Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Time Inc. | a8k9302016cover.htm |

| EX-99.1 - EXHIBIT 99.1 - Time Inc. | exhibit9913q16pr.htm |

THIRD QUARTER 2016

Financial Results

NOVEMBER 3, 2016

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995;

particularly statements regarding future financial and operating results of Time Inc. (the “Company”) and its business. These

statements are based on management’s current expectations or beliefs, and are subject to uncertainty and changes in

circumstances. Actual results may vary materially from those expressed or implied in this presentation due to changes in

economic, business, competitive, technological, strategic, regulatory and/or other factors. More detailed information about these

factors may be found in the Company’s filings with the Securities and Exchange Commission, including its most recent Annual

Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. The Company is under no obligation, and expressly

disclaims any such obligation, to update or alter its forward-looking statements, whether as a result of new information, future

events or otherwise.

Non-GAAP financial measures such as Operating income before depreciation and amortization (“OIBDA”), Adjusted OIBDA,

Adjusted Diluted Earnings Per Share (EPS) and Free Cash Flow, as included in this presentation, are supplemental measures that

are not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Definitions of these measures and

reconciliations to the most directly-comparable U.S. GAAP measures are included at the end of this presentation deck. Our non-

GAAP financial measures have limitations as analytical and comparative tools and you should consider OIBDA, Adjusted OIBDA,

Adjusted Diluted EPS and Free Cash Flow in addition to, and not as a substitute for, the Company’s Operating income (loss), Net

income (loss), Diluted EPS and various cash flow measures (e.g., Cash provided by (used in) operations), as well as other measures

of financial performance and liquidity reported in accordance with U.S. GAAP.

Note: Throughout the presentation, certain numbers may not sum to the total due to rounding.

2

Disclaimer

Total revenues declined 3% year-over-year including approx. 200 bps related to FX.

Total advertising revenues increased 5% year-over year.

Digital advertising revenues increased 63%, representing 31% of total advertising revenues.

Operating expenses decreased 3% year over year including approx. 200 bps related to FX.

Operating loss of ($167) million versus an Operating loss of ($899) million last year.

Adjusted OIBDA was $100 million versus $113 million last year.

Quarter-end cash, cash equivalents and short-term investments of $304 million or $3.06 per share.

In conjunction with our realignment program and other actions, we incurred $43 million of net

restructuring and severance costs.

We now expect 2016 Operating income of $15 million to $25 million.

We are narrowing our 2016 Adjusted OIBDA outlook to a range of $400 million to $415 million.

3Q16 Financial Highlights

3

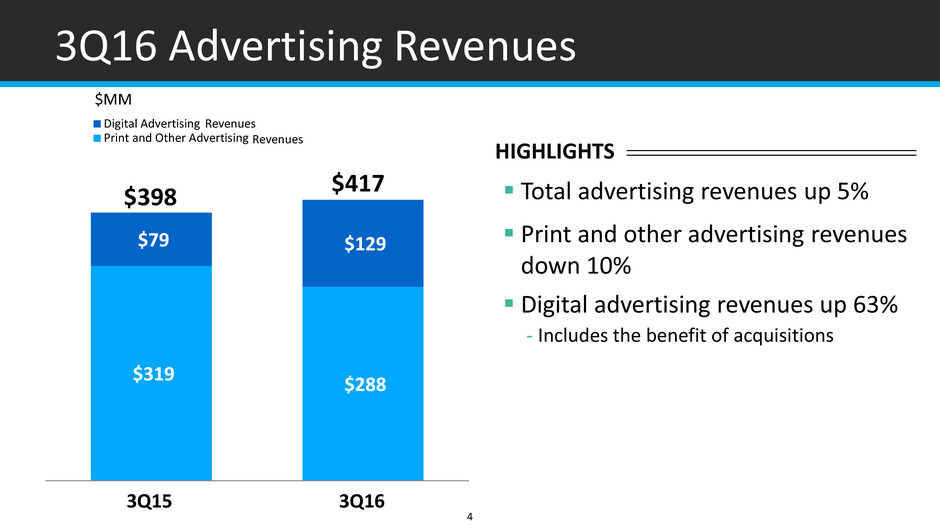

$319

$288

$79 $129

2015 2016

Digital Advertising

Print and Other Advertising

3Q16 Advertising Revenues

Total advertising revenues up 5%

Print and other advertising revenues

down 10%

Digital advertising revenues up 63%

- Includes the benefit of acquisitions

$398

$417

4

HIGHLIGHTS

3Q 3Q

$MM

Revenues

Revenues

$168

$148

$86

$68

$7

$7

Other Circulation Revenues

Newsstand Revenues

Subscription Revenues

Subscription revenues down 12%

Newsstand revenues down 21%

$MM

$261

$223

3Q16 Circulation Revenues

HIGHLIGHTS

3Q15 3Q16

5

3Q16 Other Revenues

Other revenues down 4%

$114

$110

HIGHLIGHTS

3Q15 3Q16

$MM

6

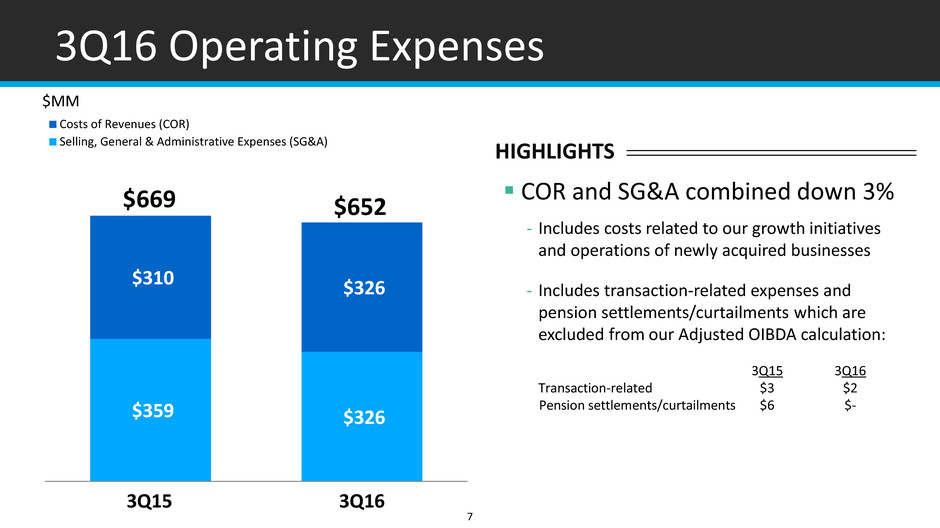

$359 $326

$310 $326

Costs of Revenues (COR)

Selling, General & Administrative Expenses (SG&A)

3Q16 Operating Expenses

COR and SG&A combined down 3%

- Includes costs related to our growth initiatives

and operations of newly acquired businesses

- Includes transaction-related expenses and

pension settlements/curtailments which are

excluded from our Adjusted OIBDA calculation:

3Q15 3Q16

Transaction-related $3 $2

Pension settlements/curtailments $6 $-

$652 $669

HIGHLIGHTS

3Q15 3Q16

$MM

7

1 2

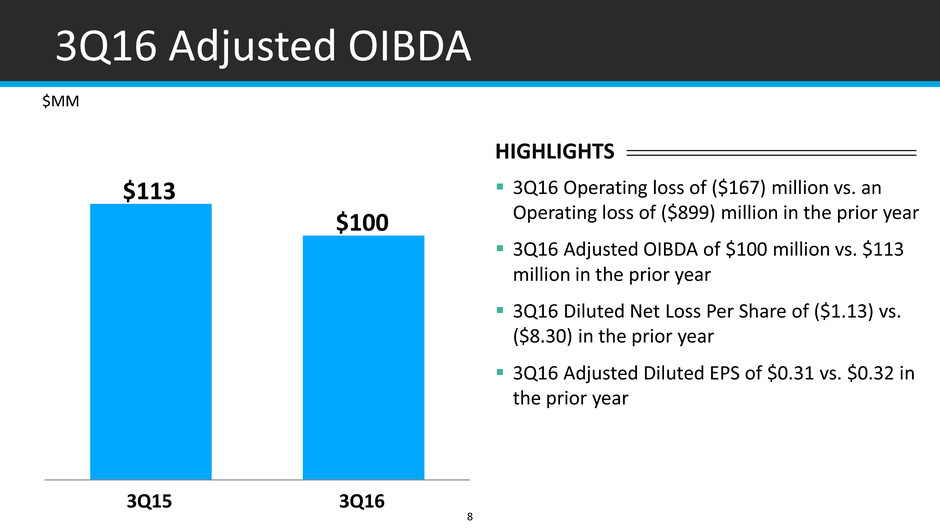

3Q16 Adjusted OIBDA

$113

$100

3Q16 Operating loss of ($167) million vs. an

Operating loss of ($899) million in the prior year

3Q16 Adjusted OIBDA of $100 million vs. $113

million in the prior year

3Q16 Diluted Net Loss Per Share of ($1.13) vs.

($8.30) in the prior year

3Q16 Adjusted Diluted EPS of $0.31 vs. $0.32 in

the prior year

HIGHLIGHTS

3Q15 3Q16

$MM

8

3Q16 Cash Update

HIGHLIGHTS

3Q16 ending cash, cash equivalents and short-term

investments of $304 million

Cash provided by operations of $79 million

Quarterly dividend of $0.19 per share, or

$19 million, paid on 9/15/16

$5 million face value of debt purchased at a discount of

$4.9 million (excluding accrued interest)

Stock buyback of $17 million (on settlement date basis)

As of 9/30/16, net leverage ratio of 2.44x

- Target net leverage ratio 2.0x to 2.5x

9

CHANGES IN CASH, CASH EQUIVALENTS

AND SHORT-TERM INVESTMENTS

Beginning Cash Balance 7/1/16 $380

Free Cash Flow

Acquisitions/Divestitures, net

Purchase of common stock

Dividends paid

Repurchase of Senior Notes

Other

62

(95)

(17)

(19)

(5)

(2)

Ending Cash Balance 9/30/16 $304

Time Inc. Outlook For 2016

1 We define Adjusted OIBDA as OIBDA adjusted for impairments of Goodwill, intangibles, fixed assets and investments; Restructuring and severance costs; (Gain)

loss on operating assets, net; Pension settlements/curtailments; and Other costs related to mergers, acquisitions, investments and dispositions.

2 The Previous Full Year 2016 Outlook assumed USD to GBP exchange rate of 1.3 for the remainder of the year. The Current Full Year 2016 Outlook assumes USD

to GBP exchange rate of 1.2 for the remainder of the year.

3 2015 Actual capital expenditures were offset by $46 million of tenant improvements allowances.

$MM

FY 2015

ACTUALS

PREVIOUS FY 2016

OUTLOOK RANGE2

CURRENT FY 2016

OUTLOOK RANGE2

Revenues (5)% 0% - 1.5% (1%) – 0%

Operating income (loss) ($823) $215 - $240 $15 - $25

Adjusted OIBDA1 $440 $400 - $430 $400 - $415

Investment spending,

net

($30) ($20) ($20)

Capital expenditures $166 $95 - $105 $95 - $105

Real estate related3 $115 $50 $50

Core & growth $51 $45 - $55 $45 - $55

10

Q&A

Appendix

13

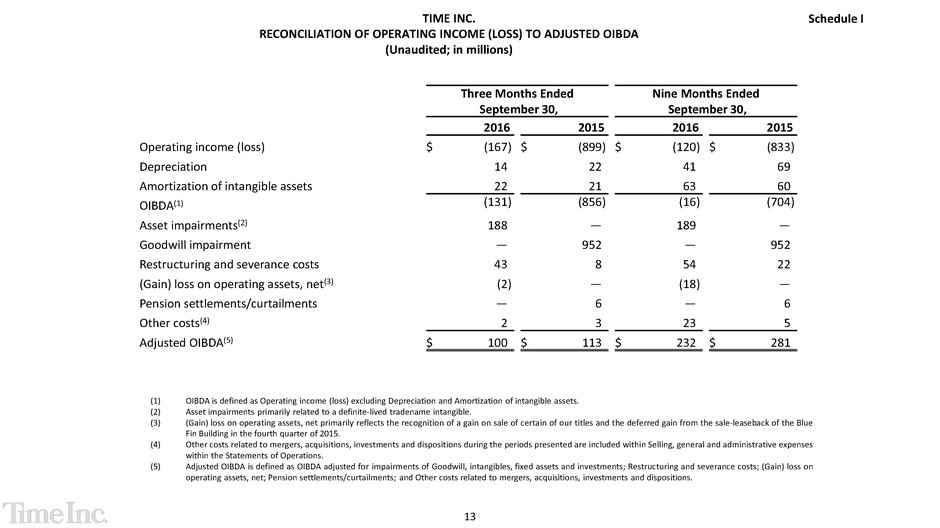

(1) OIBDA is defined as Operating income (loss) excluding Depreciation and Amortization of intangible assets.

(2) Asset impairments primarily related to a definite-lived tradename intangible.

(3) (Gain) loss on operating assets, net primarily reflects the recognition of a gain on sale of certain of our titles and the deferred gain from the sale-leaseback of the Blue

Fin Building in the fourth quarter of 2015.

(4) Other costs related to mergers, acquisitions, investments and dispositions during the periods presented are included within Selling, general and administrative expenses

within the Statements of Operations.

(5) Adjusted OIBDA is defined as OIBDA adjusted for impairments of Goodwill, intangibles, fixed assets and investments; Restructuring and severance costs; (Gain) loss on

operating assets, net; Pension settlements/curtailments; and Other costs related to mergers, acquisitions, investments and dispositions.

TIME INC.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED OIBDA

(Unaudited; in millions)

Schedule I

Three Months Ended

September 30,

Nine Months Ended

September 30,

2016 2015 2016 2015

Operating income (loss) $ (167 ) $ (899 ) $ (120 ) $ (833 )

Depreciation 14 22 41 69

Amortization of intangible assets 22 21 63 60

OIBDA(1) (131 ) (856 ) (16 ) (704 )

Asset impairments(2) 188 — 189 —

Goodwill impairment — 952 — 952

Restructuring and severance costs 43 8 54 22

(Gain) loss on operating assets, net(3) (2 ) — (18 ) —

Pension settlements/curtailments — 6 — 6

Other costs(4) 2 3 23 5

Adjusted OIBDA(5) $ 100 $ 113 $ 232 $ 281

14

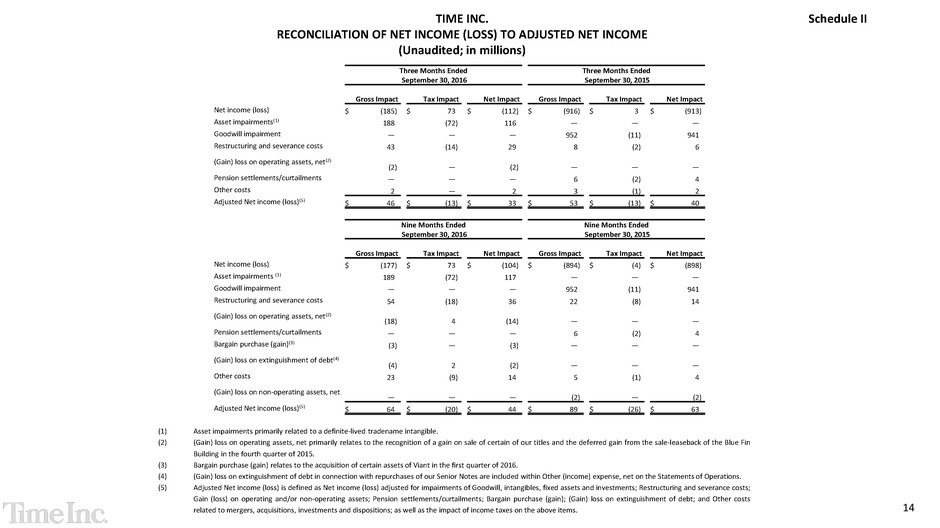

TIME INC.

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED NET INCOME

(Unaudited; in millions)

Schedule II

(1) Asset impairments primarily related to a definite-lived tradename intangible.

(2) (Gain) loss on operating assets, net primarily relates to the recognition of a gain on sale of certain of our titles and the deferred gain from the sale-leaseback of the Blue Fin

Building in the fourth quarter of 2015.

(3) Bargain purchase (gain) relates to the acquisition of certain assets of Viant in the first quarter of 2016.

(4) (Gain) loss on extinguishment of debt in connection with repurchases of our Senior Notes are included within Other (income) expense, net on the Statements of Operations.

(5) Adjusted Net income (loss) is defined as Net income (loss) adjusted for impairments of Goodwill, intangibles, fixed assets and investments; Restructuring and severance costs;

Gain (loss) on operating and/or non-operating assets; Pension settlements/curtailments; Bargain purchase (gain); (Gain) loss on extinguishment of debt; and Other costs

related to mergers, acquisitions, investments and dispositions; as well as the impact of income taxes on the above items.

Three Months Ended

September 30, 2016

Three Months Ended

September 30, 2015

Gross Impact Tax Impact Net Impact Gross Impact Tax Impact Net Impact

Net income (loss) $ (185 ) $ 73 $ (112 ) $ (916 ) $ 3 $ (913 )

Asset impairments(1) 188 (72 ) 116 — — —

Goodwill impairment — — — 952 (11 ) 941

Restructuring and severance costs 43 (14 ) 29 8 (2 ) 6

(Gain) loss on operating assets, net(2)

(2 ) —

(2 ) —

—

—

Pension settlements/curtailments — — — 6 (2 ) 4

Other costs 2 — 2 3 (1 ) 2

Adjusted Net income (loss)(5) $ 46 $ (13 ) $ 33 $ 53 $ (13 ) $ 40

Nine Months Ended

September 30, 2016

Nine Months Ended

September 30, 2015

Gross Impact Tax Impact Net Impact Gross Impact Tax Impact Net Impact

Net income (loss) $ (177 ) $ 73 $ (104 ) $ (894 ) $ (4 ) $ (898 )

Asset impairments (1) 189 (72 ) 117 — — —

Goodwill impairment — — — 952 (11 ) 941

Restructuring and severance costs 54 (18 ) 36 22 (8 ) 14

(Gain) loss on operating assets, net(2)

(18 ) 4

(14 ) —

—

—

Pension settlements/curtailments — — — 6 (2 ) 4

Bargain purchase (gain)(3) (3 ) — (3 ) — — —

(Gain) loss on extinguishment of debt(4)

(4 ) 2

(2 ) —

—

—

Other costs 23 (9 ) 14 5 (1 ) 4

(Gain) loss on non-operating assets, net

—

—

—

(2 ) —

(2 )

Adjusted Net income (loss)(5) $ 64 $ (20 ) $ 44 $ 89 $ (26 ) $ 63

Schedule III

TIME INC.

RECONCILIATION OF DILUTED EPS TO ADJUSTED DILUTED EPS

(Unaudited; all per share amounts are net of tax)

(1) Asset impairments primarily related to a definite-lived tradename intangible.

(2) (Gain) loss on operating assets, net primarily relates to the recognition of a gain on sale of certain of our titles and the deferred gain from the sale-leaseback of the Blue Fin Building in the

fourth quarter of 2015.

(3) Bargain purchase (gain) relates to the acquisition of certain assets of Viant in the first quarter of 2016.

(4) (Gain) loss on extinguishment of debt in connection with repurchases of our Senior Notes are included within Other (income) expense, net on the Statements of Operations.

(5) Adjusted Diluted EPS is defined as Diluted EPS adjusted for impairments of Goodwill, intangibles, fixed assets and investments; Restructuring and severance costs; Gain (loss) on operating

and/or non-operating assets; Pension settlements/curtailments; Bargain purchase (gain); (Gain) loss on extinguishment of debt; and Other costs related to mergers, acquisitions,

investments and dispositions; as well as the impact of income taxes on the above items.

(6) For periods in which we were in a net loss position, we have used the expected diluted shares in the calculation of Adjusted Diluted EPS as if we were in a net income position, without

giving effect to the impact of participating securities.

15

Three Months Ended

September 30,

Nine Months Ended

September 30,

2016 2015 2016 2015

Basic net income (loss) per common share $ (1.13 ) $ (8.30 ) $ (1.05 ) $ (8.17 )

Asset impairments(1) 1.16 — 1.17 —

Goodwill impairment — 8.51 — 8.51

Restructuring and severance costs 0.28 0.05 0.35 0.13

(Gain) loss on operating assets, net(2) (0.02 ) — (0.14 ) —

Pension settlements/curtailments — 0.04 — 0.04

Bargain purchase (gain)(3) — — (0.03 ) —

(Gain) loss on extinguishment of debt(4) — — (0.03 ) —

Other costs 0.02 0.02 0.15 0.04

(Gain) loss on non-operating assets, net — — — (0.02 )

Adjusted Diluted EPS(5)(6) $ 0.31 $ 0.32 $ 0.42 $ 0.53

16

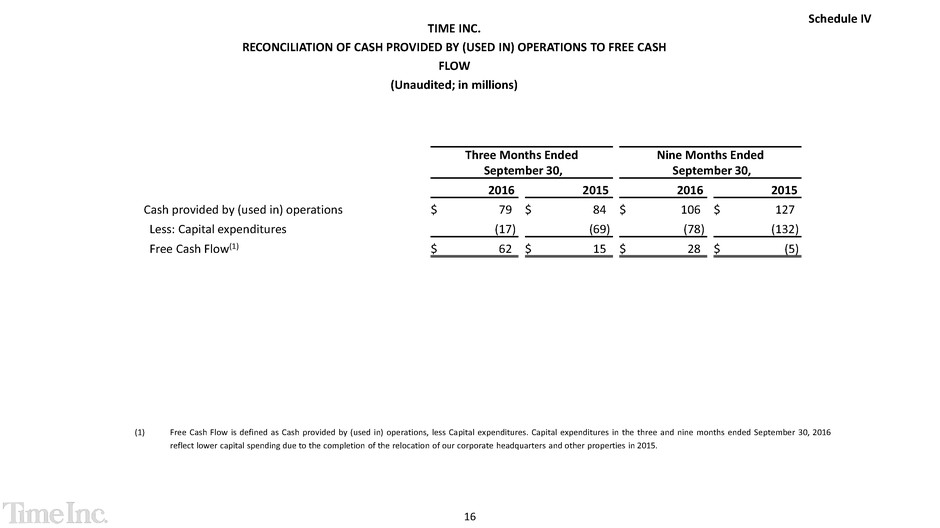

TIME INC.

RECONCILIATION OF CASH PROVIDED BY (USED IN) OPERATIONS TO FREE CASH

FLOW

(Unaudited; in millions)

Schedule IV

(1) Free Cash Flow is defined as Cash provided by (used in) operations, less Capital expenditures. Capital expenditures in the three and nine months ended September 30, 2016

reflect lower capital spending due to the completion of the relocation of our corporate headquarters and other properties in 2015.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2016 2015 2016 2015

Cash provided by (used in) operations $ 79 $ 84 $ 106 $ 127

Less: Capital expenditures (17 ) (69 ) (78 ) (132 )

Free Cash Flow(1) $ 62 $ 15 $ 28 $ (5 )

17

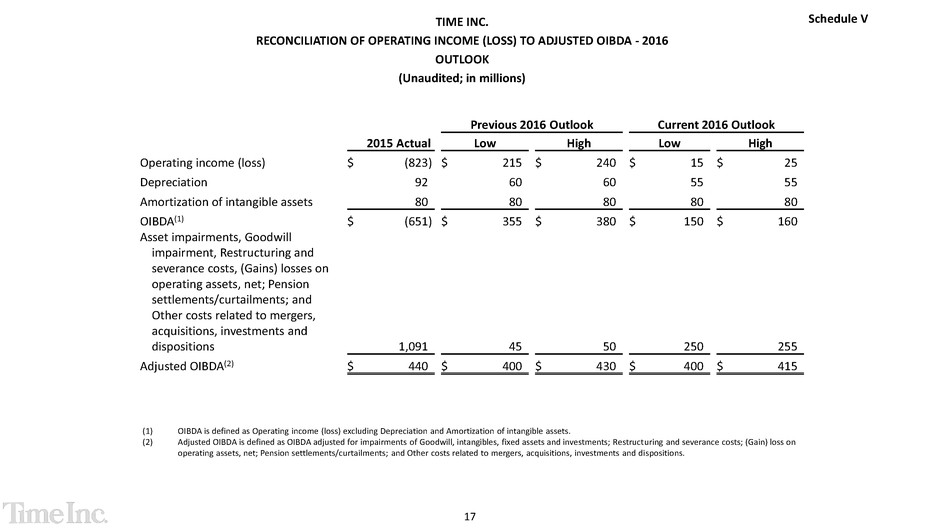

Schedule V TIME INC.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED OIBDA - 2016

OUTLOOK

(Unaudited; in millions)

(1) OIBDA is defined as Operating income (loss) excluding Depreciation and Amortization of intangible assets.

(2) Adjusted OIBDA is defined as OIBDA adjusted for impairments of Goodwill, intangibles, fixed assets and investments; Restructuring and severance costs; (Gain) loss on

operating assets, net; Pension settlements/curtailments; and Other costs related to mergers, acquisitions, investments and dispositions.

Previous 2016 Outlook Current 2016 Outlook

2015 Actual Low High Low High

Operating income (loss) $ (823 ) $ 215 $ 240 $ 15 $ 25

Depreciation 92 60 60 55 55

Amortization of intangible assets 80 80 80 80 80

OIBDA(1) $ (651 ) $ 355 $ 380 $ 150 $ 160

Asset impairments, Goodwill

impairment, Restructuring and

severance costs, (Gains) losses on

operating assets, net; Pension

settlements/curtailments; and

Other costs related to mergers,

acquisitions, investments and

dispositions 1,091

45

50

250

255

Adjusted OIBDA(2) $ 440 $ 400 $ 430 $ 400 $ 415