Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - FIRSTENERGY CORP | ex992fe-09302016.htm |

| EX-99.1 - EXHIBIT 99.1 - FIRSTENERGY CORP | ex991fe-09302016.htm |

| 8-K - 8-K - FIRSTENERGY CORP | a8-kdated11042016.htm |

3Q 2016 Earnings Call

Charles E. Jones, President and CEO

James F. Pearson, EVP and CFO

November 4, 2016

Forward-Looking Statements

2 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Forward-Looking Statements: This presentation includes forward-looking statements based on information currently available to management. Such statements are subject to certain risks and uncertainties. These statements include

declarations regarding management's intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” "forecast," "target," "will," "intend," “believe,”

"project," “estimate," "plan" and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be

materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the speed and nature of increased competition in the electric utility

industry, in general, and the retail sales market in particular; the ability to experience growth in the Regulated Distribution and Regulated Transmission segments; the accomplishment of our regulatory and operational goals in

connection with our transmission investment plan, including, but not limited to, the proposed transmission asset transfer to Mid-Atlantic Interstate Transmission, LLC, and the effectiveness of our strategy to reflect a more regulated

business profile; changes in assumptions regarding economic conditions within our territories, assessment of the reliability of our transmission system, or the availability of capital or other resources supporting identified transmission

investment opportunities; the impact of the regulatory process and resulting outcomes on the matters at the federal level and in the various states in which we do business including, but not limited to, matters related to rates and the

Electric Security Plan IV; the impact of the federal regulatory process on Federal Energy Regulatory Commission (FERC)-regulated entities and transactions, in particular FERC regulation of wholesale energy and capacity markets,

including PJM Interconnection, L.L.C. (PJM) markets and FERC-jurisdictional wholesale transactions; FERC regulation of cost-of-service rates, including FERC Opinion No. 531's revised Return on Equity methodology for FERC-

jurisdictional wholesale generation and transmission utility service; and FERC’s compliance and enforcement activity, including compliance and enforcement activity related to North American Electric Reliability Corporation’s

mandatory reliability standards; the uncertainties of various cost recovery and cost allocation issues resulting from American Transmission Systems, Incorporated's realignment into PJM; economic or weather conditions affecting future

sales and margins such as a polar vortex or other significant weather events, and all associated regulatory events or actions; changing energy, capacity and commodity market prices including, but not limited to, coal, natural gas and

oil prices, and their availability and impact on margins and asset valuations, including without limitation impairments thereon; the risks and uncertainties at the Competitive Energy Services (CES) segment, including FirstEnergy

Solutions Corp. and its subsidiaries and FirstEnergy Nuclear Operating Company, related to continued depressed wholesale energy and capacity markets, and the viability and/or success of strategic business alternatives, such as

potential CES generating unit asset sales, the potential conversion of the remaining generation fleet from competitive operations to a regulated or regulated-like construct or the potential need to deactivate additional generating units;

the continued ability of our regulated utilities to recover their costs; costs being higher than anticipated and the success of our policies to control costs and to mitigate low energy, capacity and market prices; other legislative and

regulatory changes, and revised environmental requirements, including, but not limited to, the effects of the United States Environmental Protection Agency’s Clean Power Plan, Coal Combustion Residuals regulations, Cross-State Air

Pollution Rule and Mercury and Air Toxics Standards programs, including our estimated costs of compliance, Clean Water Act (CWA) waste water effluent limitations for power plants, and CWA 316(b) water intake regulation; the

uncertainty of the timing and amounts of the capital expenditures that may arise in connection with any litigation, including New Source Review litigation, or potential regulatory initiatives or rulemakings (including that such initiatives or

rulemakings could result in our decision to deactivate or idle certain generating units); the uncertainties associated with the deactivation of older regulated and competitive units, including the impact on vendor commitments, such as

long-term fuel and transportation agreements, and as it relates to the reliability of the transmission grid, the timing thereof; the impact of other future changes to the operational status or availability of our generating units and any

capacity performance charges associated with unit unavailability; adverse regulatory or legal decisions and outcomes with respect to our nuclear operations (including, but not limited to, the revocation or non-renewal of necessary

licenses, approvals or operating permits by the Nuclear Regulatory Commission or as a result of the incident at Japan's Fukushima Daiichi Nuclear Plant); issues arising from the indications of cracking in the shield building at Davis-

Besse; the risks and uncertainties associated with litigation, arbitration, mediation and like proceedings, including, but not limited to, any such proceedings related to vendor commitments, such as long-term fuel and transportation

agreements; the impact of labor disruptions by our unionized workforce; replacement power costs being higher than anticipated or not fully hedged; the ability to comply with applicable state and federal reliability standards and energy

efficiency and peak demand reduction mandates; changes in customers' demand for power, including, but not limited to, changes resulting from the implementation of state and federal energy efficiency and peak demand reduction

mandates; the ability to accomplish or realize anticipated benefits from strategic and financial goals, including, but not limited to, the ability to continue to reduce costs and to successfully execute our financial plans designed to

improve our credit metrics and strengthen our balance sheet through, among other actions, our cash flow improvement plan and other proposed capital raising initiatives; our ability to improve electric commodity margins and the

impact of, among other factors, the increased cost of fuel and fuel transportation on such margins; changing market conditions that could affect the measurement of certain liabilities and the value of assets held in our Nuclear

Decommissioning Trusts, pension trusts and other trust funds, and cause us and/or our subsidiaries to make additional contributions sooner, or in amounts that are larger than currently anticipated; the impact of changes to significant

accounting policies; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us and

our subsidiaries; further actions that may be taken by credit rating agencies that could negatively affect us and/or our subsidiaries' access to financing, increase the costs thereof, increase requirements to post additional collateral to

support, or accelerate payments under outstanding commodity positions, letters of credit and other financial guarantees, and the impact of these events on the financial condition and liquidity of FirstEnergy and/or its subsidiaries,

specifically the subsidiaries within the CES segment; the risks and uncertainties surrounding FirstEnergy's need to obtain waivers from its bank group under FirstEnergy's credit facilities caused by a debt to total capitalization ratio in

excess of 65% resulting from impairment charges or other events at CES; changes in national and regional economic conditions affecting us, our subsidiaries and/or our major industrial and commercial customers, and other

counterparties with which we do business, including fuel suppliers; the impact of any changes in tax laws or regulations or adverse tax audit results or rulings; issues concerning the stability of domestic and foreign financial institutions

and counterparties with which we do business; the risks associated with cyber-attacks and other disruptions to our information technology system that may compromise our generation, transmission and/or distribution services and data

security breaches of sensitive data, intellectual property and proprietary or personally identifiable information regarding our business, employees, shareholders, customers, suppliers, business partners and other individuals in our data

centers and on our networks; and the risks and other factors discussed from time to time in our United States Securities and Exchange Commission (SEC) filings, and other similar factors. Dividends declared from time to time on

FirstEnergy Corp.'s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.'s Board of Directors at the time of the actual declarations. A security rating is

not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. The foregoing factors should not be

construed as exhaustive and should be read in conjunction with the other cautionary statements and risks that are included in our filings with the SEC, including but not limited to the most recent Annual Report on Form 10-K and any

subsequent Quarterly Reports on Form 10-Q. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on our business or the extent to which any

factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy expressly disclaims any current intention to update, except as required by law, any forward-

looking statements contained herein as a result of new information, future events or otherwise.

Non-GAAP Financial Matters

This presentation contains references to non-GAAP financial measures including, among others, Operating earnings and CES

Adjusted EBITDA. In addition, Basic EPS and Basic EPS-Operating, each calculated on a segment basis, are also non-GAAP

financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial

performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the

most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United

States (GAAP). Operating earnings are not calculated in accordance with GAAP because they exclude the impact of “special items”.

Basic EPS for each segment is calculated by dividing segment net income (loss) on a GAAP basis by the basic weighted average

shares outstanding for the period. Basic EPS-Operating for each segment is calculated by dividing segment Operating earnings, which

exclude special items as discussed above, by the basic weighted average shares outstanding for the period. Management uses non-

GAAP financial measures such as Operating earnings and CES Adjusted EBITDA to evaluate the company’s performance and

manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate

historical and ongoing performance comparisons. Additionally, management uses Basic EPS and Basic EPS-Operating by segment to

further evaluate FirstEnergy’s performance by segment and references these non-GAAP financial measures in its decision-making.

Management believes that the non-GAAP financial measures of “Operating earnings,” “Basic EPS” by segment and “Basic EPS-

Operating” by segment provide consistent and comparable measures of performance of its businesses to help shareholders

understand performance trends. All of these non-GAAP financial measures are intended to complement, and are not considered as

alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be

comparable to similarly titled measures used by other entities.

Pursuant to the requirements of Regulation G, FirstEnergy has provided quantitative reconciliations within this presentation of the non-

GAAP financial measures to the most directly comparable GAAP financial measures. Refer to appendix pages 10-14 and 19-21.

3 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Financial Highlights

■ Reported 3Q16 GAAP earnings of $0.89 per basic share

■ Reported 3Q16 Operating (non-GAAP) earnings* of $0.90 per basic share

3Q16 Earnings Results

* Refer to the appendix (pg.10-14) for reconciliations between GAAP and Operating (non-GAAP) earnings

2016 Earnings Guidance

■ 2016 GAAP losses forecasted to be ($1.30) – ($0.90) per basic share

– Includes asset impairment/plant exit costs of $2.97 per share and estimate of Pension/OPEB mark-to-market

adjustment of $0.45 - $0.75 per share

■ Increasing our 2016 Operating (non-GAAP) earnings guidance* range to $2.60 - $2.70 per basic

share

■ Assumes up to $500M of additional equity by year-end 2016

4 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Quarterly Highlights

Regulatory Updates

■ Pennsylvania Rate Case: Filed settlements with PA PUC, which allows for incremental revenue of ~$291M across

our four PA utilities; rates are expected to be effective January 27, 2017

■ New Jersey Rate Case: Reached settlement-in-principle with Rate Counsel and NJBPU, which would provide an

annual revenue increase of ~$80M effective January 1, 2017

■ Ohio Distribution Modernization Rider (DMR): PUCO authorized our Ohio utilities to collect $204M per year

through 2019 with a possible two-year extension

■ Transmission Updates: MAIT and JCP&L filed for forward-looking formula rates with FERC; expect rates to become

effective January 1, 2017

■ Believe that a vertically integrated or regulated-like construct is the best way to provide reliable and affordable

electric service to customers, both now and in the future

■ A strategic review of our competitive business is underway and we are pursuing options to thoughtfully and

expeditiously move away from competitive markets

■ Plan to determine viability of several alternatives over near term and goal is to implement these strategic options

over the next 12 to 18 months

■ Plan to begin legislative and regulatory efforts designed to preserve our generation assets, including:

– Converting competitive generation units to a regulated or regulated-like construct in Ohio, while seeking a solution for nuclear units in

Ohio and PA that recognizes their environmental benefits

– Mon Power plans to conduct an RFP process by the end of the year for its generation shortfall in WV. We would expect that AE

Supply would likely offer the Pleasants plant into that process.

– Exploring the sale of any or all competitive assets, particularly AE Supply’s gas and hydro units

Competitive Updates

5 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Quarterly Highlights

■ An accelerated timeframe is necessary so that we can remove lingering uncertainty and ensure that our

company is fully focused on the transition to becoming a fully regulated company

■ CES segment to remain cash flow positive each year in 2017 and 2018

Competitive Updates

Financial Updates

We remain firmly focused on continuing to position our company for

success through our customer-focused regulated strategy

6 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

■ Met with rating agencies last week and expect rating decisions to be announced shortly

■ Continued viability of FES is pressured by certain risks, which could cause FES to take additional actions,

including restructuring its debt and other financial obligations, or seeking bankruptcy protection

– 2018 debt maturities

– Potential adverse outcomes in rail transportation contract disputes

– Lack of viable alternative strategies

■ One single qualified pension plan covers all FE employees; $921M pension obligation to employees of

competitive business would remain a FE obligation

■ FE Corp. formal guarantee in place related to CES’ energy contracts, deferred compensation benefits and

certain generation-related matters of $168M

■ Planning to move forward with bringing on independent board members at FES

3Q 2016 Earnings Summary

■ Reported 3Q16 GAAP earnings of $0.89 per share compared to GAAP earnings

of $0.94 per share in 3Q15

– 3Q16 GAAP results include special items totaling $0.01 per share, which includes mark-to-market

adjustments, merger accounting for commodity contracts and regulatory charges

– 3Q15 GAAP results include special items totaling $0.04 per share, which includes trust securities

impairments, mark-to-market adjustments, merger accounting for commodity contracts, regulatory

charges, impact of non-core asset sales/impairments and retail repositioning charges

■ Reported 3Q16 operating (non-GAAP) earnings* of $0.90 per share, a decrease

of $0.08 from 3Q15 operating (non-GAAP) earnings* of $0.98 per share

– Results exceeded our expectations due to the impact of extreme summer temperatures on our

Regulated Distribution segment and strong operating performance across the company

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call 7

* Refer to the appendix (pg. 10) for reconciliations between GAAP and Operating (non-GAAP) earnings

3Q 2016 Earnings Drivers

Quarter-over-Quarter (Basic EPS / Operating*)

3Q16 vs. 3Q15 Earnings Per Share Variance

Basic EPS Operating*

Regulated Distribution +$0.10 +$0.09

Regulated Transmission +$0.01 +$0.01

Competitive Energy Services ($0.14) ($0.15)

Corp/Other ($0.02) ($0.03)

FE Consolidated ($0.05) ($0.08) ■ Regulated Distribution +$0.10 / +$0.09:

– Results impacted primarily by higher weather-related wires revenues, partially offset by higher pension/OPEB expense and

general taxes

– Total distribution deliveries increased by 6.9% in 3Q16; Cooling-degree-days were 28% above 3Q15 and 46% above normal

– Industrial deliveries increased 2.4%, primarily due to higher usage in the shale gas, coal and steel sectors

– Special Items – Include charges reflecting the impact of regulatory orders requiring certain commitments and/or

disallowing the recoverability of costs

■ Regulated Transmission +$0.01 / +$0.01:

– Results impacted by higher revenues from the recovery of incremental operating expenses and a higher rate base at ATSI

and TrAIL, partially offset by a lower ROE at ATSI as well as higher depreciation expense and general taxes

■ Competitive Energy Services ($0.14) / ($0.15):

– Results impacted by lower commodity margin due primarily to lower capacity revenues, partially offset by increased

wholesale sales. Lower contract sales, which decreased in line with CES’ hedging strategy, were partially offset by lower

expenses.

– Special Items – Impact of mark-to-market adjustments and merger accounting for commodity contracts

■ Corporate ($0.02) / ($0.03):

– Results impacted by a higher Consolidated effective income tax rate and higher interest expense, partially offset by lower

O&M

8

Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the weighted average basic shares outstanding for the period.

The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount. The income tax rates range from 35% to 42%.

* Refer to the appendix (pg. 10) for reconciliation between GAAP and Operating (non-GAAP) earnings

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Appendix

9 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Earnings Per Share (EPS) – 3Q 2016 and 3Q 2015

Reconciliation of GAAP to Operating (Non-GAAP) Earnings

(In millions, except per share amounts)

10 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the weighted average basic shares outstanding for the period. The current

and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount. The income tax rates range from 35% to 42%.

Earnings Per Share (EPS) – YTD 2016 and YTD 2015

Reconciliation of GAAP to Operating (Non-GAAP) Earnings

(In millions, except per share amounts)

11 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the weighted average basic shares outstanding for the period. The current

and deferred income tax effect was calculated by applying the subsidiaries‘ statutory tax rate to the pre-tax amount with the exception of Asset impairment/Plant exit costs that included an impairment of goodwill, of which $433

million of the $800 million pre-tax impairment was non-deductible for tax purposes, and valuation allowances against state and local NOL carryforwards of $159 million. With the exception of these items included in Asset

impairment/Plant exit costs, the income tax rates range from 35% to 42%.

12

Earnings Per Share (EPS) – Forecast for 2016

Reconciliation of GAAP to Operating (Non-GAAP) Earnings

(In millions, except per share amounts)

1 Based on current discount rates ranging from 4.00% to 3.75% for the pension plans and 3.75% to 3.50% for the OPEB plans and actual gains on plan assets through September 30, 2016 of 11%.

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

2 Per share amounts for the special items above are based on the after-tax effect of each item, divided by the weighted average basic shares outstanding and includes the estimated dilutive impact of

additional common stock in the fourth quarter of 2016. The current and deferred income tax effect was calculated by applying the subsidiaries’ statutory tax rate to the pre-tax amount with the exception

of Asset impairment/Plant exit costs that included an impairment of goodwill, of which $433 million of the $800 million pre-tax impairment was non-deductible for tax purposes, and valuation allowances

against state and local NOL carryforwards of $159 million. With the exception of these items included in Asset impairment/Plant exit costs, the income tax rates range from 35% to 42%.

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call 13

FE Corp. Income Statements – 3Q 2016 and 3Q 2015

Consolidated GAAP and Special Items

(In millions, except per share amounts)

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call 14

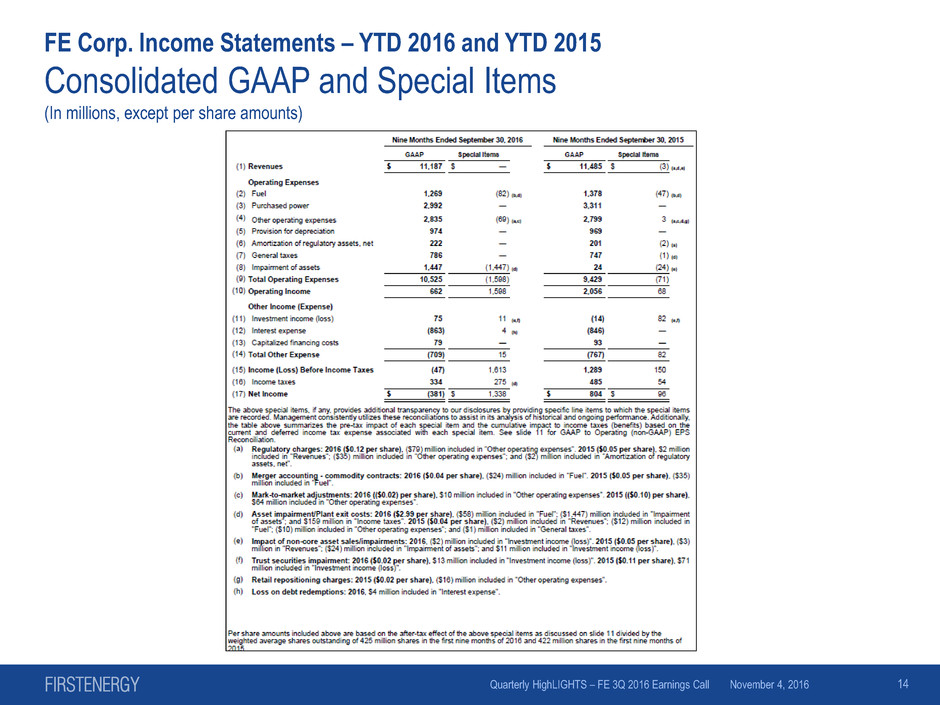

FE Corp. Income Statements – YTD 2016 and YTD 2015

Consolidated GAAP and Special Items

(In millions, except per share amounts)

Ohio – Regulatory Update

ESP IV – Powering Ohio’s Progress

■ Implemented ESP IV on June 1, 2016

■ ESP IV term is June 1, 2016, through May 31, 2024

– Contemplates base distribution rate freeze for the term of ESP IV

– Continues Delivery Capital Recovery Rider, with increases in annual revenue caps to earn a return on

and of incremental distribution plant in service since last rate case

– $30M June 1, 2016 to May 31, 2019

– $20M June 1, 2019 to May 31, 2022

– $15M June 1, 2022 to May 31, 2024

– Commitment to robust energy efficiency offerings, including continued recovery of lost distribution

revenue and shared savings

– 2017-2019 Energy Efficiency Portfolio Plan filed April 15, based on a goal to achieve 800,000 MWH of savings

annually.

– Business plan filed on February 29, 2016, with options to invest in grid modernization initiatives in Ohio;

awaiting PUCO direction

– Provisions related to federal advocacy and resource diversification

– Support for economic development, job retention and low income customers

– Provision to decouple distribution rates for residential customers starting January 1, 2019

15 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Ohio – Regulatory Update

ESP IV – Powering Ohio’s Progress

■ PUCO issued its Entry on Rehearing on October 12, 2016

– Denies the Ohio Utilities’ modified Rider RRS proposal

– Adopts the PUCO Staff’s recommendation of Rider DMR with modifications

– Rider DMR should be grossed up for taxes to the prevailing federal corporate income tax rate, which raises

Rider DMR to approximately $204 million annually

– Three-year term, with possibility for a two-year extension

– Excluded from significantly excessive earnings test

– Recovery of Rider DMR is subject to three conditions: (1) retention of the corporate headquarters and nexus

of operations in Akron, Ohio; (2) no change in control of FE’s Ohio Utilities; and (3) a demonstration of

sufficient progress in the implementation of grid modernization programs approved by the PUCO

16 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

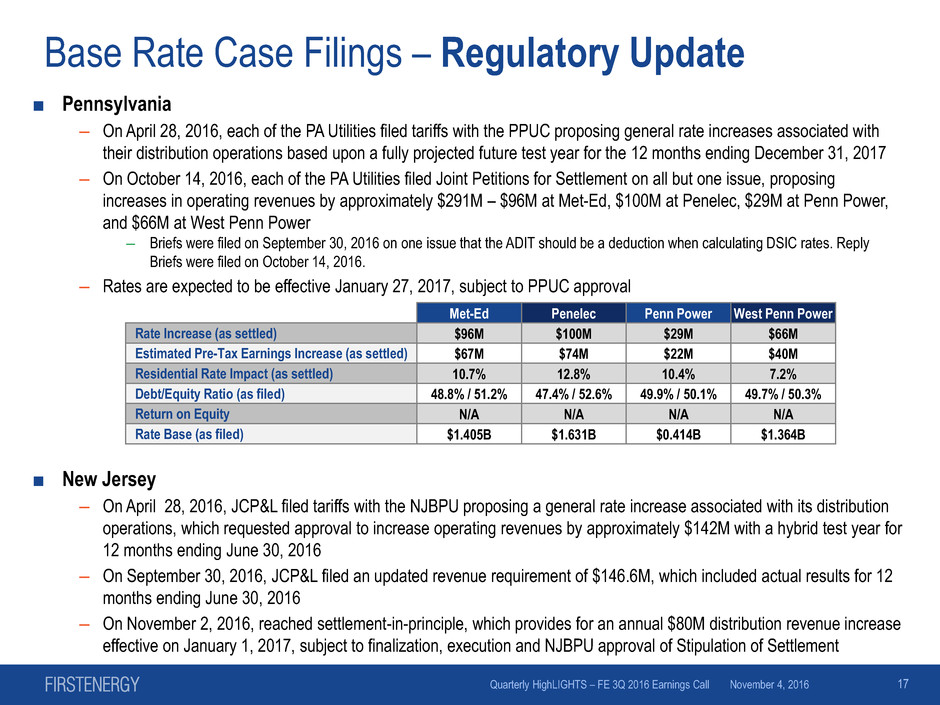

Base Rate Case Filings – Regulatory Update

■ Pennsylvania

– On April 28, 2016, each of the PA Utilities filed tariffs with the PPUC proposing general rate increases associated with

their distribution operations based upon a fully projected future test year for the 12 months ending December 31, 2017

– On October 14, 2016, each of the PA Utilities filed Joint Petitions for Settlement on all but one issue, proposing

increases in operating revenues by approximately $291M – $96M at Met-Ed, $100M at Penelec, $29M at Penn Power,

and $66M at West Penn Power

– Briefs were filed on September 30, 2016 on one issue that the ADIT should be a deduction when calculating DSIC rates. Reply

Briefs were filed on October 14, 2016.

– Rates are expected to be effective January 27, 2017, subject to PPUC approval

■ New Jersey

– On April 28, 2016, JCP&L filed tariffs with the NJBPU proposing a general rate increase associated with its distribution

operations, which requested approval to increase operating revenues by approximately $142M with a hybrid test year for

12 months ending June 30, 2016

– On September 30, 2016, JCP&L filed an updated revenue requirement of $146.6M, which included actual results for 12

months ending June 30, 2016

– On November 2, 2016, reached settlement-in-principle, which provides for an annual $80M distribution revenue increase

effective on January 1, 2017, subject to finalization, execution and NJBPU approval of Stipulation of Settlement

Met-Ed Penelec Penn Power West Penn Power

Rate Increase (as settled) $96M $100M $29M $66M

Estimated Pre-Tax Earnings Increase (as settled) $67M $74M $22M $40M

Residential Rate Impact (as settled) 10.7% 12.8% 10.4% 7.2%

Debt/Equity Ratio (as filed) 48.8% / 51.2% 47.4% / 52.6% 49.9% / 50.1% 49.7% / 50.3%

Return on Equity N/A N/A N/A N/A

Rate Base (as filed) $1.405B $1.631B $0.414B $1.364B

17 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

MAIT Transmission – Regulatory Update

■ On June 19, 2015, Met-Ed, Penelec, JCP&L, FET and MAIT made filings with FERC, the

NJBPU and the PPUC requesting authorization for Met-Ed, Penelec and JCP&L to

contribute their transmission assets to MAIT, a subsidiary of FET

– FERC

– FERC order issued February 18, 2016, approving the transaction

– Pennsylvania

– In July 2016, received PPUC approval, with minor modifications

– New Jersey

– MAIT withdrew its New Jersey application in September 2016

– Therefore, only the FERC-jurisdictional transmission assets from Pennsylvania (Penelec and Met-Ed)

will be transferred to MAIT

■ Next step is for MAIT and JCP&L to update their respective transmission rates

– Expected to establish separate transmission rates for MAIT and for JCP&L

– On October 28, 2016, MAIT and JCP&L filed under Federal Power Act section 205 of a “forward-

looking” formula rate for recovery of MAIT’s and JCP&L’s transmission costs; requested that rates

become effective January 1, 2017, subject to regulatory approval

18 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

2016F Adjusted EBITDA

Competitive Energy Services

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Closed Q1-Q3

Contract Sales: 41m MWh $825

$90 - $100

$815

$920 - $950 CES 2016F Adjusted EBITDA(2)

Closed Q1-Q3

Wholesale: 10m MWh(1) $175

Committed Q4

Contract Sales: 12m MWh $210 - $230

Q4 Open: 3m MWh

(Excludes ~3m MWh of annual distribution losses/pumping)

$(1,365)

2016F ($M)

Capacity Revenue

Other Revenue

Average $/MWh

$54 Contract Rate

less $(18) Supply Cost

less $(16) Delivery Cost

$20 avg. net margin

$28 Wholesale Price

plus $7 Financial Gain

less $(18) Supply Cost

$17 avg. net margin

$27-$29 Wholesale Price

plus $4 - $3 Financial Gain

less $(18) Supply Cost

$13-14 avg. net margin

$51 Contract Rate

less $(18) Supply Cost

less $(14) – (15) Delivery Cost

$18-19 avg. net margin

Other Operating Expenses

$170

Q4 Financially-Hedged: 4m MWh

Total Q4 Wholesale: 7m MWh

See slide 20 for additional notes describing the line items.

1 9m MWh notional amount of Q1-Q3 wholesale sales were

hedged financially.

2 Total CES 2016F Adjusted EBITDA, a non-GAAP financial

measure, is reconciled to 2016F CES Net Income on slide 21,

and is based on market prices as of September 30, 2016.

19

Notes on 2016F Adjusted EBITDA

Competitive Energy Services

20

Closed Q1- Q3

Contract Sales:

Includes actual physical volume of contract sales through 09/30/2016.

Contract Rate represents average realized rate based on actual committed contract prices and customer usage.

Supply Cost rate represents the overall realized cost of all supply sources to serve contract sales obligations, including Fuel (coal,

natural gas and nuclear generation) and Purchased Power (firm and spot purchased power). Average Fossil fuel rate = $24/MWh and

Average Nuclear fuel rate = $7/MWh.

Delivery Cost rate represents the average realized capacity and transmission expenses, including delivery expenses associated with

serving loads and net of transmission revenues (including Financial Transmission Rights and ancillary services).

Committed Q4

Contract Sales:

Expected physical volume and average realized rate of contract sales based on expected power flow for the remainder of 2016.

Volume is subject to fluctuations due to weather and customer behavior.

Closed Q1-Q3

Wholesale:

Includes actual volume of physical wholesale spot sales at the average realized price and Financial Gains through 9/30/2016.

Financial Gains represent the impact of realized gains on settlement of forward financially-settled transactions.

Total Q4

Wholesale:

Includes expected volume of physical wholesale spot sales for the remainder of 2016 at a range of expected realized prices at CES’

generation resources and based on 9/30/2016 market forwards. Includes volumes that may be sold through incremental Contract

Sales.

A portion of the total expected volume of physical spot sales into PJM is price-hedged through forward financial transactions that will

settle at Q4 market prices. Financial gain range is based on expected settlement value of the notional amount of firm forward financial

wholesale sales transactions at a forward AD Hub price range of $27-$29/MWh.

Volume is subject to energy market prices and generating unit performance.

Capacity

Revenue:

Capacity revenue includes revenues from legacy BRA, incremental/transitional capacity auctions, bilateral transactions and capacity

transmission rights.

Other Revenue: Projected annual non-commodity revenue primarily comprised of lease revenue on sale and leaseback transactions and other

affiliated transactions, that is included in “Revenues – Unregulated Businesses” on the Consolidated Statements of Income.

Excludes Investment Income that is excluded from Adjusted EBITDA (see slide 21).

Other Operating

Expenses:

Projected annual expenses related primarily to generation, retail, corporate support and general taxes, that are included in “Other

Operating Expenses” on the Consolidated Statements of Income.

Excludes Income Taxes, Depreciation, Amortization and Interest Expense, net, that is excluded from Adjusted EBITDA (see slide 21).

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

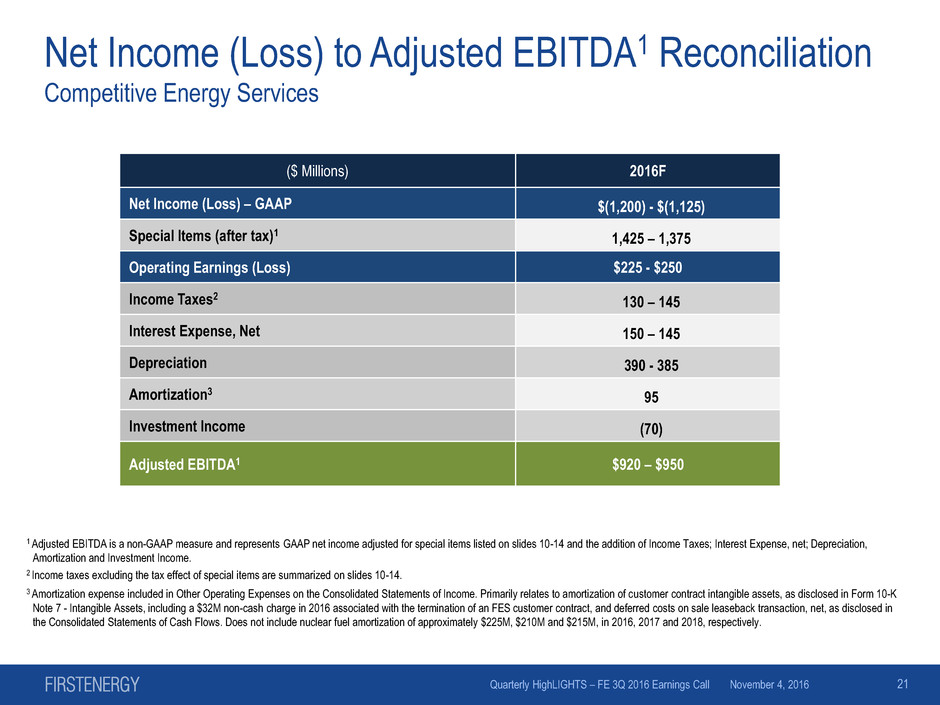

Net Income (Loss) to Adjusted EBITDA1 Reconciliation

Competitive Energy Services

21

($ Millions) 2016F

Net Income (Loss) – GAAP $(1,200) - $(1,125)

Special Items (after tax)1 1,425 – 1,375

Operating Earnings (Loss) $225 - $250

Income Taxes2 130 – 145

Interest Expense, Net 150 – 145

Depreciation 390 - 385

Amortization3 95

Investment Income (70)

Adjusted EBITDA1 $920 – $950

1 Adjusted EBITDA is a non-GAAP measure and represents GAAP net income adjusted for special items listed on slides 10-14 and the addition of Income Taxes; Interest Expense, net; Depreciation,

Amortization and Investment Income.

2 Income taxes excluding the tax effect of special items are summarized on slides 10-14.

3 Amortization expense included in Other Operating Expenses on the Consolidated Statements of Income. Primarily relates to amortization of customer contract intangible assets, as disclosed in Form 10-K

Note 7 - Intangible Assets, including a $32M non-cash charge in 2016 associated with the termination of an FES customer contract, and deferred costs on sale leaseback transaction, net, as disclosed in

the Consolidated Statements of Cash Flows. Does not include nuclear fuel amortization of approximately $225M, $210M and $215M, in 2016, 2017 and 2018, respectively.

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

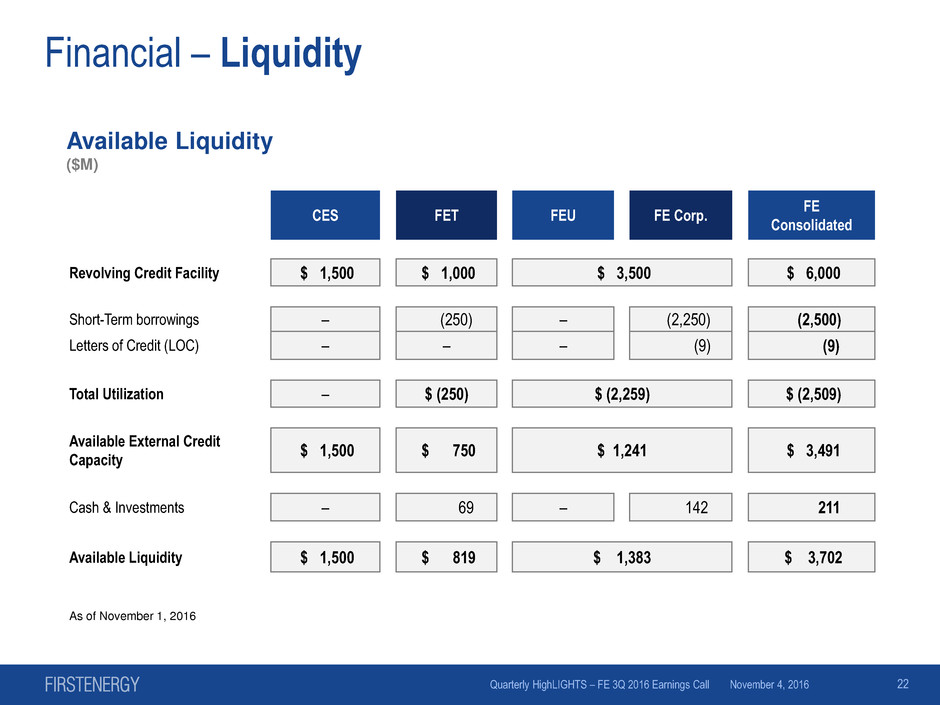

Available Liquidity

($M)

Financial – Liquidity

CES FET FEU FE Corp.

FE

Consolidated

Revolving Credit Facility $ 1,500 $ 1,000 $ 3,500 $ 6,000

Short-Term borrowings – (250) – (2,250) (2,500)

Letters of Credit (LOC) – – – (9) (9)

Total Utilization – $ (250) $ (2,259) $ (2,509)

Available External Credit

Capacity

$ 1,500 $ 750 $ 1,241 $ 3,491

Cash & Investments – 69 – 142 211

Available Liquidity $ 1,500 $ 819 $ 1,383 $ 3,702

As of November 1, 2016

22 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Financial – Parental Guarantees

FirstEnergy Corp. Parent

Competitive Regulated Corp/Other

$M Expiration $M Expiration $M Expiration

Energy-Related & Retail Contracts $28 2017-2030 – – – –

Deferred Compensation Arrangements $136 – $179 – $229 –

Other $4 2016-2017 $4 2030 $4 –

Total FE Corp. Guarantees on behalf of

subsidiaries

$168 $183 $233

Unfunded Pension/OPEB Obligations*

As of December 31, 2015

$841 $1,725 $1,468

23 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

As of September 30, 2016

* FE Corp. is committed to fund all unfunded pension/OPEB obligations.

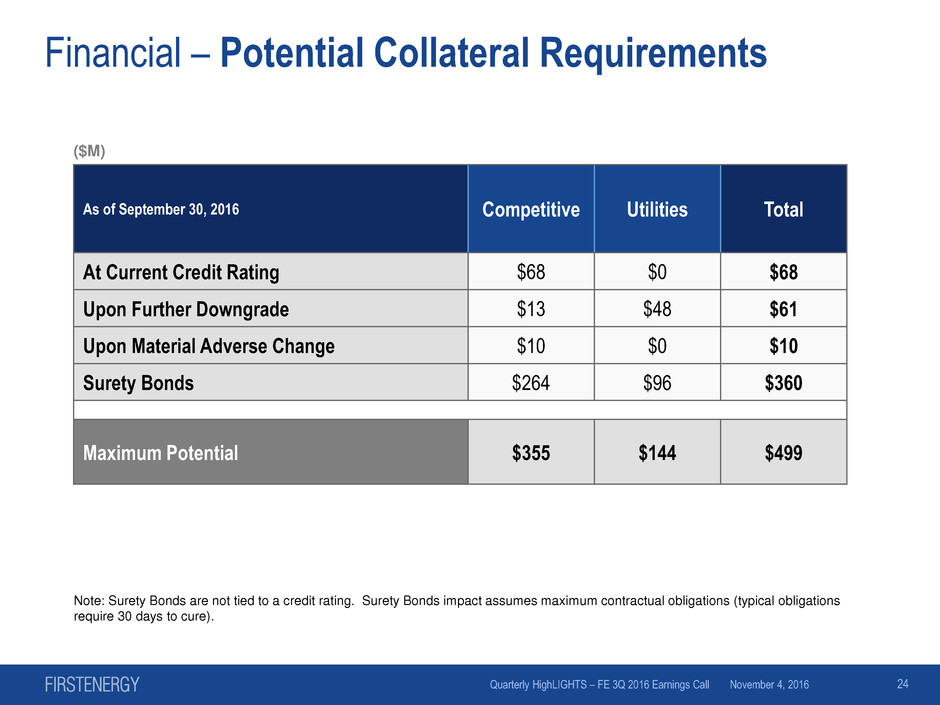

Financial – Potential Collateral Requirements

November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call 24

($M)

Note: Surety Bonds are not tied to a credit rating. Surety Bonds impact assumes maximum contractual obligations (typical obligations

require 30 days to cure).

As of September 30, 2016 Competitive Utilities Total

At Current Credit Rating $68 $0 $68

Upon Further Downgrade $13 $48 $61

Upon Material Adverse Change $10 $0 $10

Surety Bonds $264 $96 $360

Maximum Potential $355 $144 $499

Financial – Consolidated Long-Term Debt Maturities

FEGEN / FENUGEN FE Corp. FEU FES / AE Supply FET

Excludes securitization bonds

As of September 30, 2016

($M)

25 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

0

400

800

1,200

1,600

2,000

2,400

2016 2018 2020 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 2048 2050 2052 2054 2056

Weighted

Avg. Rate of

Maturing

Debt

6.44 5.93 7.25 6.79 7.38 5.92 5.90 4.53 4.37 4.16 5.09 4.85 4.05 4.70 4.08 4.23 5.40 5.07 4.62 4.24

Financial – Outstanding Debt by Legal Entity

($M)

Totals may not foot due to rounding

26 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Short-term Debt 2,725

Long-term Debt 4,200

Debt Subtotal 6,925

Premiums 4

Unamortized Issuance Costs (9)

Total Balance Sheet Debt 6,920

Short-term Debt - 2 - - - - 82 139 24 111

Long-term Debt 650 1,330 350 153 850 1,125 1,950 1,224 445 525

Securitization Bonds 135 164 40 - - - 97 293 98 -

Debt Subtotal 785 1,496 390 153 850 1,125 2,129 1,655 567 636

Discounts (8) (2) (0) - (1) (1) (6) (1) - -

Unamortized Issuance Costs (2) (4) (2) (1) (4) (4) (7) (12) (4) (1)

Purchase Accounting - - - - - - - 13 4 5

Capital Leases 19 15 9 4 15 22 - 4 4 7

Total Balance Sheet Debt 793 1,506 396 156 860 1,142 2,115 1,660 571 647

Short-term Debt 250 - -

Long-term Debt 1,000 950 625

Debt Subtotal 1,250 950 625

Discounts (2) (4) (0)

Unamortized Issuance Costs (8) (6) (4)

Total Balance Sheet Debt 1,241 940 621

Short-term Debt 101 - - 52 30

Long-term Debt 696 1,163 1,135 521 100

Debt Subtotal 797 1,163 1,135 573 130

Discounts (1) - - - -

Unamortized Issuance Costs (4) (5) (6) - (0)

Purchase Accounting - - - (28) -

Capital Leases - 9 - 0 -

Total Balance Sheet Debt 792 1,167 1,129 545 129

Hold Co.

At 9/30/2016

Utilities

At 9/30/2016

Competitive Energy Services

At 9/30/2016

West

Penn Power

FES

Hold Co.

FE

Generation

FE Nuclear

Generation

Allegheny

Energy

Supply

Allegheny

Generating

Metropolitan

Edison

Pennsylvania

Electric

Jersey

Central

Mon

Power

Potomac

Edison

Penn

Power

Transmission

At 9/30/2016

TrAIL

FE

Hold Co.

Ohio

Edison

Cleveland

Electric

Toledo

Edison

FET

Hold Co.

ATSI

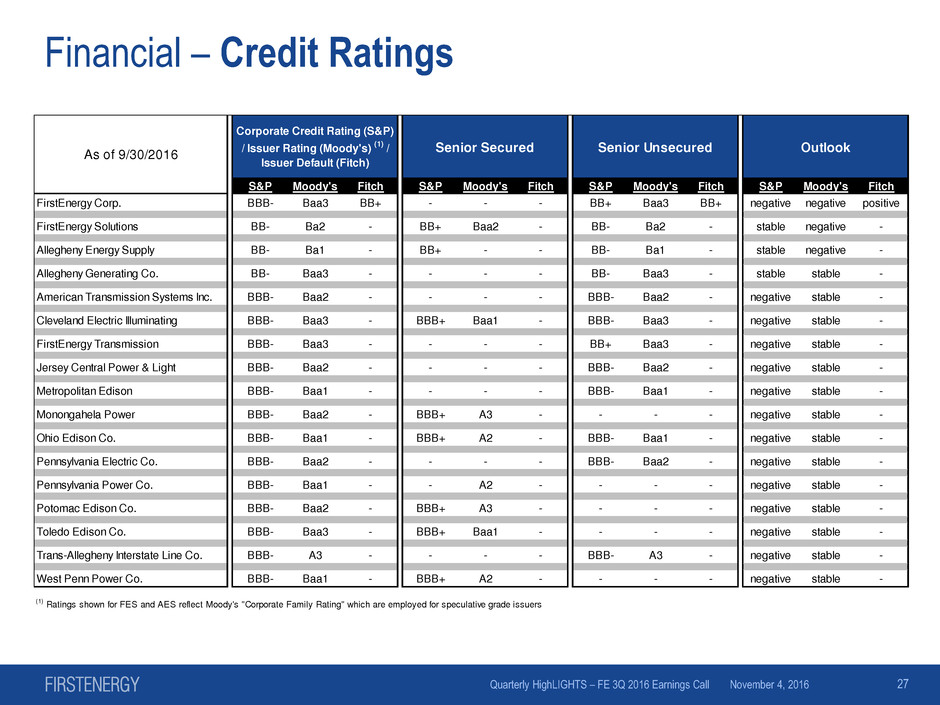

Financial – Credit Ratings

27 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call

Corporate Credit Rating (S&P)

/ Issuer Rating (Moody's)

(1)

/

Issuer Default (Fitch)

Senior Secured Senior Unsecured Outlook

S&P Moody's Fitch S&P Moody's Fitch S&P Moody's Fitch S&P Moody's Fitch

FirstEnergy Corp. BBB- Baa3 BB+ - - - BB+ Baa3 BB+ negative negative positive

FirstEnergy Solutions BB- Ba2 - BB+ Baa2 - BB- Ba2 - stable negative -

Allegheny Energy Supply BB- Ba1 - BB+ - - BB- Ba1 - stable negative -

Allegheny Generating Co. BB- Baa3 - - - - BB- Baa3 - stable stable -

American Transmission Systems Inc. BBB- Baa2 - - - - BBB- Baa2 - negative stable -

Cleveland Electric Illuminating BBB- Baa3 - BBB+ Baa1 - BBB- Baa3 - negative stable -

FirstEnergy Transmission BBB- Baa3 - - - - BB+ Baa3 - negative stable -

Jersey Central Power & Light BBB- Baa2 - - - - BBB- Baa2 - negative stable -

Metropolitan Edison BBB- Baa1 - - - - BBB- Baa1 - negative stable -

Monongahela Power BBB- Baa2 - BBB+ A3 - - - - negative stable -

Ohio Edison Co. BBB- Baa1 - BBB+ A2 - BBB- Baa1 - negative stable -

Pennsylvania Electric Co. BBB- Baa2 - - - - BBB- Baa2 - negative stable -

Pennsylvania Power Co. BBB- Baa1 - - A2 - - - - negative stable -

Potomac Edison Co. BBB- Baa2 - BBB+ A3 - - - - negative stable -

Toledo Edison Co. BBB- Baa3 - BBB+ Baa1 - - - - negative stable -

Trans-Allegheny Interstate Line Co. BBB- A3 - - - - BBB- A3 - negative stable -

West Penn Power Co. BBB- Baa1 - BBB+ A2 - - - - negative stable -

(1) Ratings shown for FES and AES reflect Moody's "Corporate Family Rating" which are employed for speculative grade issuers

As of 9/30/2016

Financial – Credit Providers

$6,000 Revolving Credit Facilities

Term Loans

$7,449 TOTAL

158 Vehicle Leases

87 Letters of Credit (LOC)

$7,200 SUB-TOTAL

1,200

Sale Leaseback LOC 4

($M)

Bank of America

Bank of New York Mellon

Bank of Nova Scotia

Barclays Bank

BBVA

BNP Paribas

CIBC

Citibank

Citizens Bank

CoBank

Credit Agricole

Credit Suisse

Fifth Third Bank

FirstMerit

First National Bank

Goldman Sachs

Huntington National Bank

Industrial & Commercial Bank of China

JP Morgan Chase

Keybank

Mizuho

Morgan Stanley

National Cooperative Services

PNC

Regions Bank

Royal Bank of Canada

Santander

Sumitomo Mitsui

TD Bank

Union Bank/Bank of Tokyo Mitsubishi

US Bank

Wells Fargo

32 financial institutions provide ~$7.4B aggregate credit commitment

As of September 30, 2016

28 November 4, 2016 Quarterly HighLIGHTS – FE 3Q 2016 Earnings Call