Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION EEI CONFERENCE NOV 2016 - GREAT PLAINS ENERGY INC | a8-kinvestorpresentationee.htm |

GREAT PLAINS ENERGY

EEI INVESTOR

PRESENTATION

November 2016

OUR

FUTURE

FOCUS

Exhibit 99.1

2016 EEI INVESTOR PRESENTATION

FORWARD-LOOKING STATEMENTS

2

Statements made in this report that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as of the date

when made. Forward-looking statements include, but are not limited to, statements relating to Great Plains Energy’s proposed acquisition of Westar Energy, Inc.

(Westar), the outcome of regulatory proceedings, cost estimates of capital projects, adjusted earnings guidance for 2016 and other matters affecting future

operations. In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great Plains Energy and KCP&L are providing a

number of important factors that could cause actual results to differ materially from the provided forward-looking information. These important factors include: future

economic conditions in regional, national and international markets and their effects on sales, prices and costs; prices and availability of electricity in regional and

national wholesale markets; market perception of the energy industry, Great Plains Energy and KCP&L; changes in business strategy, operations or development

plans; the outcome of contract negotiations for goods and services; effects of current or proposed state and federal legislative and regulatory actions or

developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the

Companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental

matters including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates and

credit spreads and in availability and cost of capital and the effects on derivatives and hedges, nuclear decommissioning trust and pension plan assets and costs;

impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties

to satisfy their contractual commitments; impact of terrorist acts, including, but not limited to, cyber terrorism; ability to carry out marketing and sales plans; weather

conditions including, but not limited to, weather-related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; the

inherent uncertainties in estimating the effects of weather, economic conditions and other factors on customer consumption and financial results; ability to achieve

generation goals and the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of

generation, transmission, distribution or other projects; Great Plains Energy's ability to successfully manage its transmission joint venture or to integrate the

transmission joint ventures of Westar; the inherent risks associated with the ownership and operation of a nuclear facility including, but not limited to, environmental,

health, safety, regulatory and financial risks; workforce risks, including, but not limited to, increased costs of retirement, health care and other benefits; the ability of

Great Plains Energy to obtain the regulatory approvals necessary to complete the anticipated acquisition of Westar; the risk that a condition to the closing of the

anticipated acquisition of Westar or the committed debt or equity financing may not be satisfied or that the anticipated acquisition may fail to close; the failure to

obtain, or to obtain on favorable terms, any financings necessary to complete or permanently finance the anticipated acquisition of Westar and the costs of such

financing; the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted relating to the anticipated acquisition of

Westar; the costs incurred to consummate the anticipated acquisition of Westar; the possibility that the expected value creation from the anticipated acquisition of

Westar will not be realized, or will not be realized within the expected time period; the credit ratings of Great Plains Energy following the anticipated acquisition of

Westar; disruption from the anticipated acquisition of Westar making it more difficult to maintain relationships with customers, employees, regulators or suppliers; the

diversion of management time and attention on the proposed transactions; and other risks and uncertainties.

ADJUSTED EPS NON-GAAP FINANCIAL MEASURES

2016 EEI INVESTOR PRESENTATION 3

In addition to earnings available for common shareholders, Great Plains Energy's management uses adjusted earnings (non-GAAP) to evaluate earnings

without the impact of costs to achieve the anticipated acquisition of Westar. Adjusted earnings excludes certain costs, expenses, gains and losses

resulting from the anticipated acquisition. This information is intended to enhance an investor's overall understanding of results. Adjusted earnings is used

internally to measure performance against budget and in reports for management and the Board of Directors. Adjusted earnings is a financial measure

that is not calculated in accordance with GAAP and may not be comparable to other companies’ presentations or more useful than the GAAP information

provided elsewhere.

Great Plains Energy provides its earnings guidance based on a non-GAAP measure and does not provide the most directly comparable GAAP measure or

a reconciliation to the most directly comparable GAAP measure due to the inherent difficulty in forecasting and quantifying certain amounts that are

necessary for such reconciliation, including certain costs, expenses, gains and losses resulting from the anticipated acquisition of Westar.

Continue to promote the economic strength of the region,

improve the customer experience and grow earnings

OUR STRATEGIC PRIORITIES

EXECUTING OUR PLAN FOR CONTINUED GROWTH

BEST-IN-CLASS

OPERATIONS

CUSTOMER

ENGAGEMENT

• Disciplined execution to

deliver reliable and low

cost power

• Focused on earning our

allowed return by actively

managing regulatory lag

• Proactive economic

development

• Transition toward

sustainable energy portfolio

• Responsive to changing

customer expectations

− Technology investments

that facilitate more

informed customer

interaction

− Expand comprehensive

suite of energy-related

products and services

TARGETED

INVESTMENTS

• Balanced strategic growth

initiatives through national

transmission opportunities

and flexibility for

opportunistic growth

• Acquisition of Westar

expected to drive

incremental investment

opportunities

4 2016 EEI INVESTOR PRESENTATION

SUCCESSFUL INTEGRATION OF WESTAR

Combination of Great Plains Energy and Westar Energy creates a leading Midwest utility better positioned to serve customers,

meet the region’s energy needs, optimize investments and achieve improved and more stable, long-term financial returns

COMPELLING STRATEGIC AND GEOGRAPHIC FIT

Great Plains Energy

Power Plants

Transmission Lines:

Projects

Operating

Electric Territory

Headquarters

Westar

Power Plants

Electric Territory

Headquarters

Shared Power

Plants

COMBINED SERVICE TERRITORY1 FUTURE CORPORATE HEADQUARTERS

KEY OPERATING METRICS

Source: SNL, Great Plains Energy and Westar Investor Presentations.

1. Excludes Great Plains’ power plant in the Mississippi Delta and Westar’s Spring Creek Energy Center in Logan County, OK.

2. Estimated rate base based on ordered and settled rate cases.

3. Excludes 920MW of purchased power.

Great

Plains

Energy Westar Combined

Rate Base ($B)2 $6.7 $7.1 $13.8

Electric Customers 853,000 702,000 1,555,000

Generation Capacity

(MW)

6,446 6,267² 12,713

Transmission Miles 3,600 6,300 9,900

Distribution Miles 22,500 28,800 51,300

Great Plains Energy: Downtown, Kansas City, Missouri

Kansas Operations: Downtown, Topeka, Kansas

5 2016 EEI INVESTOR PRESENTATION

WESTAR ACQUISITION REMAINS ON TRACK TO CLOSE IN SPRING 2017

WE REMAIN AS CONFIDENT AS EVER ABOUT THE SIGNIFICANT VALUE THIS COMBINATION WILL

DELIVER TO SHAREHOLDERS, CUSTOMERS AND THE COMMUNITIES WE SERVE

6 2016 EEI INVESTOR PRESENTATION

Combination creates a leading Midwest utility

• Enhanced earnings stability and dividend growth profile

provides opportunities for cost savings and investment

optimization across combined company

• Consistent track record of operational excellence and

commitment to superior customer service and reliability

• Enhanced operating platform to drive cost savings and

benefits for more than 900,000 Kansas customers and

600,000 Missouri customers

• Ability to deliver more competitive rates and meet the

region’s energy needs

• Expected to maintain strong investment grade ratings with

solid free cash flow profile to facilitate investment and debt

repayment without incremental equity following the closing of

the transaction

WE REMAIN CONFIDENT ABOUT THE SIGNIFICANT V LUE THIS COMBINATION WILL

SHAREHOLDER APPROVALS

STAKEHOLDER VOTES

APPROVALS

GRANTED

GXP and WR

Shareholders √ 3Q 2016

REGULATORY APPROVALS

STAKEHOLDER FILED

APPROVAL

ANTICIPATED

Kansas √ 2Q 2017

FERC √ 1Q 2017

NRC √ 1Q 2017

U.S. DOJ/FTC

(Hart-Scott-Rodino) √ Approved

FCC 4Q 2016 4Q 2016

BASE PLAN INCREMENTAL OPPPORTUNITIES FROM

WESTAR TRANSACTION

EPS

GROWTH

TARGET

• Annualized EPS growth of 4% to 5% through

20201

• Rate base growth of 2% to 3% through 20202

• Focus on minimizing regulatory lag

• Annualized EPS growth of 6% to 8% through

20201

• Rate base growth of 3% to 4% through 20202

• Focus on minimizing regulatory lag

DIVIDEND

GROWTH

TARGET

• Dividend growth of 5% to 7% through 2020

• Dividend payout ratio of 60% to 70% through

2020

• Dividend growth of 5% to 7% through 2020

• Dividend payout ratio of 60% to 70% through

2020

TOTAL

RETURN

• Balanced total shareholder return profile

• Potential for top-quartile total shareholder return

profile

7

ENHANCED SHAREHOLDER RETURN PROFILE OVER STANDALONE PLAN

2016 EEI INVESTOR PRESENTATION

1. Based on our original 2016 EPS guidance range of $1.65 - $1.80

2. Includes the impact of bonus depreciation

Enhanced platform to deliver compelling shareholder returns

SIGNIFICANT OPPORTUNITIES FOR EFFICIENCIES

FROM COMPLEMENTARY OPERATIONS AND ADJACENT SERVICE TERRITORIES

Combination of Great Plains Energy and Westar Energy provides significant opportunities for increased

efficiency, cost savings and investment optimization across the combined company

8

Operations

~38%

Supply Chain

~32%

Shared Services

~12%

CapEx1

~18%

ESTIMATED NET EFFICIENCIES OF ~$200 MILLION IN YEAR 3 AND BEYOND

1. Includes estimated pre-tax customer cost of capital and depreciation impacts.

2016 EEI INVESTOR PRESENTATION

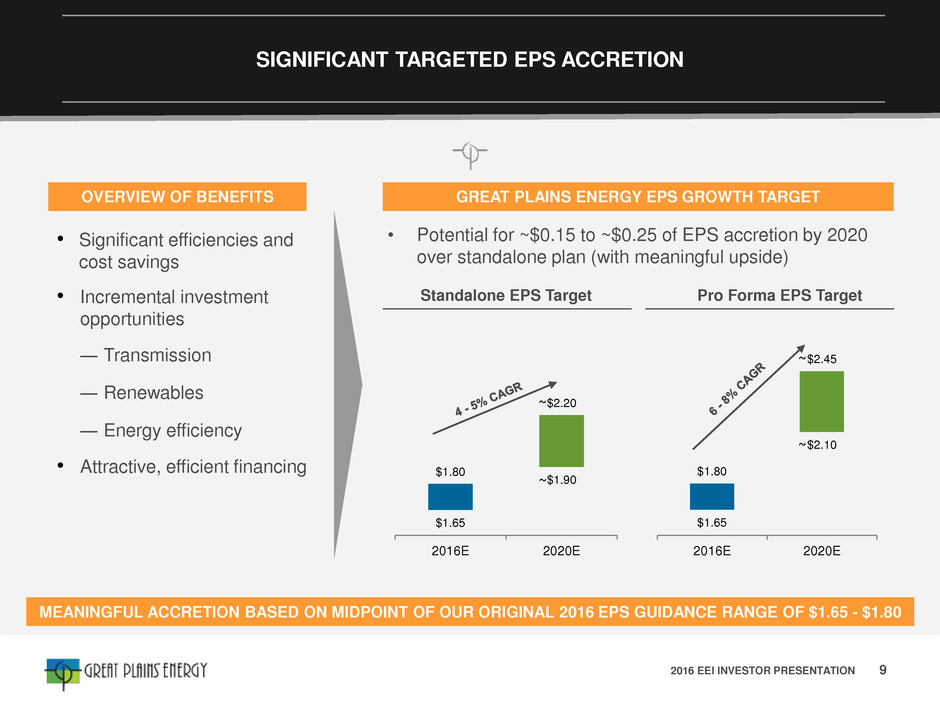

• Significant efficiencies and

cost savings

• Incremental investment

opportunities

― Transmission

― Renewables

― Energy efficiency

• Attractive, efficient financing

SIGNIFICANT TARGETED EPS ACCRETION

OVERVIEW OF BENEFITS GREAT PLAINS ENERGY EPS GROWTH TARGET

9

• Potential for ~$0.15 to ~$0.25 of EPS accretion by 2020

over standalone plan (with meaningful upside)

MEANINGFUL ACCRETION BASED ON MIDPOINT OF OUR ORIGINAL 2016 EPS GUIDANCE RANGE OF $1.65 - $1.80

Standalone EPS Target Pro Forma EPS Target

$1.65

$1.90

$1.80

$2.20

2016E 2020E

~

~

$1.65

$2.10

$1.80

$2.45

2016E 2020E

~

~

2016 EEI INVESTOR PRESENTATION

1

4

.0

%

1

3

.6

%

1

0

.1

%

8

.5

%

7

.5

%

7

.7

%

7

.4

%

8

.1

%

7

.0

%

7

.1

%

7

.2

%

5

.8

%

7

.1

%

5

.2

%

6

.4

%

5

.9

%

6

.6

%

6

.3

%

6

.1

%

6

.0

%

6

.5

%

5

.0

%

6

.0

%

5

.5

%

4

.2

%

5

.0

%

5

.7

%

4

.5

%

4

.5

%

3

.5

%

4

.2

%

4

.4

%

3

.7

%

4

.8

%

4

.0

%

3

.0

%

2

.7

%

2

.8

%

0

.7

%

0

.2

%

0

.0

%

(0

.9

)%

(9

.2

)%

2

.8

%

2

.9

%

2

.7

%

3

.0

%

3

.5

%

3

.2

%

3

.5

%

2

.7

%

3

.7

%

3

.4

%

2

.9

%

4

.2

%

2

.7

%

4

.5

%

3

.3

%

3

.7

%

2

.9

%

3

.1

%

3

.2

%

3

.3

%

2

.7

%

3

.9

%

2

.6

%

3

.1

%

4

.3

%

3

.5

%

2

.7

%

3

.7

%

3

.5

%

4

.3

%

3

.4

%

3

.2

%

3

.6

%

2

.0

%

2

.8

%

3

.5

%

3

.3

%

3

.2

%

4

.4

%

3

.7

%

3

.9

%

4

.2

%

4

.7

%

1

6

.8

%

1

6

.4

%

1

2

.7

%

1

1

.5

%

1

1

.0

%

1

0

.9

%

1

0

.9

%

1

0

.8

%

1

0

.7

%

1

0

.5

%

1

0

.2

%

1

0

.0

%

9

.8

%

9

.7

%

9

.7

%

9

.6

%

9

.6

%

9

.4

%

9

.4

%

9

.3

%

9

.2

%

8

.9

%

8

.7

%

8

.6

%

8

.6

%

8

.5

%

8

.4

%

8

.2

%

8

.0

%

7

.8

%

7

.6

%

7

.6

%

7

.4

%

6

.9

%

6

.8

%

6

.5

%

6

.0

%

6

.0

%

5

.1

%

3

.9

%

3

.9

%

3

.3

%

(4

.5

)%

EPS Growth Dividend Yield

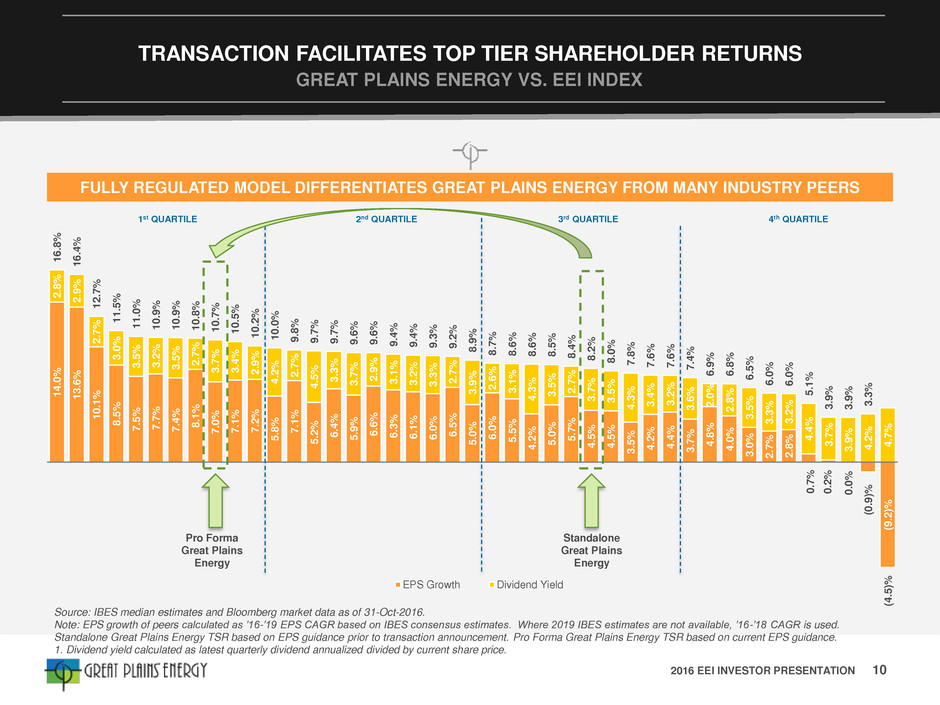

TRANSACTION FACILITATES TOP TIER SHAREHOLDER RETURNS

Source: IBES median estimates and Bloomberg market data as of 31-Oct-2016.

Note: EPS growth of peers calculated as ’16-’19 EPS CAGR based on IBES consensus estimates. Where 2019 IBES estimates are not available, ’16-’18 CAGR is used.

Standalone Great Plains Energy TSR based on EPS guidance prior to transaction announcement. Pro Forma Great Plains Energy TSR based on current EPS guidance.

1. Dividend yield calculated as latest quarterly dividend annualized divided by current share price.

GREAT PLAINS ENERGY VS. EEI INDEX

FULLY REGULATED MODEL DIFFERENTIATES GREAT PLAINS ENERGY FROM MANY INDUSTRY PEERS

Pro Forma

Great Plains

Energy

Standalone

Great Plains

Energy

4th QUARTILE 1st QUARTILE 2nd QUARTILE 3rd QUARTILE

10 2016 EEI INVESTOR PRESENTATION

$18.8

$11.8 $8.8

$12.1

$7.5 $8.7 $8.5 $8.1 $6.2 $4.3 $3.9 $4.2 $3.0

$28.8

$21.4 $21.4 $20.1

$14.7

$13.0 $12.8

$11.8

$9.1 $8.5 $6.2 $5.9 $4.5

Combined

Company

WR GXP¹

Market Cap EV

TRANSFORMATION INTO A LEADING MIDWEST UTILITY

SELECTED MID-CAP UTILITIES BY ENTERPRISE VALUE ($BN)

Source: Company filings, investor presentations, Bloomberg market data as of 31-Oct-2016.

1. GXP market cap of $4.3bn does not include new shares issued in October 2016 equity issuance.

$17.0

$13.7

$12.1 $11.8

$8.9

$7.1 $7.0 $6.6

$5.7

$4.4

$3.4 $3.3 $2.5

WR GXP

SELECTED MID-CAP UTILITIES BY CUSTOMERS (MILLIONS) SELECTED MID-CAP UTILITIES BY RATE BASE ($BN)

4.4

4.0

3.5

3.3

1.6 1.4 1.2 1.1

0.9 0.9 0.8 0.7

0.1

GXP WR Combined

Company

Combined

Company

11 2016 EEI INVESTOR PRESENTATION

PRO FORMA CREDIT METRICS

SUPPORTS INVESTMENT GRADE RATINGS

PROJECTED CASH FROM OPERATIONS / TOTAL DEBT

12

PROJECTED INTEREST COVERAGE RATIO

13 – 14%

14 – 15%

Year 1 Year 2 Year 3

15.5 – 16.5%

4.0 – 4.5x

4.5 – 5.0x

Year 1 Year 2 Year 3

4.25 – 4.75x

• Significant combined company free cash flow facilitates improving credit metrics over time

• Rating agencies confirmed solid investment grade ratings at transaction close1

1. GPE senior unsecured debt is currently rated BBB at S&P with a negative outlook and Baa2 at Moody's and under review for possible downgrade. We expect to maintain our

investment grade ratings.

2016 EEI INVESTOR PRESENTATION

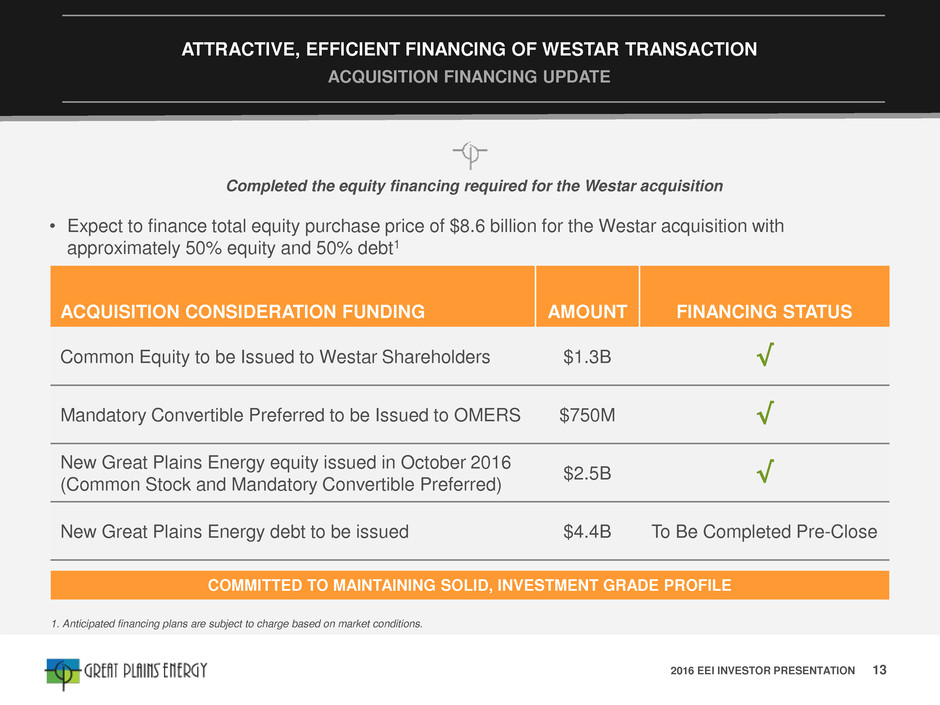

ATTRACTIVE, EFFICIENT FINANCING OF WESTAR TRANSACTION

ACQUISITION FINANCING UPDATE

13 2016 EEI INVESTOR PRESENTATION

Completed the equity financing required for the Westar acquisition

ACQUISITION CONSIDERATION FUNDING AMOUNT FINANCING STATUS

Common Equity to be Issued to Westar Shareholders $1.3B √

Mandatory Convertible Preferred to be Issued to OMERS $750M √

New Great Plains Energy equity issued in October 2016

(Common Stock and Mandatory Convertible Preferred)

$2.5B √

New Great Plains Energy debt to be issued $4.4B To Be Completed Pre-Close

COMMITTED TO MAINTAINING SOLID, INVESTMENT GRADE PROFILE

1. Anticipated financing plans are subject to charge based on market conditions.

• Expect to finance total equity purchase price of $8.6 billion for the Westar acquisition with

approximately 50% equity and 50% debt1

COMBINATION EXPANDS GEOGRAPHIC AND REGULATORY DIVERSIFICATION

1. Customer breakdown by jurisdiction based on retail sales generation for 12/31/2015.

2. KCP&L and GMO are also subject to regulation by The Federal Energy Regulatory Commission (FERC) with respect to transmission, wholesale sales and rates, and other matters.

Rate base as of 12/31/2015. KCP&L and GMO have approximately $360mm of assets and FERC transmission formula rates.

3. Westar Energy generation excludes 920MW generation under PPA, includes 480MW renewables under development. Generation capacity as of 12/31/2015.

Standalone Great Plains Energy Standalone Westar Energy Combined Company

G

eo

g

rap

h

y

b

y

C

u

st

o

me

r1

Ra

te B

a

s

e

M

ix

b

y

Juri

s

d

icti

o

n

2

Capacit

y

M

ix

(M

W

)3

MO

72%

KS

28% KS

100%

KS

60%

MO

40%

MO

67%

KS

33%

KS

81%

FERC

19%

KS

56%

MO

34%

FERC

10%

Coal

56% Natural

Gas & Oil

35%

Nuclear

9%

Renewable

1%

Coal

52% Natural

Gas & Oil

35%

Nuclear

8%

Renewable

5%

Coal

48%

Natural

Gas

35%

Nuclear

8%

Renewable

9%

14 2016 EEI INVESTOR PRESENTATION

Solid track record of execution and constructive regulatory treatment with opportunities for

improvements in regulatory framework

OUR REGULATORY PRIORITIES

• Approval of Westar acquisition

• Committed to work toward comprehensive regulatory reform

and expect to propose legislation again in 2017 in Missouri

• Concluded GMO rate case; new retail rates effective

December 2016

• KCP&L Missouri filed $62.9 million1 general rate case on July

1, 2016, to recover investments and to address cost of

service lag

• Expect to file abbreviated rate case for KCP&L Kansas by

November 9, 2016

MANAGING LEGISLATIVE AND REGULATORY ENVIRONMENT

1. Does not include net fuel and purchased power of $27.2 million that absent the case would flow through a fuel recovery mechanism. Total requested increase in base rates including

net fuel and purchased power is $90.1 million or 10.77%.

15 2016 EEI INVESTOR PRESENTATION

MISSOURI PUBLIC SERVICE COMMISSION (MPSC) KANSAS CORPORATION COMMISSION (KCC)

Mr. Daniel Y. Hall (D)

Chair (since August 2015)

Term began: September 2013

Term expires: September 2019

Mr. Jay S. Emler (R)

Chair (since January 2016)

Term began: January 2014, reappointed May 2015

Term expires: March 2019

Mr. Stephen M. Stoll (D)

Commissioner

Term began: June 2012

Term expires: December 2017

Ms. Shari Feist Albrecht (I)

Commissioner

Term began: June 2012

Term expired: March 2016

Mr. William P. Kenney (R)

Commissioner

Term began: January 2013

Term expires: January 2019

Mr. Pat Apple (R)

Commissioner

Term began: March 2014

Term expires: March 2018

Mr. Scott T. Rupp (R)

Commissioner

Term began: March 2014

Term expires: March 2020

Ms. Maida J. Coleman (D)

Commissioner

Term began: August 2015

Term expires: August 2021

MPSC consists of five (5) members, including the Chairman, who are appointed

by the Governor and confirmed by the Senate.

Members serve six-year terms (may continue to serve after term expires until

reappointed or replaced)

Governor appoints one member to serve as Chairman

KCC consists of three (3) members, including the Chairman, who are appointed by

the Governor and confirmed by the Senate.

Members serve four-year terms (may continue to serve after term expires until

reappointed or replaced)

Commissioners elect one member to serve as Chairman

STATE COMMISSIONERS

16 2016 EEI INVESTOR PRESENTATION

ROADMAP TO CLOSE FOR ACQUISITION

1. Kansas has 300 days following filing to rule on transaction.

17 2016 EEI INVESTOR PRESENTATION

2016 2017

Q2 Q3 Q4 Q1 Q2

Acquisition Announcement

Regulatory Filings (U.S. DOJ/FTC, Kansas1, NRC, FERC)

Secure Appropriate State and Federal Regulatory Approvals

File Proxy Statement / Hold Special Shareholder Meetings

Public Equity (Common/Mandatory) Financings

Public Debt Financing

Receive Regulatory Approvals

Target Close

TRADITIONAL 11-MONTH RATE CASE TIMELINE IN MISSOURI AND ~8 MONTHS IN KANSAS

RATE CASE TIMELINE

TRANSACTION EXPECTED TO MITIGATE RATE INCREASES OVER TIME

18 2016 EEI INVESTOR PRESENTATION

2016 2017

Q1 Q3 Q4 Q1 – Q4

GMO general rate case filing1

KCP&L MO general rate case filing2

Anticipated KCP&L KS abbreviated rate case filing

Anticipated Westar abbreviated rate case filing

Anticipated KCP&L KS, KCP&L MO, GMO and Westar rate case

filings

1. New retail rates effective December 22, 2016.

2. Expect new retail rates to be effective late May 2017.

19

FULL-YEAR 2016 EARNINGS OUTLOOK

2016 EEI INVESTOR PRESENTATION

EARNINGS

GUIDANCE

• Narrowing and increasing 2016 adjusted EPS (non-GAAP) guidance range

from $1.65 - $1.80 to $1.75 - $1.85

REVENUE

ASSUMPTIONS

• Normal weather for the remainder of 2016

• Weather-normalized demand growth

- 12-months ended September 30, 2016, weather-normalized demand up

0.3%, net of an estimated 0.7% impact from energy efficiency—in line with

full year estimate of flat to 0.5%

• New retail rates and cost recovery mechanisms in KCP&L’s Missouri and

Kansas jurisdictions effective September 29, 2015 and October 1, 2015,

respectively

OTHER

DRIVERS

• Disciplined cost and capital management

• Effective tax rate of approximately 37% in 2016

TRANSOURCE ENERGY, LLC

NATIONAL PLATFORM TO PURSUE COMPETITIVE TRANSMISSION OPPORTUNITIES

Well-positioned to compete and deliver innovative transmission solutions

1. The venture excludes transmission projects in the Electric Reliability Council of Texas (ERCOT) and AEP’s existing transmission project joint ventures

• Joint venture between

Great Plains Energy

(13.5%) and AEP (86.5%)

structured to pursue

competitive transmission

projects1

• Total project portfolio

approximately $600 million

• Positioned for sustainable,

long-term growth in

competitive transmission

market

20 2016 EEI INVESTOR PRESENTATION

APPENDIX

21 2016 EEI INVESTOR PRESENTATION

PRO FORMA COMBINED COMPANY

CORPORATE STRUCTURE

Great Plains Energy

Baa2 / BBB

Revolver Size: $200mm

Kansas City Power &

Light

Baa1 / BBB+

Revolver Size: $600mm

KCP&L Greater Missouri

Operations

Baa2 / BBB+

Revolver Size: $450mm

Westar

A2 / A1

Revolver Size: $1,000mm

Kansas Gas & Electric

A2 / A1

.

1. Westar and KGE ratings shown are senior secured ratings given term debt is all secured.

22 2016 EEI INVESTOR PRESENTATION

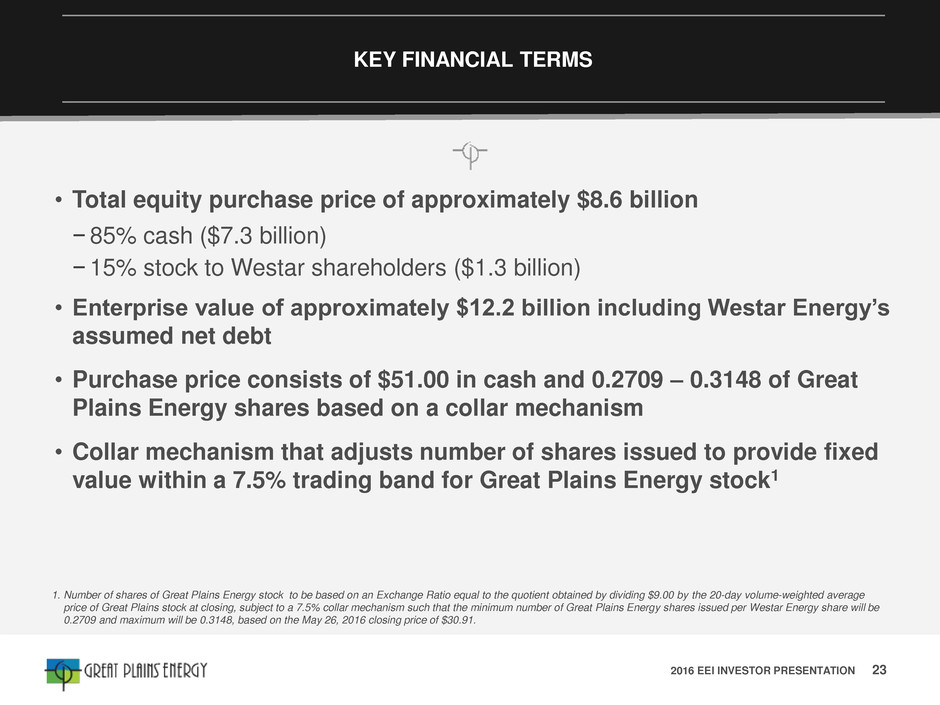

KEY FINANCIAL TERMS

1. Number of shares of Great Plains Energy stock to be based on an Exchange Ratio equal to the quotient obtained by dividing $9.00 by the 20-day volume-weighted average

price of Great Plains stock at closing, subject to a 7.5% collar mechanism such that the minimum number of Great Plains Energy shares issued per Westar Energy share will be

0.2709 and maximum will be 0.3148, based on the May 26, 2016 closing price of $30.91.

23

• Total equity purchase price of approximately $8.6 billion

−85% cash ($7.3 billion)

−15% stock to Westar shareholders ($1.3 billion)

• Enterprise value of approximately $12.2 billion including Westar Energy’s

assumed net debt

• Purchase price consists of $51.00 in cash and 0.2709 – 0.3148 of Great

Plains Energy shares based on a collar mechanism

• Collar mechanism that adjusts number of shares issued to provide fixed

value within a 7.5% trading band for Great Plains Energy stock1

2016 EEI INVESTOR PRESENTATION

24

Lori Wright

Vice President – Corporate Planning, Investor Relations and Treasurer

(816) 556-2506

lori.wright@kcpl.com

Calvin Girard

Senior Manager, Investor Relations

(816) 654-1777

calvin.girard@kcpl.com

CONTACT INFORMATION

NYSE: Great Plains Energy (GXP)

INVESTOR RELATIONS INFORMATION

2016 EEI INVESTOR PRESENTATION