Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PAR PACIFIC HOLDINGS, INC. | a2016-11x3form8xkxinvestor.htm |

Investor Presentation

November 2016

2

Forward-Looking Statements / Disclaimers

The information contained in this presentation has been prepared to assist you in making your own evaluation of the company and does not purport to contain all of the

information you may consider important. Any estimates or projections with respect to future performance have been provided to assist you in your evaluation but

should not be relied upon as an accurate representation of future results. Certain statements, estimates and financial information contained in this presentation

constitute forward-looking statements.

Such forward-looking statements involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from the results

implied or expressed in such forward-looking statements. While presented with numerical specificity, certain forward-looking statements are based (1) upon assumptions

that are inherently subject to significant business, economic, regulatory, environmental, seasonal and competitive uncertainties, contingencies and risks including,

without limitation, our ability to maintain adequate liquidity, to realize the potential benefit of our net operating loss tax carryforwards, to obtain sufficient debt and

equity financings, our capital costs, well production performance, and operating costs, anticipated commodity pricing, differentials or crack spreads, anticipated or

projected pricing information related to oil, NGLs, and natural gas, realize the potential benefits of our supply and offtake agreements, assumptions inherent in a sum-of-

the-parts valuation of our business, our ability to realize the benefit of our investment in Laramie Energy, LLC, assumptions related to our investment in Laramie Energy, LLC,

including completion activity and projected capital contributions, Laramie Energy, LLC’s financial and operational performance and plans for 2016, the potential uplift of an

MLP, our ability to meet environmental and regulatory requirements without additional capital expenditures, anticipated refined product demand and Hawaii petroleum

use, projected Hawaiian air travel, our acquisition integration strategy, including the acquisition of Wyoming Refining Company and assumptions upon which it was based,

anticipated mid-cycle Adjusted EBITDA projections and estimated cost synergies from the acquisition, our ability to increase refinery throughput and profitability, our ability

to evaluate and pursue strategic and growth opportunities, our estimates of 2016 on-island sales volumes, our estimates related to 2016 Adjusted EBITDA and certain other

financial measures, our estimates related to the annual gross margin impact of changes in RINs prices, and other known and unknown risks (all of which are difficult to predict

and many of which are beyond the company's control), some of which are further discussed in the company’s periodic and other filings with the SEC and (2) upon assumptions

with respect to future business decisions that are subject to change.

There can be no assurance that the results implied or expressed in such forward-looking statements or the underlying assumptions will be realized and that actual results of

operations or future events will not be materially different from the results implied or expressed in such forward-looking statements. Under no circumstances should the

inclusion of the forward-looking statements be regarded as a representation, undertaking, warranty or prediction by the company or any other person with respect to the

accuracy thereof or the accuracy of the underlying assumptions, or that the company will achieve or is likely to achieve any particular results. The forward-looking

statements are made as of the date hereof and the company disclaims any intent or obligation to update publicly or to revise any of the forward-looking statements,

whether as a result of new information, future events or otherwise, except as may be required by applicable law. Recipients are cautioned that forward-looking statements

are not guarantees of future performance and, accordingly, recipients are expressly cautioned not to put undue reliance on forward-looking statements due to the inherent

uncertainty therein.

This presentation contains non-GAAP financial measures, such as Adjusted EBITDA, Adjusted Net Income (loss), Laramie Energy Adjusted EBITDAX, and PV10/PV20. Please

see the Appendix for the definitions and reconciliations to GAAP of the non-GAAP financial measures that are based on reconcilable historical information.

Cautionary Note

Regarding Hydrocarbon Quantities

The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable, and possible reserve

estimates. We have provided Laramie Energy, LLC (“Laramie”) internally generated estimates for proved and probable reserve estimates (collectively, “2P”) in this

presentation in accordance with SEC guidelines and definitions. The reserve estimates as of June 30, 2016 included in this presentation have been prepared by Laramie’s

internal reserve engineers and have not been reviewed or audited by Laramie’s independent reserve engineers. Actual quantities that may be ultimately recovered from

Laramie’s interests may differ substantially from the estimates in this presentation. Factors affecting ultimate recovery include the scope of Laramie’s ongoing drilling

program, which is directly affected by commodity prices, the availability of capital, drilling and production costs, the availability of drilling services and equipment, drilling

results, lease expirations, transportation constraints, regulatory approvals and other factors; and actual drilling results, including geological and mechanical factors and

recovery rates.

3

Our Business Platforms

Retail - Distributor and Marketer of Refined Products

Gasoline and diesel distributed through 91 locations across Hawaii

Exclusive provider of 76 and 7-Eleven branded outlets in Hawaii

Launching Hele, a new local brand; 37 retail stations will be rebranded

Competitive Natural Gas Producer – Laramie Energy

Average well cost of approximately $1MM delivering over 1.8 Bcfe EURs

7,500+ drilling locations across 136,000 net acres

Cash operating costs competitive with low cost basins in the U.S.

A

n

A

cq

ui

st

io

n-

O

ri

en

te

d

Co

m

pa

ny

____________________

(1) As measured by Nelson Complexity rating.

(2) Par Pacific owns 42.3% of Laramie Energy, LLC

Hawaii Refinery

94,000 bpd 5.7 complexity refinery (1)

50% distillate yield configuration

Crudes sourced world-wide

Wyoming Refinery

18,000 bpd 11.0 (1) complexity refinery

95% light products yield

Tailored for Powder River Basin & Bakken

crude

Hawaii

Storage capacity of 5.4 million barrels

with 27-mile pipeline

3 barges deliver products to 8 refined

product terminals

Wyoming

140 miles of crude oil gathering systems

40 miles of refined products pipeline

Approximately 650 Mbls of storage

capacity

Refining

Logistics

Retail

Laramie Energy

4

Growth Opportunity Framework

Tier 1

• Refining

• Marketing

• Midstream & downstream

logistics

Tier 2

• E&P with Laramie tie-in

• Upstream logistics

• Gathering systems

• Gas processing

• Chemical / process businesses

Tier 3

• E&P without Laramie tie-in

• Oilfield services

• Power generation

• Non-oil logistics

Strategic

Factors

Existing

Competencies

NOL

Refining

System

Integration

Hawaii

Wyoming

Laramie

Target acquisitions that generate risk-adjusted returns on capital and are accretive to

sum of the parts valuation of Par Pacific

Refining Segment

6

Refining Unit Capacity (MBPD)

Crude Unit 94

Vacuum Distillation Unit 40

Hydrocracker 18

Catalytic Reformer 13

Visbreaker 11

Hydrogen Plant (MMCFD) 18

Naphtha Hydrotreater 13

Cogeneration Turbine Unit 20 MW

Hawaii Refinery

Asset Highlights

Largest and most complex refinery in Hawaii

Distillate yield configured for Hawaii demand

Asset location and configuration favorably positioned to

benefit from cost-advantaged crude

Anticipated ability to meet environmental and regulatory

requirements without material capital expenditures

Identified opportunities to increase downstream

conversion and complexity

Asset Detail2016 YTD Crude Sourcing (1) 2016 YTD Yield Profile (1)

____________________

(1) Numbers are as of September 30, 2016.

7

Hawaii Refinery Operating Trends

Total Sales VolumeProduction Cost(1) Throughput Volume

Increased refinery throughput generates economies of scale with higher efficiency

and lower production cost

On-island demand and refining margin environment are the primary constraints for

refinery utilization as:

Enhancing on-island sales improves margin from favorable market pricing and

reduced cost of freight

Products export contribution is stronger in favorable market conditions

___________________

(1) Management uses production costs per barrel to evaluate performance and compare efficiency to other companies in the industry. There are a variety of ways to calculate production costs per barrel; different companies within

the industry calculate it in different ways. We calculate production costs per barrel by dividing all direct production costs, which include the costs to run the refinery including personnel costs, repair and maintenance costs,

insurance, utilities and other miscellaneous costs, by total refining throughput. Our production costs are included in Operating expense (excluding depreciation) on our condensed consolidated statement of operations, which also

includes costs related to our bulk marketing operations.

(MBbl/d) (MBbl/d)

($ / bbl)

66

75

81

73

80

74

78

54

40

55

70

85

Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16

68

82

75 74

76

81

70 71

40

55

70

85

Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16

$5.41

$3.88

$2.94

$3.90

$3.51

$3.74

$3.15

$5.42

0.00

1.50

3.00

4.50

$6.00

Q4 '14Q1 '15Q2 '15Q3 '15Q4 '15Q1 '16Q2 '16Q3 '16

8

-2

0

2

4

6

8

10

$12

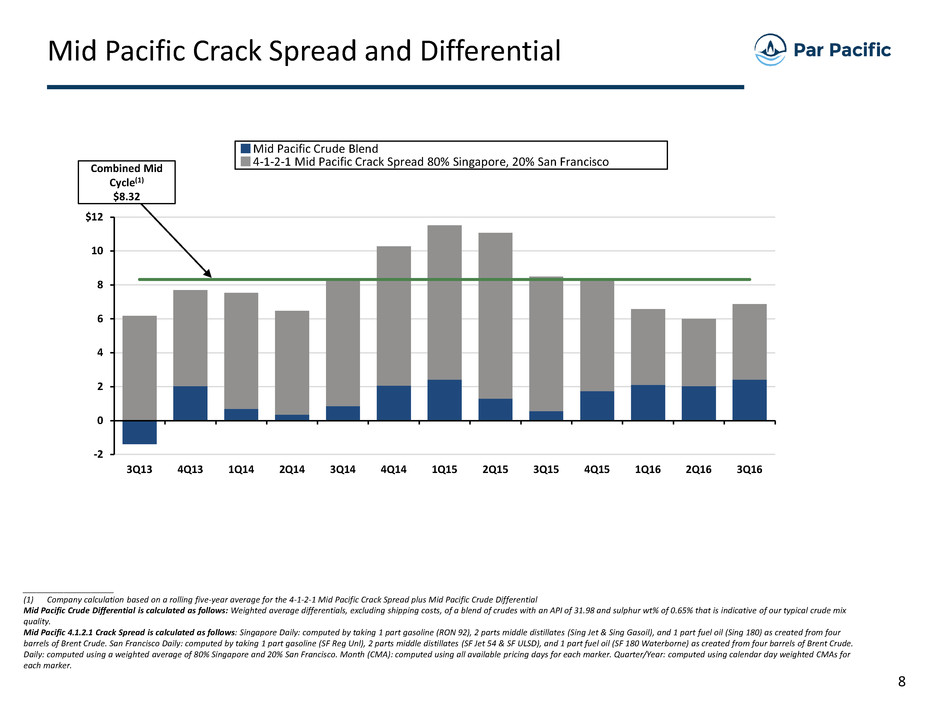

3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Mid Pacific Crack Spread and Differential

____________________

(1) Company calculation based on a rolling five-year average for the 4-1-2-1 Mid Pacific Crack Spread plus Mid Pacific Crude Differential

Mid Pacific Crude Differential is calculated as follows: Weighted average differentials, excluding shipping costs, of a blend of crudes with an API of 31.98 and sulphur wt% of 0.65% that is indicative of our typical crude mix

quality.

Mid Pacific 4.1.2.1 Crack Spread is calculated as follows: Singapore Daily: computed by taking 1 part gasoline (RON 92), 2 parts middle distillates (Sing Jet & Sing Gasoil), and 1 part fuel oil (Sing 180) as created from four

barrels of Brent Crude. San Francisco Daily: computed by taking 1 part gasoline (SF Reg Unl), 2 parts middle distillates (SF Jet 54 & SF ULSD), and 1 part fuel oil (SF 180 Waterborne) as created from four barrels of Brent Crude.

Daily: computed using a weighted average of 80% Singapore and 20% San Francisco. Month (CMA): computed using all available pricing days for each marker. Quarter/Year: computed using calendar day weighted CMAs for

each marker.

Combined Mid

Cycle(1)

$8.32

Mid Pacific Crude Blend

4-1-2-1 Mid Pacific Crack Spread 80% Singapore, 20% San Francisco

9

Leader in Niche Hawaiian Market

Hawaii Air Travel(2)

____________________

(1) Source: DBEDT; EIA, including military demand per Par Pacific internal estimates.

(2) Source: Number of visitors per DBEDT.

(3) Year to date through September 30, 2016.

Hawaii Refined Product Demand(1) Hawaii Refinery Yield

2016 YTD(3)2015

Shortage of available distillate capacity in Hawaii Ability to reconfigure yield based on product demand

Air travel to and from Hawaii projected to continue to grow Fuel oil utilized for ~70% of electricity generation

(In Thousands)

Hawaii Petroleum Use(1)

Electricity

Production

Commercial

Aviation

Marine

Transport

Military Use

Other

28%

28%

27%

6%

8%

3%

Ground

Transportation

MBbl/d

60 59

72

50

0

8

16

24

32

40

48

56

64

72

80

Other Products Distillate

Total Production

Total Demand

Gasoline

Distillate

Fuel oils

Other

products44%

23%

6%

27%

7,500

7,800

8,100

8,400

8,700

9,000

9,300

2014 2015 2016E 2017E 2018E 2019E

10

Wyoming Refinery

Refinery Operations

Product Profile(1)Refinery Asset Detail

Refining Unit Capacity (MBPD)

Crude Unit 18

Residual Fluid Catalytic Cracker 7

Catalytic Reformer 3

Alkylation 1

Naphtha Hydrotreater 3

Diesel Hydrotreater 6

Isomerization 4

Refinery located in Newcastle, Wyoming

Complex refinery with an estimated Nelson Complexity

Index of 11.0

Increased processing capacity from 14,000 bpd to 18,000

bpd

Completed isomerization project in the second half of 2016

to drive additional value

Attractive light products yield over 95%

Over $95MM in capital invested by prior owners over the last four years

to modernize, expand, and upgrade operations

____________________

(1) Figures represent two year average from 2014 to year end 2015.

11

$4

$9

$14

$19

$24

$29

$34

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16

Wyoming Crack Spread

____________________

(1) Company calculation based on a rolling two years and nine month average.

Wyoming 3-2-1 Index is calculated as follows:

Rapid City Daily: Computed by taking 2 part gasoline and 1 part distillate (ULSD) as created from a barrel of West Texas Intermediate Crude.

Denver Daily: Computed by taking 2 part gasoline and 1 part distillate (ULSD) as created from a barrel of West Texas Intermediate Crude. Pricing is based 50% on applicable product pricing in Rapid City, South Dakota, and 50% on

applicable product pricing in Denver, Colorado.

Daily: computed using a weighted average of 50% Rapid City and 50% Denver.

Mid Cycle(1)

$21.13

Logistics Segment

13

30,000 Bbls

185,000 Bbls

138,000 Bbls

135,000 Bbls

12,000 Bbls

Hawaiian Assets MapAsset Highlights

Hawaii Logistics

Integrated system enhances flexibility and profitability

Difficult to replicate asset base

Multiple advantages from single point mooring

Increased safety and flexibility

Enhanced distribution capability

Additional uptime from wind and sea conditions

Latin America

South America

North America

Middle East

Africa

Asia

Logistics network represents a critical

component of Hawaii operations

Asset Detail

Number of Terminals 8

Crude Storage Capacity (MMBbls) 2.4

Other Storage Capacity (MMBbls) 3.0

Number of Barges 3

Miles of Pipeline 27

____________________

(1) Figures represent offsite storage amounts.

(1)

Refinery

Terminal Crude Inflows

Crude Refined Products

Outflows

14

Wyoming Logistics

Logistics Assets

140-mile crude oil pipeline gathering system

providing direct access to Powder River Basin crude

Directly connected to the Butte pipeline, allowing

for Bakken crude access

40-mile products pipeline feeds into the Magellan

Products Line en route to Rapid City, South Dakota

Jet fuel terminal in Rapid City and pipeline

connecting to the Ellsworth Air Force Base

650 MBbls of crude and refined product tankage

with expansion opportunities identified

Truck racks and a loading facility at the refinery

Well-positioned to benefit from regional development

Crude Inflows

Refined Products Outflows

Retail Segment

16

Retail

Asset Highlights

Extensive footprint across five islands in Hawaii

Mid Pac acquisition significantly expanded scale and

operating capabilities

Anticipated continued volume growth from increased

retail and distribution network

Several identified opportunities to enhance profitability

through continued integration and asset optimization

Asset Details

Retail Segment 91 locations

Fuel Sales (LTM 9/30/16) 91 MM gallons

Company Operated

38Convenience Stores

Fee-Owned Sites 22

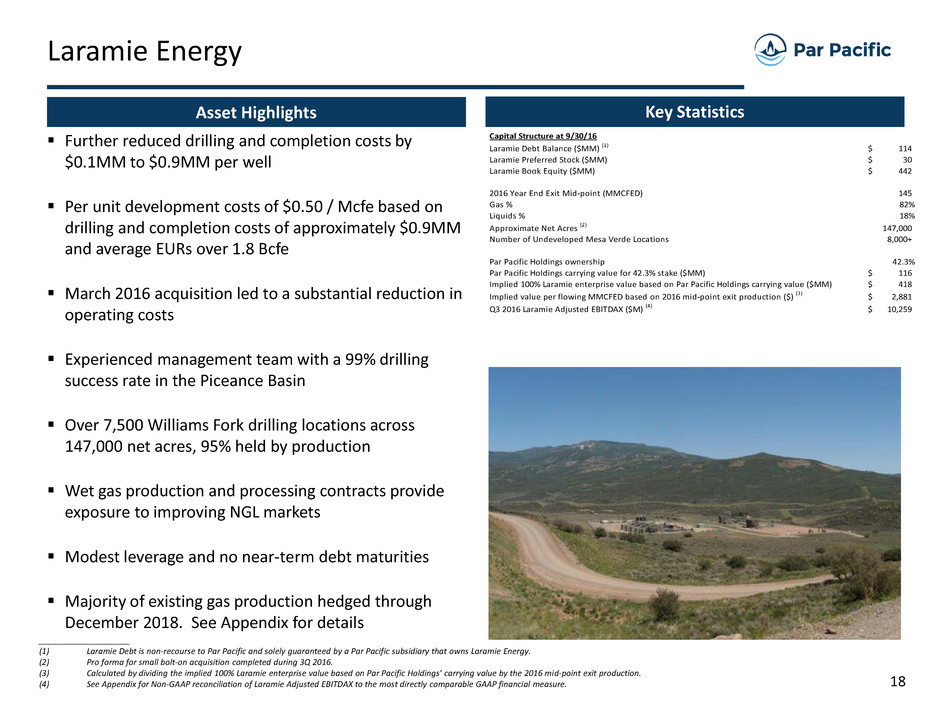

Laramie Energy

18

Further reduced drilling and completion costs by

$0.1MM to $0.9MM per well

Per unit development costs of $0.50 / Mcfe based on

drilling and completion costs of approximately $0.9MM

and average EURs over 1.8 Bcfe

March 2016 acquisition led to a substantial reduction in

operating costs

Experienced management team with a 99% drilling

success rate in the Piceance Basin

Over 7,500 Williams Fork drilling locations across

147,000 net acres, 95% held by production

Wet gas production and processing contracts provide

exposure to improving NGL markets

Modest leverage and no near-term debt maturities

Majority of existing gas production hedged through

December 2018. See Appendix for details

Asset Highlights

Laramie Energy

Mid Year Reserve Update

____________________

(1) Laramie Debt is non-recourse to Par Pacific and solely guaranteed by a Par Pacific subsidiary that owns Laramie Energy.

(2) Pro forma for small bolt-on acquisition completed during 3Q 2016.

(3) Calculated by dividing the implied 100% Laramie enterprise value based on Par Pacific Holdings’ carrying value by the 2016 mid-point exit production.

(4) See Appendix for Non-GAAP reconciliation of Laramie Adjusted EBITDAX to the most directly comparable GAAP financial measure.

Key Statistics

Capital Structure at 9/30/16

Laramie Debt Balance ($MM) (1) 114$

Laramie Preferred Stock ($MM) 30$

Laramie Book Equity ($MM) 442$

2016 Year End Exit Mid-point (MMCFED) 145

Gas % 82%

Liquids % 18%

Approximate Net Acres (2) 147,000

Number of Undeveloped Mesa Verde Locations 8,000+

Par Pacific Holdings ownership 42.3%

Par Pacific Holdings carrying value for 42.3% stake ($MM) 116$

Implied 100% Laramie enterprise value based on Par Pacific Holdings carrying value ($MM) 418$

Implied value per flowing MMCFED based on 2016 mid-point exit production ($) (3) 2,881$

Q3 2016 Laramie Adjusted EBITDAX ($M) (4) 10,259$

19

Anticipate completing majority of 41 uncompleted

well inventory with an average net revenue interest of

93% per well

Continue to drive cost improvements

One rig program commencing in fourth quarter

Evaluate adding additional rigs during 1Q 2017

Development Activity

Laramie Energy

____________________

Note: Figures may not sum to total due to rounding.

(1) Figures for 100% of Laramie Energy. Assumes modest completion activity of $10-20MM in the second half of 2016.

Production Profile(1)

(MMcfe/d)

Drivers of Cost Reduction Unit Costs

G&A spread over a larger base of production

Aggressive field cost management

Benefit from water infrastructure investment

Optimization of available gathering, processing, and

transportation (“GPT”) infrastructure

Financial Overview

21

____________________

Note: Adjusted EBITDA is a non-GAAP financial measure. See the Appendix for a reconciliation to the most directly comparable GAAP financial measure.

Par Pacific Adjusted EBITDA

22

Capitalization Profile

___________________

(1) Deferred financing costs were previously reported as an asset. However, beginning in 2015 we reported deferred financing costs as a reduction of debt due to a change in GAAP.

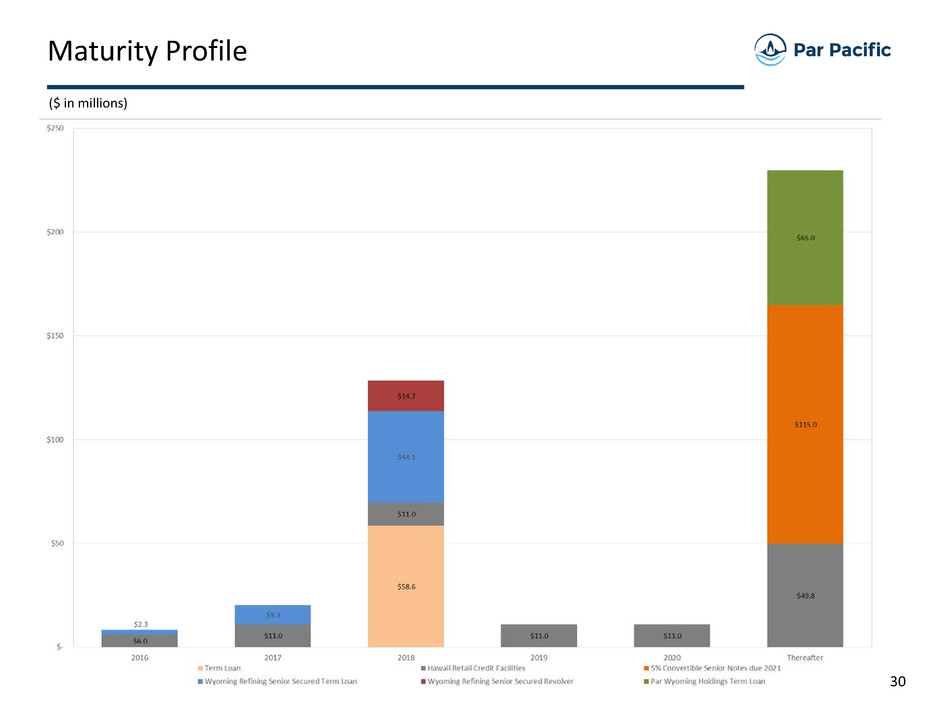

No material maturities until 2018

1

As of

($ in millions) 10/28/2016

Cash & Cash Equivalents (as of 10/28/2016) $51

Debt

Term Loan 59

Hawaii Retail Credit Facilities 100

5% Convertible Senior Notes due 2021 115

Wyoming Refining Senior Secured Term Loan 56

Wyoming Refining Senior Secured Revolver 15

Par Wyoming Holdings Term Loan 65

Total Debt 409

Equity:

Book Value of Equity $352

Total Shareholders Equity $352

Total Capitalization $761

23

Net Operating Loss Carryforward

Differentiated Asset

Relative to Peers

Potential to Enhance

Cash Flow with Growth

Provides a Competitive Advantage

for Growth Opportunities

$1.4 billion NOL generates potentially significant value for Par Pacific

Selected Benefits Illustrative Value to Par

($ in millions)

8.0% 10.0% 12.0%

$25 $98 $84 $73

$50 $197 $168 $146

$75 $256 $226 $201

Discount Rate

A

n

n

u

al

P

re

-T

ax

E

ar

n

in

gs

(1)

____________________

(1) Assumes $1.4 billion NOL and 35% tax rate.

24

Par Pacific Summary

Enterprise Value (2)Key Statistics

____________________

(1) Represents Par Pacific’s 42.3% share of Laramie Energy. Calculated based on midpoint of 2016E production.

(2) Closing stock price and 45,506,173 shares of common stock outstanding as of October 28, 2016. Debt & cash amounts are as of October 28, 2016.

(3) Numbers may not add due to rounding.

Total Adjusted EBITDA includes losses of $6 million related to Texadian

operations that have been significantly wound down in 2016, and $3.7

million for entry into a settlement agreement to satisfy certain obligations

related to the Point Arguello Unit offshore California.

Net Operating Loss (NOL) Carryforwards

NOL Gross Balance $1,457

Closing Share Price $13.38

Shares Outstanding 45.5

Market Capitalization $609

Principal Amount of Debt 409

Cash (51)

Net Debt 358

Total Enterprise Value $967

Laramie Energy (Par Pacific Holdings investment)

Investment Book Value $116

2016 mid point exit production (MMcfe/d) (1) 61

($ in millions, except per share data)

Adjusted EBITDA LTM Sept. '16

Refining $18

Logistics $23

Retail $30

Corporate & Other ($51)

Total Adjusted EBITDA (3) $20

Appendix

26

Laramie Energy Hedging Program

2H 2016 2017 2018

NYMEX Fixed Price Swap

Hedged Volume (Mcf/day) 92,169 83,240 75,072

Average Floor Price ($/Mcf) $2.605 $2.605 $2.605

CIG Basis Swap

Volume Hedged (Mcf/day) 92,169 83,240 75,072

Average CIG Differential to NYMEX ($0.272) ($0.267) ($0.259)

NGL Hedges

Propane (gal/day) 37,000 -- --

Propane ($/gal) $0.465

Pentane (gal/day) 11,500 -- --

Pentane Floor Price ($/gal) $0.850 -- --

27

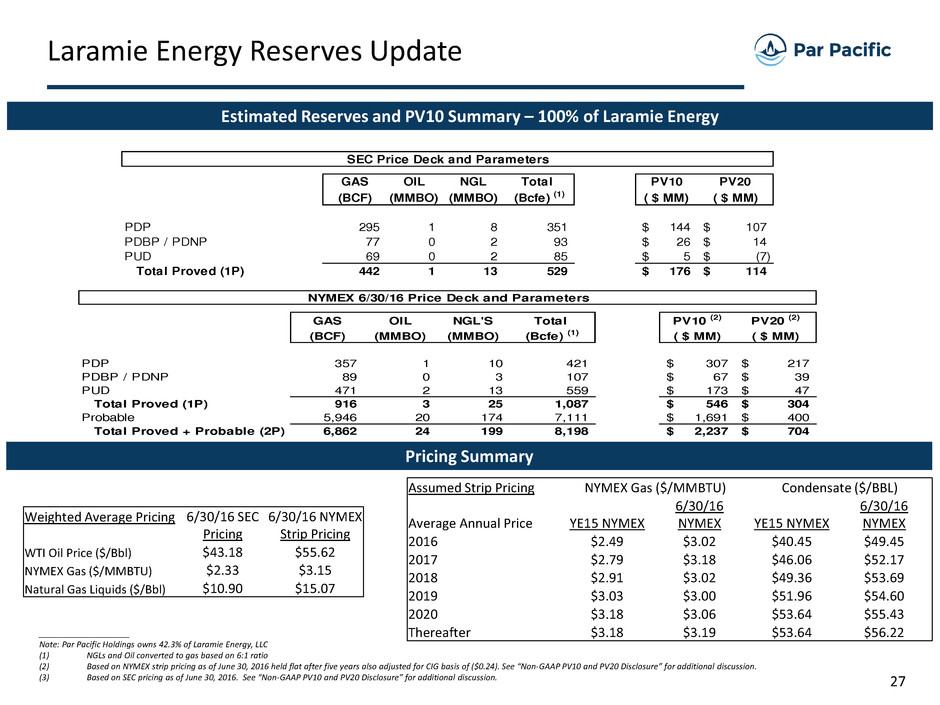

Estimated Reserves and PV10 Summary – 100% of Laramie Energy

Laramie Energy Reserves Update

____________________

Note: Par Pacific Holdings owns 42.3% of Laramie Energy, LLC

(1) NGLs and Oil converted to gas based on 6:1 ratio

(2) Based on NYMEX strip pricing as of June 30, 2016 held flat after five years also adjusted for CIG basis of ($0.24). See “Non-GAAP PV10 and PV20 Disclosure” for additional discussion.

(3) Based on SEC pricing as of June 30, 2016. See “Non-GAAP PV10 and PV20 Disclosure” for additional discussion.

Pricing Summary

Weighted Average Pricing 6/30/16 SEC

Pricing

6/30/16 NYMEX

Strip Pricing

WTI Oil Price ($/Bbl) $43.18 $55.62

NYMEX Gas ($/MMBTU) $2.33 $3.15

Natural Gas Liquids ($/Bbl) $10.90 $15.07

Assumed Strip Pricing NYMEX Gas ($/MMBTU) Condensate ($/BBL)

Average Annual Price YE15 NYMEX

6/30/16

NYMEX YE15 NYMEX

6/30/16

NYMEX

2016 $2.49 $3.02 $40.45 $49.45

2017 $2.79 $3.18 $46.06 $52.17

2018 $2.91 $3.02 $49.36 $53.69

2019 $3.03 $3.00 $51.96 $54.60

2020 $3.18 $3.06 $53.64 $55.43

Thereafter $3.18 $3.19 $53.64 $56.22

NYMEX 6/30/16 Price Deck and Parameters

GAS OIL NGL'S Total PV10 (2) PV20 (2)

(BCF) (MMBO) (MMBO) (Bcfe) (1) ( $ MM) ( $ MM)

PDP 357 1 10 421 307$ 217$

PDBP / PDNP 89 0 3 107 67$ 39$

PUD 471 2 13 559 173$ 47$

Total Proved (1P) 916 3 25 1,087 546$ 304$

Probable 5,946 20 174 7,111 1,691$ 400$

Total Proved + Probable (2P) 6,862 24 199 8,198 2,237$ 704$

SEC Price Deck and Parameters

GAS OIL NGL Total PV10 PV20

(BCF) (MMBO) (MMBO) (Bcfe) (1) ( $ MM) ( $ MM)

PDP 295 1 8 351 144$ 107$

PDBP / PDNP 77 0 2 93 26$ 14$

PUD 69 0 2 85 5$ (7)$

Total Proved (1P) 442 1 13 529 176$ 114$

28

MESA

RIO BLANCOI I I

GARFIELDIII

Collbranll rollb anllll rro lb anlo lb an

De Beque e eque e eque e eque

SiltiltilililttilililRiflei lfi lei li lffi lei li le

New Castle lte as le l ltte as le le as le

Battlement Mesal tt ta le en esal l tt ttt ta le en esal a le en esa

Palisadelialisadelilialisadelialisade

Cliftonliftli onliliftftlili onli

Fruitvalei lr tF ui valei li lr tr tF ui valei lF ui vale

Redlandsledlandslledlandsledlands

Rangelylangelyllangelylangely

Meekerreekerreekeeeke

Fruitair tF ui aiir tr tF ui aiF ui a

Laramie Energy Acreage

Adams

Elbert

Lake

Eagle

Pitkin

Weld

Jackson

Garfield

Rio Blanco

Costilla

Las Animas

Moffat

Routt

Lincoln

Washington

Kiowa

BentOtero

PuebloCuster

HuerfanoAlamosa

Rio Grande

Hinsdale

Ouray

San Juan

San Miguel

La Plata

Dolores

Montezuma

Montrose

Delta

Chaffee

Gunnison

Mesa

Nebraskareb askarreb askaeb aska

New Mexico ie exico i ie exico ie exico

Wyomingiyo ingiiyo ingiyo ing

Coloradol rolo adoll rrolo adololo ado

Utahtahttahah

Denver

Cheyenne

Arapahoe

Archuleta

Baca

Boulder

Cheyenne

Conejos

Crowley

El Paso

Fremont

Grand

Kit Carson

Larimer

Logan

Mineral

Morgan

Park

Phill ips

Prowers

Saguache

Sedgwick

Teller

Yuma

Colorado

All of Laramie's acreage is located in Rio Blanco,

Garfield and Mesa Counties, Colorado

North Area - Rio Blanco County

Central Area - Garfield County

South Area - Collbran, Mesa County

Over 23,000 net mineral acres

Over 26,000 fee surface acres

Laramie’s

Core

Acreage

North Central SouthLease Acreage:

70

70

Garfield Mesa Rio Blanco

Net Co. Net Net Co. Net Net Co. Net %

2016 280 280 1,553 1,547 0 0 1.3%

2017 242 242 2,115 2,115 0 0 1.7%

2018 0 0 0 0 480 480 0.4%

2019 0 0 3 3 2,286 457 0.3%

2020 3,712 742 97 97 80 16 0.6%

Totals 4,234 1,264 3,768 3,762 2,846 953 4.4%

Acreage Expiration Summary

29

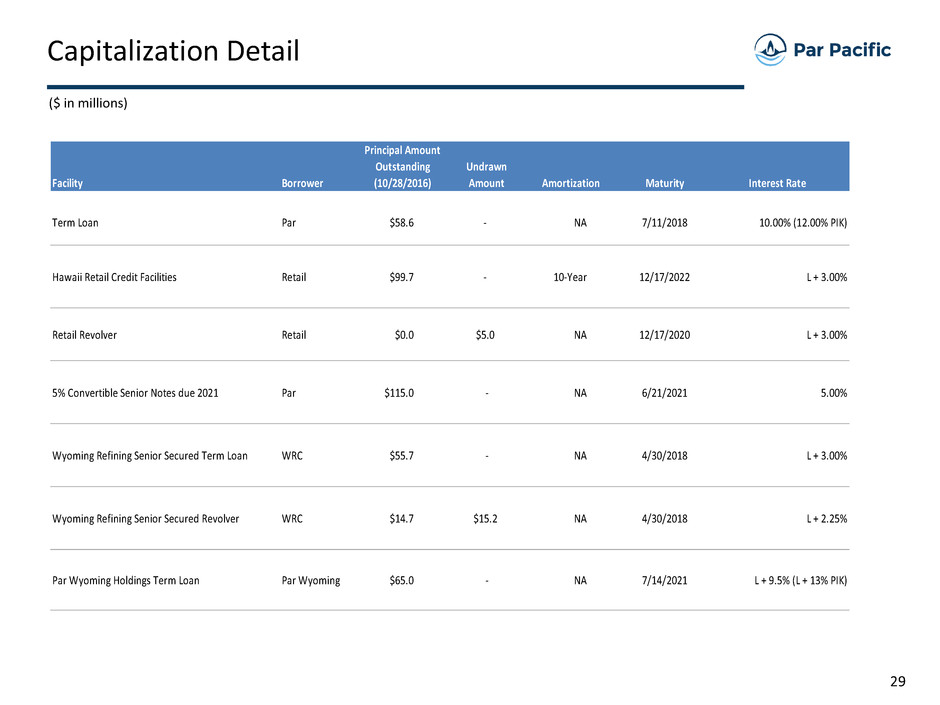

Capitalization Detail

($ in millions)

Facility Borrower

Principal Amount

Outstanding

(10/28/2016)

Undrawn

Amount Amortization Maturity Interest Rate

Term Loan Par $58.6 - NA 7/11/2018 10.00% (12.00% PIK)

Hawaii Retail Credit Facilities Retail $99.7 - 10-Year 12/17/2022 L + 3.00%

Retail Revolver Retail $0.0 $5.0 NA 12/17/2020 L + 3.00%

5% Convertible Senior Notes due 2021 Par $115.0 - NA 6/21/2021 5.00%

Wyoming Refining Senior Secured Term Loan WRC $55.7 - NA 4/30/2018 L + 3.00%

Wyoming Refining Senior Secured Revolver WRC $14.7 $15.2 NA 4/30/2018 L + 2.25%

Par Wyoming Holdings Term Loan Par Wyoming $65.0 - NA 7/14/2021 L + 9.5% (L + 13% PIK)

30

Maturity Profile

($ in millions)

31

Annual Gross Margin Impact of $0.1/gallon Change In RIN Price

$0.09

$0.34

$0.12

$0.19

$0.06 $0.06

$0.19

$0.07

$0.09 $0.09

$0.00/Bbl

$0.05/Bbl

$0.10/Bbl

$0.15/Bbl

$0.20/Bbl

$0.25/Bbl

$0.30/Bbl

$0.35/Bbl

$0.40/Bbl

ALJ CVRR DK HFC MPC PARR PBF TSO VLO WNR

Annual Gross Margin Impact per Barrel

$0.1/gallon change in RIN price

Source: Barclay's U.S. Independent Refiners RIN Report & Company data

32

Non-GAAP Financial Measures

Consolidated Adjusted EBITDA and Adjusted Net Income (Loss) Reconciliation(1)

(in thousands)

_____________________________________________

(1) We believe Adjusted Net Income (Loss) and Adjusted EBITDA are useful supplemental financial measures that allow investors to assess: (1) The financial performance of our

assets without regard to financing methods, capital structure or historical cost basis. (2) The ability of our assets to generate cash to pay interest on our indebtedness, and (3)

Our operating performance and return on invested capital as compared to other companies without regard to financing methods and capital structure. Adjusted Net Income

(Loss) and Adjusted EBITDA should not be considered in isolation or as a substitute for operating income (loss), net income (loss), cash flows provided by operating, investing

and financing activities, or other income or cash flow statement data prepared in accordance with GAAP. Adjusted Net Income (Loss) and Adjusted EBITDA presented by other

companies may not be comparable to our presentation as other companies may define these terms differently.

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

Net income (loss) $31,660 $462 $11,723 $14,740 (66,836)$ (18,673)$ (13,088)$ (27,761)$

Adjustments to Net income (loss):

Unrealized loss (gain) on derivatives (698) 2,406 (1,980) 4,360 6,110 992 (8,406) 1,117

Acquisition and integration expense 2,561 1,061 470 280 195 671 845 2,047

- - (18,585) 295 1,531 - (8,573) -

Loss on termination of financing agreements 1,788 - 19,229 - 440 - - -

Change in value of common stock warrants (315) 5,022 (3,313) 1,023 932 (1,644) (1,176) (657)

Change in value of contingent consideration 2,909 4,929 9,495 4,255 (229) (6,176) (3,552) (1,025)

Inventory valuation adjustment 2,444 (2,179) 44 (10,762) 19,586 18,322 (1,059) 7,324

Impairment expense - - - 9,639 - - - -

Adjusted Net Income (loss) $40,349 $11,701 $17,083 $23,830 ($38,271) ($6,508) ($35,009) ($18,955)

Depreciation, depletion and amortization 4,628 3,251 5,005 4,596 7,066 5,095 5,100 9,643

Interest expense and financing costs, net 4,015 5,557 5,825 4,387 4,387 4,613 6,106 11,232

Equity losses (earnings) from Laramie Energy, LLC (1,475) 1,826 2,950 1,355 49,852 1,871 16,948 (3,659)

Income tax expense (benefit) (342) 65 (22) 174 (246) 336 89 30

Adjusted EBITDA $47,175 $22,400 $30,841 $34,342 $22,788 $5,407 ($6,766) ($1,709)

2014 2015

Release of tax valuation allowance

2016

33

Non-GAAP Financial Measures

Consolidated Adjusted EBITDA Reconciliation (1)

For the twelve months ended September 30, 2016

(in thousands)

_____________________________________________

(1) Refer to description of Adjusted Net Income (Loss) and Adjusted EBITDA on the previous slide.

Net loss (126,358)$

Adjustments to Net loss:

Unrealized gain on derivatives (187)

Acquisition and integration expense 3,758

(7,042)

Loss on termination of financing agreements 440

Change in value of common stock warrants (2,545)

Change in value of contingent consideration (10,982)

Inventory valuation adjustment 44,173

Adjusted Net Income (loss) (98,743)$

Depreciation, depletion and amortization 26,904

Interest expense and financing costs, net 26,338

Equity losses from Laramie Energy, LLC 65,012

Income tax expense 209

Adjusted EBITDA $19,720

Release of tax valuation allowance

34

Non-GAAP Financial Measures

Adjusted EBITDA by Segment Reconciliation(1)

(in thousands)

Refining Retail Logistics

Corporate,

Texadian and

Other

Operating income (loss) (41,656)$ 22,835$ 18,552$ (54,658)$

Depreciation, depletion and amortization 13,715 6,676 3,966 2,548

Unrealized loss (gain) on derivatives (757) - - 570

Inventory valuation adjustment 47,108 - - (2,937)

Acquisition and Integration expense - - - 3,758

Adjusted EBITDA 18,410$ 29,511$ 22,518$ (50,719)$

Twelve months ended September 30, 2016

_____________________________________________

(1) Adjusted EBITDA by segment is defined as operating income (loss) by segment excluding unrealized (gains) losses on derivatives, inventory valuation adjustment,

acquisition and integration expense, and depreciation, depletion and amortization expense. We believe Adjusted EBITDA by segment is a useful supplemental

financial measure to evaluate the economic performance of our segments without regard to financing methods, capital structure or historical cost basis. Adjusted

EBITDA by segment presented by other companies may not be comparable to our presentation as other companies may define these terms differently.

35

Laramie Energy Adjusted EBITDAX

(in thousands)

Note: We believe Laramie’s Adjusted EBITDAX is a useful supplemental financial measure because it allows investors to more effectively evaluate Laramie’s operating

performance as compared other companies without regard to financing methods and capital structure. Adjusted EBITDAX is also a material component used in

measuring compliance with the covenants contained in Laramie’s existing credit agreement. Laramie excludes the items listed above from net income (loss) in arriving at

Adjusted EBITDAX because these amounts can vary substantially from company to company within the oil and gas industry depending upon, among other things,

accounting methods and capital structures. Adjusted EBITDAX excludes the effect of bonus accrual, equity-based compensation expense, and abandoned property and

expired lease expense and therefore differs from Non-GAAP financial measures used by Par that do not exclude the effects of these items. Adjusted EBITDAX should not

be considered in isolation or as a substitute for operating income (loss), net income (loss), or other income or cash flow statement data prepared in accordance with

GAAP. Adjusted EBITDAX presented by other companies may not be comparable to Laramie’s presentation as other companies may define terms differently.

Three months ended

September 30,

2016

Net (loss) income 5,057

-

Commodity derivative gains (11,743)

-

Gains (losses) on settled derivative instruments (923)

-

Interest expense 1,017

-

Non-cash preferred dividend 946

-

Depreciation, depletion, amortization, and accretion 13,986

-

Exploration expense 28

-

Bonus accrual 663

-

Equity based compensation expense 1,605

-

Disposal of assets gain (375)

Total Adjusted EBITDAX 10,259

36

Non-GAAP PV10 and PV-20 Disclosure

Non-GAAP PV10 and PV20 Disclosure

PV10 and PV20 are considered non-GAAP financial measures under SEC regulations because they do not include the effects of

future income taxes, as is required in computing the standardized measure of discounted future net cash flows. However, our

PV10/PV20 and our standardized measure of discounted future net cash flows are equivalent as we do not project to be taxable

or pay cash income taxes based on our available tax assets and additional tax assets generated in the development of reserves

because the tax basis of our oil and gas properties and NOL carryforwards exceeds the amount of discounted future net

earnings. PV10/PV20 should not be considered a substitute for, or superior to, measures prepared in accordance with U.S.

generally accepted accounting principles. We believe that PV10 and PV20 are important measures that can be used to evaluate

the relative significance of our natural gas and oil properties to other companies and that PV10 and PV20 are widely used by

securities analysts and investors when evaluating oil and gas companies. PV10 and PV20 computed on the same basis as the

standardized measure of discounted future net cash flows but without deducting income taxes.