Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ally Financial Inc. | bancanalystsofbostonpres8-.htm |

1

Ally Financial Inc.

BancAnalysts Association of Boston Conference

November 3, 2016

2

Forward-Looking Statements and Additional Information

The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

This information is preliminary and based on company and third party data available at the time of the presentation

In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,”

“estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “explore,” “positions,” “intend,” “evaluate,”

“pursue,” “seek,” “may,” “would, ” “could, ” “should, ” “believe, ” “potential, ” “continue,” or the negative of these words, or similar expressions is

intended to identify forward-looking statements. All statements herein and in related management comments, other than statements of historical

fact, including without limitation, statements about future events and financial performance, are forward-looking statements that involve certain

risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are

reasonable, these statements are not guarantees of any events or financial results, and Ally’s actual results may differ materially due to numerous

important factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or

supplemented in subsequent reports filed with the SEC. Such factors include, among others, the following: maintaining the mutually beneficial

relationship between Ally and General Motors, and Ally and Chrysler and our ability to further diversify our business; our ability to maintain

relationships with automotive dealers; the significant regulation and restrictions that we are subject to as a bank holding company and financial

holding company; the potential for deterioration in the residual value of off-lease vehicles; disruptions in the market in which we fund our

operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may require or that result from changes in

the accounting rules or their application, which could result in an impact on earnings; changes in our credit ratings; changes in economic

conditions, currency exchange rates or political stability in the markets in which we operate; and changes in the existing or the adoption of new

laws, regulations, policies or other activities of governments, agencies and similar organizations (including as a result of the Dodd-Frank Act and

Basel III).

Investors are cautioned not to place undue reliance on forward-looking statements. Ally undertakes no obligation to update publicly or otherwise

revise any forward-looking statements, whether as a result of new information, future events or other such factors that affect the subject of these

statements, except where expressly required by law. Certain non-GAAP measures are provided in this presentation which are important to the

reader of the Consolidated Financial Statements but should be supplemental and not a substitute for to primary U.S. GAAP measures.

Reconciliation of non-GAAP financial measures are included within this presentation.

Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s operations. The specific products include

retail installment sales contracts, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase, acquisition or

direct origination of various “loan” products.

3

Key Messages

• Unique opportunity in banking

– “Best Online Bank”(1) - well positioned with trends towards digital financial services

– Self-help EPS growth with ROE expansion path

– Deposit growth a significant driver of value

– Returning significant capital to shareholders relative to market capitalization

• Optimizing business mix in auto finance

– Expanding risk-adjusted returns

– Successfully offsetting lease portfolio decline

• Positioned for future with product expansion initiatives

– Reinforce customer-centric brand proposition

– Grow and deepen customer relationships

– Diversify, strengthen franchise and support efficient deposit growth

(1) “Best Online Bank” by Money magazine from 2011-2016

4

Summary of Strategic Path

Theme:

Past Current Future

Repair

Optimize and

Plant Seeds

Grow

Operational

Focus

Financial &

Capital

Focus

Core

ROTCE(1)

Objective

• Diversify from OEM

contracts

• Grow deposits as

funding source

• Optimize returns in

Auto Finance

• Identify and introduce

growth opportunities

• Diversify revenue

streams

• Demonstrate ability

to prudently grow

• Repay TARP

• Address legacy

mortgage issues

• Cut expense base

• Significant share

buybacks

• Full bank

normalization

• Expense efficiency

• Share buybacks

• Increasing dividend

• Capital efficient

growth

n/a 10+/-% 12+/-%

(1) Represents a non-GAAP financial measure. See page 25 for calculation methodology and details.

5

Brand proposition: Relentless ally for the customer

Simple, straightforward approach to banking – customer is at the core

Do It Right Customer-centricity Digital Simple

Build emotional relationship

with customer beyond

financial transactions

24/7 human customer

service

No branches = Great Rates

No geographical

constraints

Customer service that

actually serves

Smart

Solutions oriented and

deliver products that are

never status quo

Innovative

Align with disruptive trends

Transparent

Deliver the plain and

simple truth – no hidden

messages or fees

Low Fee / Great Rate

Fair and transparent fees;

attractive, not top rate

DO RIGHT TIRELESSLY INNOVATE OBSESS OVER THE CUSTOMER

6

Collaborative Culture Breeds an Innovative Company

Alignment of Brand, Culture and Strategy

Brand: Do It Right

• First ever company-wide brand

campaign

• Demonstrates our relentlessness to

be an ally for customers

• Unified customer brand promise

supports growth and diversification

Culture: LEAD

• A clearly defined culture that unifies

all associates around four core

values

Look Externally

Execute with Excellence

Act with Professionalism

Deliver Results

• Associates held accountable for

the “how” as well as the “what”

7

0.4

0.5

0.6

0.8

0.9

1.1

1.2

$22

$28

$35

$43

$48

$55

$66

2010 2011 2012 2013 2014 2015 2016 est.

Retail Deposit Customers

(millions)

Ally Bank Retail Deposits

($ billions)

Proven Success with Digital Deposit Growth

Strong Retail Customer and Deposit Growth

21% CAGR

20% CAGR ~

8

Attractive Demographic Trends

Growing Millennial Segment

New Deposit Customers by Generation

9

Summary of New Products and Growth Areas

Digital Wealth

Management

Mortgage

Credit Card

Corporate

Finance

Additional

Vehicle Finance

Channels

Investment

Portfolio

Integration underway – branding under Ally expected 1Q 17

Aligns with strengths of deposit business

Expect to launch direct-to-consumer product in 4Q 16

Cornerstone product that provides long-term growth upside

Cash back card with additional reward linked to deposit account

Meets customer request and future optionality for diversification

Efficient capital deployment and further revenue diversification

>40% growth YoY – diversified business with attractive ROE

Part of Ally since 1999

Example: Transportation and Equipment Finance, Blue Yield,

Beepi – more to come

Position for future as auto lending evolves

10

Strategic Benefits of Product Expansion

P Support brand awareness and customer retention

P Drive consistent deposit growth

P Minimize deposit beta

P Diversify revenue

P Drive additional, capital efficient fee income

P Provide long runway for EPS growth

P Align company with growth trends in digital financial services

P Improve ROE – individually higher ROE products and supports optimization of auto

Strengthen franchise in a low-risk, capital efficient manner

11

% of Retail, Lease, Commercial and total Insurance Assets (end of period)

21% 22%

27%

14% 9% 4%

14% 18% 23%

12% 16%

11%

30% 29% 30%

8% 6% 6%

2012 2014 2016

Standard loan - new Subvented loan - new Lease Used Commercial Insurance

Dealer Financial Services Progression

2012 3Q 2016

• Notable competitive advantages:

− In business since 1919

− Broad product suite – new, used, super prime to subprime, lease, commercial, insurance, SmartAuction

− Differentiated approach to service – Relentless Ally for Dealers

− Superior application and data flow for managing credit and optimizing returns

• Business successfully diversified and transitioned from manufacturer-centric incentive products

Leading full service, full spectrum auto lender

2014

15.7k

1.7M

New vehicle subvented

loans and leases ~15% of

current dealer financial

services portfolio

16.8k

2.3M

18.2k

2.9M

Dealer Relationships

Qu rterly applications (avg., # millions)

12

Last 12 Months Ended Inc/(Dec)

3Q 16 3Q 15 YoY

($ millions)

Net Financing Revenue $2,249 $1,895 $354

Provision Expense 873 678 195

Risk-Adjusted Margin $1,376 $1,217 $159

Retail

Auto

Improving Returns in Auto Finance Business

• Net financing revenue growth ~1.8x provision expense over the comparable last 12 months

– Provision expense impact also driven by higher outstanding loan balance and increase in coverage ratio

Improving risk-adjusted margin in retail auto loan portfolio

Note: Net financing revenue by product based on segment interest expense allocations

(1) - Estimated average annualized yield is a forward-looking non-GAAP financial measure that management believes is helpful to readers in evaluating the estimated profitability of loan originations during

the period. There is no comparable GAAP measure as the yield is an estimate. See page 18 for details.

Retail Auto Yield

Current Portfolio 5.6%

2016 YTD Originated Yield(1) 5.9%

Total Auto Balance

(avg. daily balance; $ billions)

$111.4 $115.1 $114.2 $112.8 $112.4

Retail net financing revenue offsetting lease decline

($ millions)

$136 $144 $145 $152 $150

$231 $212 $201 $213 $192

$504 $544 $549

$564 $591

$871

$900 $896

$929 $933

3Q15 4Q15 1Q16 2Q16 3Q16

Commercial Auto Lease Retail Total Auto Net Financing Revenue

13

YTD 16 YTD 15

Originated yield

(1) 5.86% 5.27%

Priced NAALR

(2) -1.20% -1.11%

Risk-adjusted yield

(3) 4.65% 4.16%

125% Priced NAALR

(2) -1.51%

Pro forma Risk-adjusted yield

(3) 4.35%

Optimizing Risk-Adjusted Yields(3)

YTD 16

4.65%

Estimated Risk-Adjusted Retail Auto Yield(3)

• Higher yields from optimizing mix and pricing actions have more than offset higher expected loss

rates, even if losses increase beyond expectations

• We expect loans to remain profitable over the life of the loan – even in a Great Recession type stress

(1) Originated yield represents the estimated average annualized yield for loans originated during the period, using yield expectations at origination

(2) Estimated net average annualized loss rate (“NAALR”) on originations at the time of booking

(3) Estimated risk-adjusted retail auto yield is a forward-looking non-GAAP financial measure. See page 18 for calculation methodology and details.

3.00%

3.50%

4.00%

4.50%

5.00%

5.50%

6.00%

Priced Loss Expectation

80% Priced Loss Expectation

125% Priced Loss Expectation

Priced Loss Expectation (Avg. 2014-2015)

14

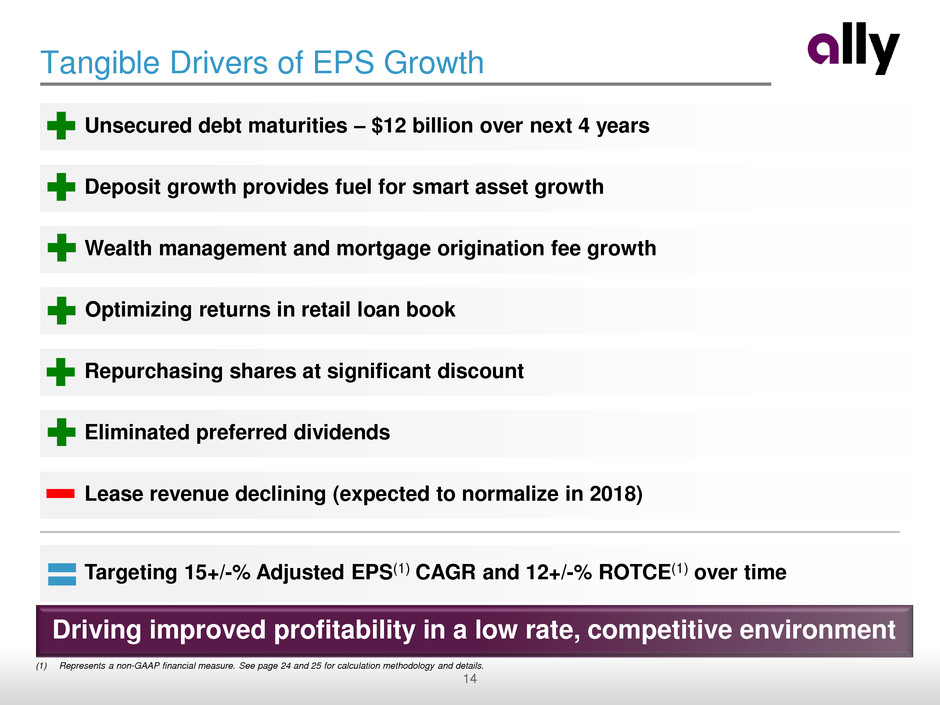

Tangible Drivers of EPS Growth

• Unsecured debt maturities – $12 billion over next 4 years

• Deposit growth provides fuel for smart asset growth

• Repurchasing shares at significant discount

• Wealth management and mortgage origination fee growth

• Eliminated preferred dividends

• Lease revenue declining (expected to normalize in 2018)

• Targeting 15+/-% Adjusted EPS(1) CAGR and 12+/-% ROTCE(1) over time

Driving improved profitability in a low rate, competitive environment

• Optimizing returns in retail loan book

(1) Represents a non-GAAP financial measure. See page 24 and 25 for calculation methodology and details.

15

Last 12 Months (LTM) ending 9/30/16 vs. comparable LTM - Adjusted EPS Growth

21.1%

14.6%

13.2%

7.0%

3.3% 3.2%

2.2% 1.8%

0.8% 0.8% 0.6% 0.6%

-0.6%

-1.7% -1.7% -1.9%

-2.8%

-6.9%

-9.3%

-14.7%

RF CFG ALLY MTB DFS STI USB JPM PNC HBAN SYF FITB KEY STT BBT WFC COF BAC CMA C

EPS Growth Comparison

Focused on delivering long runway of strong EPS growth

Source: Bloomberg Adjusted EPS, last 12 months ended 9/30/16 vs. last 12 months ended 9/30/15

(1) Represents a non-GAAP financial measure. See page 24 calculation methodology and details.

(1)

16

Conclusion: Strategic Priorities

Significantly grow deposit customer base

− Reduce capital markets funding

− More customers to offer new products

− Ultimately lowers deposit beta and allows for pricing optimization

Successfully introduce new banking products – more than a deposit gatherer

− Reinforce customer relationships

− Diversify revenue and improve ROE

− Leverage brand, culture and scalability of the franchise

Position auto finance for the future

− Experts in point-of-sale financing

− Evolve if ride-sharing, autonomous and direct lending grows

− Investing in technology and partnerships

Maintain leading, well respected digital banking brand

Protect book value and deliver attractive, long-term returns

Drive value for shareholders, customers, communities and associates

1

2

3

4

5

6

Strategy: Build the leading modern, digital financial services company

17 CONFIDENTIAL

Supplemental

18

Notes on non-GAAP and other financial measures

Supplemental

1) Core pre-tax income is a non-GAAP financial measure that adjusts pre-tax income from continuing operations by excluding (1) original issue discount (OID)

amortization expense and (2) repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities. Management believes core

pre-tax income can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 26 for

calculation methodology and details.

2) Core net income available to common is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE and that,

like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate

earnings. Core net income available to common adjusts GAAP net income available to common for discontinued operations net of tax, tax-effected OID expense, tax-

effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock capital

actions. See page 24 for calculation methodology and details.

3) Controllable expenses primarily includes employee related costs, consulting and legal fees, marketing, information technology, facility, portfolio servicing and

restructuring expenses.

4) U.S. consumer auto originations

New Retail Subvented – subvented rate new vehicle loans

New Retail Standard – standard rate new vehicle loans

Lease – new vehicle lease originations

Used – used vehicle loans

Growth – total originations from non-GM/Chrysler dealers

5) Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance receivables and loans excluding loans measured at fair

value and loans held-for-sale.

6) Tangible Common Equity is defined as common stockholders’ equity less goodwill and identifiable intangible assets (other than mortgage servicing rights), net of

deferred tax liabilities. Ally considers various measures when evaluating capital adequacy, including tangible common equity. Tangible common equity is not formally

defined by GAAP or codified in the federal banking regulations and, therefore, is considered to be a non-GAAP financial measure. Ally believes that tangible common

equity is important because we believe readers may assess our capital adequacy using this measure. Additionally, presentation of this measure allows readers to

compare certain aspects of our capital adequacy on the same basis to other companies in the industry. For purposes of calculating Core return on tangible common

equity (Core ROTCE), tangible common equity is further adjusted for unamortized original issuance discount and net deferred tax asset. See page 25 for more details.

7) Estimated risk-adjusted retail auto yield is a forward-looking non-GAAP financial measure that management believes is helpful to readers in evaluating the estimated

profitability of loan originations during the period. Estimated risk-adjusted retail auto yield is determined by calculating the estimated average annualized yield less the

estimated net average annualized loss rate (NAALR) for loans originated during the period, using yield and loss expectations at origination. We believe this metric, and

the changes to this metric, are also useful to investors in assessing the pricing of loans originated during the period and in comparing the profitability of loan originations

across periods and against the overall current portfolio of loans.

The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements,

but which are supplemental to and not a substitute for U.S. GAAP measures: Adjusted Earnings per Share (Adjusted EPS), Core Pre-Tax

Income, Core Net Income Available to Common, Core Return on Tangible Common Equity (Core ROTCE), Estimated Risk-Adjusted Retail

Auto Yield, Adjusted Efficiency Ratio, fully phased-in Common Equity Tier 1 (CET1) capital and Adjusted Tangible Book Value per Share

(Adjusted TBVPS). These measures are used by management and we believe are useful to investors in assessing the company’s operating

performance and capital measures. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to

GAAP later in this document.

19

Third Quarter Financial Results

Supplemental

(1) Represents a non-GAAP financial measure. Excludes OID. See page 26 for calculation methodology and details.

(2) Repositioning items are primarily related to the extinguishment of high-cost legacy debt and strategic activities. Other primarily includes certain discrete tax items. See page

24 for details.

(3) Represents a non-GAAP financial measure. See pages 24, 25 and 26 for calculation methodology and details.

(4) 2Q16 effective tax rate was impacted by a $98 million tax benefit from a tax reserve release related to a prior year federal tax return

($ millions except per share data) 3Q 16 2Q 16 3Q 15 2Q 16 3Q 15

Net financing revenue (excld OID) (1) 1,011$ 998$ 981$ 13$ 29$

OID expense (15) (14) (11) (1) (3)

Net financing revenue (as reported) 996 984 970 12 26

Total other revenue 388 374 332 14 56

Provision for loan losses 258 172 211 86 47

Controllable expenses 479 463 452 16 27

Other noninterest expenses 256 310 222 (54) 34

Pre-tax income from continuing operations 391$ 413$ 417$ (22)$ (26)$

Income tax expense 130 56 144 74 (14)

(Loss) income from discontinued operations, net of tax (52) 3 (5) (55) (47)

Net income 209$ 360$ 268$ (151)$ (59)$

Preferred dividends - 15 38 (15) (38)

Net income available to common 209$ 345$ 230$ (136)$ (21)$

3Q 16 2Q 16 3Q 15 2Q 16 3Q 15

GAAP EPS (diluted) $0.43 $0.71 $0.47 (0.28)$ (0.04)$

Discontinued operations, net of tax 0.11 (0.01) 0.01 0.11 0.10

OID expense 0.02 0.02 0.02 0.00 0.00

Repositioning / other (2) - (0.18) 0.00 0.18 (0.00)

Adjusted EPS (3) $0.56 $0.54 $0.51 0.02$ 0.06$

Core ROTCE (3) 9.8% 9.7% 9.2%

Adjusted Efficiency Ratio (3) 45.9% 43.7% 43.7%

Effective Tax Rate (4) 33.2% 13.7% 34.5%

Increase / (Decrease) vs.

20

Net Interest Margin

Supplemental

• Net Interest Margin (“NIM”) of 2.69% up 5 bps YoY driven by higher retail auto yields

• NIM (excluding OID) (1) of 2.73% up 6 bps YoY

• Increased asset sensitivity during 3Q

(1) Represents a non-GAAP financial measure. Excludes OID. See page 26 for calculation methodology and details.

(2) Includes brokered deposits. Includes average noninterest-bearing deposits of $97 million in 3Q16, $91 million in 2Q16, and $91 million in 3Q15

(3) Includes Demand Notes, FHLB, and Repurchase Agreements

(4) Excludes dividend income from equity investments

Net Interest Margin Variance

($ millions)

Average

Balance Yield

Average

Balance Yield

Average

Balance Yield

Retail Auto Loan 64,223$ 5.58% 63,621$ 5.47% 62,115$ 5.24%

Auto Lease (net of dep) 13,232 7.25% 14,392 7.46% 17,519 6.84%

Commercial Auto 34,905 3.03% 34,800 3.03% 31,726 2.85%

Corporate Finance 3,115 6.39% 2,973 6.36% 2,309 6.19%

Mortgage 11,052 3.24% 10,764 3.36% 9,564 3.36%

Cash, Securities and Other 20,080 1.98% 20,269 1.94% 21,413 1.83%

Total Earning Assets 146,607$ 4.47% 146,819$ 4.47% 144,646$ 4.30%

Interest Revenue 1,648$ 1,630$ 1,567$

LT Unsecured Debt 21,714$ 4.87% 22,698$ 4.80% 20,884$ 4.96%

Secured Debt 32,343 1.62% 34,019 1.56% 42,150 1.19%

Deposits (2) 74,263 1.14% 71,570 1.14% 62,882 1.14%

Other Borrowings (3) 10,834 1.14% 10,862 1.15% 11,890 0.83%

Total Funding Sources (1) 139,154$ 1.83% 139,149$ 1.84% 137,806$ 1.71%

Interest Expense 641$ 637$ 593$

Net Financing Revenue (4) 1,007$ 993$ 974$

NIM (excluding OID) (1) 2.73% 2.72% 2.67%

NIM (as reported) 2.69% 2.68% 2.64%

3Q 16 2Q 16 3Q 15

21

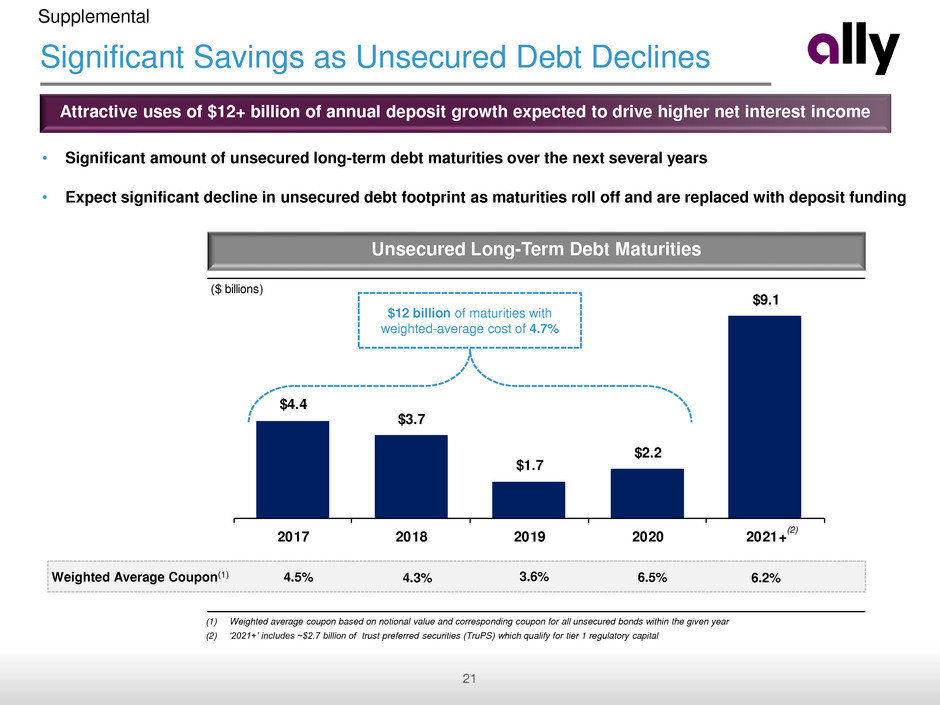

Significant Savings as Unsecured Debt Declines

Supplemental

($ billions)

$4.4

$3.7

$1.7

$2.2

$9.1

2017 2018 2019 2020 2021+

Unsecured Long-Term Debt Maturities

• Significant amount of unsecured long-term debt maturities over the next several years

• Expect significant decline in unsecured debt footprint as maturities roll off and are replaced with deposit funding

Weighted Average Coupon(1) 4.5% 4.3% 3.6% 6.5% 6.2%

(1) Weighted average coupon based on notional value and corresponding coupon for all unsecured bonds within the given year

(2) ‘2021+’ includes ~$2.7 billion of trust preferred securities (TruPS) which qualify for tier 1 regulatory capital

Attractive uses of $12+ billion of annual deposit growth expected to drive higher net interest income

$12 billion of maturities with

weighted-average cost of 4.7%

(2)

22

Illustrative View of Potential Deposit Growth Value

$40+ billion

Deposit Growth

next 3-4 years

Retail

Sweep

Brokered

2.0%+

Attractive Uses

Retire Unsecured Debt

Reduce Secured Debt

Capital Efficient Asset

Growth

− Mortgage

− Securities portfolio

− Corporate Finance

− Alternative Auto

$800+ million

Incremental Profits

Contribution

Margin on average Incremental Revenue

~$1.20-$1.40 of

incremental annual

EPS

Does not include:

− Higher asset yields

− Wealth Management

fee growth

− Mortgage origination

fee growth

− Other drivers

Customer growth also important strategically with product expansion initiatives

Supplemental

23

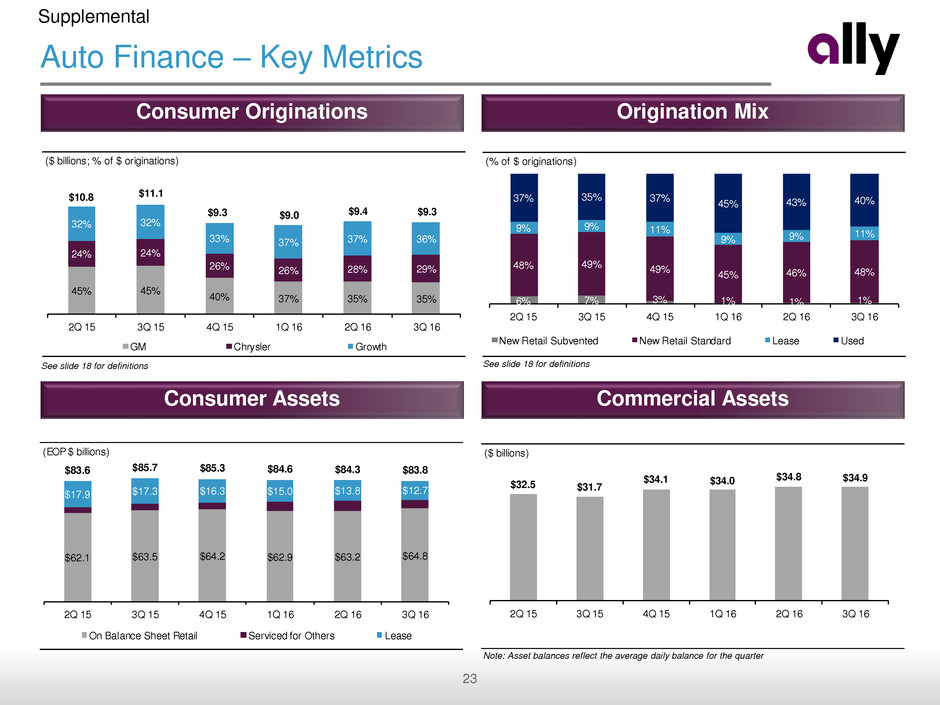

Auto Finance – Key Metrics

Supplemental

(EOP $ billions)

$62.1 $63.5 $64.2 $62.9 $63.2 $64.8

$17.9 $17.3 $16.3 $15.0 $13.8 $12.7

$83.6 $85.7 $85.3 $84.6 $84.3 $83.8

2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16

On Balance Sheet Retail Serviced for Others Lease

($ billions)

$32.5 $31.7

$34.1 $34.0 $34.8 $34.9

2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16

(% of $ originations)

6% 7% 3% 1% 1% 1%

48% 49% 49%

45% 46% 48%

9% 9% 11%

9% 9%

11%

37% 35% 37%

45% 43% 40%

2Q 1 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16

New Retail Subvented New Retail Standard Lease Used

($ billions; % of $ originations)

45% 45%

40% 37% 35% 35%

24% 24%

26% 26% 28% 29%

32% 32%

33% 37% 37% 36%

$10.8 $11.1

$9.3 $9.0 $9.4 $9.3

2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16

GM Chrysler Growth

See slide 18 for definitions

Consumer Assets Commercial Assets

Consumer Originations Origination Mix

Note: Asset balances reflect the average daily balance for the quarter

See slide 18 for definitions

24

GAAP to Core Results

Supplemental

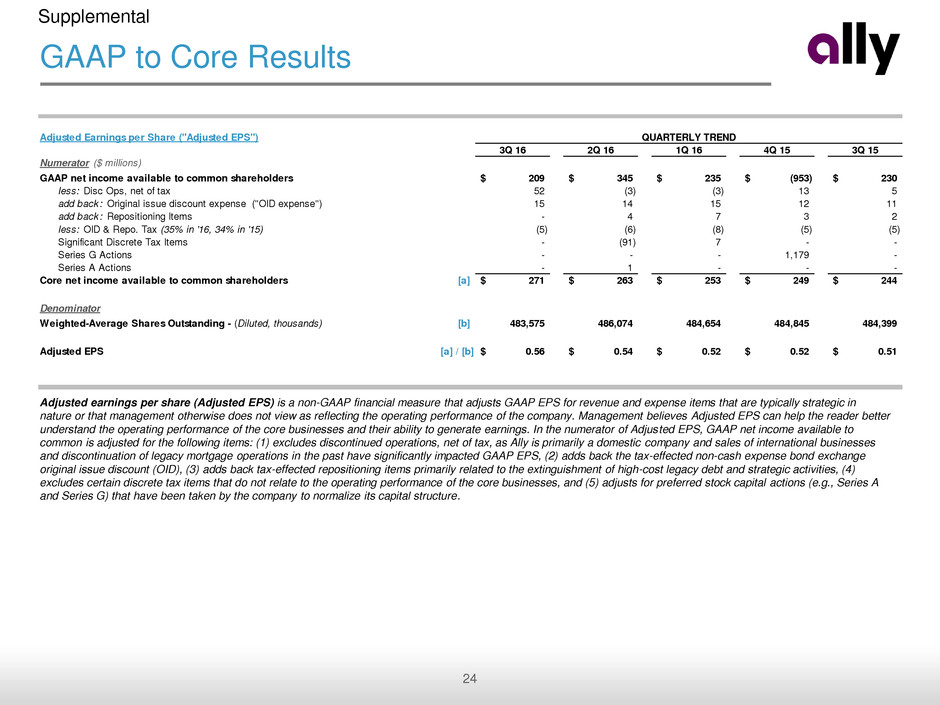

Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in

nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better

understand the operating performance of the core businesses and their ability to generate earnings. In the numerator of Adjusted EPS, GAAP net income available to

common is adjusted for the following items: (1) excludes discontinued operations, net of tax, as Ally is primarily a domestic company and sales of international businesses

and discontinuation of legacy mortgage operations in the past have significantly impacted GAAP EPS, (2) adds back the tax-effected non-cash expense bond exchange

original issue discount (OID), (3) adds back tax-effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, (4)

excludes certain discrete tax items that do not relate to the operating performance of the core businesses, and (5) adjusts for preferred stock capital actions (e.g., Series A

and Series G) that have been taken by the company to normalize its capital structure.

Adjusted Earnings per Share ("Adjusted EPS")

3Q 16 2Q 16 1Q 16 4Q 15 3Q 15

Numerator ($ millions)

GAAP net income available to common shareholders 209$ 345$ 235$ (953)$ 230$

less: Disc Ops, net of tax 52 (3) (3) 13 5

add back: Original issue discount expense ("OID expense") 15 14 15 12 11

add back: Repositioning Items - 4 7 3 2

less: OID & Repo. Tax (35% in '16, 34% in '15) (5) (6) (8) (5) (5)

Significant Discrete Tax Items - (91) 7 - -

Series G Actions - - - 1,179 -

Series A Actions - 1 - - -

Core net income available to common shareholders [a] 271$ 263$ 253$ 249$ 244$

Denominator

Weighted-Average Shares Outstanding - (Diluted, thousands) [b] 483,575 486,074 484,654 484,845 484,399

Adjusted EPS [a] / [b] 0.56$ 0.54$ 0.52$ 0.52$ 0.51$

QUARTERLY TREND

25

GAAP to Core Results

Supplemental

Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the

ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for

unamortized OID and net DTA. Ally’s Core net income available to common utilized a static 34% tax rate for purposes of calculating Core ROTCE through 4Q 2015. As of

1Q 2016, Ally’s Core net income available to common for purposes of calculating Core ROTCE is based on the actual effective tax rate for the period adjusted for any

discrete tax items including tax reserve releases, which aligns with the methodology used calculating adjusted earnings per share.

(1) In the numerator of Core ROTCE, GAAP net income available to common is adjusted for discontinued operations net of tax, tax-effected OID expense, tax-effected

repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock capital

actions.

(2) In the denominator, GAAP shareholder’s equity is adjusted for preferred equity and goodwill and identifiable intangibles net of DTL, unamortized OID, and net DTA.

Core Return on Tangible Common Equity ("Core ROTCE")

3Q 16 2Q 16 1Q 16 4Q 15 3Q 15

Numerator ($ millions)

GAAP net income available to common shareholders 209$ 345$ 235$ (953)$ 230$

less: Disc Ops, net of tax 52 (3) (3) 13 5

add back: Original issue discount expense ("OID expense") 15 14 15 12 11

add back: Repositioning Items - 4 7 3 2

less: OID & Repo. Tax (35% in '16, 34% in '15) (5) (6) (8) (5) (5)

Significant Discrete Tax Items & Other - (91) 7 8 2

Series G Actions - - - 1,179 -

Series A Actions - 1 - - -

Core net income available to common shareholders [a] 271$ 263$ 253$ 257$ 246$

Denominator (2-period average, $ billions)

GAAP shareholder's equity 13.6$ 13.7$ 13.6$ 14.0$ 14.4$

less: Preferred equity - 0.3 0.7 0.8 0.8

less: Goodwill & identifiable intangibles, net of deferred tax liabilities ("DTLs") 0.3 0.1 0.0 0.0 0.0

Tangible common equity 13.3$ 13.2$ 12.9$ 13.2$ 13.6$

less: Unamortized original issue discount ("OID discount") 1.3 1.3 1.3 1.3 1.3

less: Net deferred tax asset ("DTA") 1.0 1.1 1.2 1.4 1.5

Normalized common equity [b] 11.0$ 10.8$ 10.4$ 10.5$ 10.7$

Core Return on Tangible Common Equity [a] / [b] 9.8% 9.7% 9.8% 9.8% 9.2%

QUARTERLY TREND

26

GAAP to Core Results

Supplemental

Adjusted efficiency ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending

businesses with those of its peers. In the numerator of Adjusted efficiency ratio, total noninterest expense is adjusted for Insurance segment expense, repositioning items

primarily related to strategic activities and rep and warrant expense. In the denominator, total net revenue is adjusted for Insurance segment revenue, repositioning items

primarily related to the extinguishment of high-cost legacy debt and original issue discount (OID).

Adjusted Efficiency Ratio

3Q 16 2Q 16 1Q 16 4Q 15 3Q 15

Numerator ($ millions)

Total noninterest expense 735$ 773$ 710$ 668$ 674$

less: Rep and warrant expense (2) (3) (1) (2) (3)

less: Insurance expense 222 293 218 201 209

less: Repositioning items - 4 4 1 2

Adjusted noninterest expense [a] 515$ 479$ 488$ 468$ 465$

Denominator ($ millions)

Tota net revenue 1,384$ 1,358$ 1,327$ 1,339$ 1,302$

add: Original issue discount 15 14 15 12 11

add: Repositioning items - - 3 2 -

less: Insurance revenue 278 275 268 279 249

Adjusted net revenue [b] 1,121$ 1,097$ 1,076$ 1,074$ 1,064$

Adjusted Efficiency Ratio [a] / [b] 45.9% 43.7% 45.4% 43.6% 43.7%

QUARTERLY TREND

$ in millions

GAAP

OID &

Repositioning

Items

Non-GAAP (1) GAAP

OID &

Repositioning

Items

Non-GAAP (1) GAAP

OID &

Repositioning

Items

Non-GAAP (1)

Consolidat d Ally

Net financi g revenue 996$ 15$ 1,011$ 984$ 14$ 998$ 970$ 11$ 981$

Total other revenue 388 - 388 374 - 374 332 - 332

Provision for loan losses 258 - 258 172 - 172 211 - 211

Controllable expen es 479 - 479 463 (4) 459 452 (2) 449

Other noninterest expense 256 - 256 310 (0) 310 222 - 222

Pre-tax income from continuing ops 391$ 15$ 406$ 413$ 18$ 431$ 417$ 14$ 431$

Corpor / Other (incl. Legacy & Wealth)

N t f nci g revenue (6)$ 15$ 9$ (16)$ 14$ (2)$ 45$ 11$ 56$

Total other revenue (loss) 46 - 46 34 - 34 26 - 26

Provision for loan losses (16) - (16) (1) - (1) 3 - 3

Noninterest expense 63 - 63 37 (4) 33 32 (2) 30

Pre-tax income (loss) from continuing ops (7)$ 15$ 8$ (18)$ 18$ (0)$ 36$ 14$ 50$

3Q 16 2Q 16 3Q 15