thereunder, , relating to (i) the pollution, protection or cleanup of the environment, (ii) the impact of the Use or Release of Hazardous Substances on property, health or safety, (iii) the Use or Release of Hazardous Substances, (iv) occupational safety and health, industrial hygiene or the protection of human, plant or animal health or welfare (each solely to the extent related to the Use or Release of Hazardous Substances) or (v) the liability for or costs of other actual or threatened danger to the environment or human health (with respect to exposure to Hazardous Substances). The term “Environmental Law” includes, but is not limited to, the following statutes, as amended, any successors thereto, and any regulations promulgated pursuant thereto, and any state or local statutes, ordinances, rules, regulations and the like addressing similar issues: the Comprehensive Environmental Response, Compensation, and Liability Act; the Emergency Planning and Community Right-to-Know Act; the Hazardous Materials Transportation Act; the Resource Conservation and Recovery Act (including Subtitle I relating to underground storage tanks); the Clean Water Act; the Clean Air Act; the Toxic Substances Control Act; the Safe Drinking Water Act; the Occupational Safety and Health Act (to the extent related to exposure to Hazardous Substances); the Federal Water Pollution Control Act; the Federal Insecticide, Fungicide and Rodenticide Act; the Endangered Species Act; the National Environmental Policy Act; and the River and Harbors Appropriation Act. The term “Environmental Law” also includes, but is not limited to, federal state and local laws, statutes ordinances, rules, regulations and the like, as well as principals of common law, conditioning transfer of property upon a negative declaration or other approval of a Governmental Authority of the environmental condition of a property; or requiring notification or disclosure of Releases of Hazardous Substances or other environmental conditions of a property to any Governmental Authority or other Person, whether or not in connection with transfer of title to or interest in property.

“Environmental Reports” means “Phase I Environmental Site Assessments” as referred to in the ASTM Standards on Environmental Site Assessments for Commercial Real Estate, E 1527-13 (and, if necessary, “Phase II Environmental Site Assessments”), prepared by an independent environmental auditor approved by Lender and delivered to Lender in connection with the Loan and any amendments or supplements thereto delivered to Lender, and shall also include any other environmental reports delivered to Lender pursuant to this Agreement and the Environmental Indemnity.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time, and the regulations promulgated thereunder.

8

“ERISA Affiliate” means, at any time, each trade or business (whether or not incorporated) that would, at the time, be treated together with Borrower as a single employer under Title IV or Section 302 of ERISA or Section 412 of the Code.

“Escrow Refunds” has the meaning set forth in the Mortgage Loan Agreement.

“Event of Default” has the meaning set forth in Section 7.1.

“Excess Release Proceeds” shall mean any and all Net Proceeds received by Property Owner or Borrower in connection with the release of any portion of the Collateral pursuant to Section 2.2 hereof in excess of the sum of the Principal Release Price, the “Principal Release Price” (as defined in the Mortgage Loan Agreement) of the Property to which such Collateral relates and the Release Deposit Amount (if any).

“Exception Report” means the report prepared by Borrower and attached to this Agreement as Schedule B, setting forth any exceptions to the representations set forth in Article IV.

“Exculpated Person” means each Person that is an affiliate, equityholder, beneficiary, trustee, member, officer, director, agent, manager, independent manager, employee or partner of Borrower or Sponsor.

“Extension Term” has the meaning set forth in Section 1.1(c).

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantially comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreement entered into pursuant to Section 1471(b)(1) of the Code, any intergovernmental agreement entered into in connection with any of the foregoing and any fiscal or regulatory legislation, rules, or practices adopted pursuant to any such intergovernmental agreement.

“Federal Trade Embargo” means any federal law imposing trade restrictions, including (i) the Trading with the Enemy Act, as amended, and each of the foreign assets control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended), (ii) the International Emergency Economic Powers Act (50 U.S.C. §§ 1701 et seq., as amended), (iii) any enabling legislation or executive order relating to the foregoing, (iv) Executive Order 13224, and (v) the PATRIOT Act.

“Fee Acquisition” has the meaning set forth in the Mortgage Loan Agreement.

“Fiscal Quarter” means the 13-week or 14-week period after the preceding fiscal year or quarter end date, generally ending on the Saturday nearest to April 30, July 31, October 31 and January 31 of each year, or such other fiscal quarter of Borrower as Borrower may select from time to time with the prior consent of Lender, such consent not to be unreasonably withheld, delayed or conditioned.

9

“Fiscal Year” means each 52-week or 53-week period ending on the Saturday nearest to January 31 of each year, or such other fiscal year of Borrower as Borrower may select from time to time with the prior consent of Lender, not to be unreasonably withheld, delayed or conditioned.

“Fitch” means Fitch, Inc. and its successors.

“Force Majeure” means a delay due to acts of God, governmental restrictions, stays, judgments, orders, decrees, enemy actions, civil commotion, fire, casualty, strikes, work stoppage, shortages of labor or materials or similar causes beyond the reasonable control of Borrower; provided that (1) any period of Force Majeure shall apply only to performance of the obligations necessarily affected by such circumstance and shall continue only so long as Borrower is continuously and diligently using all commercially reasonable efforts to minimize the duration thereof; and (2) Force Majeure shall not include the unavailability or insufficiency of funds unless caused by the events set forth in the definition hereof.

“Four-Wall EBITDAR” has the meaning set forth in the Mortgage Loan Agreement.

“Four-Wall EBITDAR to Rent Ratio” has the meaning set forth in the Mortgage Loan Agreement.

“GAAP” means generally accepted accounting principles in the United States of America, consistently applied.

“Giraffe Holdings” means Giraffe Holdings, LLC, a Delaware limited liability company.

“Governmental Authority” means any federal, state, county, regional, local or municipal government, any bureau, department, agency or political subdivision thereof and any Person with jurisdiction exercising executive, legislative, judicial, taxing, regulatory or administrative functions of or pertaining to government (including any court).

“Ground Lease” means, with respect to each Property, any ground lease described in the applicable Title Insurance Policy or the applicable Mortgage, as such ground lease may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance herewith.

“Ground Leased Parcel” means, with respect to each Property, any portion of such Property with respect to which Property Owner is the lessee under a Ground Lease.

“Ground Rent” means rent payable by Property Owner pursuant to the Ground Lease, if any.

“Guaranty” means that certain guaranty, dated as of the Closing Date, executed by Sponsor for the benefit of Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

10

“Hazardous Substances” means any and all substances (whether solid, liquid or gas) defined, listed, or otherwise classified as hazardous wastes, hazardous substances, hazardous materials, extremely hazardous wastes, toxic substances, toxic pollutants, contaminants, pollutants or words of similar meaning or regulatory effect under applicable Environmental Laws or the presence of which on, in or under any of the Properties is prohibited or requires investigation or remediation under applicable Environmental Law, including petroleum and petroleum by-products, asbestos and asbestos-containing materials, toxic mold, polychlorinated biphenyls, lead and radon, and compounds containing them (including gasoline, diesel fuel, oil and lead-based paint), pesticides and radioactive materials, flammables and explosives and compounds containing them, but excluding those substances commonly used in the operation and maintenance of properties of kind and nature similar to those of the Properties that are used at the Properties in compliance with all Environmental Laws and in a manner that does not result in contamination of any Property or in a Material Adverse Effect.

“Increased Costs” has the meaning set forth in Section 1.4(e).

“Indebtedness” means the Principal Indebtedness, together with interest and all other monetary obligations and liabilities of Borrower under the Loan Documents, including all transaction costs, Yield Maintenance Premiums (to the extent payable hereunder), late fees and other amounts due or to become due to Lender pursuant to this Agreement, under the Notes or in accordance with any of the other Loan Documents, and all other amounts, sums and expenses reimbursable by Borrower to Lender hereunder or pursuant to the Notes or any of the other Loan Documents.

“Indemnified Parties” has the meaning set forth in Section 9.17.

“Independent Director” of any corporation or limited liability company means an individual who is provided by CT Corporation, Corporation Service Company, Delaware Trust, National Registered Agents, Inc., Wilmington Trust Company, Stewart Management Company, Lord Securities Corporation or, if none of those companies is then providing professional independent directors or managers, another nationally-recognized company reasonably approved by Lender, in each case that is not an affiliate of Borrower or Property Owner and that provides professional independent directors or managers and other corporate services in the ordinary course of its business, and which individual is duly appointed as a member of the board of directors of such corporation or limited liability company or as a “manager” of such limited liability company within the meaning of Section 18-101(10) of the Delaware Limited Liability Company Act and is not, and has never been, and will not while serving as Independent Director be, any of the following:

(i) a member (other than an independent, non-economic “springing” member), partner, equityholder, manager, director, officer or employee of such corporation or limited liability company or any of its equityholders or affiliates (other than as an independent director or manager of an affiliate of such corporation or limited liability company that is not in the direct chain of ownership of such corporation or limited liability company and that is required by a creditor to be a single purpose bankruptcy remote entity, provided that such independent director or manager is employed by a company that routinely provides professional independent directors or managers);

11

(ii) a creditor, supplier or service provider (including provider of professional services) to such corporation or limited liability company or any of its equityholders or affiliates (other than a nationally recognized company that routinely provides professional independent managers or directors and that also provides lien search and other similar services to such corporation or limited liability company or any of its equityholders or affiliates in the ordinary course of business);

(iii) a family member of any such member, partner, equityholder, manager, director, officer, employee, creditor, supplier or service provider; or

(iv) a Person that controls (whether directly, indirectly or otherwise) any of (i), (ii) or (iii) above.

A natural person who otherwise satisfies the foregoing definition other than subparagraph (i) by reason of being the Independent Director of a Single-Purpose Entity affiliated with the corporation or limited liability company in question shall not be disqualified from serving as an Independent Director of such corporation or limited liability company, provided that the fees that such natural person earns from serving as Independent Director of affiliates of such corporation or limited liability company in any given year constitute in the aggregate less than five percent of such natural person’s annual income for that year. The same natural persons may not serve as Independent Directors of a corporation or limited liability company and, at the same time, serve as Independent Directors of an equityholder or member of such corporation or limited liability company.

“Insurance Requirements” means, collectively, (i) all material terms of any insurance policy required pursuant to this Agreement or the Mortgage Loan Agreement and (ii) all material regulations and then-current standards applicable to or affecting any of the Properties or any portion thereof which may, at any time, be recommended by the board of fire underwriters, if any, having jurisdiction over any of the Properties.

“Intercreditor Agreement” has the meaning set forth in Section 9.33.

“Interest Accrual Period” means each period from and including the 15th day of a calendar month through and including the 14th day of the immediately succeeding calendar month; provided, that, prior to a Securitization, Lender shall have the right, in connection with a change in the Payment Date in accordance with the definition thereof, to make a corresponding change to the Interest Accrual Period. Notwithstanding the foregoing, the first Interest Accrual Period shall commence on and include the Closing Date.

“Interest Rate” means 12.5% per annum.

“Irrevocable Redirection Letter” means that certain Irrevocable Redirection Letter, dated as of the date hereof, from Property Owner to Mortgage Lender, and acknowledged and agreed to by Borrower, Lender and Mortgage Lender.

12

“Lead Lender” means Brigade Leveraged Capital Structures Fund Ltd. or, from time to time, a single Lender that is either then the sole Lender or has otherwise been designated as the replacement Lead Lender by the then current Lead Lender.

“Lease” means any lease (including, without limitation, the Master Lease), license, letting, concession, occupancy agreement, sublease to which Property Owner, Master Tenant or any other Person is a party or has a consent right, or other agreement (whether written or oral and whether now or hereafter in effect) under which Property Owner and Master Tenant is a lessor, sublessor, licensor or other grantor existing as of the Closing Date or thereafter entered into by Property Owner and Master Tenant, in each case pursuant to which any Person is granted a possessory interest in, or right to use or occupy all or any portion of any space in any of the Properties, and every modification or amendment thereof, and every guarantee of the performance and observance of the covenants, conditions and agreements to be performed and observed by the other party thereto.

“Legal Requirements” means all governmental statutes, laws, rules, orders, regulations, ordinances, judgments, decrees and injunctions of Governmental Authorities (including Environmental Laws and zoning restrictions) affecting Borrower, Property Owner, Sponsor, Master Tenant, the Properties or any other Collateral or any portion thereof or the construction, ownership, use, alteration or operation thereof, or any portion thereof (whether now or hereafter enacted and in force), and all permits, licenses and authorizations and regulations relating thereto.

“Lender” has the meaning set forth in the first paragraph of this Agreement and in Section 9.7.

“Lending Parties” has the meaning set forth in Section 9.23(a).

“Lien” means any mortgage, lien (statutory or other), pledge, hypothecation, assignment, security interest, restrictive covenant, easement, or any other encumbrance on or affecting any Mortgage Loan Collateral or Collateral or any portion thereof, or any interest therein (including any conditional sale or other title retention agreement, any sale-leaseback, any financing lease or similar transaction having substantially the same economic effect as any of the foregoing, the filing of any financing statement or similar instrument under the Uniform Commercial Code or comparable law of any other jurisdiction, and mechanics’, materialmen’s and other similar liens and encumbrances, as well as any option to purchase, right of first refusal, right of first offer or similar right).

“Loan” has the meaning set forth in Section 1.1(a).

“Loan Amount” means Eighty-Eight Million and No/100 Dollars ($88,000,000).

“Loan Documents” means this Agreement, the Note, the Pledge Agreement (and related financing statements), the Environmental Indemnity, the Subordination of Domestic Services Agreement, the Guaranty, the Irrevocable Redirection Letter and all other agreements, instruments, certificates and documents necessary to effectuate the granting to Lender of Liens on the Collateral or otherwise in satisfaction of the requirements of this Agreement or the other documents listed above or hereafter entered into by Lender and Borrower in connection with the Loan, as all of the aforesaid may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance herewith.

13

“Lockbox Account” has the meaning set forth in the Mortgage Loan Agreement.

“Lockbox Account Agreement” has the meaning set forth in Section 3.1(a).

“Loss Proceeds” means amounts, awards or payments payable to Borrower, Property Owner, Lender and/or Mortgage Lender in respect of all or any portion of any Property in connection with a Casualty or Condemnation thereof (after the deduction therefrom and payment to Borrower, Property Owner, Lender and/or Mortgage Lender, respectively, of any and all reasonable expenses incurred by such Persons in the recovery thereof, including all attorneys’ fees and disbursements, the fees of insurance experts and adjusters and the costs incurred in any litigation or arbitration with respect to such Casualty or Condemnation).

“Mandatory Mezzanine Prepayment” means any and all (i) Available Excess Cash, (ii) Escrow Refunds and (iii) Excess Release Proceeds.

“Master Lease” means that certain Second Amended and Restated Master Lease, dated as of the date hereof, by and between Borrower, as landlord, and Master Tenant, as tenant, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

“Master Lease Rents” shall mean all amounts payable to Borrower on account of or by virtue of the Master Lease, but, for avoidance of doubt, excluding any Ground Rent.

“Master Tenant” means Toys “R” Us-Delaware, Inc., together with its permitted successors and assigns.

“Material Adverse Effect” means a material adverse effect upon (i) Property Owner’s title to any Property and/or Borrower’s title to the Collateral, (ii) the ability of the Properties to generate net cash flow sufficient to service the Loan and the Mortgage Loan, (iii) the ability of Borrower, Property Owner or Sponsor to perform any material provision of any Loan Document or Mortgage Loan Document, as the case may be, (iv) Lender’s ability to enforce and derive the principal benefit of the security intended to be provided by the Pledge Agreement and the other Loan Documents, or (v) the value of the Collateral, or the value, use or operation of any individual Property or the operation or occupancy thereof.

“Material Agreements” means each contract and agreement (other than Leases, the Domestic Services Agreement and any contract or agreement for financial and consulting services entered into on an arm’s length basis and having commercially reasonable, market terms and pursuant to which at least one other Person other than Property Owner or Borrower is an obligor) entered into by Borrower or Property Owner, or otherwise imposing obligations on Borrower or Property Owner, under which Borrower or Property Owner would have the obligation to pay more than $500,000 per annum or that cannot be terminated by Borrower or Property Owner without cause upon 60 days’ notice or less without payment of a termination fee, or that is with an affiliate of Borrower or Property Owner.

14

“Material Alteration” means any Alteration to be performed by or on behalf of Borrower or Property Owner at any of the Properties that (a) is reasonably expected to result in a Material Adverse Effect with respect to the applicable Property, or (b) is reasonably expected to cost in excess of the Threshold Amount, as determined by an independent architect (except for Alterations in connection with (i) Tenant Improvements under and pursuant to Leases existing as of the Closing Date (pursuant to the terms thereof in existence as of the Closing Date) or Leases thereafter entered into in accordance with this Agreement, (ii) Alterations by Tenants pursuant to Leases that are permitted or do not require landlord’s approval or funds of landlord, in each case under the applicable Lease, (iii) the remediation of any Deferred Maintenance Condition in accordance with the Mortgage Loan Agreement, (iv) restoration of a Property following a Casualty or Condemnation in accordance with the Mortgage Loan Agreement), (v) any Alterations required pursuant to applicable law, (vi) Alterations included on any Approved Annual Budget and (vii) non-structural, cosmetic Alterations to the Property, such as painting, carpeting, and installation of tenant fixtures).

“Material Sublease Period” means any period during which twenty-five percent (25%) or more of the rentable square feet of the Properties, in the aggregate, are subject to a sublease between Master Tenant, as landlord, and a subtenant, as tenant.

“Maturity Date” means the Payment Date in November, 2019, as same may be extended in accordance with Section 1.1(d), or such earlier date as may result from acceleration of the Loan in accordance with this Agreement.

“Mezzanine Loan Permitted Encumbrances” means, collectively, the Liens created by the Loan Documents.

“Moody’s” means Moody’s Investors Service, Inc. and its successors.

“Morningstar” means Morningstar Credit Ratings, LLC or its applicable affiliate, and its successors.

“Mortgage” has the meaning set forth in the Mortgage Loan Agreement.

“Mortgage Lender” means, collectively, Goldman Sachs Mortgage Company, a New York limited partnership, and Bank of America, N.A., a national banking association, or any successor or assign thereof as “Lender” under and as defined in the Mortgage Loan Agreement.

“Mortgage Loan” means that certain mortgage loan made on the date hereof by Mortgage Lender to Property Owner.

“Mortgage Loan Agreement” means that certain Loan Agreement, dated as of the date hereof, by and among Mortgage Lender and Property Owner, pursuant to which the Mortgage Loan was made as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance with this Agreement.

“Mortgage Loan Cash Management Account” means the “Cash Management Account” as defined in the Mortgage Loan Agreement.

15

“Mortgage Loan Cash Management Agreement” means the “Cash Management and Control Agreement” as defined in the Mortgage Loan Agreement.

“Mortgage Loan Collateral” means the “Collateral” as defined in the Mortgage Loan Agreement.

“Mortgage Loan Collateral Accounts” means the “Collateral Accounts” as defined in the Mortgage Loan Agreement.

“Mortgage Loan Documents” means the “Loan Documents” as defined in the Mortgage Loan Agreement.

“Mortgage Loan Event of Default” means an “Event of Default” under and as defined in the Mortgage Loan Agreement.

“Mortgage Loan Permitted Encumbrances” means “Permitted Encumbrances” as defined in the Mortgage Loan Agreement.

“Net Operating Income” has the meaning set forth in the Mortgage Loan Agreement.

“Net Sales Proceeds” has the meaning set forth in the Mortgage Loan Agreement.

“Nonconsolidation Opinion” means the opinion letter, dated the Closing Date, delivered by Borrower’s counsel to Lender and addressing issues relating to substantive consolidation in bankruptcy.

“Northville Condominium” means the Woodridge Grove, Wayne County Condominium Subdivision governing Store # 9249 in Northville, Michigan.

“Note(s)” means, individually and/or collectively, Note A-1, Note A-2, Note A-3, Note A-4, Note A-5, Note A-6, Note A-7, Note A-8, Note A-9 and Note A-10, which collectively evidence the Loan.

“Note A-1” means that certain Mezzanine Promissory Note A-1 in the original principal amount of $25,000,000.00, dated as of the Closing Date, made by Borrower to Lead Lender, as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note A-2” means that certain Mezzanine Promissory Note A-2 in the original principal amount of $23,500,000.00, dated as of the Closing Date, made by Borrower to Brigade Credit Fund II Ltd., as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note A-3” means that certain Mezzanine Promissory Note A-3 in the original principal amount of $15,000,000.00, dated as of the Closing Date, made by Borrower to Brigade Structured Credit Fund Ltd., as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

16

“Note A-4” means that certain Mezzanine Promissory Note A-4 in the original principal amount of $6,100,000.00, dated as of the Closing Date, made by Borrower to Los Angeles County Employees Retirement Association, as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note A-5” means that certain Mezzanine Promissory Note A-5 in the original principal amount of $5,500,000.00, dated as of the Closing Date, made by Borrower to Brigade Distressed Value Master Fund Ltd., as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note A-6” means that certain Mezzanine Promissory Note A-6 in the original principal amount of $3,200,000.00, dated as of the Closing Date, made by Borrower to The Coca-Cola Company Master Retirement Trust, as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note A-7” means that certain Mezzanine Promissory Note A-7 in the original principal amount of $2,800,000.00, dated as of the Closing Date, made by Borrower to FedEx Corporation Employees’ Pension Trust, as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note A-8” means that certain Mezzanine Promissory Note A-8 in the original principal amount of $2,700,000.00, dated as of the Closing Date, made by Borrower to Delta Master Trust, as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note A-9” means that certain Mezzanine Promissory Note A-9 in the original principal amount of $2,200,000.00, dated as of the Closing Date, made by Borrower to Brigade Opportunistic Credit Fund—ICIP, Ltd., as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Note A-10” means that certain Mezzanine Promissory Note A-9 in the original principal amount of $2,000,000.00, dated as of the Closing Date, made by Borrower to Brigade Opportunistic Credit Fund 16 LLC, as the same may be replaced by multiple notes and as otherwise assigned (in whole or in part), amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“OFAC List” means the list of specially designated nationals and blocked persons subject to financial sanctions that is maintained by the U.S. Treasury Department, Office of Foreign Assets Control and any other similar list maintained by the U.S. Treasury Department,

17

Office of Foreign Assets Control pursuant to any applicable governmental statutes, laws, rules, orders, regulations, ordinances, judgments, decrees and injunctions of Governmental Authorities, including trade embargo, economic sanctions, or other prohibitions imposed by Executive Order of the President of the United States. The OFAC List currently is accessible at http://www.treasury.gov/ofac/downloads/t11sdn.pdf.

“Officer’s Certificate” means a certificate delivered to Lender that is signed by an authorized officer of Borrower and certifies the information therein to such officer’s actual knowledge.

“Other Connection Taxes” means, with respect to any Lender or Person to whom there has been an Assignment or Participation of a Loan, as applicable, taxes imposed as a result of a present or former connection between such Lender or Person and the jurisdiction imposing such tax (other than connections arising from such Lender or Person having executed, delivered, become a party to, performed its obligations under, received payments under, or engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in any Loan or Loan Document).

“PACE Debt” means any amounts owed in respect of energy retrofit lending programs, commonly known as “PACE loans”. For avoidance of doubt, PACE Debt is not Permitted Debt and Liens securing PACE Debt are not Permitted Encumbrances.

“Par Prepayment Date” means the first Payment Date following the 18-month anniversary of the Closing Date.

“Participant Register” has the meaning set forth in Section 9.7(c).

“Participation” has the meaning set forth in Section 9.7(b).

“PATRIOT Act” means the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act (Title III of Pub. L. 107-56) (signed into law October 26, 2001), as amended from time to time.

“Payment Date” means, with respect to each Interest Accrual Period, the ninth day of the calendar month in which such Interest Accrual Period ends; provided, that prior to a Securitization, Lender shall have the right to change the Payment Date so long as a corresponding change to the Interest Accrual Period is also made. Whenever a Payment Date is not a Business Day, the entire amount that would have been due and payable on such Payment Date shall instead be due and payable on the immediately preceding Business Day.

“Permits” means all licenses, permits, variances and certificates used in connection with the ownership, operation, use or occupancy of each of the Properties (including certificates of occupancy, business licenses, state health department licenses, licenses to conduct business).

18

“Permitted Debt” means:

(a) with respect to Property Owner, the “Permitted Debt” as defined in the Mortgage Loan Agreement as in effect on the date hereof; and

(b) (i) the Indebtedness and (ii) items related thereto, including, without limitation, indebtedness not to exceed (1) that which is required for Borrower’s on-going administration and compliance with the Loan Documents plus (2) $10,000, and in each case of (1) and (2) is not material in the aggregate that is incidental to Borrower’s activities as a member of Property Owner.

“Permitted Encumbrances” means collectively, the Mortgage Loan Permitted Encumbrances and the Mezzanine Loan Permitted Encumbrances.

“Permitted Investments” has the meaning set forth in the Mortgage Loan Agreement (except that any consent of Mortgage Lender required thereunder shall for purposes hereof also require the consent of Lender).

“Person” means any natural person, corporation, limited liability company, partnership, joint venture, estate, trust, unincorporated association or Governmental Authority and any fiduciary acting in such capacity on behalf of any of the foregoing.

“Plan Assets” means assets, within the meaning of 29 C.F.R. Section 2510.3-101, as modified by Section 3(42) of ERISA, of any (i) employee benefit plan (as defined in Section 3(3) of ERISA) subject to Title I of ERISA, (ii) plan (as defined in Section 4975(e)(1) of the Code) subject to Section 4975 of the Code, or (iii) governmental plan (as defined in Section 3(32) of ERISA) subject to federal, state or local laws, rules or regulations substantially similar to Title I of ERISA or Section 4975 of the Code.

“Pledge Agreement” means that certain Pledge and Security Agreement, dated as of the date hereof, executed by Borrower in favor of Lender, as the same may from time to time be amended, restated, replaced, supplemented or otherwise modified in accordance herewith.

“Policies” has the meaning set forth in the Mortgage Loan Agreement.

“Principal Indebtedness” means the principal balance of the Loan outstanding from time to time.

“Principal Release Price” means in connection with a release of the portion of the Collateral relating to a Property pursuant to Section 2.2 of this Agreement, an amount equal to (i) if less than $44,000,000 has been prepaid pursuant to Section 2.2 of this Agreement, then one hundred ten percent (110%) of the Allocated Loan Amount of such Property being released, and (ii) if $44,000,000 or more has been prepaid pursuant to Section 2.2 of this Agreement, then one hundred fifteen percent (115%) of the Allocated Loan Amount of such Property being released thereafter.

“Prior Loan” has the meaning set forth in Section 4.17(c).

“Prohibited Change of Control” means the occurrence of either or both of the following: (i) the failure of Property Owner and/or Borrower to be Controlled by Sponsor or one or more Qualified Equityholders (individually or collectively), or (ii) the failure of Master Tenant, Borrower or Property Owner to be Controlled by Sponsor or the same Qualified Equityholder(s) that Control Borrower.

19

“Prohibited Pledge” has the meaning set forth in Section 7.1(f).

“Prohibited Use” means any use or proposed use of any Property or portion thereof for the following:

(i) any mortuary, funeral home or crematorium;

(ii) any massage parlor appealing to prurient interests;

(iii) any adult book or film store, adult entertainment nightclub or similar business appealing to prurient interests or selling or displaying pornographic or obscene materials;

(iv) any motor fuel or other hydrocarbon filling or dispensing station (other than a business that sells pre-filled propane tanks or dispenses and sells propane from an above-ground propane storage tank located on such Property as an ancillary part of its business and in accordance with applicable Legal Requirements);

(v) any manufacturing, distilling, refining, smelting, agricultural (other than the sale of agricultural items and maintenance area devoted to the sale of garden items, plants, shrubs and gardening and farming supplies and tools) or mining operation;

(vi) any living quarters, sleeping apartments or lodging rooms;

(vii) any animal raising facility (except that this provision shall not prohibit a veterinary hospital or pet shops or the maintenance of live animals for sale or the provision of veterinary services in conjunction with the operation of any such pet shop);

(viii) any flea market, amusement park, pool or billiard hall, dance hall or discotheque, carnival, circus, casino, bingo parlor, gaming hall, off-track betting parlor or other gambling operation or facility (except that a business may sell sale of lottery tickets and similar gaming activities as an ancillary part of its business and a restaurant may contain an arcade or similar facility for its customers, provided that such arcade or similar facility is not the primary use of the Property for example, Dave & Buster’s, Chuck E. Cheese’s and such similar establishments are permitted uses);

(ix) any central laundry, dry cleaning facility or laundromat;

(x) any use which produces explosion or other damaging or dangerous hazard (including the storage, display or sale of explosives or fireworks) (but excluding the sale of propane as permitted by clause (iv) above);

(xi) any use which violates any of the Permitted Encumbrances; or

20

(xii) any so called “head shop,” “marijuana dispensary” or other similar business engaged in the sale of marijuana, rolling paper or other drug paraphernalia.

“Properties” means the real property described on Schedule A, together with all buildings and other improvements thereon and all personal property appurtenant thereto; and “Property” means an individual property included in the Properties or all Properties collectively, as the context may require.

“Property Owner” means Toys “R” Us Property Company II, LLC, a Delaware limited liability company, together with its successors and permitted assigns.

“Qualified Equityholder” means (i) Sponsor, (ii) Bain Capital Partners, LLC, (iii) Kohlberg Kravis Roberts & Co. L.P., (iv) Vornado Realty Trust, (v) any Person approved by Lender with respect to which the Rating Condition is satisfied, or (vi) a bank, saving and loan association, investment bank, insurance company, trust company, commercial credit corporation, pension plan, pension fund or pension advisory firm, mutual fund, government entity or plan, real estate company, investment fund or an institution substantially similar to any of the foregoing or any wholly-owned subsidiary of such Person which is Controlled by such Person, provided in each case under this clause (vi) that such Person (x) has total assets (in name or under management) in excess of $1,000,000,000 and (except with respect to a pension advisory firm or similar fiduciary) capital/statutory surplus or shareholder’s equity in excess of $500,000,000 (in both cases, exclusive of the Properties), and (y) is regularly engaged in the business of owning and operating comparable properties, or (vii) with respect to clauses (i) through (vi) above, any wholly-owned subsidiary of such Person which is Controlled by such Person.

“Rating Agency” means, prior to the final Securitization of the Loan, each of S&P and Morningstar, or any other nationally-recognized statistical rating agency that has been designated by Lender and, after the final Securitization of the Loan, shall mean any of the foregoing that have rated and continue to rate any of the Certificates (excluding unsolicited ratings).

“Rating Condition” means, with respect to any proposed action, the receipt by Lender of confirmation in writing from each of the Rating Agencies that continues to rate the outstanding Certificates that such action shall not result, in and of itself, in a downgrade, withdrawal, or qualification of any rating then assigned to any outstanding Certificates; except that if all or any portion of the Loan has not been Securitized pursuant to a Securitization rated by the Rating Agencies, then “Rating Condition” shall instead mean the receipt of prior written approval of both (x) the applicable Rating Agencies (if and to the extent that any portion of the Loan has been Securitized pursuant to a Securitization or series of Securitizations rated by such Rating Agencies and such Rating Agencies continue to rate the outstanding Certificates), and (y) Lender in its sole discretion (unless this Agreement otherwise provides that Lender will act in its reasonable discretion). No Rating Condition shall be regarded as having been satisfied unless and until any conditions imposed on the effectiveness of any confirmation from any Rating Agency shall have been satisfied. Lender shall have the right in its sole discretion to waive a Rating Condition requirement with respect to any Rating Agency that Lender determines has declined to review the applicable proposal.

21

“Regulatory Change” means any change after the Closing Date in federal, state or foreign laws or regulations or the adoption or the making, after such date, of any interpretations, directives or requests applying to a class of banks or companies controlling banks, including Lender, of or under any federal, state or foreign laws or regulations (whether or not having the force of law) by any court or governmental or monetary authority charged with the interpretation or administration thereof.

“Release” with respect to any Hazardous Substance means any release, deposit, discharge, emission, leaking, leaching, spilling, seeping, migrating, injecting, pumping, pouring, emptying, escaping, dumping, or other disposing of Hazardous Substances into or through the indoor or outdoor environment, and “Released” has the meaning correlative thereto.

“Release Deposit Amount” has the meaning set forth in Section 2.2(c).

“Rent Instruction” means that certain obligation contained in the Master Lease with respect to payments of Master Lease Rent directly into the Lockbox Account.

“Revenues” has the meaning set forth in the Mortgage Loan Agreement.

“S&P” means Standard & Poor’s Ratings Services, and its successors.

“Securitization” means a transaction in which, in the case of the Loan, all or any portion of the Loan is deposited into one or more trusts which issue Certificates to investors, or a similar transaction, and, in the case of the Mortgage Loan, all or any portion of the Mortgage Loan is deposited into one or more trusts which issue Certificates to investors, or a similar transaction; and the terms “Securitize” and “Securitized” have meanings correlative to the foregoing.

“Servicer” means the entity or entities appointed by Lender from time to time to serve as servicer and/or special servicer of the Loan. If at any time no entity is so appointed, the term “Servicer” shall be deemed to refer to Lender.

“Severed Loan Documents” has the meaning set forth in Section 7.2(e).

“Single-Purpose Entity” means (x) with respect to Property Owner, a “Single-Purpose Entity” as such term is defined in the Mortgage Loan Agreement and (y) with respect to Borrower, a Person that:

(a) was formed under the laws of the State of Delaware solely for the purpose of acquiring and holding an ownership interest in Property Owner;

(b) does not engage in any business unrelated to its ownership interest in Property Owner;

(c) does not own any assets other than those related to its ownership interest in Property Owner (and does not and will not own any assets on which Lender does not have a Lien, other than excess cash that has been released to Borrower by Property Owner in accordance with the terms of the Mortgage Loan Agreement);

22

(d) does not have any Debt other than Permitted Debt;

(e) maintains books, accounts, records and financial statements that are separate and apart from those of any other Person and does not list its assets as assets on the financial statement of any other Person (except that such Person’s financial position, assets, results of operations and cash flows may be included in the consolidated financial statements of an Affiliate of such Person in accordance with GAAP, provided that (i) appropriate notation is made on such consolidated financial statements to indicate the separateness of such Person from such Affiliate and to indicate that such Person’s assets and credit are not available to satisfy the debts or other obligations of such Affiliate or any other Person and (ii) such assets shall also be listed on such Person’s own separate balance sheet);

maintains stationery, invoices and checks (if any) bearing its own name;

(g) is subject to and complies with all of the limitations on powers and separateness requirements set forth in the organizational documentation of such Person as of the Closing Date;

(h) holds itself out as being a Person separate and apart from each other Person and does not identify itself as a division or part of another Person and holds itself out of the public as a legal entity separate and distinct from any other Person;

(i) conducts its business solely in its own name;

(j) corrects any misunderstanding actually known to it regarding its separate identity, maintains an arms’-length relationship with its Affiliates and only enters into a transaction, contract or agreement with an Affiliate in the ordinary course of business upon terms and conditions that are intrinsically fair, commercially reasonable and substantially similar to those that would be available on an arms’-length basis with unaffiliated third parties;

(k) pays its own liabilities out of its own funds, including the salaries of its own employees, if any (provided that the foregoing shall not require such Person’s equityholders to make any additional capital contributions or loans to such Person) and fairly and reasonably allocates any overhead that is shared with an Affiliate, including paying for shared office space and services performed by any officer or employee of an Affiliate;

(l) maintains a sufficient number of employees, if any, in light of its contemplated business operations;

(m) conducts its business so that the assumptions made with respect to it that are contained in the Nonconsolidation Opinion shall at all times be true and correct in all material respects;

(n) maintains its assets in such a manner that it will not be costly or difficult to segregate, ascertain or identify its individual assets from those of any other Person;

23

(o) observes all applicable entity-level formalities in all material respects;

(p) does not commingle its assets with those of any other Person, and holds its assets in its own name;

(q) does not assume, guarantee or become obligated for the debts or obligations of any other Person, and does not hold out its assets or credit as being available to satisfy the debts, obligations or securities of others;

(r) does not hold out its assets or credit of any Affiliate as being available to satisfy its debts or obligations;

(s) does not acquire obligations or securities of its direct or indirect equityholders;

(t) does not pledge its assets for the benefit of any other Person and does not make any loans or advances to any other Person;

(u) intends to maintain adequate capital in light of its contemplated business operations (provided that the foregoing shall not require such Person’s partners, members or shareholders to make any additional capital contributions or loans to such Person);

(v) has two Independent Directors and has organizational documents that (i) provide that the Independent Directors shall consider only the interests of Borrower, including its creditors, and shall have no fiduciary duties to Borrower’s equityholders (except to the extent of their respective interests in Borrower), and (ii) prohibit the replacement of any Independent Director without Cause and without giving at least two Business Days’ prior written notice to Lender and the Rating Agencies (except in the case of the death, legal incapacity, or voluntary non-collusive resignation of an Independent Director, in which case no prior notice to Lender or the Rating Agencies shall be required in connection with the replacement of such Independent Director with a new Independent Director that is provided by any of the companies listed in the definition of “Independent Director”);

(w) if it is a single member limited liability company, has organizational documents that provide that upon the occurrence of any event that causes it to have no members while the Loan is outstanding, at least one of its Independent Directors shall automatically be admitted as its sole member and shall preserve and continue its existence without dissolution;

(x) files its own tax returns separate from those of any other Person, except to the extent it is not required to file tax returns under applicable law, and pays any taxes required to be paid by it under applicable law only from its own funds; and

(y) has by-laws or an operating agreement which provides that, for so long as the Loan is outstanding, such Person shall not take or consent to any of the following actions except to the extent expressly permitted in this Agreement and the other Loan Documents:

24