Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TRUIST FINANCIAL CORP | exh991bibleconfnov2016.htm |

| 8-K - 8-K - TRUIST FINANCIAL CORP | form8kbibleconfnov2016.htm |

2

Agenda

BB&T vision and mission

BB&T overview

Performance recap

Balancing expense objectives

Well-positioned for the future

4

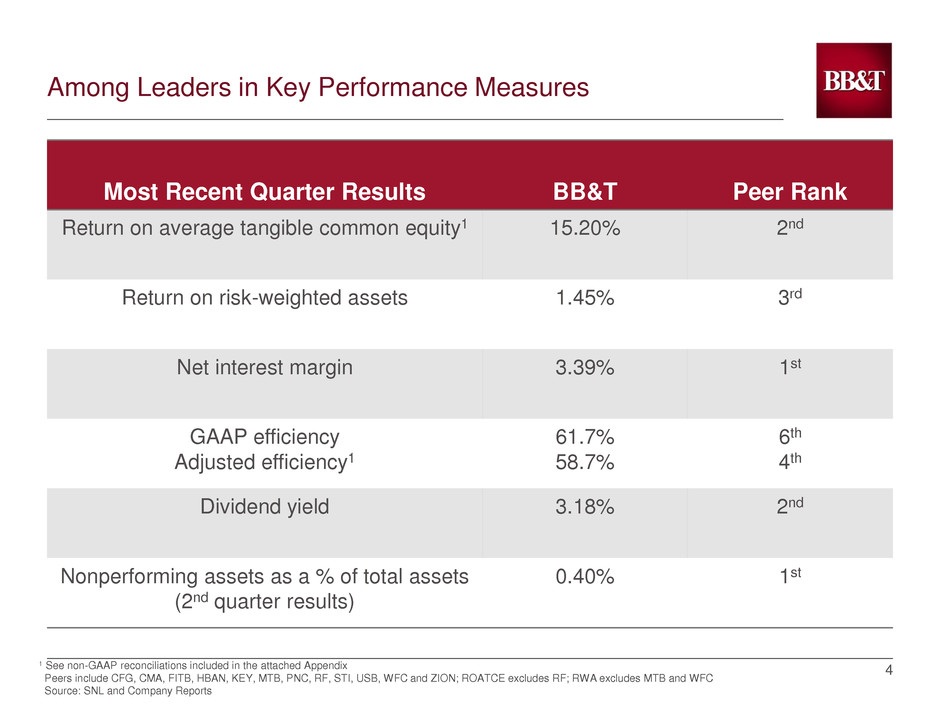

Among Leaders in Key Performance Measures

Most Recent Quarter Results BB&T Peer Rank

Return on average tangible common equity1 15.20% 2nd

Return on risk-weighted assets 1.45% 3rd

Net interest margin 3.39% 1st

GAAP efficiency

Adjusted efficiency1

61.7%

58.7%

6th

4th

Dividend yield 3.18% 2nd

Nonperforming assets as a % of total assets

(2nd quarter results)

0.40% 1st

1 See non-GAAP reconciliations included in the attached Appendix

Peers include CFG, CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, WFC and ZION; ROATCE excludes RF; RWA excludes MTB and WFC

Source: SNL and Company Reports

5

BB&T is…

A values-driven highly profitable growth organization. While we have had a very

successful merger history, our primary focus is on organic growth; nonetheless, we are

well positioned for strategic opportunities.

Our fundamental strategy is to deliver the best value proposition in our markets.

Recognizing value is a function of quality to price, our focus is on delivering high quality

client service resulting in the Perfect Client Experience.

Our over-arching purpose is to achieve our vision and mission, consistent with our

values, with the ultimate goal of maximizing shareholder returns.

6

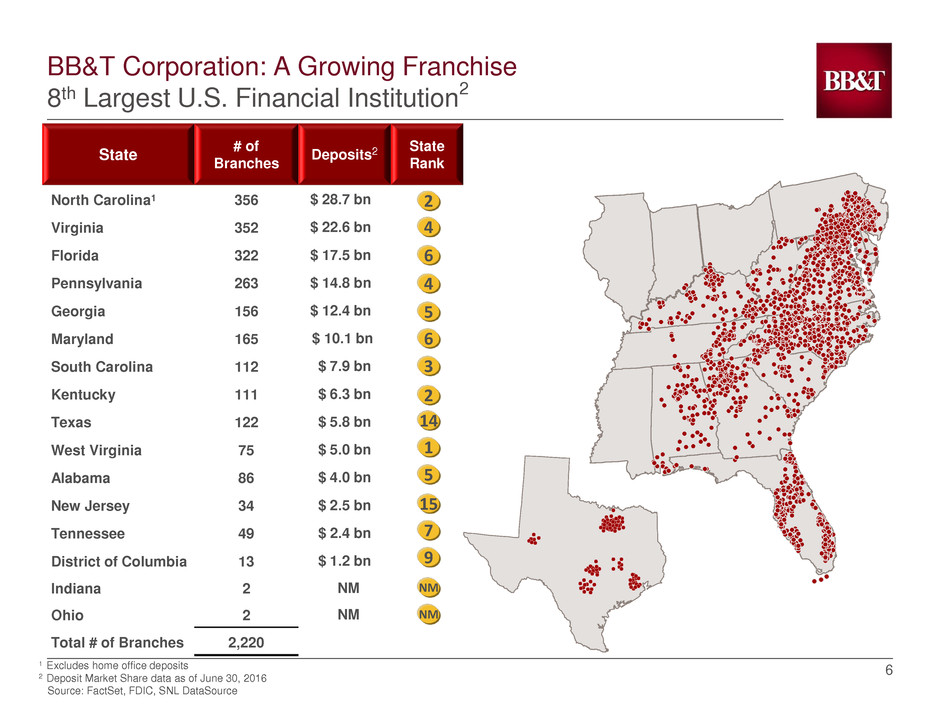

1 Excludes home office deposits

2 Deposit Market Share data as of June 30, 2016

Source: FactSet, FDIC, SNL DataSource

State

# of

Branches

Deposits2

State

Rank

North Carolina1 356 $ 28.7 bn

Virginia 352 $ 22.6 bn

Florida 322 $ 17.5 bn

Pennsylvania 263 $ 14.8 bn

Georgia 156 $ 12.4 bn

Maryland 165 $ 10.1 bn

South Carolina 112 $ 7.9 bn

Kentucky 111 $ 6.3 bn

Texas 122 $ 5.8 bn

West Virginia 75 $ 5.0 bn

Alabama 86 $ 4.0 bn

New Jersey 34 $ 2.5 bn

Tennessee 49 $ 2.4 bn

District of Columbia 13 $ 1.2 bn

Indiana 2 NM

Ohio 2 NM

Total # of Branches 2,220

BB&T Corporation: A Growing Franchise

8th Largest U.S. Financial Institution2

15

7

NM

4

2

6

4

2

14

3

5

1

5

NM

6

9

7

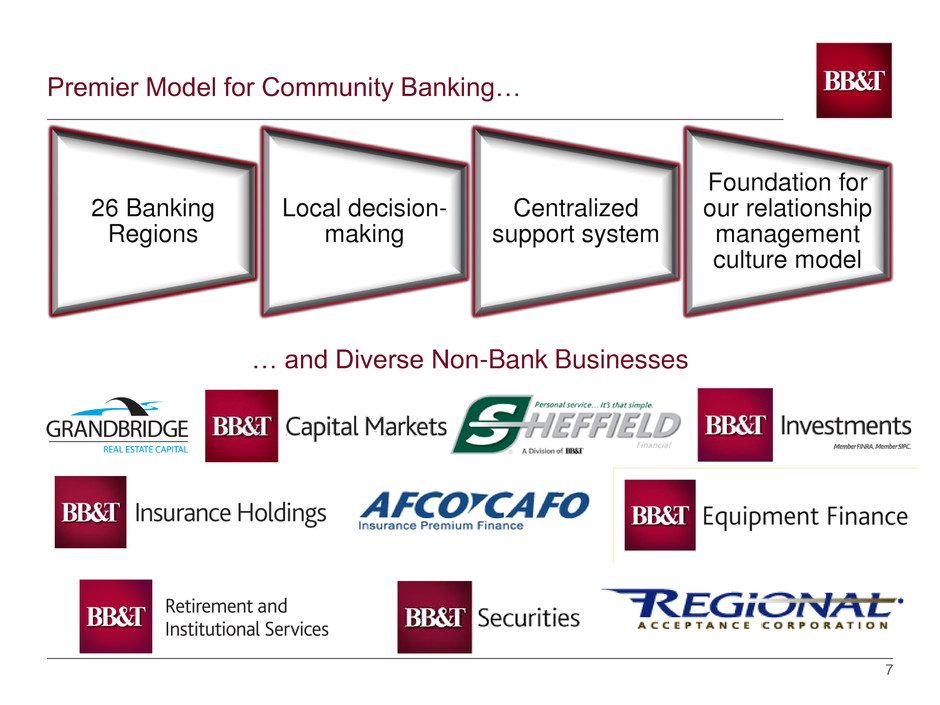

Premier Model for Community Banking…

26 Banking

Regions

Local decision-

making

Centralized

support system

Foundation for

our relationship

management

culture model

… and Diverse Non-Bank Businesses

8

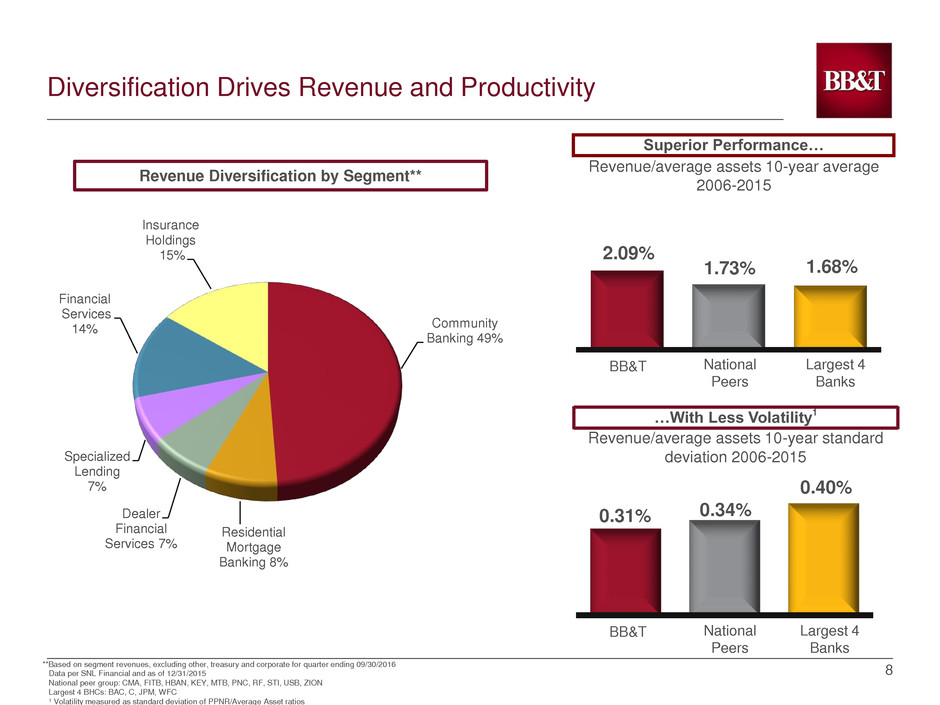

Diversification Drives Revenue and Productivity

**Based on segment revenues, excluding other, treasury and corporate for quarter ending 09/30/2016

2.09%

1.73% 1.68%

Superior Performance…

BB&T National

Peers

Largest 4

Banks

Revenue/average assets 10-year average

2006-2015

…With Less Volatility1

0.31% 0.34%

0.40%

Revenue/average assets 10-year standard

deviation 2006-2015

BB&T National

Peers

Largest 4

Banks

Data per SNL Financial and as of 12/31/2015

National peer group: CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, ZION

Largest 4 BHCs: BAC, C, JPM, WFC

1 Volatility measured as standard deviation of PPNR/Average Asset ratios

Revenue Diversification by Segment**

Community

Banking 49%

Residential

Mortgage

Banking 8%

Dealer

Financial

Services 7%

Specialized

Lending

7%

Financial

Services

14%

Insurance

Holdings

15%

9

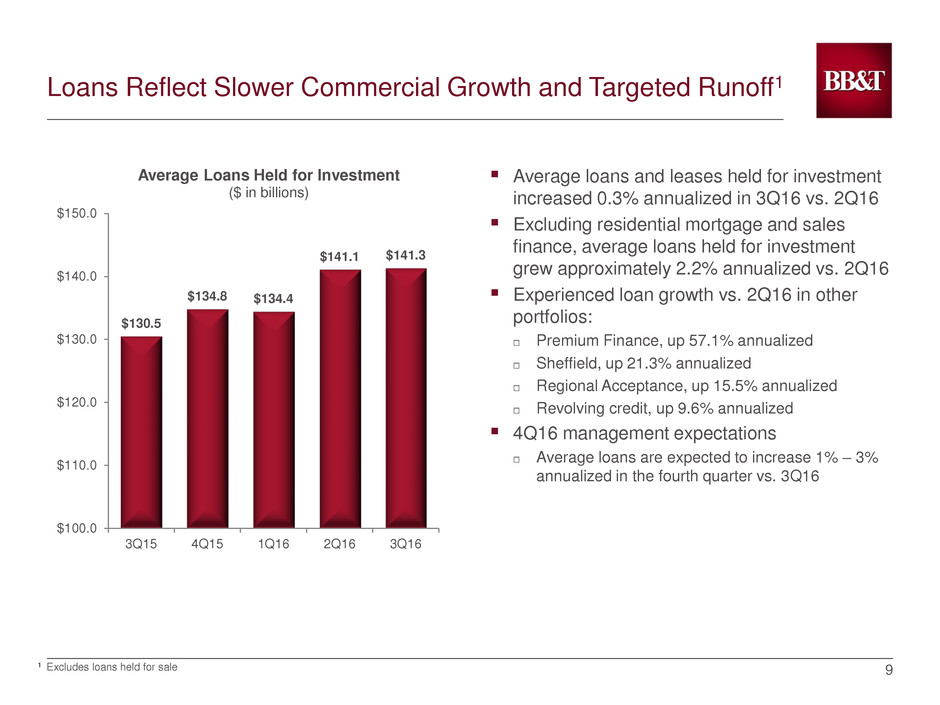

Loans Reflect Slower Commercial Growth and Targeted Runoff1

Average loans and leases held for investment

increased 0.3% annualized in 3Q16 vs. 2Q16

Excluding residential mortgage and sales

finance, average loans held for investment

grew approximately 2.2% annualized vs. 2Q16

Experienced loan growth vs. 2Q16 in other

portfolios:

Premium Finance, up 57.1% annualized

Sheffield, up 21.3% annualized

Regional Acceptance, up 15.5% annualized

Revolving credit, up 9.6% annualized

4Q16 management expectations

Average loans are expected to increase 1% – 3%

annualized in the fourth quarter vs. 3Q16

1 Excludes loans held for sale

$130.5

$134.8 $134.4

$141.1 $141.3

$100.0

$110.0

$120.0

$130.0

$140.0

$150.0

3Q15 4Q15 1Q16 2Q16 3Q16

Average Loans Held for Investment

($ in billions)

10

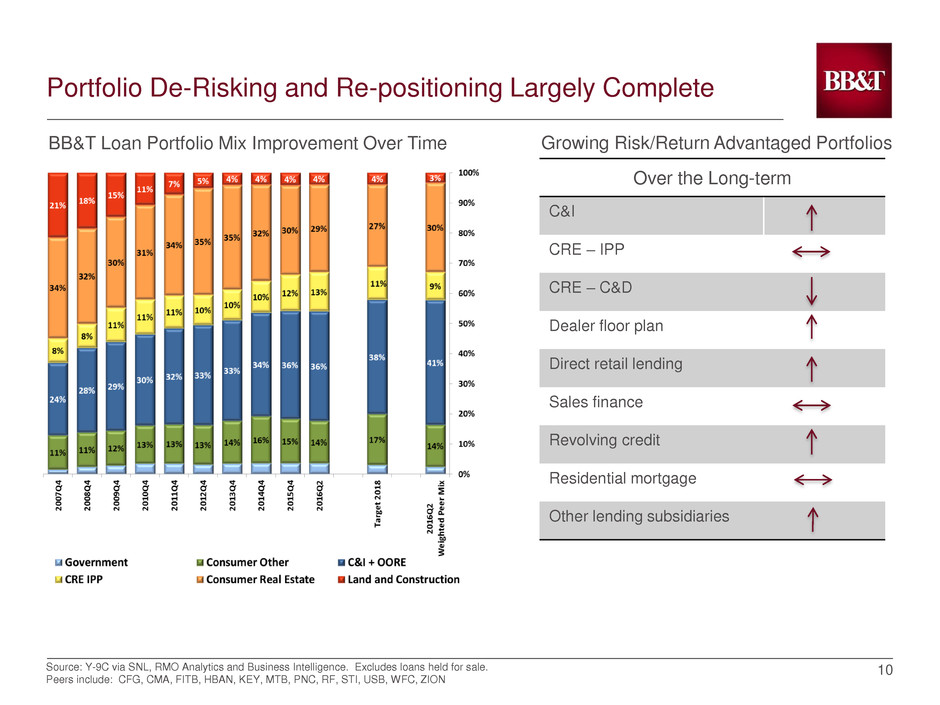

Portfolio De-Risking and Re-positioning Largely Complete

Source: Y-9C via SNL, RMO Analytics and Business Intelligence. Excludes loans held for sale.

Peers include: CFG, CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, WFC, ZION

BB&T Loan Portfolio Mix Improvement Over Time

Over the Long-term

C&I

CRE – IPP

CRE – C&D

Dealer floor plan

Direct retail lending

Sales finance

Revolving credit

Residential mortgage

Other lending subsidiaries

Growing Risk/Return Advantaged Portfolios

11

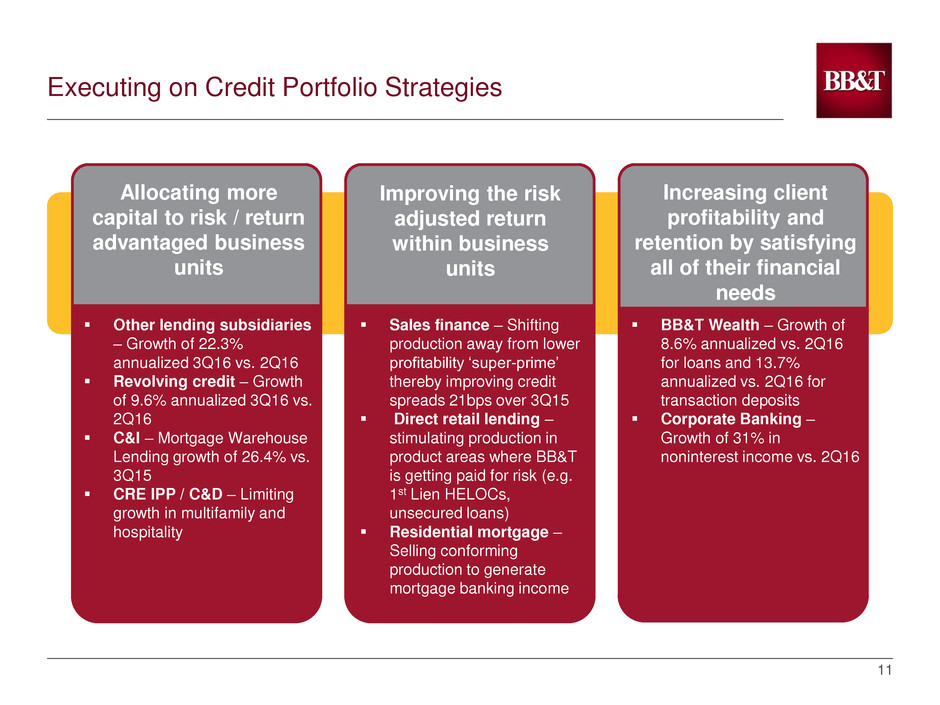

Executing on Credit Portfolio Strategies

Allocating more

capital to risk / return

advantaged business

units

Improving the risk

adjusted return

within business

units

Increasing client

profitability and

retention by satisfying

all of their financial

needs

Other lending subsidiaries

– Growth of 22.3%

annualized 3Q16 vs. 2Q16

Revolving credit – Growth

of 9.6% annualized 3Q16 vs.

2Q16

C&I – Mortgage Warehouse

Lending growth of 26.4% vs.

3Q15

CRE IPP / C&D – Limiting

growth in multifamily and

hospitality

Sales finance – Shifting

production away from lower

profitability ‘super-prime’

thereby improving credit

spreads 21bps over 3Q15

Direct retail lending –

stimulating production in

product areas where BB&T

is getting paid for risk (e.g.

1st Lien HELOCs,

unsecured loans)

Residential mortgage –

Selling conforming

production to generate

mortgage banking income

BB&T Wealth – Growth of

8.6% annualized vs. 2Q16

for loans and 13.7%

annualized vs. 2Q16 for

transaction deposits

Corporate Banking –

Growth of 31% in

noninterest income vs. 2Q16

12

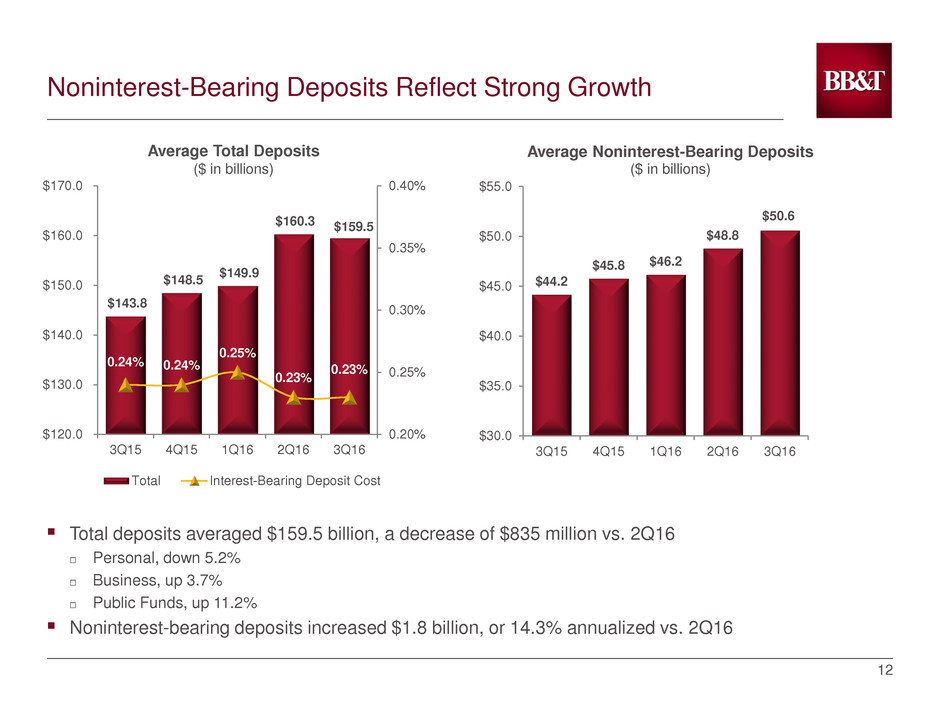

Noninterest-Bearing Deposits Reflect Strong Growth

$143.8

$148.5

$149.9

$160.3 $159.5

0.24% 0.24%

0.25%

0.23%

0.23%

0.20%

0.25%

0.30%

0.35%

0.40%

$120.0

$130.0

$140.0

$150.0

$160.0

$170.0

3Q15 4Q15 1Q16 2Q16 3Q16

Total Interest-Bearing Deposit Cost

Total deposits averaged $159.5 billion, a decrease of $835 million vs. 2Q16

Personal, down 5.2%

Business, up 3.7%

Public Funds, up 11.2%

Noninterest-bearing deposits increased $1.8 billion, or 14.3% annualized vs. 2Q16

Average Total Deposits

($ in billions)

$44.2

$45.8 $46.2

$48.8

$50.6

$30.0

$35.0

$40.0

$45.0

$50.0

$55.0

3Q15 4Q15 1Q16 2Q16 3Q16

Average Noninterest-Bearing Deposits

($ in billions)

13

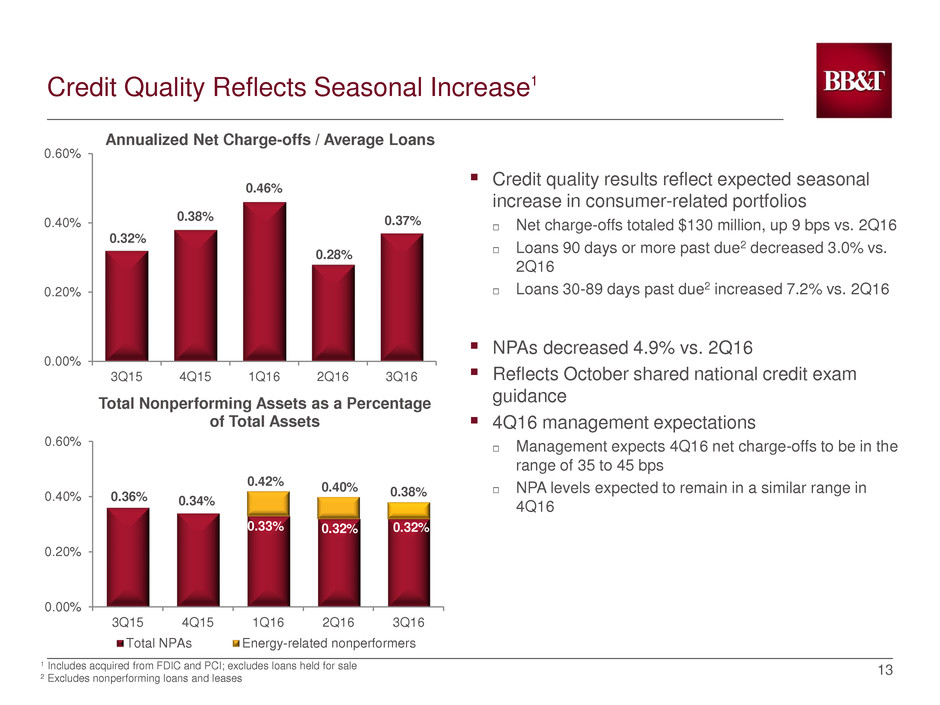

Credit Quality Reflects Seasonal Increase1

Credit quality results reflect expected seasonal

increase in consumer-related portfolios

Net charge-offs totaled $130 million, up 9 bps vs. 2Q16

Loans 90 days or more past due2 decreased 3.0% vs.

2Q16

Loans 30-89 days past due2 increased 7.2% vs. 2Q16

NPAs decreased 4.9% vs. 2Q16

Reflects October shared national credit exam

guidance

4Q16 management expectations

Management expects 4Q16 net charge-offs to be in the

range of 35 to 45 bps

NPA levels expected to remain in a similar range in

4Q16

0.36% 0.34%

0.42%

0.32%

0.38%

0.33%

0.40%

0.32%

0.00%

0.20%

0.40%

0.60%

3Q15 4Q15 1Q16 2Q16 3Q16

Total Nonperforming Assets as a Percentage

of Total Assets

Total NPAs Energy-related nonperformers

Annualized Net Charge-offs / Average Loans

1 Includes acquired from FDIC and PCI; excludes loans held for sale

2 Excludes nonperforming loans and leases

0.32%

0.38%

0.46%

0.28%

0.37%

0.00%

0.20%

0.40%

0.60%

3Q15 4Q15 1Q16 2Q16 3Q16

14

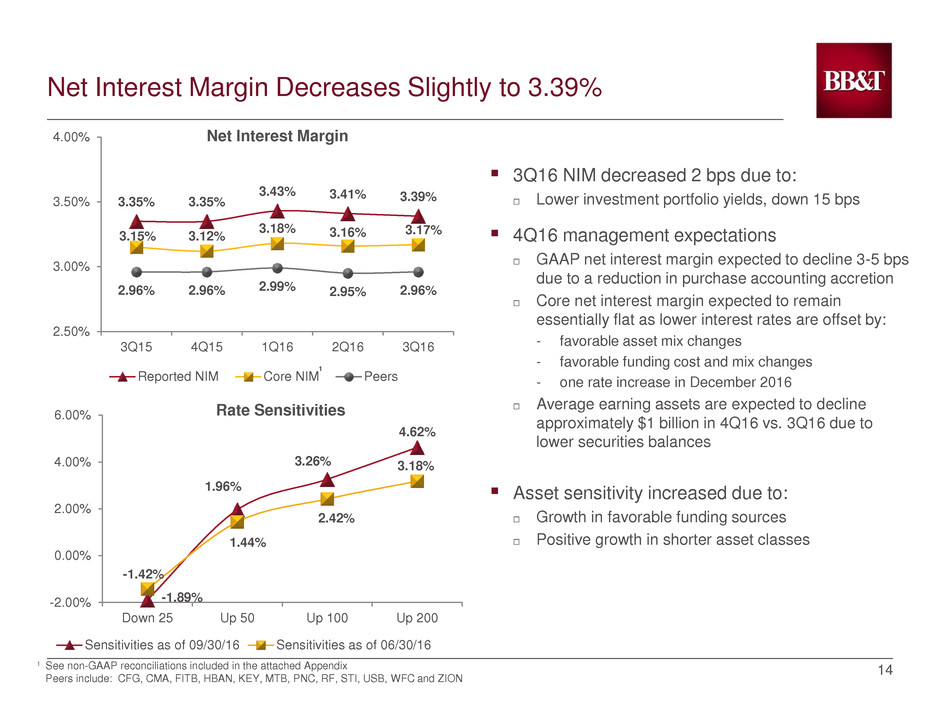

Net Interest Margin Decreases Slightly to 3.39%

3.35% 3.35%

3.43% 3.41% 3.39%

3.15% 3.12%

3.18% 3.16% 3.17%

2.96% 2.96% 2.99% 2.95% 2.96%

2.50%

3.00%

3.50%

4.00%

3Q15 4Q15 1Q16 2Q16 3Q16

Reported NIM Core NIM Peers

3Q16 NIM decreased 2 bps due to:

Lower investment portfolio yields, down 15 bps

4Q16 management expectations

GAAP net interest margin expected to decline 3-5 bps

due to a reduction in purchase accounting accretion

Core net interest margin expected to remain

essentially flat as lower interest rates are offset by:

- favorable asset mix changes

- favorable funding cost and mix changes

- one rate increase in December 2016

Average earning assets are expected to decline

approximately $1 billion in 4Q16 vs. 3Q16 due to

lower securities balances

Asset sensitivity increased due to:

Growth in favorable funding sources

Positive growth in shorter asset classes

Net Interest Margin

1

-1.89%

1.96%

3.26%

4.62%

-1.42%

1.44%

2.42%

3.18%

-2.00%

0.00%

2.00%

4.00%

6.00%

Down 25 Up 50 Up 100 Up 200

Sensitivities as of 09/30/16 Sensitivities as of 06/30/16

Rate Sensitivities

1 See non-GAAP reconciliations included in the attached Appendix

Peers include: CFG, CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, WFC and ZION

15

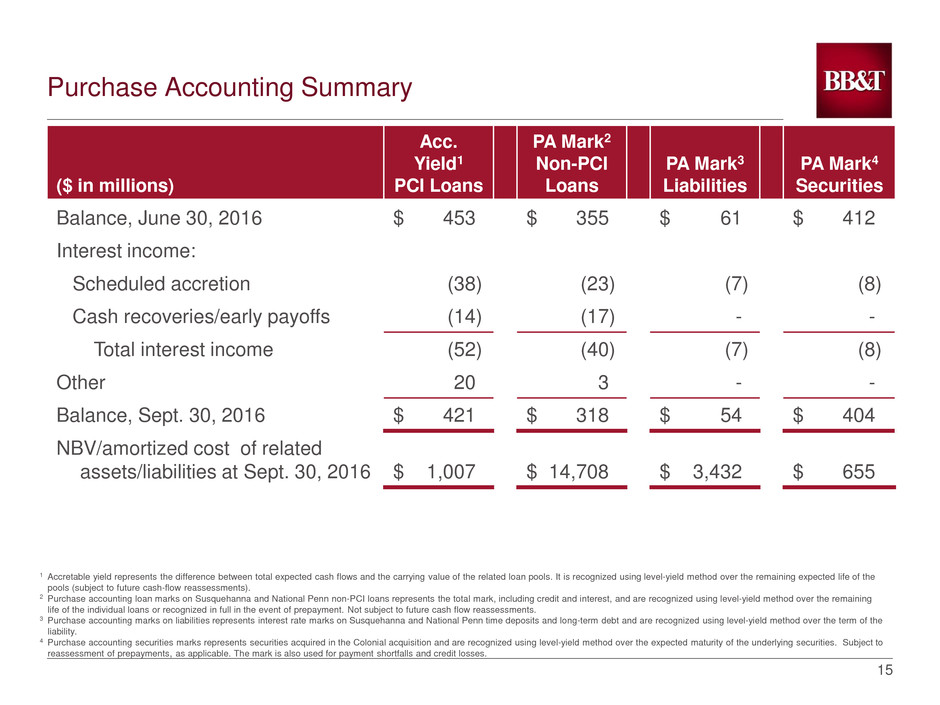

Purchase Accounting Summary

($ in millions)

Acc.

Yield1

PCI Loans

PA Mark2

Non-PCI

Loans

PA Mark3

Liabilities

PA Mark4

Securities

Balance, June 30, 2016 $ 453 $ 355 $ 61 $ 412

Interest income:

Scheduled accretion (38) (23) (7) (8)

Cash recoveries/early payoffs (14) (17) - -

Total interest income (52) (40) (7) (8)

Other 20 3 - -

Balance, Sept. 30, 2016 $ 421 $ 318 $ 54 $ 404

NBV/amortized cost of related

assets/liabilities at Sept. 30, 2016 $ 1,007 $ 14,708 $ 3,432 $ 655

1 Accretable yield represents the difference between total expected cash flows and the carrying value of the related loan pools. It is recognized using level-yield method over the remaining expected life of the

pools (subject to future cash-flow reassessments).

2 Purchase accounting loan marks on Susquehanna and National Penn non-PCI loans represents the total mark, including credit and interest, and are recognized using level-yield method over the remaining

life of the individual loans or recognized in full in the event of prepayment. Not subject to future cash flow reassessments.

3 Purchase accounting marks on liabilities represents interest rate marks on Susquehanna and National Penn time deposits and long-term debt and are recognized using level-yield method over the term of the

liability.

4 Purchase accounting securities marks represents securities acquired in the Colonial acquisition and are recognized using level-yield method over the expected maturity of the underlying securities. Subject to

reassessment of prepayments, as applicable. The mark is also used for payment shortfalls and credit losses.

16

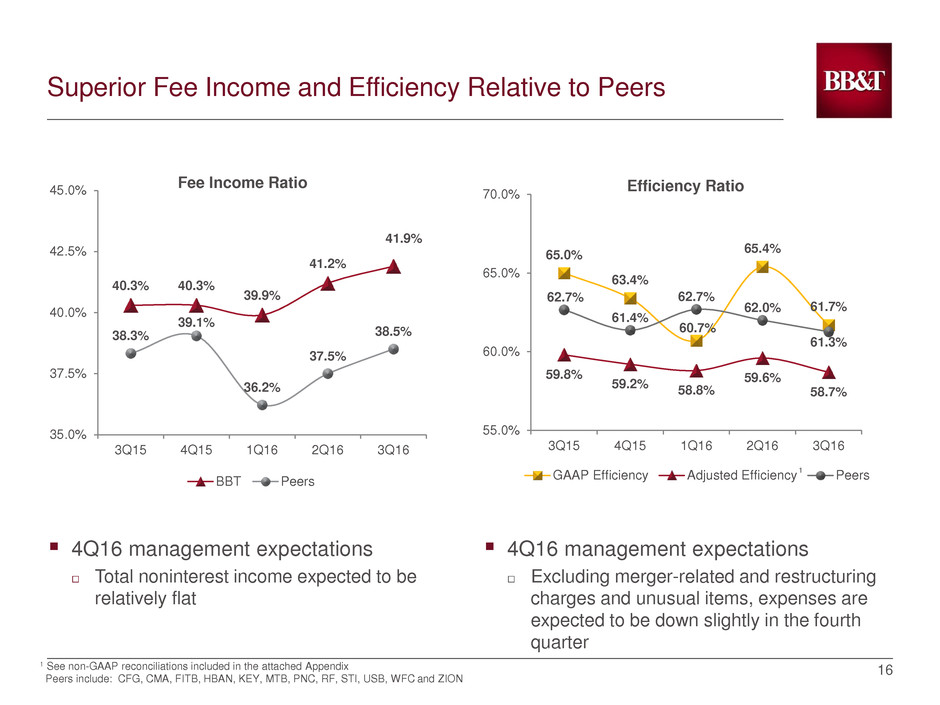

4Q16 management expectations

Total noninterest income expected to be

relatively flat

40.3% 40.3%

39.9%

41.2%

41.9%

38.3%

39.1%

36.2%

37.5%

38.5%

35.0%

37.5%

40.0%

42.5%

45.0%

3Q15 4Q15 1Q16 2Q16 3Q16

Fee Income Ratio

BBT Peers

1 See non-GAAP reconciliations included in the attached Appendix

Peers include: CFG, CMA, FITB, HBAN, KEY, MTB, PNC, RF, STI, USB, WFC and ZION

Superior Fee Income and Efficiency Relative to Peers

65.0%

63.4%

60.7%

65.4%

61.7%

59.8%

59.2% 58.8%

59.6%

58.7%

62.7%

61.4%

62.7%

62.0%

61.3%

55.0%

60.0%

65.0%

70.0%

3Q15 4Q15 1Q16 2Q16 3Q16

Efficiency Ratio

GAAP Efficiency Adjusted Efficiency Peers

4Q16 management expectations

Excluding merger-related and restructuring

charges and unusual items, expenses are

expected to be down slightly in the fourth

quarter

1

17

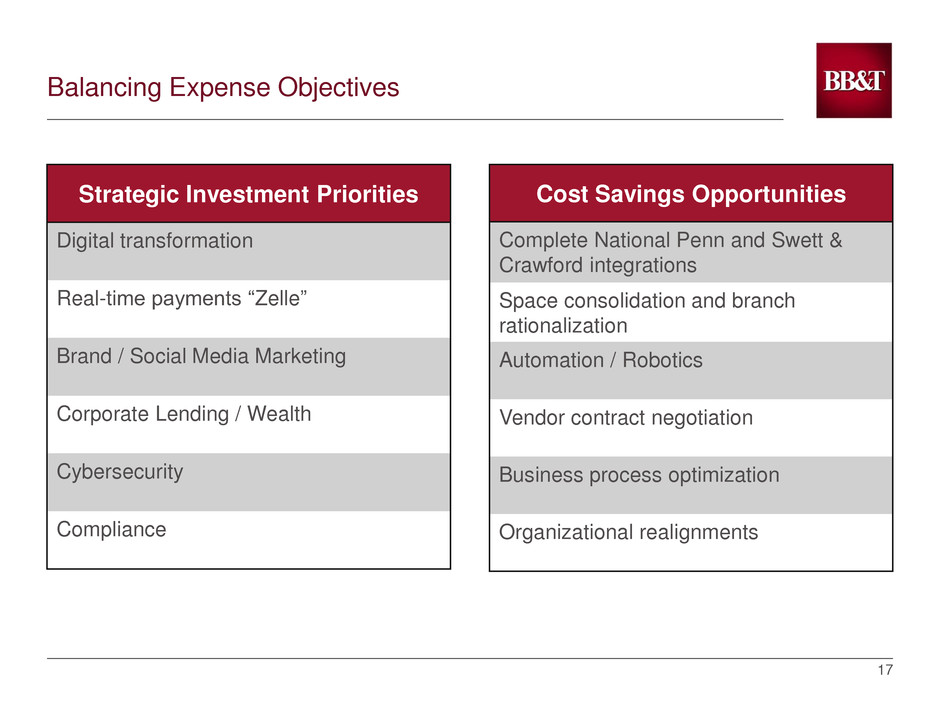

Balancing Expense Objectives

Strategic Investment Priorities

Digital transformation

Real-time payments “Zelle”

Brand / Social Media Marketing

Corporate Lending / Wealth

Cybersecurity

Compliance

Cost Savings Opportunities

Complete National Penn and Swett &

Crawford integrations

Space consolidation and branch

rationalization

Automation / Robotics

Vendor contract negotiation

Business process optimization

Organizational realignments

18

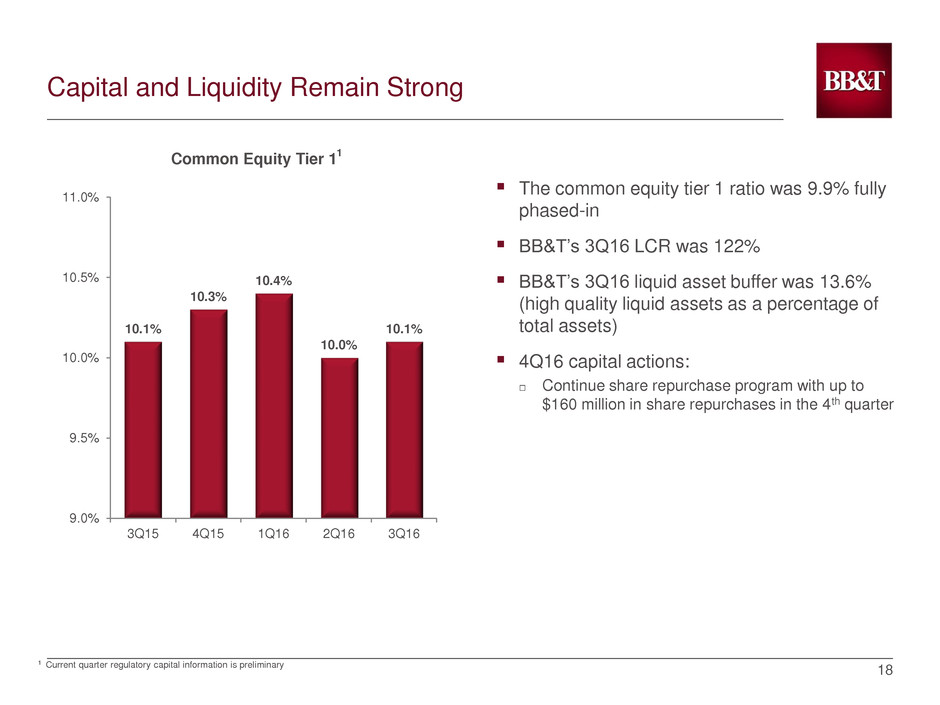

Capital and Liquidity Remain Strong

10.1%

10.3%

10.4%

10.0%

10.1%

9.0%

9.5%

10.0%

10.5%

11.0%

3Q15 4Q15 1Q16 2Q16 3Q16

The common equity tier 1 ratio was 9.9% fully

phased-in

BB&T’s 3Q16 LCR was 122%

BB&T’s 3Q16 liquid asset buffer was 13.6%

(high quality liquid assets as a percentage of

total assets)

4Q16 capital actions:

Continue share repurchase program with up to

$160 million in share repurchases in the 4th quarter

1 Current quarter regulatory capital information is preliminary

Common Equity Tier 1

1

19

Well-Positioned For the Future

Pennsylvania integration going well

Diversification drives long-term stability / less volatility

Maintaining long-term performance advantages

Most diversified insurance brokerage platform in the industry

Achieving targeted cost savings / intensifying focus on expenses

Investments in digital opportunities

U by BB&T

Strong dividend

Among the highest dividend payout ratios

Unique and non-negotiable culture

20

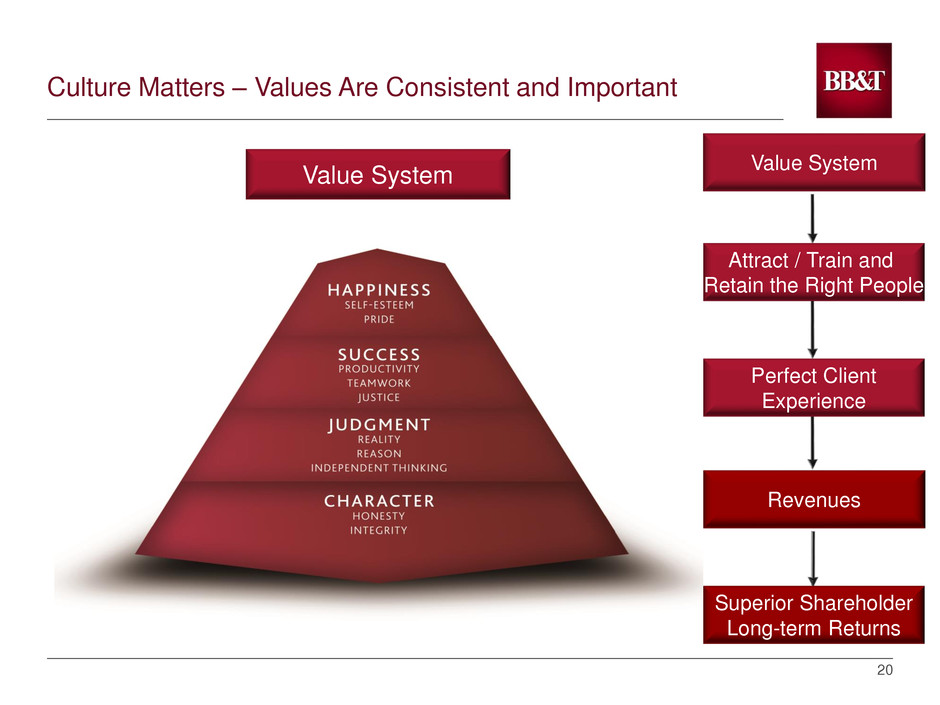

Value System

Revenues

Superior Shareholder

Long-term Returns

Value System

Attract / Train and

Retain the Right People

Perfect Client

Experience

Culture Matters – Values Are Consistent and Important

Appendix

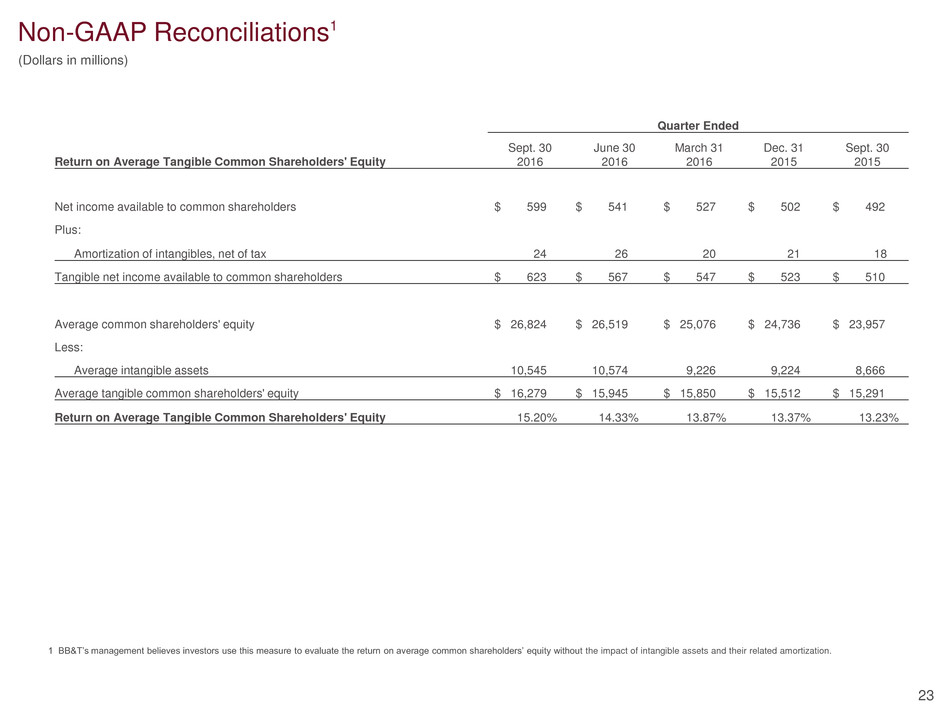

23

1 BB&T’s management believes investors use this measure to evaluate the return on average common shareholders’ equity without the impact of intangible assets and their related amortization.

Non-GAAP Reconciliations1

(Dollars in millions)

Quarter Ended

Sept. 30 June 30 March 31 Dec. 31 Sept. 30

Return on Average Tangible Common Shareholders' Equity 2016 2016 2016 2015 2015

Net income available to common shareholders $ 599 $ 541 $ 527 $ 502 $ 492

Plus:

Amortization of intangibles, net of tax 24 26 20 21 18

Tangible net income available to common shareholders $ 623 $ 567 $ 547 $ 523 $ 510

Average common shareholders' equity $ 26,824 $ 26,519 $ 25,076 $ 24,736 $ 23,957

Less:

Average intangible assets 10,545 10,574 9,226 9,224 8,666

Average tangible common shareholders' equity $ 16,279 $ 15,945 $ 15,850 $ 15,512 $ 15,291

Return on Average Tangible Common Shareholders' Equity 15.20% 14.33% 13.87% 13.37% 13.23%

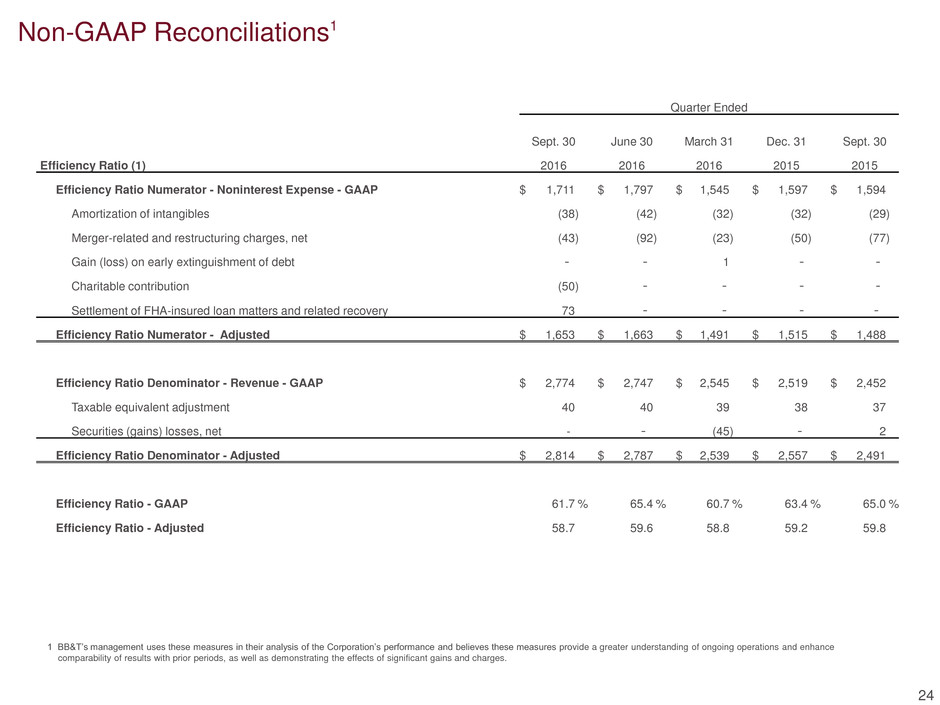

Non-GAAP Reconciliations1

24

1 BB&T’s management uses these measures in their analysis of the Corporation’s performance and believes these measures provide a greater understanding of ongoing operations and enhance

comparability of results with prior periods, as well as demonstrating the effects of significant gains and charges.

Quarter Ended

Sept. 30 June 30 March 31 Dec. 31 Sept. 30

Efficiency Ratio (1) 2016 2016 2016 2015 2015

Efficiency Ratio Numerator - Noninterest Expense - GAAP $ 1,711

$ 1,797

$ 1,545

$ 1,597

$ 1,594

Amortization of intangibles (38 ) (42 ) (32 ) (32 ) (29 )

Merger-related and restructuring charges, net (43 ) (92 ) (23 ) (50 ) (77 )

Gain (loss) on early extinguishment of debt -

-

1

-

-

Charitable contribution (50 ) -

-

-

-

Settlement of FHA-insured loan matters and related recovery 73

-

-

-

-

Efficiency Ratio Numerator - Adjusted $ 1,653

$ 1,663

$ 1,491

$ 1,515

$ 1,488

Efficiency Ratio Denominator - Revenue - GAAP $ 2,774

$ 2,747

$ 2,545

$ 2,519

$ 2,452

Taxable equivalent adjustment 40

40

39

38

37

Securities (gains) losses, net -

-

(45 ) -

2

Efficiency Ratio Denominator - Adjusted $ 2,814

$ 2,787

$ 2,539

$ 2,557

$ 2,491

Efficiency Ratio - GAAP 61.7 % 65.4 % 60.7 % 63.4 % 65.0 %

Efficiency Ratio - Adjusted 58.7 59.6 58.8 59.2 59.8

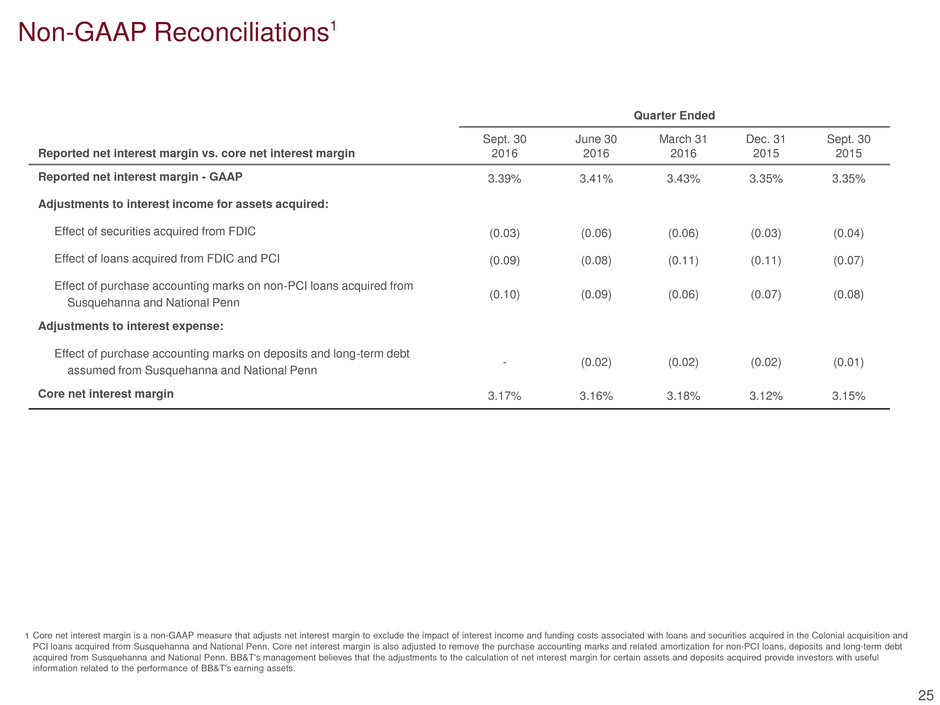

Non-GAAP Reconciliations1

Quarter Ended

Reported net interest margin vs. core net interest margin

Sept. 30

2016

June 30

2016

March 31

2016

Dec. 31

2015

Sept. 30

2015

Reported net interest margin - GAAP 3.39% 3.41% 3.43% 3.35% 3.35%

Adjustments to interest income for assets acquired:

Effect of securities acquired from FDIC (0.03) (0.06) (0.06) (0.03) (0.04)

Effect of loans acquired from FDIC and PCI (0.09) (0.08) (0.11) (0.11) (0.07)

Effect of purchase accounting marks on non-PCI loans acquired from

Susquehanna and National Penn

(0.10) (0.09) (0.06) (0.07) (0.08)

Adjustments to interest expense:

Effect of purchase accounting marks on deposits and long-term debt

assumed from Susquehanna and National Penn

- (0.02) (0.02) (0.02) (0.01)

Core net interest margin 3.17% 3.16% 3.18% 3.12% 3.15%

25

Core net interest margin is a non-GAAP measure that adjusts net interest margin to exclude the impact of interest income and funding costs associated with loans and securities acquired in the Colonial acquisition and

PCI loans acquired from Susquehanna and National Penn. Core net interest margin is also adjusted to remove the purchase accounting marks and related amortization for non-PCI loans, deposits and long-term debt

acquired from Susquehanna and National Penn. BB&T's management believes that the adjustments to the calculation of net interest margin for certain assets and deposits acquired provide investors with useful

information related to the performance of BB&T's earning assets.

1